Press Release Svatantra Micro Housing Finance Corporation Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2014-15

1 annual report 2014-15 2014-15 Microfinance Institutions Network annual report annual report 2014-15 contents 4 | President’s Message 6 | CEO’s Message 1 2 8 | About MFIN 20 | Governance 3 4 32 | Our Work 51 | Industry Trends 5 6 56 | Microfinance Plus 64 | Awards and Recognition 7 Annex 1: List of MFIN Members 67 | MFIN Financials Annex 2: Board Attendance Annex 3: Abbreviations 3 2014-15 annual report President’s Message Dear Friends, I have had the privilege of being part attention and not mere lip service of the team led by visionary Vijay from the Central Government Mahajan since 2009 when 23 MFIs and the Reserve Bank of India got together and set up Alpha to (RBI). Prime Minister Modi has bring new discipline and direction to put financial inclusion at the top of the microfinance sector. The first act the government’s agenda with the was to contribute to a corpus of Rs. spectacular launch of Jan Dhan 2.5 crores and invest in High Mark Yojana, MUDRA Bank and the in order to put in place credit bureau various insurance programmes. He services for the sector. MFIN was has set a hectic pace; yet as a realist formed in November 2009 with the he realises that a comprehensive main objective of establishing itself financial inclusion for the poor as a Self-Regulatory Organisation is likely to take 20 years - RBI’s (SRO). Alok joined MFIN as CEO centenary year. The RBI under the in July 2010. I had to fill in the big leadership of Governor Raghuram shoes of Vijay once he retired as Rajan has taken the pro-active step President in July 2013. -

Corporate Governance Convergence: Lessons from the Indian Experience Afra Afsharipour

Northwestern Journal of International Law & Business Volume 29 Issue 2 Spring Spring 2009 Corporate Governance Convergence: Lessons from the Indian Experience Afra Afsharipour Follow this and additional works at: http://scholarlycommons.law.northwestern.edu/njilb Part of the Corporation and Enterprise Law Commons Recommended Citation Afra Afsharipour, Corporate Governance Convergence: Lessons from the Indian Experience, 29 Nw. J. Int'l L. & Bus. 335 (2009) This Article is brought to you for free and open access by Northwestern University School of Law Scholarly Commons. It has been accepted for inclusion in Northwestern Journal of International Law & Business by an authorized administrator of Northwestern University School of Law Scholarly Commons. Corporate Governance Convergence: Lessons from the Indian Experience Afra Afsharipour* Abstract: Over the past two decades, corporate governance reforms have emerged as a centralfocus of corporatelaw in countries across the development spectrum. Various legal scholars studying these reform efforts have engaged in a vigorous debate about whether globalization will lead to convergence of corporategovernance laws toward one model of governance: namely the Anglo- American, dispersed shareholder model, or whether existing national characteristicswill thwart convergence. Despite rapid economic growth and reforms in developing countries such as India, the legal literature discussing this debateprimarily focuses on developed economies. This Article examines recent corporategovernance reforms in India as a case study for evaluating the competing claims on global convergence of corporate governance standards currently polarizing the field of corporate law. This Article seeks to make a fresh contribution to the convergence debate by examining the implications of India 's corporate governance reform efforts. It contends that the Indian experience demonstrates that traditional theories predicting convergence, or a lack thereof fail to fully capture the trajectory of actual corporate governance reforms. -

