Taxing Wages 2019 © Oecd 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Creating Market Incentives for Greener Products Policy Manual for Eastern Partnership Countries

Creating Market Incentives for Greener Products Policy Manual for Eastern Partnership Countries Creating Incentives for Greener Products Policy Manual for Eastern Partnership Countries 2014 About the OECD The OECD is a unique forum where governments work together to address the economic, social and environmental challenges of globalisation. The OECD is also at the forefront of efforts to understand and to help governments respond to new developments and concerns, such as corporate governance, the information economy and the challenges of an ageing population. The Organisation provides a setting where governments can compare policy experiences, seek answers to common problems, identify good practice and work to co-ordinate domestic and international policies. The OECD member countries are: Australia, Austria, Belgium, Canada, Chile, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea, Luxembourg, Mexico, the Netherlands, New Zealand, Norway, Poland, Portugal, the Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. The European Union takes part in the work of the OECD. Since the 1990s, the OECD Task Force for the Implementation of the Environmental Action Programme (the EAP Task Force) has been supporting countries of Eastern Europe, Caucasus and Central Asia to reconcile their environment and economic goals. About the EaP GREEN programme The “Greening Economies in the European Union’s Eastern Neighbourhood” (EaP GREEN) programme aims to support the six Eastern Partnership countries to move towards green economy by decoupling economic growth from environmental degradation and resource depletion. The six EaP countries are: Armenia, Azerbaijan, Belarus, Georgia, Republic of Moldova and Ukraine. -

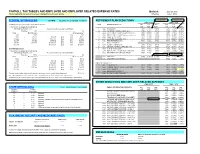

PAYROLL TAX TABLES and EMPLOYEE and EMPLOYER RELATED EXPENSE RATES Updated: June 27, 2012 *Items Highlighted in Yellow Have Been Changed Since the Last Update

PAYROLL TAX TABLES AND EMPLOYEE AND EMPLOYER RELATED EXPENSE RATES Updated: June 27, 2012 *items highlighted in yellow have been changed since the last update. Effective: July 1, 2012 FEDERAL WITHHOLDING 26 PAYS FEDERAL TAX ID NUMBER 86-6004791 RETIREMENT PLAN DEDUCTIONS 10.5% AT 50/50 10.5% AT 50/50 EMPLOYEE EMPLOYER (a) SINGLE person (including head of household) - CODE RETIREMENT PLAN DED OLD NEW DED OLD NEW If the amount of wages (after subtracting CODE RATE RATE CODE RATE RATE withholding allowances) is: The amount of income tax to withhold is: 1 ASRS PLAN-ASRS 7903 11.13% 10.90% 7904 9.87% 10.90% Not Over $83 ............................................................................................. $0 2 CORP JUVENILE CORRECTIONS (501) 7905 8.41% 8.41% 7906 9.92% 12.30% Over But not over - of excess over - 3 EORP ELECTED OFFICIALS & JUDGES (415) 7907 10.00% 11.50% 7908 17.96% 20.87% $83 - $417 10% $83 4 PSRS PUBLIC SAFETY (007) (ER pays 5% EE share) 7909 3.65% 4.55% 7910 38.30% 48.71% $417 - $1,442 $33.40 plus 15% $417 5 PSRS GAME & FISH (035) 7911 8.65% 9.55% 7912 43.35% 50.54% $1,442 - $3,377 $187.15 plus 25% $1,442 6 PSRS AG INVESTIGATORS (151) 7913 8.65% 9.55% 7914 90.08% 136.04% $3,377 - $6,954 $670.90 plus 28% $3,377 7 PSRS FIRE FIGHTERS (119) 7915 8.65% 9.55% 7916 17.76% 20.54% $6,954 - $15,019 $1,672.46 plus 33% $6,954 9 N/A NO RETIREMENT $15,019 ………………………………………………………$4,333.91 plus 35% $15,019 0 CORP CORRECTIONS (500) 7901 8.41% 8.41% 7902 9.15% 11.14% B PSRS LIQUOR CONTROL OFFICER (164) 7923 8.65% 9.55% 7924 38.77% 46.99% (b) MARRIED person F PSRS STATE PARKS (204) 7931 8.65% 9.55% 7932 18.50% 25.16% If the amount of wages (after subtracting G CORP PUBLIC SAFETY DISPATCHERS (563) 7933 7.96% 7.96% 7934 7.50% 7.90% withholding allowances) is: The amount of income tax to withhold is: H PSRS DEFERRED RET OPTION (DROP) 7957 8.65% 9.55% 0.24% AT 50/50 Not Over $312 ............................................................................................ -

