NLEX Corporation and a Subsidiary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vol 14 No 10

www.punto.com.ph FOR COVID VAX P 10.00 Central V 14 P Gapan earmarks N 10 unto! M - S+ J, 4 - 9, 2021 PANANAW NG MALAYANG PILIPINO! Luzon initial P150-M B, A(%*); M. G GAPAN CITY - The city government has allo- cated an initial fund of P150 million for the procurement of vac- cine against the coro- navirus disease, Mayor Emerson Pascual said Thursday. Pascual said the funding for the vaccine was approved by the sangguniang panlung- sod on Wednesday. “Kung kakakapusin pa, magdadagdag pa po kami,” he added. Pascual In a video address, Pascual said the an- kasakit o mamamatay ti-Covid vaccination dahil sa Covid-19,” the program intends to mayor said. benefi t every resi- There was no im- dent of this city. mediate information “Bakit napagkaisah- as to the schedule of an po namin yan? Dahil procurement but Vice The Subic Freeport Expressway capacity expansion. C " ayaw po namin na may Mayor Dodong Bautis- taga-Gapan na magka- P*/& 6 3#&*5& MOTORISTS REJOICE AC allots P25-M 3 NLEX projects Seeks P50-M counterpart from DOH ANGELES CITY – idents of Angeles City With frontline medical especially those mem- near completion workers and those be- bers of vulnerable sec- longing to marginal- tor will receive free vac- ized sectors as priority, cine against the virus,” ITY OF SAN FERNANDO – Three major road projects – all aimed Mayor Carmelo “Pogi” Lazatin said in his let- Lazatin, Jr. has allotted ter to Health Secretary at improving the mobility and safety of motorists – are set to be P25 million for the pro- Francisco Duque. -

PS Rbs CPU Directory for Website February 2021.Xlsx

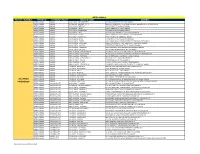

METRO MANILA PAYOUT CHANNELS PROVINCE CITY/MUNICIPALITY BRANCH NAME ADDRESS METRO MANILA MANILA H VILLARICA - BLUMENTRITT 1 1714 BLUMENTRITT ST. STA CRUZ MANILA METRO MANILA MANILA H VILLARICA - BLUMENTRITT 2 1601 COR. BLUEMNTRITT ST & RIZAL AVE BRGY 363,ZONE 037 STA CRUZ MANILA METRO MANILA MANILA H VILLARICA - BUSTILLOS 443 FIGUERAS ST. SAMPALOC MANILA METRO MANILA MANILA H VILLARICA - PACO 1 # 1122 PEDRO GIL ST., PACO MANILA METRO MANILA MANILA H VILLARICA - PADRE RADA 656 PADRE RADA ST TONDO MANILA METRO MANILA MANILA H VILLARICA - PRITIL 1 1835 NICOLAS ZAMORA ST TONDO BGY 86 MANILA METRO MANILA MANILA H VILLARICA - QUINTA 200 VILLALOBOS ST COR C PALANCA ST QUIAPO MANILA METRO MANILA MANILA H VILLARICA - SAMPALOC 1 1706 J. FAJARDO ST. SAMPALOC MANILA METRO MANILA MANILA HL VILLARICA - D JOSE 1574 D.JOSE ST STA. CRUZ NORTH,MANILA METRO MANILA MANILA HL VILLARICA - ESPAÑA 1664 ESPANA BLVD COR MA CRISTINA ST SAMPALOC EAST,MANILA METRO MANILA MANILA HL VILLARICA - LAON LAAN 1285 E. LAON LAAN ST., COR. MACEDA ST., SAMPALOC MANILA METRO MANILA MANILA HL VILLARICA - MACEDA 1758 RETIRO CORNER MACEDA ST. SAMPALOC MANILA METRO MANILA MANILA HL VILLARICA - PANDACAN 1922 J ZAMORA ST BRGY 851 ZONE 93 PANDACAN MANILA METRO MANILA MANILA HL VILLARICA - STA. ANA 1 3421-25 NEW PANADEROS ST. STA.ANA MANILA METRO MANILA MANILA HRV VILLARICA - ERMITA MANILA UYGUANGCO RD., BO. STO. NIÑO BRGY 187 TALA CALOOCAN METRO MANILA MANILA HRV VILLARICA - GAGALANGIN 2710 JUAN LUNA ST GAGALANGIN BRGY 185 ZONE 016 TONDO MANILA METRO MANILA MANILA HRV VILLARICA - HERMOSA 1157 B. HERMOSA ST. MANUGUIT TONDO MANILA METRO MANILA MANILA HRV VILLARICA - ILAYA MANILA #33 ARANETA ST. -

