Growing Shareholder Value

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

2017 ANNUAL REPORT NAVIGATING TOMORROW CONTENTS 1 Chairman’s Message 3 2017 Financial Summary 4 Year in Review 8 Our Community 12 Our Employees 14 Client Profiles 22 2017 Financial Report 24 Relative Stock Prices 25 Bank of Hawaii Locations 26 Managing Committee 28 Board of Directors 29 Shareholder Information NaVIGATING TOMORROW The story of Bank of Hawaii began on Dec. 27, 1897, when Bank of Hawaii became the first chartered and incorporated bank to do business in the Republic of Hawaii. For more than 120 years, we have been helping generations of families, individuals, community organizations and businesses achieve their dreams. The cover image was taken at Bank of Hawaii’s Main Branch grand re-opening in August 2017, when a new Branch of Tomorrow concept was unveiled for its flagship location in downtown Honolulu. Designed with modern technology, digital conveniences and private spaces for personal interactions, the branch features elements of the Hawaiian voyaging canoe, which has always had special meaning for Bank of Hawaii. The Bank of Hawaii canoe, Ulu o ka lā, was commissioned in 2015 and continues to serve as a symbol for the bank. The unique circular overlay pays tribute to the original iron gate at Main Branch. Bank of Hawaii marked 120 years of doing business in 2017, and continues to help its customers explore new possibilities and navigate toward their financial and life goals. View Bank of Hawaii’s 2017 digital summary annual report, featuring videos of our ©2017, Bank of Hawaii Corporation. Bank of Hawaii®, Bankoh® and the Bank of Hawaii logo are Chairman, clients, registered trademarks of Bank of Hawaii. -

Kōkua Creating Good

CONNECTED THROUGH KŌKUA CREATING GOOD. BUILDING STRONGER COMMUNITIES. BANK OF HAWAII COMMUNITY REPORT 2018 workplace where all of our employees feel With nearly half of Hawaii’s people they belong and are able to reach their struggling to get by, the problems full potential to authentically connect outlined in the ALICE report are complex. to the community we serve. Bank of But they’re not insurmountable if we Hawaii has outwardly demonstrated its combine forces to address the issues. support for our LGBTQ community as a One of the most important things for us sponsor of the Honolulu Rainbow Film to do is to realize that the well-being of Festival, and for the first time in 2018, ALICE community members is, in fact, the Honolulu Pride Parade & Festival. our own well-being. We are all connected. I was so proud to march in solidarity Whether we participate from the business, with more than 300 of our employees legislative or philanthropic sectors, we Aloha, and their friends and family alongside each have a vested interest in finding our Bank of Hawaii float in the solutions and ensuring the continued Helping people access a better life Honolulu Pride Parade in October. health of our community. is what Bank of Hawaii does both in a A number of natural disasters in Bank of Hawaii has been helping the professional capacity, and as a caring 2018—volcanic eruptions, typhoons community for over 120 years, and collaborative partner in the community. and tropical storms—brought increased we invite others to partner with our We invest in the innovative vision of challenges to our community, and an efforts. -

The Value of Service SUMMARY ANNUAL REPORT 2005 BANK of HAWAII CORPORATION and SUBSIDIARIES

