Disney, Marvel and the Value of “Hidden Assets”

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aliens of Marvel Universe

Index DEM's Foreword: 2 GUNA 42 RIGELLIANS 26 AJM’s Foreword: 2 HERMS 42 R'MALK'I 26 TO THE STARS: 4 HIBERS 16 ROCLITES 26 Building a Starship: 5 HORUSIANS 17 R'ZAHNIANS 27 The Milky Way Galaxy: 8 HUJAH 17 SAGITTARIANS 27 The Races of the Milky Way: 9 INTERDITES 17 SARKS 27 The Andromeda Galaxy: 35 JUDANS 17 Saurids 47 Races of the Skrull Empire: 36 KALLUSIANS 39 sidri 47 Races Opposing the Skrulls: 39 KAMADO 18 SIRIANS 27 Neutral/Noncombatant Races: 41 KAWA 42 SIRIS 28 Races from Other Galaxies 45 KLKLX 18 SIRUSITES 28 Reference points on the net 50 KODABAKS 18 SKRULLS 36 AAKON 9 Korbinites 45 SLIGS 28 A'ASKAVARII 9 KOSMOSIANS 18 S'MGGANI 28 ACHERNONIANS 9 KRONANS 19 SNEEPERS 29 A-CHILTARIANS 9 KRYLORIANS 43 SOLONS 29 ALPHA CENTAURIANS 10 KT'KN 19 SSSTH 29 ARCTURANS 10 KYMELLIANS 19 stenth 29 ASTRANS 10 LANDLAKS 20 STONIANS 30 AUTOCRONS 11 LAXIDAZIANS 20 TAURIANS 30 axi-tun 45 LEM 20 technarchy 30 BA-BANI 11 LEVIANS 20 TEKTONS 38 BADOON 11 LUMINA 21 THUVRIANS 31 BETANS 11 MAKLUANS 21 TRIBBITES 31 CENTAURIANS 12 MANDOS 43 tribunals 48 CENTURII 12 MEGANS 21 TSILN 31 CIEGRIMITES 41 MEKKANS 21 tsyrani 48 CHR’YLITES 45 mephitisoids 46 UL'LULA'NS 32 CLAVIANS 12 m'ndavians 22 VEGANS 32 CONTRAXIANS 12 MOBIANS 43 vorms 49 COURGA 13 MORANI 36 VRELLNEXIANS 32 DAKKAMITES 13 MYNDAI 22 WILAMEANIS 40 DEONISTS 13 nanda 22 WOBBS 44 DIRE WRAITHS 39 NYMENIANS 44 XANDARIANS 40 DRUFFS 41 OVOIDS 23 XANTAREANS 33 ELAN 13 PEGASUSIANS 23 XANTHA 33 ENTEMEN 14 PHANTOMS 23 Xartans 49 ERGONS 14 PHERAGOTS 44 XERONIANS 33 FLB'DBI 14 plodex 46 XIXIX 33 FOMALHAUTI 14 POPPUPIANS 24 YIRBEK 38 FONABI 15 PROCYONITES 24 YRDS 49 FORTESQUIANS 15 QUEEGA 36 ZENN-LAVIANS 34 FROMA 15 QUISTS 24 Z'NOX 38 GEGKU 39 QUONS 25 ZN'RX (Snarks) 34 GLX 16 rajaks 47 ZUNDAMITES 34 GRAMOSIANS 16 REPTOIDS 25 Races Reference Table 51 GRUNDS 16 Rhunians 25 Blank Alien Race Sheet 54 1 The Universe of Marvel: Spacecraft and Aliens for the Marvel Super Heroes Game By David Edward Martin & Andrew James McFayden With help by TY_STATES , Aunt P and the crowd from www.classicmarvel.com . -

