Tax Policies for Inclusive Growth in a Changing World │ 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SHOULD WE TAX UNHEALTHY FOODS and DRINKS? Donald Marron, Maeve Gearing, and John Iselin December 2015

SHOULD WE TAX UNHEALTHY FOODS AND DRINKS? Donald Marron, Maeve Gearing, and John Iselin December 2015 Donald Marron is director of economic policy initiatives and Institute fellow at the Urban Institute, Maeve Gearing is a research associate at the Urban Institute, and John Iselin is a research assistant at the Urban-Brookings Tax Policy Center. The authors thank Laudan Aron, Kyle Caswell, Philip Cook, Stan Dorn, Lisa Dubay, William Gale, Genevieve Kenney, Adele Morris, Eric Toder, and Elaine Waxman for helpful comments and conversations; Joseph Rosenberg for running the Tax Policy Center model; Cindy Zheng for research assistance; Elizabeth Forney for editing; and Joanna Teitelbaum for formatting. This report was funded by the Laura and John Arnold Foundation. We thank our funders, who make it possible for Urban to advance its mission. The views expressed are those of the authors and should not be attributed to our funders, the Urban-Brookings Tax Policy Center, the Urban Institute, or its trustees. Funders do not determine our research findings or the insights and recommendations of our experts. For more information on our funding principles, go to urban.org/support. TAX POLICY CENTER | URBAN INSTITUTE & BROOKINGS INSTITUTION EXECUTIVE SUMMARY A healthy diet is essential to a long and vibrant life. But there is increasing evidence that our diets are not as healthy as we would like. Obesity, diabetes, hypertension, and other conditions linked to what we eat and drink are major challenges globally. By some estimates, obesity alone may be responsible for almost 3 million deaths each year and some $2 trillion in medical costs and lost productivity (Dobbs et al. -

U.S Trade Policy-Making in the Eighties

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Politics and Economics in the Eighties Volume Author/Editor: Alberto Alesina and Geoffrey Carliner, editors Volume Publisher: University of Chicago Press Volume ISBN: 0-226-01280-8 Volume URL: http://www.nber.org/books/ales91-1 Conference Date: May 14-15, 1990 Publication Date: January 1991 Chapter Title: U.S Trade Policy-making in the Eighties Chapter Author: I. M. Destler Chapter URL: http://www.nber.org/chapters/c5420 Chapter pages in book: (p. 251 - 284) 8 U. S. Trade Policy-making in the Eighties I. M. Destler 8.1 Introduction As the 1970s wound to a close, Robert Strauss, President Jimmy Carter’s Special Trade Representative, won overwhelming congressional approval of the Tokyo Round agreements. This was a triumph of both substance and polit- ical process: an important set of trade liberalizing agreements, endorsed through an innovative “fast-track” process that balanced the executive need for negotiating leeway with congressional determination to act explicitly on the results. And it was accompanied by substantial improvement in the nonoil merchandise trade balance. Both the substance of trade policy and the process of executive- congressional collaboration would be sorely tested in the 1980s. During the first Reagan administration, a mix of tight money and loose budgets drove the dollar skyward and sent international balances awry. The merchandise trade deficit rose above $100 billion in 1984, there to remain through the decade (see table 8.1). The ratio of U.S. imports to exports peaked at 1.64 in 1986, a disproportion not seen since the War between the States. -

Paying for Government in South Carolina: a Citizen's Guide

P Paying for Government in South Carolina A Citizen’s Guide by Holley Hewitt Ulbrich Ada Louise Steirer June 2003 Strom Thurmond Institute of Government and Public Affairs Clemson University Funded by the R.C. Edwards Endowment and the Office of the President Contents ◗ Before You Read This Booklet . Three ◗ The Ideal Revenue System . Five ◗ Answering Tax Questions . Eight ◗ State Sales and Use Taxes . Ten ◗ Local Sales Taxes . Twelve ◗ State and Local Excise Taxes . Fourteen ◗ Local Property Taxes . Sixteen ◗ State Income Tax . Nineteen ◗ Fees and Charges . Twenty-one ◗ What Can a Citizen Do? . Twenty-three About the Authors Dr. Ulbrich is Alumna Professor Emerita of Economics at Clemson University and Senior Fellow of the Strom Thurmond Institute. She has written extensively about tax policy. Ms. Steirer is a research associate in community and economic development at the Institute. Both have experience as elected and appointed officials. The views presented here are not necessarily those of the Strom Thurmond Institute of Government and Public Affairs or of Clemson University. The Institute sponsors research and public service programs to enhance civic awareness of public policy issues and improve the quality of national, state, and local government. The Institute, a public service activity of Clemson University, is a nonprofit, nonpartisan, tax-exempt public policy research organization. Before You Read This Booklet the purpose ◗ This booklet has been written to help citizens of South Carolina understand how their state and local tax system works and why we use the revenue sources we do. Understanding how the system works may not change how you feel about taxes. -

How Does a Surplus Affect the Formulation and Conduct of Monetary Policy?”

