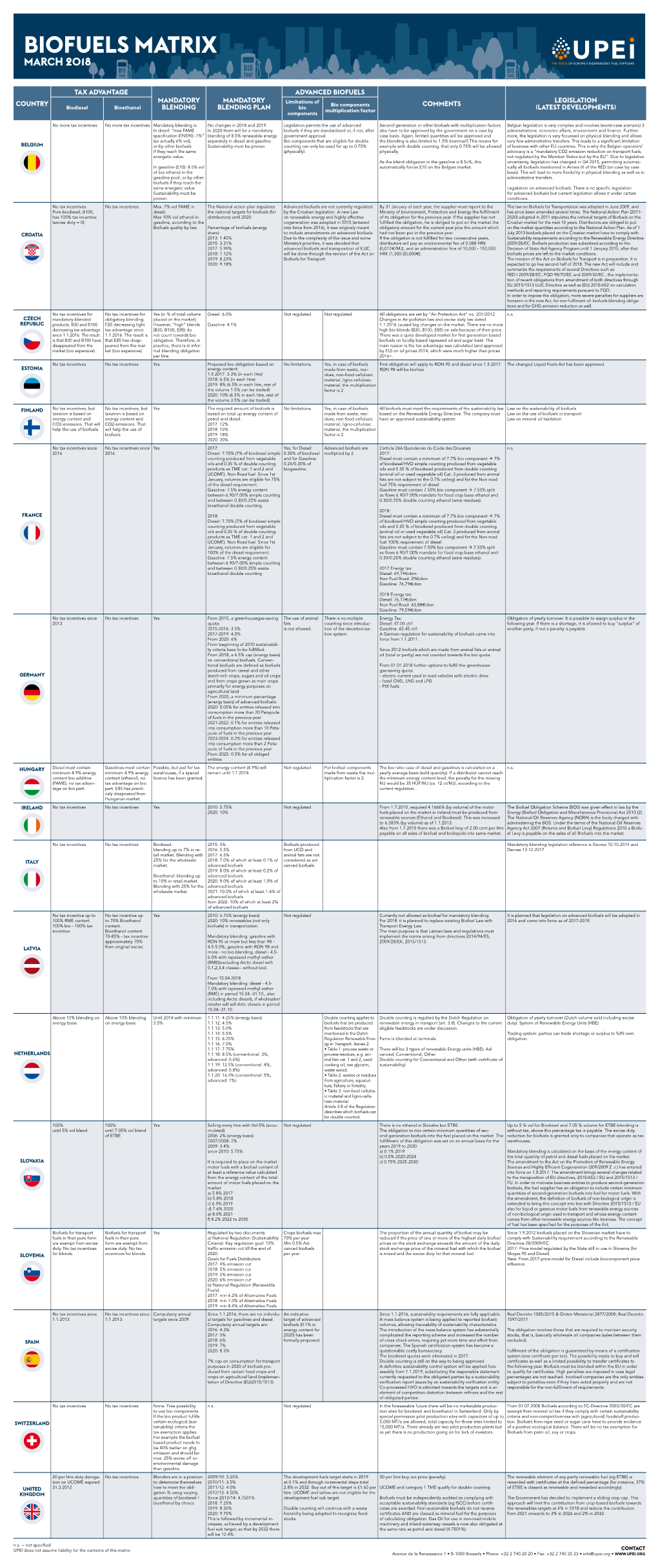

Biofuels Matrix

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Current and Future Trends in Chinese Environmental and Energy Law and Policy

