Research Dynamics Sample Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pizza Hut & Wingstreet

1 Pizza Hut & Wingstreet 734 Linden Drive Eden, North Carolina 27288 2 SANDS INVESTMENT GROUP EXCLUSIVELY MARKETED BY: MATTHEW RIZNYK ANDREW ACKERMAN Lic. # 404102 Lic. # 311619 404.383.3244 | DIRECT 770.626.0445 | DIRECT [email protected] [email protected] 1501 Johnson Ferry Road, Suite 200 Marietta, GA 30062 844.4.SIG.NNN www.SIGnnn.com In Cooperation With: Sands Investment Group North Carolina, LLC – Lic. # 29362 BoR: Amar Goli- Lic. # 310575 3 SANDS INVESTMENT GROUP TABLE OF CONTENTS 04 06 07 12 14 INVESTMENT OVERVIEW LEASE ABSTRACT PROPERTY OVERVIEW AREA OVERVIEW TENANT OVERVIEW Investment Summary Lease Summary Property Images City OvervieW Tenant Profiles Investment Highlights Rent Roll Location, Aerial & Retail Maps Demographics Parent Company © 2021 Sands Investment Group (SIG). The information contained in this ‘Offering Memorandum,’ has been obtained from sources believed to be reliable. Sands Investment Group does not doubt its accuracy; hoWever, Sands Investment Group makes no guarantee, representation or warranty about the accuracy contained herein. It is the responsibility of each individual to conduct thorough due diligence on any and all information that is passed on about the property to determine its accuracy and completeness. Any and all projections, market assumptions and cash floW analysis are used to help determine a potential overvieW on the property, hoWever there is no guarantee or assurance these projections, market assumptions and cash floW analysis are subject to change with property and market conditions. Sands Investment Group encourages all potential interested buyers to seek advice from your tax, financial and legal advisors before making any real estate purchase and transaction. -

Transferring Competitive Advantage Into International Markets Chick-Fil-A Case Study

Journal of Business and Economics, ISSN 2155-7950, USA May 2016, Volume 7, No. 5, pp. 828-835 DOI: 10.15341/jbe(2155-7950)/05.07.2016/010 © Academic Star Publishing Company, 2016 http://www.academicstar.us Transferring Competitive Advantage into International Markets Chick-fil-A Case Study Michael Furick (School of Business, Georgia Gwinnett College, Lawrenceville, Georgia, USA) Abstract: Chick-fil-A is the largest fast food restaurant chain in the U.S. specializing in chicken. The company has had 46 years of sales growth with 2014 revenue of $6 billion. The company only operates in the U.S. and this case study examines whether Chick-fil-A’s business model can be successful if used in an international expansion. The issues of country advantage, competitive advantage and transferability are discussed with a detailed examination of the Chick-fil-A business model. Chick-fil-A’s business model may not transfer internationally without significant changes and the reasons are discussed. Key words: competitive advantage; transferability; Chick-fil-A JEL codes: L100, L660 1. Introduction The first step in an international expansion is determining whether the available resources are sufficient and whether the company has products and services that can compete in foreign markets. The firm has to recognize the distinction between country-specific and firm-specific advantages. In general, global expansion tends to be more attractive for firms with firm-specific advantages rather than just country-specific advantages, but in either case, the transferability of the advantages can be a major issue. Chick-fil-A has produced an outstanding record of success in the U.S. -

Kentucky Fried Chicken Original Recipes

Kentucky Fried Chicken Original Recipes Colonel Harland Sanders Kentucky Fried Chicken Original Recipes Table of Contents Title Page.............................................................................................................................................................1 Preface..................................................................................................................................................................2 KFC BBQ Baked Beans ....................................................................................................................................4 KFC Pork BBQ Sauce ......................................................................................................................................5 KFC Buttermilk Biscuits ..................................................................................................................................6 KFC Cole Slaw ..................................................................................................................................................7 KFC Corn Muffins ............................................................................................................................................8 KFC Extra Crispy .............................................................................................................................................9 KFC Extra Crispy Strips ................................................................................................................................10 -