No Free Lunch: Higher Superannuation Means Lower Wages

No free lunch: Higher superannuation means lower wages February 2020 Brendan Coates, Will Mackey, and Matt Cowgill No free lunch: Higher superannuation means lower wages Grattan Institute Support Grattan Institute Working Paper No. 2020-01, February 2020 Founding members Endowment Supporters This working paper was written by Brendan Coates, Will Mackey, and The Myer Foundation Matt Cowgill. Owain Emslie and Jonathan Nolan made valuable National Australia Bank contributions to the report. Susan McKinnon Foundation We would like to thank Jeff Borland, Bob Breunig, Rebecca Cassells, Affiliate Partners Rafal Chomik, John Freebairn, Sean Innis, Guyonne Kalb, Mike Keating, Kristen Sobeck, Geoff Warren, Roger Wilkins, and a number of Medibank Private others for their comments on this working paper. We would also like to Susan McKinnon Foundation thank Grattan Institute’s Public Policy Committee. Veitch Lister Consulting Analysis in this paper used the R programming language (R Core Senior Affiliates Team, 2019) and a range of R packages including the Tidyverse Cuffe Family Foundation (Wickham et al, 2019). Maddocks The opinions in this paper are those of the authors and do not The Myer Foundation necessarily represent the views of Grattan Institute’s founding PwC members, affiliates, individual board members, reference group Scanlon Foundation members, or reviewers. Any remaining errors or omissions are the Trawalla Foundation responsibility of the authors. Wesfarmers Grattan Institute is an independent think tank focused on Australian Westpac public policy. Our work is independent, practical, and rigorous. We aim Affiliates to improve policy outcomes by engaging with decision makers and the broader community. Allens Ashurst For further information on the Institute’s programs, or to join our mailing Corrs list, please go to: http://www.grattan.edu.au/. -

Main Economic Indicators: Comparative Methodological Analysis: Wage Related Statistics

MAIN ECONOMIC INDICATORS: COMPARATIVE METHODOLOGICAL ANALYSIS: WAGE RELATED STATISTICS VOLUME 2002 SUPPLEMENT 3 FOREWORD This publication provides comparisons of methodologies used by OECD Member countries to compile key short-term and annual data on wage related statistics. These statistics comprise annual and infra-annual statistics on wages and earnings, minimum wages, labour costs, labour prices, unit labour costs, and household income. Also, because of their use in the compilation of these statistics, the publication also includes an initial analysis of hours of work statistics. In its coverage of short-term indicators it is related to analytical publications previously published by the OECD for indicators published in the monthly publication, Main Economic Indicators (MEI) for: industry, retail and construction indicators; and price indices. The primary purpose of this publication is to provide users with methodological information underlying the compilation of wage related statistics. The analysis provided for these statistics is designed to ensure their appropriate use by analysts in an international context. The information will also enable national statistical institutes and other agencies responsible for compiling such statistics to compare their methodologies and data sources with those used in other countries. Finally, it will provide a range of options for countries in the process of creating their own wage related statistics, or overhauling existing indicators. The analysis in this publication focuses on issues of data comparability in the context of existing international statistical guidelines and recommendations published by the OECD and other international agencies such as the United Nations Statistical Division (UNSD), the International Labour Organisation (ILO), and the Statistical Office of the European Communities (Eurostat). -