Pace International Law Review Volume 18 Issue 1 Spring 2006 Article 9 April 2006 The Current and Future Trends in Chinese Environmental and Energy Law and Policy Mingde Cao Follow this and additional works at: https://digitalcommons.pace.edu/pilr Recommended Citation Mingde Cao, The Current and Future Trends in Chinese Environmental and Energy Law and Policy, 18 Pace Int'l L. Rev. 253 (2006) Available at: https://digitalcommons.pace.edu/pilr/vol18/iss1/9 This Article is brought to you for free and open access by the School of Law at DigitalCommons@Pace. It has been accepted for inclusion in Pace International Law Review by an authorized administrator of DigitalCommons@Pace. For more information, please contact [email protected]. THE CURRENT AND FUTURE TRENDS IN CHINESE ENVIRONMENTAL AND ENERGY LAW AND POLICY Mingde Caot I. Chinese Environmental and Energy Law and Policy: Transmitting from First Generation to Second Generation ................................ 255 II. The Current and Future Trends in Chinese Environmental and Energy Law and Policy ....... 258 A. Ethical Transition from Anthropocentrism to Eco-centrism ................................... 258 B. Transition from a Development Economy to Recycling and Cleaning Production Economy in Environmental and Resource Law ............. 262 C. Transition from Restricting Development and Utilization of Non-renewable Energies to Encouraging Investment and Operation of Renewable Energies ........................... 266 III. Conclusion ......................................... 268 In the period from 1979 to 2003, the yearly average growth rate of gross domestic product (GDP) in China was 9.4 percent,' while, at the same time, sixteen of the world's twenty most air- polluted cities were in China, according to the World Health Or- t Mingde Cao, PhD, is professor of law at Southwest University of Political Science and Law in Chongqing, China. -

Course Syllabus Global Energy Law & Policy: Europe in Transition The

Vermont Law School | Environmental Law Center | Summer Session 2021 | Term 2 Course Syllabus Global Energy Law & Policy: Europe in Transition The Trilemma of Liberalization, Decarbonization and Energy Security (2 credits) Course instructor: Dr. Anna-Alexandra Marhold E-mail: a.a.marhold [at] law.leidenuniv.nl; amarhold [at] vermontlaw.edu Class meeting dates and times: June 21 – 24 and June 28 – July 1, 9am – 12 pm (EST) (via MS Teams, links will be provided on TWEN) Method of grading: In-class participation, in-class presentation/group assignment (20%) + final paper (80%) Prerequisite courses: None; Some prior knowledge of public international law/EU law recommended Course description: Europe is facing a significant challenge to realize the transition to a low carbon economy while at the same time guaranteeing its energy security. It walks on a tight rope between ensuring a secure, competitive and sustainable energy supply for its citizens, while meeting its own climate commitments as well as those under the Paris Agreement. For that reason, Europe has set ambitious targets in its new EU Green Deal: it aims to become climate neutral and to have no net emissions of greenhouse gasses by 2025, in addition to decouple economic growth from resource use. The transition to a low carbon economy in the EU is accompanied by many obstacles (regulatory, geo-political and technical). Our course aims to give a comprehensive insight into global and EU (renewable) energy law and policy and the challenges ahead. It will start out by situating the EU in the larger context of international law and policy, understanding its geo-political situation pertaining to energy. -

ENERGY and ENVIRONMENTAL SERVICES: Negotiating Objectives and Development Priorities

UNCTAD/DITC/TNCD/2003/3 UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT Geneva ENERGY AND ENVIRONMENTAL SERVICES: Negotiating Objectives and Development Priorities UNITED NATIONS New York and Geneva, 2003 Note • The symbols of United Nations documents are composed of capital letters combined with figures. Mention of such a symbol indicates a reference to a United Nations document. • The views expressed in this volume are those of the authors and do not necessarily reflect the views of the United Nations Secretariat. The designations employed and the presentation of the material do not imply the expression of any opinion whatsoever on the part of the United Nations Secretariat concerning the legal status of any country, territory, city or area, or of its authorities, or concerning the delimitation of its frontiers or boundaries, or regarding its economic system or degree of development. • Material in this publication may be freely quoted or reprinted, but acknowledgement is requested, together with a reference to the document number. A copy of the publication containing the quotation or reprint should be sent to the UNCTAD secretariat at: Palais des Nations, 1211 Geneva 10, Switzerland. UNCTAD/DITC/TNCD/2003/3 CONTENTS Page Acknowledgements ......................................................... iv Foreword ......................................................................... vi Rubens Ricupero I. Energy Services ............................................... 1 1. Energy services, energy policies and the Doha Agenda Murray Gibbs ..................................................... 3 2. International trade in energy services and the developing countries Simonetta Zarrilli ............................................... 23 3. Defining energy services for the GATS: An issue under discussion Jasmin Tacoa-Vielma ......................................... 70 4. An overview of the negotiating proposals on energy services under the GATS negotiations: Canada Josée De Menezes ........................... -

