Global Industrials

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China Construction Machinery

10 Feb 2020 CMB International Securities | Equity Research | Sector Update China Construction Machinery Scenario analysis on the resumption of factory production OUTPERFORM (Maintain) Factories in China, except Hubei, are scheduled to resume operation today. We China Capital Goods evaluate the companies under our coverage from several dimensions, including location of factories, capacity utilization, downstream demand and cash flow Wayne Fung, CFA management. Our base case scenario suggests that the overall earnings impact (852) 3900 0826 for the full year should be limited, as the sales volume in 1Q (the traditional peak [email protected] season) will potentially be shifted to 2Q or 3Q (low seasons) when the construction activities pick up when the epidemic is under control. We believe potential share price volatility in the near term will serve as opportunities to accumulate quality names such as SANY Heavy (600031 CH, BUY, TP: RMB19.0), Jiangsu Hengli (601100 CH, BUY, TP: RMB54.0) and Weichai Power (2338 HK, BUY, TP: HK$17.9 / 000338 CH, BUY, TP: RMB15.9). Utilization rate to gradually increase. For the companies under our coverage, no production base is located in Hubei province (figure 1). Some companies such as Weichai, SANY Heavy and Zoomlion have already resumed production since last week while others will restart today. That said, we do expect most of them will only ramp up its production gradually due to the potential labour shortage in the near term. Companies are trying their best to ramp up production to fulfil the existing orders, based on our check. Related Reports Expect mild delay on downstream demand. -

China Construction Machinery

21 Jan 2020 CMB International Securities | Equity Research | Sector Update China Construction Machinery SANY & Hengli issued +ve profit alert; Expect SANYI the next OUTPERFORM (Maintain) After the positive profit alert released by Zoomlion (1157 HK / 000157 CH, BUY) China Capital Goods last week followed by favourable share price reaction, SANY Heavy (600031 CH, BUY, Top pick) and Jiangsu Hengli (601100 CH, BUY) also released positive Wayne Fung, CFA alert yesterday with net profit in 2019E up 76-93% YoY and 47-53% YoY (852) 3900 0826 respectively. The strong earnings growth reaffirms our positive stance on both [email protected] companies. On the other hand, within our universe, we expect SANYI (631 HK, BUY) will potentially issue positive alert as well, which should serve as near term share price catalyst. SANY Heavy’s net profit in 2019E surged 76-93% YoY. According to the Company, the net profit range is RMB10.8-11.8bn, with mid-point of RMB11.3bn slightly above our estimate of RMB11.1bn. This implies 4Q19E earnings of RMB1.64-2.64bn, up 33%-114% YoY, with a mid-point of RMB2.14bn higher than our estimate of RMB1.97bn. The growth was driven by all business lines including excavator, crane, concrete, and pilling machinery. Besides, production efficiency enhancement and operating leverage also helped drive the earnings growth. Going forward, we expect an extended upcycle of excavator, together with the strong cycle of concrete and crane machinery, will continue to offer earnings surprise in 2020E. Jiangsu Hengli’s net profit in 2019E grew 47-53% YoY. -

Reports Available the European Service

REPORTS AVAILABLE THE EUROPEAN SERVICE MARKET REPORTS: MONTHLY EQUIPMENT ANALYSES AGRICULTURAL DIESEL ENGINES MOTOR GRADERS TRACTORS France Germany France Germany Germany Italy ROUGH TERRAIN Italy UK LIFT TRUCKS UK France DUMP TRUCKS Germany ASPHALT FINISHERS France Italy Germany Germany UK Italy Italy UK UK SKID-STEER LOADERS BACKHOE LOADERS HYDRAULIC France Europe EXCAVATORS Germany France Italy COMPACTION Germany SUBSCRIPTIONUK SERVICES FOR FURTHER DETAILS, Available on an annual subscription basis and published PLEASE CONTACT: EQUIPMENT Italy monthly, they monitor, analyse and provide objective opinions on these key construction equipment markets. David C.A. Phillips Simon Battersby n WESTERN EUROPE Managing Director Sales Account Manager Off-Highway Research Limited Off-Highway Research Ltd. France UK n CHINA* WHEELED Southfields, Southview Road, Southfields, Southview Road, n INDIA Wadhurst, East Sussex, Wadhurst, East Sussex, * Also available in Chinese language version. TN5 6TP, United Kingdom TN5 6TP, United Kingdom Germany LOADERS T: +44 (0)1892 786 270 T: +44 (0)1892 786 232 Each service is made up of the following elements: F: +44 (0)1892 784 086 F: +44 (0)1892 784 086 Italy MINI EXCAVATORS n COMPANY PROFILESFrance E: [email protected] E: [email protected] n EQUIPMENT ANALYSES www.offhighway.co.uk www.offhighway.co.uk n COUNTRY ANALYSES (Europe only) UK France n MARKET REPORTSGermany CHINA INDIA n ENQUIRY PRIVILEGES SHI Yang Samir Bansal Off-Highway Research Ltd. Off-Highway Research India Germany DATABASEItaly -

