CHANGZHOU HAWD FLOORING CO. V. US

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Real Estate and Construction-210204-EN

Real Estate and Construction Beijing Guangzhou Hong Kong Shanghai Shenzhen 27/F, North Tower 17/F, International Finance 26/F, One Exchange Square 24/F, HKRI Centre Two, 17/F, Tower One, Kerry Plaza Beijing Kerry Centre Place, 8 Huaxia Road, 8 Connaught Place, Central HKRI Taikoo Hui 1 Zhong Xin Si Road 1 Guanghua Road Zhujiang New Town Hong Kong 288 Shi Men Yi Road Futian District Chaoyang District Guangzhou 510623, China Shanghai 200041, China Shenzhen 518048, China Beijing 100020, China Tel: +86 10 5769 5600 Tel: +86 20 3225 3888 Tel: +852 3976 8888 Tel: +86 21 2208 1166 Tel: +86 755 8159 3999 Fax:+86 10 5769 5788 Fax:+86 20 3225 3899 Fax:+852 2110 4285 Fax:+86 21 5298 5599 Fax:+86 755 8159 3900 www.fangdalaw.com Real Estate and Construction 01 Real Estate and Construction Practice Fangda’s Real Estate and Construction Practice Team excels at providing one-stop and full-scale services to leading real estate market players, including real estate developers, real estate private equity sponsors, institutional investors, financial institutions and other corporations and individuals in complicated domestic and cross-border real estate transactions. Our lawyers are frequently appointed as arbitrators in real estate and construction-related disputes. Our strength in this area includes a combination of understanding the traditions of the Chinese market and practice and our abundant experience in serving international clients, complemented by services for non-contentious and contentious cases. We are one of the few firms based in China that can provide integrated real estate and construction related legal services, and present practical advice based on our knowledge and experience in the local market. -

Slip Op. 20-178 UNITED STATES COURT of INTERNATIONAL TRADE Before: Timothy C. Stanceu, Chief Judge Consol. Court No. 15-00225 O

Slip Op. 20-178 UNITED STATES COURT OF INTERNATIONAL TRADE JIANGSU SENMAO BAMBOO AND WOOD INDUSTRY CO., LTD., et al., Plaintiffs, and GUANGDONG YIHUA TIMBER INDUSTRY CO., LTD., et al., Plaintiff-Intervenors, Before: Timothy C. Stanceu, Chief Judge v. Consol. Court No. 15-00225 UNITED STATES, Defendant, and COALITION FOR AMERICAN HARDWOOD PARITY, et al., Defendant-Intervenors. OPINION [Sustaining an agency determination issued in response to the court’s order in an antidumping duty proceeding.] Dated: December 10, 2020 Jeffrey S. Neeley, Husch Blackwell, LLP, of Washington, D.C., for plaintiffs and defendant-intervenors Jiangsu Senmao Bamboo and Wood Industry Co., Ltd., Baishan Huafeng Wooden Product Co., Ltd., Changbai Mountain Development and Protection Zone Hongtu Wood Industrial Co., Ltd., Chinafloors Timber (China) Co., Ltd., Dalian Consol. Court No. 15-00225 Page 2 Kemian Wood Industry Co., Ltd., Dalian Qianqiu Wooden Product Co., Ltd., Dasso Industrial Group Co., Ltd., Dongtai Fuan Universal Dynamics, LLC., Dun Hua Sen Tai Wood Co., Ltd., Dunhua City Wanrong Wood Industry Co., Ltd., Fusong Jinlong Wooden Group Co., Ltd., Fusong Jinqiu Wooden Product Co., Ltd., Fusong Qianqiu Wooden Product Co., Ltd., Guangzhou Panyu Kangda Board Co., Ltd., Hunchun Forest Wolf Wooden Industry Co., Ltd., Jiafeng Wood (Suzhou) Co., Ltd., Jiangsu Guyu International Trading Co., Ltd., Jiangsu Kentier Wood Co., Ltd., Jiangsu Mingle Flooring Co., Ltd., Jiangsu Simba Flooring Co., Ltd., Jiashan HuiJiaLe Decoration Material Co., Ltd., Jilin Forest Industry Jinqiao Flooring Group Co., Ltd., Kemian Wood Industry (Kunshan) Co., Ltd., Nanjing Minglin Wooden Industry Co., Ltd., Puli Trading Limited, Shanghai Lizhong Wood Products Co., Ltd./The Lizhong Wood Industry Limited Company of Shanghai/Linyi Youyou Wood Co., Ltd., Suzhou Dongda Wood Co., Ltd., Tongxiang Jisheng Import And Export Co., Ltd., Zhejiang Fudeli Timber Industry Co., Ltd., and Zhejiang Shiyou Timber Co., Ltd. -

