International Trade Policy That Works for U.S. Workers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

06Dem Internationalen Steuerwettbewerb Begegnen

DEM INTERNATIONALEN STEUERWETTBEWERB 06BEGEGNEN I. Motivation II. Der Tax Cuts and Jobs Act und seine Auswirkungen 1. Wesentliche Elemente der Steuerreform 2. Makroökonomische Auswirkungen der Steuerreform III. Deutschland im internationalen Steuerwettbewerb 1. Gewinnsteuersätze international im Abwärtstrend 2. Diskriminierende Besteuerung von mobilen und immobilen Aktivitäten IV. Herausforderungen bei der internationalen Besteuerung 1. Prinzipien zur Festlegung der Besteuerungsrechte 2. Besteuerung der Digitalwirtschaft als Herausforderung 3. Alternative Harmonisierungsbestrebungen V. Steuerpolitische Optionen zur Förderung privater Investitionen 1. Moderate Senkung der Steuerbelastung 2. Abbau von Verzerrungen Eine andere Meinung Literatur Dem internationalen Steuerwettbewerb begegnen – Kapitel 6 DAS WICHTIGSTE IN KÜRZE Zu Beginn des Jahres 2018 wurde in den Vereinigten Staaten mit dem Tax Cuts and Jobs Act (TCJA) eine umfangreiche Steuerreform umgesetzt, die zum einen die Steuersätze auf Arbeits- und Kapi- taleinkommen deutlich reduziert hat, zum anderen die Besteuerung multinationaler Unternehmen neu ordnet. Dies ist die größte Steuerreform seit dem Tax Reform Act 1986 und dürfte sich in viel- facher Hinsicht auf die Wirtschaft in den Vereinigten Staaten auswirken. Es ist eine zusätzliche Belebung des US-amerikanischen Wirtschaftswachstums zu erwarten, was wiederum das deut- sche Wirtschaftswachstum anregen dürfte. Mit Belgien, Frankreich und Italien haben Staaten mit ehemals höheren Steuersätzen als Deutsch- land ebenfalls die Steuersätze gesenkt und weitere Senkungen angekündigt. Bei den tariflichen Gewinnsteuersätzen rückt Deutschland damit allmählich wieder an die Spitze der OECD-Länder. Die Steuertarife sind jedoch nur ein Bestandteil eines Steuersystems. Die Bemessungsgrundlage, auf die der Steuersatz angewandt wird, ist gleichermaßen von Bedeutung. In diesem Kontext wird unter dem Begriff „Smart Tax Competition“ diskutiert, inwieweit steuerliche Anreize gezielt gesetzt werden können, um bestimmte, sehr mobile Aktivitäten anzuziehen. -

SHOULD WE TAX UNHEALTHY FOODS and DRINKS? Donald Marron, Maeve Gearing, and John Iselin December 2015

SHOULD WE TAX UNHEALTHY FOODS AND DRINKS? Donald Marron, Maeve Gearing, and John Iselin December 2015 Donald Marron is director of economic policy initiatives and Institute fellow at the Urban Institute, Maeve Gearing is a research associate at the Urban Institute, and John Iselin is a research assistant at the Urban-Brookings Tax Policy Center. The authors thank Laudan Aron, Kyle Caswell, Philip Cook, Stan Dorn, Lisa Dubay, William Gale, Genevieve Kenney, Adele Morris, Eric Toder, and Elaine Waxman for helpful comments and conversations; Joseph Rosenberg for running the Tax Policy Center model; Cindy Zheng for research assistance; Elizabeth Forney for editing; and Joanna Teitelbaum for formatting. This report was funded by the Laura and John Arnold Foundation. We thank our funders, who make it possible for Urban to advance its mission. The views expressed are those of the authors and should not be attributed to our funders, the Urban-Brookings Tax Policy Center, the Urban Institute, or its trustees. Funders do not determine our research findings or the insights and recommendations of our experts. For more information on our funding principles, go to urban.org/support. TAX POLICY CENTER | URBAN INSTITUTE & BROOKINGS INSTITUTION EXECUTIVE SUMMARY A healthy diet is essential to a long and vibrant life. But there is increasing evidence that our diets are not as healthy as we would like. Obesity, diabetes, hypertension, and other conditions linked to what we eat and drink are major challenges globally. By some estimates, obesity alone may be responsible for almost 3 million deaths each year and some $2 trillion in medical costs and lost productivity (Dobbs et al. -

