ALFA Corporate Note January 18, 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

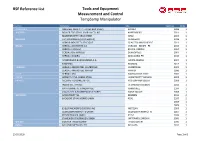

BSE Reference List Tools and Equipment Measurement and Control Tempsamp Manipulator

BSE Reference List Tools and Equipment Measurement and Control TempSamp Manipulator Country Company City Start-up Units AUSTRALIA ONESTEEL NSW PTY. LTD (EX BHP STEEL) SYDNEY 1998 1 AUSTRIA BÖHLER EDELSTAHL GMBH & CO. KG KAPFENBERG 2011 1 MARIENHUETTE GRAZ GMBH GRAZ 2003 1 BELGIUM THY MARCINELLE (RIVA GROUP) CHARLEROI 1998 1 USINOR INDUSTEEL BELGIQUE CHALEROI MARCHIENNE 2011 1 BRAZIL GERDAU ACONORTE S.A. CURADO - RECIFE - PE 2010 1 GERDAU COSIGUA RIO DE JANEIRO 2004 1 GERDAU DIVINOPOLIS DIVINOPOLIS 2003 1 GERDAU GUAIRA ARAUCARIA-PR 2010 1 SIDERURGICA BARRA MANSA S.A. BARRA MANSA 2007 1 SINOBRAS MARABA 2012 1 CANADA GERDAU AMERISTEEL CAMBRIDGE CAMBRIDGE 2001 1 GERDAU AMERISTEEL WHITBY WHITBY 1996 1 CHILE GERDAU AZA SANTIAGO DE CHILE 2005 1 CHINA JIANGYIN XING CHENG STEEL JIANGYIN CITY JIANGSU 2004 1 FRANCE ASCOMETAL USINE DE FOS FOS-SUR-MER CEDEX 2008 1 INDUSTEEL FRANCE LE CREUSOT (CEDEX) 2016 1 ISPAT UNIMETAL GANDRANGE AMNÉVILLE 1994 2 VALLOUREC & MANNESMANN TUBES SAINT SAULVE 2008 1 GERMANY ARCELORMITTAL BREMEN 2016 2 BADISCHE STAHLWERKE GMBH KEHL 1997 2 2008 1 2009 1 EDELSTAHLWERKE BUDERUS AG WETZLAR 2004 1 GEORGSMARIENHÜTTE GMBH GEORGSMARIENHÜTTE 2007 1 PEINER TRÄGER GMBH PEINE 1999 2 STAHLWERK THÜRINGEN GMBH UNTERWELLENBORN 2006 1 GREECE SIDENOR THESSALONIKI THESSALONIKI 1999 1 INDIA ADHUNIK METALIKS LTD. KOLKATA 2010 1 29.05.2018 Page 1 of 3 BSE Reference List Tools and Equipment Measurement and Control TempSamp Manipulator Country Company City Start-up Units INDIA JINDAL SOUTH WEST TORANAGALLU 2013 1 INDONESIA PT ISPAT INDO SURABAYA 2011 1 ITALY ALFA ACCIAI S.P.A. SAN POLO - BRESCIA 1996 1 ASO OSPITALETTO 1996 1 FERALPI LONATO LONATO 1998 1 FERRERO S. -

Program Information Banco Santander-Chile

Program Information Banco Santander-Chile PROGRAM INFORMATION Type of Information: Program Information Date of Announcement: April 1, 2015 Issuer Name: Banco Santander-Chile (the "Issuer") Name and Title of Representative: Emiliano Muratore, Managing Director – Head of ALM Robert Moreno, Managing Director - Investor Relations Address of Head Office: Bandera 140, Santiago, Chile Telephone: +562-320-2000 Contact Person: Attorney-in-Fact: Eiichi Kanda, Attorney-at-law Toshifumi Kajiwara, Attorney-at-law Clifford Chance Law Office (Gaikokuho Kyodo Jigyo) Address: Akasaka Tameike Tower, 6th Floor 17-7, Akasaka 2-Chome Minato-ku, Tokyo 107-0052 Telephone: 81-3-5561-6600 Type of Securities: Bonds (the "Bonds") Scheduled Issuance Period: April 3, 2015 to April 2, 2016 Maximum Outstanding Issuance Amount: JPY 200 billion Address of Website for Announcement: http://www.jpx.co.jp/equities/products/tpbm/annou ncement/index.html Status of Submission of Annual Securities None Reports or Issuer Filing Information: Notes to Investors: 1. TOKYO PRO-BOND Market is a market for professional investors, etc. (Tokutei Toushika tou) as defined in Article 2, Paragraph 3, Item 2 (b) (2) of the Financial Instruments and Exchange Act of Japan (Law No. 25 of 1948, as amended, the "FIEA") (the "Professional Investors, Etc."). Bonds listed on the market ("Listed Bonds") may involve high investment risk. Investors should be aware of the listing eligibility and timely disclosure requirements that apply to issuers of Listed Bonds on the TOKYO PRO-BOND Market and associated risks such as the fluctuation of market prices and shall bear responsibility for their investments. Prospective investors should make investment decisions after having carefully considered the contents of this Program Information. -