Avengers Vol 1 Chapter 7: Space Pirates Within Seconds, the Entire

Earth-717: Avengers Vol 1 Chapter 7: Space Pirates Within seconds, the entire Senatorium was in chaos. The Dark Revenant opened fire on the Nova cruisers surrounding the space station, completely taking them by surprise. The two Pariahs also fired their main laser cannons, and together managed to effortlessly slice apart a Nova warship. The smaller Skrull vessels moved in on the defensive fleet, and the Skrull starfighters began swarming around any targets within range. Adora immediately gathered the Senate members and had them surrounded by Nova guards. The crowds began screaming and panicking, fleeing in all directions. Adora looked at the heroes as the Supreme Intelligence's hologram faded. “I'm getting the Senate out of here! If you want to help . then help.” Before any of the heroes could respond, the Dark Revenant launched multiple interceptor craft. These were cylindrical shuttles that struck the hull of the Senatorium and started drilling through them. While a handful were shot down by the Senatorium's turrets, a few of them still managed to latch on to the exterior of the station. Once holes were pierced by their drills, Skrull and Mekkan troops began flooding inside. Steve turned back to Adora. “We'll help your people fight them off however we can. Get the Senate to safety!” Adora hurriedly nodded before rushing off after the Senate and their guards. Steve held up his shield. Tasha equipped her repulsors and locked her helmet in place. Carol charged both of her hands with energy and started to hover. Thor held his hammer at the ready. -

Limits, Malice and the Immortal Hulk

https://lthj.qut.edu.au/ LAW, TECHNOLOGY AND HUMANS Volume 2 (2) 2020 https://doi.org/10.5204/lthj.1581 Before the Law: Limits, Malice and The Immortal Hulk Neal Curtis The University of Auckland, New Zealand Abstract This article uses Kafka's short story 'Before the Law' to offer a reading of Al Ewing's The Immortal Hulk. This is in turn used to explore our desire to encounter the Law understood as a form of completeness. The article differentiates between 'the Law' as completeness or limitlessness and 'the law' understood as limitation. The article also examines this desire to experience completeness or limitlessness in the work of George Bataille who argued such an experience was the path to sovereignty. In response it also considers Francois Flahault's critique of Bataille who argued Bataille failed to understand limitlessness is split between a 'good infinite' and a 'bad infinite', and that it is only the latter that can ultimately satisfy us. The article then proposes The Hulk, especially as presented in Al Ewing's The Immortal Hulk, is a study in where our desire for limitlessness can take us. Ultimately it proposes we turn ourselves away from the Law and towards the law that preserves and protects our incompleteness. Keywords: Law; sovereignty; comics; superheroes; The Hulk Introduction From Jean Bodin to Carl Schmitt, the foundation of the law, or what we more readily understand as sovereignty, is marked by a significant division. The law is a limit in the sense of determining what is permitted and what is proscribed, but the authority for this limit is often said to derive from something unlimited. -

Red Hulk - Marvel Universe Wiki: the Definitive Online Source for Marvel Super Hero Bios

Red Hulk - Marvel Universe Wiki: The definitive online source for Marvel super hero bios. 5/20/13 11:00 PM Red Hulk As a young man, Thaddeus Ross enlisted in the military and received his nickname from his troops because he "struck like a thunderbolt" when leading them into action. Now he has become the very thing he hated most in life. He is the Red Hulk. Military Man General Thaddeus E. Ross was born into a family with a proud tradition of military ser- vice. Both his father and his grandfather served heroically in past American wars. As a boy Thaddeus immersed himself in military history, and he learned how to fly by barn- storming at country fairs. When he came of age Ross enlisted in the military, graduating first in his class at West Point. He married Karen Lee, the daughter of his commanding officer at the time. Ross rapidly rose in rank to captain and then major while serving in his first war. Ross made a great reputation as a leader in combat, but after the war, he was stationed at the nu- clear research facility at Los Alamos, New Mexico. There he met nuclear physicist Brian Banner, the father of Robert Bruce Banner. Ross had risen to the rank of colonel by the time he was sent to his next war, during which he became a general in the U.S. Air Force (Ross never rose beyond three-star gen- eral). As he gloried in combat, he was dissatisfied with the "desk jobs" he was given be- fore and after the war. -