(CSHP) DOLE-Regional Office No. 3 April 2019

REGIONAL REPORT ON THE APPROVED/CONCURRED CONSTRUCTION SAFETY & HEALTH PROGRAM (CSHP) DOLE-Regional Office No. 3 April 2019 Date No. Company Name and Address Project Name Approved Sampaguita St., Doña KARPA BUILDERS AND 1 Francisca, Balanga City, Construction of Streetlights Barangay Bantan Munti, Pilar, Bataan 3/26/2019 TRADING Bataan BPQ CONSTRUCTION AND Doña Francisca, Balanga 2 Rehabilitation of Seawall Barangay Tortugas, Balanga City, Bataan 3/26/2019 TRADING City, Bataan Repair / Rehabilitation of Fourteen (14) Classroom School Building POLYMER-VIC Doña Francisca, Balanga 3 at A.G. Llamas Elementary School, Barangay Poblacion, Mariveles, 3/26/2019 CONSTRUCTION City, Bataan Bataan POLYMER-VIC Doña Francisca, Balanga Construction of Slope Protection Talimundoc-Doña Road Barangay 4 3/26/2019 CONSTRUCTION City, Bataan Talimundoc, Orani, Bataan PACKAGE 2 a.) Design & Build for the Construction of Two (2) Storey Four (4) Classroom School Bldg Sto. Niño Elem. School, Dinalupihan, Bataan; b.) Design & Building for the Construction of Two (2) Units Two (2) Storey Four (4) Classroom School Bldg San POLYMER-VIC Doña Francisca, Balanga 5 Ramon Elem. School, Dinalupihan, Bataan; c.) Design & Build for 3/26/2019 CONSTRUCTION City, Bataan the Construction of Two (2) Storey Four (4) Classroom School Building Colo Elem. School, Dinalupihan, Bataan; d.) Design & Build for the Construction of Two (2) Storey Four (4) Classroom School Bldg Pinulot Elem. School, Dinalupihan, Bataan Sunflower St., Doña E.R. VENZON Rehabilitation of Drainage System at Barangay Camacho, City of 6 Francisca, Balanga City, 3/26/2019 CONSTRUCTION Balanga, Bataan Bataan Construction of Concrete Revetment at Barangay Munting 7 RCS CONSTRUCTION #461 Yakal St., Panilao, Pilar 3/26/2019 Batangas, City of Balanga, Bataan Construction of Multi-Purpose Building at Barangay Pto. -

NLEX Corporation and a Subsidiary

NLEX Corporation (A Subsidiary of Metro Pacific Tollways North Corporation) and A Subsidiary Consolidated Financial Statements December 31, 2018 and 2017 and Years Ended December 31, 2018, 2017 and 2016 and Independent Auditor’s Report SyCip Gorres Velayo & Co. Tel: (632) 891 0307 BOA/PRC Reg. No. 0001, 6760 Ayala Avenue Fax: (632) 819 0872 October 4, 2018, valid until August 24, 2021 1226 Makati City ey.com/ph SEC Accreditation No. 0012-FR-5 (Group A), Philippines November 6, 2018, valid until November 5, 2021 INDEPENDENT AUDITOR’S REPORT The Stockholders and the Board of Directors NLEX Corporation Opinion We have audited the consolidated financial statements of NLEX Corporation (a subsidiary of Metro Pacific Tollways North Corporation) and its subsidiary (the Company), which comprise the consolidated statements of financial position as at December 31, 2018 and 2017, and the consolidated statements of income, consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows for each of the three years in the period ended December 31, 2018, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as at December 31, 2018 and 2017, and its consolidated financial performance and its consolidated cash flows for each of the three years in the period ended December 31, 2018 in accordance with Philippine Financial Reporting Standards (PFRSs). Basis for Opinion We conducted our audits in accordance with Philippine Standards on Auditing (PSAs). -

