BSE Reference List Consulting and Qualification Rolling Mill

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

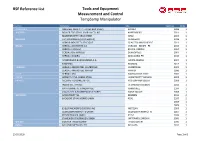

BSE Reference List Tools and Equipment Measurement and Control Tempsamp Manipulator

BSE Reference List Tools and Equipment Measurement and Control TempSamp Manipulator Country Company City Start-up Units AUSTRALIA ONESTEEL NSW PTY. LTD (EX BHP STEEL) SYDNEY 1998 1 AUSTRIA BÖHLER EDELSTAHL GMBH & CO. KG KAPFENBERG 2011 1 MARIENHUETTE GRAZ GMBH GRAZ 2003 1 BELGIUM THY MARCINELLE (RIVA GROUP) CHARLEROI 1998 1 USINOR INDUSTEEL BELGIQUE CHALEROI MARCHIENNE 2011 1 BRAZIL GERDAU ACONORTE S.A. CURADO - RECIFE - PE 2010 1 GERDAU COSIGUA RIO DE JANEIRO 2004 1 GERDAU DIVINOPOLIS DIVINOPOLIS 2003 1 GERDAU GUAIRA ARAUCARIA-PR 2010 1 SIDERURGICA BARRA MANSA S.A. BARRA MANSA 2007 1 SINOBRAS MARABA 2012 1 CANADA GERDAU AMERISTEEL CAMBRIDGE CAMBRIDGE 2001 1 GERDAU AMERISTEEL WHITBY WHITBY 1996 1 CHILE GERDAU AZA SANTIAGO DE CHILE 2005 1 CHINA JIANGYIN XING CHENG STEEL JIANGYIN CITY JIANGSU 2004 1 FRANCE ASCOMETAL USINE DE FOS FOS-SUR-MER CEDEX 2008 1 INDUSTEEL FRANCE LE CREUSOT (CEDEX) 2016 1 ISPAT UNIMETAL GANDRANGE AMNÉVILLE 1994 2 VALLOUREC & MANNESMANN TUBES SAINT SAULVE 2008 1 GERMANY ARCELORMITTAL BREMEN 2016 2 BADISCHE STAHLWERKE GMBH KEHL 1997 2 2008 1 2009 1 EDELSTAHLWERKE BUDERUS AG WETZLAR 2004 1 GEORGSMARIENHÜTTE GMBH GEORGSMARIENHÜTTE 2007 1 PEINER TRÄGER GMBH PEINE 1999 2 STAHLWERK THÜRINGEN GMBH UNTERWELLENBORN 2006 1 GREECE SIDENOR THESSALONIKI THESSALONIKI 1999 1 INDIA ADHUNIK METALIKS LTD. KOLKATA 2010 1 29.05.2018 Page 1 of 3 BSE Reference List Tools and Equipment Measurement and Control TempSamp Manipulator Country Company City Start-up Units INDIA JINDAL SOUTH WEST TORANAGALLU 2013 1 INDONESIA PT ISPAT INDO SURABAYA 2011 1 ITALY ALFA ACCIAI S.P.A. SAN POLO - BRESCIA 1996 1 ASO OSPITALETTO 1996 1 FERALPI LONATO LONATO 1998 1 FERRERO S. -

Program Information Banco Santander-Chile

Program Information Banco Santander-Chile PROGRAM INFORMATION Type of Information: Program Information Date of Announcement: April 1, 2015 Issuer Name: Banco Santander-Chile (the "Issuer") Name and Title of Representative: Emiliano Muratore, Managing Director – Head of ALM Robert Moreno, Managing Director - Investor Relations Address of Head Office: Bandera 140, Santiago, Chile Telephone: +562-320-2000 Contact Person: Attorney-in-Fact: Eiichi Kanda, Attorney-at-law Toshifumi Kajiwara, Attorney-at-law Clifford Chance Law Office (Gaikokuho Kyodo Jigyo) Address: Akasaka Tameike Tower, 6th Floor 17-7, Akasaka 2-Chome Minato-ku, Tokyo 107-0052 Telephone: 81-3-5561-6600 Type of Securities: Bonds (the "Bonds") Scheduled Issuance Period: April 3, 2015 to April 2, 2016 Maximum Outstanding Issuance Amount: JPY 200 billion Address of Website for Announcement: http://www.jpx.co.jp/equities/products/tpbm/annou ncement/index.html Status of Submission of Annual Securities None Reports or Issuer Filing Information: Notes to Investors: 1. TOKYO PRO-BOND Market is a market for professional investors, etc. (Tokutei Toushika tou) as defined in Article 2, Paragraph 3, Item 2 (b) (2) of the Financial Instruments and Exchange Act of Japan (Law No. 25 of 1948, as amended, the "FIEA") (the "Professional Investors, Etc."). Bonds listed on the market ("Listed Bonds") may involve high investment risk. Investors should be aware of the listing eligibility and timely disclosure requirements that apply to issuers of Listed Bonds on the TOKYO PRO-BOND Market and associated risks such as the fluctuation of market prices and shall bear responsibility for their investments. Prospective investors should make investment decisions after having carefully considered the contents of this Program Information. -

