LISTED INVESTMENT COMPANIES. [email protected]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Continuing to Innovate with a Focus on Global Business Initiatives Aligned with Changes in Our Markets

NEWSLETTER September 2018 BANDAI NAMCO Holdings Inc. BANDAI NAMCO Mirai-Kenkyusho 5-37-8 Shiba, Minato-ku, Tokyo 108-0014 Mitsuaki Taguchi Interview with the President President & Representative Director, BANDAI NAMCO Holdings Inc. Continuing to innovate with a focus on global business initiatives aligned with changes in our markets Under the Mid-term Plan, the Group announced a mid-term vision of CHANGE for the NEXT — Empower, Gain Momentum, and Accelerate Evolution, and launched a five-Unit system. In the first quarter, the Group achieved record-high sales. In these ways, the Mid-term Plan has gotten off to a favorable start. In this issue of the newsletter, BANDAI NAMCO Holdings’ President Mitsuaki Taguchi discusses the future results forecast and the situation with each of the Group’s Units. How were the results in the first What is the outlook for the future? for the mature fan base, BANDAI SPIRITS quarter? Taguchi: In our industry, the environment is CO., LTD., a new company that consolidates Taguchi: In the first quarter of FY2019.3, in undergoing drastic changes, and it is difficult the mature fan base business of the Toys and comparison with the same period of the previous to forecast all of the future trends based on Hobby Unit, started fullscale operation. With year, each business recorded favorable overall three months of results. Considering bolstered a separate organizational structure and a clarified progress with core IP* and products/services, marketing and promotion for businesses mission, the sense of speed in this business despite differences in the home video game recording favorable results; recent business has increased. -

BANDAI NAMCO Holdings Inc

BANDAI NAMCO Holdings Inc. Notice of the Fifteenth Ordinary General Meeting of Shareholders to be held on June 22, 2020 An English translation of the original notice in Japanese DISCLAIMER The following is an English translation of the Japanese original “Notice of the Fifteenth Ordinary General Meeting of Shareholders of BANDAI NAMCO Holdings Inc.” which meeting is to be held on June 22, 2020. The Company provides this translation for your reference and convenience only and does not guarantee its accuracy or otherwise. In the event of any discrepancies, the Japanese original notice shall prevail. These documents have been prepared solely in accordance with Japanese law and are offered here for informational purposes only. In particular, please note that the financial statements included in the following translation have been prepared in accordance with Japanese GAAP. * The English version of this Notice of the Fifteenth Ordinary General Meeting of Shareholders reflects the revisions announced in “Notice Regarding Partial Revision to the Notice of the Fifteenth Ordinary General Meeting of Shareholders” (in Japanese only) released on June 1, 2020 and June 10, 2020. 1 Securities code: 7832 June 5, 2020 5-37-8 Shiba, Minato-ku, Tokyo BANDAI NAMCO Holdings Inc. Mitsuaki Taguchi President and Representative Director Dear Shareholders, NOTICE OF THE FIFTEENTH ORDINARY GENERAL MEETING OF SHAREHOLDERS We would like to inform you that the Fifteenth Ordinary General Meeting of Shareholders of BANDAI NAMCO Holdings Inc. (“the Company”) will be held as set forth below. Although we will hold the General Meeting of Shareholders while being as thorough as possible in taking measures to prevent infection, for this fiscal year, we encourage you to exercise your voting rights in writing or via the Internet in advance instead of attending the meeting in order to prevent the spread of COVID-19. -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 04 December 2020 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 13.48 -3.02 2.04 -24.57 -5.73 13.14 21.69 66.61 - - ABC Adelaide Brighton 3.23 2.22 3.19 -2.46 -0.08 -18.14 -17.52 -1.18 4.55 98 ABP Abacus Property Grp 3.15 -0.63 6.42 21.82 -10.83 4.23 -3.52 6.74 8.37 69 AFI Australian Foundat 7.22 -0.82 8.41 17.95 9.38 13.38 9.55 8.04 7.01 75 AGL AGL Energy Limited 13.52 -1.46 5.54 -20.24 -27.72 -9.15 -12.47 1.87 3.88 102 AIA Auckland Internation 7.32 -0.41 8.77 11.76 -12.65 5.08 9.74 10.98 18.12 22 ALD Ampol Limited 30.77 0.46 21.00 9.73 -8.08 8.66 -1.78 0.93 10.77 56 ALL Aristocrat Leisure 31.84 -3.74 3.67 17.51 -3.91 17.25 14.09 28.04 29.23 7 ALQ ALS Limited 9.52 -2.36 -0.98 31.69 7.40 14.26 14.25 21.73 5.54 90 ALU Altium Limited 35.72 2.09 -5.53 -1.48 2.44 24.33 41.36 50.26 71.58 1 ALX Atlas Arteria 6.48 -1.22 8.91 -2.66 -11.90 3.02 5.85 12.80 18.17 21 AMC Amcor PLC 15.34 -0.84 0.16 3.68 8.49 11.97 3.36 6.80 13.24 39 AMP AMP Limited 1.72 -1.15 3.30 2.84 0.04 -12.32 -25.31 -14.07 -2.03 121 ANN Ansell Limited 35.68 -5.06 -14.07 0.81 26.57 27.11 14.59 12.75 11.78 48 ANZ ANZ Banking Grp Ltd 23.30 0.91 22.54 24.41 -1.20 -1.64 -1.47 2.25 5.11 94 APA APA Group 10.18 -3.69 -6.86 -9.84 -0.47 13.21 7.59 8.16 14.00 36 APE AP Eagers Limited 13.25 -0.53 14.13 81.51 37.33 41.67 21.54 5.80 20.09 20 APT Afterpay Touch 94.50 -0.21 -6.20 81.03 224.97 -

