July 2018 , 2018 Oriental Land Co., Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IR Presentation Material

IR Presentation Material August, 2021 Oriental Land Co., Ltd. This material has been specifically prepared for institutional investors who are not familiar with our company, and is not presentation material for the earnings presentation. Contents I. Business Outline II. Growth Investments beyond FY3/22 I-I. Theme Park Business III. For Long-term Sustainable Growth I-II. Hotel Business IV. Appendix I-III. Overview Cautionary Statement The purpose of this document is to provide information on the operating results and future management strategies of the OLC Group, and not to solicit investment in securities issued by the Company. 2 The data disclosed in this document are based on the judgments and available information as of the date of publication. The OLC Group's business is sensitive to factors such as customer preferences, and social and economic conditions, and therefore the forecasts and outlook presented in this document contain uncertainties. Theme Park attendance figures have been rounded, and financial figures have been truncated. Please refrain from reprinting this document. 2 I. Business Outline Corporate Profile I. Business Outline Corporate Data Stock Information Established July 11, 1960 Tokyo Stock Stock Listing Code Exchange, First No. Total Assets Section 4661 ¥1,040.4 billion [consolidated] Shareholders’ Investment Unit 100 shares Equity ¥759.9 billion [consolidated] Stock Price ¥15,400 JCR : AA [Stable] Aggregate Market Bond Ratings 4 ¥5,600.8 billion R&I : AA- [Stable] Price [As of March 31, 2021] [As of July 28, 2021] Corporate Mission Business Domain Our mission is to create happiness and “We pursue businesses that fill your contentment by offering wonderful heart with energy and happiness” We strive to create new value in a high-value dreams and moving experiences created business for enriching and nourishing people’s hearts with original, imaginative ideas and appealing to abundant humanity and happiness 4 History and Business Description I. -

Tokyo Disney Resort Toy Story® Hotel

April 6, 2021 FOR IMMEDIATE RELEASE Publicity Department Oriental Land Co., Ltd. Name Announced for the Fifth Disney Hotel to Open in Japan Tokyo Disney Resort Toy Story® Hotel URAYASU, CHIBA—Oriental Land Co., Ltd. announced today that the name of the fifth Disney hotel to open in Japan will be Tokyo Disney Resort Toy Story Hotel. The hotel’s exterior, entrance, lobby and other areas will bring to life the world of toys based on the popular Disney and Pixar Toy Story film series. The new hotel is situated directly in front of Bayside Station on the Disney Resort Line, providing convenient access to both Tokyo Disneyland® and Tokyo DisneySea® Parks. Guests staying here will find that their dream-filled Disney experience continues from the Parks to the hotel. Tokyo Disney Resort Toy Story Hotel will be the first “moderate type” Disney hotel in Japan, offering guests a new option between the existing “deluxe type” and “value type” Disney hotels. Offering 595 guest rooms with a unified design and specifications, as well as facilities and services to ensure a comfortable stay, this hotel will offer guests accommodations that are in easier reach compared to a deluxe type hotel. With this new hotel and the opening of the new themed port, Fantasy Springs, in Tokyo DisneySea, Tokyo Disney Resort® will be able to meet the needs of even more guests and make their stay a richer experience as the Resort continues to grow and evolve. Please see attachment for an overview of the hotel. © Disney/Pixar For inquiries from the general public Tokyo Disney Resort Information Center 0570-00-8632 (10:00 a.m. -

Download "Information Book"

