Chennai Market Watch, Office: H1 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Krishenggbrochure2.Pdf

KRISH ENGINEERING Company Profile About Us KRISH ENGINEERING, founded in 2012 by a team of pioneering and futurist professionals, is a customer oriented company, working round the clock to offer complete satisfaction to our esteemed clients. Our Mission Our ultimate aim is to serve you- our customer- with outstanding air conditioners, complete HVAC services, and after sales services. We are one of the few reputed service teams in the industry offering air conditioners of world-class brand like Daikin home appliances. With our exceptional customer support system, high performing products, and HVAC services, we have carved out a distinguished niche in the market within a short span of time. Our Services We are well equipped with top-notch facilities to offer excellent repair and maintenance services. Currently, we undertake Supply and Installation of HVAC equipments and are also well-known for supply and installation of leading Market brands HVAC equipment works, MEP works, VRVs and VRF, air conditioning contracts, as well as after-sale services for all types of air conditioners. We offer customers reliable consultation, contracting, implementation, equipment supply, control and automation services at a very reasonable and affordable price. We’ve recruited a team of dynamic individuals who are well-qualified and skilled to carry out mechanical, electrical and electronical troubleshooting using the latest technology. KRISH ENGINEERING Who We Are We have a strong and experienced team of technicians and engineers, who possess expertise in the field of HVAC and allied products design, supply, installation and commissioning. We are dealers of DAIKIN, the most advanced air conditioning systems with innovative VRT technology. -

APPENDIX I FORM-1 (I) Basic Information # Item Details Proposed Industrial Park with Automobile and Automobile Ancillary 1

APPENDIX I FORM-1 (I) Basic Information # Item Details Proposed industrial park with automobile and automobile ancillary 1. Name of the Project manufacturing industries, electronics and consumable durables, IT hardware, fibre glass manufacture, foundries, (ferrous and non ferrous <5000 tonnes/annum), ceramics and glass industries, packaging industry, R&D facilities, tanneries, leather and leather footwear industries, light and heavy engineering etc in existing industrial storehouse/ warehouse & other engineering Industries area in “IndoSpace AS Industrial Park Pvt Ltd” Vallam, Kancheepuram District 2. S. No. in the schedule 7(c) viz < 50 hectares and built up area of <st1,50,000 sqm deemed as B2 category under 1 December 2009 EIA notification 3. Proposed capacity/area/length/tonnage Total Plot Area: 2 to be handled/command area/lease 142773 m (or) 14.28 Hectares area/number of wells to be drilled. Built up area after Expansion2 : 79628.28 m Annexure-22 The area break up details are enclosed as 4. New/Expansion/Modernization Expansion - Proposed industrial park with automobile and automobile ancillary manufacturing industries, electronics and consumable durables, IT hardware, fibre glass manufacture, foundries, ferrous and non ferrous <5000 tonnes/annum , ceramics and glass industries, packaging industry, R&D facilities, tanneries, leather and leather footwear industries, light and heavy engineering etc in existing industrial storehouse/ warehouse & other engineering Industries area Previous EC obtained for the existing site by AS Cargo movers Pvt Ltd vide Letter No. Annexure -2 . SEIAA / TN/EC/8(a)/107/F- 383/2010 / dt.16.12.2010 is enclosed as and the requisition for EC name change from AS Cargo movers Pvt ltd to Indo space AS industrial park has already been submitted at Annexure - 7 SEIAA on 15.05.14, the acknowledgement copy is enclosed as 2 5. -

