PROPERTY INSIGHTS India Quarter 1, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mumbai Residential June 2019 Marketbeats

MUMBAI RESIDENTIAL JUNE 2019 MARKETBEATS 2.5% 62% 27% GROWTH IN UNIT SHARE OF MID SHARE OF THANE SUB_MARKET L A U N C H E S (Q- o - Q) SEGMENT IN Q2 2019 IN LAUNCHES (Q2 2019) HIGHLIGHTS RENTAL VALUES AS OF Q2 2019* Average Quoted Rent QoQ YoY Short term Submarket New launches see marginal increase (INR/Month) Change (%) Change (%) outlook New unit launches have now grown for the third consecutive quarter, with 15,994 units High-end segment launched in Q2 2019, marking a 2.5% q-o-q increase. Thane and the Extended Eastern South 60,000 – 700,000 0% 0% South Central 60,000 - 550,000 0% 0% and Western Suburbs submarkets were the biggest contributors, accounting for around Eastern 25,000 – 400,000 0% 0% Suburbs 58% share in the overall launches. Eastern Suburbs also accounted for a notable 17% Western 50,000 – 800,000 0% 0% share of total quarterly launches. Prominent developers active during the quarter with new Suburbs-Prime Mid segment project launches included Poddar Housing, Kalpataru Group, Siddha Group and Runwal Eastern 18,000 – 70,000 0% 0% Suburbs Developers. Going forward, we expect the suburban and peripheral locations to account for Western 20,000 – 80,000 0% 0% a major share of new launch activity in the near future. Suburbs Thane 14,000 – 28,000 0% 0% Mid segment dominates new launches Navi Mumbai 10,000 – 50,000 0% 0% The mid segment continues to be the focus with a 62% share of the total unit launches during the quarter; translating to a q-o-q rise of 15% in absolute terms. -

Estate 5 BHK Brochure

4 & 5 BHK LUXURY HOMES Hiranandani Estate, Thane Hiranandani Estate, Off Ghodbunder Road, Thane (W) Call:(+91 22) 2586 6000 / 2545 8001 / 2545 8760 / 2545 8761 Corp. Off.: Olympia, Central Avenue, Hiranandani Business Park, Powai, Mumbai - 400 076. [email protected] • www.hiranandani.com Rodas Enclave-Leona, Royce-4 BHK & Basilius-5 BHK are mortgaged with HDFC Ltd. The No Objection Certificate (NOC)/permission of the mortgagee Bank would be provided for sale of flats/units/property, if required. Welcome to the Premium Hiranandani Living! ABUNDANTLY YOURS Standard apartment of Basilius building for reference purpose only. The furniture & fixtures shown in the above flat are not part of apartment amenities. EXTRAVAGANTLY, oering style with a rich sense of prestige, quality and opulence, heightened by the cascades of natural light and spacious living. Actual image shot at Rodas Enclave, Thane. LUXURIOUSLY, navigating the chasm between classic and contemporary design to complete the elaborated living. • Marble flooring in living, dining and bedrooms • Double glazed windows • French windows in living room • Large deck in living/dining with sliding balcony doors Standard apartment of Basilius building for reference purpose only. The furniture & fixtures shown in the above flat are not part of apartment amenities. CLASSICALLY, veering towards the modern and eclectic. Standard apartment of Basilius building for reference purpose only. The furniture & fixtures shown in the above flat are not part of apartment amenities. EXCLUSIVELY, meant for the discerning few! Here’s an access to gold class living that has been tastefully designed and thoughtfully serviced, oering only and only a ‘royal treatment’. • Air-conditioner in living, dining and bedrooms • Belgian wood laminate flooring in common bedroom • Space for walk–in wardrobe in apartments • Back up for selected light points in each flat Standard apartment of Basilius building for reference purpose only. -

