Norwegian Banks the Outlook Is Bright, Valuations Are Attractive

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Resolution Plan 2018 Public Section

RESOLUTION PLAN 2018 PUBLIC SECTION TABLE OF CONTENTS Page INTRODUCTION ......................................................................................................................... 1 1. Names of Material Entities .................................................................................... 3 2. Description of Core Business Lines ....................................................................... 3 3. Summary Financial Information Regarding Assets, Liabilities, Capital, and Major Funding Sources. .................................................................................. 4 4. Description of Derivatives and Hedging Activities ............................................... 7 5. Memberships in Material Payment, Clearing, and Settlement Systems ................ 7 6. Description of Foreign Operations......................................................................... 8 7. Identities of Material Supervisory Authorities ...................................................... 8 8. Identities of Principal Officers ............................................................................... 9 9. Corporate Governance Structure and Processes Related to Resolution Planning ............................................................................................................... 10 10. Material Management Information Systems ........................................................ 11 11. High Level Description of Resolution Strategy ................................................... 12 -i- INTRODUCTION Section -

Wells Fargo International Equity Fund

QUARTERLY MUTUAL FUND COMMENTARY Q4 2020 | All information is as of 12/31/2020 unless otherwise indicated. Wells Fargo International Equity Fund Quarterly review GENERAL FUND INFORMATION ● The International Equity Fund underperformed the MSCI ACWI ex USA Index (Net) Ticker: WFENX and the MSCI ACWI ex USA Value Index (Net) for the quarter that ended December 31, 2020. Portfolio managers: Dale A. Winner, ● Performance was driven largely by stock selection, with positive contributions coming CFA®; and Venk Lal from investments in the industrials and materials sectors as well as in China/Hong Subadvisor: Wells Capital Kong and Canada. Management Inc. ● Positions in information technology (IT) and health care as well as in France and Japan Category: Foreign large value detracted from performance. Market review FUND STRATEGY ● Maintains a core equity style that International equity markets initially declined in October before advancing 19.6% in the emphasizes bottom-up stock final two months of the year as multiple COVID-19 vaccines reached 90%+ efficacy and selection based on rigorous, uncertainty surrounding the U.S. presidential election receded, resulting in a 17.0% in-depth, fundamental company return for the MSCI All Country World ex USA Index (Net) in the fourth quarter, the research highest quarterly return since the third quarter of 2009. In this environment, the Global ● Uses a bottom-up research process Purchasing Managers’ Index (PMI) reached 53.3 in October, the highest level since that targets companies with August 2018, but fell back to 52.7 in December, still in expansionary territory. Emerging underestimated earnings growth markets outperformed developed markets and sovereign yields saw mixed fluctuations potential or those trading at during the period, including the U.S. -

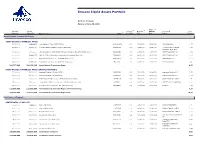

Invesco Liquid Assets Portfolio

Invesco Liquid Assets Portfolio Portfolio Holdings Data as of June 30, 2021 4 2 3 Final Principal Market 1 Coupon/ Maturity Maturity Associated % of Amount Value ($) Name of Issue CUSIP Yield (%) Date Date Issuer Portfolio Asset Backed Commercial Paper ASSET-BACKED COMMERCIAL PAPER 25,000,000 24,998,958 Ionic Capital III Trust (CEP-UBS AG) 46220WUG9 0.13 07/16/2021 07/16/2021 UBS GROUP AG 1.27 37,777,000 37,774,140 Lexington Parker Capital Company (Multi-CEP) 52953AUV5 0.15 07/29/2021 07/29/2021 Lexington Parker Capital 1.93 Company (Multi-CEP) 10,500,000 10,500,000 LMA Americas LLC (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QXR6 0.05 10/25/2021 10/25/2021 CREDIT AGRICOLE SA 0.54 40,000,000 39,992,272 LMA SA (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QW30 0.24 09/03/2021 09/03/2021 CREDIT AGRICOLE SA 2.04 20,000,000 20,000,000 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JW26 0.14 09/02/2021 09/02/2021 BNP PARIBAS SA 1.02 55,000,000 54,964,250 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JY81 0.14 11/08/2021 11/08/2021 BNP PARIBAS SA 2.80 188,277,000 188,229,620 Asset-Backed Commercial Paper 9.60 ASSET-BACKED COMMERCIAL PAPER (INTEREST BEARING) 50,000,000 50,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VG1 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 2.55 25,000,000 25,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VL0 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 1.27 10,000,000 10,000,000 Bedford Row Funding Corp. -