Appendix C Historical Records of Flood Damage

Appendix C Historical Records of Flood Damage Appendix C Historical Records of Flood Damage Flood damage data are available in each province for major flood events. These consist of information sent to OCD-NDRRMC in Camp Aguinaldo, Quezon City. In order to grasp the flood occurrence in the target river basins as well as flood damage due to tropical typhoons, historical records between 1990 and 2012 were collected from OCD-NDRRMC and summarized as follows: Statistical Data on Typhoon Oriented Flooding in 1990 - 2012 Casualties Houses Damaged Estimated Damage No. of Affected Occurrence Dead Injured Missing Population Totally Partially (PHP million) 221 18,035 20,914 6,093 109,243,360 1,860,992 5,529,468 294,783 Source: OCD-NDRRMC The nationwide consolidated information in the table above shows that a total of 221 flood occurrences due mainly to typhoons and flood damage of PHP 295 billion (average of PHP 12.8 billion/year) were recorded in the logbook of OCD. A summary (annual records) is tabulated in Page C-2 and further detailed damage records with associated typhoon events and corresponding regions are tabulated in Page C-3 to C-10. Based on the records of the regions in the table, the affected target river basins (among 19) were identified for respective flood events as enumerated in Pages C-11 to C-19. C-1 Summary of Damage by Destructive Typhoons Year 1990 – 2012 Causalities Population Affected Houses Damaged Estimated Damage (PHP mil.) Ye ar Dead Injured Missing Families Persons Totally Partially Agriculture Infrastructure Private -

Toll Teller: Tatak Nlex-Sctex

MGA BAGONG CODA LINES: DANNY BGY. MGA PROYEKTO SA BRIDGING THE SANTOS: SUCLABAN, OBRA SA SCTEX DISTANCE SUPER ANGAT SA KUSINA NG TSUPER KALINISAN PAMPANGA PAHINA 3 PAHINA 5 PAHINA 7 PAHINA 11 PAHINA 12 2 NLEX-SCTEX BALITANG TOLL TELLER: TATAK NLEX-SCTEX agdating sa usapang World masigurado na tama ang iyong Ayra PClass Expressway, una sa toll na babayaran. CAÑETE listahan dito sa Pilipinas ang • State the amount of toll - NLEX at SCTEX. Bukod sa kahit na may toll fare indicator napakaganda at smooth na na makikita sa bandang unahan kalsada nito, ang Excellent ng lane ay kinakailangan pa ring VOLUME 15 ISSUE 4 2019 Customer Service na ibinibigay sabihin ng teller ang eksaktong sa mga motorista sa ilalim ng toll fee na babayaran ng pamunuan ng NLEX Corporation motorista para sa mas malinaw ay isa sa mga dahilan kaya na transaksiyon. Ang pagsingil nananatili itong nangunguna ng tamang toll fee ay striktong at tinutularan. ipinatutupad. Bilang mga frontliner, ang • Acknowledge amount LIGTAS NA BIYAHE SA CANDABA VIADUCT toll tellers ng NLEX-SCTEX received or Count the change ay mayroong tinatawag na - kailangang bilanging maigi ng KEY STEPS. Ito ay gabay sa teller ang perang ibinigay at ang pagbibigay at paghahatid ng perang isusukli. Ito ay para sa Excellent Customer Service sa mas maayos na transaksiyon sa mga motorista. motorista. • Classify vehicle - lahat ng sasakyan na dumaraan sa toll lane Paalala sa ating mga motorista: ay sinusuring mabuti ng ating mga mas mainam na bilangin din natin toll teller upang siguraduhin na muna ang ating sukli bago umalis Pagsasaayos Ng Viaduct, Sisimulan Na! tama at naaayon ang classification ng sasakyan. -

Metro Pacific Tollways Corporation and Subsidiaries

Metro Pacific Tollways Corporation (A Subsidiary of Metro Pacific Investments Corporation) and Subsidiaries Consolidated Financial Statements December 31, 2019 and 2018 and Independent Auditor’s Report SyCip Gorres Velayo & Co. Tel: (632) 891 0307 BOA/PRC Reg. No. 0001, 6760 Ayala Avenue Fax: (632) 819 0872 October 4, 2018, valid until August 24, 2021 1226 Makati City ey.com/ph SEC Accreditation No. 0012-FR-5 (Group A), Philippines November 6, 2018, valid until November 5, 2021 INDEPENDENT AUDITOR’S REPORT The Board of Directors and Stockholders Metro Pacific Tollways Corporation Opinion We have audited the consolidated financial statements of Metro Pacific Tollways Corporation (a subsidiary of Metro Pacific Investments Corporation) and its subsidiaries (the Company), which comprise the consolidated balance sheets as at December 31, 2019 and 2018, and the consolidated statements of income, consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows for the years then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as at December 31, 2019 and 2018, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with Philippine Financial Reporting Standards (PFRSs). Basis for Opinion We conducted our audits in accordance with Philippine Standards on Auditing (PSAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. -

08 NOVEMBER 2020, SUNDAY ✓ Headline STRATEGIC November 08, 2020 COMMUNICATION & Editorial Date INITIATIVES Column SERVICE 1 of 2 Opinion Page Feature Article