Tier 1 Manufacturing Sites

TIER 1 MANUFACTURING SITES - Produced January 2021 SUPPLIER NAME MANUFACTURING SITE NAME ADDRESS PRODUCT TYPE No of EMPLOYEES Albania Calzaturificio Maritan Spa George & Alex 4 Street Of Shijak Durres Apparel 100 - 500 Calzificio Eire Srl Italstyle Shpk Kombinati Tekstileve 5000 Berat Apparel 100 - 500 Extreme Sa Extreme Korca Bul 6 Deshmoret L7Nr 1 Korce Apparel 100 - 500 Bangladesh Acs Textiles (Bangladesh) Ltd Acs Textiles & Towel (Bangladesh) Tetlabo Ward 3 Parabo Narayangonj Rupgonj 1460 Home 1000 - PLUS Akh Eco Apparels Ltd Akh Eco Apparels Ltd 495 Balitha Shah Belishwer Dhamrai Dhaka 1800 Apparel 1000 - PLUS Albion Apparel Group Ltd Thianis Apparels Ltd Unit Fs Fb3 Road No2 Cepz Chittagong Apparel 1000 - PLUS Asmara International Ltd Artistic Design Ltd 232 233 Narasinghpur Savar Dhaka Ashulia Apparel 1000 - PLUS Asmara International Ltd Hameem - Creative Wash (Laundry) Nishat Nagar Tongi Gazipur Apparel 1000 - PLUS Aykroyd & Sons Ltd Taqwa Fabrics Ltd Kewa Boherarchala Gila Beradeed Sreepur Gazipur Apparel 500 - 1000 Bespoke By Ges Unip Lda Panasia Clothing Ltd Aziz Chowdhury Complex 2 Vogra Joydebpur Gazipur Apparel 1000 - PLUS Bm Fashions (Uk) Ltd Amantex Limited Boiragirchala Sreepur Gazipur Apparel 1000 - PLUS Bm Fashions (Uk) Ltd Asrotex Ltd Betjuri Naun Bazar Sreepur Gazipur Apparel 500 - 1000 Bm Fashions (Uk) Ltd Metro Knitting & Dyeing Mills Ltd (Factory-02) Charabag Ashulia Savar Dhaka Apparel 1000 - PLUS Bm Fashions (Uk) Ltd Tanzila Textile Ltd Baroipara Ashulia Savar Dhaka Apparel 1000 - PLUS Bm Fashions (Uk) Ltd Taqwa -

Factory Address Country

Factory Address Country Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

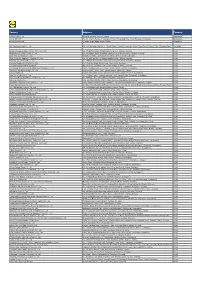

2020 NN Development Zone Directory4

Development Zone Directory Shanghai, Jiangsu, Zhejiang 2020 Contents Introduction 4 Shanghai 6 Jiangsu 11 Zhejiang 22 Others 32 Imprint Address Publisher: SwissCham China SwissCham Shanghai Administrator: SwissCham Shanghai Carlton Building, 11th Floor, Room1138, 21 Project execution, editorial and Huanghe Road, Shanghai, 200003. P. R. translations: Nini Qi (lead), China Eric Ma 中国上海市黄河路21号鸿祥大厦1138室 邮编 Project direction: Peter Bachmann :200003 Tel: 021 5368 1248 Copyright 2020 SwissCham China Web: https://www.swisscham.org/shanghai/ 2 Development Zone Directory 2020 Dear Readers, A lot has changed since we published our first edition of the Development Zone Directory back in 2017. But China remains one of the top investment hotspots in the world, despite ongoing trade and other disputes the country faces. While it is true that companies and countries are relocating or building up additional supply chains to lessen their dependence on China, it is also a fact that no other country has the industrial capacity, growing middle class and growth potential. The Chinese market attracts the most foreign direct investment and it well may do so for many years to come, given the large untapped markets in the central and western part of the country. Earlier this year, Premier Li Keqiang mentioned that there are 600 million Chinese citizens living with RMB 1,000 of monthly disposable income. While this may sounds surprising, it also shows the potential that Chinese inner regions have for the future. Investing in China and selling to the Chinese consumers is something that makes sense for companies from around the world. The development zones listed in this directory are here to support and help foreign investors to deal with the unique challenges in the Chinese market. -