the value of service SUMMARY ANNUAL REPORT 2005 BANK OF HAWAII CORPORATION AND SUBSIDIARIES FINANCIAL SUMMARY (DOLLARS IN THOUSANDS EXCEPT PER SHARE AMOUNTS) FOR THE YEAR ENDED DECEMBER 31 2005 2004 EARNINGS HIGHLIGHTS AND PERFORMANCE RATIOS Net Income $ 181,561 $ 173,339 Basic Earnings Per Share 3.50 3.26 Diluted Earnings Per Share 3.41 3.08 Dividends Declared Per Share 1.36 1.23 Net Income to Average Total Assets (ROA) 1.81% 1.78% Net Income to Average Shareholders’ Equity (ROE) 24.83% 22.78% Net Interest Margin1 4.37% 4.32% Efficiency Ratio2 53.15% 56.14% AS OF DECEMBER 31 STATEMENT OF CONDITION HIGHLIGHTS AND PERFORMANCE RATIOS Total Assets $ 10,187,038 $ 9,766,191 Net Loans 6,077,446 5,880,134 Total Deposits 7,907,468 7,564,667 Total Shareholders’ Equity 693,352 814,834 Book Value Per Common Share $ 13.52 $ 14.83 Allowance / Loans and Leases Outstanding 1.48% 1.78% Employees (FTE) 2,585 2,623 Branches and Offices 85 87 Market Price Per Share of Common Stock for the Year Ended December 31: Closing $ 51.54 $ 50.74 High $ 54.44 $ 51.10 Low $ 43.82 $ 40.97 FOR THE QUARTER ENDED DECEMBER 31 EARNINGS HIGHLIGHTS AND PERFORMANCE RATIOS Net Income $ 44,781 $ 46,241 Basic Earnings Per Share 0.88 0.86 Diluted Earnings Per Share 0.86 0.82 Net Income to Average Total Assets (ROA) 1.76% 1.89% Net Income to Average Shareholders’ Equity (ROE) 25.19% 23.63% Net Interest Margin1 4.42% 4.40% Efficiency Ratio2 53.92% 55.37% 1 The net interest margin is defined as net interest income, on a fully-taxable equivalent basis, as a percentage of average earning assets. -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of Report (Date of earliest event reported): September 4, 2020 FIRST HAWAIIAN, INC. (Exact Name of Registrant as Specified in Its Charter) Delaware (State or Other Jurisdiction of Incorporation) 001-14585 99-0156159 (Commission File Number) (IRS Employer Identification No.) 999 Bishop St., 29th Floor Honolulu, Hawaii 96813 (Address of Principal Executive Offices) (Zip Code) (808) 525-7000 (Registrant’s Telephone Number, Including Area Code) Not Applicable (Former Name or Former Address, if Changed Since Last Report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: Title of each class: Trading Symbol(s) Name of each exchange on which registered: Common Stock, par value $0.01 per share FHB NASDAQ Global Select Market Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). -

Bank of Hawaii RSSD # 795968

PUBLIC DISCLOSURE August 8, 2016 COMMUNITY REINVESTMENT ACT PERFORMANCE EVALUATION Bank of Hawaii RSSD # 795968 130 Merchant Street Honolulu, Hawaii, 96813 Federal Reserve Bank of San Francisco 101 Market Street San Francisco, California 94105 NOTE: This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low‐ and moderate‐income neighborhoods, consistent with the safe and sound operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Bank of Hawaii CRA Public Evaluation Honolulu, Hawaii August 8, 2016 TABLE OF CONTENTS INSTITUTION RATING ................................................................................................ 1 Institution’s CRA Rating ....................................................................................................... 1 INSTITUTION ........................................................................................................... 2 Description of Institution ..................................................................................................... 2 Scope of Examination .......................................................................................................... 3 CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS -

FHB Investor Presentation

Investor Presentation February / March 2021 0 DISCLAIMER Forward-Looking Statements This presentation contains, and from time-to-time in connection with this presentation our management may make, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward looking statements reflect our views at such time with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “might,” “should,” “could,” “predict,” “potential,” “believe,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would,” “annualized,” and “outlook,” or the negative version of these words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, and any such forward-looking statements are subject to risks, assumptions, estimates and uncertainties that are difficult to predict. Further, statements about the potential effects of the COVID-19 pandemic on our businesses and financial results and conditions may constitute forward-looking statements and are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control, including the scope and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on our customers, third parties and us. -

