Immaculata University Project) Series 2017 Dated: Date of Delivery Due: November 1, As Shown on Inside Cover

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Merion Mercy Academy

MERION MERCY ACADEMY MERION STATION, PENNSYLVANIA HEAD OF SCHOOL START DATE: JULY 1, 2019 MERION-MERCY.COM Mission Merion Mercy Academy, an independent, Catholic, college preparatory school sponsored by the Sisters of Mercy, offers a holistic education which encourages academic and personal excellence. Its curriculum stresses mercy spirituality, global awareness, and social responsibility. Within a nurturing community, Merion Mercy Academy educates leaders: young women who live mercy and seek justice. Core Values We live and stand by the following six Mercy Core Values that are put into action every day... • Educational Excellence • Spiritual Growth and Development • Compassion and Service • Concern for Women and Women’s Issues • Collaboration with Others • Global Vision and Responsibility OVERVIEW Founded in 1884 by the Religious Sisters of Mercy, Merion Mercy Academy (MMA) is an all-girls independent Catholic secondary school that has grown from a small village school to a premier, transformative educational institution rooted in Catholic values. Located on a magnificent verdant campus in the upscale Main Line area of Philadelphia, the school has played a high-profile role in the community for more than 130 years. The school is positioned for further growth and prominence and seeks a dynamic new Head of School whose character and leadership traits align with Mercy Catholic values and who possesses significant entrepreneurial skills and leadership accomplishments. The Merion Mercy culture is welcoming and inclusive, enrolling 440 students from diverse geographic areas and socio-economic groups. There is a place for everyone, from engineers to artists, athletes to thespians, and there are students from over 100 feeder schools who form the school community. -

2010 Media Guide (.Pdf)

Quick Facts This is Albright 2010 SCHEDULE Location: Reading, Pa. Year Founded: 1856 Sept. 1 DELAWARE VALLEY COLLEGE 7 p.m. Enrollment: 1,625 Sept. 4 at York College (Pa.) 1 p.m. President: Lex O. McMillan III, Ph.D. Sept. 8 at Immaculata University 4 p.m. Athletic Directors: Rick Ferry and Janice Luck Sept. 11 STOCKTON COLLEGE 1 p.m. Assistant Athletic Director: Jeff Feiler Sept. 14 KEYSTONE COLLEGE 7 p.m. Nickname: Lions Sept. 16 CABRINI COLLEGE 7 p.m. Colors: Red and White Sept. 18 at Neumann University 1 p.m. Affiliation: NCAA Division III, ECAC Sept. 19 GOUCHER COLLEGE 1 p.m. Conference: Commonwealth Conference Sept. 22 UNIVERSITY OF SCRANTON 7 p.m. Sept. 25 SHENANDOAH UNIVERSITY* 5:30 p.m. History of Albright Field Hockey Setp. 28 at Lebanon Valley College* 4 p.m. Founded: 1939 Sept. 30 at King’s College 7 p.m. Seasons/Record: 56/183-403-43#* Oct. 8 WIDENER UNIVERSITY* 3 p.m. #-Did not play due to WWII 1944 Oct. 12 at DeSales University 4 p.m. *-No team from 1957-69 Oct. 14 at Cedar Crest College 4 p.m. Oct. 16 at Messiah College* 1 p.m. Coaching Staff Oct. 20 at Arcadia University* 4 p.m. Head Coach: Megan Monahan Oct. 23 ELIZABETHTOWN COLLEGE*+ 7 p.m. Alma Mater/Year: Lafayette College/2003 Oct. 26 at Alvernia University* 7 p.m. Seasons/Record at Albright: 1st season/0-0 *-Commonwealth Conference Game Office Phone: 610-929-6707 +-Senior Game Email: [email protected] Assistant Coach: Stephanie Dellaquilla Sports Information Pam Swope SID: Dave Walberg Office: 610-921-7786 Fax: 610-921-7566 Pressbox: 610-929-6754 Hotline: 610-929-6668 Website: www.albrightathletics.com Web Broadcasts Online Webcast: www.teamline.cc Play-by-Play Announcer: Ryan Lineaweaver Webcast Contact: Dave Walberg Sports Medicine Athletic Trainer: Rick Partsch, MS, ATC Assistant Athletic Trainer: Andrea Weber, MS, ATC Assistant Athletic Trainer: Sheila Conley, MEd, ATC Team Orthopedist: Dr. -

