LISTED INVESTMENT COMPANIES. [email protected]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 04 December 2020 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 13.48 -3.02 2.04 -24.57 -5.73 13.14 21.69 66.61 - - ABC Adelaide Brighton 3.23 2.22 3.19 -2.46 -0.08 -18.14 -17.52 -1.18 4.55 98 ABP Abacus Property Grp 3.15 -0.63 6.42 21.82 -10.83 4.23 -3.52 6.74 8.37 69 AFI Australian Foundat 7.22 -0.82 8.41 17.95 9.38 13.38 9.55 8.04 7.01 75 AGL AGL Energy Limited 13.52 -1.46 5.54 -20.24 -27.72 -9.15 -12.47 1.87 3.88 102 AIA Auckland Internation 7.32 -0.41 8.77 11.76 -12.65 5.08 9.74 10.98 18.12 22 ALD Ampol Limited 30.77 0.46 21.00 9.73 -8.08 8.66 -1.78 0.93 10.77 56 ALL Aristocrat Leisure 31.84 -3.74 3.67 17.51 -3.91 17.25 14.09 28.04 29.23 7 ALQ ALS Limited 9.52 -2.36 -0.98 31.69 7.40 14.26 14.25 21.73 5.54 90 ALU Altium Limited 35.72 2.09 -5.53 -1.48 2.44 24.33 41.36 50.26 71.58 1 ALX Atlas Arteria 6.48 -1.22 8.91 -2.66 -11.90 3.02 5.85 12.80 18.17 21 AMC Amcor PLC 15.34 -0.84 0.16 3.68 8.49 11.97 3.36 6.80 13.24 39 AMP AMP Limited 1.72 -1.15 3.30 2.84 0.04 -12.32 -25.31 -14.07 -2.03 121 ANN Ansell Limited 35.68 -5.06 -14.07 0.81 26.57 27.11 14.59 12.75 11.78 48 ANZ ANZ Banking Grp Ltd 23.30 0.91 22.54 24.41 -1.20 -1.64 -1.47 2.25 5.11 94 APA APA Group 10.18 -3.69 -6.86 -9.84 -0.47 13.21 7.59 8.16 14.00 36 APE AP Eagers Limited 13.25 -0.53 14.13 81.51 37.33 41.67 21.54 5.80 20.09 20 APT Afterpay Touch 94.50 -0.21 -6.20 81.03 224.97 -

Morningstar Equity Research Coverage

December 2019 Equity Research Coverage Morningstar covers more than 200 companies in We use the following guidelines to Contact Details Australia and New Zealand as part of our global determine our Australian equity coverage: Australia stock coverage of about 1,500 companies. We are × Nearly all companies in the S&P/ASX 100 Index. Helpdesk: +61 2 9276 4446 Email: [email protected] one of the largest research teams globally with × Companies in the S&P/ASX 200 Index which more than 100 analysts, associates, and have an economic moat and/or have cash flow New Zealand strategists, including 17 in Australia. Local analysts which is at least mildly predictable. Helpdesk: +64 9 915 6770 regularly glean insights from our global sector teams × In total, Morningstar will cover about 80% of Email: [email protected] in China, Europe, and the United States, enriching S&P/ASX 200 companies (which typically the process and enhancing outcomes for investors. equates to about 95% of S&P/ASX 200 by Our research philosophy focuses on bottom-up market capitalisation). Companies we choose analysis, developing differentiated and deep not to cover in this index are usually unattractive opinions on competitive forces, growth prospects, for most portfolios, in our opinion. and valuations for every company we cover. We × About 30 ex-S&P/ASX 200 stocks are selected publish on each company under coverage at least on Morningstar’s judgement of each security's quarterly, and as events demand, to ensure investment merit − which includes a very investment ideas are always relevant. strong lean towards high-quality companies We are an independent research house, and with sustainable competitive advantages, or therefore determine our coverage universe based economic moats. -