ANNUAL REPORT 2018 to Generate Economic and Social Value Through Our Companies and Institutions

ANNUAL REPORT 2018 To generate economic and social value through our companies and institutions. We have established a mission, a vision and values that are both our beacons and guidelines to plan strategies and projects in the pursuit of success. Fomento Económico Mexicano, S.A.B. de C.V., or FEMSA, is a leader in the beverage industry through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume; and in the beer industry, through ownership of the second largest equity stake in Heineken, one of the world’s leading brewers with operations in over 70 countries. We participate in the retail industry through FEMSA Comercio, comprising a Proximity Division, operating OXXO, a small-format store chain; a Health Division, which includes all drugstores and related operations; and a Fuel Division, which operates the OXXO GAS chain of retail service stations. Through FEMSA Negocios Estratégicos (FEMSA Strategic Businesses) we provide logistics, point-of-sale refrigeration solutions and plastics solutions to FEMSA’s business units and third-party clients. FEMSA’s 2018 integrated Annual Report reflects our commitment to strong corporate governance and transparency, as exemplified by our mission, vision and values. Our financial and sustainability results are for the twelve months ended December 31, 2018, compared to the twelve months ended December 31, 2017. This report was prepared in accordance with the Global Reporting Initiative (GRI) Standards and the United Nations Global Compact, this represents our Communication on Progress for 2018. Contents Discover Our Corporate Identity 1 FEMSA at a Glance 2 Value Creation Highlights 4 Social and Environmental Value 6 Dear Shareholders 8 FEMSA Comercio 10 Coca-Cola FEMSA 18 FEMSA Strategic Businesses 28 FEMSA Foundation 32 Corporate Governance 40 Financial Summary 44 Management’s Discussion & Analysis 46 Contact 52 Over the past several decades, FEMSA has evolved from an integrated beverage platform to a multifaceted business with a broad set of capabilities and opportunities. -

ITAÚ UNIBANCO HOLDING S.A. (Exact Name of Registrant As Specified in Its Charter)

As filed with the Securities and Exchange Commission on April 29, 2016 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM 20-F REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2015 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 001-15276 ITAÚ UNIBANCO HOLDING S.A. (Exact name of Registrant as specified in its charter) Federative Republic of Brazil (Jurisdiction of incorporation or organization) Praça Alfredo Egydio de Souza Aranha, 100 04344-902 São Paulo, SP, Brazil (Address of principal executive offices) Marcelo Kopel Investor Relations Officer Itaú Unibanco Holding S.A. Praça Alfredo Egydio de Souza Aranha, 100 04344-902 São Paulo, SP, Brazil +55 11 2794 3547 [email protected] (Name, Telephone, E-mail and/or Facsimilie number and Address of Company Contact Person) ________________________ Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Preferred Shares, no par value New York Stock Exchange(*) American Depositary Shares (as evidenced by American Depositary New York Stock Exchange Receipts), each representing 1 (one) Preferred Share (*) Not for trading purposes, but only in connection with the listing of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. -

Banco Santander Chile Form 20-F 2008

2008 Banco Santander Chile Form 20-F 2008 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) " REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2008 OR " TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 1-14554 BANCO SANTANDER-CHILE (d/b/a Santander, Banco Santander, Banco Santander Santiago, and Santander Santiago) (Exact name of Registrant as specified in its charter) SANTANDER-CHILE BANK (d/b/a Santander, Banco Santander, Santander Santiago Bank, and Santander Santiago) (Translation of Registrant’s name into English) Chile (Jurisdiction of incorporation) Bandera 140 Santiago, Chile Telephone: 011-562 320-2000 (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares (“ADS”), each representing the right to receive 1,039 Shares of New York Stock Exchange Common Stock without par value Shares of Common Stock, without par value* New York Stock Exchange * Santander-Chile’s shares of common stock are not listed for trading, but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the New York Stock Exchange. Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: 7.375% Subordinated Notes due 2012 The number of outstanding shares of each class of common stock of Banco Santander-Chile at December 31, 2008, was: 188,446,126,794 Shares of Common Stock, without par value Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Elektra (ELEKTRA) Marcela Martínez Suárez [email protected] (52-55) 5169-9384