BANDAI NAMCO Group FACT BOOK 2019 BANDAI NAMCO Group FACT BOOK 2019

BANDAI NAMCO Group FACT BOOK 2019 BANDAI NAMCO Group FACT BOOK 2019 TABLE OF CONTENTS 1 BANDAI NAMCO Group Outline 3 Related Market Data Group Organization Toys and Hobby 01 Overview of Group Organization 20 Toy Market 21 Plastic Model Market Results of Operations Figure Market 02 Consolidated Business Performance Capsule Toy Market Management Indicators Card Product Market 03 Sales by Category 22 Candy Toy Market Children’s Lifestyle (Sundries) Market Products / Service Data Babies’ / Children’s Clothing Market 04 Sales of IPs Toys and Hobby Unit Network Entertainment 06 Network Entertainment Unit 22 Game App Market 07 Real Entertainment Unit Top Publishers in the Global App Market Visual and Music Production Unit 23 Home Video Game Market IP Creation Unit Real Entertainment 23 Amusement Machine Market 2 BANDAI NAMCO Group’s History Amusement Facility Market History 08 BANDAI’s History Visual and Music Production NAMCO’s History 24 Visual Software Market 16 BANDAI NAMCO Group’s History Music Content Market IP Creation 24 Animation Market Notes: 1. Figures in this report have been rounded down. 2. This English-language fact book is based on a translation of the Japanese-language fact book. 1 BANDAI NAMCO Group Outline GROUP ORGANIZATION OVERVIEW OF GROUP ORGANIZATION Units Core Company Toys and Hobby BANDAI CO., LTD. Network Entertainment BANDAI NAMCO Entertainment Inc. BANDAI NAMCO Holdings Inc. Real Entertainment BANDAI NAMCO Amusement Inc. Visual and Music Production BANDAI NAMCO Arts Inc. IP Creation SUNRISE INC. Affiliated Business -