State of Hawaii Banks and Credit Unions Last Revised 2-15-2018

State of Hawaii Banks and Credit Unions Last revised 2-15-2018 Routing Number Bank Name Address 1 City State Zip Phone 121301015 FIRST HAWAIIAN BANK P.O. BOX 1959 HONOLULU HI 96805 (808) 844-3402 121301028 BANK OF HAWAII PO BOX 2900 - ACH OPS 121 HONOLULU HI 96846 (888) 643-3888 121301057 AMERICAN SAVINGS BANK FSB PO BOX 2300 HONOLULU HI 96804 (808) 627-6439 121301578 CENTRAL PACIFIC BANK 222 NORTH SCHOOL STREET HONOLULU HI 96817 (808) 544-5530 121301772 HAWAII NATIONAL BANK OPERATIONS DEPARTMENT HONOLULU HI 96817 (808) 528-7711 121302247 BANK OF THE ORIENT (BK OF HONOLULU) 765 BISHOP STREET HONOLULU HI 96813 (808) 543-3744 121302292 BANK OF HAWAII TRUST PO BOX 2900 - ACH OPS 121 HONOLULU HI 96846 (888) 643-3888 121302360 OHANA PACIFIC BANK 1357 KAPIOLANI BLVD SUITE 102 HONOLULU HI 96814 (808) 237-6528 121302373 BANK OF THE FSM 2615 SOUTH KING ST. SUITE A-203 HONOLULU HI 96826 (808) 941-1226 121403065 FIRST HAWAIIAN BANK SAIPAN P.O. BOX 1959 HONOLULU HI 96805 (808) 844-3402 121301028 BANK OF HAWAII AMERICAN SAMOA PO BOX 2900 - ACH OPS 121 HONOLULU HI 96846 (888) 643-3888 121405018 BANK OF HAWAII GUAM PO BOX 2900 - ACH OPS 121 HONOLULU HI 96846 (888) 643-3888 121405238 FIRST HAWAIIAN BANK GUAM P.O. BOX 1959 HONOLULU HI 96805 (808) 844-3402 321370707 TERRITORIAL SAVINGS BANK 1132 BISHOP STREET SUITE 2308 HONOLULU HI 96813 (808) 946-1400 321370765 AMERICAN SAVINGS BANK FSB PO BOX 2300 HONOLULU HI 96804 (808) 627-6439 321371528 WEST OAHU COMMUNITY FCU SUITE B-205 WAIANAE HI 96792 (808) 748-4106 321378592 MC BRYDE FCU PO BX 477 ELEELE HI 96705 -

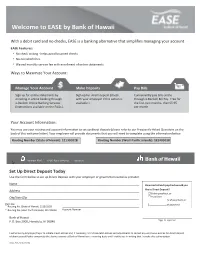

Set up Direct Deposit Today Use the Form Below to Set up Direct Deposit with Your Employer Or Government Benefits Provider

With a debit card and no checks, EASE is a banking alternative that simplifies managing your account. EASE Features: • No check writing ‐ helps avoid bounced checks • No overdraft fees • Waived monthly service fee with enrollment of online statements Ways to Maximize Your Account: Make Deposits Pay Bills Sign up for online statements by Sign up for direct deposit (check Conveniently pay bills online enrolling in online banking through with your employer if this option is through e‐Bankoh Bill Pay. Free for e‐Bankoh Online Banking Services available.) the first two months, then $5.95 (instructions available on the FAQs.) per month. Your Account Information: You may use your routing and account information to set up direct deposit (please refer to our Frequently Asked Questions on the back of this welcome letter). Your employer will provide documents that you will need to complete using the information below. Routing Number (State of Hawaii): 121301028 Routing Number (West Pacific Islands): 121405018 Set Up Direct Deposit Today Use the form below to set up Direct Deposit with your employer or government benefits provider. Name How much of each paycheck would you Address like to Direct Deposit? Entire paycheck, or City/State/Zip A portion: % of paycheck or Check one: $ of paycheck Routing No. (State of Hawaii): 121301028 Routing No. (West Pacific Islands): 121405018 Account Number Bank of Hawaii P.O. Box 2900, Honolulu, HI 96846 Sign to approve I authorize my Employer/Payor to initiate credit entries and, if necessary, to initiate debit entries and adjustments to correct any erroneous entries for direct deposit of above payroll/other amount to the above account at Bank of Hawaii on a recurring basis until I notify you in writing that I revoke this authorization. -