Transmissibility of Hand, Foot, and Mouth Disease in 97 Counties of Jiangsu Province, China, 2015- 2020

Transmissibility of Hand, Foot, and Mouth Disease in 97 Counties of Jiangsu Province, China, 2015- 2020 Wei Zhang Xiamen University Jia Rui Xiamen University Xiaoqing Cheng Jiangsu Provincial Center for Disease Control and Prevention Bin Deng Xiamen University Hesong Zhang Xiamen University Lijing Huang Xiamen University Lexin Zhang Xiamen University Simiao Zuo Xiamen University Junru Li Xiamen University XingCheng Huang Xiamen University Yanhua Su Xiamen University Benhua Zhao Xiamen University Yan Niu Chinese Center for Disease Control and Prevention, Beijing City, People’s Republic of China Hongwei Li Xiamen University Jian-li Hu Jiangsu Provincial Center for Disease Control and Prevention Tianmu Chen ( [email protected] ) Page 1/30 Xiamen University Research Article Keywords: Hand foot mouth disease, Jiangsu Province, model, transmissibility, effective reproduction number Posted Date: July 30th, 2021 DOI: https://doi.org/10.21203/rs.3.rs-752604/v1 License: This work is licensed under a Creative Commons Attribution 4.0 International License. Read Full License Page 2/30 Abstract Background: Hand, foot, and mouth disease (HFMD) has been a serious disease burden in the Asia Pacic region represented by China, and the transmission characteristics of HFMD in regions haven’t been clear. This study calculated the transmissibility of HFMD at county levels in Jiangsu Province, China, analyzed the differences of transmissibility and explored the reasons. Methods: We built susceptible-exposed-infectious-asymptomatic-removed (SEIAR) model for seasonal characteristics of HFMD, estimated effective reproduction number (Reff) by tting the incidence of HFMD in 97 counties of Jiangsu Province from 2015 to 2020, compared incidence rate and transmissibility in different counties by non -parametric test, rapid cluster analysis and rank-sum ratio. -

Federal Register/Vol. 85, No. 62/Tuesday, March 31, 2020/Notices

Federal Register / Vol. 85, No. 62 / Tuesday, March 31, 2020 / Notices 17855 IV. Request for Comments Dated: March 25, 2020. Dated: March 25, 2020. Andrew McGilvray, Jeffrey I. Kessler, Comments are invited on: (a) Whether Executive Secretary. Assistant Secretary for Enforcement and the proposed collection of information Compliance, Alternate Chairman, Foreign- [FR Doc. 2020–06637 Filed 3–30–20; 8:45 am] is necessary for the proper performance Trade Zones Board. BILLING CODE 3510–DS–P of the functions of the agency, including [FR Doc. 2020–06636 Filed 3–30–20; 8:45 am] whether the information will have BILLING CODE 3510–DS–P practical utility; (b) the accuracy of the DEPARTMENT OF COMMERCE agency’s estimate of the burden DEPARTMENT OF COMMERCE (including hours and cost) of the Foreign-Trade Zones Board proposed collection of information; (c) ways to enhance the quality, utility, and International Trade Administration [Order No. 2094] clarity of the information to be [A–570–106] collected; and (d) ways to minimize the Approval of Subzone Status; Frank’s burden of the collection of information Wooden Cabinets and Vanities and International, LLC, New Iberia and Components Thereof From the on respondents, including through the Lafayette, Louisiana use of automated collection techniques People’s Republic of China: Corrected Notice of Final Affirmative or other forms of information Pursuant to its authority under the technology. Determination of Sales at Less Than Foreign-Trade Zones Act of June 18, Fair Value Comments submitted in response to 1934, as amended (19 U.S.C. 81a–81u), this notice will be summarized and/or the Foreign-Trade Zones Board (the AGENCY: Enforcement and Compliance, included in the request for OMB Board) adopts the following Order: International Trade Administration, Department of Commerce. -