Harmonizing States' Energy Utility Regulation Frameworks and Climate Laws: a Case Study of New York

FINAL 11/15/20 © COPYRIGHT 2020 BY THE ENERGY BAR ASSOCIATION HARMONIZING STATES’ ENERGY UTILITY REGULATION FRAMEWORKS AND CLIMATE LAWS: A CASE STUDY OF NEW YORK Justin Gundlach and Elizabeth B. Stein*. Synopsis: Several states have recently passed legislation mandating ambi- tious levels of economy-wide greenhouse gas emissions reductions. Maine and New Jersey have each adopted “80 x 50” mandates, meaning that they set 2050 as the deadline for reducing annual emissions by 80% from their level in a benchmark year. Colorado’s mandate calls for a 90% reduction by 2050. California adopted a 40% by 2030 mandate in 2006 (later supplemented by executive orders directing state agencies to aim for “80 x 50” and then net-zero emissions by 2045). New York has adopted the goal of net-zero emissions by 2050, with an underlying an- nual emission reduction mandate of at least 85% below 1990 levels. Massachu- setts resembles New York, but its 2008 legislative mandate both called for an 80% reduction by 2050 and authorized updates by the Secretary of State, who in April 2020 announced a net-zero target for 2050 and mandated a reduction in annual emissions to at least 85% below 1990 levels. More state mandates are likely to be adopted in the coming years by legislatures across the country. While the laws establishing these state mandates authorize agencies to adopt new regulations and, in some cases, create ways to challenge inconsistent agency action, they do not spell out what to do about existing laws that require, authorize, or subsidize the development and use of infrastructure designed to enable the consumption of fossil fuels. -

Republic of Macedonia Ministry of Economy

Renewable Energy Coordination Group 3th Meeting, Vienna, 7 March 2017 Report on Core Topic 7: BIOFUELS AND BIOLIQUIDS Milica Andonov, Ministry of Economy of the Republic of Macedonia Report on Core Topic 7: BIOFUELS AND BIOLIQUIDS Scope of Activity The sustainability criteria for biofuels and bioliquids, introduced by Articles 17 to 21 of Directive 2009/28/EC made a crucial change for the transport sector. Scope of the criteria spreads over different sectors – transport, agriculture, and environment – and this might be one of the main reasons why none of the Contracting Parties implemented relevant provisions into the national legislation so far. Building on the results of the technical assistance provided by the Donor’s Community for the CP`s, the Deliverables of CT 7 are: Analysis of legal acts to be amended or/and developed to transpose sustainability criteria Proposals of verification system & body applicable for the CP`s Proposals of support biofuels schemes Report on Core Topic 7: BIOFUELS AND BIOLIQUIDS 2016 2017 ACTIVITY 2: Implementation of the Renewable Energy Directive Q2 Q3 Q4 Q1 Q2 Q3 Q4 Core topic 7: Biofuels and bioliquids Analysis of legal acts to be amended 1. Understanding the or/and developed to transpose sustainability criteria sustainability criteria 1. Verification system and body Recommendations for best practices 1. Support scheme Recommendations for best practices Report on Core Topic 7: BIOFUELS AND BIOLIQUIDS Analysis of the conducted questionnaire In order to fulfil the obligation from the RE CG Work Programme 2016- 2017 core topic leaders, in October prepared Questionnaire and submitted to the contracting parties for their comments. -