For Inquiries, Comments and Consultation Tokyo Disney Resort Information Center 0570-00-8632 (9:00 a.m. – 5:00 p.m.) From some mobile phones and IP phones, please call 045-330-5211. From overseas, please call +81-45-330-5211. 1-1 Maihama, Urayasu-shi, Chiba-ken 279-8511, Japan Automated Voice Information Service 0570-00-3932 (available 24 hours / in Japanese only) Tokyo Disney Resort Official Website Inquiry Form https://www.tokyodisneyresort.jp/en/tdr/bfree/info For Information on Driving to the Resort, Area Traffic, and Parking Tokyo Disney Resort Traffic Information Telephone Service 0570-00-3388 (available 24 hours / in Japanese only) The Automated Voice Information Service and Traffic Information Telephone Service are not accessible from mobile phones, IP phones, or international numbers. Note: The inquiry form is for Guests who cannot use a telephone. Tokyo Disney Resort Official Website in English https://www.tokyodisneyresort.jp/en/index.html Also available in Chinese, Indonesian, Japanese, Korean, and Thai As of Nov. 2019 Tokyo Disney Resort Information Tokyo Disney Resort Information The following facilities provide assistance to enhance your enjoyment of the Resort. Welcome to Tokyo Disney Resort®! Tokyo Disneyland® Tokyo DisneySea® Main Street House Guest Relations This Tokyo Disney Resort Information Book provides information on services and facilities available for Guests with disabilities, temporary impairments, or who require extra assistance, as well as expectant mothers and persons of advanced age, to enjoy their Resort visit to the utmost. Please use this information book as a supplement to the Tokyo Disneyland® Guide Map and the Tokyo DisneySea® Guide Map. -

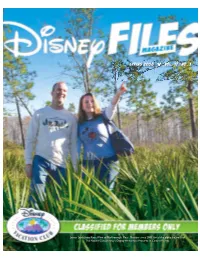

DVC Spring 2008 Magazine:Layout 1

spring 2008 vol. 17 no. 1 James Lamb joins Katie Winn of Marlborough, Mass., Member since 2003, for a hike along the trails of The Nature Conservancy’s Disney Wilderness Preserve in Central Florida. Disney Files Magazine is published by the good people at A wise frog once said, “It’s not easy being green.” (Okay, so it was a wise man with his Disney Vacation Club hand in a felt facsimile of said frog, but you get the point.) P.O. Box 10350 With all due respect to the rainbow-connecting amphibian, being green really isn’t that Lake Buena Vista, FL 32830 tough. In fact, as the frigid months of winter give way to the warm promise of spring (those sub-70 temperatures here in Florida were brutal), now’s the perfect time to enjoy the greener E-mail the magazine staff at: [email protected] side of Disney. Let’s start with The Nature Conservancy’s Disney Wilderness Preserve, pictured on our All dates, times, events and prices cover. More than 15 years ago, The Walt Disney Company entered into a relationship with printed herein are subject to The Nature Conservancy and other visionary agencies to preserve thousands of acres just change without notice. (Our lawyers minutes from the Walt Disney World® Resort at the headwaters of the Everglades ecosystem. do a happy dance when we say that.) Owned and managed by The Nature Conservancy, the protected land supports lakes, swamp systems and more than 300 wildlife species. MOVING? Today, this meticulously restored sanctuary of natural Florida is being hailed as a model Update your mailing address for land-protection efforts around the world. -

2009 Annual Report

Fiscal Year 2009 Annual Financial Report And Shareholder Letter January 2010 To the Shareholders and Cast Members of The Walt Disney Company: As I was drafting this letter, word came about the passing of a true Disney legend, Roy E. Disney. Roy devoted the better part of his life to our Company, and during his 56 year tenure, he was involved on many levels with many businesses, most notably animation. No one was a bigger champion of this art form than Roy, and it was at his urging that we returned to a full commitment to animation in the mid-1980s. Roy also introduced us to Pixar in the 1990s, a relationship that has proven vital to our success. Roy understood the essence of Disney, and his passion for the Company, his appreciation of its past and his keen interest in its future will be sorely missed. Last year was both an interesting and challenging one for your Company. On the positive side, we released two extraordinary animated films, Up and The Princess and the Frog that exemplify the very best of what we do. We received the go-ahead from China’s government to build a new theme park in Shanghai. We acquired Marvel Entertainment, whose portfolio of great stories and characters and talented creative staff complement and strengthen our own. And we reached an agreement to distribute live-action films made by Steven Spielberg’s DreamWorks SKG. At the same time, we faced a severe global economic downturn and an acceleration of secular challenges that affect several of our key businesses. -