Second Quarter 2004 Grupo Elektra (ELEKTRA) Marcela Martínez Suárez [email protected] (52-55) 5169-9384 August 5, 2004 SELL ELEKTRA * / EKT Grupo Elektra Prepays 2008 Senior Notes – Strong Price: Mx / ADR Ps 68.25 US$ 22.98 Performance at All Divisions Price Target Ps 71.00 Risk Level High • Elektra is now consolidating the Bank's results. Our comments are based on figures presented by Grupo 52 Week Range: Ps 77.20 to Ps 31.65 Elektra. During 2Q04, sales were up 20.5%, as a result of Shares Outstanding: 236.7 million strong performance at the Bank and the retail division. Market Capitalization: US$ 1.41 billion New personnel hired resulted in an 0.8-pp contraction in Enterprise Value: US$ 2.04 billion operating margin. Operating profit and EBITDA, Avg. Daily Trading Value US$ 1.4 million however, were up 12.5% and 11%, respectively. Retail Ps/share US$/ADR store formats are posting strong results, and the "Nobody 2Q EPS 1.39 0.49 Undersells Elektra" slogan has attracted more consumers. T12 EPS 6.19 2.16 The group's valuation, as measured by the EV/EBITDA T12 EBITDA 15.55 5.42 multiple, is at 6.35x, and should drop to 5.8x by year-end T12 Net Cash Earnings 11.93 4.16 2004. Our price target of Ps 71 represents a 5.54% Book Value 28.86 10.06 nominal yield, including a Ps 1.033 dividend. The above, T12 2004e coupled with the fact that Elektra is a high-risk stock, P/E 11.02x leads us to recommend Elektra as a SELL. -

Coca-Cola FEMSA, S.A.B. De C.V. Proposed Audit Committee 2021

Coca-Cola FEMSA, S.A.B. de C.V. Proposed Audit Committee 2021 Víctor Alberto Tiburcio Celorio Chairman and Financial Born: February 1951 Expert First elected to Committee: 2018 Principal occupation: Independent consultant Other directorships: Member of the board of directors and member of the audit committee of Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA”), Grupo Palacio de Hierro S.A.B. de C.V., Grupo Financiero Scotiabank Inverlat, Profuturo Afore, S.A. de C.V., Grupo Nacional Providencial S.A.B. and Fresnillo, PLC. Business Worked for over forty-three years at Mancera, S.C. (Ernst & Young Mexico), experience: serving as partner for thirty three years and as Chief Executive Officer and Chairman of the board of directors for thirteen years until his retirement in 2013. He was chairman of the board of Mexican Financial Reporting Standards and served as President of the Mexican Institute of Public Accountants. Education: Holds a Public Accountant degree from the Universidad Iberoamericana (IBERO) and Master in Business Administration from Instituto Tecnológico Autónomo de México (ITAM). Alfonso González Migoya Born: January 1945 First elected to Committee: 2007 Principal occupation: Business consultant and managing partner of Acumen Empresarial, S.A. de C.V. Other directorships: Chairman of the board of directors of Invercap Holdings, S.A.P.I. de C.V. and member of the board of directors of FEMSA, Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (Volaris), Grupo Cuprum, S.A.P.I. de C.V., y Pinturas Berel, S.A. de C.V. Member of the board of directors and member of the audit and corporate practices committees of Nemak, S.A.B. -