ANNUAL REPORT 2018 to Generate Economic and Social Value Through Our Companies and Institutions

ANNUAL REPORT 2018 To generate economic and social value through our companies and institutions. We have established a mission, a vision and values that are both our beacons and guidelines to plan strategies and projects in the pursuit of success. Fomento Económico Mexicano, S.A.B. de C.V., or FEMSA, is a leader in the beverage industry through Coca-Cola FEMSA, the largest franchise bottler of Coca-Cola products in the world by volume; and in the beer industry, through ownership of the second largest equity stake in Heineken, one of the world’s leading brewers with operations in over 70 countries. We participate in the retail industry through FEMSA Comercio, comprising a Proximity Division, operating OXXO, a small-format store chain; a Health Division, which includes all drugstores and related operations; and a Fuel Division, which operates the OXXO GAS chain of retail service stations. Through FEMSA Negocios Estratégicos (FEMSA Strategic Businesses) we provide logistics, point-of-sale refrigeration solutions and plastics solutions to FEMSA’s business units and third-party clients. FEMSA’s 2018 integrated Annual Report reflects our commitment to strong corporate governance and transparency, as exemplified by our mission, vision and values. Our financial and sustainability results are for the twelve months ended December 31, 2018, compared to the twelve months ended December 31, 2017. This report was prepared in accordance with the Global Reporting Initiative (GRI) Standards and the United Nations Global Compact, this represents our Communication on Progress for 2018. Contents Discover Our Corporate Identity 1 FEMSA at a Glance 2 Value Creation Highlights 4 Social and Environmental Value 6 Dear Shareholders 8 FEMSA Comercio 10 Coca-Cola FEMSA 18 FEMSA Strategic Businesses 28 FEMSA Foundation 32 Corporate Governance 40 Financial Summary 44 Management’s Discussion & Analysis 46 Contact 52 Over the past several decades, FEMSA has evolved from an integrated beverage platform to a multifaceted business with a broad set of capabilities and opportunities. -

TLEVISA Efficiencies Limit Pressure on Margins @Analisis Fundam

Equity Research M exico Quarterly Report July 13, 2020 TLEVISA www.banorte.com Efficiencies limit pressure on margins @analisis_fundam ▪ Televisa confirmed a weak report, reflecting the impact of the Consumer and Telecom pandemic on Content and Other Businesses, yet highlighting a solid growth in pay TV segment (mainly Cable) Valentín Mendoza Senior Strategist, Equity [email protected] ▪ Despite a sharp drop in Advertising, pressure on profitability was less than estimated, owing to cost and expense savings in the division, Juan Barbier coupled with a decrease in corporate spending Analyst [email protected] ▪ We establish a PT2020 of $30.00, which implies a FV/EBITDA 2021E multiple of 5.8x, similar to last year's average of 5.7x. Given the Buy Current Price $23.52 attractive valuation, our rating is BUY. PT 2020 $30.00 Dividend 2020e Pay TV proved its resilience. Televisa's revenues fell 7.8% y/y to $22.407 Dividend Yield (%) Upside Potential 27.6% billion, due to a 16.3% decrease in Content (Advertising -33.1%), and a 67.0% ADR current price US$5.18 slump in Other Business; both divisions being strongly impacted by the PT2020 ADR US$6.80 # Shares per ADR 5 pandemic. However, Pay TV even accelerated its growth rate, with Cable Max – Mín LTM ($) 47.14 – 22.70 advancing 10.7% and Sky 3.1%, due to a higher demand for broad-band Market Cap (US$m)) 2,988.5 Shares Outstanding (m) 2,820.0 accesses. EBITDA fell 13.2% y/y to $8.221 billion though the respective Float 80% margin eroded 230bp to 36.7%, yet being better than expected thanks to Daily Turnover US$m 94.7 Valuation metrics LTM efficiencies in Content and Corporate expenses, which partially cushioned the FV/EBITDA 5.4x impact of lower operating leverage coming from the sharp drop in Advertising P/E N.A. -