Mr Meyer answers the question “How does a surplus affect the formulation and conduct of monetary policy?” Speech by Mr Laurence H Meyer, Member of the Board of Governors of the US Federal Reserve System, before the 16th Annual Policy Conference, National Association for Business Economics, Washington, D.C. on 23 February 2000. * * * This is a conference on fiscal policy, specifically on how to allocate any potential future surpluses among debt reduction, tax cuts, and spending increases. The question you and I might be asking right now is: what is a monetary policymaker doing here? You know, of course, that I always enjoy visiting with my fellow NABE members. But what contribution can I make to this important topic? My assignment is to answer this question: How do the prevailing surplus and, especially, decisions about the allocation of future potential surpluses affect the formulation and conduct of monetary policy? The best way to understand the issues involved, in my view, is through the concept of the policy mix. Using this concept will allow us to focus on the implications of alternative combinations of monetary and fiscal policies - yielding the same level of aggregate demand - for the real interest rate, the composition of output, and the current account balance. And it also will help us understand the key source of the interdependence of monetary and fiscal policy decisions. In planning my remarks today, I intended first to discuss the analytics and the politics of the policy mix and then to illustrate the power of the analysis by using it to explain some of the important features of our current experience. -

D Quantifying the Policy Mix in a Monetary Union with National Macroprudential Policies186

D Quantifying the policy mix in a monetary union with 186 national macroprudential policies In a monetary union, targeted national macroprudential policies can be necessary to address asymmetric financial developments that are outside the scope of the single monetary policy. This special feature discusses and, using a two-country structural model, provides some model-based illustrations of the strategic interactions between a single monetary policy and jurisdiction-specific macroprudential policies. Counter- cyclical macroprudential interventions are found to be supportive to monetary policy conduct through the cycle. This complementarity is significantly reinforced when there are asymmetric financial cycles across the monetary union. Introduction Macroprudential policy in the euro area is primarily conducted by designated national macroprudential authorities, with a central coordinating and horizontal role for the ECB – especially since the establishment of the Single Supervisory Mechanism (SSM) which granted the ECB some macroprudential powers.187 The predominantly decentralised organisation of macroprudential policy-making in the euro area reflects inter alia the still incomplete integration of national banking sectors and heterogeneous financial cycles across euro area countries. In addition, as the single monetary policy mandate is to deliver price stability over the medium term for the euro area as a whole, monetary policy may actually look through financial stability risks building up in specific market segments, jurisdictions or individual countries. Such risks could also have implications for financial stability at the area-wide level. Hence, in a monetary union setting such as the euro area, nationally oriented macroprudential policies have a role to play in ensuring financial stability for all jurisdictions and supporting monetary policy conduct through the cycle. -

Intermediate Macroeconomics (Econ 300) – Spring 200 8 – Ilan Noy Practice Midterm

INTERMEDIATE MACROECONOMICS (ECON 300) – SPRING 200 8 – ILAN NOY PRACTICE MIDTERM USE GRAPHS WHENEVER THAT IS POSSIBLE!!! 1) Based on your understanding of the AS-AD model and the IS-LM model, graphically illustrate and explain what effect an increase in government expenditures will have on the economy. a) Graph everything. In your graphs, clearly illustrate the short-run and medium-run equilibria. b) Explain (in words) why the medium-run equilibrium is different from the short-run. c) Was this increase in government expenditures neutral in the medium run? Explain. 2) Explain in detail what short run effect(s) a Fed sale of bonds will have on: (a) The money market diagram; (b) The LM curve; and (c) the IS curve. 3) Explain how the unemployment rate is calculated. In your answer, include an explanation of each of the variables used to calculate the unemployment rate. 4) Increases in the budget deficit are believed to cause reductions in investment (crowding out). Based on your understanding of the IS-LM model, will a tax cut cause a reduction in investment? Explain using a graph. 5) Use the IS-LM model to answer this question. Suppose there is a simultaneous increase in government spending and increase in the money supply. Explain what effect this particular policy mix will have on output and the interest rate. Based on your analysis, do we know with certainty what effect this policy mix will have on output? Explain using a graph. 6) Explain the difference between the GDP deflator and the CPI. Which one is a better indicator of inflation? Why? 7) Based on your understanding of the AS-AD model and the IS-LM model, graphically illustrate and explain what effect an increase in taxes will have on the economy. -