Executive Compensation

EXECUTIVE COMPENSATION The following tables summarize the compensation of the Chief Executive Officer and the four other most highly compensated executive officers of Bancorp for the fiscal year 1993: SUMMARY COMPENSATION TABLE - ----------------------------------------------------------------------------------------------------------- LONG TERM ANNUAL COMPENSATION COMPENSATION Awards Payouts - ----------------------------------------------------------------------------------------------------------- Other Annual Long Term All Other Name and Compen- Incentive Compen- Principal Bonus sation Options/ Payouts sation Position Year Salary($) ($)[1] (4)[2] SARS(#)[3] ($)[4] ($)[5] - ----------------------------------------------------------------------------------------------------------- H. Howard Stephenson 1993 $591,865 $344,324 -- 0 $454,127 $ 55,830 Chmn. of Bd. & CEO 1992 569,100 421,703 -- 17,500 368,223 140,721 of Bancorp & Bank 1991 542,000 348,777 -- 15,000 323,606 23,162 Lawrence M. Johnson 1993 411,685 191,603 -- 20,000 276,394 38,834 Pres. & Dir. of 1992 395,850 234,660 -- 10,000 219,970 77,954 Bancorp & Bank 1991 377,000 194,080 -- 10,000 194,800 23,162 Richard J. Dahl 1993 251,160 116,890 -- 12,500 168,621 23,691 Exec. Vice Pres. of 1992 241,500 143,161 -- 7,500 134,300 26,612 Bancorp & Vice 1991 230,000 118,404 -- 7,500 120,000 23,162 Chmn. of Bank Thomas J. Kappock 1993 251,160 116,890 -- 12,500 168,621 23,691 Exec. Vice Pres. of 1992 241,500 143,161 -- 7,500 134,300 26,612 Bancorp & Vice 1991 230,000 118,404 -- 7,500 120,000 23,162 Chmn. of Bank John K. Tsui 1993 262,080 121,972 -- 12,500 175,952 24,721 Exec. Vice Pres. of 1992 252,000 149,386 -- 7,500 140,400 28,805 Bancorp & Vice 1991 240,000 123,552 -- 7,500 126,000 23,162 Chmn. -

Recent Pacific Islands Publications: Selected Acquisitions, January-March 1991

BOOKS NOTED RECENT PACIFIC ISLANDS PUBLICATIONS: SELECTED ACQUISITIONS, JANUARY-MARCH 1991 This list of significant new publications relating to the Pacific Islands was selected from new acquisition lists received from the libraries of Brigham Young University-Hawaii, University of Hawaii at Manoa, Bernice P. Bishop Museum, University of Auckland, and University of the South Pacific. Other libraries are invited to send contributions to the Books Noted Editor for future issues. Listings reflect the extent of information provided by each institution; some entries may be arranged by title in cases of an edited or compiled work and may include only pri mary author in cases of multiple authorship. Ahlburg, Dennis A. The North East Passage: A Study oj Pacific Islander Migration to American Samoa and the United States. Canberra: National Centre for Develop ment Studies, Australian National U., 1990. Allen, Jane. Five Upland 'Ili: Archaeological and Historical Investigations in the Kane'ohe Interchange, Interstate Highway H-3, Island of Oahu. Honolulu: Dept. of Anthro pology, Bishop Museum, 1987. Alonz, Laetitia, ed. A Collection of Palauan Legends. Koror: Palau Press Agency, 1990. Amesbury, Judith R. Native Fishing Rights and Limited Entry in Guam. Guam: Microne sian Archaeolo!,'Y Research Services, 1989. Anderson, David, ed. The PNG-Australia Relationship: Problems and Prospects. Sydney: Inst. of Public Affairs, 1990. Angleviel, Frederic. Wallis et Futuna (1801-1888): Contacts, evangelisations; incultura tions. Ph.D. thesis, U. Paul Valery, 1989. Austin, Roberts. Handcrafts of Niue. Alofi: Niue Ministry of Trade, 1988. Bank of Hawaii. An Economic Assessment of French Polynesia. Honolulu: The Bank, 1990. Barker, John, ed. -

