Trans Tasman Single Aviation Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

1995-2020 ANNUAL REPORT RESPONSIBILITY PROACTIVENESS CREATIVITY TABLE OF CONTENTS I. MESSAGE FROM CHAIRMAN OF THE BOARD OF DIRECTORS AND CHIEF EXECUTIVE OFFICER 6 II. DEVELOPMENT STRATEGY 12 Vision 12 Mission 12 Core values 12 Targets 12 Development strategy 13 III. COMPANY OVERVIEW 18 General information 18 Business lines 20 Business network 22 Establishment and Development history 24 Organization structure 26 Shareholder structure 38 Highlight events in 2019 40 Awards and Accolades in 2019 42 IV. BUSINESS PERFORMANCE 46 Key operational performance 46 Key financial indicators 49 V. ASSESSMENT OF THE BOARD OF DIRECTORS 52 On the operations of Vietnam Airlines 52 On the activities of the Board of Management (BOM) 55 On the orientation of operations for 2020 56 VI. REPORT OF THE BOARD OF MANAGEMENT ON BUSINESS RESULTS IN 2019 58 Business environment 58 Performance in various areas 60 Route network 60 Fleet 66 Flight operation 67 Commercial performance 68 Services 75 Technical areas 79 Safety and security 81 Human resource management 82 Communications and brand development 86 Information technology 90 Cooperation programs 91 Investment activities 94 Financial performance 99 Innovations in organizational structure and management policy 103 VII. ENVIRONMENTAL AND SOCIAL RESPONSIBILITIES 106 Compliance with environmental protection regulations 108 Social engagement 109 Employee welfare and benefits 112 VIII. CORPORATE GOVERNANCE 114 Corporate governance structure 114 Information and activities of the Board of Directors 116 Activities of the committees under the Board of Directors 116 Report of the Supervisory Board 117 Activities of the Chief Administrator & Corporate Secretary 119 Investor relations 119 IX. RISK MANAGEMENT 122 X. AUDITED CONSOLIDATED FINANCIAL STATEMENTS 126 To download a soft copy of Vietnam Airlines’ Annual Report 2019, please visit https://www.vietnamairlines.com/vn/about-us/investor-relations/annual-reports or scan QR code on the left-hand side. -

Aviation in the Pacific International Aviation Services Are Crucial to Trade, Growth, and Development in the Pacific Region

Pacific Studies Series About Oceanic Voyages: Aviation in the Pacific International aviation services are crucial to trade, growth, and development in the Pacific region. Improved access provided by international aviation from every other region in the world to an increasing number of islands is opening new opportunities. Tourism contributes substantially to income and employment in many Pacific countries, usually in areas outside of the main urban centers, and enables air freight services for valuable but perishable commodities that would otherwise not be marketable. Although some features of the Pacific region make provision of international aviation services a challenge, there have also been some notable successes that offer key lessons for future development. Case studies of national aviation sector experience show the value of operating on commercial principles, attracting international and OCEANIC V private-sector capital investment, assigning risk where it can best be managed, and liberalizing market access. Integration of the regional market for transport services, combined with harmonized but less restrictive regulations, would facilitate a greater range of services at more competitive prices. Pacific island country governments have the ability to create effective operating environments. When they do so, experience O shows that operators will respond with efficient service provision. YAGES: About the Asian Development Bank Av ADB aims to improve the welfare of the people in the Asia and Pacific region, IATI particularly the nearly 1.9 billion who live on less than $2 a day. Despite many success stories, the region remains home to two thirds of the world’s poor. ADB is O N IN THE PACIFIC a multilateral development finance institution owned by 67 members, 48 from the region and 19 from other parts of the globe. -

Wellington International Airport Limited Presentation to Commerce Commission Conference | 21 August 03 | Page 2

