2019 Annual Report CHAIRMAN’S LETTER

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capstone Headwaters Education Technology M&A Coverage Report

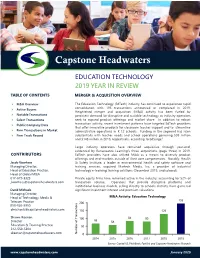

Capstone Headwaters EDUCATION TECHNOLOGY 2019 YEAR IN REVIEW TABLE OF CONTENTS MERGER & ACQUISTION OVERVIEW M&A Overview The Education Technology (EdTech) industry has continued to experience rapid consolidation with 195 transactions announced or completed in 2019. Active Buyers Heightened merger and acquisition (M&A) activity has been fueled by Notable Transactions persistent demand for disruptive and scalable technology as industry operators Select Transactions seek to expand product offerings and market share. In addition to robust transaction activity, recent investment patterns have targeted EdTech providers Public Company Data that offer innovative products for classroom teacher support and to streamline Firm Transactions in Market administrative operations in K-12 schools. Funding in the segment has risen Firm Track Record substantially with teacher needs and school operations garnering $95 million and $148 million in 2018, respectively, according to EdSurge.1 Large industry operators have remained acquisitive through year-end, evidenced by Renaissance Learning’s three acquisitions (page three) in 2019. CONTRIBUTORS EdTech providers have also utilized M&A as a means to diversify product offerings and end-markets outside of their core competencies. Notably, Health Jacob Voorhees & Safety Institute, a leader in environmental health and safety software and Managing Director, training services, acquired Martech Media, Inc, a provider of industrial Head of Education Practice, technology e-learning training solutions (December 2019, undisclosed). Head of Global M&A 617-619-3323 Private equity firms have remained active in the industry, accounting for 52% of [email protected] transaction volume. Operators that provide disruptive platforms and institutional business models, selling directly to schools districts, have garnered David Michaels significant investment interest and premium valuations. -

Partners Group Private Equity (Master Fund)

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2017-02-28 | Period of Report: 2016-12-31 SEC Accession No. 0001398344-17-002471 (HTML Version on secdatabase.com) FILER Partners Group Private Equity (Master Fund), LLC Mailing Address Business Address 1114 AVENUE OF THE 1114 AVENUE OF THE CIK:1447247| IRS No.: 800270189 | State of Incorp.:DE | Fiscal Year End: 0331 AMERICAS AMERICAS Type: N-Q | Act: 40 | File No.: 811-22241 | Film No.: 17644875 37TH FLOOR 37TH FLOOR NEW YORK NY 10036 NEW YORK NY 10036 212-908-2600 Copyright © 2017 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-22241 Partners Group Private Equity (Master Fund), LLC (Exact name of registrant as specified in charter) 1114 Avenue of the Americas, 37th Floor New York, NY 10036 (Address of principal executive offices) (Zip code) Robert M. Collins 1114 Avenue of the Americas, 37th Floor New York, NY 10036 (Name and address of agent for service) Registrant's telephone number, including area code: (212) 908-2600 Date of fiscal year end: March 31 Date of reporting period: December 31, 2016 Form N-Q is to be used by management investment companies, other than small business investment companies registered on Form N-5 (ss.ss. 239.24 and 274.5 of this chapter), to file reports with the Commission, not later than 60 days after the close of the first and third fiscal quarters, pursuant to rule 30b1-5 under the Investment Company Act of 1940 (17 CFR 270.30b1-5). -

Global Trends in Insurance M&A in 2014 and Beyond Looking Back on 2014: the Return of the Billion Dollar Transactions

GLOBAL TRENDS IN INSURANCE M&A IN 2014 AND BEYOND LOOKING baCK ON 2014: THE RETURN OF thE BILLION DOLLAR TRANSACTIONS In recent years, insurance companies have largely focused on improving their performance by 1. ACQUISITIONS ARE ON THE UP cutting costs amidst a slow post-global financial The big insurance groups are buying again, even those that crisis environment. However, the past two years suffered during the global economic crisis and have been have seen the tide change: the industry is now quiet on the M&A radar for some time. The number of seeking to bolster profits by embarking upon publically disclosed insurance deals in 2014 is up around both domestic and the potentially more lucrative 11 percent on 2013 from 316 to 354 (mergermarket). emerging market M&A. Economic confidence is growing and those insurance companies that suffered, yet survived, the rock bottom of the Not only are acquisitions on the up, the value is economic crisis are beginning to bounce back up, too. and consider opportunities to invest in their now well capitalized companies both internally and by external expansion. After a slow 2013, we saw with some billion dollar deals including Dai-ichi Life Insurance Company’s acquisition of Protective Life in a deal valued a significant uplift in M&A activity in the sector at US$5.7 billion, Canada Pension Plan Investment Board’s in 2014. For the first time in a number of years, (CPPIB’s) US$1.8 billion acquisition of Wilton Re, Manulife’s the industry has seen billion-dollar deals, some of US$4 billion acquisition of the Canadian operations which are identified in this paper. -