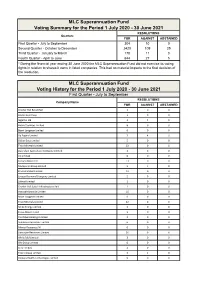

Voting Rights Exercised

MLC Superannuation Fund Voting Summary for the Period 1 July 2020 - 30 June 2021 RESOLUTIONS Quarters FOR AGAINST ABSTAINED First Quarter - July to September 304 10 0 Second Quarter - October to December 2420 109 25 Third Quarter - January to March 178 11 0 Fourth Quarter - April to June 644 27 5 * During the financial year ending 30 June 2020 the MLC Superannuation Fund did not exercise its voting rights in relation to shares it owns in listed companies. This had no material impacts to the final decision of the resolution. MLC Superannuation Fund Voting History for the Period 1 July 2020 - 30 June 2021 First Quarter - July to September RESOLUTIONS Company Name FOR AGAINST ABSTAINED Charter Hall Retail Reit 1 0 0 Alacer Gold Corp. 1 0 0 Isignthis Ltd 3 4 0 Ausnet Services Limited 8 0 0 Boart Longyear Limited 6 0 0 Ap Eagers Limited 3 4 0 Dicker Data Limited 5 0 0 Titan Minerals Limited 23 0 0 Australian Agricultural Company Limited. 4 0 0 Als Limited 6 0 0 Xanadu Mines Ltd 13 0 0 Macquarie Group Limited 5 1 0 Elixinol Global Limited 12 0 0 Lucapa Diamond Company Limited 5 0 0 Salmat Limited 1 0 0 Charter Hall Social Infrastructure Reit 1 0 0 Yancoal Australia Limited 16 0 0 Boart Longyear Limited 6 0 0 Titan Minerals Limited 22 0 0 Strike Energy Limited 2 0 0 Focus Minerals Ltd 3 0 0 Pointsbet Holdings Limited 2 0 0 Sundance Resources Limited 6 0 0 Mincor Resources Nl 6 0 0 Gascoyne Resources Limited 10 0 0 Whitefield Limited 3 0 0 Ofx Group Limited 6 0 0 Xero Limited 4 0 0 Thorn Group Limited 3 1 0 Volpara Health Technologies Limited 9 0 0 Fisher & Paykel Healthcare Corporation Limited 7 0 0 Centuria Industrial Reit Ordinary Units Fully Paid 2 0 0 Metcash Limited 5 0 0 Bionomics Limited 7 0 0 Collins Foods Limited 5 0 0 Todd River Resources Limited 10 0 0 Champion Iron Limited 10 0 0 Salmat Limited 6 0 0 Avenira Limited 4 0 0 Zip Co Limited. -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 09 October 2020 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 14.35 2.65 -12.12 -15.19 19.09 24.15 28.84 82.18 - - ABC Adelaide Brighton 3.23 12.94 18.75 48.30 16.35 -24.37 -14.42 -1.23 3.46 97 ABP Abacus Property Grp 2.94 1.38 5.00 22.20 -22.07 0.30 -2.80 3.11 7.73 69 AFI Australian Foundat 6.40 1.91 1.11 14.54 4.08 5.26 6.59 5.45 6.05 77 AGL AGL Energy Limited 13.50 0.00 -9.40 -19.81 -24.54 -10.63 -9.55 2.34 3.28 99 AIA Auckland Internation 6.99 3.25 8.54 25.49 -17.67 4.37 9.36 12.15 18.17 23 ALD Ampol Limited 24.54 7.21 1.45 2.35 -0.82 -6.35 -5.25 -2.49 10.86 54 ALL Aristocrat Leisure 30.81 3.32 7.69 34.54 0.78 7.81 14.23 28.94 25.35 9 ALQ ALS Limited 9.77 5.97 11.78 59.08 23.40 8.94 8.75 15.50 7.16 72 ALU Altium Limited 37.07 5.67 10.16 20.47 15.87 24.85 50.27 52.49 66.70 1 ALX Atlas Arteria 6.38 5.45 6.39 16.73 -21.24 1.73 9.38 14.77 18.38 21 AMC Amcor PLC 15.82 4.28 5.96 18.02 20.93 13.69 5.05 7.19 13.38 41 AMP AMP Limited 1.415 6.79 -0.37 16.04 -5.35 -28.55 -27.58 -16.04 -3.14 122 ANN Ansell Limited 38.79 4.98 6.98 33.55 49.68 27.71 21.20 17.89 12.47 46 ANZ ANZ Banking Grp Ltd 18.61 8.96 4.49 14.03 -27.43 -10.98 -8.36 -1.63 3.54 96 APA APA Group 10.67 3.39 4.51 -0.27 -1.06 7.89 14.33 7.25 14.21 36 APE AP Eagers Limited 11.10 17.46 29.82 168.77 -17.86 24.08 16.52 4.46 18.30 22 APT Afterpay Touch 89.51 12.38 20.88 306.86 156.62 -