Presentation to Commerce Commission Conference | 21 August 2003 Presentation by John Sheridan Chief Executive, Wellington International Airport Limited Presentation to Commerce Commission Conference | 21 August 03 | page 2 Introduction Aviation experience 16 years in the aviation industry including 12 years in senior airline positions and over 4 years as the Chief Executive of Wellington International Airport The interest of WIAL in the application WIAL is directly affected by the outcome Objective To clearly demonstrate the critical importance of competition for both market growth and the continuing introduction of new product and services Presentation to Commerce Commission Conference | 21 August 03 | page 3 Domestic Market: 1987 - present Ansett New Zealand commenced operations in 1987 with some immediate outcomes being: Upgraded terminal facilities The introduction of aerobridges Improved service standards. A few examples: Catering on the aircraft, lounge facilities & valet parking Most importantly Ansett New Zealand meant competition and the availability of discount fares. Average fare dilution increased from 15% to 35%-40% on those sectors where Ansett New Zealand competed The stimulation of market growth Domestic passenger numbers through Wellington airport increased by 20% in the first two years after Ansett New Zealand started operations Presentation to Commerce Commission Conference | 21 August 03 | page 4 Domestic Market: 1987 - present In the period 1995 through to November 2002 there were few initiatives in the market, with the result that growth averaged 1.3% per year only over this period. This period included the Ansett pilots dispute in 1999, the receivership of Tasman Pacific in 2001, the start-up of Qantas Airways domestic services in New Zealand and the growth of Origin Pacific. -

COVID Up, Spending Down

www.traveldaily.com.au Tuesday 4th August 2020 Industry lobbies COVID up, spending down Today’s issue of TD AN AUSTRALIAN travel Travel Daily today has six industry lobby group, established Australian consumer spend on travel: News Corp Australia Index pages of news including our by agents using a private 10 PUZZLE page. -52 -72 -89 -92 -96 -96 -96 -94 -94 -93 -91 -89 -83 -83 -78 -81 -76 -77 -80 -83 Facebook page is calling for 0 agents wishing to be part of a Jetstar suspends flts push for the Federal Government -20 QANTAS and Jetstar have to provide a financial support suspended their schedule package to assist with fixed costs -40 of flights from Sydney to and overheads. Coolangatta and Cairns for the The group has been reaching rest of the month. out to local, state and federal -60 A Qantas Group spokesperson 09 Mar members to bring attention to said the airlines were reducing the industry’s dire situation. -80 their services from Sydney to It has now received a request 16 Mar 29 Jun 06 Jul Queensland, noting there had 15 Jun 13 Jul 22 Jun from Federal Minister for Small 20 Jul -100 01 Jun 08 Jun been a significant drop in demand Business Michaelia Cash to 23 Mar 25 May 30 Mar 18 May 27 Apr 04 May 11 May for travel between Sydney 06 Apr 13 Apr 20 Apr provide details of all agents that and Queensland destinations are wishing to be part of the EXCLUSIVE “All sectors have dropped back following enhanced border initiative. -

Airline Competition in Australia Report 3: March 2021

Airline competition in Australia Report 3: March 2021 accc.gov.au Australian Competition and Consumer Commission 23 Marcus Clarke Street, Canberra, Australian Capital Territory, 2601 © Commonwealth of Australia 2021 This work is copyright. In addition to any use permitted under the Copyright Act 1968, all material contained within this work is provided under a Creative Commons Attribution 3.0 Australia licence, with the exception of: the Commonwealth Coat of Arms the ACCC and AER logos any illustration, diagram, photograph or graphic over which the Australian Competition and Consumer Commission does not hold copyright, but which may be part of or contained within this publication. The details of the relevant licence conditions are available on the Creative Commons website, as is the full legal code for the CC BY 3.0 AU licence. Requests and inquiries concerning reproduction and rights should be addressed to the Director, Content and Digital Services, ACCC, GPO Box 3131, Canberra ACT 2601. Important notice The information in this publication is for general guidance only. It does not constitute legal or other professional advice, and should not be relied on as a statement of the law in any jurisdiction. Because it is intended only as a general guide, it may contain generalisations. You should obtain professional advice if you have any specific concern. The ACCC has made every reasonable effort to provide current and accurate information, but it does not make any guarantees regarding the accuracy, currency or completeness of that information. Parties who wish to re-publish or otherwise use the information in this publication must check this information for currency and accuracy prior to publication. -

