Gamania Digital Entertainment Co., Ltd. Financial

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gamania Digital Entertainment Co., Ltd. Financial

GAMANIA DIGITAL ENTERTAINMENT CO., LTD. FINANCIAL STATEMENTS AND REPORT OF INDEPENDENT ACCOUNTANTS DECEMBER 31, 2009 AND 2008 For the convenience of readers and for information purpose only, the auditors’ report and the accompanying financial statements have been translated into English from the original Chinese version prepared and used in the Republic of China. In the event of any discrepancy between the English version and the original Chinese version or any differences in the interpretation of the two versions, the Chinese-language auditors’ report and financial statements shall prevail. Report of Independent Accountants Translated from Chinese PWCR09000120 To the Board of Directors and Stockholders of Gamania Digital Entertainment Co., Ltd. We have audited the accompanying balance sheets of Gamania Digital Entertainment Co., Ltd. as of December 31, 2009 and 2008, and the related statements of income, of changes in stockholders’ equity and of cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. As described in Note 4(7), we did not audit the financial statements of certain investees accounted for under the equity method. These long-term investments amounted to $691,506 thousand and $662,757 thousand as of December 31, 2009 and 2008, respectively, and the related investment loss was $33,714 thousand and $28,140 thousand for the years then ended, respectively. The financial statements of these companies were audited by other auditors whose reports thereon have been furnished to us, and our opinion expressed herein, insofar as it relates to long-term investments in these companies, is based solely on the reports of the other auditors. -

View Annual Report

ˆ200FoLv%3uw9ywy%ÉŠ 200FoLv%3uw9ywy% hkrdoc1 GIGAMEDIA LIMITED RR Donnelley ProFile11.2.17 HKR pf_rend25-Apr-2013 02:37 EST 480669 FS 1 2* FORM 20-F (LIVE) HKG HTM ESS 0C Page 1 of 2 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D. C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2012 Commission File Number: 000-30540 GIGAMEDIA LIMITED (Exact name of registrant as specified in its charter) REPUBLIC OF SINGAPORE (Jurisdiction of incorporation or organization) 8TH FLOOR, NO. 22, LANE 407, SECTION 2 TIDING BOULEVARD, TAIPEI, TAIWAN, R.O.C. (Address of principal executive offices) COLLIN HWANG, Chief Executive Officer 8TH FLOOR, NO. 22, LANE 407, SECTION 2 TIDING BOULEVARD, TAIPEI, TAIWAN, R.O.C. Tel: 886-2-2656-8000; Fax: 886-2-2656-8003 Securities registered or to be registered pursuant to Section 12(b) of the Exchange Act: Title of Each Class Name of Each Exchange on Which Registered Ordinary Shares The NASDAQ Stock Market LLC Securities registered or to be registered pursuant to Section 12(g) of the Exchange Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 50,719,976 ordinary shares Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

「TOKYO GAME SHOW 2006」Exhibitor List 2006.8.4 General Area AQ INTERACTIVE INC

「TOKYO GAME SHOW 2006」Exhibitor List 2006.8.4 General Area AQ INTERACTIVE INC. Toamec Corporation BROCCOLI CO., LTD. TOMY COMPANY, LTD. Canada Pavilion TOOL - DESIGNED GAMING ACCESSORIES ATI Technologies Inc. TOPPAN PRINTING CO., LTD. Autodesk Ltd TWENTIETH CENTURY FOX Enzyme Testing Labs Vodafone K.K. GestureTek Inc Groove Games Mobile Contents Area Humagade Inc Ambition Inc. SilverBirch Studios Inc BTD STUDIO Co., ltd. SplitFish Gameware Inc DAITO GIKEN, INC. Wave Generation Inc. DIGITAL WORKS ENTERTAINMENT Canadian Embassy DP-CORPORATION CAPCOM CO., LTD. FromSoftware, Inc. Cykan Entertainment Co., Ltd. Interactive Brains Co., LTD. D3PUBLISHER Inc. KOTOBUKI SOLUTION CO., LTD. D4Enterprise, Inc. Media Magic Co., Ltd. ELEVEN-UP Inc. NIHON ENTERPRISE CO., LTD. ELSA Japan Inc. PROVENCE PROMOTION EMA INNOVATION LLC - NETHRONE Quattro Media Corporation ENTERBRAIN, INC. RideonJapan, Inc. EYE POWER SPORTS co., ltd. SEALZ, Inc. FREEM CO LTD. Serendipity Co., Ltd. GAMEINSTINCT Spicysoft Corporation GENKI Co., Ltd. T2i Entertainment Co., Ltd. G-star Organizing Committee UAT Corporation HAMSTER Corporation HUDSON SOFT COMPANY, LIMITED Kids' Area INTERNET RADIO STATION <ONSEN> CAPCOM CO., LTD. IREM SOFTWARE ENGINEERING INC. NAMCO BANDAI Games Inc. KDDI CORPORATION NHN Japan Corporation KOEI CO., Ltd. Konami Digital Entertainment Co., Ltd. Game School Area Marvelous Interactive Inc. ACT College of Information & Communication Technology Media Works Inc. Aso Business Computer College Microsoft Co., Ltd. Digital Entertainment Academy Corporation MOCOMTECH CO., LTD. Higashi-Nihon Design & Computer College MOMOTARO KINGDOM International Art & Design College MORI TOYS CO., LTD. JAPAN ELECTRONICS COLLEGE NAMCO BANDAI Games Inc. Kanagawa Computer Culture College NeoWiz Japan Corporation Kobe Institute of Computing / Kobe College of Computing NETTS CO., LTD. -