08 NOVEMBER 2020, SUNDAY ✓ Headline STRATEGIC November 08, 2020 COMMUNICATION & Editorial Date INITIATIVES Column SERVICE 1 of 2 Opinion Page Feature Article Pasay mayor nagpasalamat sa DENR sa water quality monitoring treatment November 7, 2020 @ 12:20 PM 18 hours ago Manila, Philippines – Pinasalamatan kahapon ni Pasay City Mayor Emi Calixto- Rubiano ang kagawaran ng Department of Environment and Natural Resources (DENR) sa paglalagay ng naturang ahensya ng pitong solar-powered water monitoring buoys sa baybayin na nasasakupan ng naturang lungsod. Partikular na pinasalamatan ni Calixto-Rubiano si DENR Secretary Roy Cimatu at ang SM Prime Holding Company sa pagkakapili sa lungsod na mapanatiling malinis ang baybayin sa nasasakupang teritoryo at hurisdiksyon ng Pasay. Sinabi ni Calixto-Rubiano na ang layunin sa paglalagay ng water monitoring buoy upang makapagbigay ng real-time, tumpak at mapagkakatiwalaang kalidad ng pagsusukat sa nasasakop na baybayin ng lungsod. Source: https://cebudailynews.inquirer.net/349547/capitol-to-furnish-cimatu-full-report-on- ✓ Headline STRATEGIC November 08, 2020 COMMUNICATION & Editorial Date INITIATIVES Column SERVICE 2 of 2 Opinion Page Feature Article Sa panig naman ni Cimatu, sinabi ng kalihim na malaki ang maitutulong ng mga monitoring buoys sa 13 ahensya ng gobyerno sa kanilang paglilinis, pagre-rehabilitate at pagpre-preserba ng Manila Bay base na rin sa mandamus na inisyu ng Korte Suprema noong 2016. Ipinakita din ng DENR kay Calixto-Rubiano kung papaano makatutulong ang mga inilagay na water buoys sa pagmo-monitor ng temperatura ng tubig dagat, lebel ng oxygen nito, labo at lalim ng tubig gayundin ang pamamalagi ng kemikal sa tubig dagat na bahagi ng rehabilitasyon ng Manila Bay. -

Nlex Harbor Link Project New Caloocan Interchange, C3 to Mel Lopez Boulevard (Formerly R-10) Bukas Na!

MGA PROYEKTO REYMAN SINA MARVIC AT TRUCKING: BAYANING SA NLEX-SCTEX, ANG TUNAY NA MARVIN: MGA CHEMIST TULOY ANG TAGUMPAY AY BAYANI SA HARAP TEACHER ROHIT ARANGKADA! NASA PATULOY NA PAGPUPUNYAGI NG MANIBELA TILWANI PAHINA 3 PAHINA 5 PAHINA 7 PAHINA 11 VOLUME 16 ISSUE 4 2020 20 MINUTONG BIYAHE MULA QUEZON CITY HANGGANG R10 NLEX HARBOR LINK PROJECT NEW CALOOCAN INTERCHANGE, C3 TO MEL LOPEZ BOULEVARD (FORMERLY R-10) BUKAS NA! as mabilis at mas ligtas nang makakabiyahe patungo sa Port Area sa Maynila sa pagbubukas ng 2.6-kilometrong MNLEX Harbor Link C3-R10 Section. Pinangunahan nina Department of Public Works and Highways (DPWH) Secretary Mark A. Villar at NLEX Corporation President and General Manager J. Luigi L. Bautista ang opening event ng nasabing bagong daanan. kabuuang istorya sa pahina 2 STOPOVER 2 (MULA SA PAHINA 1) 20 MINUTONG BIYAHE MULA QUEZON CITY HANGGANG R10 NLEX HARBOR LINK PROJECT NEW CALOOCAN INTERCHANGE, C3 TO MEL LOPEZ BOULEVARD (FORMERLY R-10) BUKAS NA! WORDTUMINGIN NANG DIRETSO. HUNT ni Micah Aquino I-CHECK ANG KALIWA’T KANAN. Liezel LINAWAN ANG MGA MATA. UY S A N T O N I Ñ O D E M A L O L O S V B A Y K A T F I E S T A N G K U L I A T N M A L A T A R L A K E P P R C Q S A U F E S T I V A L O F L I G H T S H I U N L U G L U G A N P A N C I T M A L A B O N A N L D I N A G Y A N G B Z J S B Q S B L T C Q P L D I F E S T I V A L B B Q Y I U A C A O I A H L A A L P A H I Y A S A O G Y S B N O T G N A R N A L-R (MPTC Chief Communication Officer Romulo Quimbo Jr., NLEX Corporation President and Gen. -