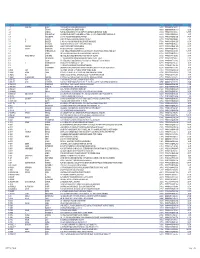

Reg. No Name in Full Residential Address Gender Contact No

Reg. No Name in Full Residential Address Gender Contact No. Email id Remarks 20001 MUDKONDWAR SHRUTIKA HOSPITAL, TAHSIL Male 9420020369 [email protected] RENEWAL UP TO 26/04/2018 PRASHANT NAMDEORAO OFFICE ROAD, AT/P/TAL- GEORAI, 431127 BEED Maharashtra 20002 RADHIKA BABURAJ FLAT NO.10-E, ABAD MAINE Female 9886745848 / [email protected] RENEWAL UP TO 26/04/2018 PLAZA OPP.CMFRI, MARINE 8281300696 DRIVE, KOCHI, KERALA 682018 Kerela 20003 KULKARNI VAISHALI HARISH CHANDRA RESEARCH Female 0532 2274022 / [email protected] RENEWAL UP TO 26/04/2018 MADHUKAR INSTITUTE, CHHATNAG ROAD, 8874709114 JHUSI, ALLAHABAD 211019 ALLAHABAD Uttar Pradesh 20004 BICHU VAISHALI 6, KOLABA HOUSE, BPT OFFICENT Female 022 22182011 / NOT RENEW SHRIRANG QUARTERS, DUMYANE RD., 9819791683 COLABA 400005 MUMBAI Maharashtra 20005 DOSHI DOLLY MAHENDRA 7-A, PUTLIBAI BHAVAN, ZAVER Female 9892399719 [email protected] RENEWAL UP TO 26/04/2018 ROAD, MULUND (W) 400080 MUMBAI Maharashtra 20006 PRABHU SAYALI GAJANAN F1,CHINTAMANI PLAZA, KUDAL Female 02362 223223 / [email protected] RENEWAL UP TO 26/04/2018 OPP POLICE STATION,MAIN ROAD 9422434365 KUDAL 416520 SINDHUDURG Maharashtra 20007 RUKADIKAR WAHEEDA 385/B, ALISHAN BUILDING, Female 9890346988 DR.NAUSHAD.INAMDAR@GMA RENEWAL UP TO 26/04/2018 BABASAHEB MHAISAL VES, PANCHIL NAGAR, IL.COM MEHDHE PLOT- 13, MIRAJ 416410 SANGLI Maharashtra 20008 GHORPADE TEJAL A-7 / A-8, SHIVSHAKTI APT., Male 02312650525 / NOT RENEW CHANDRAHAS GIANT HOUSE, SARLAKSHAN 9226377667 PARK KOLHAPUR Maharashtra 20009 JAIN MAMTA -

Maha Eseva Kendra List

महा-ई-सेवा कᴂ 饍ा車ची यादी Sr. VLE Name Palghar CSC Address Location Pincode Mobile Maha E Sewa Kendra Nitin Bhaidas Rampur 1 Rampur Kosbad Road Near 401702 8237635961 Mothe (551636) Market Rampur Jayprakash Gholwad Gholwad Near 2 Ramchandra Gholwad 401702 9860891473 Jalaram Temple Gholwad Bari Bhika Bandu Parnaka Parnaka Parnaka Dahanu (M 3 401602 9637999157 Sonawane Dahanu Cl) Ganpat At-Haladpada Amboli 4 Sukhad Halapada 401606 9960227641 Shishane Road Haladpada Dhangda Nr Saideep Hospital At Post Malyan Tq Dhanu Amul Ramdas Dahanu (M 5 East Dist Thane-401602 401602 9967910609 Tandel Cl) Malyan Sai Deep Hospital Dahanu E Santosh Muskan S S Sanstha 6 Ramchandra 16,Sidhhi Complex,Kasa Kasa Kh. 401607 9049494194 Patil Dahanu Jawhar Road Gayatri Enterprizes, Muskan 16,Siddhicomplex, 7 Swayamrojgar 16,Siddhicomplex Dahanu Kasa Kh. 401607 9049494194 Seva Sahakari Jawhar Road Near Bank Of Maharashtra Kasa Jahir Kasim Maha E Seva Kendra 8 Vangaon 401103 9423533665 Shaikh Chinchani Road Vangaon Maha E Seva Kendra Jayvanti Dahanu (M 9 Dahanu Fort Near Ganesh 401601 9273039057 Rajendra Bari Cl) Mandir Tahsildar Office Maha E Seva Center Dhakti Dahanu Dhakti Dhakti 10 Kishor R Bari 401601 9860002524 Dahanu Bariwada Near Bus Dahanu Stop Maha E Seva Kendra Bordi Akshay 11 Shop No 511 Netaji Road Bordi 401701 8149107404 Bprakash Raut Opp Ram Mandir Bordi Muskan Maha E Seva Kendra 12 Swayamrojgar Ashagad 401602 7066822781 Ashagad Seva Sahakari Maha E-Seva Kendra 2 Prafful Dahanu-Vangaon Road 13 Jaywant Saravali 401602 8087930398 Near Savta Bridge Vaidya Ghungerpada At Dhundalwadi Darshana Dhundalwad 14 Dhundalwadi Talathi 401606 9765284663 Vilas Hilim i Office Ramij Kashim Maha E Seva Kendra 15 Aine 401103 9423533665 Shaikh Charoti Road Aina Maha E Seva Center Chinchani Vangaon Naka 01 Prathomasatv Bulding Chinchani 16 Kishor R Bari 401503 9860002524 Dahanu Khadi - Boisar (Ct) Road Near State Bank A.T.M. -