Polycentricity in the Yangtze River Delta Urban Agglomeration (YRDUA): More Cohesion Or More Disparities?

sustainability Article Polycentricity in the Yangtze River Delta Urban Agglomeration (YRDUA): More Cohesion or More Disparities? Wen Chen 1, Komali Yenneti 2,*, Yehua Dennis Wei 3 , Feng Yuan 1, Jiawei Wu 1 and Jinlong Gao 1 1 Key Laboratory of Watershed Geographic Sciences, Nanjing Institute of Geography and Limnology, Chinese Academy of Sciences, 73 East Beijing Road, Nanjing 210008, China; [email protected] (W.C.); [email protected] (F.Y.); [email protected] (J.W.); [email protected] (J.G.) 2 Faculty of Built Environment, University of New South Wales (UNSW), Sydney, NSW 2052, Australia 3 Department of Geography, University of Utah, Salt Lake City, UT 84112, USA; [email protected] * Correspondence: [email protected] Received: 23 April 2019; Accepted: 28 May 2019; Published: 1 June 2019 Abstract: Urban spatial structure is a critical component of urban planning and development, and among the different urban spatial structure strategies, ‘polycentric mega-city region (PMR)’ has recently received great research and public policy interest in China. However, there is a lack of systematic understanding on the spatiality of PMR from a pluralistic perspective. This study aims to fill this gap by investigating the spatiality of PMR in the Yangtze River Delta Urban Agglomeration (YRDUA) using city-level data on gross domestic product (GDP), population share, and urban income growth for the period 2000–2013. The results reveal that economically, the YRDUA is experiencing greater polycentricity, but in terms of social welfare, the region manifests growing monocentricity. We further find that the triple transition framework (marketization, urbanization, and decentralization) can greatly explain the observed patterns. -

Final Chien and Wu Formatted

The Transformation of China’s Urban Entrepreneurialism: The Case Study of the City of Kunshan By Shiuh-Shen Chien, National Taiwan University Fulong Wu, University College London Abstract This article examines the formation and transformation of urban entrepreneurialism in the context of China’s market transition. Using the case study of Kunshan, which is ranked as one of the hundred “economically strongest county-level jurisdictions” in the country, the authors argue that two phases of urban entrepreneurialism—one from the 1990s until 2005, and another from 2005 onward—can be roughly distinguished. The first phase of urban entrepreneurialism was more market driven and locally initiated in the context of territorial competition. The second phase of urban entrepreneurialism involves greater intervention on the part of the state in the form of urban planning and top-down government coordination and regional collaboration. The evolution of Kunshan’s urban entrepreneurialism is not a result of deregulation or the retreat of the state. Rather, it is a consequence of reregulation by the municipal government with the goal of territorial consolidation. Introduction There is no doubt that local authorities the world over play a crucial role in promoting economic development in the context of globalization (Harvey 1989; Brenner 2003; Ward 2003; Jessop and Sum 2000). On the one hand, globalization may cause huge unexpected job loss when investors decide to shut down their companies and move out. Capital flight may also create opportunities in a different site. To deal with these challenges and opportunities, local authorities become entrepreneurial in improving their regions, in the hopes of accommodating more business investment and attracting more quality human capital. -

