Credit Guide & Privacy Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

S Sh Ow Wc Car Rds S

Morgan Gallup Poll SSHOWWCCARDS Yoour Opinion Counts Your answers to all questions will be treated in strict confidence and only used for statistical purposess. ACT Rounds: 2448 / 2449 / 2450 / 2451 PAGE 1 ACT ROTATION 4 4/4 x:\systems\database\cards\docs\2500\2080.doc Front page - ACT A 2 ES 2448 / 2449 / 2450 / 2451 PAGE 1 Alfa Romeo Holden Kia Mini Tesla 8501 Giulia 1531 Acadia 7930 Carnival 9545 Cabrio/Convertible 0603 Model 3 8499 Giulietta 1230 Astra 7344 Cerato 9544 Clubman 0601 Model S 8502 Stelvio 1110 Barina 7540 Optima 9540 Cooper/Hatch 0602 Model X 1832 Captiva 7343 Picanto 9541 Countryman Audi Toyota 1886 Colorado 7215 Rio Mitsubishi 8636 A1/S1 4120 86 1512 Commodore Tourer 7347 Rondo 3110 ASX 8696 A3/S3 4121 C-HR 1506 Commodore 7216 Sorento 3201 Eclipse Cross 4320 Camry/Camry Hybrid 8693 A4/S4 3210 Lancer 1602 Equinox 7348 Soul 4200 Corolla 8738 A5/S5 3230 Mirage 1570 HSV (Holden Special 7213 Sportage 4214 Fortuner 8694 A6/S6 Vehicle) 3713 Outlander PHEV 7142 Stinger 4830 Hiace 8727 A7/S7 1112 Spark 3711 Outlander Land Rover 4820 Hilux 8695 A8/S8 1819 Trailblazer 3235 Pajero Sport 9840 Defender 4861 Kluger 8728 Q2 1879 Trax 3860 Pajero 8726 Q3 9831 Discovery Sport 3820 Triton 4950 Landcruiser Honda 8737 Q5 9830 Discovery Nissan 4880 Prado 9721 Range Rover Evoque 4116 Prius C 8735 Q7 7300 Accord 5386 350Z/370Z 9615 Range Rover Sport 4117 Prius V 8699 TT 7303 City 5401 Juke 9611 Range Rover Velar 4115 Prius 7200 Civic 5387 Leaf BMW 9610 Range Rover 4760 RAV4 7840 CR-V 5850 Navara PAGE 2 PAGE 2 8446 1-Series 4730 Tarago 7841 -

Suncorp Banks on Cortell and Leads the Pack with Next Generation Business Reporting … SBR XBRL 2.1

“Prior to Cortell’s fully automated solution, it took several people, several days to provide the numbers. Submitting an APRA report is now as simple as pushing a button and analysing the data.” James Corner, Executive Manager, Financial Control, Suncorp banks on Cortell and leads the pack with next generation business reporting … SBR XBRL 2.1 uncorp Bank is Australia’s 5th in a series of linked spreadsheets and Discover a clear view ahead! largest listed bank, with banking databases that passed through multiple Cortell is here to help. S origins dating back to 1902. They teams and accountants and other financial are part of the Suncorp Group, a top 25 leaders' hands before a two-dimensional Australian company operating some of report was produced. These processes the most respected banking, insurance were inadequate to meet the multi- and wealth brands in Australia and New dimensional requirements of 2.1 and Zealand. future taxonomy releases. Nor did these As a regional bank, Suncorp delivers processes address the common problems banking services to over one million of manual, error prone processes that personal and business banking customers were time consuming and difficult to including: Personal; Small to Medium audit. Enterprises; Commercial Lending; and The Strategy Agribusiness. James Corner was the owner of Financial Suncorp Bank customers have access to Reporting for Suncorp Bank and was 192 branches, agencies and Business confident XBRL was critical to the success Banking Centres across Australia. of the organisation. Corner had first-hand The Challenge experience with XBRL overseas and could clearly see its many benefits. -

