The Henderson Smaller Companies Investment Trust Plc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Customer Engagement Summit 2016

OFFICIAL CUSTOMER EVENT ENGAGEMENT GUIDE SUMMIT 2016 TUESDAY, 8 NOVEMBER 2016 WESTMINSTER PARK PLAZA, LONDON TECHNOLOGY THE GREAT ENABLER PLATINUM GOLD ORGANISED BY: CustomerEngagementSummit.com @EngageCustomer #EngageSummits Find out more: www.verint.com/customer-engagement THE TEAM WELCOME Steve Hurst Editorial Director E: [email protected] T: 01932 506 304 Nick Rust WELCOME Sales Director E: [email protected] T: 01932 506 301 James Cottee Sponsorship Sales E: [email protected] T: 01932 506 309 Claire O’Brien Sponsorship Sales E: [email protected] T: 01932 506 308 Robert Cox A warm welcome to our fifth Customer Engagement Sponsorship Sales E: [email protected] Summit, now firmly established as Europe’s premier T: 01932 302 110 and most highly regarded customer and employee Katie Donaldson Marketing Executive engagement conference. E: [email protected] T: 01932 506 302 Our flagship Summit has gained a reputation for delivering leading-edge world class case-study led content in a business-like yet informal atmosphere which is conducive to delegate, speaker Claire Poole and sponsor networking. It’s a place both to learn and to do business. The overarching theme of Conference Producer this year’s Summit is ‘Technology the Great Enabler’ as we continue to recognise the critical E: [email protected] role that new technologies and innovations are playing in the fields of customer and employee T: 01932 506 300 engagement. Dan Keen We have several new elements to further improve this year’s Summit – not least our move to Delegate Sales E: [email protected] this new bigger venue, the iconic London Westminster Bridge Park Plaza Hotel following on T: 01932 506 306 from four hugely successful Summits at the London Victoria Park Plaza. -

26490 Christmas Trading Index 2015.Indd

DAMP SPIRITS?The OC&C Christmas Trading Index 2015 THE OC&C CHRISTMAS TRADING INDEX 2015 A merry online Christmas Mild weather but lukewarm sales Overall retail like-for-likes were broadly flat in Christmas 2015, The mildest December for more than 100 years, coming after continuing the trend of the previous 3 years. Over the entire an unseasonably warm November, had a more chilling effect period from 2011 to present, UK retail has benefited in aggregate on retailer sales – particularly in fashion where outerwear and from less than 0.5% of like-for-like growth – indicating how hard winter clothing sales were depressed and significant discounting retailers are having to fight for consumer spend. activity was needed to move product. With early autumn also being unseasonably warm, this has been a challenging quarter What spend growth there is continues to be captured by the online or two for the clothing sector – and the full picture may only channel, experiencing an acceleration of growth rates, much of emerge when annual profit announcements reveal what level this growth being driven by mobile. Making mobile at the centre of markdown needed to be invested. Retailers will need to of online strategy rather than an afterthought is likely to be continue to build flexibility into supply chains, reduce lead times critical to future success – particular in attracting the millennial and increase open-to-buy levels to give flexibility to counter generation of shoppers. increasingly erratic weather. The corollary of this was poor footfall on the streets – down by 2% in aggregate across all location types (and Retail Parks the only Christmas winners locations seeing any footfall growth this year). -

Vanguard Total World Stock Index Fund Annual Report October 31, 2020

Annual Report | October 31, 2020 Vanguard Total World Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

DATABANK INSIDE the CITY SAM CHAMBERS the WEEK in the MARKETS the ECONOMY Consumer Prices Index Current Rate Prev

10 The Sunday Times December 20, 2020 BUSINESS Liam Kelly first. BDO said the RICS’s finished with milder tickings- by Paul Marcuse. This is success of TV drama Strike Bosses of the rickety treasury, reserves and off over interbank transfer where the four NEDs sat. and the West End play Harry investment policies were processes and the Many of the RICS’s 134,000 Potter and the Cursed Child. “not properly version- implementation of actions. members are already The reason for the RICS are on the ropes controlled, appear to be out The report was not shared irritated at having to pay fees dividend damage pre-dated of date and have never been beyond the RICS’s audit to an organisation that seems the pandemic: higher costs The Royal Institution of annual fees of about £540 are communicated to the committee until four NEDs to do little more than chase squeezed pre-tax profits at Chartered Surveyors (RICS) now due — more details of treasury team”, who “just got hold of it, tried to speak them endlessly about “CPD” Brontë — which Rowling runs responded to last weekend’s the report their institution follow instructions ... and to then president Chris — continuing professional with her long-time agent Neil revelation that four non- has strangely failed to share. rely on their own experience Brooke about it — and had development. Those who Blair, 54 — from £7.2m to executive directors had been The 152-year-old body, from previous ... roles”. their contracts terminated pressed £500,000-a-year £4.8m. However, newly filed dismissed for trying to raise which sets professional The second was banking. -