Gamania Digital Entertainment

Gamania Digital Entertainment CFO Hank Su May. 4, 2011 Disclaimer This presentation material contains forward-looking statements and information. Forward-looking statements are statements that are not historical facts, including statements about our beliefs and expectations. Any statement in this presentation material that states our beliefs, expectations, predictions or intentions is a forward- looking statement. These statements are based on plans, estimates and projections as they are currently available to the management of Gamania Digital Entertainment Co., Ltd. Forward-looking statements therefore speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events, or otherwise. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could therefore cause actual results to differ materially from those contained in any forward-looking statement. 2 Table of Contents Company Overview Operating Performance 2011 Outlook 3 Company Overview Leading Online Game Service Provider North America Europe Asia • USA • Netherland • HQ: Taiwan • Hong Kong • Japan • Korea • China Snapshot Game Titles in Operation Leading Online game operator and developer Operated 22 MMOGs; “Lineage” & “Maple Story” Headquarters in Taiwan are major titles Subsidiaries in Taipei, Tokyo, Hong Kong, Beijing, Operated 17 Casual Games; “CSO”, “Kart Rider”, Shanghai, Seoul, Irvine & Amsterdam “BnB”, “Elsword”, & “Mabinogi” are most popular Listed in 2002 (6180.TT) Operated 5 Web Games; “Koihime” is best-selling Market Cap: NT$ 7,257 M (as of April. 28, 2011) Operated 1 Mobile Game; the new title is “Hero:108” Employees around 1 ,670 (as of March. -

Promising Investment Opportunities

Overview of Korea’s Industries 2012 Cultural Contents • Parts and Materials • Auto Parts • Displays • Semiconductors • Tourism and Leisure • Aerospace • Medical / Bio • Finance • ICT Industry • Fine Chemicals • Logistics and Distribution • Cultural Contents • New and Renewable Energy PROMISING INVESTMENT OPPORTUNITIES 02_ Industry Overview and Prospects 08_ Business Trends 09_ Promising Regions and Sectors for Foreign Investment 11_ Current Status and Successful Cases of Foreign Investment in Cultural Contents 12_ Incentives for Foreign-Invested Cultural Contents Companies 13_ Relevant Organizations Cultural Contents 02 03 1. Industry Overview and Prospects Growth Rate and Shares of Global Cultural Contents Market 1. Industry Overview and Prospects (USD billion) 2006~2010 2010~2015 Share in 2006 2010 2015 CAGR CAGR 2010 total Global Cultural Contents Market North America 489 481 607 -0.4% 4.7% 33.9% Europe, Middle East, Africa 422 477 614 3.1% 5.2% 33.6% Current Status and Prospects by Region Asia 310 395 541 6.2% 6.5% 27.8% ·In 2010, the global cultural contents industry amounted to USD 1.42 trillion, up 12.1% compared to South America 45 66 109 10.1% 10.5% 4.7% 2006. It is expected to grow to USD 1.87 trillion by 2015, jumping 31.8% from 2010. Total 1,266 1,420 1,871 2.9% 5.7% 100% ·The world’s largest cultural contents market is North America, at USD 481 billion, followed by Source: PWC, Global Entertainment and Media Outlook: 2011-2015, 2011. Europe, the Middle East and Africa at USD 477 billion, Asia at USD 395 billion, and South America at USD 66 billion. -