The Evolution of the Financial Services Industry and Its Impact on U.S

THOUGHT LEADERSHIP SERIES THE EVOLUTION OF THE FINANCIAL SERVICES INDUSTRY AND ITS IMPACT ON U.S. OFFICE SPACE June 2017 TABLE OF CONTENTS OVERVIEW OF U.S. FINANCIAL SERVICES INDUSTRY I PAGE: 4 OVERVIEW OF OFFICE MARKET CONDITIONS IN 11 MAJOR FINANCIAL CENTERS PAGE: 8 A. ATLANTA, GA PAGE: 8 B. BOSTON, MA PAGE: 10 C. CHARLOTTE, NC PAGE: 12 D. CHICAGO, IL PAGE: 14 E. DALLAS-FORT WORTH, TX II PAGE: 16 F. DENVER, CO PAGE: 18 G. MANHATTAN, NY PAGE: 20 H. ORANGE COUNTY, CA PAGE: 22 I. SAN FRANCISCO, CA PAGE: 24 J. WASHINGTON, DC PAGE: 26 K. WILMINGTON, DE PAGE: 28 MARKET SUMMARY AND ACTION STEPS III PAGE: 30 KEY FINDINGS The financial services sector has adapted its office-space usage in ways that are consistent with many office-using industries. However, its relationship to real estate has changed as a result of its role within the broader economy. In particular, four major causes have spurred a reduction in gross leasing activity by financial services firms: increased government regulation following the Great Recession of 2007-2009, cost reduction, efficient space utilization, and the emergence of the financial technology (fintech) sector. While demand for office space among financial services tenants has edged down recently overall, industry demand is inconsistent among major metros. For example, leasing increased for financial services tenants in San Francisco from 10% of all leasing activity in 2015 to 20% in 2016, while leasing among tenants in New York City declined from 32% to 20% over the same time period. Leasing trends within the financial services industry correlate with: the types of institutions involved, environments with policies and incentives that are conducive to doing business, the scale of operations and access to a highly-skilled talent pool, a shift from some urban to suburban locations, and a desire for new construction. -

Quarterly Report DNB Bank ASA 3Q19

DNB Bank A company in the DNB Group Third quarter report 2019 (Unaudited) Q3 Financial highlights Income statement DNB Bank Group 3rd quarter 3rd quarter January-September Full year Amounts in NOK million 2019 2018 2019 2018 2018 Net interest income 10 150 9 299 29 367 27 634 37 388 Net commissions and fees 1 536 1 431 4 799 4 721 6 605 Net gains on financial instruments at fair value 1 523 611 3 622 905 1 351 Other operating income 612 581 1 839 1 939 2 522 Net other operating income 3 672 2 623 10 260 7 564 10 478 Total income 13 822 11 922 39 627 35 198 47 866 Operating expenses (5 318) (5 114) (16 108) (15 189) (20 681) Restructuring costs and non-recurring effects (134) (26) (177) (106) (565) Pre-tax operating profit before impairment 8 370 6 782 23 343 19 902 26 620 Net gains on fixed and intangible assets (40) (3) (43) 480 529 Impairment of financial instruments (1 247) (11) (2 014) 374 139 Pre-tax operating profit 7 083 6 769 21 286 20 756 27 288 Tax expense (1 417) (1 354) (4 257) (4 151) (4 976) Profit from operations held for sale, after taxes (36) (42) (117) (63) (204) Profit for the period 5 631 5 373 16 912 16 542 22 109 Balance sheet 30 Sept. 31 Dec. 30 Sept. Amounts in NOK million 2019 2018 2018 Total assets 2 576 850 2 307 710 2 387 216 Loans to customers 1 673 924 1 598 017 1 561 867 Deposits from customers 983 472 940 087 995 154 Total equity 215 989 207 933 200 665 Average total assets 2 543 839 2 434 354 2 454 510 Key figures and alternative performance measures 3rd quarter 3rd quarter January-September Full year 2019 -