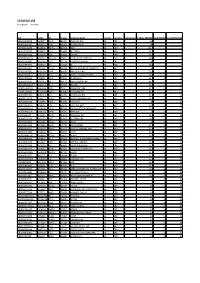

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Frasers Group FRAS Retailers — GBP 6.975 at close 22 September 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 22-Sep-2021 22-Sep-2021 22-Sep-2021 7 160 170 1D WTD MTD YTD 160 Absolute 2.1 6.2 4.3 54.5 6.5 150 Rel.Sector 1.1 6.2 1.0 29.3 150 Rel.Market 0.8 4.7 5.0 39.1 6 140 140 5.5 VALUATION 130 130 5 Trailing 120 120 Relative Price Relative Price Relative 4.5 110 PE -ve Absolute Price (local currency) (local Price Absolute 110 4 EV/EBITDA 8.5 100 100 PB 2.9 3.5 90 PCF 7.0 3 90 80 Div Yield 0.0 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Price/Sales 1.0 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 1.2 100 100 100 Div Payout 0.0 90 90 90 ROE -ve 80 80 80 Share Index) Share Share Sector) Share - - 70 70 70 DESCRIPTION 60 60 60 50 The Company a retailing of sports and leisure 50 50 RSI RSI (Absolute) 40 clothing, footwear and equipment, wholesale 40 40 distribution and sale of sports and leisure clothing, 30 footwear and equipment under Group owned or 30 20 30 licensed brands and licensing of Group brands. -

Weekend News Summary

Weekend News Summary THE SUNDAY TIMES INDICES THIS MORNING Current (%) 1W% Change U.S. demands Mike Lynch’s extradition for ‘$11 billion fraud’: U.S. Value Change* authorities have formally requested that Mike Lynch be extradited to FTSE 100 7,307.2 0.1% -0.8% the United States to face charges over the $11 billion sale of DAX 30 13,224.7 -0.1% 0.1% Autonomy. CAC 40 5,925.4 -0.2% 0.8% Discussions at Talktalk are on hold: Plans to sell the fledgling fibre DJIA** 28,004.9 - 1.2% broadband network being developed by Talktalk have been S&P 500** 3,120.5 - 0.9% postponed after Labour said that, if it formed the next government, it NASDAQ Comp.** 8,540.8 - 0.8% would aim to build a national network and offer free internet to all. Nikkei 225 23,416.8 0.5% -0.4% Hang Seng 40 26,681.1 1.4% -4.8% Capital & Counties walks away at Earls Court: Capital & Counties Shanghai Comp 2,909.2 0.6% Properties has agreed to sell a huge development site in West -2.5% Kospi 2,160.7 -0.1% London after the site’s value more than halved in four years. 1.2% BSE Sensex 40,284.2 -0.2% 0.1% Business comes before needs of Chief Executives, says Forth Ports S&P/ASX 200 6,766.8 -0.4% 1.0% head Charles Hammond: Charles Hammond, who has been at Forth Current Values as at 11:15 BST, *%Chg from Friday Close, ** As on Friday Close Ports since 2001, told The Times and KPMG regional growth summit in Glasgow that the needs of the company should be prioritised over the individual at the top. -

November 2016

Hampton-Alexander Review FTSE Women Leaders Improving gender balance in FTSE Leadership November 2016 Sponsored by It is clear that the voluntary business-led framework to improve the number of women at the top of British business is working and it is time to extend the focus beyond the boardroom. Today we launch the next stage in the journey where FTSE 100 companies will aim for a third of their all-important leadership roles to be occupied by women by the end of 2020. Sir Philip Hampton Dame Helen Alexander Chair Deputy Chair Hampton-Alexander Review Steering Group Charles Berry Fiona Cannon OBE Simon Collins Andrew Duff Alison Platt CMG Denise Wilson OBE Advisory Panel Carolyn Fairbairn Andrew Ninian Brenda Trenowden CBI The Investment Association 30% Club Lady Barbara Judge Professor Cilla Snowball Professor Susan Vinnicombe CBE Institute of Directors Women's Business Council Cranfield University 2 Contents Forewords 4 Word from our Sponsors 6 Executive Summary 8 The Recommendations 10 Evidence 12 A ‘How To' for Companies to Consider 16 The CEO Voice 18 Emerging Research 22 A Focus on Industry 26 Women on Boards 30 Closing word from the Steering Group 36 Appendices Appendix A – Detailed analysis of FTSE progress WOB 38 Appendix B - FTSE 100 ranking WOB 39 Appendix C - FTSE 250 rankings WOB 43 Appendix D - FTSE 350 together rankings WOB 53 Appendix E - Key Research and Further Reading 68 www.ftsewomenleaders.com 3 Ministers’ Foreword Margot James MP The Rt Hon Justine Greening MP Parliamentary Under Secretary of State Secretary of State for Education and Minister for and Minister for Small Business, Women and Equalities Consumers & Corporate Responsibility In July, the Prime Minister Theresa May set out her vision for a country that works for everyone. -