Project Proposals (In Chinese)

13 August 2015 Final Extended Report Assessment of the normative and policy framework governing the Chinese economy and its impact on international competition For: AEGIS EUROPE Cross-sector Alliance Representing European Manufacturing Brussels Belgium THINK!DESK China Research & Consulting Prof. Dr. Markus Taube & Dr. Christian Schmidkonz GbR Merzstrasse 18 81679 München Tel.: +49 - (0)89 - 26 21 27 82 [email protected] www.thinkdesk.de This report has been prepared by: Prof. Dr. Markus Taube Peter Thomas in der Heiden © THINK!DESK China Research & Consulting 2015 Seite 2 Contents Executive Summary ························································································· 12 1. Introduction ······························································································ 28 Part I: The Management of the Chinese Economy: Institutional Set-up and Policy Instruments 2. Centralised Planning and Market Forces in the Chinese Economy ··················· 33 2.1 The Role of Planning in the Chinese Economy ············································ 33 2.1.1 Types of Plans ··············································································· 33 2.1.2 Plans and Complementary Documents················································ 42 2.2 Dedicated Government Programmes for Industry Guidance ··························· 46 2.2.1 Subsidies – An Overview ································································· 46 2.2.1.1 Examples for Preferential Policies and Grant Giving Operations by Local Governments -

Lonking (3339 HK)

Equity Research | Construction Machinery Oct 17, 2017 Lonking (3339 HK) Buy (initiation) Beneficiary of the upcycle in China’s construction machinery industry; Target price: HK$4.30 initiate at Buy Initiate at Buy with TP of HK$4.30 We like Lonking for three main reasons: 1) it stands to benefit from the current upcycle in China’s construction machinery sector; 2) product price Dominic Chan, CFA, FRM increases should spur further business momentum; 3) market share gains demonstrate its SFC CE No. APP609 competiveness. We forecast net profit will rise 81% and 24% respectively in 2017/18, and [email protected] that net profit will see a CAGR of 37% during 2016-19. We initiate our coverage with a Buy +852 3719 1218 rating and target price of HK$4.30, based on 15x 2018E P/E and 2.0x 2018E P/B, its historical averages since 2006, and a 10% discount to the average 2018E P/E of its international peers. GF Securities (Hong Kong) Brokerage Limited 29-30/F, Li Po Chun Chambers Upcycle in China’s construction machinery industry Construction machinery sales 189 Des Voeux Road Central volume in China has been on the rise since 2H16. In 9M17, loader sales volume came in at Hong Kong 67,786 units, up 48% YoY, while excavator sales volume was 101,934units, up a substantial 100% YoY. This strong sales volume has been driven by steady FAI in China’s infrastructure, property and mining sectors, and replacements of machines sold during 2010-2012, after 6-8 years’ use. -