Deals, Dollars, and Disputes

Deals, Dollars, and Disputes MAXIMIZING VALUE MINIMIZING RISK A Summary of Private Equity Transactions for the Quarter Ended September 30, 2014 CONTENTS Our Process and Methodology ................................................ 1 Summary of Q3 2014 PE Firm Transaction Activity ................ 2 Volume of PE Deals Announced and Completed ......................................... 2 Top 25 PE Firm Transactions by Deal Value Completed During Q3 2014 ............................................................................................... 3 Industry Sector Transaction Analyses ........................................................... 4 Purchase Price Premium for Transactions Involving Controlling Stakes ........................................................................................... 6 PE Acquisition Type Analyses ........................................................................ 7 Featured Transactions and Insights ........................................ 8 Value Creation through Industry Consolidation ........................................... 8 In Good Company with Private Equity: LuLu*s and H.I.G. ......................... 11 Introduction We are pleased to present you with our Deals, Dollars, and Disputes report for the quarter ended September 30th, 2014. Our analysis involves a study of the merger and and acquisition transactions involving private equity firms (“PE firms”) during the Our Objective recent quarter. Our objective in preparing this report is to provide a general overview of the volume and value -

– Onex Partners to Become a Majority Investor in Newport Healthcare –

FOR IMMEDIATE RELEASE All amounts in U.S. dollars unless otherwise stated – Onex Partners to Become a Majority Investor in Newport Healthcare – Toronto, June 7, 2021 – Onex Corporation (“Onex”) (TSX: ONEX) today announced that Onex Partners V (“Onex Partners”) has agreed to acquire Newport Healthcare (“Newport” or “the company”), in partnership with the company’s management team. Newport is a leading provider in the United States of evidence-based healing centers for teens and young adults struggling with primary mental health issues. Newport offers a family-systems approach, providing gender-specific, individualized, integrated programs that encompass clinical therapy, academic support, and experiential practices. Offerings include residential treatment centers, Partial Hospitalization Programs, and Intensive Outpatient Programs. Newport nurtures the physical, psychological, social, educational, and spiritual needs of individuals, from a foundation of compassionate care, clinical expertise, and unconditional love. Newport's primary mission is to empower lives and restore families. Joe Procopio, CEO of Newport stated, “At a time when our country is in the midst of a mental health epidemic, we are thrilled to be partnering with the team at Onex, continuing our mission to be at the forefront of providing life changing care, and extending those services to more families in need.” “Newport is committed to delivering the highest quality care to its clients and addressing the nationwide shortage of mental health resources for teens and young adults by expanding access to care. We are excited to support Newport and its vision to be the leader in the sustainable healing of teens and young adults,” said Josh Hausman, an Onex Managing Director. -

Notice of Annual Meeting of Shareholders to Be Held May 13, 2021 and Information Circular

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 13, 2021 AND INFORMATION CIRCULAR NOTICE OF ANNUAL MEETING OF SHAREHOLDERS NOTICE IS HEREBY GIVEN that an annual meeting of the shareholders of Onex Corporation (the “Corporation”) will be held on Thursday, the 13th day of May, 2021 at 10:00 a.m. (Eastern Daylight Savings Time). Due to the continuing public health impact of the global coronavirus (COVID-19) pandemic and in consideration of the health and safety of our shareholders, colleagues and the broader community, this year’s meeting will be held in a virtual meeting format only, by way of a live audio webcast. Shareholders will be able to listen, vote and submit questions at the meeting in real time through a web-based platform instead of attending the meeting in person. You can attend the virtual meeting by joining the live audio webcast online at https://web.lumiagm.com/465190078. The purpose of the meeting is the following: 1. to receive and consider the consolidated balance sheets of the Corporation as at December 31, 2020 and the consolidated statements of earnings, shareholders’ equity and cash flows for the year then ended, together with the report of the auditor thereon; 2. to appoint an auditor of the Corporation; 3. to authorize the directors of the Corporation to fix the remuneration of the auditor; 4. to elect directors of the Corporation; 5. to consider and approve, on an advisory basis, a resolution accepting the Corporation’s approach to executive compensation; and 6. to transact such further and other business as may properly come before the meeting or any adjournment to postponement thereof. -