The Henderson Smaller Companies Investment Trust Plc

The Henderson Smaller Companies Investment Trust plc Update for the half-year ended 30 November 2020 0009960_H047066_Smaller Companies_Interim_V8a.indd 1 30/01/2021 00:07 The Henderson Smaller Companies Investment Trust plc Investment objective The Company aims to maximise shareholders’ total returns (capital and income) by investing in smaller companies that are quoted in the United Kingdom. This update contains material extracted from the unaudited half-year results of the Company for the six months ended 30 November 2020. The unabridged results for the half-year are available on the Company’s website: www.hendersonsmallercompanies.com 0009960_H047066_Smaller Companies_Interim_V8a.indd 102 29/01/2021 07:11 Update for the half-year ended 30 November 2020 Performance Performance for the six months to 30 November 2020 NAV1 Benchmark2 Share price3 Interim dividend4 20.6% 20.8% 27.7% 7.0p NAV per share at period end Share price at period end 30 Nov 2020 30 Nov 2020 1,017.4p 972.0p 31 May 2020 31 May 2020 859.1p 777.0p Net Assets 30 Nov 2020 31 May 2020 £760.0m £641.8m Total return performance (including dividends reinvested) 6 months 1 year 3 years 5 years 10 years % % % % % NAV¹ 20.6 3.1 13.6 55.4 278.9 Benchmark² 20.8 -3.1 -1.7 26.7 143.3 Share price3 27.7 2.4 26.6 66.4 354.5 Average sector NAV5 14.3 -0.5 -0.7 36.4 176.4 Average sector share price6 10.6 -8.5 -8.2 9.5 163.2 FTSE All-Share Index 6.9 -10.3 -1.9 22.1 77.3 Sources: Morningstar for the AIC, Janus Henderson, Refinitiv Datastream 1 Net asset value (‘NAV’) per ordinary share total -

Money Week Quote Jan 24Th 2020

CITYVIEW P16 TRADINGT P30 PLUS Russia’sbiggeest HopH on board The £1 coin obstacle to NationalN worth £1m growth ExpressE COLLECTABLES P39 MoneyWeek MAKE IT,KEEP IT,SPEND IT 24 JANUARY2020 |ISSUE 983 |£4.50 Game on Howtoplay theworld’s hottestsector Page 24 BRITAIN’SBEST-SELLING FINANCIAL MAGAZINE MONEYWEEK.COM BAILSCOLIETTISHGIFFORDMORTEURGAGEOPEAINVENGSTMENROWTHTTTRURUSSTT THE BAILLIE GIFFORD EUROPEAN GROWTH TRUST WASFORMERLYTHE EUROPEAN INVESTMENT TRUST ANEW ROUTE INTO EUROPE. The Baillie GiffordEuropeanGrowthTrust bringsourwealthof experience inEuropean investingtothe investment trust sector. OurEuropean managers look forexceptionalgrowthcompanies.Theywant to identifythe big winners across thecontinent. Investmentswill be high qualitybusinesses, possibly founder-managed, with strong competitive positionsand credible prospectsfor long-term earnings growth. Please remember that changingstock market conditions will affect thevalue of theinvestment in thetrust andany income from it.Investorsmay notget back theamountinvested. Areyou lookingfor growth potentialacrossEurope? call 0800 9172112 or visitusatwww.bgeuropeangrowth.com AKey Information Documentisavailablebycontacting us. Long-term investment partners Your callmay be recordedfor trainingormonitoring purposes. Issuedand approvedbyBaillie Gifford&Co Limited,whose registered address is at Calton Square,1Greenside Row, Edinburgh,EH1 3AN, UnitedKingdom. BaillieGifford &CoLimited is theauthorisedAlternativeInvestmentFund Managerand Company Secretaryofthe Company. BaillieGifford &CoLimitedisauthorisedand -