Global Industrials: Push by Japan, China Into 3D Printing

03 June 2013 Americas/United States Equity Research Electrical Equipment / Capital Goods i-Spy Global Industrials Weekly Research Analysts COMMENT Julian Mitchell 212 325 6668 [email protected] Push by Japan, China into 3D printing; more Charles Clarke 212 538 7095 competition in industrial automation software [email protected] Jonathan Shaffer ■ Japan and China making a push in 3D printing: Many Japanese 3D print- 212 325 1259 [email protected] related stocks had a strong bounce last week, due to reports that the Japanese government is bringing together the public and private sector in order to develop a high-performance sand-cast 3D printer for the mass production of cast-iron parts. These are used in diverse industries such as automotive, power gen This Week (6/3/2013 - 6/9/2013) Macro Events equipment and construction machinery. The target ASP per printer is JPY20m or 6/3 Euro-Zone May PMI Mfg (final) lower; the project cost is estimated at JPY3bn. China's biggest white goods 6/3 Germany May PMI Mfg (final) manufacturer, Haier, also announced its plan to enter the 3D printer market. 6/3 France May PMI Mfg (final) ■ Competition continues to intensify in industrial automation software: 6/3 UK May PMI Mfg 6/3 China HSBC May Mfg PMI Software comprises the single largest cost element of industrial automation 6/4 UK May PMI Construction projects today, and our Industry report last August highlighted that competition, 6/5 US Apr Factory Orders and M&A, is likely to intensify in this space, as the hardware vendors expand 6/6 Germany Apr Factory Orders their presence here. -

(Main Products) Electrical Equipments Chongqing Yuneng

Post Name of enterprise Industry Address Tel. Web Main business (main products) code Electrical equipments Aluminum stranded conductor steel-reinforced Chongqing Yuneng Manufacture No.1, Jinguo Avenue, National http://www.cqtaishan.co wire up to 1000kV, power cable up to 500kV, Taishan Electric of electric Agricultural Technology Park, 401120 023-61898188 m/ magnetic conductor, cable used for electric Wire&Cable Co., Ltd. wire & cable Yubei Dist., Chongqing equipment, special cable and so on Manufacture of ABB Chongqing No. 1, Huayannan Village, EHV transformers and reactors of 500kV and transformers, 400052 023 69093688 http://www.abb.com.cn/ Transformer Co., Ltd. Jiulongpo Dist., Chongqing above rectifiers & inductors Switch disconnectors with capacity up to 220kV, 110kV, SF6 gas insulated switchgear Manufacture (GIS)and self-interrupter SF6 circuit of breaker, 10~220kV Oil power transformer Chongqing AEA Electric distribution No.38, Jingjiqiao, Shapingba http://www.cqaea.com 400051 023-61717786 and CT&PT, 0.6~35kV resin cast power (group) Co., Ltd. switches & Dist., Chongqing / transformer and CT&PT, complete sets of control switch devices up to 35kV, prefabricated equipments substations, integrated power automation system and so on Manufacture Chongqing Electric of Yuqingsi, Zhongliangshan, http://www.cemf.com. AC&DC motors, small and medium-sized 400052 023-89093000 Machine Federation Ltd. electromotor Chongqing cn/ generators, turbines and so on s Wire, cable, anaerobic copper bar, electric Chongqing Pigeon Manufacture No. 998, Konggang http://www.cq-cable.co copper wire, copper profile, copper and Electric Wire&Cable Co., of electric 401120 023-67166111 Avenue,Yubei Dist., Chongqing m/ copper alloy rod, HV&LV electric porcelain Ltd. -

FTSE Publications

2 FTSE Russell Publications FTSE Global All Cap ex Canada 19 August 2019 China A Inclusion Indicative Index Weight Data as at Closing on 28 June 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 1&1 Drillisch <0.005 GERMANY Accell Group <0.005 NETHERLANDS Advanced Wireless Semiconductor <0.005 TAIWAN 1st Source <0.005 USA Accent Group <0.005 AUSTRALIA AdvanSix <0.005 USA 21Vianet Group (ADS) (N Shares) <0.005 CHINA Accenture Cl A 0.23 USA Advantech 0.01 TAIWAN 2U <0.005 USA Acciona S.A. <0.005 SPAIN Advantest Corp 0.01 JAPAN 360 Security (A) <0.005 CHINA ACCO Brands <0.005 USA Advtech <0.005 SOUTH AFRICA 361 Degrees International (P Chip) <0.005 CHINA Accor 0.02 FRANCE Adyen 0.02 NETHERLANDS 3-D Systems <0.005 USA Accordia Golf Trust <0.005 SINGAPORE Aecc Aero Engine Control (A) <0.005 CHINA 3i Group 0.03 UNITED Accton Technology <0.005 TAIWAN Aecc Aero Science Technology (A) <0.005 CHINA KINGDOM Ace Hardware Indonesia <0.005 INDONESIA AECC Aviation Power (A) <0.005 CHINA 3M Company 0.19 USA Acea <0.005 ITALY AECI <0.005 SOUTH AFRICA 3M India <0.005 INDIA Acer <0.005 TAIWAN AECOM 0.01 USA 3SBio (P Chip) <0.005 CHINA Acerinox <0.005 SPAIN Aedas Homes <0.005 SPAIN 51job ADR (N Shares) <0.005 CHINA Achilles <0.005 JAPAN Aedifica <0.005 BELGIUM 58.com ADS (N Shares) 0.01 CHINA ACI Worldwide 0.01 USA Aegean Airlines SA <0.005 GREECE 5I5j Holding Group (A) <0.005 CHINA Ackermans & Van Haaren 0.01 BELGIUM Aegion Corp. -