Bad Weather Forces Vietnamese Fishermen to Seek Safety of Subic

Subic bay news vol 12 no 41 20.00Php Tapas Bar and Restaurant 2nd Floor Subic Gas Bldg 724, Dewey Avenue, Subic Bay Freeport Zone Phisgoc Bad Weather Forces Vietnamese workforce Fishermen To Seek Safety Of Subic FIVE (5) Vietnamese fishing vessels car- rying over a hundred fishermen entered Subic Bay this afternoon to seek shelter ready for from bad weather in the West Philip- pines Sea. Subic Bay Metropolitan Author- ity (SBMA) Law Enforcement Dept. and SEA Games Philippine Coast Guard personnel guid- ed the vessels to a designated sheltering The Philippine Southeast Asian Games anchorage area in the bay. Organizing Committee (Phisgoc) held a Earlier, the Vietnamese Embassy pep rally on Saturday to motivate the in Manila sent a message to the Dept. of workforce of the coming 30th Southeast Foreign Affairs, Philippine Coast Guard Asian Games for a successful hosting of and Philippine Navy requesting that as- the 11-nation sportsfest. sistance be extended to Vietnamese House Speaker and Phisgoc fishermen who might seek refuge in- Chairman Alan Peter Cayetano encour- side Philippine Territory due to the Low aged the 527 members of the workforce Pressure Area (LPA) that developed into who will be deployed in various venues a Tropical Depression in the West Philip- in Metro Manila, Southern Luzon, Subic pines Sea. and New Clark City in Capas, Tarlac to “The Embassy would like to ask work hard and come up with their best the competent authorities to allow the effort for the staging of the Games. Vietnamese fishing vessels and ships car- ``Kung ano ang ating itatanim, rying the Vietnam’s flag to be anchored yun ang ating aanihin. -

First Philippine Infrastructure

Metro Pacific Tollways Corporation (A Subsidiary of Metro Pacific Investments Corporation) and Subsidiaries Consolidated Financial Statements December 31, 2017 and 2016 and Independent Auditor’s Report SyCip Gorres Velayo & Co. Tel: (632) 891 0307 BOA/PRC Reg. No. 0001, 6760 Ayala Avenue Fax: (632) 819 0872 December 14, 2015, valid until December 31, 2018 1226 Makati City ey.com/ph SEC Accreditation No. 0012-FR-4 (Group A), Philippines November 10, 2015, valid until November 9, 2018 INDEPENDENT AUDITOR’S REPORT The Board of Directors and Stockholders Metro Pacific Tollways Corporation Opinion We have audited the consolidated financial statements of Metro Pacific Tollways Corporation (a subsidiary of Metro Pacific Investments Corporation) and its subsidiaries (the Company), which comprise the consolidated balance sheets as at December 31, 2017 and 2016, and the consolidated statements of income, consolidated statements of comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows for the years then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as at December 31, 2017 and 2016, and its consolidated financial performance and its consolidated cash flows for the years then ended in accordance with Philippine Financial Reporting Standards (PFRSs). Basis for Opinion We conducted our audits in accordance with Philippine Standards on Auditing (PSAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. -

Central Number 26 Mon - Sat May 03-08, 2021Punto! PANANAW NG MALAYANG PILIPINO! Luzon DONORS URGED Be Proactive Sustain Pantries, Vs

www.punto.com.ph P 10.00 Volume 14 Central Number 26 Mon - Sat May 03-08, 2021Punto! PANANAW NG MALAYANG PILIPINO! Luzon DONORS URGED Be proactive Sustain pantries, vs. Covid CITY OF SAN FER- Sometimes, an elderly NANDO – Gov. Den- is brought to the hospital nis “Delta” Pineda went when his or her oxygen livestream on social level is already below media Monday to en- 80. In cases like this, support farmers join his constituents to no matter how good our By Bong Z. Lacson be proactive in battling doctors are, they will Covid-19 as cases con- have a hard time treat- tinue to increase, along ing patients,” he said. ITY OF SAN FERNANDO – Twice the charity, double the with a rise in mortalities. With this, the gov- impact. Pineda cited one ernor urged the pub- cause of the upward lic to be more attentive trend is that the pub- of their conditions, and CThis, in effect, has the community pantries in people struggling to make stressed the need to also lic, especially the elder- of the elderly in their come out of the initiative Pampanga. a living for themselves help local farmers cope ly, do not immediately households. of former Lubao mayor “There is a need to because of job losses with the adverse impact go to the hospital even “Admittedly, we are now 2nd District board sustain the community due to the pandemic,” of the pandemic to their if they already manifest late in paying attention member Mylyn Pineda- pantries especially in areas Cayabyab said. livelihood.