Trade Marks Journal No: 1925 , 28/10/2019 Class 25

Trade Marks Journal No: 1925 , 28/10/2019 Class 25 1324069 06/12/2004 BISWANATH SAHA trading as ;SATYAM CUT PIECE NORTH NASHRA COLONY,PLOT 271,RANAGHAT,P.O.NASHRA,DIST.NADIA,W.B. Address for service in India/Agents address: D. SEN & CO. 6, OLD POST OFFICE STREET, GROUND FLOOR, CALCUTTA - 700 001. Used Since :01/12/2004 KOLKATA SHIRTS AND TROUSERS. 3850 Trade Marks Journal No: 1925 , 28/10/2019 Class 25 DRYJEANS CO. 2596444 15/09/2013 GAGANDEEP JOLLY trading as ;FRIENDS GARMENTS B-2-738, BHAI MANNA SINGH NAGAR, LUDHIANA (PB.) MERCHANTS & MANUFACTURERS Address for service in India/Attorney address: MAHTTASS B-43/3,udham singh nagar, LUDHIANA Used Since :01/02/2010 DELHI Hosiery & Readymade Garments. REGISTRATION OF THIS TRADE MARK SHALL GIVE NO RIGHT TO THE EXCLUSIVE USE OF THE.WORDS i.e.,"JEANS CO." and "MARK TO BE USED AS A WHOLE". 3851 Trade Marks Journal No: 1925 , 28/10/2019 Class 25 2760751 24/06/2014 TEAMWORK ARTS PRIVATE LIMITED S-349, Panchsheel Park, New Delhi - 110017 MANUFACTURER AND TRADER (A COMPANY INCORPORATED UNDER THE COMPANIES ACT, 1956) Address for service in India/Attorney address: SINGH & SINGH LAW FIRM LLP C-139,Defence Colony,New Delhi-110 024 Used Since :01/01/2000 To be associated with: 2760748 DELHI CLOTHING INCLUDING BEACH CLOTHES, BELTS, CLOTHING OF LEATHER, COALS, COSTUMES, GLOVES, HOODS, OUTER CLOTHING, OVERALLS, PANTS, PAPER CLOTHING, PULLOVERS, PYJAMAS, SARIS, SCARVES, SHAWLS, SHIRTS, SKIRTS, SOCKS, SUITS, SWEATERS, TEE-SHIRTS, TROUSERS, VESTS, WAISTCOATS; FOOTWEAR INCLUDING SHOES, SLIPPERS; HEADGEAR INCLUDING BANDANAS, BERETS, CAPS, HATS, HEADBANDS; AS INCLUDED IN CLASS 25. -

Select out of Options

Quarter 1: Jan-Mar 2016 Type of Donor, i.e. Purpose (select out of individual or options like Amount of Name of the donor Address of the Donor Date of Receipt institutional, economical, social, grant received Corporate cultural, religious, etc) Unit- I. SEZ 1,Bagmane Developers Pvt EMC Software and Services Corporate Limited-SEZ, Marathahalli Outer Ring Road, Social 34,29,000 04-01-2017 India Private Limited Doddanekkundi, Bangalore-560037 16th Floor, Tower II B, One Indiabulls Centre, Bloomberg Data Services Corporate Jupiter Mills, Off Senapati Bapat Marg, Lower Social 10,018 17-01-2017 (India) Pvt Ltd Parel, Mumbai-400013 Ammado AG, Fitzwilliam House, 3-4 Upper The Ammado Foundation Institutional Social 21,737 12-01-2017 Pembroke Street, Dublin 2, Ireland 128 Prinsep Street, #01-01 Sin Thai Hin Billion Bricks Ltd Corporate Social 15,99,425 13-01-2017 Building, Singapore-188655 Anuradha Chitrapu Individual 17, Locust St, Belmont-02478 Social 1,46,634 19-01-2017 14 Robinson Road #13-00, Far East Finance B1G1 Giving Institutional Social 75,135 25-01-2017 Building, Singapore-048545 Charities Aid Foundation of 1800 Diagonal Rd #150, Alexandria, VA Institutional Social 3,390 25-01-2017 America 22314, United States Phn-+1 703-549-8931 Charities Aid Foundation of 1800 Diagonal Rd #150, Alexandria, VA Institutional Social 13,628 25-01-2017 America 22314, United States Phn-+1 703-549-8931 Charities Aid Foundation of 1800 Diagonal Rd #150, Alexandria, VA Institutional Social 93,564 25-01-2017 America 22314, United States Phn-+1 703-549-8931 Charities Aid Foundation of 1800 Diagonal Rd #150, Alexandria, VA Institutional Social 50,172 25-01-2017 America 22314, United States Phn-+1 703-549-8931 Page 1 of 8 Quarter 1: Jan-Mar 2016 Type of Donor, i.e. -