Vs System 2PCG Rules

Issues and Arcs Our first two Arcs featured Beast Vs. System® 2PCG® has been Deadpool and the Marvel Note that Acrobatic doubles his reformatted from its small Cinematic Universe. This Arc DEF whether he is attacking and big box expansions into is all about Spider-Man and OR defending. a monthly release. From now his friends and enemies. The on every three months of Vs. previous two Issues featured ® System® 2PCG® content will the Spider-Friends and the 2 BEAST have a specific theme and dastardly Sinister Syndicate. SUPPORTING CHARA CTER be called an "Arc." There will This Issue introduces more be one new set almost every cards for an NYC team we’ve ® month. Most of these will be featured before – The Defenders ( ). 55-card “Issues” (like this one), Climb At the start of your Main Phase, you may exhaust a location. If you do, put a +1/+1 counter on Beast. and sometimes there will be a Acrobatic While in combat, Beast gets 200-card “Giant-Sized Issue,” 2 | 2 struck with double his DEF. DFX-010 ©2018 UDC. which is great for new players. 1 THE NEW DEFENDERS Namor Atlantis Rises adds a new row to Devil-Slayer When Devil-Slayer and the All three of Namor’s Rage powers your side, between your back row His Shadow Cloak lets him defender strike each other: DO count face-down exhausted and your resource row, for the attack hidden and stunned • Devil-Slayer can be stunned enemy characters as well. rest of the game. A player can’t characters. -

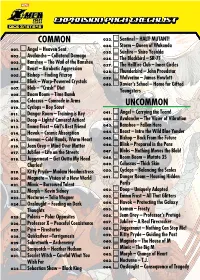

Checklist Card

COMMON 033. Sentinel – HALT! MUTANT! 034. Storm – Queen of Wakanda 001. Angel – Heaven Sent 035. Sunfi re – Shiro Yoshida 002. Avalanche – Collateral Damage 036. The Blackbird – SR-71 003. Banshee – The Wail of the Banshee 037. The Hellfi re Club – Inner Circles 004. Beast – Acrobatic Aggression 038. Thunderbird – John Proudstar 005. Bishop – Finding Fitzroy 039. Wolverine – James Howlett 006. Blink – Warp-Powered Crystals 040. Xavier’s School – Home for Gifted 007. Blob – “Crash” Diet Youngsters 008. Boom Boom – Time Bomb 009. Colossus – Comrade in Arms UNCOMMON 010. Cyclops – Boy Scout 011. Danger Room – Training is Key 041. Angel – Carrying the Team! 012. Doop – Lights! Camera! Action! 042. Avalanche – The Vizier of Vibration 013. Emma Frost – Girl’s Best Friend 043. Banshee – Fallen Hero 014. Havok – Cosmic Absorption 044. Beast – Intro the Wild Blue Yonder 015. Iceman – Cold Hands, Warm Heart 045. Bishop – Back From the Future 016. Jean Grey – Mind Over Matter 046. Blink – Prepared in the Pens 017. Jubilee – Life on the Streets 047. Blobs – Nothing Moves the Blob! 018. Juggernaut – Get Outta My Head 048. Boom Boom – Mutate 35 Charles! 049. Colossus – Thick Skin 019. Kitty Pryde– Madam Headmistress 050. Cyclops – Balancing the Scales 020. Magneto – Vision of a New World 051. Danger Room – Housing Hidden 021. Mimic – Borrowed Talent Perils 022. Morph – Kevin Sidney 052. Doop – Uniquely Adapted 023. Nocturne – Talia Wagner 053. Emma Frost – All That Glitters 024. Onslaught – Feeding on Dark 054. Havok – Protecting the Galaxy Thoughts 055. Iceman – Frosty 025. Polaris – Polar Opposites 056. Jean Grey – Professor’s Protégé 026. Professor X – Peaceful Coexistence 057. -