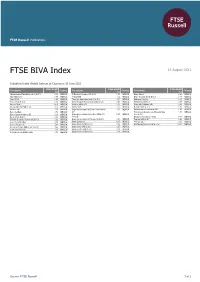

FTSE BIVA Index

2 FTSE Russell Publications 19 August 2021 FTSE BIVA Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Administradora Fibra Danhos S.A. de C.V. 0.15 MEXICO El Puerto de Liverpool SA de CV 0.53 MEXICO Grupo Mexico 8.89 MEXICO Alfa SAB de CV 0.89 MEXICO Femsa UBD 9.2 MEXICO Grupo Rotoplas S.A.B. de C.V. 0.17 MEXICO Alpek S.A.B. 0.28 MEXICO Fibra Uno Administracion S.A. de C.V. 1.91 MEXICO Industrias Penoles 1.02 MEXICO Alsea S.A.B. de C.V. 0.56 MEXICO Genomma Lab Internacional S.A.B. de C.V. 0.46 MEXICO Kimberly Clark Mex A 0.88 MEXICO America Movil L 13.59 MEXICO Gentera SAB de CV 0.35 MEXICO Megacable Holdings SAB 0.64 MEXICO Arca Continental SAB de CV 1.53 MEXICO Gruma SA B 1.37 MEXICO Nemak S.A.B. de C.V. 0.16 MEXICO Bachoco Ubl 0.36 MEXICO Grupo Aeroportuario del Centro Norte Sab de 1.31 MEXICO Orbia Advance Corporation SAB 1.59 MEXICO Banco del Bajio 0.76 MEXICO CV Promotora y Operadora de Infraestructura 1.05 MEXICO Banco Santander Mexico (B) 0.43 MEXICO Grupo Aeroportuario del Pacifico SAB de CV 2.27 MEXICO S.A. de C.V. Becle S.A.B. de C.V. 0.86 MEXICO Series B Qualitas Controladora y Vesta 0.48 MEXICO Bolsa Mexicana de Valores SAB de CV 0.62 MEXICO Grupo Aeroportuario del Sureste SA de CV 2.21 MEXICO Regional SAB de CV 0.83 MEXICO Cementos Chihuahua 0.79 MEXICO Grupo Banorte O 11.15 MEXICO Televisa 'Cpo' 4.38 MEXICO Cemex Sa Cpo Line 7.43 MEXICO Grupo Bimbo S.A.B. -

ALFA Corporate Note January 18, 2019

Equity Research Mexico ALFA Corporate Note January 18, 2019 Focused on strengthening its balance sheet www.banorte.com @analisis_fundam . Through our sum-of-the-parts valuation model, we have set a 2019 PT of MXN$ 29.50, which represents a 5.9x 2019e EV/EBITDA multiple, Marissa Garza similar to the current level. We extend a BUY recommendation Mining/Chemicals/Industrials/Financials/Railways [email protected] . The company’s strategy remains focused on strengthening its financial situation, through the sale of non-strategic assets, without neglecting new opportunities that may arise BUY Current Price MXN$24.58 PT2019 MXN$29.50 . In 2019 we anticipate a 3.7% increase in revenue and an 8.1% rise in Dividend 2019 MXN$0.65 EBITDA yoy, supported by improved profitability in all its Dividend (%) 2.7% subsidiaries, highlighting the figures of Alpek, Nemak and Sigma Upside Potential 23.4% Max – Mín LTM 25.54-19.53 2019, key year to strengthen Alfa’s financial situation. The company’s Market Cap (USD$m) 6,534.5 Shares outstanding (m) 5,055.1 strategy is focused on maintaining a long-term value creation approach and Float 54.5% guarantee the excellence of key operations. Accordingly, Alfa will maintain a Daily Turnover (MXN$m) 168.5 Valuation Metrics LTM * conservative profile throughout the year, focusing on enhancing its balance FV/EBITDA Adj 5.8x sheet, through the sale of non-strategic assets, as we have confirmed with P/E 16.0x Axtel’s recent divestment of operations (the sale of Axtel’s residential fiber- to-the-home- business in December) and Alpek (with the recent agreement for Relative performance to MEXBOL the sale of two cogeneration energy plants). -

Striving to Overcome the Economic Crisis: Progress and Diversification of Mexican Multinationals’ Export of Capital

Striving to overcome the economic crisis: Progress and diversification of Mexican multinationals’ export of capital Report dated December 28, 2011 EMBARGO: The contents of this report cannot be quoted or summarized in any print or electronic media before December 28, 2011, 7:00 a.m. Mexico City; 8:00 a.m. NewYork; and 1 p.m. GMT. Mexico City and New York, December 28, 2011: The Institute for Economic Research (IIEc) of the National Autonomous University of Mexico (UNAM) and the Vale Columbia Center on Sustainable International Investment (VCC), a joint initiative of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their third survey of Mexican multinationals today. 1 The survey is part of a long-term study of the rapid global expansion of multinational enterprises 2 (MNEs) from emerging markets. The present report focuses on data for the year 2010. Highlights In 2010, the top 20 Mexican MNEs had foreign assets of USDD 123 billion (table 1 below), foreign sales of USDD 71 billion, and employed 255,340 people abroad (see annex table 1 in annex I). The top two firms, America Movil and CEMEX, together controlled USDD 85 billion in foreign assets, accounting for nearly 70% of the assets on the list. The top four firms (including FEMSA and Grupo Mexico) jointly held USDD 104 billion, which represents almost 85% of the list’s foreign assets. Leading industries in this ranking, by numbers of MNEs, are non-metallic minerals (four companies) and food and beverages (another four companies). -