Facts About Asia: India’S Thriving Technology Industry

Teaching Asia’s Giants: India Facts About Asia: India’s Thriving Technology Industry The Infy hallmark pyramid. It serves as the multimedia studio for Infosys’s headquarters in Bangalore. Source: Wikimedia Commons at https://tinyurl.com/y4orqfx4. Introduction North American readers of this journal, even if they are not especially tech savvy, are likely familiar with Silicon Valley, located in the San Francisco Bay area, and many of the companies like Apple and Google that make the region their home. Fewer are likely aware of India’s own “Silicon Valley” and the various Indian private compa- nies and startups that help to make the IT sector one of the more faster growing sectors of the economy and cre- ate the prospect of India becoming a world leader in technology companies. According to the 2020 Global Innovation Index, an annual study of the most innovative countries across a series of industries published by World Intellectual Property Organization (WIPO), Cornell University and IN- SEAD, a top international private business school, India ranks as the world’s top exporter of information tech- nology (IT) and eighth in the number of science and engineering graduates. The IT industry is a highly significant part of the Indian economy today with the sector contributing 7.7% of India’s total GDP by 2017, a most impressive increase from 1998 when IT accounted for only 1.2% of the nation’s GDP. IT revenues in 2019 totaled US $180 billion. As of 2020, India’s IT workforce accounts for 4.36 million employees and the United States accounts for two-thirds of India’s IT services exports. -

1841 , 19/03/2018 Class 36 1804594 09/04/2009 Trading As

Trade Marks Journal No: 1841 , 19/03/2018 Class 36 1804594 09/04/2009 PACL LIMITED trading as ;PACL LIMITED 7TH FLOOR GOPALDAS BHAWAN BARAKHAMBA ROAD NEW DELHI . Address for service in India/Attorney address: LEX CONSULTING F-6B, ARJUN PALACE, (OPP. ARCHANA COMPLEX), B-45 GREATER KAILASH PART-I NEW DELHI (SOUTH) 110048 Proposed to be Used DELHI INSURANCE; FINANCIAL AFFAIRS; MONETARY AFFAIRS; REAL ESTATE AFFAIRS; SERVICES DEALING WITH INSURANCE SUCH AS SERVICES RENDERED BY AGENTS OR BROKERS ENGAGED IN INSURANCE, SERVICES RENDERED TO INSURED, AND INSURANCE UNDERWRITING SERVICES; FINANCIAL INFORMATION, MANAGEMENT, SPONSORSHIP SERVICES; FUND INVESTMENT, FUND RAISING, FUND TRANSFER, HIRE-PURCHASE FINANCING, LEASE PURCHASE FINANCING, LENDING AGAINST SECURITY, RENTING OF APARTMENT, APARTMENT HOUSE MANAGEMENT, SERVICES OF REALTY ADMINISTRATORS OF BUILDINGS, I.E., SERVICES OF LETTING OR VALUATION OR FINANCING; BUSINESS LIQUIDATION SERVICES, CAPITAL INVESTMENT, ACQUISITION, TAKEOVERS, DEALING IN STOCK, SHARES, DEBENTURES, BONDS AND UNITS OF UNIT TRUST OF INDIA, PROVIDE LOANS WITH OR WITHOUT SECURITY, UNDERTAKE AND EXECUTE TRUST, AGENCY, TO ENTER INTO CONTRACT WITH LEASEHOLDERS, BORROWERS, LENDERS, ANNUITANTS, ENDOWMENTS .AND DEALS IN ALL TYPES OF FUNDS; REAL ESTATE AGENCY, REAL ESTATE MANAGEMENT, REAL ESTATE APPRAISALS, BROKERS; RENTING OF OFFICES, APARTMENTS, FLATS, LEASING OF FARMS; CONSULTANCY, ASSISTANCE, EVALUATION, MANAGEMENT AND INFORMATION ON INSURANCE, FINANCIAL AFFAIRS, MONETARY AFFAIRS, REAL ESTATE AFFAIRS. 7217 Trade Marks Journal No: -