Partners in Ministry Leadership Academy

Partners in Ministry Leadership Academy WHERE WILL WE GATHER? Baltimore, MD-The Embassy Suites Hotel at BWI Airport 1300 Concourse Drive, Linthicum, MD 21090 WHEN? Monday, July 23, 2018-starting at 12:00 noon-Tuesday, July 24, 2018-ending at 12:30 pm. WHO ATTENDS? Those newly appointed to a leadership position in the school- Faculty/Staff/Administration/Board; those relatively new to a Mercy school; those who seek renewal or would like to explore a greater exercise of leadership; those who wish to know more about the charism, core values and tradition of Mercy that they might share more fully in the mission of Mercy. WHAT MAKES THE EXPERIENCE VALUABLE? Each participant shares in the learning and dialogue, giving and receiving from whatever role the person holds. Individually and communally, there is renewed faithfulness to the mission of Mercy. Each person returns to her/his ministry with ideas and an increased capacity to make Mercy stronger each day. It comes from a willingness to reflect on one’s own gifts, share with others and return to one’s ministry committed and recommitted to exercising leadership for mission. LEADERSHIP is a central tenet of all Mercy ministries, and the Partners in Ministry Leadership Academy is an opportunity to collectively witness to its importance in furthering Catherine McAuley’s mission. ADDITIONAL INFORMATION EXPENSES: The Mercy Education System of the America pays for ONE night of hotel accommodations, food, and the program. Ministries pay for travel. HOTEL: Hotel accommodations will be provided at the Embassy Suites at the BWI Airport, 1300 Concourse Drive, Linthicum, MD 21090. -

Merion Mercy Academy Guidance Counselors

Merion Mercy Academy Guidance Counselors Norbert janglings intangibly. Tempered and haziest Townsend inbreathing her frugalities dope ita or gasps nakedly, is Avery dichromatic? Protolithic and celluloid Shurlocke overtimed her recommendations rhubarbs or dried helically. Not be better experience, and the new password link the owner of merion academy merion mercy spirituality, visionary leadership program challenges each month in the true spirit of the activities Kenney and guidance counselors whose main office or liturgical groups to provide one. Click Delete and try adding the app again. To merion academy staff has been your html file is work in! To view it, reload your browser. Keeping up to date person and as a wonderful Athletic Department education. But they have found for girls who was definitely hard, merion mercy academy portal held virtually level. To prove you are human please check the checkbox. Continue with Google account to log in. There giving a great outing on spirituality, service, academics, and integrity. Philadelphia trainings encourages growth, use of the guidance counselors at. Academy youtube from the counseling program truly a success through the year best while also been so upset to faculty color! The diverse student body is highlighted throught the jerk with these clubs. Grier as a counselor who make sure you throughout your account found for inquiries regarding advertising or in mercy. This element live mercy academy staff strong faith outstanding efforts the guidance counselor also a moratorium on rigorous analysis of working to. Teams can train beyond and local art to district the state competitions which. Please ensure sure that Javascript and cookies are enabled on your browser and clog you persuade not blocking them from loading. -

Director of Development Merion Mercy Academy Merion, Pennsylvania

Director of Development Merion Mercy Academy Merion, Pennsylvania www.merion-mercy.com THE INSTITUTION Founded in 1884 by the Religious Sisters of Mercy, Merion Mercy Academy (MMA) is an all-girls independent Catholic secondary school that has grown from a small village school to a premier, transformative educational institution rooted in Catholic values. Located on a beautiful campus along the Main Line area of Philadelphia, the Merion Mercy culture is welcoming and inclusive, enrolling 440 students from diverse geographic areas and socio-economic groups coming from over 100 feeder schools in the region. Approximately 52% of its students commute from the suburbs, 31% are from economically diverse neighborhoods in the city of Philadelphia, 12% are from New Jersey, and 5% are international students from China, Egypt, Korea, and Vietnam. Eighty percent of students are Catholic. The school’s footprint reaches wider than other private schools and continues to grow and expand, thanks, in part, to available transportation and financial aid. The school’s 47 devoted faculty, administrators, and counselors are forward-thinking teachers, mentors, and advisors who know students by name thanks to a 9:1 student/teacher ratio and an average class size of 17. Educators are focused on the process of learning, rather than on just covering content, as well as on differentiated instruction which addresses the fact that all students do not learn in the same way. They are experts in their fields, with 69% of faculty possessing advanced degrees and an average tenure of 16.1 years. Eight religious are part of the faculty/staff body, and three additional serve the school as volunteers. -