Newsletter Final 2018.Cdr

SARALA BIRLA PUBLIC SCHOOL LETTERETTER April-July 2018-19 Speaking Personally... Learning is not a process that ends with the conclusion of one's school career. It is indeed a lifelong process. In an era of competition , success can only be achieved if one makes the right kind of effort at the right time. India is one of the few countries in the world that is blessed with rich cultural heritage, highly hard working pool of young people seeking new knowledge and education to raise India's stature to the top economies in the world. We, the members of Sarala Birla family, consistently give our young wards the proper orientation to become the successful, dynamic citizens of tomorrow. So, we focus on B. K. Dalan multidisciplinary way of teaching as education is the tool which helps us in removing all our doubts and Secretary fears about all the challenges. As we know school is the miniature of society: hence we, at SBPS teach children the importance of tolerance. It is their preparatory stage for entering public life and respecting each other's culture .Discipline, values and integrity are the foundation of this school. We respect the individuality of the students and help them develop inter and intra personal skill because we strongly believe in the theory of 'multiple intelligence'. Our pedagogy is child – centric with emphasis on inquiry and project‐based learning. We focus not only on scholastic and co‐scholastic but also on development of skills. Communication is one of the most important skills for a person so our school promotes multilingualism to Pradip Varma Head, Personnel & Admin. -

NSDL UPDATE June 2018

NSDL UPDATE June 2018 News Articles Addition to demat rejection reason code for Issuers/ RTAs A new rejection reason has been added in the list of reasons for rejection of dematerialisation request by Issuers/ RTAs: Rejection Code Rejection Reason 47*(Refer note) Physical Shares transferred/transmitted to IEPF Demat Account *The demat rejection code ‘47 - cancelled by investor’ which was in use between October 23, 2009 and December 16, 2010 has been assigned a new code ‘98 - Cancelled by Investor’. Participants are advised to incorporate the new rejection code ‘98 - Cancelled by Investor’ in their back office system in place of ‘47 - cancelled by investor’ to ensure that SOT/ Demat rejection request reports generated from back office system shows the proper rejection reason for the cancellation done in past. Reference: Circular No. NSDL/POLICY/2018/0026 dated May 8, 2018, available on NSDL website www.nsdl.co.in Subscription to SPEED-e During May 2018, one more Participant has subscribed to the SPEED-e facility - Allahabad Bank (DP ID IN300853) Clients of the above mentioned Participant can now avail the facility of submitting various instructions through SPEED-e facility. This takes the total number of Participants which have subscribed to SPEED-e to 201. Training Programmes for Participants: NISM / NSDL-DO training / certification programme for Participants To facilitate officials of Participants to prepare and appear for NISM - Series VI Depository Operations Certification Examination (DOCE), NSDL conducted three training programmes -

August 19, 2020 INFORMATION MEMORANDUM SVATANTRA

August 19, 2020 INFORMATION MEMORANDUM SVATANTRA MICROFIN PRIVATE LIMITED A private limited company incorporated under the Companies Act, 2013 Date of Incorporation: February 17, 2012 Registered Office: Level 20, Sunshine Tower, Senapati Bapat Marg, Elphinstone Road, Mumbai – 400 013; Telephone No.: 022 61415900 E-mail: [email protected] Website: www.svatantramicrofin.com INFORMATION MEMORANDUM UNDER COMPANIES ACT, 2013, SCHEDULE I OF SEBI (ISSUE AND LISTING OF DEBT SECURITIES) REGULATIONS, 2008 ("SEBI DEBT LISTING REGULATIONS"), AS AMENDED FROM TIME TO TIME Issue of 250 (Two Hundred and Fifty) Rated, Listed, Senior, Secured, Redeemable, Taxable, Non-Convertible Debentures, each having a face value of Rs. 10,00,000/- (Indian Rupees Ten Lakh), aggregating up to Rs. 25,00,00,000/- (Indian Rupees Twenty-Five Crore) issued on a fully paid basis and on a private placement basis (the “Issue”) Dated: August 19, 2020 Background: This information memorandum ("Information Memorandum" or "Disclosure Document") is related to the Debentures (as defined below) to be issued by Svatantra Microfin Private Limited (the “Issuer” or “Company” or "Svatantra") on a private placement basis and contains relevant information and disclosures required for the purpose of issuing of the Debentures. The issue of the Debentures comprised in the Issue and described under this Information Memorandum has been authorized by the Issuer through resolutions of the shareholders under Section 180(1)(c) and 180(1)(a) of the Act (as defined below) dated April 19, 2019 and the resolution of the borrowing committee of the Board of Directors dated August 17, 2020 read with the resolution passed by the board of directors of the Issuer on May 30, 2020 and the Memorandum and Articles of Association of the Company. -