Energy Law Basics Duvivier 00 Fmt.Qxp 11/23/16 11:45 AM Page Ii Duvivier 00 Fmt.Qxp 11/23/16 11:45 AM Page Iii

duvivier 00 fmt.qxp 11/23/16 11:45 AM Page i Energy Law Basics duvivier 00 fmt.qxp 11/23/16 11:45 AM Page ii duvivier 00 fmt.qxp 11/23/16 11:45 AM Page iii Energy Law Basics K.K. DuVivier Carolina Academic Press Durham, North Carolina duvivier 00 fmt.qxp 11/23/16 11:45 AM Page iv Copyright © 2017 K.K. DuVivier All Rights Reserved ISBN 978-0-76986-952-0 LCCN 2016960221 Carolina Academic Press, LLC 700 Kent Street Durham, NC 27701 Telephone (919) 489-7486 Fax (919) 493-5668 www.cap-press.com Printed in the United States of America duvivier 00 fmt.qxp 11/23/16 11:45 AM Page v To my children, their children, and all children as my effort to bestow on your world a better energy future. duvivier 00 fmt.qxp 11/23/16 11:45 AM Page vi duvivier 00 fmt.qxp 11/23/16 11:45 AM Page vii Contents Acknowledgments xxiii Part I Context and Global Energy Issues 1 Chapter 1 · The Life of an Energy Lawyer 3 A. Energy Practice 3 B. Staying on Top of Energy Practice 4 C. Reliable Information 6 D. Energy Basics 7 Chapter 2 · Climate Change 11 Climate Change Timeline 11 A. Climate Science 13 B. Intergovernmental Panel on Climate Change (IPCC) 15 C. International Climate Change Treaties 16 1. United Nations Framework Convention on Climate Change 18 2. The Kyoto Protocol 19 3. Beyond the Kyoto Protocol 23 D. U.S. Climate Change Law and Policy 24 1. -

Climate Change and the Convergence of Environmental and Energy Law

Fordham Environmental Law Review Volume 24, Number 2 2017 Article 3 Climate Change and the Convergence of Environmental and Energy Law Alexandra B. Klass∗ ∗University of Minnesota Law School, [email protected] Copyright c 2017 by the authors. Fordham Environmental Law Review is produced by The Berkeley Electronic Press (bepress). http://ir.lawnet.fordham.edu/elr CLIMATE CHANGE AND THE CONVERGENCE OF ENVIRONMENTAL AND ENERGY LAW Alexandra B. Klass* INTRODUCTION Upon being asked to contribute to the Fordham Environmental Law Review's 20th Anniversary book on the trajectory of environmental law over the past twenty years, I quickly realized that a reflection on twenty years of environmental law would also be, for me, a reflection on my twenty years as an environmental lawyer and scholar. I graduated from law school in 1992, practiced environmental law for just over ten years, and then moved to academia, where I have taught and written about environmental law for just under ten years. This type of reflection necessarily causes one to think about what has changed and what has remained the same during these twenty years, as well as future of the field. Much is the same. Environmental law is still concerned with clean air, clean water, protecting species, remediating contaminated property, and ensuring decisions are made with sufficient information on and concern for potential adverse environmental impacts. Differing visions of federalism, in the context of jurisdiction over wetlands, the scope of the federal government's authority to protect species on private lands, and other areas, continue both in Congress and the courts. The lack of major federal legislation in the environmental law area has also been a constant over these past twenty years, with Congress limiting itself primarily to targeted fixes to existing legislation such as Comprehensive Environmental Response, Compensation, and Liability Act ("CERCLA") and the Clean Air Act, even while the Environmental Protection Agency * Julius E. -