ITAÚ UNIBANCO HOLDING S.A. (Exact Name of Registrant As Specified in Its Charter)

As filed with the Securities and Exchange Commission on April 29, 2016 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM 20-F REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2015 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 001-15276 ITAÚ UNIBANCO HOLDING S.A. (Exact name of Registrant as specified in its charter) Federative Republic of Brazil (Jurisdiction of incorporation or organization) Praça Alfredo Egydio de Souza Aranha, 100 04344-902 São Paulo, SP, Brazil (Address of principal executive offices) Marcelo Kopel Investor Relations Officer Itaú Unibanco Holding S.A. Praça Alfredo Egydio de Souza Aranha, 100 04344-902 São Paulo, SP, Brazil +55 11 2794 3547 [email protected] (Name, Telephone, E-mail and/or Facsimilie number and Address of Company Contact Person) ________________________ Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Preferred Shares, no par value New York Stock Exchange(*) American Depositary Shares (as evidenced by American Depositary New York Stock Exchange Receipts), each representing 1 (one) Preferred Share (*) Not for trading purposes, but only in connection with the listing of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. -

General Atlantic Appoints Enrique L. Castillo, Javier Molinar and Luis F

General Atlantic Appoints Enrique L. Castillo, Javier Molinar and Luis F. Cervantes as Special Advisors in Mexico GREENWICH and SÃO PAULO - February 5, 2013 General Atlantic LLC (“GA”), a leading global growth equity firm, today announced that it has appointed Enrique L. Castillo, Javier Molinar and Luis F. Cervantes as Special Advisors. Mr. Castillo, Mr. Molinar and Mr. Cervantes will work with GA’s Latin America team to help identify business opportunities in Mexico. With approximately US$ 17 billion in capital under management, GA invests in and provides strategic support for growth companies around the world. “We are pleased to welcome Enrique, Javier and Luis to our global team of advisors to help us evaluate investment opportunities in Mexico,” said William Ford, CEO of General Atlantic. “Their expertise will be very helpful to our team and is in keeping with our philosophy of building local expertise to help companies grow globally.” Martin Escobari, Managing Director and Head of GA’s Latin America investing program, added, “We are already active in Mexico through many of our portfolio companies which have local operations. As Mexico enters a new phase of rapid reforms and economic growth, we look forward to partnering with Mexican entrepreneurs to fund and support the expansion plans of their companies.” Enrique L. Castillo is former Chairman and CEO of Ixe Grupo Financiero, which merged in 2010 with Grupo Financiero Banorte. He currently acts as a board member of Banorte. In addition, Mr. Castillo is the former head of the Mexican Bankers Association and member of the board of Grupo Casa Saba, Medica Sur, Grupo Aeroportuario del Pacifico, Grupo Herdez, Grupo Alfa, Cultiva and Southern Copper Corporation. -

Banco Santander Chile Form 20-F 2008

2008 Banco Santander Chile Form 20-F 2008 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) " REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2008 OR " TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 1-14554 BANCO SANTANDER-CHILE (d/b/a Santander, Banco Santander, Banco Santander Santiago, and Santander Santiago) (Exact name of Registrant as specified in its charter) SANTANDER-CHILE BANK (d/b/a Santander, Banco Santander, Santander Santiago Bank, and Santander Santiago) (Translation of Registrant’s name into English) Chile (Jurisdiction of incorporation) Bandera 140 Santiago, Chile Telephone: 011-562 320-2000 (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares (“ADS”), each representing the right to receive 1,039 Shares of New York Stock Exchange Common Stock without par value Shares of Common Stock, without par value* New York Stock Exchange * Santander-Chile’s shares of common stock are not listed for trading, but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the New York Stock Exchange. Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: 7.375% Subordinated Notes due 2012 The number of outstanding shares of each class of common stock of Banco Santander-Chile at December 31, 2008, was: 188,446,126,794 Shares of Common Stock, without par value Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Diapositiva 1