Grasim Industries Ltd, Aditya Birla Group Announced the First Edition of Liva Protégé 2015- a National-Level Designer Hunt

Grasim Industries Ltd, Aditya Birla Group Announced the First Edition of Liva Protégé 2015- A National-Level Designer Hunt Liva Protégé 2015, a pan India designer hunt for recognizing India’s future stars in the field of fashion, takes pride in announcing that after covering over 12 cities, top 50 fashion institutes and touching more than a hundred students across India, it has reached the final leg of the journey – the Grand Finale showcased the work of its Top 12 finalists on 23rd December, 2015 in Mumbai. The annual, pan-India hunt for the brightest fashion designers in India was open to final year students of select colleges. The competition gives them chance to showcase their talent and get mentored by some of the biggest names in the industry. The winner of Liva Protege gets an opportunity to work with the prestigious in house design team of online fashion e commerce venture of Aditya Birla Group –ABOF.com (All About Fashion) OR an opportunity to have upto 5 of his/her designs sold onwww.abof.com besides a cash prize of INR2,00,000. The First runner up gets an opportunity to have upto 3 of his/her designs sold on www.abof.com and a cash Actress Soha Ali Khan with prize of INR 1,00,000 . The Second runner up will win a cash Mr. K.K. Maheshwari prize of INR50,000. Liva Protégé is powered by Liva – a new-age fabric, from the house of Birla Cellulose, designed to infuse incredible fluidity into garments. It aims to tap into the great Indian talent pool and ensure that promising fashion designers in India get their rightful place under the sun, and help India keep shining across the global fashion landscape. -

04 Delhi / Jaipur / Agra / Delhi TOUR SCHEDULE

MAHATMA GANDHI MOHANDAS KARAMCHAND GANDHI 2 October 1869 - 30 January 1948 PROGRAM- 04 Delhi / Jaipur / Agra / Delhi TOUR SCHEDULE Day 01 Arrive Delhi Upon arrival, after clearing immigration and custom, you will be met and transferred to your hotel. (Check-in at 1200hrs) Overnight at hotel / Home Stay Day 02 Delhi Following breakfast, Full day city tour of Old & New Delhi Old Delhi: Visit Raj Ghat, National Gandhi museum (Closed on Mondays), Old Delhi Here you will drive past Red Fort, the most opulent Fort and Palace of the Mughal Empire: Raj Ghat, the memorial site of the Mahatma Gandhi, Jama Masjid, the largest mosque in India and Chandni Chowk, the bustling and colourful market of the old city (Red Fort Closed on Mondays) Afternoon, visit New Delhi. Gandhi Smriti formerly known as Birla House or Birla Bhavan, is a museum dedicated to Mahatma Gandhi, situated on Tees January Road, formerly Albuquerque Road, in New Delhi, India. It is the location where Mahatma Gandhi spent the last 144 days of his life and was assassinated on 30 January 1948. It was originally the house of the Indian business tycoons, the Birla family. It is now also home to the Eternal Gandhi Multimedia Museum, which was established in 2005. The museum is open for all days except Mondays and National Holidays Visits to such sights Humayun’s Tomb (1586): Built in the mid-16th century by Haji Begum, wife of Humayun, the second Moghul emperor, this is an early example of Moghul architecture. The elements in-'tte design — a squat building, lightened by high arched entrances, topped by a bulbous dome and surrounded by formal gardens — were to be refined over the years to the magnificence of the Taj Mahal in Agra. -

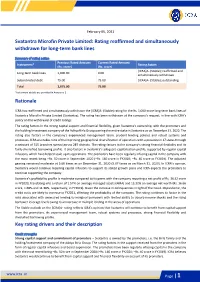

Svatantra Microfin Private Limited: Rating Reaffirmed and Simultaneously Withdrawn for Long-Term Bank Lines