Galileo Low Cost Air

Galileo Low Cost Air Frequently Asked Questions v1.8 Document Name Page: 1 Disclaimer This guide should be used for guidance purposes only and should not be relied upon as taxation or legal advice, nor used in substitution for obtaining your own taxation or legal advice. No reliance may be placed on the information contained in this document. Galileo disclaims all representations made in this guide, including but not limited to representations as to the quality and accuracy of the information contained in this document. This guide is subject to change without notice. Neither the whole nor any part of this document shall be disclosed to any party in any form without the written consent of Galileo International. Trademarks Galileo International may have patents or pending patent applications, trademarks copyrights, or other intellectual property rights covering subject matter in this document. The furnishing of this document does not give you any license to these patents, trademarks, copyrights, or other intellectual property rights except as expressly provided in any written license agreement from Galileo International. All other companies and product names are trademarks or registered trademarks of their respective holders. Copyright © 2007 Galileo International. All rights reserved. All Travelport logos and marks as well as all other proprietary materials depicted herein are the property of Travelport and/or its subsidiaries. © Copyright 1999-2007. All rights reserved. Information in this document is subject to change without notice. The software described in this document is furnished under a license agreement or non-disclosure agreement. The software may be used or copied only in accordance with the terms of those agreements. -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios -

Jetstar Cadet Pilot Program

Jetstar Cadet Pilot Program NFORMATION BOOKL ETTHE JETSTAR CADET PILOT PROGRAM The Jetstar Cadet Pilot Program is an outstanding opportunity designed to equip successful graduates with the skills, qualifications and experience required for a future career as an airline pilot. Jetstar and its industry partners offer you a unique opportunity to be trained to become a fully qualified Commercial Pilot whilst providing you with the experience and knowledge to further your career in the airline industry. We invite you to discover the opportunities that the Jetstar Cadet Pilot Program can provide to you. Your experiences as a Jetstar Cadet are the foundation of your aviation career. You will be provided with the best training, aircraft, and facilities available in Australia. Our approved Flight Training Organisations (FTO’s) have been assessed by Jetstar to ensure that they meet our specific training requirements and stringent safety standards. Supporting our training organisations is Swinburne University in Melbourne offering a unique University experience and providing excellent tuition in sound aviation principles that will equip you with the necessary theoretical knowledge to progress your aviation career. Jetstar is committed to ensuring that the costs of flight training are not prohibitive to your pursuit of a career within the Aviation Industry. We have introduced, in conjunction with our University partner, a number of measures including FEE-HELP, to ensure that the Jetstar Cadet Pilot Program is one of the most cost effective ways to complete your flight training. Future graduating Cadets can look forward to the potential of operating some of the most technologically advanced aircraft in the world including the Boeing 787 and A320/A321 NEO. -