Fast Food Restaurants, Fast Casual Restaurants, and Casual Dining Restaurants

Commercial Revalue 2016 Assessment roll QUICK SERVICE RESTAURANTS AREA 413 King County, Department of Assessments Seattle, Washington John Wilson, Assessor Department of Assessments Accounting Division John Wilson 500 Fourth Avenue, ADM-AS-0740 Seattle, WA 98104-2384 Assessor (206) 205-0444 FAX (206) 296-0106 Email: [email protected] http://www.kingcounty.gov/assessor/ Dear Property Owners: Property assessments are being completed by our team throughout the year and valuation notices are being mailed out as neighborhoods are completed. We value your property at fee simple, reflecting property at its highest and best use and following the requirements of state law (RCW 84.40.030) to appraise property at true and fair value. We are continuing to work hard to implement your feedback and ensure we provide accurate and timely information to you. This has resulted in significant improvements to our website and online tools for your convenience. The following report summarizes the results of the assessments for this area along with a map located inside the report. It is meant to provide you with information about the process used and basis for property assessments in your area. Fairness, accuracy, and uniform assessments set the foundation for effective government. I am pleased to incorporate your input as we make continuous and ongoing improvements to best serve you. Our goal is to ensure every taxpayer is treated fairly and equitably. Our office is here to serve you. Please don’t hesitate to contact us if you should have questions, comments or concerns about the property assessment process and how it relates to your property. -

Greenwich Jollibee Bonchon Kfc Classic Savory Mang

GREENWICH JOLLIBEE BONCHON Ground Level Ground Level Ground Level (042) 373 77-11 (042) 710-0002 (042) 717-4911 KFC BUDDY’S RESTAURANT CLASSIC SAVORY Ground Level Second Level Ground Level (042) 323-2189 (042) 710-48-22 (042) 373-4606 MANG INASAL CHOWKING RED RIBBON Ground Level Ground Level Ground Level (042) 795-3800 (042) 717-3416 (042) 717-2943 COMMUNITY CURBSIDE SM CITY LUCENA SM CITY LUCENA SMSUPERMALLS.COM PICK-UP & TAKE-OUT RIDER DELIVERY PICK-UP BURGER KING DUNKIN DONUTS INFINITEA Ground Level Ground Level Third Level (042) 717-9532 CHATIME GERRY’S RESTARANT KOFFEE KLATCH Ground Level Ground Level Second Level 0906-483-1459 (042) 717-9515 (042) 713-0214 CLYDES GONG CHA MAX’S RESTAURANT Ground Level Second Level Second Level 0923-957-5922 09753097279 (042) 717-9032 COMMUNITY CURBSIDE SM CITY LUCENA SM CITY LUCENA SMSUPERMALLS.COM PICK-UP & TAKE-OUT RIDER DELIVERY PICK-UP PAN DE MANILA POTATO CORNER STARBUCKS Ground Level Third Level Ground Level 0977-797-0973 0925-889-3600 0917-851-5292 PEPPER LUNCH SHAWARMA SHACK TOKYO TOKYO Ground Level Ground Level Second Level (042) 717-0094 0917-793-0263 POP AND MIX SIOMAI HOUSE TURKS Third Level Second Level Third Level 0917-639-0902 0999-887-0919 COMMUNITY CURBSIDE SM CITY LUCENA SM CITY LUCENA SMSUPERMALLS.COM PICK-UP & TAKE-OUT RIDER DELIVERY PICK-UP WINGED POTATO ZARK’S BURGER Third Level Ground Level 0927-759-3789 (042) 717-0094 OPPA BUFFALO WINGS SAMGYEOPSAL AND THINGS Second Level Ground Level 0966-985-4089 (042) 322-9483 COMMUNITY CURBSIDE SM CITY LUCENA SM CITY LUCENA SMSUPERMALLS.COM -