Prospects in Emerging Markets Drive CEO Confidence

www.pwc.com/ceosurvey Growth reimagined Prospects in emerging markets drive CEO confidence 14th Annual Global CEO Survey Armando Garza Sada Chairman of the Board of Directors, Alfa, S.A.B. de C.V., Mexico Interview Transcripts Armando Garza Sada Chairman of the Board of Directors, Alfa, S.A.B. de C.V., Mexico Alfa is a Mexican company incorporated Summary in 1974. Its corporate offices are located in San Pedro Garza García, Nuevo León. • In recent years, our companies have Measured in terms of its income, Alfa is been able to increase their market one of the largest diversified industrial share, while our customers were doing companies in Mexico. It comprises four so too. This has allowed us to grow. business groups: Alpek (petrochemicals), • We serve our markets “from the Nemak (high-tech aluminum auto bottom up”; that is, we try to discover parts), Sigma (refrigerated food) and or anticipate the needs of our Alestra (telecommunications). Alfa has customers in order to provide them manufacturing operations in Argentina, with the best possible solutions. Austria, Brazil, Canada, China, Costa • In Alpek we have interesting Rica, the Czech Republic, the Dominican investment opportunities. We recently Republic, El Salvador, Germany, entered into a process of acquiring Hungary, Mexico, Peru, Poland, Slovakia petrochemical plants from Eastman and the United States. Alfa markets its Chemical Co., which produce raw products in more than 70 countries materials for polyester in all its around the world. applications. Armando Garza Sada has been the • In Nemak, the expectation of Chairman of the Board of Directors of accelerated growth of the automotive Alfa since March 2010. -

SANTANDER LATIN AMERICAN INVESTMENT GRADE ESG BOND Agosto 2021 Información General Política De Inversión

SANTANDER LATIN AMERICAN INVESTMENT GRADE ESG BOND Agosto 2021 Información general Política de inversión El Subfondo invertirá principalmente en bonos corporativos emitidos por emisores corporativos latinoamericanos o por empresas que obtienen más del 60% de sus ingresos de sus operaciones en la región. El Subfondo trata de mantener una puntuación ESG superior a la de su índice de referencia. Gestor Alfredo Mordezki ISIN LU2208607957 Fecha de lanzamiento 22/02/2021 Divisa de Clase USD Rentabilidad acumulada (%)¹ Aportación Mínima 500.000,00 $ Comisión de Gestión 0,25% 1M 3M 6M YTD 1Y Lanzam. Valor Liquidativo 101,79 $ Fondo 0,50 2,41 2,34 - - 2,39 Patrimonio de Fondo $32,62M Índice 0,69 2,42 2,00 - - 1,47 Número de posiciones 51 Duración Media 6,97 YTM Media 3,27% Índice100% JPM CEMBI IG Global Diversified Latam Categoría Rentabilidad anual (%)¹ Entidad gestora Santander AM Lux 2021* 2020 2019 2018 2017 2016 Fondo 2,39 - - - - - Índice 1,47 - - - - - * Desde inicio. Estadísticas* Fondo Índice Volatilidad (%) Ratio de Sharpe Volatilidad anual (%)¹ Ratio de Información Beta 2021* 2020 2019 2018 2017 2016 R2 Fondo 1,92 - - - - - Alfa (%) Índice 1,83 - - - - - Alfa de Jensen (%) * Desde inicio. Correlación Ratio de Treynor Tracking Error (%) * Menos de un año de história, imposible calcular estadísticos. Rendimiento acumulado desde lanzamiento Rentabilidad mensual (%)¹ Ene Feb Mar Abr May Jun Jul Ago Sep Oct Nov Dic Total 2021 - - -0,83 0,45 0,32 1,23 0,65 0,50 - - - - 2,39 2020 - - - - - - - - - - - - 2019 - - - - - - - - - - - - 2018 - - - - - - - - - - - - 2017 - - - - - - - - - - - - 2016 - - - - - - - - - - - - ¹ Cálculos netos de comisiones. Pág. 1 Distribución de cartera 10 principales posiciones (%) 28,47 Divisa (%) Cable Onda Sa 4.5% 30-jan-2030 3,11 USD 100,02 Banco Santander-chile 2.7% 10-jan-2025 2,89 EUR -0,02 Corporacion Lindley S.a.