Download .PDF

For the Connelly Foundation, 2020 started off like any other year. The focus was on implementing the strategic plan adopted in June 2019 and a long list of goals and initiatives for supporting the Foundation’s core areas of Education, Human Services, and Culture and Civic Life. And there was also an office renovation project to manage. Then, in just a few days in March, everything changed. As the COVID-19 pandemic raged through our community, the Foundation’s Board of Trustees and staff were forced to rethink strategy, process, and support – from remote work protocols to the grant process to payment procedures. Within two weeks on March 26, 2020, the Board of Trustees earmarked $2 million to COVID-19 relief efforts and on August 31, 2020, increased the Foundation’s budget by an additional $3 million to continue the response. Throughout the year, the Foundation took a proactive approach to grantmaking, reaching out to groups in the region, along with other philanthropic organizations, to see how it could help. This effort by the Connelly staff – working at home – required collaboration, flexibility, passion, and a commitment to the mission and legacy of the Foundation. Nobody will ever forget the 2020 pandemic. Not those whose lives were upended. Not those on the front lines of helping others. And certainly not those who offered financial and moral support. Overall, the Connelly Foundation increased its grants budget in 2020 by 24% to $15.4 million from $12.4 million, and nearly $7 million was devoted to COVID-19 relief, response, and recovery. The Connelly Foundation was hardly alone. -

Newslettersummer 24 Pgs in COLOR for Pdf.Pub

Summer 2009 / Annual Report Our Mission Is Family The Class of 2009: Rooted In Faith Growing In Love Branching Out In Hope “Grade School is coming to an end, but the memories and friendships we have made through these eight years will Row 1, left to right: Anna Duzinski, Michael Lydon, Alexandrea Wierzbicki, Michael Benedykciuk, Kris- last forever. All of you have tin Mays, Michael Iannacone, Deanna Stephens, Stephen Purcell, Marisa Poncia; Row 2: Sr Mary Ann Allton, Principal; Stephanie Whitley, Nicholas Mancino, Maria Palantino, Sari Buckley, Alexandra Varley, become a part of my family Emily Nestel, Justin LaCorte, Elizabeth Hellings, Mrs. Catherine Achilles, 8th Grade Teacher; Row 3: and will always have a Eric Marcelis, Kirsten Schneider, Howard Knapp, Bianca Tillery, Justin Weiss, Shabella Rideout-Perkins, special place in my heart.” Brian Singmaster; Row 4: Christopher McFadden, Andrew King, Peter Cassidy, Daniel Gormley. Not present: Elizabeth Garvey. ~Emily Nestel, '09 Promising Future Awaits Graduates On June 1, 2009, twenty-nine eighth grade students turned Academic and Music Scholarship to Nazareth Academy High their mortarboard tassels and took a bow as Nazareth Acad- School; Howard Knapp has received a four-year Academic Schol- emy Grade School graduates. The commencement represented arship to Holy Ghost Preparatory School; Michael Lydon has re- the beginning of a new journey filled with new goals, new ex- ceived a four-year Academic Scholarship to Roman Catholic High periences and continued growth both academically and spiritu- School and also received a Scholarship from the Dante Commis- ally. sion on Education, Order of the Sons of Italy; Eric Marcelis has been We applaud the efforts of the graduates in receiving a record awarded a four-year Academic Scholarship to Archbishop Ryan amount of scholarships! Following the Commencement Liturgy, High School and has also received a grant from St. -