Investment Menu 9 August 2021

Investment Menu 9 August 2021 This Investment Menu provides you with up-to-date listing of the Investment Options available through Australian Practical Investor Service. You should read the relevant disclosure documentation or seek appropriate professional advice before making an investment decision. The information in this Investment Menu refers to the Australian Practical Investor Service Guide dated 15 June 2020. Part 1: Core Menu Managed Funds Term Deposits NAME CODE NAME TYPE AMP BANK Janus Henderson Tactical Income IOF0145AU ANZ BANK Mercer Diversified Alternatives MIN0026AU BANK OF QUEENSLAND BANK Mercer Income Plus MIN0027AU GOLDFIELDS MONEY BANK State Street Australian Cash Trust SST0003AU MEMBERS EQUITY BANK BANK State Street Global Equity SST0050AU NAB BANK State Street Multi-Asset Builder SST0052AU Page 1 of 16 Part 2: Full Menu NAME CODE Cromwell Phoenix Property Securities CRM0008AU Managed Funds Cromwell Direct Property CRM0018AU NAME CODE Aberdeen Standard Australian Fixed Income CRS0004AU AAP0001AU Candriam Sustainable Global Equity Bentham Global Income CSA0038AU Ausbil Australian Geared Equity AAP0002AU Bentham Syndicated Loan CSA0046AU Ausbil MicroCap AAP0007AU Eley Griffiths Small Companies EGG0001AU Ausbil Australian Active Equity AAP0103AU Aberdeen Standard Asian Opportunities EQI0028AU Ausbil Australian Emerging Leaders AAP0104AU PIMCO Australian Bond Wholesale ETL0015AU Ausbil Active Dividend Income Wholesale AAP3656AU PIMCO Diversified Fixed Interest Wholesale ETL0016AU AllianceBernstein Managed Volatility Equities ACM0006AU PIMCO Global Bond Wholesale ETL0018AU Advance Balanced Multi Blend Wholesale ADV0050AU Aberdeen Standard Emerging Opportunities ETL0032AU Advance Growth Multi Blend Wholesale ADV0085AU MFS Fully Hedged Global Equity Trust ETL0041AU Advance High Growth Multi Blend Wholesale ADV0087AU SGH 20 ETL0042AU Advance Moderate Multi Blend Wholesale ADV0091AU SGH ICE ETL0062AU Fairview Equity Partners Emerging Companies ANT0002AU T. -

LISTED INVESTMENT COMPANIES. [email protected]

21 November 2019 September Quarter 2019 William Gormly LISTED INVESTMENT COMPANIES. [email protected] Market Update The market capitalisation of ASX Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) grew 6.1% to $47.9m in the September 2019 quarter. The report has now Inside this edition increased to feature 70 of the 112 LIC/LITs and account for 94.8% of the market size of the LIC/LIT sector. The LIC/LITs in the report combined deliver a return 4.6% for the month, which just lagged the overall sector of 4.7%. Partners Group Global Income Fund (PGG), the Market Update sole IPO for the quarter, raised $550m of new capital for a global private debt mandate. PGG Sector Summary is a LIT that aims to provide unitholders with a target monthly cash distribution of RBA Cash Profiles of 70 LIC/LITs Rate + 4% p.a. $794.6m was raised in secondary offerings, with NB Global Corporate Income Trust (NBI) raising a total of $476.3m via and Entitlement and Shortfall Offer. Plato Income Maximiser Limited (PL8) and Gryphon Capital Income Trust (GCI) also came back to market with successful secondary raisings. $47.5m as raised from options Index exercised and underwritten, whilst $96.8m came from Dividend Reinvestment Plans. Table of Contents 2 The top performing LIC/LIT for the quarter was Naos Small Cap Opportunities Company Market Update 3 Limited (NSC) with a share price return of 29.2% and a pre-tax (post realised gain) NTA Summary return of 25.7%. Domestic Equity 8 Global Equity 14 Top Investment Picks Specialist Strategy 20 MFF Capital Investments Limited (MFF): Continued superior long-term performance Premium/Discount to NTA 24 Share Price Pre-Tax NTA Prem/Disc Net Yield 1yr Returns: Share Price Pre-Tax NTA Liquidity 25 $3.17 $3.46 -8.2% 1.1% 14.0% 12.0% Global equity mandate that has provided shareholders with a net return greater than 20% p.a. -

PART 1: Core Menu PART 2: Full Menu Pooled Investment Options Pooled Investment Options