We've Come a Long Way

AO World plc World AO Annual Report Accounts Annual and AO World plc AO Park 5A The Parklands Lostock Bolton BL6 4SD 2014 We’ve come a long way... This Report is printed on materials which are FSC® certified from well-managed forests. These materials contain ECF (Elemental Chlorine Free) pulp and are 100% Recyclable. Designed by Carnegie Orr +44 (0)20 7610 6140 AO World plc www.carnegieorr.com Annual Report and Accounts 2014 Overview Contents Overview Our governance Our results For our shareholders’ ifc 2014 highlights 36 Corporate Governance 64 Independent Auditors’ information — 02 Our culture Statement Report 92 Shareholder information 01-07 36 68 Chairman’s introduction Consolidated statement Our strategic report 38 Board of Directors of comprehensive income 08 Chairman’s statement 40 Leadership 69 Consolidated statement Our strategic report 10 Chief Executive’s letter 42 Effectiveness of financial position 16 Our markets 44 Accountability 70 Consolidated statement 18 Our strategy 48 Directors’ Remuneration of changes in equity 20 Our business model Report 71 Consolidated statement 22 Our resources and 49 Remuneration Policy of cash flows 72 relationships Report Notes to the consolidated 24 Corporate social 54 Annual Report on financial statements — responsibility Remuneration 90 Company balance sheet 08-33 26 Key performance 58 Directors’ Report 91 Notes to the Company indicators financial statements 26 Our performance governance Our 32 Our risks and uncertainties — 34-61 Our results It started from nothing: a one pound bet in a pub We’re busy little bees, keep up-to-date online... — in Bolton, Christmas Eve 1999. 62-91 That people would eventually use the internet For our shareholders’ information to buy ‘white goods’ and that this could potentially create a multi-billion pound international business. -

STOXX UK 180 Selection List

STOXX UK 180 Last Updated: 20210301 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) GB00B10RZP78 B10RZP7 ULVR.L 091321 UNILEVER PLC GB GBP Y 113 1 1 GB0009895292 0989529 AZN.L 098952 ASTRAZENECA GB GBP Y 105 2 2 GB0005405286 0540528 HSBA.L 040054 HSBC GB GBP Y 101.6 3 3 GB0007188757 0718875 RIO.L 071887 RIO TINTO GB GBP Y 76.5 4 7 GB0002374006 0237400 DGE.L 039600 DIAGEO GB GBP Y 75.8 5 4 GB00B03MLX29 B09CBL4 RDSa.AS B09CBL ROYAL DUTCH SHELL A GB EUR Y 69.3 6 8 GB0009252882 0925288 GSK.L 037178 GLAXOSMITHKLINE GB GBP Y 69 7 5 GB0007980591 0798059 BP.L 013849 BP GB GBP Y 68.3 8 9 GB0002875804 0287580 BATS.L 028758 BRITISH AMERICAN TOBACCO GB GBP Y 62 9 6 GB00BH0P3Z91 BH0P3Z9 BHPB.L 005666 BHP GROUP PLC. GB GBP Y 55.2 10 11 GB00B24CGK77 B24CGK7 RB.L 072769 RECKITT BENCKISER GRP GB GBP Y 50.9 11 10 GB0007099541 0709954 PRU.L 070995 PRUDENTIAL GB GBP Y 42.3 12 14 GB00B1XZS820 B1XZS82 AAL.L 490151 ANGLO AMERICAN GB GBP Y 40.5 13 15 GB00B2B0DG97 B2B0DG9 REL.L 073087 RELX PLC GB GBP Y 38.6 14 12 GB00BH4HKS39 BH4HKS3 VOD.L 071921 VODAFONE GRP GB GBP Y 37.7 15 13 JE00B4T3BW64 B4T3BW6 GLEN.L GB10B3 GLENCORE PLC GB GBP Y 36.5 16 18 GB00BDR05C01 BDR05C0 NG.L 024282 NATIONAL GRID GB GBP Y 32.7 17 16 GB0008706128 0870612 LLOY.L 087061 LLOYDS BANKING GRP GB GBP Y 31.8 18 22 GB0031348658 3134865 BARC.L 007820 BARCLAYS GB GBP Y 30 19 23 GB00BD6K4575 BD6K457 CPG.L 053315 COMPASS GRP GB GBP Y 29.9 20 21 GB00B0SWJX34 B0SWJX3 LSEG.L 095298 LONDON STOCK EXCHANGE GB GBP Y 25.2 21 17 GB00B19NLV48 B19NLV4