Highlights for April 2007 Bengal Shrachi Housing Development Limited Direct News

HIGHLIGHTS FOR APRIL 2007 BENGAL SHRACHI HOUSING DEVELOPMENT LIMITED DIRECT NEWS Corporate Profiling – Bengal Shrachi Housing Development limited • Coverage has appeared in The Hindu Business Line • Coverage has appeared in The Telegraph • Coverage has appeared in The Times of India • Coverage has appeared in Realty Plus Launch of Rosedale Garden Complex show-flats • Story was aired on NDTV [Hot Property] • Story was aired on Zee Business [Property Plus] • Story was aired on CNBC – Awaz [Prime Property] SNAPSHOTS • Pallonji mass housing project set for a launch – S P Shukhobrishti, claimed to be India’s largest mass housing project, meant for the lower and middle-income groups of society, developed by Shapoorji Pallonji, is up for sale. Rs 1500 crore project will have 20,000 dwelling units in the form of 12,000 one- BHK flats and 8,000 two – BHK flats. Most of the flats have been designed to have balconies overlooking open green spaces. The complex would have a central water body and jogging tracks and have a ventilation design to catch the southern breezes. • Siliguri to get Rs 200-cr City Center – Bengal Ambuja is investing Rs 200 cr to build a mall hotel in Siliguri, in the name of City Centre. Siliguri mall hotel would house 4 – levels of mall, one level of multiplex, hotel and banquets, and 2 levels of hotels. Siliguri’s City Centre is expected to be 1.5-time bigger than City Centre II, coming up in Rajarhat. Bengal Ambuja is also planning a similar mall- hotel City 1 Centre in Haldia at an estimated investment of Rs 150 crore which would be spread over 5 acre. -

Indeus 1683385 05/05/2008 Indeus Life Sciences Private Limited 206, Hamilton A, Hiranandani Estate, Ghodbunder Road, Patilpada, Thane-400602, Maharashtra, India

Trade Marks Journal No: 1828 , 18/12/2017 Class 42 INDEUS 1683385 05/05/2008 INDEUS LIFE SCIENCES PRIVATE LIMITED 206, HAMILTON A, HIRANANDANI ESTATE, GHODBUNDER ROAD, PATILPADA, THANE-400602, MAHARASHTRA, INDIA. SERVICE PROVIDER (A COMPANY INCORPRATED UNDER THE COMPANIES ACT, 1956). Address for service in India/Attorney address: KHAITAN & CO. ONE INDIABULLS CENTRE,13TH FLOOR,841 SENAPATI BAPAT MARG,ELPHINSTONE ROAD,MUMBAI 400013,INDIA. Used Since :01/04/2007 MUMBAI RESEARCH AND DEVELOPMENT ACTIVITY IN PHARMACEUTICALS, INCLUDING BUT NOT ONLY LIMITED TO FORMULATION/ GALENICAL /DOSAGE FORMS AND TO DEVELOP NEW DRUG DELIVERY SYSTEMS AND TO CARRY OUT PROCESS DEVELOPMENT AND UPGRADATION FOR ACTIVE PHARMACEUTICALS INGREDIENTS AND INTERMEDIATES ANALYTICAL METHOD DEVELOPMENT AND SUPPORT DOSSIER DEVELOPMENT TRANSFER OF TECHNOLOGY TECHNICAL PACKAGES AND SCALE UP ASSISTANCE AND TO CONDUCT/ SUB CONDUCT PILOT AND PIVOTAL BIO-EQUIVALENCE STUDIES. 6517 Trade Marks Journal No: 1828 , 18/12/2017 Class 42 1829917 16/06/2009 MR.DEVANG Y. JOSHI trading as ;BHADRASHILP CONSULTANTS 419, RASHTRADEEP COMPLEX, RASHTRIYA SHALA, MAIN ROAD, RAJKOT - SERVICE PROVIDER Address for service in India/Agents address: MAKHIJA & ASSOCIATES. 12/160, DAULAT NAGAR, THANE (E)-400 603. Used Since :12/04/2000 AHMEDABAD ARCHITECTURAL CONSULTANCY AND ENGINEERING SERVICES. 6518 Trade Marks Journal No: 1828 , 18/12/2017 Class 42 2020523 08/09/2010 SHRI HEMANG PANDIT trading as ;M/S. PANDIT HOLDINGS 3rd Floor, Adarsh Complex, Near Swastik Cross Roads, Navrangpura, Ahmedabad - 380009. Gujarat, India Service Provider An Indian Partnership Firm Address for service in India/Agents address: PARKER & PARKER COMPANY. A-3, TRADE CENTER, NR. STADIUM CIRCLE, C.G. ROAD, AHMEDABAD - 380 009. -