SR NO First Name Middle Name Last Name Address Pincode Folio

SR NO First Name Middle Name Last Name Address Pincode Folio Amount 1 A SPRAKASH REDDY 25 A D REGIMENT C/O 56 APO AMBALA CANTT 133001 0000IN30047642435822 22.50 2 A THYAGRAJ 19 JAYA CHEDANAGAR CHEMBUR MUMBAI 400089 0000000000VQA0017773 135.00 3 A SRINIVAS FLAT NO 305 BUILDING NO 30 VSNL STAFF QTRS OSHIWARA JOGESHWARI MUMBAI 400102 0000IN30047641828243 1,800.00 4 A PURUSHOTHAM C/O SREE KRISHNA MURTY & SON MEDICAL STORES 9 10 32 D S TEMPLE STREET WARANGAL AP 506002 0000IN30102220028476 90.00 5 A VASUNDHARA 29-19-70 II FLR DORNAKAL ROAD VIJAYAWADA 520002 0000000000VQA0034395 405.00 6 A H SRINIVAS H NO 2-220, NEAR S B H, MADHURANAGAR, KAKINADA, 533004 0000IN30226910944446 112.50 7 A R BASHEER D. NO. 10-24-1038 JUMMA MASJID ROAD, BUNDER MANGALORE 575001 0000000000VQA0032687 135.00 8 A NATARAJAN ANUGRAHA 9 SUBADRAL STREET TRIPLICANE CHENNAI 600005 0000000000VQA0042317 135.00 9 A GAYATHRI BHASKARAAN 48/B16 GIRIAPPA ROAD T NAGAR CHENNAI 600017 0000000000VQA0041978 135.00 10 A VATSALA BHASKARAN 48/B16 GIRIAPPA ROAD T NAGAR CHENNAI 600017 0000000000VQA0041977 135.00 11 A DHEENADAYALAN 14 AND 15 BALASUBRAMANI STREET GAJAVINAYAGA CITY, VENKATAPURAM CHENNAI, TAMILNADU 600053 0000IN30154914678295 1,350.00 12 A AYINAN NO 34 JEEVANANDAM STREET VINAYAKAPURAM AMBATTUR CHENNAI 600053 0000000000VQA0042517 135.00 13 A RAJASHANMUGA SUNDARAM NO 5 THELUNGU STREET ORATHANADU POST AND TK THANJAVUR 614625 0000IN30177414782892 180.00 14 A PALANICHAMY 1 / 28B ANNA COLONY KONAR CHATRAM MALLIYAMPATTU POST TRICHY 620102 0000IN30108022454737 112.50 15 A Vasanthi W/o G -

Important Notice

183rd Meeting of State Level Expert Appraisal Committee-1 (SEAC-1) Date: 11th to 14th May, 2020. Important Notice 1. All Project Proponent’s and Consultants are requested to send Mobile Number, Name and email id’s of two representatives of PP and two representatives of Consultants to book for Video Conferencing and sending required information. 2. The above information shall be sent on [email protected] and Whats app Number (9820919831) of Shri.Vibhute (Sci-II, Environment Department ) by Friday (8th May) 12.00 Noon. 3. PP shall also send pdf copies of presentation, Form I/II, EMP, CER on following Whats app Number and email address of SEAC-1 Members before 10th May, 2020. Sr.No Name Mobile Number Email I’d 1 Shri. Umakant Dangat 9881899999 [email protected] 2 Shri. P. P. Nandusekar 9869440138 [email protected] 3 Shri.Kanhaiya M. Shah 9822047906 [email protected] 4 Shri. Arvind Dhole 9920266455 [email protected] 5 Shri. Hemant 7722082336 [email protected] Sahastrabuddhe 6 Shri. Abhay Thakur 9930252452 [email protected] 7 Dr. S.N. Patil 9423937400 [email protected] 8 Shri.Abhay Pimparkar 9890624888 [email protected] 4. Details of link for Video Conferencing will be communicated shortly. AGENDA Sr. Details UID No. Date Time Slot No. 1. Environmental Clearance for the production of 03524/152185 11/05/2020 11.15 AM to Pharmaceutical Excipients by G. M Chemical at plot 12.00 Noon no. C-233 and 234, TTC Industrial area, MIDC Pawane, Turbhe, Navi Mumbai by G.M. Chemical. 2. -