BANDAI NAMCO Holdings Inc

February 8, 2021 Name of listed company: BANDAI NAMCO Holdings Inc. Name of representative: Mitsuaki Taguchi, President and Representative Director (Code Number: 7832 TSE 1st section) Contact: Yuji Asako, Director, Division General Manager of the Corporate Planning Division Notice Regarding Changes in Representative Directors BANDAI NAMCO Holdings Inc. (“the Company”) hereby announces that the Board of Directors meeting has passed the resolution today to change the Representative Directors of the Company. 1. Reasons for changes The BANDAI NAMCO Group (“the Group”) will embark on a new Mid-term Plan from April 2022, reflecting a new strategic direction for BANDAI NAMCO in a new era of dramatically changing sense of values and lifestyles. From April 2021, each business will join together in a united effort to a greater degree than before under the ALL BANDAI NAMCO concept in preparation for the next Mid-term Plan. The Company will reorganize its Unit structure to further strengthen its IP Axis Strategy in the global market, and will change to a new structure for its directors. Under the new director structure, Masaru Kawaguchi will be appointed President and Representative Director, and will lead the formulation of the next Mid-term Plan, as well as preparations for the execution of strategies and establishment of the business foundation. Mitsuaki Taguchi will participate in management as Chairman and Director from a wide ranging perspective on group management, utilizing the insight gained from his role as Representative Director up until now. 2. Details of changes Directors to be appointed Name Current position President and Representative Chairman and Director Mitsuaki Taguchi Director President and Representative Executive Vice President and Masaru Kawaguchi Director Director 3. -

Lengua Y Cultura En Español En El Japón De La Era Reiwa

Lengua y cultura en español en el Japón de la era Reiwa Ángel Badillo Matos Enero 2021 Príncipe de Vergara, 51 28006 Madrid (Spain) www.realinstitutoelcano.org www.blog.rielcano.org www.globalpresence.realinstitutoelcano.org Lengua y cultura en español en el Japón de la era Reiwa Ángel Badillo Matos - Real Instituto Elcano - Enero 2021 Real Instituto Elcano - Madrid - España www.realinstitutoelcano.org © de la presente edición: Instituto Cervantes y Fundación Real Instituto Elcano de Estudios Internacionales y Estratégicos Coeditan: Instituto Cervantes y Fundación Real Instituto Elcano de Estudios Internacionales y Estratégicos ISBN: 978-84-92983-25-4 Depósito Legal: M-3043-2021 Lengua y cultura en español en el Japón de la era Reiwa Índice 1. Resumen Ejecutivo 2. Presentación 3. Cultura y educación en el Japón contemporáneo 3.1. ¿Un “superpoder” blando? Cultura y política cultural en el Japón contemporáneo 3.2. Otakus globales de la cultura kawaii 3.3. La construcción de la relación bilateral España-Japón 3.4. El campo cultural en la relación bilateral 3.5. Un caso especial: la presencia hispanoamericana en Japón (y viceversa) 3.6. La enseñanza del español en Japón 3.7. El español y el sistema educativo japonés 3.8. El español más allá del sistema educativo formal 4. A modo de conclusión Anexo Referencias Lengua y cultura en español en el Japón de la era Reiwa 1. Resumen Ejecutivo El Real Instituto Elcano –el más importante de los think tanks especializados en relaciones internacionales en España y uno de los más relevantes de Europa en este campo– inició en 2020 una serie de estudios acerca de la circulación de la cultura de España y en español en Asia. -

VANGUARD STAR FUNDS Form N-CSRS Filed 2021-06-29

SECURITIES AND EXCHANGE COMMISSION FORM N-CSRS Certified semi-annual shareholder report of registered management investment companies filed on Form N-CSR Filing Date: 2021-06-29 | Period of Report: 2021-04-30 SEC Accession No. 0001104659-21-086780 (HTML Version on secdatabase.com) FILER VANGUARD STAR FUNDS Mailing Address Business Address PO BOX 2600 PO BOX 2600 CIK:736054| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 V26 V26 Type: N-CSRS | Act: 40 | File No.: 811-03919 | Film No.: 211057747 VALLEY FORGE PA 19482 VALLEY FORGE PA 19482 6106691000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-CSR CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES Investment Company Act file number: 811-03919 Name of Registrant: Vanguard STAR Funds Address of Registrant: P.O. Box 2600 Valley Forge, PA 19482 Name and address of agent for service: Anne E. Robinson, Esquire P.O. Box 876 Valley Forge, PA 19482 Registrant’s telephone number, including area code: (610) 669-1000 Date of fiscal year end: October 31 Date of reporting period: November 1, 2020—April 30, 2021 Item 1: Reports to Shareholders Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Semiannual Report | April 30, 2021 Vanguard LifeStrategy® Funds Vanguard LifeStrategy Income Fund Vanguard LifeStrategy Conservative Growth Fund Vanguard -