Investment Menu 9 August 2021 This Investment Menu provides you with up-to-date listing of the Investment Options available through Australian Practical Superannuation. You should read the relevant disclosure documentation or seek appropriate professional advice before making an investment decision. The information in this Investment Menu refers to the Australian Practical Superannuation Product Disclosure Statement dated 1 December 2020. PART 1: Core Menu PART 2: Full Menu Pooled Investment Options Pooled Investment Options NAME NAME Enhanced Cash Enhanced Cash 50/50 50/50 Passive Balanced Passive Balanced High Growth High Growth Passive High Growth Passive High Growth Managed Funds Managed Funds Holding Limits on certain Managed Funds investments are noted in Holding Limits on certain Managed Funds investments are noted in the menu table. the menu table. HOLDING HOLDING NAME CODE NAME CODE LIMIT LIMIT Janus Henderson Tactical Income IOF0145AU 20% AAP0007AU Ausbil MicroCap State Street Australian Cash Trust SST0003AU Ausbil Australian Emerging Leaders AAP0104AU State Street Multi-Asset Builder SST0052AU Ausbil Active Dividend Income State Street Global Equity SST0050AU Wholesale AAP3656AU AllianceBernstein Managed Volatility Equities ACM0006AU Term Deposits Fairview Equity Partners Holding limits do not apply to Term Deposits. Emerging Companies ANT0002AU NAME TYPE APN AREIT APN0008AU AMP BANK Smallco Investment ASC0001AU ANZ BANK Smallco Broadcap ASC0003AU BANK OF QUEENSLAND BANK Platypus Australian Equities Trust Wholesale AUS0030AU -

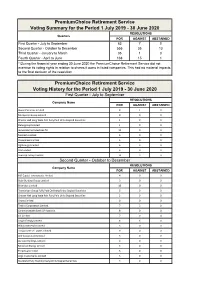

Voting Rights Exercised 2019-2020

PremiumChoice Retirement Service Voting Summary for the Period 1 July 2019 - 30 June 2020 RESOLUTIONS Quarters FOR AGAINST ABSTAINED First Quarter - July to September 63 7 0 Second Quarter - October to December 555 35 13 Third Quarter - January to March 35 1 0 Fourth Quarter - April to June 138 15 1 * During the financial year ending 30 June 2020 the PremiumChoice Retirement Service did not exercise its voting rights in relation to shares it owns in listed companies. This had no material impacts to the final decision of the resolution. PremiumChoice Retirement Service Voting History for the Period 1 July 2019 - 30 June 2020 First Quarter - July to September RESOLUTIONS Company Name FOR AGAINST ABSTAINED Ausnet Services Limited 9 1 0 Macquarie Group Limited 9 0 0 Charter Hall Long Wale Reit Fully Paid Units Stapled Securities 1 0 0 Duluxgroup Limited 1 0 0 James Hardie Industries Plc 13 0 0 Metcash Limited 5 0 0 Onemarket Limited 3 0 0 Agl Energy Limited. 6 3 0 Asx Limited 6 0 0 Suncorp Group Limited 10 3 0 Second Quarter - October to December RESOLUTIONS Company Name FOR AGAINST ABSTAINED Mff Capital Investments Limited 4 0 0 Baby Bunting Group Limited 3 0 0 Brambles Limited 10 0 0 Transurban Group Fully Paid Ordinary/Units Stapled Securities 6 0 0 Charter Hall Long Wale Reit Fully Paid Units Stapled Securities 2 0 0 Orora Limited 8 0 0 Telstra Corporation Limited. 7 2 0 Commonwealth Bank Of Australia. 8 0 0 Csl Limited 7 0 0 Origin Energy Limited 8 6 0 Pilbara Minerals Limited 5 0 0 Treasury Wine Estates Limited 9 0 0 Arb Corporation Limited. -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 06 November 2020 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 13.71 0.29 -3.18 -26.05 21.22 18.95 24.23 80.78 - - ABC Adelaide Brighton 3.21 13.43 3.22 31.88 -0.68 -22.02 -16.89 -1.37 2.99 101 ABP Abacus Property Grp 3.09 11.55 5.82 29.82 -15.59 1.33 -2.85 4.75 8.31 66 AFI Australian Foundat 6.75 3.69 6.97 19.62 3.86 9.23 7.94 6.33 6.12 77 AGL AGL Energy Limited 12.85 2.96 -6.20 -18.93 -29.55 -9.16 -13.97 0.97 3.28 99 AIA Auckland Internation 6.69 2.29 -1.33 21.86 -20.55 2.02 8.37 8.31 16.73 26 ALD Ampol Limited 25.66 -1.08 6.65 6.63 -4.38 0.22 -6.14 -1.02 10.27 54 ALL Aristocrat Leisure 31.67 10.62 3.03 28.90 3.53 9.37 11.25 28.62 24.93 13 ALQ ALS Limited 9.61 2.78 3.33 43.27 19.34 12.22 7.65 15.79 6.61 74 ALU Altium Limited 38.19 2.72 7.88 8.73 23.10 32.83 46.59 53.36 73.72 1 ALX Atlas Arteria 6.05 7.27 -5.47 5.30 -20.09 -1.37 3.62 12.17 17.27 23 AMC Amcor PLC 16.07 8.51 4.42 22.17 17.51 14.04 6.48 6.99 12.99 40 AMP AMP Limited 1.70 11.11 26.39 30.89 -4.24 -17.11 -25.12 -14.26 -2.56 119 ANN Ansell Limited 41.70 3.76 10.93 42.45 50.12 37.22 21.91 17.84 13.18 38 ANZ ANZ Banking Grp Ltd 19.60 4.20 9.56 22.53 -20.58 -7.76 -7.10 0.21 3.61 96 APA APA Group 10.89 3.81 3.03 -1.33 0.98 11.62 11.31 7.69 14.16 33 APE AP Eagers Limited 12.65 16.48 19.45 178.02 2.51 36.55 19.79 5.46 19.44 19 APT Afterpay Touch 100.50 3.94 20.39 152.51 287.43 178.04 -