Taxation Paradigms: JOHN WEBB SUBMISSION APRIL 2009

Taxation Paradigms: What is the East Anglian Perception? JOHN WEBB A thesis submitted in partial fulfilment of the requirements of Bournemouth University for the degree of Doctor of Philosophy SUBMISSION APRIL 2009 BOURNEMOUTH UNIVERSITY What we calf t[ie beginningis oftenthe end And to makean endis to makea beginning ?fie endis wherewe start ++++++++++++++++++ Weshall not ceasefrom exploration And the of exploring end .. Wilt to arrivewhere we started +++++++++++++++++ 7.S f: Cwt(1974,208: 209) ? fie Four Quartets,Coffected Poems, 1909-1962 London: Faderand Fader 2 Acknowledgements The path of a part time PhD is long and at times painful and is only achievablewith the continued support of family, friends and colleagues. There is only one place to start and that is my immediate family; my wife, Libby, and daughter Amy, have shown incredible patienceover the last few years and deserve my earnest thanks and admiration for their fantastic support. It is far too easy to defer researchwhilst there is pressingand important targets to be met at work. My Dean of Faculty and Head of Department have shown consistent support and, in particular over the last year my workload has been managedto allow completion. Particularthanks are reservedfor the most patientand supportiveperson - my supervisor ProfessorPhilip Hardwick.I am sure I am one of many researcherswho would not have completed without Philip - thank you. ABSTRACT Ever since the Peasant'sRevolt in 1379, collection of our taxes has been unpopular. In particular when the taxes are viewed as unfair the population have reacted in significant and even violent ways. For example the Hearth Tax of 1662, Window Tax of 1747 and the Poll tax of the 1990's have experiencedpublic rejection of these levies. -

Tax Us If You Can 2012 FINAL.Pdf

City Research Online City, University of London Institutional Repository Citation: Murphy, R. and Christensen, J.F. (2012). Tax us if you can. Chesham, UK: Tax Justice Network. This is the published version of the paper. This version of the publication may differ from the final published version. Permanent repository link: https://openaccess.city.ac.uk/id/eprint/16543/ Link to published version: Copyright: City Research Online aims to make research outputs of City, University of London available to a wider audience. Copyright and Moral Rights remain with the author(s) and/or copyright holders. URLs from City Research Online may be freely distributed and linked to. Reuse: Copies of full items can be used for personal research or study, educational, or not-for-profit purposes without prior permission or charge. Provided that the authors, title and full bibliographic details are credited, a hyperlink and/or URL is given for the original metadata page and the content is not changed in any way. City Research Online: http://openaccess.city.ac.uk/ [email protected] tax us nd if you can 2Edition INTRODUCTION TO THE TAX JUSTICE NETWORK The Tax Justice Network (TJN) brings together charities, non-governmental organisations, trade unions, social movements, churches and individuals with common interest in working for international tax co-operation and against tax avoidance, tax evasion and tax competition. What we share is our commitment to reducing poverty and inequality and enhancing the well being of the least well off around the world. In an era of globalisation, TJN is committed to a socially just, democratic and progressive system of taxation. -

The Macroeconomics Effects of a Negative Income

The Macroeconomics e¤ects of a Negative Income Tax Martin Lopez-Daneri Department of Economics The University of Iowa February 17, 2010 Abstract I study a revenue neutral tax reform from the actual US Income Tax to a Negative Income Tax (N.I.T.) in a life-cycle economy with individual heterogeneity. I compare di¤erent transfers in a stationary equilibrium. I …nd that the optimal tax rate is 19.51% with a transfer of 11% of GDP per capita, roughly $5,172.79. The average welfare gain amounts to a 1.7% annual increase of individual consumption. All agents bene…t from the reform. There is a 17.52% increase in GDP per capita and a decrease of 13% in Capital per labor. Capital per Output declines 10.22%. 1 Introduction The actual US Income Tax has managed to become increasingly complex, because of its numerous tax credits, deductions, overlapping provisions and increasing marginal rates. The Income Tax introduces a considerable number of distortions in the economy. There have been several proposals to simplify it. However, this paper focuses on one of them: a Negative Income Tax (NIT). In this paper, I ask the following questions: What are the macroeconomic e¤ects of replacing the Income Tax with a Negative Income Tax? Speci…cally, is there any welfare gain from this Revenue-Neutral Reform? Particularly, I am considering a NIT that taxes all income at the same marginal rate and 1 makes a lump-sum transfer to all households. Not only does the tax proposed is simple but also all households have a minimum income assured. -