The Urban-Brookings Tax Policy Center Microsimulation Model: Documentation and Methodology for Version 0304

The Urban-Brookings Tax Policy Center Microsimulation Model: Documentation and Methodology for Version 0304 Jeffrey Rohaly Adam Carasso Mohammed Adeel Saleem January 10, 2005 Jeffrey Rohaly is a research associate at the Urban Institute and director of tax modeling for the Tax Policy Center. Adam Carasso is a research associate at the Urban Institute. Mohammed Adeel Saleem is a research assistant at the Urban Institute. This documentation covers version 0304 of the model, which was developed in March 2004. The authors thank Len Burman and Kim Rueben for helpful comments and suggestions and John O’Hare for providing background on statistical matching. Views expressed are those of the authors and do not necessarily reflect the views of the Urban Institute, the Brookings Institution, their boards, or their sponsors. Documentation and Methodology: Tax Model Version 0304 A. Introduction.................................................................................................................... 3 Overview................................................................................................................................. 3 History..................................................................................................................................... 5 B. Source Data .................................................................................................................... 7 SOI Public Use File ............................................................................................................... -

Tax Administrations and the Challenges of the Digital

LISBON TAX SUMMIT TAX ADMINISTRATIONS AND THE CHALLENGES OF THE DIGITAL WORLD 24 - 26 October 2018 Lisbon, Portugal SUMMARY REPORT LISBON TAX SUMMIT TAX ADMINISTRATIONS AND THE CHALLENGES OF DIGITAL WORLD CONTENTS DAY 1 FAIR AND EFFECTIVE TAXATION ACROSS THE DIGITAL ECONOMY 2 SESSION 1 INAUGURAL SESSION 2 SESSION 2 KEYNOTES: FAIR AND EFFECTIVE TAXATION ACROSS THE DIGITAL ECONOMY 3 SESSION 3 PANEL: HOW TO TAX DIGITAL BUSINESSES - COUNTRIES EXPERIENCES 4 SESSION 4 PANEL: TAX TRANSPARENCY IN THE DIGITAL ERA 6 SESSION 5 ROUND TABLE: DIGITAL TAXATION. IMPLICATIONS, CONCERNS ON THE POLICY AND ADMINISTRATION SIDES 7 SESSION 6 ROUND TABLE: TREATMENT OF CRYPTOCURRENCIES 14 AND INITIAL COIN OFFERINGS 8 DAY 2 MAKING TAX ADMINISTRATION DIGITAL 9 SESSION 7 KEYNOTE: MAKING TAX ADMINISTRATION DIGITAL 9 SESSION 8 PANEL: GETTING CLOSER TO THE FACTS. REAL-TIME CONTROLS FOR TAX ADMINISTRATION PURPOSES 10 SESSION 9 PANEL: PUBLIC SERVICE DELIVERY 11 SESSION 10 PANEL: HUMAN RESOURCES & CAPACITY BUILDING 13 SESSION 11 ROUND TABLE: TAX AND CUSTOMS DIGITAL ADMINISTRATIONS 14 SESSION 12 PANEL: ADVANCED ANALYTICS FOR COMPLIANCE CONTROL 15 DAY 3 VISION OF THE FUTURE: CHALLENGES AND OPPORTUNITIES OF TAX DIGITIZATION 16 SESSION 13 KEYNOTE: VISION OF THE FUTURE: CHALLENGES AND OPPORTUNITIES OF TAX DIGITIZATION 16 SESSION 14 PANEL: NEW TECHNOLOGIES TO ENHANCE TAX COMPLIANCE AND COLLECTION 17 SESSION 15 PANEL: TAX DIGITIZATION: VIEWS AND PERSPECTIVES OF BUSINESS COMMUNITY 18 SESSION 16 ROUND TABLE: TAX ADMINISTRATION IN 10 - 15 YEARS, HOW ARE WE COPING WITH THE PACE OF -