Davis Global Fund

DGF ANNUAL REVIEW 2021 Davis Global Fund Update from Portfolio Manager Danton Goei The Equity Specialists DGF | ANNUAL REVIEW [ 1 ] Davis Global Fund Annual Review 2021 Please provide an update on the long-term We also learned that while the novel virus was performance and more recent results for Davis highly transmissible, exacerbated by asymptomatic Global Fund. Discuss the current positioning: carriers, the mortality rate was lower than initially feared. As overwhelmed hospitals recovered, record For the year 2020, Davis Global Fund returned high unemployment levels fell, and the Federal 23.06%, compared with a 16.25% return for Reserve further eased monetary policy, equity the MSCI ACWI (All Country World Index), an markets recovered, looking ahead to the end of outperformance of 6.81%. In the first half of 2020, Davis Global Fund returned −4.87%, though it still the pandemic. outperformed the index by 1.38%. This weak market The beginning of the end was on November 9, environment in the first half was followed by a very when Pfizer and its partner, German biotech firm strong rebound in the second half, when the Fund returned 29.36% for the six months, compared to BioNTech, announced the results of their Phase 3 the market return of 24.01%. interim analysis, showing vaccine efficacy of over 90%. This stunning level of efficacy, achieved in less In the first half of 2020, the rapid spread of than 10 months after the genetic sequence of the the COVID-19 pandemic led to a wide range of novel virus was first shared globally on January 11, reasonable disaster scenario forecasts, given the was astounding. -

Wells Fargo VT International Equity Fund

Annual Report December 31, 2020 Wells Fargo VT International Equity Fund Contents Letter to shareholders............................................................................2 Performance highlights..........................................................................6 Fund expenses .......................................................................................10 Portfolio of investments ........................................................................11 Financial statements Statement of assets and liabilities............................................................ 14 Statement of operations.........................................................................15 Reduce clutter. Statement of changes in net assets .........................................................16 Financial highlights ................................................................................. 17 Save trees. Sign up for Notes to financial statements.................................................................19 electronic delivery Report of independent registered public accounting firm.........................26 of prospectuses and shareholder Other information..................................................................................27 reports at wellsfargo.com/ advantagedelivery The views expressed and any forward-looking statements are as of December 31, 2020, unless otherwise noted, and are those of the Fund's portfolio managers and/or Wells Fargo Asset Management. Discussions of individual securities or the markets -

The EEA the Norwegian Banking Sector, The

Case No: 77452 Document No: 1046871 Decision No: 022119/COL EFTA SURVEILLANCE AUTHORITY DECISION of 2 April2019 closing proceedings initiated against Finans Norge, Bits, BankID Norge, DNB and Nordea pursuant to Article 53 of the EEA Agreement (Case No 77452 - e-Payment services in Norway) THE EFTA SURVEILLANCE AUTHORITY, HAVING REGARD to the Agreement on the European Economic Area ("the EEA Agreement"), and in particular Article 55 thereof, HAVING REGARD to the EFTA Surveillance Authority's ("the Authority'') Decision No l95ll6lCOL of 25 October 2016 to initiate proceedings against Finans Norge, Bits AS, BankID Norge AS, DNB Bank ASA, DNB ASA, NordeaBank AB (publ) and Nordea Bank Norge ASA, WHEREAS: l. In October 2075, the Authority received a complaint from the Trustly Group AB ("Trustly''), a provider of electronic payment ("e-payment") services established in Sweden, regarding an alleged coordinated blocking of its ability to provide its e- payment services in Norway by several members of the Norwegian banking sector.l 2. Following a preliminary review of documents collected from the relevant members of the Norwegian banking sector, the Authority decided that there was sufficient information to initiate proceedings,2 pursuant to Article 2(1) of Chapter III of Protocol 4 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice ("SCA"), and require an in-depth investigation in respect ofl Finans Norge and its related organisation Bits AS; I The complaint was initially addressed to the Norwegian Competition Authority in April 2015. Pursuant to the rules governing cooperation between the EFTA Surveillance Authority and the national competition authorities of the EFTA States, the case was allocated to the Authority in October 2015: see Chapter III of Protocol 4 to the SCA and the EFTA Surveillance Authority Notice on cooperation within the EFTA Network ofCompetitionAuthorities (OJC 227,21.9.2006,p. -