Iran: US Concerns and Policy Responses

Order Code RL32048 Iran: U.S. Concerns and Policy Responses Updated March 13, 2007 Kenneth Katzman Specialist in Middle Eastern Affairs Foreign Affairs, Defense, and Trade Division Iran: U.S. Concerns and Policy Responses Summary According to the Administration’s “National Security Strategy” document released on March 16, 2006, the United States “may face no greater challenge from a single country than Iran.” That perception, generated first and foremost by Iran’s developing nuclear program, intensified following the military confrontation between Iranian-armed and assisted Lebanese Hezbollah and Israel in July-August 2006. To date, the Bush Administration has pursued several avenues to attempt to contain the potential threat posed by Iran, but the Administration’s focus on preventing an Iranian nuclear weapons breakthrough — as well as on stabilizing Iraq — has brought diplomatic strategy to the forefront. The Bush Administration announced May 31, 2006, it would negotiate with Iran in concert with U.S. allies if Iran suspends uranium enrichment. However, Iran did not comply with an August 31, 2006, deadline to cease uranium enrichment, contained in U.N. Security Council Resolution 1696 (July 31, 2006). After almost four months of negotiations during which Russia and, to a lesser extent, China, argued that diplomacy with Iran would yield greater results than would sanctions, the Security Council imposed modest sanctions on trade with Iran’s nuclear infrastructure and a freeze on trade with and the assets of related entities and personalities. (Resolution 1737, passed unanimously on December 23, 2006). Iran remains out of compliance, and the international community is discussing further sanctions against Iran. -

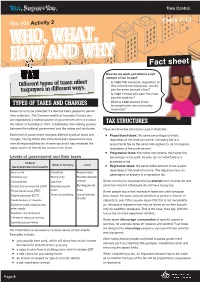

WHO, WHAT, HOW and WHY Fact Sheet

Ta x , Super+You. Take Control. Years 7-12 Tax 101 Activity 2 WHO, WHAT, HOW AND WHY Fact sheet How do we work out what is a fair amount of tax to pay? • Is it fair that everyone, regardless of Different types of taxes affect their income and expenses, should taxpayers in different ways. pay the same amount of tax? • Is it fair if those who earn the most pay the most tax? • What is a fair amount of tax TYPES OF TAXES AND CHARGES for people who use community resources? Taxes can only be collected if a law has been passed to permit their collection. The Commonwealth of Australia Constitution Act established a federal system of government when it created TAX STRUCTURES the nation of Australia in 1901. It distributes law-making powers between the national government and the states and territories. There are three tax structures used in Australia: Each level of government imposes different types of taxes and Proportional taxes: the same percentage is levied, charges. During World War II the Australian Government took regardless of the level of income. Company tax is a over all responsibilities for income tax and it has remained the proportional tax as the same rate applies for all companies, major source of federal tax revenue ever since. regardless of the profit earned. Progressive taxes: the higher the income, the higher the Levels of government and their taxes percentage of tax paid. Income tax for individuals is a Federal progressive tax. State or territory Local (Australian/Commonwealth) Regressive taxes: the same dollar amount of tax is paid, regardless of the level of income. -

Hakelberg Rixen End of Neoliberal Tax Policy

Is Neoliberalism Still Spreading? The Impact of International Cooperation on Capital Taxation Lukas Hakelberg and Thomas Rixen Freie Universität Berlin Ihnestr. 22 14195 Berlin, Germany E.mail: [email protected] and [email protected] Postprint. Please cite as: Hakelberg, L. and T. Rixen (2020). "Is neoliberalism still spreading? The impact of international cooperation on capital taxation." Review of International Political Economy. https://doi.org/10.1080/09692290.2020.1752769 Acknowledgments Leo Ahrens, Fulya Apaydin, Frank Bandau, Benjamin Braun, Benjamin Faude, Valeska Gerstung, Leonard Geyer, Matthias vom Hau, Steffen Hurka, Friederike Kelle, Christoph Knill, Simon Linder, Daniel Mertens, Richard Murphy, Sol Picciotto, Nils Redeker, Max Schaub, Yves Steinebach, Alexandros Tokhi, Frank Borge Wietzke, Michael Zürn and other participants at the ECPR General Conference in Oslo 2017, the IBEI Research Seminar and Workshop ‘Pol- icy-Making in Hard Times’ in Barcelona in 2017, the Conference of the German Political Sci- ence Association’s (DVPW) Political Economy Section in Darmstadt 2018, the Tax Justice Network’s Annual Conference 2018 in Lima and the Global Governance Colloquium at the Social Science Research Center Berlin (WZB) in May 2019 as well as three anonymous re- viewers provided very helpful comments and suggestions. We thank all of them. Is Neoliberalism Still Spreading? The Impact of International Cooperation on Capital Taxation Abstract The downward trend in capital taxes since the 1980s has recently reversed for personal capital income. At the same time, it continued for corporate profits. Why have these tax rates diverged after a long period of parallel decline? We argue that the answer lies in different levels of change in the fights against tax evasion and tax avoidance. -