The Lightning Bolt

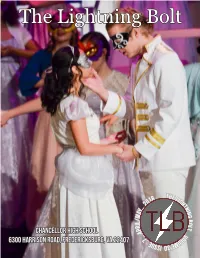

The Lightning Bolt 8 THE L 01 IGH . 2 T .. N y IN a G m B / O l i L T r p . A . V Chancellor High school . O . l 7 u . m e e u 6300 Harrison road, fredericksburg, va 22407 3 S S 0 I 1 April/May 2018 Mrs. Gattie Adviser Tyler Jacobs Editor-in-Chief Photo by Sarah Ransom and Naomi Nichols in the forefront, Jaime Ericson attends the Prince’s Ball in our spring makayla tardie dancing as townspeople. production of Cinderella Co-Editor-in-Chief/ Design editor Elizabeth Owusu News Editor becca Alicandro Photo by Makayla Tardie Photo by Lifetouch Ladies of the ball lament with one of Cinderella’s Kaitlyn Schwinn in action during a game. Features Editor stepsisters, played by Olivia Royster. Savannah Aversa Junior sports editor Ava purcell Junior op-ed editor Photo by TLB Staff Photo by TLB Staff The baseball team circles up in preparation before their game. Taylor sullivan Staff reporter Gynger adams staff reporter Photo by Makayla Tardie Photo by Molly McMullen Katelyn Siget and Molly McMullen chilling out at an Makayla Tardie, Natalie Masaitis, and Katelyn Siget art museum in D.C. taking a journey on the art field trip. April/May 2018 2 Editorials Going Beyond and Saying Goodbye By Tyler Jacobs indeed. longer be a Chancellor Charger, remain consistent and to always Editor-in-Chief While I am anxious to instead I’ll be transitioning to a have a smile for another person So here we are at the end of the pursue these paths, there is a Rowan Prof. -

KFC Social Responsibility Management Project

EXECUTIVE SUMMARY This project is all about KFC (Kentucky Fried Chicken). In this project, the history, its establishment, its restaurants network all over the world, is being discussed. We mainly focused on its being socially responsible aspect. Besides being a big profit earning organization it is also working for the betterment of the society. We have covered all the aspects regarding KFC’s socially responsible in Asia and rest of the world. If we look generally on KFC, Food, fun & festivity, this is what KFC is all about leading the market since its inception; KFC provides the ultimate chicken meals for a Chicken Loving Nation. Be it colonel sanders secret original recipe chicken or the hot & spicy version, every bit brings a YUM on our face. Serving delicious and hygienic food in a relaxing environment made KFC everyone's favorite, since then KFC has been constantly introducing new products and opening new restaurants for its customers. KFC was already in the minds of people for their unique and great taste. But since after being engaging itself in different social acts it has become more prominent among the people. 2 CONTENTS Topic Page # 1. Introduction…………………………………………………………….. 05 2. KFC- History………………………………………………….. 07 3. KFC Logo & Design…………………………………………... 09 4. Mission & Vision Statement…………………………………... 10 5. External Environment…………………………………………. 11 6. Strategy………………………………………………………… 12 7. Organization Structure & Design……………………………… 12 8. Culture…………………………………………………………. 13 9. HRM…………………………………………………………… 13 10. International Operations……………………………………….. 13 11. Social Responsibility…………………………………………... 14 12. KFC & Cupola………………………………………………… 15 13. KFC & FCSR…………………………………………………. 19 14. KFC CSR- Worldwide………………………………………… 21 15. KFC CSR- Asia……………………………………………….. 24 16. KFC CSR- Pakistan…………………………………………… 26 17. Conclusion……………………………………………………. -