DNB Bank ASA

DNB Bank ASA (incorporated in Norway) Issue of €750,000,000 Dated Subordinated Notes due 2023 under the €45,000,000,000 Euro Medium Term Note Programme Issue Price: 99.548 per cent. The €750,000,000 Dated Subordinated Notes due 2023 (the “Notes”) are being issued by DNB Bank ASA (the “Issuer”) as a series of securities under the Euro Medium Term Note Programme (the “Programme”) of the Issuer. The Notes will bear interest from (and including) 26th September, 2013 (the “Issue Date”) to (but excluding) 26th September, 2018 (the “Optional Redemption Date”) at a fixed rate of 3.00 per cent. per annum. From (and including) the Optional Redemption Date to (but excluding) 26th September, 2023, the Notes will bear interest at a fixed rate of 1.77 per cent. per annum above the then applying annual swap rate for euro swap transactions with a maturity of five years determined in accordance with market convention. Interest on the Notes will be payable in arrear on 26th September in each year (each an “Interest Payment Date”). Subject as provided herein and to the prior approval of the Financial Supervisory Authority of Norway (Finanstilsynet) (the “Norwegian FSA”), the Notes may be redeemed at the option of the Issuer in whole, but not in part only, (i) on the Optional Redemption Date, (ii) at any time for certain withholding tax reasons or (iii) upon the occurrence of a Capital Event (as defined herein), in each case at their principal amount together with interest accrued to (but excluding) the date of redemption. -

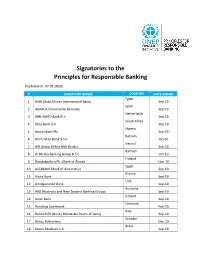

Signatories to the Principles for Responsible Banking

Signatories to the Principles for Responsible Banking (Updated on: 07.09.2020) # SIGNATORY BANKS COUNTRY DATE SIGNED Egypt 1 AAIB (Arab African International Bank) Sep-19 Spain 2 ABANCA Corporación Bancaria Sep-19 Netherlands 3 ABN AMRO Bank N.V. Sep-19 South Africa 4 Absa Bank Ltd. Sep-19 Nigeria 5 Access Bank Plc Sep-19 Bahrain 6 Ahli United Bank B.S.C Jan-20 Ireland 7 AIB Group (Allied Irish Banks) Sep-19 Bahrain 8 Al Baraka Banking Group B.S.C. Oct-19 Finland 9 Ålandsbanken Plc. (Bank of Åland) Nov-19 Egypt 10 ALEXBANK (Bank of Alexandria) Sep-19 Greece 11 Alpha Bank Sep-19 USA 12 Amalgamated Bank Sep-19 Australia 13 ANZ (Australia and New Zealand Banking Group) Sep-19 Iceland 14 Arion Bank Sep-19 Denmark 15 Aurskorg Sparebank Feb-20 Italy 16 Banca MPS (Banca Monte dei Paschi di Siena) Sep-19 Ecuador 17 Banco Bolivariano Dec-19 Brazil 18 Banco Bradesco S.A. Sep-19 Brazil 19 Banco da Amazônia Jan-20 Argentina 20 Banco de Galicia y Buenos Aires SA Sep-19 Ecuador 21 Banco de la Produccion S.A Produbanco Sep-19 Ecuador 22 Banco de Machala S.A. Sep-19 Mexico 23 Banco del Bajio, S.A. Aug-20 Ecuador 24 Banco Diners Club del Ecuador S.A. Nov-19 Nicaragua 25 Banco Grupo Promerica Nicaragua Sep-19 Ecuador 26 Banco Guayaquil Sep-19 El Salvador 27 Banco Hipotecario de El Salvador S.A. Sep-19 Ecuador 28 Banco Pichincha Sep-19 Dominican Republic 29 Banco Popular Dominicano Sep-19 Costa Rica 30 Banco Promerica Costa Rica Sep-19 Paraguay 31 Banco Regional Jul-20 Spain 32 Banco Sabadell Sep-19 Ecuador 33 Banco Solidario Nov-19 Colombia 34 Bancolombia -