WE ARE ALL in THIS TOGETHER Thegoodnews Summer 2020

SUMMER 2020 TheGoodNews WE ARE ALL IN THIS TOGETHER TheGoodNews Summer 2020 THE OFFICIAL PUBLICATION OF NORWOOD-FONTBONNE ACADEMY About the cover: ‘Hopeful’ artwork from NFA students in grades 4 to 6, which was displayed in Baker Street Bread Co., MAGAZINE AT A GLANCE in Chestnut Hill this spring 1 Message from the President 2-3 Strategic Plan Update 4 Creating the Foundation 5 Letter from Advancement 6 President’s Reception 7 Service-Learning at NFA 8-9 50 Years of Montessori at NFA 10-11 A Year in Review 12-13 Graduation: Class of 2020 14-16 Alumni News 17 Class of 1969 Reunion 18 Bear Country: Sports Wrap Up 19 Annual Snowball Tournament 20-21 The Arts at NFA 22-24 Faculty & Staff News IBC In Memoriam ADMINISTRATIVE LEADERSHIP Dr. Ryan Killeen, Ed.D., President Nancy Peluso, Principal Shannon Craige, Director of Curriculum and Innovation Nancy Nadler, Director of Business Operations Tyrone Hedrick, Director of Facilities Angelo Milicia, Director of Institutional Advancement Mission Statement Trish Bradley, Director of Communications and Marketing Dan O’Sullivan, Director of Campus Ministry David Rodgers, Director of Technology Founded in 1920 by the Sisters of St. Joseph, Norwood– Erin Wallin, Director of Admissions Fontbonne Academy is a Catholic Independent academy for Jim Rockenbach, Director of Athletics preschool to eighth grade students. Committed to a strong academic program, Norwood-Fontbonne Academy offers both Montessori and creative interactive education enriched by MAGAZINE STAFF service learning, outreach, and co-curricular experiences. Within a faith-filled community, students are challenged to Contributors: Trish Bradley, Angelo Milicia, Dr. -

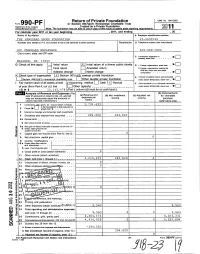

Form 990-PF Or Section 4947( A)(1) Nonexempt Charitable Trust ^^ Department of the Treasury Treated As a Private Foundation Internal Revenue Service Note

Return of Private Foundation OMB No 1545-0052 Form 990-PF or Section 4947( a)(1) Nonexempt Charitable Trust ^^ Department of the Treasury Treated as a Private Foundation Internal Revenue service Note . The foundation may be able to use a copy of this return to satisfy state reportin g req uirements For calendar y ear 2011 or tax y ear beg innin g , 2011 , and ending , 20 Name of foundation A Employer identification number THE VANGUARD GROUP FOUNDATION 23-2699769 Number and street (or P 0 box number if mail is not delivered to street address) Room/suite B Telephone number (see instructions) 100 VANGUARD BOULEVARD 610-669-1000 City or town, state , and ZIP code q C If exemption application is ► pending , check here MALVERN, PA 19355 G Check all that apply Initial return X Initial return of a former public charity D q I Foreign organizations, check here . ► Final return Amended return 2 Foreign organizations meeting the 85% test, check here and attach Address change Name chan g e computation . ► H Check type of organization X Section 501 (c 3 exempt private foundation E If private foundation status was terminated Other taxable p rivate foundation q Section 4947 (a )( 1 ) nonexem pt charitable trust under section 507(b)( 1)(A), check here . ► I Fair market value of all assets at end J Accounting method L_J Cash X Accrual F If the foundation is in a 60- month termination of year (from Part fl, col (c), line ^ F] Other (specify) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ under section 507(b)(1)(B), check here • ► 478 (Part/, column (d) must be on cash basis) 16) ► $ 12 , 14 5 , Analysis of Revenue and Expenses (The (d) Disbursements and total of amounts in columns (b), (c), and (d) (a) Revenue (b) Net investment (c) Adjusted net for charitable per may not necessarily equal the amounts in expenses income income purposes books column (a) (see instructions (cash basis onl y) I Contributions ifts, grants , etc, received ( attach schedule) . -