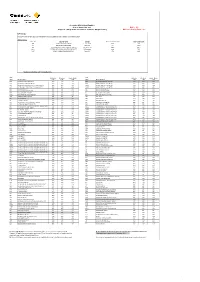

Commsec Margin Lending Approved Securities List

Accepted ASX Listed Equities as at 21 September 2021 Buffer - 5% Subject to change at the discretion of CommSec Margin Lending Maximum Gearing Ratio - 90% LVR Changes Changes since the last Approved Securities List was published are outlined in the below table: ASX Securities ASX Code Security Name Change Previous Portfolio LVR New Portfolio LVR AST AUSNET SERVICES LIMITED Capped LVR 75% 75% BGL BELLEVUE GOLD LIMITED New LVR 0% 40%* SXL SOUTHERN CROSS MEDIA GROUP LIMITED Uncapped LVR 40%* 40%* QLTY BETASHARES GLOBAL QUALITY LEADERS ETF LVR Increase 65% 70% CLNE VANECK GLOBAL CLEAN ENERGY ETF New LVR 0% 65% *Available via facilities with PLVR enabled only ASX Portfolio Standard Single Stock ASX Portfolio Standard Single Stock Code Security Name LVR LVR LVR Code Security Name LVR LVR LVR A200 BETASHARES AUSTRALIA 200 ETF 80% 75% 70% BNKS BETASHARES GLOBAL BANKS ETF 70% 65% 60% A2M THE A2 MILK COMPANY LIMITED 55% 50% 45% BOQ BANK OF QUEENSLAND LIMITED 70% 65% 60% AAA BETASHARES AUSTRALIAN HIGH INTEREST CASH ETF 90% 85% 80% BOQPE BANK OF QUEENSLAND LIMITED 70% 65% 60% AAC AUSTRALIAN AGRICULTURAL COMPANY LIMITED 50% 45% 40% BOQPF BANK OF QUEENSLAND LIMITED 70% 65% 60% ABA AUSWIDE BANK LTD 50% 45% 40% BPT BEACH ENERGY LIMITED 50% 45% 40% ABC ADELAIDE BRIGHTON LIMITED 60% 55% 50% BRG BREVILLE GROUP LIMITED 65% 60% 55% ABP ABACUS PROPERTY GROUP 65% 60% 55% BSL BLUESCOPE STEEL LIMITED 70% 65% 60% ACDC ETFS BATTERY TECH & LITHIUM ETF 60% 55% 50% BVS BRAVURA SOLUTIONS LIMITED 45% 40% 35% AD8 AUDINATE GROUP LIMITED 40% 0% 0% BWP BWP TRUST 70% 65% 60% ADH ADAIRS LIMITED 45% 40% 35% BWX BWX LIMITED 45% 40% 35% ADI APN INDUSTRIA REIT 60% 55% 50% BXB BRAMBLES LIMITED 80% 75% 70% AEF AUSTRALIAN ETHICAL INVESTMENT LIMITED 40% 35% 30% CAJ CAPITOL HEALTH LIMITED 40% 0% 0% AFG AUSTRALIAN FINANCE GROUP LTD 40% 35% 30% CAR CARSALES.COM LIMITED. -