Financial Results 3Q13 October 2013 1 Summary of Results 2 Financial Highlights GFNORTE registered profits of Ps 9.89 billion for 9M13, 25% higher YoY as a result of the operating leverage obtained from increases in total revenues, as well as a slower pace of growth in operating expenses, which coupled with the inclusion of Afore Bancomer‟s profits in Subsidiaries‟ results and the use of tax credits in 2Q13, offset higher loan loss provisions. In 3Q13 net income totaled Ps 3.53 billion, 27% higher YoY driven by higher positive operating leverage and the inclusion of Afore Bancomer‟s profits in Subsidiaries‟ results, and is 9% above QoQ due to an increase in net interest income, a decrease in operating expenses and provisions, as well as the profits generated by the Holding Company given the positive FX effect of the dollar investments held in order to finalize Generali's acquisition and the interest earned in its investments. During 9M13, Return on Equity (ROE), was 14.3%, 21 basis points more YoY. ROE for 3Q13 was 14.0%, 49 basis points below 3Q12 and 135 basis points below 2Q13 while Return on Tangible Equity (ROTE) was 18.1% in 3Q13, 99 basis points below 3Q12 and 147 basis points below 2Q13. The decrease in both financial ratios was mainly due to the equity increase following GFNorte‟s Public Offering on July 22, 2013. Return on Assets (ROA) during 9M13 was 1.4%, 16 basis points higher YoY. ROA for the quarter was 1.5%, 20 basis points above 3Q12 and 10 basis points above 2Q13. -

Emerging Index - QSR

2 FTSE Russell Publications 19 August 2021 FTSE RAFI Emerging Index - QSR Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) Absa Group Limited 0.29 SOUTH BRF S.A. 0.21 BRAZIL China Taiping Insurance Holdings (Red 0.16 CHINA AFRICA BTG Pactual Participations UNT11 0.09 BRAZIL Chip) Acer 0.07 TAIWAN BYD (A) (SC SZ) 0.03 CHINA China Tower (H) 0.17 CHINA Adaro Energy PT 0.04 INDONESIA BYD (H) 0.12 CHINA China Vanke (A) (SC SZ) 0.09 CHINA ADVANCED INFO SERVICE 0.16 THAILAND Canadian Solar (N Shares) 0.08 CHINA China Vanke (H) 0.2 CHINA Aeroflot Russian Airlines 0.09 RUSSIA Capitec Bank Hldgs Ltd 0.05 SOUTH Chongqing Rural Commercial Bank (A) (SC 0.01 CHINA Agile Group Holdings (P Chip) 0.04 CHINA AFRICA SH) Agricultural Bank of China (A) (SC SH) 0.27 CHINA Catcher Technology 0.2 TAIWAN Chongqing Rural Commercial Bank (H) 0.04 CHINA Agricultural Bank of China (H) 0.66 CHINA Cathay Financial Holding 0.29 TAIWAN Chunghwa Telecom 0.32 TAIWAN Air China (A) (SC SH) 0.02 CHINA CCR SA 0.14 BRAZIL Cia Paranaense de Energia 0.01 BRAZIL Air China (H) 0.06 CHINA Cemex Sa Cpo Line 0.7 MEXICO Cia Paranaense de Energia (B) 0.07 BRAZIL Airports of Thailand 0.04 THAILAND Cemig ON 0.03 BRAZIL Cielo SA 0.13 BRAZIL Akbank 0.18 TURKEY Cemig PN 0.18 BRAZIL CIFI Holdings (Group) (P Chip) 0.03 CHINA Al Rajhi Banking & Investment Corp 0.52 SAUDI Cencosud 0.04 CHILE CIMB Group Holdings 0.11 MALAYSIA ARABIA Centrais Eletricas Brasileiras S.A. -