Attachment A

Attachment A Register of Investments and Cash as at 30 November 2018 6 REGISTER OF INVESTMENTS AND CASH AS AT 30 NOVEMBER 2018 Monthly Monthly Net Net Returns Investment Rating Amount $ Net Return Rolling 12 Maturity Date Term (months) Date Institution Returns Annualised Months Call Account Westpac Bank AA 38,036,854 0.15% 1.75% 1.75% 1‐Dec‐18 22‐May‐12 0 Total 38,036,854 0.15% 1.75% 1.75% Term Deposits (TD) Bank of Queensland A 5,000,000 0.22% 2.60% 2.60% 7‐Dec‐18 8‐Dec‐17 12 Credit Union Australia Ltd A 5,000,000 0.22% 2.65% 2.65% 7‐Dec‐18 5‐Feb‐18 10 Suncorp Bank A 5,000,000 0.23% 2.70% 2.70% 7‐Dec‐18 8‐Aug‐18 4 Bank of Queensland A 5,000,000 0.22% 2.60% 2.60% 11‐Dec‐18 1‐Mar‐18 9 ME Bank A 5,000,000 0.22% 2.60% 2.60% 13‐Dec‐18 29‐Jun‐18 5 National Aust Bank AA 5,000,000 0.23% 2.80% 2.80% 13‐Dec‐18 15‐Jun‐18 6 Bank of Queensland A 5,000,000 0.22% 2.60% 2.60% 14‐Dec‐18 9‐Feb‐18 10 Bank of Queensland A 5,000,000 0.22% 2.60% 2.60% 14‐Dec‐18 14‐Feb‐18 10 Bendigo & Adelaide Bank A 5,000,000 0.23% 2.80% 2.80% 14‐Dec‐18 4‐Jul‐18 5 ME Bank A 5,000,000 0.22% 2.60% 2.60% 17‐Dec‐18 1‐Mar‐18 10 National Aust Bank AA 5,000,000 0.23% 2.80% 2.80% 18‐Dec‐18 28‐Jun‐18 6 ME Bank A 5,000,000 0.23% 2.70% 2.70% 20‐Dec‐18 9‐Apr‐18 8 Bankwest AA 5,000,000 0.23% 2.70% 2.70% 21‐Dec‐18 24‐Aug‐18 4 Bankwest AA 5,000,000 0.22% 2.65% 2.65% 21‐Dec‐18 29‐Aug‐18 4 Bankwest AA 5,000,000 0.22% 2.65% 2.65% 28‐Dec‐18 28‐Aug‐18 4 Bankwest AA 5,000,000 0.23% 2.70% 2.70% 4‐Jan‐19 23‐Aug‐18 4 Westpac Banking Corporation (Fixed Rate , interest paid quaterly) AA 5,000,000 -

The Adoption of Social Media by Australian Banks to Communicate with the Public

The Adoption of Social Media by Australian Banks to Communicate with the Public by Vindaya Asanga Senadheera MISM, M.Sc. in Computer Engineering Submitted in fulfilment of the requirements for the degree of Doctor of Philosophy Department of Information Systems and Business Analytics Faculty of Business & Law Deakin University May, 2015 Dedication This dissertation is dedicated to my father and late mother who have been a pillar of support for me during my academic development, and to my loving wife and children for giving inspiration and purpose to my life. Acknowledgements This thesis represents the work and contributions of many remarkable people who I must acknowledge individually and as a group. First and foremost, I would like to extend my sincere thanks to my supervisory group that enabled successful completion of my research study: x Professor Matthew Warren for his dedication throughout this research study as the principal supervisor and as the primary source of knowledge that yielded substantial contribution to the research. x Associate Professor Shona Leitch for her flexible approach to work that made me feel that my research was her priority and enabled me to maintain sustained interest in the study. x Dr Graeme Pye for his ability as an experienced academic to generate continued enthusiasm that enabled me to overcome challenging situations. I would also like to acknowledge the contributions of the following people and organisations that provided indirect support and assistance: x Dr Scott Salzman for his expert advice on matters relating to quantitative research. x Professor Roger Horn for his academic insights delivered through seminars, workshops and chapter retreats. -