The Water-Energy-Climate Nexus Under International Law: a Central Asian Perspective

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by University of Michigan School of Law Michigan Journal of Environmental & Administrative Law Volume 5 Issue 2 2016 The Water-Energy-Climate Nexus Under International Law: A Central Asian Perspective Anatole Boute The Chinese University of Hong Kong Follow this and additional works at: https://repository.law.umich.edu/mjeal Part of the Environmental Law Commons, International Law Commons, and the Natural Resources Law Commons Recommended Citation Anatole Boute, The Water-Energy-Climate Nexus Under International Law: A Central Asian Perspective, 5 MICH. J. ENVTL. & ADMIN. L. 371 (2016). Available at: https://repository.law.umich.edu/mjeal/vol5/iss2/2 This Article is brought to you for free and open access by the Journals at University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in Michigan Journal of Environmental & Administrative Law by an authorized editor of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. \\jciprod01\productn\M\MEA\5-2\MEA202.txt unknown Seq: 1 18-MAY-16 13:27 THE WATER-ENERGY-CLIMATE NEXUS UNDER INTERNATIONAL LAW: A CENTRAL ASIAN PERSPECTIVE Anatole Boute* ABSTRACT Water, energy, and climate change are intrinsically related to each other but are nonetheless subject to different international legal regimes. The fragmented nature of water, energy, and climate governance represents a challenge for the sustainable management of resources in the energy and water landscape of the 21st century. Regulatory choices in one field can potentially undermine the policy objectives pursued in the other fields. -

Agenda for a Sustainable America

AGENDA FOR A SUSTAINABLE AMERICA John C. Dernbach, Editor ELI Press Environmental Law Institute Washington, D.C. Environmental Law Institute 2000 L Street NW, Washington, DC 20036 Published January 2009. All rights reserved. No part of this work may be reproduced or transmitted in any form by any means, electronic or mechanical, including photocopying and recording, or by any information storage or retrieval system, without permission in writing. Copyright is not claimed as to any part of the original work prepared by a United States government officer or employee as part of that person’s official duties. Printed in the United States of America ISBN 978-1-58576-133-3 For Tess, Becky, and all who will inherit this world AGENDA FOR A SUSTAINABLE AMERICA Table of Contents Preface ..............................................ix Editor and Contributing Author ............................xiii Contributing Authors ....................................xv I. Introduction Chapter 1: Sustainable Development and the United States by John C. Dernbach ...................................3 Chapter 2: Progress Toward Sustainability: A Report Card by the Contributing Authors..............................15 Chapter 3: Agenda for a Sustainable America by the Contributing Authors..............................27 II. Six Areas of Greater Progress Chapter 4: Local Governance and Sustainability: Major Progress, Significant Challenges by Jonathan D. Weiss ..................................43 Chapter 5: Brownfields Development: From Individual Sites to Smart Growth -

Biofuel Application As a Factor of Sustainable Development Ensuring: the Case of Russia

energies Article Biofuel Application as a Factor of Sustainable Development Ensuring: The Case of Russia Ekaterina S. Titova Federal Research Centre «Fundamentals of Biotechnology» of the Russian Academy of Sciences, Leninsky Prospect, 33, bld. 2, 119071 Moscow, Russia; [email protected] Received: 24 September 2019; Accepted: 15 October 2019; Published: 17 October 2019 Abstract: Diffusion of the biofuels (BF) using is justified by opening up the opportunities for obtaining fuel and energy from previously inaccessible sources and by the existence of energy-deficient regions, in particular in Russia. Works of different scientists on the problems of creating and using BF were the methodological basis of this study. Information on the state and prospects of the development of renewable energy sources in Russian regions was collected from regulatory documents and was obtained by employing a questionnaire survey. For the study of the collected materials, the different methods of comparative analysis, and the methods of expert assessments were used. The results of the Status-Quo analysis of BF production in Russia have shown that the creation of BF performed relatively successfully. However, there are many more perspectives, connected with expanding the utilization of the different raw materials. Also, the analysis of organizational and economic mechanisms applied for production of BF and the obtained data on several organizations-producers allowed for proposing six indexes for the assessment of the BF production effectiveness. It is suggested that BF production in Russia will contribute to the sustainable development of a number of the country’s regions in the near future. Keywords: biofuel; risk analysis; sustainable development; renewable energy; biomass; biotechnology; anthropogenic waste processing; energy resource assessment 1. -