081231 PGLI-LPE Monthly Report

Monthly Newsletter Partners Group Listed Investments - Listed Private Equity (I) as of 31 December 2008 The Partners Group Listed Investments - Listed Private Equity fund provides efficient access to the asset class private equity overcoming the normally associated hurdle of illiquidity. The Fund invests in companies, which do mainly private equity investments and are listed on major stock exchanges. Out of an investment universe of over 240 companies world wide, the fund management actively screens a target list of around 50 companies, which fit the minimum criteria. Monthly Facts ReportKey Date of Inception: 6 September 2004 Partners Group Listed Investments – Listed Private Equity (I) Fund Currency: EUR resembled its LPX50 benchmark index by declining 13.4% in Fund Domicile: Luxembourg December. Contributing significantly to the unusually Close of Financial Year: 31 December negative mood in the listed private equity market during the Investment Advisor: Partners Group AG month were the sharp drops in the share prices of Distributions: Accumulated heavyweights SVG Capital and 3i Group. SVG Capital, a Management Fee (Net of Administration and Custodian Fees): 1.15% London-listed fund of funds, announced that the uncalled ISIN: LU0196152606 commitments vis-à-vis its private equity partner Permira will Valor: 1902989 be reduced by 40% and that the company is planning launch WKN: A0B61A a capital GBP 200 million rights issue. Those announcements Bloomberg Ticker: PGILPQI LX led to a sharp drop in the price of SVG Capital’s shares. The Total Net Assets: EUR 43.26m stock of 3i Group also came under pressure after Moody’s downgraded the company’s rating. -

15665 Onex Q1

Management’s Discussion and Analysis and Financial Statements First Quarter Ended March 31, 2007 ONEX CORPORATION Onex makes private equity investments through the Onex Partners and ONCAP family of Funds. Through these Funds, which have third-party capital as well as Onex’ capital, Onex generates annual management fee income from third-party capital and is currently entitled to a carried interest on more than $3.8 billion of that capital. It also has a Real Estate Fund and a Public Markets Fund. Onex’ operating companies have annual revenues of approximately $28 billion, assets of $28 billion and 184,000 employees worldwide. These companies are in a variety of industries, including electronics manufacturing services, aerostructures manufacturing, healthcare, financial services, metal services, aircraft & aftermarket service, customer support services, theatre exhibition, personal care products and communications infrastructure. Onex works in partnership with the management teams of our operating companies to build the value of these businesses. Onex is listed on the Toronto Stock Exchange under the symbol OCX. Table of Contents 3 Management’s Discussion and Analysis 20 Consolidated Financial Statements 36 Shareholder Information Throughout this report, all amounts are in Canadian dollars unless otherwise indicated. 2007 FIRST-QUARTER HIGHLIGHTS Onex’ share price was up 13 percent to $32.06 per share in the first quarter of 2007. Onex and its operating companies completed three significant acquisitions in the quarter: • The $3.8 billion purchase of Hawker Beechcraft, a leading manufacturer of business jet, turboprop and piston aircraft, was completed in March; • Tube City IMS, a leading provider of outsourced services to steel mills, was acquired in a $730 million transaction in January; and • ClientLogic acquired SITEL Corporation (now operating as Sitel Worldwide Corporation) in January and tripled the size of its business. -

2020 Annual Report CHAIRMAN’S LETTER

2020 Annual Report CHAIRMAN’S LETTER Dear Shareholders, 2020 was a year like no other. Like most others, we did not see the COVID-19 pandemic coming. However, as a seasoned, long-term investor we have experience through many cycles and market disruptions. We know the value of patience and the importance of maintaining a strong balance sheet. Across our organization, we focus on building meaningful relationships, diving deep into the industries we cover and building a diversified investment portfolio. These are our core investing princi- ples, allowing us to continue investing and creating value no matter the environment, while ensuring we are never a forced seller. A year like 2020 highlighted the importance of our discipline. Each of our platforms executed on value creation strategies throughout the year. Overall, we grew Investing Capital per share by 18%, which is our strongest year of growth since 2013. We also increased Onex’ total assets under management by 14% to approximately $44 billion, including our acquisition of Falcon Investment Advisors (“Falcon”). We continue to have a strong balance sheet and are investing in our Asset and Wealth Management platforms to better position ourselves for sustainable earnings growth. Within our Private Equity platform, our team was active, even as in-person interactions temporarily ground to a halt. We invested a total of $2.5 billion in the year, of which nearly $670 million came from Onex. The most notable investments were Onex Partners V’s acquisition of OneDigital, a leading U.S. provider of employee benefits insurance brokerage and retirement consulting services, and the Fund’s add-on investment in Convex, our de novo specialty insurer and reinsurer focused on complex risks. -