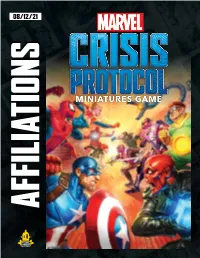

Affiliation List

AFFILIATIONS 08/12/21 AFFILIATION LIST Below you will find a list of all current affiliations cards and characters on them. As more characters are added to the game this list will be updated. A-FORCE • She-Hulk (k) • Blade • Angela • Cable • Black Cat • Captain Marvel • Black Widow • Deadpool • Black Widow, Agent of S.H.I.E.L.D. • Hawkeye • Captain Marvel • Hulk • Crystal • Iron Fist • Domino • Iron Man • Gamora • Luke Cage • Medusa • Quicksilver • Okoye • Scarlet Witch • Scarlet Witch • She-Hulk • Shuri • Thor, Prince of Asgard • Storm • Vision • Valkyrie • War Machine • Wasp • Wasp ASGARD • Wolverine BLACK ORDER • Thor, Prince of Asgard (k) • Angela • Thanos, The Mad Titan (k) • Enchantress • Black Dwarf • Hela, Queen of Hel • Corvus Glaive • Loki, God of Mischief • Ebony Maw • Valkyrie • Proxima Midnight AVENGERS BROTHERHOOD OF MUTANTS • Captain America (Steve Rogers) (k) • Magneto (k) • Captain America (Sam Wilson) (k) • Mystique (k) • Ant-Man • Juggernaut • Beast • Quicksilver • Black Panther • Sabretooth • Black Widow • Scarlet Witch • Black Widow, Agent of S.H.I.E.L.D. • Toad Atomic Mass Games and logo are TM of Atomic Mass Games. Atomic Mass Games, 1995 County Road B2 W, Roseville, MN, 55113, USA, 1-651-639-1905. © 2021 MARVEL Actual components may vary from those shown. CABAL DARK DIMENSION • Red Skull (k) • Dormammu (k) • Sin (k) DEFENDERS • Baron Zemo • Doctor Strange (k) • Bob, Agent of Hydra • Amazing Spider-Man • Bullseye • Blade • Cassandra Nova • Daredevil • Crossbones • Ghost Rider • Enchantress • Hawkeye • Killmonger • Hulk • Kingpin • Iron Fist • Loki, God of Mischief • Luke Cage • Magneto • Moon Knight • Mister Sinister • Scarlet Witch • M.O.D.O.K. • Spider-Man (Peter Parker) • Mysterio • Valkyrie • Mystique • Wolverine • Omega Red • Wong • Sabretooth GUARDIANS OF THE GALAXY • Ultron k • Viper • Star-Lord ( ) CRIMINAL SYNDICATE • Angela • Drax the Destroyer • Kingpin (k) • Gamora • Black Cat • Groot • Bullseye • Nebula • Crossbones • Rocket Raccoon • Green Goblin • Ronan the Accuser • Killmonger INHUMANS • Kraven the Hunter • M.O.D.O.K. -

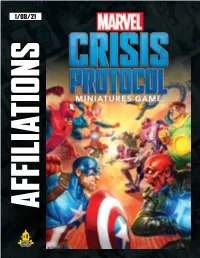

AFFILIATION LIST • Black Panther • Black Widow Below You Will Find a List of All Current Affiliations Cards and Characters on Them