The Little Downpayment Savings Policy That Could

This article was downloaded by: [George Mason University] On: 27 August 2015, At: 04:02 Publisher: Routledge Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: 5 Howick Place, London, SW1P 1WG Housing and Society Publication details, including instructions for authors and subscription information: http://www.tandfonline.com/loi/rhas20 The little downpayment savings policy that could: revisiting building and loan societies and their products in times of the tight credit box and the pending housing finance reform Katrin Anackera a School of Policy, Government and International Affairs, 3351 Fairfax Drive, MSN 3B1, Arlington, VA 22201, USA Published online: 25 Aug 2015. Click for updates To cite this article: Katrin Anacker (2015): The little downpayment savings policy that could: revisiting building and loan societies and their products in times of the tight credit box and the pending housing finance reform, Housing and Society, DOI: 10.1080/08882746.2015.1076128 To link to this article: http://dx.doi.org/10.1080/08882746.2015.1076128 PLEASE SCROLL DOWN FOR ARTICLE Taylor & Francis makes every effort to ensure the accuracy of all the information (the “Content”) contained in the publications on our platform. However, Taylor & Francis, our agents, and our licensors make no representations or warranties whatsoever as to the accuracy, completeness, or suitability for any purpose of the Content. Any opinions and views expressed in this publication are the opinions and views of the authors, and are not the views of or endorsed by Taylor & Francis. The accuracy of the Content should not be relied upon and should be independently verified with primary sources of information. -

Paying for Government in South Carolina: a Citizen's Guide

P Paying for Government in South Carolina A Citizen’s Guide by Holley Hewitt Ulbrich Ada Louise Steirer June 2003 Strom Thurmond Institute of Government and Public Affairs Clemson University Funded by the R.C. Edwards Endowment and the Office of the President Contents ◗ Before You Read This Booklet . Three ◗ The Ideal Revenue System . Five ◗ Answering Tax Questions . Eight ◗ State Sales and Use Taxes . Ten ◗ Local Sales Taxes . Twelve ◗ State and Local Excise Taxes . Fourteen ◗ Local Property Taxes . Sixteen ◗ State Income Tax . Nineteen ◗ Fees and Charges . Twenty-one ◗ What Can a Citizen Do? . Twenty-three About the Authors Dr. Ulbrich is Alumna Professor Emerita of Economics at Clemson University and Senior Fellow of the Strom Thurmond Institute. She has written extensively about tax policy. Ms. Steirer is a research associate in community and economic development at the Institute. Both have experience as elected and appointed officials. The views presented here are not necessarily those of the Strom Thurmond Institute of Government and Public Affairs or of Clemson University. The Institute sponsors research and public service programs to enhance civic awareness of public policy issues and improve the quality of national, state, and local government. The Institute, a public service activity of Clemson University, is a nonprofit, nonpartisan, tax-exempt public policy research organization. Before You Read This Booklet the purpose ◗ This booklet has been written to help citizens of South Carolina understand how their state and local tax system works and why we use the revenue sources we do. Understanding how the system works may not change how you feel about taxes. -