1.4. Coding and Decoding of Airlines 1.4.1. Coding Of

1.4. CODING AND DECODING OF AIRLINES 1.4.1. CODING OF AIRLINES In addition to the airlines' full names in alphabetical order the list below also contains: - Column 1: the airlines' prefix numbers (Cargo) - Column 2: the airlines' 2 character designators - Column 3: the airlines' 3 letter designators A Explanation of symbols: + IATA Member & IATA Associate Member * controlled duplication # Party to the IATA Standard Interline Traffic Agreement (see section 8.1.1.) © Cargo carrier only Full name of carrier 1 2 3 40-Mile Air, Ltd. Q5 MLA AAA - Air Alps Aviation A6 LPV AB Varmlandsflyg T9 ABX Air, Inc. © 832 GB Ada Air + 121 ZY ADE Adria Airways + # 165 JP ADR Aegean Airlines S.A. + # 390 A3 AEE Aer Arann Express (Comharbairt Gaillimh Teo) 809 RE REA Aeris SH AIS Aer Lingus Limited + # 053 EI EIN Aero Airlines A.S. 350 EE Aero Asia International Ltd. + # 532 E4 Aero Benin S.A. EM Aero California + 078 JR SER Aero-Charter 187 DW UCR Aero Continente 929 N6 ACQ Aero Continente Dominicana 9D Aero Express Del Ecuador - Trans AM © 144 7T Aero Honduras S.A. d/b/a/ Sol Air 4S Aero Lineas Sosa P4 Aero Lloyd Flugreisen GmbH & Co. YP AEF Aero Republica S.A. 845 P5 RPB Aero Zambia + # 509 Z9 Aero-Condor S.A. Q6 Aero Contractors Company of Nigeria Ltd. AJ NIG Aero-Service BF Aerocaribe 723 QA CBE Aerocaribbean S.A. 164 7L CRN Aerocontinente Chile S.A. C7 Aeroejecutivo S.A. de C.V. 456 SX AJO Aeroflot Russian Airlines + # 555 SU AFL Aeroflot-Don 733 D9 DNV Aerofreight Airlines JSC RS Aeroline GmbH 7E AWU Aerolineas Argentinas + # 044 AR ARG Aerolineas Centrales de Colombia (ACES) + 137 VX AES Aerolineas de Baleares AeBal 059 DF ABH Aerolineas Dominicanas S.A. -

DIA Flight Schedule Template.V2

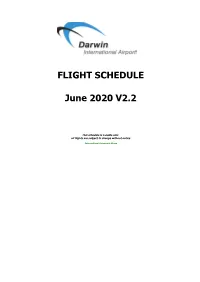

FLIGHT SCHEDULE June 2020 V2.2 This schedule is a guide only all flights are subject to change without notice International Services in Green MONDAY ARRIVALS DEPARTURES FLIGHT FROM STA A/C FLIGHT TO STD FROM TO EM2 TL 0404 GTE 0600 29-Jun-20 29-Jun-20 E70 TL 0160 CNS 0645 29-Jun-20 29-Jun-20 E70 TL 0112 MCV 0700 1-Jun-20 22-Jun-20 E70 TL 510 DIL 0700 29-Jun-20 29-Jun-20 EM2 TL 0404 GTE 0710 1-Jun-20 22-Jun-20 EM2 TL 0250 ASP 0825 1-Jun-20 29-Jun-20 EM2 TL 0214 MGT 0830 29-Jun-20 29-Jun-20 TL 0405 GTE 0935 EM2 29-Jun-20 29-Jun-20 E70 TL 0182 WTB 0950 29-Jun-20 29-Jun-20 EM2 TL 0200 ELC 1010 29-Jun-20 29-Jun-20 TL 0113 MCV 1010 E70 1-Jun-20 29-Jun-20 TL 511 DIL 1020 E70 29-Jun-20 29-Jun-20 EM2 TL 0212 MNG 1030 1-Jun-20 22-Jun-20 E70 TL 0182 TSV 1050 1-Jun-20 22-Jun-20 E70 TL 0510 DIL 1055 8-Jun-20 22-Jun-20 TL 0405 GTE 1050 EM2 1-Jun-20 22-Jun-20 EM2 TL 0414 GOV 1100 1-Jun-20 22-Jun-20 E70 TL 0332 BME 1140 8-Jun-20 22-Jun-20 TL881 TTX 1220 EM2 22-Jun-20 22-Jun-20 QF850 PER 1230 73H QF849 PER 1340 15-Jun-20 29-Jun-20 TL 0215 MNG 1255 EM2 29-Jun-20 29-Jun-20 TL 0201 ELC 1320 EM2 29-Jun-20 29-Jun-20 EM2 TL 0216 ELC 1330 29-Jun-20 29-Jun-20 TL 0338 PER 1330 E70 1-Jun-20 22-Jun-20 E70 TL 0332 BME 1405 29-Jun-20 29-Jun-20 TL 0511 DIL 1405 E70 8-Jun-20 22-Jun-20 TL 0213 MNG 1410 EM2 1-Jun-20 22-Jun-20 TL 0161 GOV 1415 E70 29-Jun-20 29-Jun-20 EM2 TL 0406 GOV 1440 15-Jun-20 22-Jun-20 EM2 TL 0672 TCA 1440 1-Jun-20 29-Jun-20 TL 0415 GOV 1450 EM2 1-Jun-20 22-Jun-20 EM2 TL 0406 GTE 1530 29-Jun-20 29-Jun-20 TL 0183 TSV 1650 E70 8-Jun-20 22-Jun-20 E70 -