Sbr Xbrl 2.1

“Prior to Cortell’s fully automated solution, it took several people, several days to provide the numbers. Submitting an APRA report is now as simple as pushing a button and analysing the data.” James Corner, Executive Manager, Financial Control, Suncorp Bank Suncorp banks on Cortell and leads the pack with next generation business reporting … SBR XBRL 2.1 Suncorp Bank is Australia’s 5th largest listed passed through multiple teams and Discover a clear view ahead! bank, with banking origins dating back to accountants and other financial leaders' Cortell is here to help. 1902. They are part of the Suncorp Group, a hands before a two-dimensional report was top 25 Australian company operating some produced. These processes were inadequate of the most respected banking, insurance to meet the multi-dimensional requirements and wealth brands in Australia and New of 2.1 and future taxonomy releases. Nor did Zealand. these processes address the common As a regional bank, Suncorp delivers banking problems of manual, error prone processes services to over one million personal and that were time consuming and difficult to business banking customers including: audit. Personal; Small to Medium Enterprises; The Strategy Commercial Lending; and Agribusiness. James Corner was the owner of Financial Suncorp Bank customers have access to 192 Reporting for Suncorp Bank and was branches, agencies and Business Banking confident XBRL was critical to the success of Centres across Australia. the organisation. Corner had first-hand The Challenge experience with XBRL overseas and could clearly see its many benefits. APRA introduced XBRL 2.0 taxonomy in 2002 Suncorp Bank went to market and evaluated and it was replaced in July 2011 with the CASE STUDY SBR Taxonomy XBRL 2.1. -

Regional Banks - Bank of Queensland, Bendigo and Adelaide Bank, ME Bank and Suncorp Bank

26 May 2015 The Hon. Bruce Billson MP Minister for Small Business c/- General Manager Small Business, Competition and Consumer Policy Division The Treasury Langton Crescent PARKES ACT 2600 Dear Minister, Thank you for the opportunity to make a submission to the Commonwealth Treasury as part of the consultation on the recommendations of the Final Report of the Competition Policy Review. This submission is made on behalf of the Regional Banks - Bank of Queensland, Bendigo and Adelaide Bank, ME Bank and Suncorp Bank. These four banks made a comprehensive submission1 to the Government’s Financial System Inquiry (FSI) last year which covers many aspects of competition in retail banking. The Final Report of the Competition Policy Review has made significant recommendations to reform competition policy across a number of priority areas. The purpose of this submission is to highlight key issues in our FSI Submission that we believe are also relevant to the Competition Policy Review. While these issues have not been specifically addressed in the Competition Policy Review Final Report, we believe they are important to achieve genuine competition in retail banking, fostered through a fair, transparent and open banking system. We believe that consumers, small business, and the wider economy will be the primary beneficiaries of a stronger banking industry comprised of vibrant competitors of differing size and business approaches, competing on a level playing field. Traditionally, Australia’s banking system has proven robust and stable. However, developments since the Global Financial Crisis have re-shaped much of the competitive and regulatory environment resulting in inefficiencies which provide significant advantages to Australia’s largest banks. -

Board of Directors

Board of Directors John Story, Chairman BA, LLB, FAICD Age 65 Chairman since December 2010, Chairman of Suncorp-Metway Ltd since March 2003 and director since January 1995 Chairman Echo Entertainment Group Limited Director CSR Limited Chancellor, The University of Queensland Ziggy Switkowski, L to R: Ziggy Switkowski, Stuart Grimshaw, Paula Dwyer, Patrick Snowball, Ewoud Kulk, Chairman elect John Story, Bill Bartlett, Ilana Atlas, Geoff Ricketts BSc (Hons), PhD, FAICD, FTSE Age 63 Director since December 2010 and director of Suncorp-Metway Ltd since Ewoud Kulk Ziggy Switkowski – Chairman elect September 2005 BEcon, FAICD Age 65 Dr Zygmunt (Ziggy) Switkowski has been Chairman Opera Australia endorsed by the Board as Suncorp’s next Director Tabcorp Holdings Limited, Director since December 2010 and director Chairman and will assume the role following Lynas Corporation Ltd and Oil Search Limited of Suncorp-Metway Ltd since March 2007 current Chairman John Story’s retirement Chancellor, RMIT University Chairman AA Insurance Limited (NZ) at the conclusion of the 2011 Annual Ilana Atlas Director Westmead Millennium Institute General Meeting in October. BJuris (Hons) (WAust), LLB (Hons) (WAust), LLM (Syd) Geoff Ricketts Dr Switkowski is a distinguished Australian Age 56 business leader and, having served LLB (Hons) on the Suncorp Board since 2005, will Director since January 2011 and director of Age 65 Suncorp-Metway Ltd since that time ensure continuity as the Group executes Director since December 2010 and director of the strategic plans already outlined to Chairman Bell Shakespeare Suncorp-Metway Ltd since March 2007 shareholders. He has extensive senior Director Coca-Cola Amatil Limited Chairman Lion Nathan National Foods Limited executive operating and Board experience and Westfield Holdings Limited from leading large Australian and Director Spotless Group Limited, Pro-Chancellor, Australian National University international organisations. -