KFC 5230 W Madison St Chicago, Illinois

NET LEASE INVESTMENT OFFERING KFC NET5230 LEASE W INVESTMENT Madison OFFERING St Chicago, Illinois TABLE OF CONTENTS I. Executive Summary II. Location Overview III. Market & Tenant Overview Executive Summary Site Plan Tenant Profile Investment Highlights Aerial Location Overview Property Overview Map Demographics NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. It STATEMENT: is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale a single tenant net leased KFC property located SUMMARY: in Chicago, Illinois. -

Media Contact: Lori Eberenz 502-874-8100 [email protected]

Media Contact: Lori Eberenz 502-874-8100 [email protected] KFC IS PROVIDING ONE MILLION PIECES OF KENTUCKY FRIED CHICKEN TO FEED COMMUNITIES ACROSS AMERICA The fried chicken brand is supporting local communities in need alongside franchisees at more than 4,000 restaurants nationwide March 31, 2020 – LOUISVILLE, Ky. – Today, Kentucky Fried Chicken® announced it will send one million pieces of chicken to KFC restaurants across the country, earmarked specifically to support local communities in need through donation during the COVID-19 pandemic. KFC and its franchisees operate more than 4,000 U.S. restaurants, serving Americans in all 50 states, and has continued feeding America through delivery, drive-thru and carryout during this unprecedented crisis. In recent weeks, many KFC franchisees, who live in and employ more than 80,000 team members in their local communities in America, are already showing up to support their local communities in a big way. From donating one thousand meals to frontline healthcare workers in southern Indiana (AJS, Inc., a 42-year KFC franchisee) to delivering KFC meals to essential workers (KBP Foods, KFC’s largest franchisee), KFC restaurant teams across the country are setting an example of what it means to band together in a time when it’s needed most. KFC U.S. is supporting its nationwide workforce and providing the means to do even more in their communities by shipping every KFC in the U.S. additional chicken supply – at no cost – that’s specifically purposed for good. “Seeing our franchisees coming together and helping their neighbors during this crisis has inspired us to do more,” said Kevin Hochman, president, KFC U.S. -

Air Fryer Chicken Cook Times

AAIIRR FFRRYYEERR CCHHIICCKKEENN CCOOOOKK TTIIMMEESS TEMP TEMP TIME (C) (F) Southern Air Fried Chicken Drumsticks 15 mins 185c 365f G Chicken Thighs & Root Mash 20 mins 190c 375f E L Air Fryer Chicken Thighs & Potatoes 25 mins 180c 360f Air Fryer Chicken Drumsticks 13 mins 175c 347f Air Fryer Southern Fried Chicken 15 mins 180c 360f Lemon Pepper Chicken 15 mins 180c 360f Air Fryer Chicken Breast 12 mins 175c 350f T Air Fryer Chicken Wrapped In Bacon 22 mins 170c 340f S Air Fryer Greek Chicken Souvlaki 9 mins 180c 180f A Air Fryer Chicken Spiedie 30 mins 185c 365f E Flourless Air Fryer Chicken Nuggets R 10 mins 180c 360f B Air Fryer Chicken For Tacos 25 mins 180c 360f Air Fryer Jerk Chicken 28 mins 180c 360f Jamaican Jerk Meatballs 14 mins 180c 360f Air Fryer Chicken Nuggets 10 mins 180c 360f Air Fryer Chicken Tenders 10 mins 175c 350f KFC Popcorn Chicken In The Air Fryer 12 mins 180c 360f D Air Fryer KFC Chicken Strips 12 mins 160c 320f E 12 mins 180c 360f D KFC Chicken In The Air Fryer A Air Fried Chicken Schnitzel 12 mins 180c 360f E Breaded Chicken In The Air Fryer 12 mins 180c 360f R Cheese Chicken Dippers 20 mins 180c 360f B Chicken Cordon Bleu 30 mins 180c 360f Air Fryer Chicken Cutlets 10 mins 180c 360f Air Fryer Ritz Cracker Chicken 16 mins 175c 350f AAIIRR FFRRYYEERR CCHHIICCKKEENN CCOOOOKK TTIIMMEESS TEMP TEMP TIME (C) (F) S G Jamaican Jerk Chicken Wings 15 mins 180c 360f N I Nandos Chicken Wings In The Air Fryer 25 mins 180c 360f Buffalo Chicken Wings In The Air Fryer 20 mins W 180c 360f Air Fryer Chinese Chicken Wings 22 mins -