Elektra (ELEKTRA) Marcela Martínez Suárez [email protected] (52-55) 5169-9384

Second Quarter 2004 Grupo Elektra (ELEKTRA) Marcela Martínez Suárez [email protected] (52-55) 5169-9384 August 5, 2004 SELL ELEKTRA * / EKT Grupo Elektra Prepays 2008 Senior Notes – Strong Price: Mx / ADR Ps 68.25 US$ 22.98 Performance at All Divisions Price Target Ps 71.00 Risk Level High • Elektra is now consolidating the Bank's results. Our comments are based on figures presented by Grupo 52 Week Range: Ps 77.20 to Ps 31.65 Elektra. During 2Q04, sales were up 20.5%, as a result of Shares Outstanding: 236.7 million strong performance at the Bank and the retail division. Market Capitalization: US$ 1.41 billion New personnel hired resulted in an 0.8-pp contraction in Enterprise Value: US$ 2.04 billion operating margin. Operating profit and EBITDA, Avg. Daily Trading Value US$ 1.4 million however, were up 12.5% and 11%, respectively. Retail Ps/share US$/ADR store formats are posting strong results, and the "Nobody 2Q EPS 1.39 0.49 Undersells Elektra" slogan has attracted more consumers. T12 EPS 6.19 2.16 The group's valuation, as measured by the EV/EBITDA T12 EBITDA 15.55 5.42 multiple, is at 6.35x, and should drop to 5.8x by year-end T12 Net Cash Earnings 11.93 4.16 2004. Our price target of Ps 71 represents a 5.54% Book Value 28.86 10.06 nominal yield, including a Ps 1.033 dividend. The above, T12 2004e coupled with the fact that Elektra is a high-risk stock, P/E 11.02x leads us to recommend Elektra as a SELL. -

Equity Research Mexico

Equity Research Mexico Quarterly Report February 24, 2020 TLEVISA www.banorte.com Content grew while profitability improved @analisis_fundam ▪ Televisa´s report beat expectations, as Content revenues grew y/y aided Consumer and Telecoms by stable advertising sales, while Cable segment maintained solid dynamics Valentín Mendoza Senior Strategist, Equity ▪ Particularly, the 110bp profitability improvement, due to operating [email protected] efficiencies, stood out. Thus, results should be welcomed by the market. Jorge Izquierdo We will release our PT2020 shortly Analyst [email protected] Operating efficiencies boosted margin expansion. In spite of a challenging economic environment and a significant drop in government advertising Under review Current Price $42.84 expenditures, Televisa´s figures came above expectations. Revenues growth PT 2020 accelerated (+4.7% y/y) to $28,003 million, while EBITDA increased 7.7% to Dividend 2020e Dividend Yield (%) $10,660 million with a 110bp margin expansion to 38.1%. The latter was Upside Potential ADR current price US$11.34 explained by operating efficiencies which contributed to a 7.0% y/y reduction PT2020 ADR in operating expenses. Meanwhile, Content segment sales growth (+2.4% y/y) # Shares per ADR 5 Max – Mín LTM ($) 49.64 – 28.98 was a nice surprise, after advertising revenues stabilized (+0.3% y/y), though Market Cap (US$m) 6,557.0 its impressive 170bp margin improvement was another plus on the report. Cable Shares Outstanding (m) 2,882.4 Float 80% segment continued posting double-digit growth rates (15.7%), supported by a Daily Turnover US$m 98.4 6.8% RGU increase and a 4.5% advance in ARPU, yet profitability decreased Valuation metrics TTM FV/EBITDA 6.2x by 80bp. -

Coca-Cola FEMSA, S.A.B. De C.V. Proposed Audit Committee 2021

Coca-Cola FEMSA, S.A.B. de C.V. Proposed Audit Committee 2021 Víctor Alberto Tiburcio Celorio Chairman and Financial Born: February 1951 Expert First elected to Committee: 2018 Principal occupation: Independent consultant Other directorships: Member of the board of directors and member of the audit committee of Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA”), Grupo Palacio de Hierro S.A.B. de C.V., Grupo Financiero Scotiabank Inverlat, Profuturo Afore, S.A. de C.V., Grupo Nacional Providencial S.A.B. and Fresnillo, PLC. Business Worked for over forty-three years at Mancera, S.C. (Ernst & Young Mexico), experience: serving as partner for thirty three years and as Chief Executive Officer and Chairman of the board of directors for thirteen years until his retirement in 2013. He was chairman of the board of Mexican Financial Reporting Standards and served as President of the Mexican Institute of Public Accountants. Education: Holds a Public Accountant degree from the Universidad Iberoamericana (IBERO) and Master in Business Administration from Instituto Tecnológico Autónomo de México (ITAM). Alfonso González Migoya Born: January 1945 First elected to Committee: 2007 Principal occupation: Business consultant and managing partner of Acumen Empresarial, S.A. de C.V. Other directorships: Chairman of the board of directors of Invercap Holdings, S.A.P.I. de C.V. and member of the board of directors of FEMSA, Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (Volaris), Grupo Cuprum, S.A.P.I. de C.V., y Pinturas Berel, S.A. de C.V. Member of the board of directors and member of the audit and corporate practices committees of Nemak, S.A.B.