February 05, 2021 Svatantra Microfin Private Limited: Rating reaffirmed and simultaneously withdrawn for long-term bank lines Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) [ICRA]A- (Stable); reaffirmed and Long-term bank lines 1,000.00 0.00 simultaneously withdrawn Subordinated debt 75.00 75.00 [ICRA]A- (Stable); outstanding Total 1,075.00 75.00 *Instrument details are provided in Annexure-1 Rationale ICRA has reaffirmed and simultaneously withdrawn the [ICRA]A- (Stable) rating for the Rs. 1,000-crore long-term bank lines of Svatantra Microfin Private Limited (Svatantra). The rating has been withdrawn at the company’s request, in line with ICRA’s policy on the withdrawal of credit ratings. The rating factors in the strong capital support and financial flexibility, given Svatantra’s ownership, with the promoters and the holding/investment company of the Aditya Birla Group owning the entire stake in Svatantra as on December 31, 2020. The rating also factors in the company’s experienced management team, prudent lending policies and robust systems and processes. ICRA also takes note of the improving geographical diversification of operations with a presence in 17 states through a network of 515 branches spread across 249 districts. The rating factors in the company’s strong financial flexibility and its fairly-diversified borrowing profile. It also factors in Svatantra’s adequate capitalisation profile, supported by regular capital infusions, which have helped scale up its operations. The promoters have been regularly infusing capital in the company with the most recent being ~Rs. -

AC 70 Special Issue

AtIN-HOUSE MAGAZINEChambal OF CHAMBAL FERTILISERS AND CHEMICALS LIMITED A legend, a visionary and a philanthropist. We pledge to keep his legacy alive. A legacy of ethical, moral and human values. Shri Krishna Kumar Birla TIVE EDITION 1918-2008 COMMEMORA SPECIAL Contents • Lead, Kindly Light 01 - 02 • The 'Birla' Legacy 03 • His Early Years 04 • Doyen of the Indian Industry 05 • Milestones in His Life 06 • A Multifaceted Personality 07 - 08 • Soulmates in Life and Eternity... 09 • His Torchbearers 10 • Zuari – Chambal – Paradeep – His Fertiliser Initiative 11 - 12 • Reaching out to the Society 13 • His Passion – Spread of Education 14 • “Babu” - The Person, a Tribute 15 - 16 REFERENCES • “Brushes with History- An Autobiography • Indo Asian News Service 1.9.08 • In League of Eminence & Condolence Letters 17 - 22 • The Hindustan Times - 1.9.08 • Press Trust of India - 1.9.08 • BITS Pilani Press Release - 1.9.08 • Wikipedia.org • Reference Library- Zuari Industries Limited, Chambal Fertilisers & Chemicals Limited • Shardhanjali 23 - 24 Complited, Edited & Published by : Saima Sharif on behalf of Chambal Fertilisers and Chemicals Limited With special thanks to Ms. Jyotsana Sud AT CHAMBAL is an in-house magazine, meant for private circulation only. News and views in this publication do not necessarily represent the opinion and verdict of the management of the company. Contents • Lead, Kindly Light 01 - 02 • The 'Birla' Legacy 03 • His Early Years 04 • Doyen of the Indian Industry 05 • Milestones in His Life 06 • A Multifaceted Personality -

CRISIL Indices Factsheet March 15 2021

CRISIL Indices Factsheet March 15, 2021 1 Table of Contents Constituent Details – 15 March 2021 ....................................................................................................... 3 Portfolio Parameters – 15 March 2021 ....................................................................................................38 Composite Index Weights .....................................................................................................................41 Features and Methodology....................................................................................................................51 Weighing Approach/Methodology..........................................................................................................57 List of CRISIL Indices – Objectives and Inception Dates .........................................................................72 Constituent Details – 15 March 2021 The securities that would form a part of the indices with effect from 15 March 2021 are as follows: Sr. Redemption Index Index ISIN Issuer/Security Name Coupon No Date* Weights Bharat Sanchar Nigam 1 INE103D08021 23-Sep-30 6.79% 7.46% Ltd. 06.79% 23-Sep-2030 FCI 06.65% (Series IX ) 2 INE861G08076 23-Oct-30 6.65% 10.00% 23-Oct-2030 HDFC 07.25% (Series X- 3 INE001A07SO0 17-Jun-30 7.25% 10.00% 006) 17-Jun-2030 IRFC 06.85% (Series 153) 4 INE053F07CS5 29-Oct-40 6.85% 10.00% 29-Oct-2040 L&T Infrastructure Fin 5 INE691I07EO1 08.10% (Series B of FY 28-Jun-30 8.10% 0.45% 2020-21) 28-Jun-2030 LICHF 08.70% (TRANCHE 6 INE115A07OB4 -