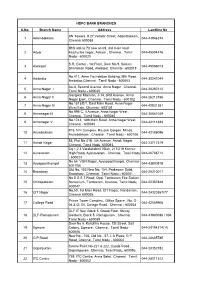

S.No. Branch Name Address Landline No 1 Adambakkam an Towers

HDFC BANK BRANCHES S.No. Branch Name Address Landline No AN Towers, # 27,Vellalar Street, Adambakkam, 1 Adambakkam 044-43846374 Chennai 600088 IRIS old no.70 new no 69, 3rd main road 2 Adyar kasthuriba nagar, Adayar , Chennai. Tamil 044-45504476 Nadu - 600020 S.R. Center , 1st Floor, Door No.9, Sriman 3 Alwarpet 044-45066013 Srinivasan Road, Alwarpet, Chennai - 600018 No.411, Amm Foundation Building, Mth Road, 4 Ambattur 044-30241044 Ambattur,Chennai. Tamil Nadu - 600053 Aa-8, Second Avenue, Anna Nagar , Chennai. 5 Anna Nagar I 044-26287412 Tamil Nadu - 600040 Gangwal Mansion, J-14, 3Rd Avenue, Anna 6 Anna Nagar II 044-26212456 Nagar East , Chennai. Tamil Nadu - 600102 No.1513/E/1, East Main Road, Anna Nagar 7 Anna Nagar IV 044-42831361 West Extn, Chennai - 600101 No.995-C, Ii Avenue, Anna Nagar West , 8 Annanagar III 044-30541049 Chennai. Tamil Nadu - 600040 No.1743, 18th Main Road, Anna Nagar West, 9 Annanagar V 044-42114388 Chennai - 600040 #15, N K Complex, Razack Gargen, Mmda, 10 Arumbakkam 044-42186096 Arumbakkam , Chennai. Tamil Nadu - 600106 53, Plot No 41B, 4th Avenue, Ashok Nagar, 11 Ashok Nagar 044-23717319 Chennai, Tamil Nadu, 600083. Cg 1,2,3 Varalakshmi Villah, 217/219 Konnur 12 Aynavaram High Road, Ayanavaram , Chennai. Tamil Nadu 044-26748712 - 600023 No 64, VGN Nagar, Ayyappanthangal, Chennai - 13 Ayyappanthangal 044-43800515 600 056. Old No, 153 New No, 154, Prakasam Salai, 14 Broadway 044-25210011 Broadway , Chennai. Tamil Nadu - 600001 No 5 G S T Road, Opp. Tambaram Fire Station, 15 Chitlapakkam Sanitorium, Tambaram, Chennai, Tamil Nadu, 044-22387848 600047. -

Realty Newsfor PRIVATE CIRCULATION ONLY Close at 3.5 Million Sq

A Comprehensive Page -> 2 Page -> 3 Page -> 4 Update On Realty Scenario In And Around APPCCAssociation of Professional Property Consultants Chennai Chennai Realty Chennai’s office supply during TAX PLANNING Data the 2nd half of 2021 will be Gifts received from Chennai continues to attract approximately 5.4 m sq. ft. non-relatives too can also leading developers to come and The yearend absorption may be completely exempt invest in commercial projects. from income tax. Realty NewsFOR PRIVATE CIRCULATION ONLY close at 3.5 million sq. ft Vol.1, Issue 8, August 2021 During his 100-day sojourn in the office, Investors Conclave chief minister MK Stalin has begun well with an influx Boosts Investment of Rs 28,508 crore Tamil Nadu. This digital accelerator programme sanctions grant to the start-up projects engaged investment for 49 proj- in innovation, research and development. The government has sanctioned a sum of Rs 5 crore ects that will generate for this programme. In all, 75 applications have been received, out of which five organisations employment for 83,482 have been selected for sanction of the grant. Chief minister MK Stalin has handedover the people in the state, sanction orders to the five companies. General Electric has proposed to establish a reports V Nagarajan. centre of excellence to enhance of production of aircraft and aeronautical components for indus- tries in the aerospace and defence sector using advanced manufacturing technologies. An MoU fter assuming power as chief minister was signed between the General Electric of Tamil Nadu, MK Stalin has been Company and TIDCO in the presence of chief planning to inject a fresh lease of life minister. -