Presentation to Institutional Investors on Gamania Digital Entertainment

Contents Company Overview Industry Introduction Earnings Review Investment Highlights 2 Company Overview 3 High-quality Online Game Operator Snapshot Online game operator and developer Headquarter established in Taipei in 1995 Branch in Tokyo, HK, Beijing, Shanghai, & Seoul Listed in 2002 (6180.TT) Capital about NT$1,588m (US$47m) Employees around 1,100 Beijing Seoul Main Game Titles Shanghai Tokyo Operate 17 MMOGs, “Lineage” & “Maple Story” HK Taipei are flagship titles Operates 16 Casuals, of which “Kart Rider”, “BnB”, and “Getamped” are for all ages Launched 13 titles in 2008 and plan to launch over 15 new titles in 2009 4 Milestones Headquarter was established in Taipei in 1995 19951995 ~ 2000 Launched first self-developed PC-game “Convenience Store” Established Gamania corporate logo “Convenience Store” was granted “The Best Game” by Taipei Computer Association Launched first Massively Multi-player online game (MMOG) “Lineage” “Lineage” was granted the “The Best Online Game” by Taipei Computer Association 20011995 ~ 2005 Gamania Logo was granted “The Golden Award” in the Top10 Design” in Taiwan Gamania logo was granted “The Golden Award” and revealed in China CIS Year Book “Hero 108” was granted “Digital Content Prototype Design Award: Animation” Launched “Maple Story” and successfully attract the young users “Zodiac” was granted the “Digital Content Prototype Design Award: Online Game” 20061995 ~ Now Launched casual game “Kart Rider” Launched first self-developed MMOG “Bright Shadow” Launched Self-developed MMOG “Zodiac” & “XianMoDao” “ gamania.com ” was ranked Top 4 in online entertainment and Top 35 in Taiwan Web100, granted by Business Next Gamania was granted “Taiwan Superior Brands” by Bureau of Foreign Trade, Ministry of Economic Affairs. -

Performance, Companies with Female CEO Performance, Companies with Female CEO 800,0 300,0

After 2010 Index values: 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 Index values: 2017 2016 2015 2014 2013 2012 2011 2010 Diversity 752,5 683,9 606,1 510,4 410,9 300,3 251,2 268,7 199,7 100,0 Diversity 280,1 254,5 225,6 189,9 152,9 111,8 93,5 100,0 MSCI Developed 260,1 238,2 218,5 214,1 194,9 151,3 130,7 138,3 125,7 100,0 MSCI Developed 188,0 172,2 158,0 154,8 140,9 109,4 94,5 100,0 MSCI EM 218,2 184,4 165,9 195,0 199,3 204,7 173,1 212,2 178,5 100,0 MSCI EM 102,8 86,9 78,2 91,9 93,9 96,4 81,6 100,0 Diversity performance: Annualised 2017 2016 2015 2014 2013 2012 2011 2010 2009 Diversity performance: Annualised 2017 2016 2015 2014 2013 2012 2011 Absolute 25 % 10 % 13 % 19 % 24 % 37 % 20 % -7 % 35 % 100 % Absolute 15,8 % 10 % 13 % 19 % 24 % 37 % 20 % -7 % MSCI World 11 % 9 % 9 % 2 % 10 % 29 % 16 % -5 % 10 % 26 % Absolute 9,4 % 9 % 9 % 2 % 10 % 29 % 16 % -5 % Relative 14 % 1 % 4 % 17 % 14 % 8 % 4 % -1 % 25 % 74 % Vs MSCI World 6,4 % 1 % 4 % 17 % 14 % 8 % 4 % -1 % Performance, Companies with female CEO Performance, Companies with female CEO 800,0 300,0 700,0 250,0 600,0 200,0 500,0 400,0 150,0 300,0 100,0 200,0 50,0 100,0 - - 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2010 2011 2012 2013 2014 2015 2016 2017 Diversity MSCI Developed MSCI EM Diversity MSCI Developed MSCI EM Market wgt Equal wgt US 41,6 % 33,2 % China 8,0 % 17,0 % India 6,6 % 4,2 % Canada 3,7 % 3,7 % Italy 3,5 % 1,7 % UK 3,4 % 5,2 % Spain 2,9 % 1,2 % Sweden 2,4 % 2,5 % Australia 2,4 % 4,7 % HongKong 2,1 % 2,2 % France 1,9 % 1,2 % Germany 1,9 % 1,2 % MSCI World USD -