AFFILIATIONS 1/08/21 AFFILIATION LIST • Black Panther • Black Widow Below you will find a list of all current affiliations cards and characters on them. As more characters are added to the game • Black Widow, Agent of S.H.I.E.L.D. this list will be updated. A-FORCE • Captain Marvel • Hawkeye • She-Hulk (k) • Hulk • Angela • Iron Man • Black Widow • She-Hulk • Black Widow, Agent of Shield • Thor, Prince of Asgard • Captain Marvel • Vision • Crystal • Wasp • Domino • Wolverine • Gamora BLACK ORDER • Medusa • Thanos, The Mad Titan (k) • Okoye • Black Dwarf • Scarlet Witch • Corvus Glaive • Shuri • Ebony Maw • Storm • Proxima Midnight • Valkyrie BROTHERHOOD OF MUTANTS • Wasp k ASGARD • Magneto ( ) • Mystique (k) • Thor, Prince of Asgard (k) • Juggernaut • Angela • Quicksilver • Enchantress • Sabretooth • Hela, Queen of Hel • Scarlet Witch • Loki, God of Mischief • Toad • Valkyrie AVENGERS • Captain America (k) • Ant-Man • Beast Atomic Mass Games and logo are TM of Atomic Mass Games. Atomic Mass Games, 1995 County Road B2 W, Roseville, MN, 55113, USA, 1-651-639-1905. © 2021 MARVEL Actual components may vary from those shown. CABAL DEFENDERS • Red Skull (k) • Doctor Strange (k) • Baron Zemo • Daredevil • Bullseye • Ghost Rider • Crossbones • Hawkeye • Enchantress • Hulk • Killmonger • Iron Fist • Kingpin • Luke Cage • Loki, God of Mischief • Spider-Man (Peter Parker) • Magneto • Valkyrie • M.O.D.O.K. • Wolverine • Mystique • Wong • Sabretooth WAKANDA • Ultron • Black Panther (k) CRIMINAL SYNDICATE • Killmonger • Kingpin (k) • Okoye • Black Cat • Shuri • Bullseye • Storm • Crossbones GUARDIANS OF THE GALAXY • Green Goblin • Star-Lord (k) • Killmonger • Angela • M.O.D.O.K. • Drax the Destroyer • Mysterio • Gamora • Taskmaster • Groot • Nebula • Rocket Raccoon • Ronan the Accuser Atomic Mass Games and logo are TM of Atomic Mass Games. -

Thesis Are Retained by the Author And/Or Other Copyright Owners

Canterbury Christ Church University’s repository of research outputs http://create.canterbury.ac.uk Copyright © and Moral Rights for this thesis are retained by the author and/or other copyright owners. A copy can be downloaded for personal non-commercial research or study, without prior permission or charge. This thesis cannot be reproduced or quoted extensively from without first obtaining permission in writing from the copyright holder/s. The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the copyright holders. When referring to this work, full bibliographic details including the author, title, awarding institution and date of the thesis must be given e.g. Walsh, M. (2018) Comic books & myths: the evolution of the mythological narratives in comic books for a contemporary myth. M.A. thesis, Canterbury Christ Church University. Contact: [email protected] Comic Books & Myths: The Evolution of the Mythological Narratives in Comic Books for a Contemporary Myth by Michael Joseph Walsh Canterbury Christ Church University Thesis submitted for the Degree of MA by Research 2018 CONTENTS Abstract .................................................................................................................................................. iii Acknowledgements ................................................................................................................................ iv The Image of Myth: .............................................................................................................................. -

Spider-Man: Into the Spider-Verse

SPIDER-MAN: INTO THE SPIDER-VERSE Screenplay by Phil Lord and Rodney Rothman Story by Phil Lord Dec. 3, 2018 SEQ. 0100 - THE ALTERNATE SPIDER-MAN “TAS” WE BEGIN ON A COMIC. The cover asks WHO IS SPIDER-MAN? SPIDER-MAN (V.O.) Alright, let’s do this one last time. My name is Peter Parker. QUICK CUTS of a BLOND PETER PARKER Pulling down his mask...a name tag that reads “Peter Parker”...various shots of Spider-Man IN ACTION. SPIDER-MAN (V.O.) I was bitten by a radioactive spider and for ten years I’ve been the one and only Spider-Man. I’m pretty sure you know the rest. UNCLE BEN tells Peter: UNCLE BEN (V.O.) With great power comes great responsibility. Uncle Ben walks into the beyond. SPIDER-MAN (V.O.) I saved a bunch of people, fell in love, saved the city, and then I saved the city again and again and again... Spiderman saves the city, kisses MJ, saves the city some more. The shots evoke ICONIC SPIDER-MAN IMAGES, but each one is subtly different, somehow altered. SPIDER-MAN (V.O.) And uh... I did this. Cut to Spider-Man dancing on the street, exactly like in the movie Spider-Man 3. SPIDER-MAN (V.O.) We don’t really talk about this. A THREE PANEL SPLIT SCREEN: shots of Spider-Man’s “products”: SPIDER-MAN (V.O.) Look, I’m a comic book, I’m a cereal, did a Christmas album. I have an excellent theme song. (MORE) 2. SPIDER-MAN (V.O.) (CONT'D) And a so-so popsicle. -