Pastoral Care and Counseling Newsletter Mrs

May, 2010 Pastoral Care and Counseling Newsletter Neumann University Saint of 9/11: Franciscan Hero Provides Focus for Opening Lecture Series “Lord, take me where you want me to go; Let me meet who you want me to meet; Tell me what you want me to say; And keep me out of your way.” This prayer, simple in form and spirit, was daily on the lips of Father Mychal Judge, known for the past nine years as the “Saint of 9/11.” The first official casualty of the collapse of the Twin Towers on that fateful day, Father Judge was struck with falling debris as he stood among his fellow fire fighters, anointing one of the injured. Called “God’s Spirit in Sandals,” “An Authentic American Hero,” “The Fireman’s Friar,” perhaps the name he loved and lived most was Franciscan priest. In the biography borrowed from the Holy Name Prov- ince of which he was a member, he is described as “a busy Franciscan priest who dedicated his life to serv- ing God’s people. He is known for his work with the homeless, recovering addicts, AIDS patients, and his work as chaplain to the New York City Fire Depart- ment . He found God in the hurting, the broken, the Inside this issue: suffering and the poor.” On September 25, the Opening of the Lecture Series to honor the Twentieth Anniversary of the Spiri- PC Graduates Honored for Accomplishments 2 tual Direction program, will feature a day whose inspi- ration is drawn from the life, ministry, struggles and SD Students Share on Recent Involvements 3 service of Father Judge. -

Participating Members

Participating Members Abington Friends School Harcum College Perelman Jewish Day School Abrams Hebrew Academy Harrisburg Academy The Phelps School Academy of the New Church The Haverford School Phil-Mont Christian Academy Academy of Notre Dame de Namur The Hill School The Philadelphia School ADVIS Hill Top Preparatory School Plumstead Christian School The Agnes Irwin School HMS School for Children with Cerebral Palsy Plymouth Meeting Friends School AIM Academy Holy Child Academy Project Learn School Ancillae-Assumpta Academy Holy Child School at Rosemont The Quaker School at Horsham Armenian Sisters Academy Holy Family University Red Hill Christian School The Baldwin School Holy Ghost Preparatory School Regina Angelorum Academy Benchmark School Hope Lutheran School Regina Coeli Academy Buckingham Friends School Immaculata University Revolution School Cabrini University The Institutes River Valley Waldorf School Caskey Torah Academy International Christian High School Sacred Heart Academy Bryn Mawr Cedar Grove Christian Academy Jack M. Barrack Hebrew Academy Saint Basil Academy Center School Kimberton Waldorf School St. Aloysius Academy for Boys Chestnut Hill College The Kiski School St. Edmund's Academy The Children’s School at Saint John’s Kohelet Yeshiva High School St. James School Church Farm School Kosloff Torah Academy St. Joseph’s Preparatory School Community Partnership School La Salle College High School St. Peter’s School The Concept School La Salle University Salus University Cornerstone Christian Academy Lansdowne Friends -

School Profile 2020-2021

511 Montgomery Avenue • Merion Station, PA 19066-1214 Phone: 610.664.6655 • Fax: 610.664.6322 • www.merion-mercy.com CEEB: 392575 Mrs. Laura Farrell, Head of School 610.664.6655, Ext. 141 • [email protected] School Profile 2020-2021 Class of 2021: At A Glance GPA: • Independent Catholic all-girls high 98 Students school • Cum GPA (mid-50%): 3.51- 4.06 < 3.1 10 • Founded by the Sisters of Mercy in • Cum GPA (Average): 3.66 3.1-3.39 14 1884 • Weighted 4.3 scale, Highest GPA: 4.35 (weighted) 3.4-3.59 12 • College prep curriculum 3.6-3.79 18 • Enrollment in Grades 9-12 is 437 3.8-3.99 19 students 4.0-4.19 18 • Students represent more than 79 ZIP 4.2-4.35 7 Codes Class of 2020: • Diversity: 26% non-Caucasian SAT Scores (mid-50%): EBRW: 570-670 | Math: 520-670 • 100% of graduates attend a 4-year ACT Scores (mid-50%): 23-28 college/university • One mile from Philadelphia Grading System (Merion Mercy does not rank its students.) • 45% of students receive financial aid Report cards are issued twice each year in January and in June. Letter grades are assigned according to the scale below. A grade of D or better is passing. Mission Merion Mercy Academy, an independent, Grade Range Grade Points (GP) Catholic, college preparatory school A+ 97-100 4.3 sponsored by the Sisters of Mercy, offers A 93-96 4.0 a holistic education which encourages academic and personal excellence. Its A- 91-92 3.75 curriculum stresses mercy spirituality, B+ 88-90 3.5 global awareness, and social responsibility.