Duke Kunshan Planning Guide March 2011

Duke-Kunshan Planning Guide Prepared by Office of the Provost Office of Global Strategy and Programs Updated March 15, 2011 “A strategic international Duke would be one that decided where in the world it is of highest institutional value for us to be active and presented our strengths not separately but together, as collaborative contributors in the work of complex problem-solving— teams of Duke partners that could help partners in other countries form the communities of trained intelligence our world increasingly needs.” – President Richard H. Brodhead, Address to the Faculty, October 2007. Preface In Duke’s current strategic plan, Making a Difference, the University identified the increased globalization of research and education as both an opportunity and a challenge for Duke. As stated in the strategic plan: “Duke has long recognized that we cannot be a great university without being an international university. We operate in an interdependent world, where what were once hard and fast borders are now permeable, where individuals are part of an increasingly global community, and where problems transcend traditional boundaries.” Duke has long been an internationally engaged university. However, the strategic focus President Brodhead discussed in his address to the faculty in 2007 is new. Over the last decades, we have emphasized bringing the world into Duke through our curriculum and research interests, in the diversity of our faculty and students and the breadth and depth of colloquia and cultural programming. But we have entered a new phase of taking Duke to the world, consistent with our mission to develop and communicate new knowledge and to put knowledge in the service of society, understood not just regionally or nationally but also globally. -

2019 Public Supplier List

2019 Public Supplier List The list of suppliers includes original design manufacturers (ODMs), final assembly, and direct material suppliers. The volume and nature of business conducted with suppliers shifts as business needs change. This list represents a snapshot covering at least 95% of Dell’s spend during fiscal year 2020. Corporate Profile Address Dell Products / Supplier Type Sustainability Site GRI Procurement Category Compal 58 First Avenue, Alienware Notebook Final Assembly and/ Compal YES Comprehensive Free Trade Latitude Notebook or Original Design Zone, Kunshan, Jiangsu, Latitude Tablet Manufacturers People’s Republic Of China Mobile Precision Notebook XPS Notebook Poweredge Server Compal 8 Nandong Road, Pingzhen IoT Desktop Final Assembly and/ Compal YES District, Taoyuan, Taiwan IoT Embedded PC or Original Design Latitude Notebook Manufacturers Latitude Tablet Mobile Precision Notebook Compal 88, Sec. 1, Zongbao Inspiron Notebook Final Assembly and/ Compal YES Avenue, Chengdu Hi-tech Vostro Notebook or Original Design Comprehensive Bonded Zone, Manufacturers Shuangliu County, Chengdu, Sichuan, People’s Republic of China Public Supplier List 2019 | Published November 2020 | 01 of 40 Corporate Profile Address Dell Products / Supplier Type Sustainability Site GRI Procurement Category Dell 2366-2388 Jinshang Road, Alienware Desktop Final Assembly and/ Dell YES Information Guangdian, Inspiron Desktop or Original Design Xiamen, Fujian, People’s Optiplex All in One Manufacturers Republic of China Optiplex Desktop Precision Desktop -

Federal Register/Vol. 84, No. 135/Monday, July 15, 2019/Notices

Federal Register / Vol. 84, No. 135 / Monday, July 15, 2019 / Notices 33739 DEPARTMENT OF COMMERCE preliminary determination and must conduct administrative reviews of state the reasons for the request. various antidumping and countervailing International Trade Administration Commerce will grant the request unless duty orders and findings with May [A–423–814, A–580–899, A–791–824] it finds compelling reasons to deny the anniversary dates. In accordance with request. Commerce’s regulations, we are Acetone From Belgium, the Republic On July 1, 2019, the petitioner initiating those administrative reviews. of Korea, and the Republic of South submitted a timely request that DATES: Applicable July 15, 2019. Africa: Postponement of Preliminary Commerce postpone the preliminary FOR FURTHER INFORMATION CONTACT: Determinations in the Less-Than-Fair- determinations in these LTFV 3 Brenda E. Brown, Office of AD/CVD Value Investigations investigations. The petitioner stated Operations, Customs Liaison Unit, that it requests postponement because Enforcement and Compliance, AGENCY: Enforcement and Compliance, the initial questionnaire responses ‘‘are International Trade Administration, International Trade Administration, substantially deficient, and it may not U.S. Department of Commerce, 1401 Department of Commerce. be possible for Commerce to obtain Constitution Avenue NW, Washington, corrected responses within the current DATES: Applicable July 15, 2019. DC 20230, telephone: (202) 482–4735. schedule.’’ 4 FOR FURTHER INFORMATION CONTACT: Alex For