Winter 2008 Vol. 17 No. 4

Winter 2008 vol. 17 no. 4 Jada and Lawrence Smith of Florida, Members since 2005, cruise past the construction site of the Treehouse Villas at Disney’s Saratoga Springs Resort & Spa. Illustration by Keelan Parham Disney Files Magazine is published by the good people at Disney Vacation Club If I were to list what I love most about living in Florida P.O. Box 10350 and working for the Mouse, “employer’s liberal use of Lake Buena Vista, FL 32830 code names” would have to make my top 10, somewhere behind “sunscreen in January” and slightly ahead of All dates, times, events and prices “humidity in January.” (Just missing the cut: “saltiness of printed herein are subject to turkey legs” and “abundance of white pants.”) change without notice. (Our lawyers Nothing delights middle managers more than sitting do a happy dance when we say that.) around a conference table acting like the room is bugged. MOVING? The rapid dropping of names like “Project Quasar” (Disney’s Update your mailing address Animal Kingdom Villas) and “Project Crystal” (Bay Lake Tower online at www.dvcmember.com at Disney’s Contemporary Resort) can transform any meeting into a scene from Windtalkers (albeit with more nametags and less Nicolas Cage). Of course, not MEMBERSHIP QUESTIONS? all codes are tough to decipher. Case in point: our cloaking of the Treehouse Villas at Disney’s Contact Member Services from Saratoga Springs Resort & Spa with the code name “Project Tarzan.” Not very subtle, but I 9 a.m.-5:30 p.m. Eastern daily at suppose it beats “Project Treehouse.” (800) 800-9800 or (407) 566-3800 You’ll read more about “Project Tarzan” in this edition of your magazine (pages 2-4), but allow me to first introduce a few other key features by revealing their rejected code names. -

Regarding Disney Hotels Reservations Hotel Reservations

June 23, 2020 Regarding Disney Hotels Reservations Hotel Reservations New Reservations New reservations will start being accepted from 11:00 a.m. on Friday, June 26, 2020 through the Tokyo Disney Resort Online Reservations & Tickets website. Please note that reservations will only be accepted up to about one month in advance. - Some of the Guest benefits and services will be different from usual, so please read the details carefully before making a reservation. - Before purchasing or making reservations, you are required to complete the User Registration of Disney Account. - The Tokyo Disney Resort Reservations Center will remain closed. For Hotel Reservations Made on or before March 31, 2020 <Guests who made reservations with Tokyo Disneyland Hotel, Disney Ambassador Hotel, and Tokyo DisneySea Hotel MiraCosta> Reservations for stays between April 1 and June 29, 2020 Guests who made reservations through the Tokyo Disney Resort Online Reservations & Tickets website (room only) or the Tokyo Disney Resort Reservations Center (by telephone): Reservations have been cancelled automatically, and your deposit will be refunded. Guests who made their reservation through the Tokyo Disney Resort Online Reservations & Tickets website will be able to receive their refund more quickly if they perform the cancellation procedures themselves. Guests who made their reservation through a travel agency: Please contact the travel agent. Guests who made their reservation through an online travel agency (Rakuten Travel, etc.): Please perform the cancellation procedures through the booking website. Reservations for stays on or after June 30, 2020 Some of the Guest benefits and services will be different from usual, so please read the details carefully before making a reservation. -

Enjoy the Magic of Walt Disney World All Year Long with Celebrations Magazine! Receive 6 Issues for $29.99* (Save More Than 15% Off the Cover Price!) *U.S