Olympia Tech Park Pvt Ltd

+91-9551087777 Olympia Tech Park Pvt Ltd. https://www.indiamart.com/olympia-tech-park/ Olympia Group is one of South India’s leading developers. Founded in July 2004, the group has developed over 2000 homes and over 5 million square feet successfully. With an emphasis on highest quality, detailing, exceptional design and ... About Us Olympia Group is one of South India’s leading developers. Founded in July 2004, the group has developed over 2000 homes and over 5 million square feet successfully. With an emphasis on highest quality, detailing, exceptional design and craftsmanship, Olympia Group has been leading the real estate market in Chennai, Kolkata, and Bangalore. Olympia Group has delivered prestigious projects enjoying national and international acclaim. Some of the projects include Olympia Technology Park: Among the world's largest LEED gold-rated green building, located in Guindy, Chennai Olympia Opaline: Chennai's first 'green' residential project Opaline Sky Villas: Super-luxury villa type apartments located on the OMR Olympia Panache: Ultra luxury villa residences on OMR Olympia Grande: Residential Apartments on Pallavaram, Chennai Reflection: Sprawling Villas, Luxury Sky Homes & high-end Boutique resort For more information, please visit https://www.indiamart.com/olympia-tech-park/aboutus.html OTHER SERVICES P r o d u c t s & S e r v i c e s Opaline Sequel Land Olympia Grande Land Developers Developers Olympia Panache Land The Goodwood Residence Developers Land Developers P r o OTHER SERVICES: d u c t s & S e r v i c e s Olympia Jayanthi Residences Olympia Opaline Land Land Developers Developers The Park Residence Land Reflection Land Developers Developers F a c t s h e e t Nature of Business :Service Provider CONTACT US Olympia Tech Park Pvt Ltd. -

Annexure I Details of New Credit Rating Assigned During April 2014 to September 2014 Issue Size Sr.No

Annexure I Details of New credit rating assigned during April 2014 to September 2014 Issue Size Sr.No. Name of the Issuer Instrument (Rs.Milllion) Rating 1 3F Industries Limited Fixed Deposit 450.0 CARE BBB+ (FD) 2 3F Oil Palm Agrotech Private Limited Bank Loan Rating 21.6 CARE BBB+ (SO) 3 3F Oil Palm Agrotech Private Limited Bank Loan Rating 30.0 CARE BBB+ (SO) 4 4 Genius Minds Bank Loan Rating 25.0 CARE C 5 A B Chemicals India Private Limited Bank Loan Rating 20.0 CARE B+ / CARE A4 6 A B Chemicals India Private Limited Bank Loan Rating 280.0 CARE A4 7 A Class Marbles India Private Limited Bank Loan Rating 40.0 CARE A4 8 A Class Marbles India Private Limited Bank Loan Rating 30.0 CARE B 9 A. B. Grain Spirits Private Limited Bank Loan Rating 1,137.1 CARE BB- 10 A. B. Grain Spirits Private Limited Bank Loan Rating 56.7 CARE A4 11 A. B. Polypacks Private Limited Bank Loan Rating 9.7 CARE BB 12 A. B. Polypacks Private Limited Bank Loan Rating 50.0 CARE BB 13 A. B. Polypacks Private Limited Bank Loan Rating 10.0 CARE A4 14 A. I. Metals Private Limited Bank Loan Rating 20.0 CARE A4 15 A. I. Metals Private Limited Bank Loan Rating 170.0 CARE B+ 16 A. N. Pandey Bank Loan Rating 40.0 CARE BB 17 A. N. Pandey Bank Loan Rating 40.0 CARE A4 18 A.K. Spintex Limited Bank Loan Rating 75.0 CARE BB- 19 AAA Roller Flour Mills Private Limited Bank Loan Rating 150.0 CARE B+ 20 Aachi Spices and Foods Private Limited Bank Loan Rating 123.8 CARE BB 21 Aachi Spices and Foods Private Limited Bank Loan Rating 60.0 CARE BB 22 Aachi Spices and Foods Private Limited