Global and China Forklift Industry Report, 2017-2021 2017 2021

Global and China Forklift Industry Report, 2017-2021 Nov. 2017 STUDY GOAL AND OBJECTIVES METHODOLOGY This report provides the industry executives with strategically signifisignificantcant Both primary and secondary research methodologies were used competitor information, analysis, insight and projection on the in preparing this study. Initially, a comprehensive and exhaustive competitive pattern and key companies in the industry, crucial to the search of the literature on this industry was conducted. These development and implementation of effective business, marketing and sources included related books and journals, trade literature, R&D programs. marketing literature, other product/promotional literature, annual reports, security analyst reports, and other publications. REPORT OBJECTIVES Subsequently, telephone interviews or email correspondence TtblihTo establish a compre hiftlhensive, factual, annua lldtddtlly updated and cost- was conducted with marketing executives etc. Other sources effective information base on market size, competition patterns, included related magazines, academics, and consulting market segments, goals and strategies of the leading players in the companies. market, reviews and forecasts. To assist potential market entrants in evaluating prospective INFORMATION SOURCES acquisition and joint venture candidates. The primary information sources include Company Reports, To complement the organizations’ internal competitor information and National Bureau of Statistics of China etc. gathering efforts with strategic -

China Construction Machinery

13 Sep 2019 CMB International Securities | Equity Research | Sector Update China Construction Machinery Implications of 1H19 results and upcoming drivers OUTPERFORM (Maintain) Construction machinery and HDT manufactures generally reported decent results China Capital Goods in 1H19. Large construction machinery players such as Zoomlion (1157 HK / 000157 CH, BUY), SANY Heavy (600031 CH, NR) and XCMG (000425 CH, NR) Wayne Fung, CFA reported significant net profit growth (100-200% YoY). Going forward, we believe (852) 3900 0826 the launch of new products, market consolidation, environmental policies driven [email protected] replacement demand and import substitution will serve as growth drivers. In the near term, the post result remarks by major construction machinery players point to a recovery of order intakes in Sep. We believe a potential pick up of infrastructure spending will boost sales volume in 4Q19E. Larger players reported better revenue growth in 1H19. The trend of industry consolidation continued with large players such as SANY Heavy and Zoomlion reported >50% YoY growth of revenue. The growth was driven by strong demand for crane and concrete machinery, as well as market share gains by both players. Smaller players such as Liugong (000528 CH, NR) and Lonking (3339 HK, HOLD) with a focus on wheel loaders reported low single digit revenue growth due to the substitution by excavator. Margin expansion. Majority of the players reported margin expansion in 1H19, on the back of operating leverage and product mix enhancement. Zoomlion and SANY Int’l (631 HK, BUY) reported 4.5ppt and 3.6ppt YoY expansion on gross margin. We expect both companies will continue to see margin upside with the launch of more products. -