Enjoy the magic of Walt Disney World all year long with Celebrations magazine! Receive 6 issues for $29.99* (save more than 15% off the cover price!) *U.S. residents only. To order outside the United States, please visit www.celebrationspress.com. To subscribe to Celebrations magazine, clip or copy the coupon below. Send check or money order for $29.99 to: YES! Celebrations Press Please send me 6 issues of PO Box 584 Celebrations magazine Uwchland, PA 19480 Name Confirmation email address Address City State Zip You can also subscribe online at www.celebrationspress.com. Cover Photography © Mike Billick Issue 52 The Statues of Walt Disney World 40 Contents Disney News ............................................................................ 8 Calendar of Events ...........................................................12 MOUSE VIEWS ......................................................... 15 Guide to the Magic by Tim Foster............................................................................16 The Disney Trees Shutters and Lenses by Tim Devine ..........................................................................18 48 Hidden Mickeys by Steve Barrett .....................................................................20 Disney Legends by Jamie Hecker ....................................................................22 Disney Cuisine by Dawn Caitano ..................................................................24 Disney Touring Tips by Elizabeth Mallers............................................................26 -

June 23, 2020 to Whom It May Concern, Tokyo Disneyland

June 23, 2020 To whom it may concern, Tokyo Disneyland ® / Tokyo DisneySea ® Reopening date and park operations procedures This is to share the decision that both Tokyo Disneyland and Tokyo DisneySea will reopen on July 1, 2020. With the reopening of both parks, we are implementing measures in accordance with the Amusement Park and Theme Park New Coronavirus Infection Containment Guidelines that were developed based on the government’s Basic Policies for Novel Coronavirus Disease Control, and additionally are following government agency guidance to give top priority to the health and safety of our guests and cast members in our operations. We will be deliberate in our operations, thoroughly implementing health and safety measures such as controlled capacity through limits on attendance, limited visitors in attractions, shops, restaurants, and other facilities, regular cleaning and sanitization, proactively requesting guests to maintain social distancing, among other things. We will also endeavor to promote health and safety by having the information filled in for the primary contact person when guests purchase tickets. 1. Basic approach to promoting health and safety We will implement health and safety measures based on the following three points: ・ Be attentive to the health conditions of everyone involved with the parks including guests and cast members ・ Conduct enhanced cleaning and sanitization measures ・ Implement social distancing and provide thoroughly ventilated air conditioning * Refer to guidelines for details. (https://www.e-yuenchi.com/pdf/amusement_park_guideline.pdf) 2. Requests to guests visiting the parks ・ Take part in temperature screening Temperature screenings will be conducted during admission time, and guests with a temperature of 37.5 degrees Celsius or above or cold-like symptoms will be asked to refrain from entering. -

Annual Report 2020 1 Corporate Philosophy Derivation of Logo Contents Sixty Years of Progress

Information IR Information Annual Report FACT BOOK 2020 Evaluation from external organizations OLC’s Fact Book 2020 provides a wide range of long-term, historical Oriental Land Co., Ltd. has been data, including financial indicators selected for inclusion in the FTSE 4 and quantitative management data. Good Index Series since 2015. 2020 IR Website Year ended March 31, 2020 http://www.olc.co.jp/en/ir.html Oriental Land Co., Ltd. has been selected for inclusion in the FTSE Blossom Japan Index since 2017. Oriental Land Co., Ltd. has been selected for inclusion in the MSCI Japan ESG Select Leaders Index* since 2017. Multi-Stakeholder Information Oriental Land Co., Ltd. has been selected for inclusion in the MSCI Japan OLC Group Empowering Women Index* since 2017. CSR Report 2020 Oriental Land Co., Ltd. has been selected as a component of the S&P/JPX Carbon CSR Website Efficient Index since 2018. http://www.olc.co.jp/en/csr. html Oriental Land Tokyo Disneyland Construction Office Oriental Land Co., Ltd. has been selected (Maihama, Urayasu City, Chiba Prefecture) as a component of the Dow Jones The office when the company's head office was first moved to Maihama in 1981. Sustainability Index (DJSI) Asia Pacific since 2020. For the second year in a row, beginning in 2019, Oriental Land Co., Ltd. has 60th Anniversary of Establishment been awarded the highest rank in the advertising services, media, and entertainment category at the Securities Analysts Association of Japan's (SAAJ) Awards for Excellence in Corporate Disclosure. * The inclusion of Oriental Land Co., Ltd. -