Children of the Atom Is the First Guidebook Star-Faring Aliens—Visited Earth Over a Million Alike")

CONTENTS Section 1: Background............................... 1 Gladiators............................................... 45 Section 2: Mutant Teams ........................... 4 Alliance of Evil ....................................... 47 X-Men...................................... 4 Mutant Force ......................................... 49 X-Factor .................................. 13 Section 3: Miscellaneous Mutants ........................ 51 New Mutants .......................... 17 Section 4: Very Important People (VIP) ................. 62 Hellfire Club ............................. 21 Villains .................................................. 62 Hellions ................................. 27 Supporting Characters ............................ 69 Brotherhood of Evil Mutants ... 30 Aliens..................................................... 72 Freedom Force ........................ 32 Section 5: The Mutant Menace ................................79 Fallen Angels ........................... 36 Section 6: Locations and Items................................83 Morlocks.................................. 39 Section 7: Dreamchild ...........................................88 Soviet Super-Soldiers ............ 43 Maps ......................................................96 Credits: Dinosaur, Diamond Lil, Electronic Mass Tarbaby, Tarot, Taskmaster, Tattletale, Designed by Colossal Kim Eastland Converter, Empath, Equilibrius, Erg, Willie Tessa, Thunderbird, Time Bomb. Edited by Scintilatin' Steve Winter Evans, Jr., Amahl Farouk, Fenris, Firestar, -

Racial Constructions and Activism Within Graphic Literature. an Analysis of Hank Mccoy, the Beast Juan D

Florida International University FIU Digital Commons FIU Electronic Theses and Dissertations University Graduate School 6-13-2018 Racial Constructions and Activism Within Graphic Literature. An Analysis of Hank McCoy, The Beast Juan D. Alfonso [email protected] DOI: 10.25148/etd.FIDC006861 Follow this and additional works at: https://digitalcommons.fiu.edu/etd Part of the American Literature Commons, American Material Culture Commons, American Popular Culture Commons, Literature in English, North America Commons, Other American Studies Commons, and the Social History Commons Recommended Citation Alfonso, Juan D., "Racial Constructions and Activism Within Graphic Literature. An Analysis of Hank McCoy, The Beast" (2018). FIU Electronic Theses and Dissertations. 3774. https://digitalcommons.fiu.edu/etd/3774 This work is brought to you for free and open access by the University Graduate School at FIU Digital Commons. It has been accepted for inclusion in FIU Electronic Theses and Dissertations by an authorized administrator of FIU Digital Commons. For more information, please contact [email protected]. FLORIDA INTERNATIONAL UNIVERSITY Miami, Florida RACIAL CONSTRUCTIONS AND ACTIVISM WITHIN GRAPHIC LITERATURE: AN ANALYSIS OF HANK MCCOY, THE BEAST A thesis submitted in partial fulfillment of the requirements for the degree of MASTER OF ARTS in ENGLISH by Juan D. Alfonso 2018 To: Dean Michael R. Heithaus College of Arts, Sciences and Education This thesis, written by Juan D. Alfonso, and entitled Racial Constructions and Activism Within Graphic Literature: An Analysis of Hank McCoy, The Beast, having been approved in respect to style and intellectual content, is referred to you for judgment. We have read this thesis and recommend that it be approved.