TESIS DOCTORAL ANTONIO SERRANO.Pdf

A mi mujer, Irene, y a mi hijo, Antonio, en compensación por todas las horas que este trabajo les ha privado de mí. ÍNDICE INTRODUCCIÓN. ............................................................................................ 33 PARTE PRIMERA: LAS ADQUISICIONES APALANCADAS DE EMPRESAS POR OPERADORES DE CAPITAL RIESGO. ANÁLISIS FINANCIERO, ECONÓMICO Y JURÍDICO. CAPÍTULO PRIMERO: INTRODUCCIÓN A LA INDUSTRIA DEL CAPITAL RIESGO. EVOLUCIÓN HISTÓRICA Y ANÁLISIS CRÍTICO. .......................... 43 1. Introducción. .......................................................................................... 43 1.1. Concepto y caracteres. ................................................................... 43 1.2. Aclaración conceptual y tipos de operaciones. ............................... 46 2. Historia del capital riesgo. ...................................................................... 49 2.1. Introducción. ................................................................................... 49 2.2. Prehistoria. ..................................................................................... 51 2.3. Orígenes del private equity moderno. ............................................. 52 2.4. Los primeros tiempos del venture capital y el crecimiento de Silicon Valley (1959-1981). ................................................................................... 54 2.5. Orígenes de las compras apalancadas (leveraged buyouts) (1955- 1981). ...................................................................................................... -

Gerald W. Schwartz University of Toronto Convocation June 3, 2016

Gerald W. Schwartz University of Toronto Convocation June 3, 2016 Mr. Chancellor: Gerry Schwartz ranks with Canada’s most successful entrepreneurs of his generation. In a storied career, he has built Onex, a remarkable company with global reach, served his country and this University with distinction, and shared his success with generous support of charitable causes in Canada and Israel. It is my privilege to present him to you to receive our University’s highest honour. Born in Winnipeg in 1941, Gerry is the only son of the late Andy and Lillian Schwartz. Andy was a successful small-business entrepreneur and Lillian was a lawyer, one of the first women called to the Manitoba bar. Gerry's academic choices reflected both of their interests; he studied Commerce and then Law at the University of Manitoba and on the side began his career as an entrepreneur. He ranked with the top students in his law school class while successfully starting his first businesses which ranged from coin set sales to carpets and later, to real estate development. He also began his long love affair with cars, becoming a certified mechanic and rebuilding a '39 Plymouth. Following articling, he decided business and not law was his passion so he headed for the Harvard Business School. An exotic summer in Geneva with Bernie Cornfeld, the then high-flying leader of Investors Overseas Services, persuaded Gerry there was no reason he could not succeed at the highest international levels of finance so after graduating from Harvard in 1970, he went to Wall Street to learn the skills of finance with which he would build his fortune. -

Leveraged Buyout Financial Model

ECONOMICS MANAGEMENT INFORMATION TECHNOLOGY Review Article LEVERAGED BUYOUT FINANCIAL MODEL Milan Maksimović1, Mlađan Maksimović2 1Belgrade Banking Academy 2The Faculty of Management, Zaječar Abstact: The situation in the global financial markets has become very turbulent in the recent decades, and as the main "culprit “ we can blame the globalization process. Multinational companies have managed to expand their business and invest the capital around the world and thus contribute to the transformation of the financial markets from the local to the global level. The first part of our work includes the history and definition the LBO model. Further on, the topic is the way of financing the first joint-stock companies, where the structure of debt and its importance are explained. The functioning of the LBO model, starting from the formation of private equity funds and up to the IPO, are analyzed, as well as its advantages and disadvantages. Keywords: Acquisition, transactions, capital market companies, investing, market risk, leveraged buyout ARTICLE INFO Article history: Recived 16 June. 2014 Recived in revised form 23 June. 2014 Accepted 30 June. 2014 Available online 29 Aug. 2014 1. INTRODUCTION During the recent decades global financial markets have been accompanied by insecurity, uncertainty, panic and greed. Multinational companies have managed to expand their business and invest the capital around the world and thus contribute to the transformation of the financial markets from the local to the global level. With the growth and development of both individual and global companies, the need for some financial institutions that could cope with the growth, in terms of providers of financial services, emerged.