2013 Individual Income Tax Rates, Standard Deductions, Personal Exemptions, and Filing Thresholds

15-Oct-15 2016 Individual Income Tax Rates, Standard Deductions, Personal Exemptions, and Filing Thresholds If your filing status is Single If your filing status is Married filing jointly Taxable Income Taxable Income But not But not Over --- over --- Marginal Rate Over --- over --- Marginal Rate $0 $9,275 10% $0 $18,550 10% $9,275 $37,650 15% $18,550 $75,300 15% $37,650 $91,150 25% $75,300 $151,900 25% $91,150 $190,150 28% $151,900 $231,450 28% $190,150 $413,350 33% $231,450 $413,350 33% $413,350 $415,050 35% $413,350 $466,950 35% $415,050 and over 39.6% $466,950 and over 39.6% If your filing status is Married filing If your filing status is Head of Household separately Taxable Income Taxable Income But not But not Over --- over --- Marginal Rate Over --- over --- Marginal Rate $0 $13,250 10% $0 $9,275 10% $13,250 $50,400 15% $9,275 $37,650 15% $50,400 $130,150 25% $37,650 $91,150 25% $130,150 $210,800 28% $91,150 $190,150 28% $210,800 $413,350 33% $190,150 $413,350 33% $413,350 $441,000 35% $413,350 $441,000 35% $441,000 and over 39.6% $441,000 and over 39.6% Standard Deduction Standard Deduction for Dependents Standard Blind/Elderly Greater of $1000 or sum of $350 and Single $6,300 $1,550 individual's earned income Married filing jointly $12,600 $1,250 Personal Exemption $4,050 Head of Household $9,300 $1,550 Married filing Threshold for Refundable separately $6,300 $1,250 Child Tax Credit $3,000 Filing Threshold Number of Blind / Elderly Exemptions 0 1 2 3 4 Single 10,350 11,900 13,450 Head of Household 13,350 14,900 16,450 Married -

Base Erosion and Profit Shifting (BEPS)

Base Erosion and Profit Shifting (BEPS) BEPS Action 7 Additional Guidance on the Attribution of Profits to Permanent Establishments 4 October 2017 2 TABLE OF CONTENTS AFME and UK Finance .................................................................................................................. 5 Andrew Cousins & Richard Newby ............................................................................................... 8 Andrew Hickman ............................................................................................................................ 13 ANIE (Federazione Nazionale Imprese Elettrotecniche ed Elettroniche) ....................................... 19 Association of British Insurers ....................................................................................................... 22 BDI ...... .......................................................................................................................................... 24 BDO...... .......................................................................................................................................... 26 BEPS Monitoring Group ................................................................................................................ 29 BIAC ... .......................................................................................................................................... 47 BusinessEurope ............................................................................................................................. -

Tax Policy State and Local Individual Income Tax

TAX POLICY CENTER BRIEFING BOOK The State of State (and Local) Tax Policy SPECIFIC STATE AND LOCAL TAXES How do state and local individual income taxes work? 1/9 Q. How do state and local individual income taxes work? A. Forty-one states and the District of Columbia levy broad-based taxes on individual income. New Hampshire and Tennessee tax only individual income from dividends and interest. Seven states do not tax individual income of any kind. Local governments in 13 states levy some type of tax on income in addition to the state income tax. State governments collected $344 billion from individual income taxes in 2016, or 27 percent of state own-source general revenue (table 1). “Own-source” revenue excludes intergovernmental transfers. Local governments—mostly concentrated in Maryland, New York, Ohio, and Pennsylvania—collected just $33 billion from individual income taxes, or 3 percent of their own-source general revenue. (Census includes the District of Columbia’s revenue in the local total.) TABLE 1 State and Local Individual Income Tax Revenue 2016 Revenue (billions) Percentage of own-source general revenue State and local $376 16% State $344 27% Local $33 3% Source: Urban-Brookings Tax Policy Center, “State and Local Finance Initiative Data Query System.” Note: Own-source general revenue does not include intergovernmental transfers. Forty-one states and the District of Columbia levy a broad-based individual income tax. New Hampshire taxes only interest and dividends, and Tennessee taxes only bond interest and stock dividends. (Tennessee is phasing its tax out and will completely eliminate it in 2022.) Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not have a state individual income tax. -

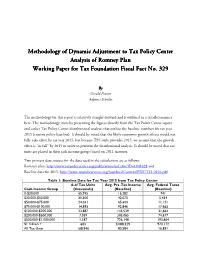

Methodology of Dynamic Adjustment to Tax Policy Center Analysis of Romney Plan Working Paper for Tax Foundation Fiscal Fact No