Formulation of the BANDAI NAMCO Group Sustainability Policy

April 16, 2021 Name of listed company: BANDAI NAMCO Holdings Inc. Name of representative: Masaru Kawaguchi, President and Representative Director (Code Number: 7832 TSE 1st section) Contact: Yuji Asako, Director, Division General Manager of the Corporate Planning Division Formulation of the BANDAI NAMCO Group Sustainability Policy Promoting sustainability activities towards realization of a sustainable society with fans, based on the IP Axis Strategy Numerical targets set for decarbonization (net-zero by 2050) The BANDAI NAMCO Group (“the Group”) is conducting CSR activities under the concept of “Fun For the Future!” to realize its mission of providing “Dreams, Fun and Inspiration.” In these activities, we formulated the “BANDAI NAMCO Group’s Important CSR Themes,” which are themes that require a particularly strong focus. We also identified “CSR Major Initiative Themes” that are to be implemented at the activity level of each Unit and affiliated business company and are conducting various activities designed to make use of the characteristics of each business. Now, to prepare for the next Mid-term Plan, which starts in April 2022, the Group has taken a wider view in light of changes in the business environment and expanding expectations and demands from society. In order to fulfill our responsibility as a member of society in realizing a sustainable society, we have formulated a Sustainability Policy for engaging in activities unique to BANDAI NAMCO utilizing our IP Axis Strategy. Specifically, under the IP Axis Strategy, we will work with fans to promote sustainability activities corresponding to social issues that should be addressed by the Group, such as environmental issues. -

Morningstar Equity Research Coverage

December 2019 Equity Research Coverage Morningstar covers more than 200 companies in We use the following guidelines to Contact Details Australia and New Zealand as part of our global determine our Australian equity coverage: Australia stock coverage of about 1,500 companies. We are × Nearly all companies in the S&P/ASX 100 Index. Helpdesk: +61 2 9276 4446 Email: [email protected] one of the largest research teams globally with × Companies in the S&P/ASX 200 Index which more than 100 analysts, associates, and have an economic moat and/or have cash flow New Zealand strategists, including 17 in Australia. Local analysts which is at least mildly predictable. Helpdesk: +64 9 915 6770 regularly glean insights from our global sector teams × In total, Morningstar will cover about 80% of Email: [email protected] in China, Europe, and the United States, enriching S&P/ASX 200 companies (which typically the process and enhancing outcomes for investors. equates to about 95% of S&P/ASX 200 by Our research philosophy focuses on bottom-up market capitalisation). Companies we choose analysis, developing differentiated and deep not to cover in this index are usually unattractive opinions on competitive forces, growth prospects, for most portfolios, in our opinion. and valuations for every company we cover. We × About 30 ex-S&P/ASX 200 stocks are selected publish on each company under coverage at least on Morningstar’s judgement of each security's quarterly, and as events demand, to ensure investment merit − which includes a very investment ideas are always relevant. strong lean towards high-quality companies We are an independent research house, and with sustainable competitive advantages, or therefore determine our coverage universe based economic moats. -