AUSTRALIA WORLD USA US Hits Vaccine Milestone NHS Faces High Expectations Emotions High As Bubble Opens High-Ranked Iranian Gene

APRIL 19 (GMT) – APRIL 20 (AEST), 2021 YOUR DAILY TOP 12 STORIES FROM FRANK NEWS FULL STORIES START ON PAGE 3 USA WORLD AUSTRALIA US hits vaccine milestone High-ranked Iranian general dies Emotions high as bubble opens Half of all adults in the US have A high-ranking general key to Iran’s Airports in Australia and New Zealand received at least one COVID-19 shot, security apparatus has died, the Islamic have been scenes of celebration and the government announced, marking Revolutionary Guard Corps announced. reunification after the long-awaited another milestone in the nation’s largest- Brig. Gen. Mohammad Hosseinzadeh opening of the trans-Tasman travel ever vaccination campaign but leaving Hejazi, who died at 65, served as deputy bubble. For the first time in more than a more work to do to convince skeptical commander of the Quds, or Jerusalem, year, Australian travellers have begun to Americans to roll up their sleeves. force of Iran’s paramilitary Revolutionary enter New Zealand without the need to Guard. The unit is an elite and influential quarantine for a fortnight. group that oversees foreign operations, and Hejazi helped lead its expeditionary forces and frequently shuttled between Iraq, Lebanon and Syria. UK UK NEW ZEALAND NHS faces high expectations Trial to study reinfection Ardern cautious over bubble Politicians may be “raising unrealistic Healthy, young volunteers who have While the trans-Tasman bubble is “a public expectations” about the amount previously had COVID-19 will be significant day” for New Zealanders, any of work the NHS in Scotland can do deliberately exposed to the virus for a moves to open the borders to other after the coronavirus pandemic, leading second time to see how the immune countries will need to be be based on doctors have warned. -

How Old Is Too Old? the Impact of Ageing Aircraft on Aviation Safety – Ii – ATSB TRANSPORT SAFETY REPORT Aviation Research and Analysis Report - B20050205

ATSB TRANSPORT SAFETY REPORT Aviation Research and Analysis Report –B20050205 Final How Old is Too Old? The impact of ageing aircraft on aviation safety – ii – ATSB TRANSPORT SAFETY REPORT Aviation Research and Analysis Report - B20050205 Final How Old is Too Old? The impact of ageing aircraft on aviation safety February 2007 – iii – Published by: Australian Transport Safety Bureau Postal address: PO Box 967, Civic Square ACT 2608 Office location: 15 Mort Street, Canberra City, Australian Capital Territory Telephone: 1800 621 372; from overseas + 61 2 6274 6130 Accident and incident notification: 1800 011 034 (24 hours) Facsimile: 02 6274 6474; from overseas + 61 2 6274 6474 E-mail: [email protected] Internet: www.atsb.gov.au © Commonwealth of Australia 2007. This work is copyright. In the interests of enhancing the value of the information contained in this publication you may copy, download, display, print, reproduce and distribute this material in unaltered form (retaining this notice). However, copyright in the material obtained from non- Commonwealth agencies, private individuals or organisations, belongs to those agencies, individuals or organisations. Where you want to use their material you will need to contact them directly. Subject to the provisions of the Copyright Act 1968, you must not make any other use of the material in this publication unless you have the permission of the Australian Transport Safety Bureau. Please direct requests for further information or authorisation to: Commonwealth Copyright Administration, Copyright Law Branch Attorney-General’s Department, Robert Garran Offices, National Circuit, Barton ACT 2600 www.ag.gov.au/cca ISBN and formal report title: see ‘Document retrieval information’ on page viii.