Social Services Legislation Amendment (Cashless Debit Card)

My name is a constituent of I have grave concerns about the likely impact of the Cashless Debit Card that the Social Services Legislation Amendment Bill 2017 would extend, because I see it as a step toward totalitarianism and the loss of our financial freedom. Contrary to Government propaganda, the Cashless Welfare card is not as user friendly as it purports to be. There are several reasons why it is a bad idea for local and regional communities with high unemployment and underemployment cohorts and for town small business owners. The mainstream media is telling stories which seem to suit the agenda of big business but fails to address the stories of small business owners who are being affected by this card and have closed shop or massively losing money. The card is produced by INDUE and to use it the business owner needs to enter into a business agreement with INDUE to lease a cashless card Eftpos machine. The cost of small business is climbing, particularly in relation to utilities. There is no way for small business owners to quantify how much of their takings is supplied by welfare recipients so making a feasibility assessment of whether or not to invest in an INDUE leased Eftpos machine is impossible. If they do invest there is no guarantee that card holders will keep using their business. The cards are geared towards big business such as Coles and Woolies. Unsurprisingly these are the very same businesses that co-own the Eftpos business so they stand to take the lions share of Government money under this card. -

A Bank a Bank Is a Financial Institution That Largely Deals with Deposits and Loans for a Variety of Reasons Such a Commercial Or Personal

A Bank A bank is a financial institution that largely deals with deposits and loans for a variety of reasons such a commercial or personal. The difference between a bank, an ADI, credit union, building society, and mutual bank ADI is an authorised deposit taking situation. An institution must be accredited to accept deposits from the public. Credit Union A credit union is a member-owned financial cooperative, controlled by its members credit at competitive rates as well as other financial services. Credit institutions are created, owned and operated by their participants. As such, they are not-for-profit enterprises that enjoy tax-exempt status. Building Society a type of financial institution that provides banking and other financial services to its members. Building societies resemble credit unions. They are similar to credit unions and savings and loan institutions, but their members are typically those in construction trades, real estate, or co-op housing. Mutual Bank A mutual savings bank is a financial institution chartered by a central or regional government, without capital stock, that is owned by its members who subscribe to a common fund. Finance and the Finance Industry Finance is a broad term that describes activities associated with banking, leverage or debt, credit, capital markets, money, and investments. Basically, finance represents money management and the process of acquiring needed funds. Finance also encompasses the oversight, creation, and study of money, banking, credit, investments, assets, and liabilities that make up financial systems. The financial sector is a section of the economy made up of firms and institutions that provide financial services to commercial and retail customers. -

For Immedia Te R Elea

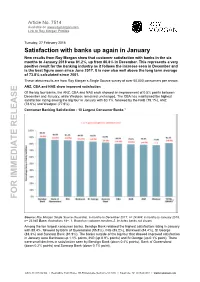

Article No. 7514 Available on www.roymorgan.com Link to Roy Morgan Profiles Tuesday, 27 February 2018 Satisfaction with banks up again in January New results from Roy Morgan show that customer satisfaction with banks in the six months to January 2018 was 81.2%, up from 80.8% in December. This represents a very positive result for the banking industry as it follows the increase seen in December and is the best figure seen since June 2017. It is now also well above the long term average of 73.8% calculated since 2001. These latest results are from Roy Morgan’s Single Source survey of over 50,000 consumers per annum. ANZ, CBA and NAB show improved satisfaction E Of the big four banks, the ANZ, CBA and NAB each showed an improvement of 0.5% points between December and January, while Westpac remained unchanged. The CBA has maintained the highest satisfaction rating among the big four in January with 80.1%, followed by the NAB (79.1%), ANZ (78.6%) and Westpac (77.9%). Consumer Banking Satisfaction - 10 Largest Consumer Banks 1 FOR IMMEDIATE RELEAS FOR IMMEDIATE Source: Roy Morgan Single Source (Australia). 6 months to December 2017, n= 24,984; 6 months to January 2018, n= 23,945 Base: Australians 14+. 1. Based on customer numbers.2. Includes banks not shown. Among the ten largest consumer banks, Bendigo Bank retained the highest satisfaction rating in January with 88.4%, followed by Bank of Queensland (85.8%), ING (85.2%), Bankwest (84.4%), St George (83.3%) and Suncorp Bank (81.9%). -