FTSE Global All Cap Choice Index

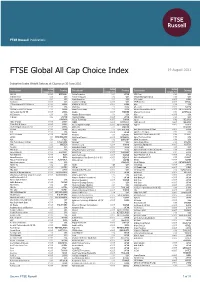

2 FTSE Russell Publications 19 August 2021 FTSE Global All Cap Choice Index Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 1&1 AG <0.005 GERMANY Activia Properties 0.01 JAPAN AES Corp. 0.03 USA 10X Genomics 0.03 USA Activision Blizzard 0.12 USA Affiliated Managers Group 0.01 USA 1Life Healthcare 0.01 USA Acuity Brands Inc 0.01 USA Affle (India) <0.005 INDIA 1st Source <0.005 USA Acushnet Holdings <0.005 USA AFI Properties <0.005 ISRAEL 21Vianet Group ADS (N Shares) <0.005 CHINA ADAMA (A) (SC SZ) <0.005 CHINA Aflac 0.06 USA 2U <0.005 USA Adani Gas 0.01 INDIA AfreecaTV <0.005 KOREA 360 DigiTech ADS (N Shares) 0.01 CHINA Adani Green Energy 0.01 INDIA African Rainbow Minerals Ltd <0.005 SOUTH AFRICA 360 Security (A) (SC SH) <0.005 CHINA Adapteo <0.005 SWEDEN Afterpay Touch Group 0.03 AUSTRALIA 3-D Systems 0.01 USA Adaptive Biotechnologies 0.01 USA Afya <0.005 USA 3i Group 0.02 UNITED Adastria Holdings <0.005 JAPAN AGCO Corp 0.01 USA KINGDOM A-Data Technology <0.005 TAIWAN Ageas 0.02 BELGIUM 3SBio (P Chip) <0.005 CHINA ADBRI <0.005 AUSTRALIA AGFA-Gevaert <0.005 BELGIUM 51job ADS (N Shares) <0.005 CHINA Adcock Ingram Holdings <0.005 SOUTH AFRICA Aggreko <0.005 UNITED 5I5j Holding Group (A) (SC SZ) <0.005 CHINA Addtech B 0.01 SWEDEN KINGDOM 77 Bank <0.005 JAPAN Adecco Group AG 0.02 SWITZERLAND Agile Group Holdings (P Chip) <0.005 CHINA 8x8 <0.005 USA Adeka <0.005 JAPAN Agilent Technologies 0.07 USA A.G.V. -

Internet/Game/Advertising Market Changes Spurring Shifts in Business Strategy

2018 Outlook Internet/Game/Advertising Market changes spurring shifts in business strategy Jee-hyun Moon +822-3774-1640 [email protected] Analysts who prepared this report are registered as research analysts in Korea but not in any other jurisdiction, including the U.S. PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES & DISCLAIMERS IN APPENDIX 1 AT THE END OF REPORT. Contents [Summary] 3 I. 2017 review 4 II. 2018 outlook 7 III. [Internet] Commerce, voice interface, cloud 12 - NAVER, Kakao, NHN Entertainment, Interpark IV. [Game] Overseas revenue growth, new titles 101 - NCsoft, Netmarble Games, Com2uS, Pearl Abyss, Webzen V. [Advertising] Inorganic growth, stable affiliate billings 144 - Cheil Worldwide, INNOCEAN Worldwide, Nasmedia [Conclusion] 162 [Summary] Shifts in business strategy coming into focus Market changes call for strategic shifts; Only those that are able to adapt and create new markets will survive Shifts in strategy [Internet] Online commerce [Game] New titles based on existing intellectual [Advertising] Strengthening ties property (IP), global expansion with affiliates, M&As Source: Mirae Asset Daewoo Research Source: Mirae Asset Daewoo Research 3 | 2018 Outlook [Internet/Game/Advertising] Mirae Asset Daewoo Research I. 2017 review In 2017, game stocks and • In 2017, game stocks and Kakao delivered robust share performances among internet/game/advertising plays. Kakao delivered robust • Kakao: Recovery in ad revenue and expectations for expansion in the value of subsidiaries share performances • Game: -

Gamania Digital Entertainment Connects Polycom® Realpresence™ Video Solutions with Microsoft® Lync™ to Streamline Operations and Accelerate R&D, Saving $US14,000