GWEC – Global Wind Report | Annual Market Update 2014

GLOBAL WIND REPORT ANNUAL MARKET UPDATE 2014 Navigating the global wind power market The Global Wind Energy Council is the international trade association for the wind power industry – communicating the benefits of wind power to national governments, policy makers and international institutions. GWEC provides authoritative research and analysis on the wind power industry in more than 80 countries around the world. Keep up to date with the most recent market insights: Global Wind Statistics 2014 February 2015 Global Wind Report 2014 March 2015 Global Wind Energy Outlook 2014 October 2014 Offshore Wind Policy and Market Assessment – A Global Outlook February 2015 Our mission is to ensure that wind power establishes itself as the answer to today‘s energy challenges, providing substantial venvironmental and economic benefits. GWEC represents the industry with or at the UNFCCC, the IEA, international financial institutions, the IPCC and IRENA. GWEC – opening up the frontiers follow us on TABLE OF CONTENTS Foreword. 4 Making the Commitment to Renewable Energy. 5 Global Status of Wind Power in 2014 . 6 Market Forecast for 2015 – 2019. 16 Green bonds offer exciting opportunities for the wind sector . .22 Emerging Africa . .26 Australia . .30 Brazil . 32 Canada. .34 Chile . .36 PR China . .38 Denmark . .42 The European Union . .44 France . .46 Germany. .48 Global offshore . 52 India . .58 Italy . .60 Japan . .62 Mexico . .64 Poland . .66 South Africa . .68 Sweden . 70 Turkey . 72 United Kingdom. 74 United States . 76 About GWEC . 78 GWEC – Global Wind 2014 Report 3 FOREWORD 014 was a great year for the wind industry, setting a The two big stories in 2014 and going forward continue 2new record of more than 51 GW installed in a single to be the precipitous drop in the price of oil, and growing year, bringing the global total close to 370 GW. -

Utility Use of Renewable Resources: Legal and Economic Implications

Denver Law Review Volume 59 Issue 4 Article 4 February 2021 Utility Use of Renewable Resources: Legal and Economic Implications Jan G. Laitos Follow this and additional works at: https://digitalcommons.du.edu/dlr Recommended Citation Jan G. Laitos, Utility Use of Renewable Resources: Legal and Economic Implications, 59 Denv. L.J. 663 (1982). This Article is brought to you for free and open access by the Denver Law Review at Digital Commons @ DU. It has been accepted for inclusion in Denver Law Review by an authorized editor of Digital Commons @ DU. For more information, please contact [email protected],[email protected]. UTILITY USE OF RENEWABLE RESOURCES: LEGAL AND ECONOMIC IMPLICATIONS* JAN G. LAITOS** I. Overview: The Nature of Utility Involvement in Renewable Energy Applications ......................................... 666 A. Types of Utilities and Their Differing Relationships to Renewable Energy ...................................... 666 1. Electric Utilities and Renewable Energy .............. 666 2. Gas Utilities and Renewable Energy ................. 669 B. Prospects for Utility Interest in Renewable Energy ....... 671 II. Utilities and Decentralized Renewable Energy Applications ... 672 A. Utilities and Nonelectric, Decentralized, Renewable Technologies ..... ................................ 673 1. The Effect of Nonelectric Renewable Technologies on U tilities ............................................. 673 2. Responses of Utilities to Nonelectric Renewable Technologies ........................................ 676 a. Utility