Business Objects to Oracle BI Conversion at Bank of Hawaii

© 2011 KPI Partners, Inc. Business Objects to Oracle BI Conversion at Bank of Hawaii client Achieving cost savings by converting from Business Objects to Oracle Business Intelligence Enterprise Edition Bank of Hawaii Industry: Banking About Bank of Hawaii Value To Bank of Hawaii Bank of Hawaii Corporation is a bank holding A hosted implementation of Business Objects Honolulu, HI USA company providing a broad range of financial was costing Bank of Hawaii more than other 2,400 employees products and services to customers in Hawaii analytics solutions and was not giving them and the Pacific Islands (Guam, nearby islands the functionality they needed. KPI Partners solution and American Samoa). The Company’s principal converted 80 Business Objects reports and 5 subsidiary, Bank of Hawaii, was founded in 1897 universes to OBIEE in 5 weeks. The result was Business Objects to Oracle BI and is the largest independent financial institu- a lower cost of ownership (TCO) and the agility Proven Methodology tion in Hawaii. Bank of Hawaii needed to support user needs Low Total Cost of Ownership (TCO) quicker than the previous solution. Greater Flexibility Challenges Bank of Hawaii was challenged with the sub- technology standard flexibility and complexity of main- taining multiple instances of Business Objects. “With Oracle BI, the There was a high cost of ownership with a Oracle Business Intelligence Bank of Hawaii now hosted implementation of the Business Objects Business Objects tool. has the agility they need to better serve Solution their users.“ Bank of Hawaii made Oracle BI its enterprise standard, working with KPI Partners to convert - Norman Dy, Business Development Director its Business Objects applications to Oracle Busi- KPI Partners ness Intelligence. -

BANK of HAWAII CONSUMER DEPOSIT ACCOUNT AGREEMENT Please Read and Save

BANK OF HAWAII CONSUMER DEPOSIT ACCOUNT AGREEMENT Please Read and Save TABLE OF CONTENTS G. DEPOSITS, CREDITS OR PAYMENTS INTO YOUR ACCOUNT A. EXPLANATION OF SOME COMMONLY USED TERMS 1. Accepting Deposits 2. Endorsing Your Check B. GENERAL ACCOUNT INFORMATION 3. Our Right to Refuse Deposits 4. Electronic Deposits to Your Account 1. The Agreement for Your Account 5. Deposits of Foreign Checks 2. Electronic Banking Services 6. Depositing Remotely Created Checks 3. Non-Business Purposes Only 7. Our Responsibility for Collecting Checks 4. Changes to This Agreement 5. Fees 6. Closing Your Account H. FUNDS AVAILABILITY 7. Rules Governing Your Account 8. Restricting Your Account or Transactions 1. Your Ability to Withdraw Funds 9. How to Contact Us 2. Longer Delays May Apply 3. Special Rules for New Accounts 4. Special Rules for West Pacific Island Branches and Accounts C. INFORMATION ABOUT YOU AND YOUR ACCOUNT 5. ATM Deposits 1. Information You Give Us 2. Identification I. CHECKS, WITHDRAWALS, TRANSFERS OR PAYMENTS OUT OF YOUR 3. Consumer Reports and Other Inquiries ACCOUNT 4. Bank of Hawaii’s Privacy Practices 5. Telephone and Electronic Communications 1. Withdrawals from Your Account; Notice About Electronic Check 6. Your Responsibility to Protect Your Checks, Cards, and Account Conversion Information 2. Conditional, Stale and Future Dated Checks 3. Facsimile Signatures 4. Check and Signature Verification D. ACCOUNT OWNERSHIP 5. Stop Payment Orders 6. Limits on Savings Account Withdrawals and Transfers 1. Some General Terms 7. Our Right to Require Advance Notice of Withdrawals 2. Authorized Persons 8. Cashing Checks for Others 3. Multiple-Signature Limitation 9.