CUSTOMER SUCCESS STORY Gamania Digital Entertainment Connects Polycom® RealPresence™ Video Solutions with Microsoft® Lync™ to Streamline Operations and Accelerate R&D, Saving $US14,000 Industry Overview Manufacturing/Gaming Gamania Digital Entertainment Co., Ltd. is a leading brand of PC online games in Taiwan. Originally established in 1996, Gamania has expanded rapidly over the past 16 years from a small Applicable Use business with only 12 employees to an international enterprise with seven offices located across • Global executive meetings Asia, the US and Europe, and over 1,800 staff worldwide. In addition to producing successful • R&D, development and engineering self-developed online games, Gamania is also famous for Lineage - a licensed title from Korea that has helped to make online games popular with a record of more than 200,000 users online problem resolution sessions at one point in Taiwan in 2010. In recent years, due to its immense success and growth, Gamania • Product development and training has expanded its business scope to include animation and brand products, thereby creating a • Business continuity fully immersive online experience for their players using its digital entertainment platform. Solution Enhanced Collaboration with Polycom and Microsoft Polycom® CX Solutions Optimised for In the online gaming industry, R&D often involves immense cross-department collaboration across globally dispersed teams. As its product lines continue to expand, Gamania prides itself on both Microsoft® Lync™, providing a complete end- -

Annual Financial Statements

ANNUAL FINANCIAL STATEMENTS December 31, 2020 TABLE OF CONTENTS Independent Auditors’ Report .............................................................................................. 3 CC&L Alternative Global Equity Fund .................................................................................... 6 CC&L Alternative Canadian Equity Fund ................................................................................ 94 CC&L Alternative Income Fund ............................................................................................. 167 Notes to Financial Statements .............................................................................................. 186 CONNOR, CLARK & LUNN FUNDS INC. Annual Financial Statements for the period ending December 31, 2020 2 KPMG LLP PO Box 10426 777 Dunsmuir Street Vancouver BC V7Y 1K3 Canada Telephone (604) 691-3000 Fax (604) 691-3031 INDEPENDENT AUDITORS’ REPORT To the Unitholders of: CC&L Alternative Global Equity Fund CC&L Alternative Canadian Equity Fund CC&L Alternative Income Fund (collectively, the “Funds”) Opinion We have audited the financial statements of the Funds, which comprise: • the statements of financial position as at December 31, 2020 and December 31, 2019 • the statements of comprehensive income for the year ended December 31, 2020 and the period from February 15, 2019 to December 31, 2019 • the statements of changes in net assets attributable to holders of redeemable units for the year ended December 31, 2020 and the period from February 15, 2019 to December -

Nexon Announces Gamania to Release Warface in Taiwan

September 25, 2013 NEXON Co., Ltd. Nexon Announces Gamania to Release Warface in Taiwan TOKYO – September 25, 2013 – NEXON Co., Ltd. (“Nexon”) (3659.TO), a worldwide leader in free-to-play online games, today announced that Gamania Digital Entertainment Co., Ltd. (“Gamania”) has been named as the exclusive distributor of Warface in Taiwan. Warface is a highly successful next-generation first-person shooter (FPS) game developed by Crytek and licensed by Nexon in Asia. Warface features compelling next-generation visuals, artificial intelligence elements and physics in a near-future military setting. Players assume the roles of elite ex-army personnel to stop a ruthless force known as Blackwood. With a constantly updated player-versus-environment (PVE) universe full of dramatic multiplayer co-op missions, Warface offers multiple character classes – each with different tactical approaches – as well as unique team interaction and intense player-versus-player (PVP) scenarios. “We are excited to work with Gamania to bring this critically-acclaimed title to players in the important Taiwan market,” said Seungwoo Choi, President and Chief Executive Officer of Nexon. “Nexon and Gamania have been trusted business partners since 2005. We look forward to continuing to work together with Gamania to bring exciting new titles to players throughout the region.” Copyright (c) 2013 Crytek All Rights Reserved. Crytek and Warface are registered trademarks or trademarks in the U.S. and other countries. About NEXON Co., Ltd. http://company.nexon.co.jp/ NEXON Co., Ltd. (“Nexon”) (3659.TO) is a worldwide leader in free-to-play online games. Founded in Korea in 1994, Nexon developed one of the world's first graphics-based massively multiplayer online games.