Methodology of Dynamic Adjustment to Tax Policy Center Analysis of Romney Plan Working Paper for Tax Foundation Fiscal Fact No. 329 ByByBy Gerald Prante Adjunct Scholar The methodology for this report is relatively straight-forward and is outlined in a detailed manner here. The methodology starts by presenting the figures directly from the Tax Policy Center report and earlier Tax Policy Center distributional analysis that outline the baseline numbers for tax year 2015 (current policy baseline). It should be noted that the likely economic growth effects would not fully take effect by tax year 2015, but because TPC only provides 2015, we assume that the growth effect is “in full” by 2015 in order to perform the distributional analysis. It should be noted that tax units are placed in their cash income groups based on 2011 incomes. Two primary data sources for the data used in the calculations are as follows: Romney plan: http://www.taxpolicycenter.org/publications/url.cfm?ID=1001628 and Baseline data for 2015: http://www.taxpolicycenter.org/numbers/Content/PDF/T12-0126.pdf . Table 1: Baseline Data for Tax Year 2015 from Tax Policy Center # of Tax Units Avg. Pre -Tax Income Avg. Federal Taxes Cash Income Group (thousands) (Baseline) (Baseline) 0-$30,000 65,745 16,282 741 $30,000 -$50,000 30,300 42,073 5,454 $50,000 -$75,000 24,031 65,604 11,121 $75,000 -$100,000 14,893 92,846 17,663 $100,000 -$200,000 23,887 145,539 31,662 $200,000 -$500,000 7,059 305,065 74,677 $500,000 -$1,000,000 1,187 726,148 193,864 $1 million + 603 3,088,329 970,172 All Tax Units 168,946 80,584 16,851 Table 2: Static Distributional Estimates of Romney Plan from TPC Report Avg. -

WHO, WHAT, HOW and WHY Fact Sheet

Ta x , Super+You. Take Control. Years 7-12 Tax 101 Activity 2 WHO, WHAT, HOW AND WHY Fact sheet How do we work out what is a fair amount of tax to pay? • Is it fair that everyone, regardless of Different types of taxes affect their income and expenses, should taxpayers in different ways. pay the same amount of tax? • Is it fair if those who earn the most pay the most tax? • What is a fair amount of tax TYPES OF TAXES AND CHARGES for people who use community resources? Taxes can only be collected if a law has been passed to permit their collection. The Commonwealth of Australia Constitution Act established a federal system of government when it created TAX STRUCTURES the nation of Australia in 1901. It distributes law-making powers between the national government and the states and territories. There are three tax structures used in Australia: Each level of government imposes different types of taxes and Proportional taxes: the same percentage is levied, charges. During World War II the Australian Government took regardless of the level of income. Company tax is a over all responsibilities for income tax and it has remained the proportional tax as the same rate applies for all companies, major source of federal tax revenue ever since. regardless of the profit earned. Progressive taxes: the higher the income, the higher the Levels of government and their taxes percentage of tax paid. Income tax for individuals is a Federal progressive tax. State or territory Local (Australian/Commonwealth) Regressive taxes: the same dollar amount of tax is paid, regardless of the level of income. -

How Do Federal Income Tax Rates Work? XXXX

TAX POLICY CENTER BRIEFING BOOK Key Elements of the U.S. Tax System INDIVIDUAL INCOME TAX How do federal income tax rates work? XXXX Q. How do federal income tax rates work? A. The federal individual income tax has seven tax rates that rise with income. Each rate applies only to income in a specific range (tax bracket). CURRENT INCOME TAX RATES AND BRACKETS The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions. Income up to the standard deduction (or itemized deductions) is thus taxed at a zero rate. Federal income tax rates are progressive: As taxable income increases, it is taxed at higher rates. Different tax rates are levied on income in different ranges (or brackets) depending on the taxpayer’s filing status. In TAX POLICY CENTER BRIEFING BOOK Key Elements of the U.S. Tax System INDIVIDUAL INCOME TAX How do federal income tax rates work? XXXX 2020 the top tax rate (37 percent) applies to taxable income over $518,400 for single filers and over $622,050 for married couples filing jointly. Additional tax schedules and rates apply to taxpayers who file as heads of household and to married individuals filing separate returns. A separate schedule of tax rates applies to capital gains and dividends. Tax brackets are adjusted annually for inflation. BASICS OF PROGRESSIVE INCOME TAXATION Each tax rate applies only to income in a specific tax bracket. Thus, if a taxpayer earns enough to reach a new bracket with a higher tax rate, his or her total income is not taxed at that rate, just the income in that bracket.