Implications of Trends Toward Protectionism

IMPLICATIONS OF TRENDS TOWARD PROTECTIONISM Vernon L. Sorenson Professor, AgriculturalPolicy and Trade Michigan State University Introduction Recent literature on trade policy suggests that the world has come full circle. Much is made of "the new mercantilism." The implication is that the economic liberalism which provided the basis for British leadership in trade policy during the 19th century and U.S. leader- ship during the post World War II period has come to an end. There is some truth in this assessment. But it falls short of representing a complete characterization of today's situation. In its original form mercantilism was oriented toward enhancing state wealth and power. The increasing protectionism of today, on the other hand, derives from at least two different conditions. One is through producer-oriented pressure groups within individual countries. Protectionism in this context is aimed at the welfare of groups that are affected by competition in the international market- place and who seek to influence policy to serve their own ends. This form of pressure has existed throughout history, but for a number of reasons has become more intense during the 1970s. A second condition that leads to greater protection is the search by governments for ways to deal with problems of national interest that stem from greatly expanded levels of interdependence and the increasingly direct linkages between domestic and international policy issues. Some of these issues generate a competitive relation- ship among countries as, for example, when nations unilaterally implement policies aimed at improved balance of payments, ex- pand exports to enhance economic growth, or they seek other national goals irrespective of their impact on the international trad- ing order. -

Indonesia: the Macroprudential Framework and the Central Bank's Policy

Indonesia: the macroprudential framework and the central bank’s policy mix Perry Warjiyo* Abstract Recent crises have clearly highlighted the importance of understanding macro- financial linkages in order to mitigate the build-up of systemic risks to financial and macroeconomic stability, and sustainable economic growth. This note describes the role of macroprudential policy as an integral part of the central bank policy mix and financial stability in Indonesia. It encompasses regulation and surveillance from a macro perspective with a focus on systemic risk. A number of macroprudential policy measures have been implemented in Indonesia, including loan-to-value (LTV) ratios, reserve requirements and a capital conservation buffer, and these have proven successful in mitigating the build-up of systemic risks to financial stability as well as strengthening monetary policy in achieving price stability. In line with the central bank’s revised mandate for combined price and financial system stability, the policy mix comprises interest rate, exchange rate, capital flow management and macroprudential elements. Our experience since 2010 shows that the current policy mix has advantages over the standard inflation targeting framework. In addition to implementing a sound macroprudential framework to promote financial stability, Indonesia has underpinned its crisis management protocol for prevention and resolution of the financial system crisis with a strong legal foundation (ie the Law on Financial System Crisis Prevention and Resolution of 2016). Keywords: central banking, policy mix, financial stability, monetary policy, macroprudential policy, crisis management JEL classification: E52, E58, H12 * Deputy Governor, Bank Indonesia. BIS Papers No 94 189 Macroprudential policy is an integral part of Indonesia’s central bank policy mix. -

The Dollar and the Policy Mix: 1971

ESSAYS IN INTERNATIONAL FINANCE NO. 85, May 1971 IIMMINIMIMINNEM THE DOLLAR AND THE POLICY MIX: 1971 ROBERT A. MUNDELL INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY Princeton, New Jersey This is the eighty-fifth number in the series ESSAYS IN IN- TERNATIONAL FINANCE, published from time to time by the International Finance Section of the Department of Eco- nomics of Princeton University. The author, Robert A. Mundell, is Professor of Eco- nomics at the University of Chicago. He has written many articles in the field of international finance and several books,including most recently, Man and Economics( 1968), International Economics (1968), Monetary Problems of the International Economy (with A. Swoboda, 1969), and Monetary Theory: Inflation, Interest and Growth in the World Economy (ii). The Section sponsors the essays in this series but takes no further responsibility for the opinions expressed in them. The writers are free to develop their topics as they wish. Their ideas may or may not be shared by the editorial com- mittee of the Section or the members of the Department. FRITZ MACHLUP, Director International Finance Section ESSAYS IN INTERNATIONAL FINANCE NO. 85, May 1971 111:LE:ME.MEMMII THE DOLLAR AND THE POLICY MIX: 1971 IIMEMINCOMENI ROBERT A. MUNDELL INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY Princeton, New Jersey Copyright © 1971, by International Finance Section Department of Economics Princeton University L.C. Card No. 70-165467 Printed in the United States of America by Princeton University Press at Princeton, New Jersey THE DOLLAR AND THE POLICY MIX: 1971 THE DEFICIT AND THE DOLLAR • A decade ago Professor Rueff characterized the American balance-of- payments deficit as a "deficit without tears." He meant that the United States could buy expensive-to-make( European) resources with cheap-to- print dollars.