Fact Sheet on Financial Arrangements Relating to Tokyo Disneyland

Legislative Council Secretariat FS30/08-09 FACT SHEET Financial arrangements relating to Tokyo Disneyland, Disneyland Paris and Hong Kong Disneyland 1. Background 1.1 At the special meeting held on 4 July 2009, the Panel on Economic Development discussed the financial arrangements relating to the proposed expansion of Hong Kong Disneyland. During the discussion, a member requested the Research and Library Services Division to provide information on the financial arrangements relating to Tokyo Disneyland, Disneyland Paris and Hong Kong Disneyland. As such, the purpose of this fact sheet is to provide the Panel with information on these three theme parks in terms of their ownership and the financial arrangements for the construction project. 1.2 This fact sheet originally intended to study the operational statistics of the three theme parks. According to the Tourism Commission of Hong Kong1, both the Government and the Walt Disney Company (Walt Disney) are bound by the confidentiality provision under the current agreement not to disclose any commercially sensitive information of Hong Kong Disneyland, including the gain or loss from the operation of the theme park. Against this, this fact sheet only lists the key operational statistics of Tokyo Disneyland and Disneyland Paris for comparison. 1 See Tourism Commission (2009). Research and Library Services Division page 1 Legislative Council Secretariat FS30/08-09 2. Tokyo Disneyland Overview 2.1 Tokyo Disneyland opened on 15 April 1983 at a cost of US$1.4 billion (HK$10.9 billion)2. It is located on a reclaimed site about 10 km from downtown Tokyo. Tokyo Disneyland is privately owned by Oriental Land, a land-reclamation company in partnership with Mitsui Real Estate and the Keisei Railway Company. -

Sixty Years of Progress

Sixtieth Anniversary of Oriental Land Sixty Years of Progress 1960– 1983– Founding of Oriental Land Co., Ltd., sea reclamation at Urayasu, Opening of Tokyo Disneyland, popularization of the Theme Park, negotiations with The Walt Disney Productions beginning of construction of Tokyo DisneySea 1960 1980 2000 1960 1974 1980 1983 1996 2000 • Founded Oriental Land Co., Ltd. • Concluded basic business alliance • Began construction of Tokyo • Opened Tokyo Disneyland • Established Maihama Resort Hotels • Opened Ikspiari and (3rd Floor of head office, Keisei Electric Railway Co., Ltd.) agreement with The Walt Disney Disneyland Co., Ltd. (currently Milial Resort Disney Ambassador Hotel Productions Hotels Co., Ltd.) (currently Disney Enterprises, Inc.) • Listed shares of OLC on the First 1962 1988 Section of the Tokyo Stock Exchange • President Kawasaki pays a courtesy 1975 • Announced of the second call on The Walt Disney Productions • Completed reclamation Park concept (currently The Walt Disney Company) work in Urayasu 1997 • Announced of the business 1964 overview of Tokyo DisneySea • Began reclamation work in 1979 Urayasu • Concluded basic business alliance 1998 agreement with The Walt Disney • Began construction of Tokyo DisneySea Keisei Electric Railway Co., Ltd. Head Office Productions (at the time of establishment) Urayasu City before (currently Disney Enterprises, Inc.) reclamation and OLC 1979 1982 1983 1998 Concluded basic business alliance agreement with At the time of establishment of Tokyo Disneyland Opened Tokyo Disneyland Began