Can My Church Benefit from a CARES Act Forgivable Loan?

I hope this finds you well and living confidently into the times. Congress passed and the President signed the CARES Act this past Friday, March 27, 2020. I write to share specific information from the CARES Act that answers some of the questions that I have heard being asked. Can my church benefit from a CARES Act forgivable loan? This question is on the minds of most pastors and church leaders since the passage of the $2 trillion relief package. As I continue to participate in some and receive information from other webcasts and conference calls across the connection, there are some things you can begin to do to prepare to apply for the loan program. While I do not encourage you to borrow funds for normal operating expenses, it appears that this loan has the potential to become a grant that you would not need to repay. Attorneys and accountants are studying the bill and awaiting guidelines from the Small Business Administration (SBA) and the U.S. Treasury on how the CARES Act will be administered. However, it appears that churches and non-profits may be able to borrow money that could be completely forgiven if they maintain their previous 12-month staffing levels through June of 2020. Key Provisions: • Paycheck Protection Program (“PPP”) - Eligible churches and non-profits will be able to borrow up to 2.5 times their average monthly payroll and benefits up to $100,000. While this appears to cap the amount to approximately $40,000 of monthly current costs, it is not yet known if that is for all employees in the salary-paying entity or per person. -

ECONOMIC INDICATORS Sources and Methods

STATISTICS DIRECTORATE MAIN ECONOMIC INDICATORS Sources and Methods LABOUR AND WAGE STATISTICS APRIL 1997 ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT Table of contents Page 1. Introduction.................................................................................................................................................. 5 2. Explanatory notes......................................................................................................................................... 9 Canada .....................................................................................................................................................10 Mexico......................................................................................................................................................23 United States.............................................................................................................................................31 Japan ........................................................................................................................................................43 Australia...................................................................................................................................................52 New Zealand.............................................................................................................................................63 Austria......................................................................................................................................................75 -

Curacao Highlights 2020

International Tax Curaçao Highlights 2020 Updated January 2020 Recent developments: For the latest tax developments relating to Curaçao, see Deloitte tax@hand. Investment basics: Currency – Netherlands Antilles Guilder (ANG) Foreign exchange control – A 1% license fee will be calculated as a percentage of the gross outflow of money on transfers from residents to nonresidents, and on foreign currency cash transactions. Holding companies may obtain an exemption from the fee. Accounting principles/financial statements – IAS/IFRS applies. Financial statements must be prepared annually. Principal business entities – These are the public and private company (NV and BV), general partnership, (private) foundation, Curaçao trust, limited partnership, and branch of a foreign corporation. Corporate taxation: Rates Corporate income tax rate 22%/3%/0% Branch tax rate 22%/3%/0% Capital gains tax rate 22%/3%/0% Residence – A corporation is resident if it is incorporated under the laws of Curaçao or managed and controlled in Curaçao. Basis – In principle, residents are taxed on worldwide income. Exemptions may apply for profits derived by permanent establishments located abroad. In addition, as from 1 July 2018, foreign-source income is excluded from the profit tax base (although there is an exception for certain services, including insurance and reinsurance activities; trust activities; the services of notaries, lawyers, public accountants and tax consultants; related services; income derived from the exploitation of intellectual property (IP); and shipping activities). Page 1 of 7 Curaçao Highlights 2020 Nonresidents are taxed only on Curaçao-source income. Foreign-source income derived by residents that is not excluded from the profit tax base is subject to corporation tax in the same way as Curaçao-source income. -