Heart Attack Entrées and Side Orders of Stroke the Salt in Restaurant Meals Is Sabotaging Your Health

Heart Attack Entrées and Side Orders of Stroke The Salt in Restaurant Meals is Sabotaging Your Health Copyright © 2009 by Center for Science in the Public Interest The Center for Science in the Public Interest (CSPI), founded in 1971, is a nonprofit health advocacy organization. CSPI conducts innovative research and advocacy programs in the areas of nutrition, food safety, and alcoholic beverages and provides consumers with current information about their own health and well-being. CSPI is supported by 850,000 subscribers in the United States and Canada to its Nutrition Action Healthletter and by foundation grants. Center for Science in the Public Interest 1875 Connecticut Avenue, NW, #300 Washington, DC 20009 Tel: 202-332-9110 Fax: 202-265-4954 Email: [email protected] Internet: www.cspinet.org Table of Contents Ten of the Saltiest Adult Meals in America…………..page i Ten of the Saltiest Kids Meals in America…………….page ii Introduction …………………………………………………….page iii Restaurant Meals Data Charts and Graphs…………..page 1 • Arby’s……………………………………………….page 1 • Burger King………………………………………page 3 • Chick-fil-A………………………………………..page 5 • Chili’s……………………………………………….page 7 • Dairy Queen……………………………………..page 9 • Denny’s…………………………………………….page 11 • Jack in the Box………………………………….page 13 • KFC………………………………………………….page 15 • McDonald’s……………………………………….page 18 • Olive Garden……………………………………..page 20 • Panera Bread……………………………………..page 22 • Pizza Hut…………………………………………..page 24 • Red Lobster……………………………………….page 25 • Sonic………………………………………………...page 28 • Subway……………………………………………..page -

Shake Shack Inc. (SHAK) Is an American-Born Premium Fast- Company Data

THE FINAL PAGE OF THIS REPORT CONTAINS A DETAILED DISCLAIMER The content and opinions in this report are written by university students from the CityU Student Research & Investment Club, and thus are for reference only. Investors are fully responsible for their investment decisions. CityU Student Research & Investment Club is not responsible for any direct or indirect loss resulting from investments referenced to this report. The opinions in this report constitute the opinion of the CityU Student Research & Investment Club and do not constitute the opinion of the City University of Hong Kong nor any governing or student body or department under the University. Rating HOLD October 14th, 2019 Price (10/19/2019 USD) 88.49 Target price (USD) 77.85 Americas % down from Price on 10/19/2019 12.02% Equity Research Market cap. (USD, b) 03.30 Restaurants Enterprise Value (USD b) 03.24 Stock ratings are relative to the coverage universe in each analyst's or each team's respective sector. Target price is for SHAKE SHACK INCORPORATED (SHAK:NYSE) 12 months. Research Analysts: Our analysis on ‘Shake Shack’ (from hereupon referred to as “Shake Shack”, Murtaza Salman Abedin “Shack” or “SHAK”) is Discounted Cash Flow valuation-driven. Shake +852 59858568 [email protected] Shack is a growing brand with rapidly rising potential, however being a small company it still faces various growth-oriented challenges. Our Daria Yong-Tong Yip [email protected] Valuation gives SHAK a fair share value of USD 77.85 (HOLD) and this Samya Malhotra has been calculated through a DCF valuation of the 5-Year forecast period [email protected] ranging from 2019E to 2023E.