Voting Rights Exercised

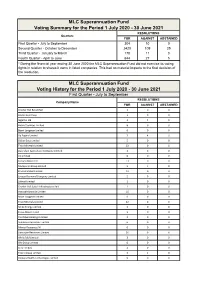

MLC Superannuation Fund Voting Summary for the Period 1 July 2020 - 30 June 2021 RESOLUTIONS Quarters FOR AGAINST ABSTAINED First Quarter - July to September 304 10 0 Second Quarter - October to December 2420 109 25 Third Quarter - January to March 178 11 0 Fourth Quarter - April to June 644 27 5 * During the financial year ending 30 June 2020 the MLC Superannuation Fund did not exercise its voting rights in relation to shares it owns in listed companies. This had no material impacts to the final decision of the resolution. MLC Superannuation Fund Voting History for the Period 1 July 2020 - 30 June 2021 First Quarter - July to September RESOLUTIONS Company Name FOR AGAINST ABSTAINED Charter Hall Retail Reit 1 0 0 Alacer Gold Corp. 1 0 0 Isignthis Ltd 3 4 0 Ausnet Services Limited 8 0 0 Boart Longyear Limited 6 0 0 Ap Eagers Limited 3 4 0 Dicker Data Limited 5 0 0 Titan Minerals Limited 23 0 0 Australian Agricultural Company Limited. 4 0 0 Als Limited 6 0 0 Xanadu Mines Ltd 13 0 0 Macquarie Group Limited 5 1 0 Elixinol Global Limited 12 0 0 Lucapa Diamond Company Limited 5 0 0 Salmat Limited 1 0 0 Charter Hall Social Infrastructure Reit 1 0 0 Yancoal Australia Limited 16 0 0 Boart Longyear Limited 6 0 0 Titan Minerals Limited 22 0 0 Strike Energy Limited 2 0 0 Focus Minerals Ltd 3 0 0 Pointsbet Holdings Limited 2 0 0 Sundance Resources Limited 6 0 0 Mincor Resources Nl 6 0 0 Gascoyne Resources Limited 10 0 0 Whitefield Limited 3 0 0 Ofx Group Limited 6 0 0 Xero Limited 4 0 0 Thorn Group Limited 3 1 0 Volpara Health Technologies Limited 9 0 0 Fisher & Paykel Healthcare Corporation Limited 7 0 0 Centuria Industrial Reit Ordinary Units Fully Paid 2 0 0 Metcash Limited 5 0 0 Bionomics Limited 7 0 0 Collins Foods Limited 5 0 0 Todd River Resources Limited 10 0 0 Champion Iron Limited 10 0 0 Salmat Limited 6 0 0 Avenira Limited 4 0 0 Zip Co Limited. -

REGISTER of SPONSORS (Tiers 2 & 5 and Sub Tiers Only)

REGISTER OF SPONSORS (Tiers 2 & 5 and Sub Tiers Only) DATE: 09-January-2017 Register of Sponsors Licensed Under the Points-based System This is a list of organisations licensed to sponsor migrants under Tiers 2 & 5 of the Points-Based System. It shows the organisation's name (in alphabetical order), the sub tier(s) they are licensed for, and their rating against each sub tier. A sponsor may be licensed under more than one tier, and may have different ratings for each tier. No. of Sponsors on Register Licensed under Tiers 2 and 5: 29,794 Organisation Name Town/City County Tier & Rating Sub Tier ?What If! Ltd London Tier 2 (A rating) Tier 2 General Tier 2 (A rating) Intra Company Transfers (ICT) @ Home Accommodation Services Ltd London Tier 2 (A rating) Tier 2 General Tier 5 (A rating) Creative & Sporting ]performance s p a c e [ london london Tier 5 (A rating) Creative & Sporting 01 Telecom Limited Brighton Tier 2 (A rating) Tier 2 General 0-two Maintenance London Tier 2 (A rating) Tier 2 General 1 Stop Print Ltd Ilford Tier 2 (A rating) Tier 2 General 1 Tech LTD London Tier 2 (A rating) Tier 2 General 10 Europe Limited Edinburgh Tier 2 (A rating) Tier 2 General Tier 2 (A rating) Intra Company Transfers (ICT) 10 GROUP LTD T/A THE 10 GROUP LONDON Tier 2 (A rating) Tier 2 General 10 Minutes With Limited London Tier 2 (A rating) Tier 2 General Page 1 of 1952 Organisation Name Town/City County Tier & Rating Sub Tier 1000heads Ltd London Tier 2 (A rating) Tier 2 General 1000mercis LTD London Tier 2 (A rating) Tier 2 General 100Starlings Ltd