Die Leiden Des Steuerlichen Wertes

Die Leiden des steuerlichen Wertes Introduction to German Tax Translation Introduction • Basis for taxation in Germany • Major legislative acts • Overview to major tax types • Recent changes to tax law • Resources Basis of Taxation • Grundgesetz (Basic Law) • Abgabenordung, “AO” (General Tax Code) • Finanzgerichtsordnung (Tax Court Procedural Code) Finanzverwaltungsgesetz (Financial/Fiscal Administration Act) Bewertungsgesetz (Valuation Act) • Establishes uniform rules on tax valuation • Applicable to all federal taxes and levies • Defines several common terms, e.g. – gemeiner Wert – Teilwert – Steuerbilanzwert – Einheitswert Major Tax Types • Direct versus indirect • Purpose – Revenue – Repricing (“social” taxes to affect demand) – Redistribution • Taxing (receiving) authority Major Legislation • Einkommensteuergesetz (Personal Income Tax Act) • Körperschaftsteuergesetz (Corporate Income Tax Act) • Umsatzsteuergesetz (Value Added Tax (VAT) Act • Gewerbesteuergesetz (Municipal Trade Tax Act) • Jahressteuergesetz (Annual Tax Act) • Erbschaftsteuergesetz (Inheritance Tax Act) • Grunderwerbsteuergesetz (Real Property Acquisition Tax Act) • Grundsteuergesetz (Real Property Tax Act) • Umwandlungssteuergesetz (Reorganization Tax Act) Tax Revenues in Germany Steuerart Tax Type 2007 revenues Percentage in € bn. 2007 Steueraufkommen Tax revenue 493.818 100.00% insgesamt in Deutschland Total in Germany Gemeinschaftliche Steuern Joint taxes 381.309 77.22% Payroll withholding Lohnsteuer und andere and other personal Einkommensteuern income taxes Direct -

Wage and Benefit Survey 2

2017 MIDDLE TENNESSEE WAGE & BENEFIT SURVEY Pickett Macon Clay Stewart Montgomery Robertson Sumner Trousdale Jackson Overton Fentress Houston Smith Dickson Putnam Cheatham Davidson Wilson Humphreys DeKalb White Cumberland n Williamson Rutherford Hickman anno Van C Warren Buren Perry Maury Lewis Bedford Coffee Marshall Moore Wayne Lawrence Giles Lincoln Franklin Dr. Murat Arik, Director Jones College of Business Business & Economic Research Center Sponsored by In Partnership with Wage and Benefit Survey 2 Wage and Benefit Survey Project Team This project is the product of the yearlong effort of the following individuals: Project Director Murat Arik, Ph.D., Director of Business and Economic Research Center (BERC) Report Preparation and Data Analysis Allison Logan, BERC Research Associate Survey Logistics and Administration Barbara Pieroni, BERC Associate Regional Networking, Field Work, Database Creation, and Mapping Kendrick Curtis, Ph.D., Assistant Executive Director, Middle Tennessee Industrial Development Association Editor Sally Govan, BERC Senior Editor Acknowledgment I would like to thank the following individuals for their contributions to this project: Nathanael Asrat, BERC undergraduate research associate; Dr. Steven Livingston, BERC associate director; and the staff of MTIDA for their work and support of this project. Business and Economic Research Center| Jennings A. Jones College of Business Wage and Benefit Survey 3 Executive Summary The Business and Economic Research Center (BERC) at Middle Tennessee State University conducted a wage and benefit survey of a 40-county region between June and October 2017. The wage and benefit survey was sponsored by Middle Tennessee Industrial Development Association (MTIDA) and USDA as well as regional partners--the Upper Cumberland Development District, the South Central Tennessee Development District, the Greater Nashville Regional Council, the Nashville Chamber of Commerce, The Highlands Economic Partnership, and Tennessee Central Economic Authority—and local chambers and economic development organizations.