Top 5 Interest Rates

TOP 5 INTEREST RATES Information displayed as of 02.04.2019 Top 5 | Variable Rates Owner Occupied Investment $500,000 at 90% LVR $500,000 at 90% LVR 3.55% Bank of Sydney 3.99% Adelaide, Suncorp, Better Choice, Auswide 3.69% BankSA, Suncorp, IMB, Auswide 4.12 % Heritage 3.77% Heritage 4.14% AMP 3.78% Qudos 4.19% Bank of Sydney 3.80% Better Choice 4.24% CBA, St George Group $1,000,000 at 70% LVR $1,000,000 at 70% LVR 3.55% Bank of Sydney, Citi Bank 3.87% Better Choice 3.64% Resimac Prime 3.89% Citi Bank, Resimac Prime 3.67% Heritage 3.99% Adelaide, Bank of Sydney, Suncorp, Auswide 3.68% Qudos 4.02% Heritage Better Choice, BankSA, IMB, Suncorp, Bank 4.04% ING, Myloan Elect 3.69% Australia, Auswide $450,000 at 60% LVR Lo Doc $450,000 at 60% LVR Lo Doc 4.15% ANZ 4.46% ANZ 4.74% Resimac Prime 4.74% Resimac Prime 4.89% Liberty 4.99% Bluestone, La Trobe 4.92% Pepper Money 5.03% Better Choice 4.96% Better Choice 5.31% Pepper Money $450,000 at 80% LVR LOC $450,000 at 80% LVR LOC 3.85% Resimac Prime 3.89% Resimac Prime 4.21% Better Choice 4.49% Suncorp 4.49% Suncorp 4.51% Better Choice 5.05% Heritage 4.74% AMP 5.24% Auswide 5.05% Heritage April 2019 Top 5 | Fixed Rates Owner Occupied | $450K at 85% LVR Investment | $450K at 85% LVR 1 Year 1 Year 3.69% Suncorp 3.99% Heritage, Adelaide, Suncorp 3.75% ING 4.09% Bank of Sydney 3.79% Adelaide 4.14% CBA 3.80% Better Choice 4.19% Maquarie, BOQ 3.83% Premium Capital 4.23% Premium Capital 2 Years 2 Years 3.65% IMB 3.89% St George 3.69% St George, NAB 3.94% Bank of Melbourne, Bankwest, BankSA 3.74% Bank of -

Star Ratings Report

2015 STAR RATINGS REPORT Transaction & Savings Account Transaction and Savings Account September 2015 Foreword The fact that the official cash rate languishes at its historic low of just 2% is great news for home loan borrowers - but the complete opposite for those trying to build up savings. Thankfully, the government has decided to axe its idea for a bank deposits tax, so that’s one thing we don’t need to worry about. It remains difficult to find a good return for your money, Mitchell Watson and most of the better accounts impose strict conditions Research Manager on their use. That’s why you’ll want to regularly check that you’re still getting the best value out there. You might be able to offset an uninspiring interest rate by finding an account that waives the regular fees. After all, every drop of water raises the sea. As we move to a cashless society, deposit accounts have become specialised in nature and are designed to cater for the different ways you use them. That’s why we research and rate deposit accounts across four savings profiles – Flexible, Regular, Junior, SMSF and Cash Manager – and three everyday transactor profiles – High, Low and Youth Transactors. Here at CANSTAR, we put more than 350 deposit accounts from 75 different institutions under the research microscope. Our five-star ratings are awarded to products that offer outstanding value in their profile. See how your current institution stacks up with what is available on the market, and switch if you’re not satisfied. Getting the best deal possible to build your savings is sensible any day of the year but absolutely essential when rates are as low as a limbo stick.