Pilot on Incubating Models of Digital Transactions for Microfinance Lending

PILOT ON INCUBATING MODELS OF DIGITAL TRANSACTIONS FOR MICROFINANCE LENDING End of the Project Report Implemented by: Technical Service Provider: Microfinance Institutions Network (MFIN) Spice Digital Ltd. Implemented by Sponsored by: Hong Kong and Shanghai Banking Corporation Limited (India) (HSBC India) Preface & Acknowledgements India is on the cusp of a digital revolution, mainly due to major influencers. First, the regulator is defining the landscape by innovation-led policies and maintaining security and risk management standards to highest levels. Second, the government is focused on moving towards a digital or less-cash economy. Third, the banks are embracing technology to accelerate digital payments using API banking. And last, we have fintech innovators who are re-imagining solutions for our day-to-day problems. Microfinance has decades of success growing and strengthening a high-touch, cash-intensive business model. Cash-based loan disbursals and collection provides various limitations over cash-less (digital) payments-based processes which includes high operational cost for the MFIs, high turnaround time, chances of frauds and inability to ascertain whether the collection amount has come from the borrower or from the group. Digital has changed the way financial services are being delivered in India and MFIs are no exception. As per MFIN publications, the MFIs are increasingly adopting cashless methods for disbursements (90% for most MFIs), however only 5% of repayments are cashless. In view of this, MFIN conducted a pilot project to understand a suitable model for loan collections using various digital payment instruments for the MFI industry, details of which are available in the report. The project focused on reviewing the adoption of multiple ways for making digital payments available in India, specifically— a) Aadhaar based payments used for financial inclusion that is built on the JAM trinity, i.e. -

Dictated Portion to Mr

REPORTABLE IN THE SUPRME COURT OF INDIA CIVIL APPELALTE JURISIDCTION CIVIL APPEAL NO. _2277 OF 2008 (Arising out of SLP (C) NO. 2089 OF 2007) Krishna Kumar Birla .... Appellant Versus Rajendra Singh Lodha and others … Respondents WITH CIVIL APPEAL NOS. 2275,2279,2276,2274,2278 OF 2007 (Arising out of SLP (C) NOS. 10176, 10571, 19040, 2090 AND 2091 OF 2007) S.B. SINHA, J. 1. Leave granted. INTRODUCTION 2 2. What is a caveatable interest within the meaning of the Indian Succession Act, 1925 (1925 Act) vis-a-vis the Rules framed by the Calcutta High Court in the year 1940 is the question involved herein. BACKGROUND FACTS 3. Smt. Priyamvada Devi Birla (PDB) and her husband Madhav Prasad Birla (MPB) were admittedly very wealthy persons. They owned an industrial empire known as the MP Birla Group of Industries. They were issueless and known for their charitable disposition. They used to run several charitable institutions. 4. Both MPB and PDB are said to have executed mutual wills on identical terms on or about 10th May, 1981 bequeathing his/her respective estate(s) barring certain specific legacies to the other and on the death of the survivor to the ‘charities’ to be nominated by the executors. However, the said wills were revoked and another set of mutual wills were executed on 13th July, 1982 in terms whereof, four executors were appointed in each set of Will (1982 Will). The executors nominated in MPB’s Will were :- 3 1. Smt. Priyamvada Devi Birla (PDB) 2. Krishna Kumar Birla (KKB) 3. Kashinath Tapuria and 4.