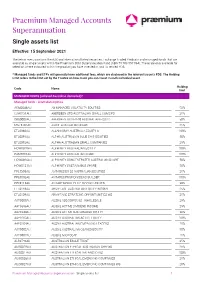

Praemium Super Single Assets List.Pdf

Praemium Managed Accounts Superannuation Single assets list Effective: 15 September 2021 The below menu contains the ASX and international listed securities, Exchange Traded Products and managed funds that are available as single assets within the Praemium SMA Superannuation Fund (ABN 75 703 857 864). These are only available for selection where indicated within the product you have invested in, and its related PDS. * Managed funds and ETPs will generally have additional fees, which are disclosed in the relevant issuer’s PDS. The Holding Limit refers to the limit set by the Trustee on how much you can invest in each individual asset. Holding Code Name limit MANAGED FUNDS (unlisted Australian domiciled)* Managed funds - Australian equities ACM0006AU AB MANAGED VOLATILITY EQUITIES 50% CSA0131AU ABERDEEN STD AUSTRALIAN SMALL COMS FD 25% CRS0003AU ABERDEEN STD EX-20 AUSTRALIAN EQS FD 50% MGE9705AU AIRLIE AUSTRALIAN SHARE 25% ETL0060AU ALLAN GRAY AUSTRALIA EQUITY A 100% ETL0091AU ALPHA AUSTRALIAN BLUE CHIP EQUITIES 50% ETL0092AU ALPHA AUSTRALIAN SMALL COMPANIES 25% HOW0019AU ALPHINITY AUSTRALIAN EQUITY 100% PAM0001AU ALPHINITY AUSTRALIAN SHARE 100% HOW0026AU ALPHINITY CONCENTRATED AUSTRALIAN SHARE 50% HOW0121AU ALPHINITY SUSTAINABLE SHARE 50% PPL5308AU ANTARES EX-20 AUSTRALIAN EQUITIES 25% PPL0002AU ANTARES PROF DIVIDEND BUILDER 100% PPL0115AU ANTARES PROF ELITE OPPORTUNITIES 50% ETL0148AU ARMYTAGE AUSTRALIAN EQUITY INCOME 25% ETL0139AU ARMYTAGE STRATEGIC OPPORTUNITIES WS 25% AAP0008AU AUSBIL 130/30 FOCUS - WHOLESALE 25% AAP3656AU AUSBIL ACTIVE -

Australian Listed Equity Proxy Voting Report

Australian Listed Equity Proxy Voting Report Vote Summary Report Reporting Period: 07/01/2019 to 12/31/2019 Location(s): All Locations Institution Account(s): All Institution Accounts Issuer Name Ticker Meeting Date Meeting Proposal Proposal Text Vote Type Number Instruction AusNet Services Ltd. AST 07/18/2019 Annual 2a Elect Li Lequan as Director For AusNet Services Ltd. AST 07/18/2019 Annual 2b Elect Tan Chee Meng as Director For AusNet Services Ltd. AST 07/18/2019 Annual 2c Elect Peter Mason as Director For AusNet Services Ltd. AST 07/18/2019 Annual 3 Approve Remuneration Report For AusNet Services Ltd. AST 07/18/2019 Annual 4a Approve Grant of Equity Awards to Nino Ficca For AusNet Services Ltd. AST 07/18/2019 Annual 4b Approve Grant of Equity Awards to Tony For Narvaez AusNet Services Ltd. AST 07/18/2019 Annual 5 Approve the Issuance of Up to 10 Percent of For the Company's Issued Capital AusNet Services Ltd. AST 07/18/2019 Annual 6 Approve Issuance of Shares Under the For Dividend Reinvestment Plan AusNet Services Ltd. AST 07/18/2019 Annual 7 Approve Issuance of Shares Under the For Employee Incentive Scheme Issuer Name Ticker Meeting Date Meeting Proposal Proposal Text Vote Type Number Instruction Macquarie Group Limited MQG 07/25/2019 Annual 2a Elect Michael J Hawker as Director For Macquarie Group Limited MQG 07/25/2019 Annual 2b Elect Michael J Coleman as Director For Macquarie Group Limited MQG 07/25/2019 Annual 2c Elect Philip M Coffey as Director For Macquarie Group Limited MQG 07/25/2019 Annual 2d Elect Jillian R Broadbent