DNB Bank ASA

BASE PROSPECTUS DNB Bank ASA (incorporated in Norway) €45,000,000,000 Euro Medium Term Note Programme On 6th April, 1998, Union Bank of Norway entered into a U.S.$1,500,000,000 Euro Medium Term Note Programme, as supplemented and amended (the “Programme”). The Programme was subsequently converted into euro and increased to €45,000,000,000. On 12th September, 2002, Union Bank of Norway converted into a public limited company and following such conversion the obligations of Union Bank of Norway became the obligations of a new entity, Union Bank of Norway ASA, which from such date became the issuer under the Programme. On 19th January, 2004, Union Bank of Norway ASA merged with Den norske Bank ASA and, as of such date, Union Bank of Norway ASA was renamed DnB NOR Bank ASA. On 11th November, 2011, DnB NOR Bank ASA was renamed DNB Bank ASA (the “Issuer” or the “Bank”). Pursuant to the Programme, the Issuer may from time to time issue notes (“Notes”) denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). Any Notes (as defined above) issued under the Programme on or after the date of this Base Prospectus are issued subject to the provisions herein. This does not affect any Notes issued prior to the date of this Base Prospectus. As more fully described herein, Notes may be issued (i) on an unsubordinated basis (“Unsubordinated Notes”) or (ii) on a subordinated basis as provided in “Terms and Conditions of the Notes” herein (“Subordinated Notes”). The Terms and Conditions of Subordinated Notes will not contain any events of default. -

Dnb Bank Asa

BASE PROSPECTUS DNB BANK ASA (incorporated in Norway) €45,000,000,000 Euro Medium Term Note Programme Under this €45,000,000,000 Euro Medium Term Note Programme (as supplemented and amended from time to time) (the "Programme"), DNB Bank ASA (the "Issuer" or the "Bank") may from time to time issue notes ("Notes") denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). Any Notes issued under the Programme on or after the date of this Base Prospectus are issued subject to the provisions herein. This does not affect any Notes issued prior to the date of this Base Prospectus. As more fully described herein, Notes may be issued (i) on an unsubordinated basis ("Senior Preferred Notes"); (ii) on a non- preferred basis as provided in "Terms and Conditions of the Notes" herein ("Senior Non-Preferred Notes"); or (iii) on a subordinated basis as provided in "Terms and Conditions of the Notes" herein ("Subordinated Notes"). Notes may be issued in bearer form ("Bearer Notes"), registered form ("Registered Notes") or uncertificated book-entry form cleared through the Norwegian Central Securities Depository, the Verdipapirsentralen ("VPS Notes" and the "VPS", respectively). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed €45,000,000,000 (or its equivalent in other currencies calculated as described herein). A description of the restrictions applicable at the date of this base prospectus (the "Base Prospectus") relating to the maturity of certain Notes is set out in "Overview of the Programme – Maturities". The Notes may be issued on a continuing basis to one or more of the Dealers specified under "Overview of the Programme – Dealers" below and any additional Dealer(s) appointed under the Programme from time to time, which appointment may be for a specific issue or on an ongoing basis (each a "Dealer" and together the "Dealers").