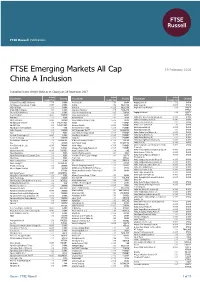

FTSE Emerging Markets All Cap China a Inclusion

FTSE Russell Publications FTSE Emerging Markets All Cap 19 February 2018 China A Inclusion Indicative Index Weight Data as at Closing on 29 December 2017 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 21Vianet Group (ADS) (N Shares) 0.01 CHINA Air China (H) 0.04 CHINA Angang Steel (H) 0.02 CHINA 361 Degrees International (P Chip) <0.005 CHINA AirAsia 0.02 MALAYSIA Angel Yeast (A) <0.005 CHINA 3SBio (P Chip) 0.04 CHINA AirAsia X <0.005 MALAYSIA Anglo American Platinum 0.03 SOUTH 51job ADR (N Shares) 0.01 CHINA Airports of Thailand 0.17 THAILAND AFRICA 58.com ADS (N Shares) 0.06 CHINA Airtac International Group 0.05 TAIWAN Anglogold Ashanti 0.08 SOUTH A.G.V. Products <0.005 TAIWAN Aisino Corporation (A) 0.01 CHINA AFRICA ABB India 0.02 INDIA Ajanta Pharma 0.01 INDIA Anhui Anke Biotechnology (Group) (A) <0.005 CHINA Ability Enterprise <0.005 TAIWAN Ajisen China Holdings (P Chip) <0.005 CHINA Anhui Chaodong Cement (A) <0.005 CHINA Aboitiz Equity Ventures 0.06 PHILIPPINES Akbank 0.1 TURKEY Anhui Conch Cement (A) 0.02 CHINA Aboitiz Power 0.02 PHILIPPINES Akcansa Cimento <0.005 TURKEY Anhui Conch Cement (H) 0.1 CHINA Abu Dhabi Commercial Bank 0.07 UAE Akenerji Elektrik Uretim <0.005 TURKEY Anhui Expressway (A) <0.005 CHINA AcBel Polytech 0.01 TAIWAN AKR Corporindo Tbk PT 0.01 INDONESIA Anhui Expressway (H) 0.01 CHINA ACC 0.02 INDIA Aksa Akrilik Ve Kimya Sanayii <0.005 TURKEY Anhui Golden Seed Winery (A) <0.005 CHINA Accelink Technologies (A) <0.005 CHINA Aksa Enerji Uretim AS <0.005 TURKEY Anhui Gujing Distillery (A) <0.005 CHINA Accton Technology 0.03 TAIWAN Aksigorta <0.005 TURKEY Anhui Gujing Distillery (B) 0.01 CHINA Ace Hardware Indonesia 0.01 INDONESIA Al Meera Consumer Goods Co. -

CMBIS Research

27 Nov 2019 CMB International Securities | Equity Research | Sector Update China Construction Machinery Four structural drivers to extend the upcycle to 2020-21E OUTPERFORM (Maintain) We believe the strict measures on emission control and pro-investment approach China Capital Goods taken by the government will offer earnings visibility to the China construction machinery sector in 2020E. Besides, leading Chinese brands, on the back of the Wayne Fung, CFA rising competitive power, have emerged as potential game changers to challenge (852) 3900 0826 the global giants. Consequently, we see continuous import substitution and [email protected] overseas opportunities as growth drivers over coming years. We initiate coverage on SANY Heavy (600031 CH, TP: RMB19.0, Top pick), Jiangsu Hengli SANY Heavy revenue mix (1H19) (601100 CH, TP: RMB54.0) and Weichai Power-A (000338 CH, TP: RMB15.9) Piling Earth moving Other with BUY rating. machinery machinery machinery 7% 3% 2% #1: Replacement demand to reach 60% of total sales; driven by emission Concrete regulations. For construction machinery, the National Emission Standard Crane machinery machinery 30% (NES) IV will be implemented in Jul 2020, such pressing timetable should 20% trigger strong replacement demand. For HDT, NES VI(a) will be implemented in Jul 2021 but we see potential of advanced preparation from local Excavator governments. Besides, some local governments have set deadline for the old 38% models to fade out on the stage. Our industry model suggests that >60% of Source: Company data, CMBIS the demand will come from replacement in 2020-21E. Jiangsu Hengli revenue mix (1H19) #2: Structural growth opportunities: Import substitution + market share Completed Component set of 9% gain.