Ward Boundaries 1 2 3 4 5 1 Population Total-9359 SC-59

Annexure - 2 Navi Mumbai Municipal Corporation If the seat is reserved for whom i.e. whether for Name Scheduled Extent of the of the Castes/Scheduled Ward No. Ward (Area, Ward Boundaries Tribes/ Backward ward, Colony etc.) Class of Citizens or if any for women (including SC Women, ST women or BCC Women) 1 2 3 4 5 1 Ishwar Anand Nagar, North - NMMC North boundary. Population Nagar Ishwar Nagar East - NMMC East boundary. Total-9359 (Part), Bali South –From Thane Belapur Railway Line SC-598 Nagar, Mukund Boundary towards Eastern Side by road near ST-113 Colony. NMMC container toilet till eastern side mahalaxmi dairy and further Southern side till Om Sidhi Vinayak Temple and further towards eastern side by footpath till compound wall of Mukund company and further northern side in line with compoung wall of Mukund company till home of Sukhraj Kahar house number 3403 and further towards eastern side from Mukund Company till NMMC eastern side boundary. West – Thane Belapur Railway Line 2 Ram Ishwar Nagar North - From Thane Belapur Railway Line Population Nagar (Part), Ram Boundary towards Eastern Side by road near Total-8883 Nagar, Mukund NMMC container toilet till eastern side SC-867 Company. mahalaxmi dairy and further Southern side ST-141 till Om Sidhi Vinayak Temple and further towards eastern side by footpath till compound wall of Mukund company and further northern side in line with compoung wall of Mukund company till home of Sukhraj Kahar house number 3403 and further towards eastern side from Mukund Company till NMMC eastern side boundary. East -NMMC Eastern side boundary South –From Thane Belapur (road) Railway Line bridge towards southern Thane Belapur Road till in front of Sathe Nagar Junction and further eastern side MIDC service road plot no. -

Mindscapes of Space, Power and Value in Mumbai

Island Studies Journal, Vol. 9, No. 2, 2014, pp. 277-292 The epistemology of a sea view: mindscapes of space, power and value in Mumbai Ramanathan Swaminathan Senior Fellow, Observer Research Foundation (ORF) Fellow, National Internet Exchange of India (NIXI) Contributing Editor, Governance Now [email protected] ABSTRACT: Mumbai is a collection of seven islands strung together by a historically layered process of reclamation, migration and resettlement. The built landscape reflects the unique geographical characteristics of Mumbai’s archipelagic nature. This paper first explores the material, non-material and epistemological contours of space in Mumbai. It establishes that the physical contouring of space through institutional, administrative and non-institutional mechanisms are architected by complex notions of distance from the city’s coasts. Second, the paper unravels the unique discursive strands of space, spatiality and territoriality of Mumbai. It builds the case that the city’s collective imaginary of value is foundationally linked to the archipelagic nature of the city. Third, the paper deconstructs the complex power dynamics how a sea view turns into a gaze: one that is at once a point of view as it is a factor that provides physical and mental form to space. In conclusion, the paper makes the case that the mindscapes of space, value and power in Mumbai have archipelagic material foundations. Keywords : archipelago, form, island, mindscape, Mumbai, power, space, value © 2014 – Institute of Island Studies, University of Prince Edward Island, Canada. Introduction: unearthing the archipelagic historiography of Mumbai A city can best be described as a collection of spaces. Not in any ontological sense or in a physically linear form, but in an ever-changing, ever-interacting mesh of spatialities and territorialities that display the relative social relations of power existing at that particular point in time (Holstein & Appadurai, 1989). -

Study of Housing Typologies in Mumbai

HOUSING TYPOLOGIES IN MUMBAI CRIT May 2007 HOUSING TYPOLOGIES IN MUMBAI CRIT May 2007 1 Research Team Prasad Shetty Rupali Gupte Ritesh Patil Aparna Parikh Neha Sabnis Benita Menezes CRIT would like to thank the Urban Age Programme, London School of Economics for providing financial support for this project. CRIT would also like to thank Yogita Lokhande, Chitra Venkatramani and Ubaid Ansari for their contributions in this project. Front Cover: Street in Fanaswadi, Inner City Area of Mumbai 2 Study of House Types in Mumbai As any other urban area with a dense history, Mumbai has several kinds of house types developed over various stages of its history. However, unlike in the case of many other cities all over the world, each one of its residences is invariably occupied by the city dwellers of this metropolis. Nothing is wasted or abandoned as old, unfitting, or dilapidated in this colossal economy. The housing condition of today’s Mumbai can be discussed through its various kinds of housing types, which form a bulk of the city’s lived spaces This study is intended towards making a compilation of house types in (and wherever relevant; around) Mumbai. House Type here means a generic representative form that helps in conceptualising all the houses that such a form represents. It is not a specific design executed by any important architect, which would be a-typical or unique. It is a form that is generated in a specific cultural epoch/condition. This generic ‘type’ can further have several variations and could be interestingly designed /interpreted / transformed by architects. -

THE ERA of TRANSCENDENCE Ane-Dombivli a FACT-FILE on the GROWTH of NAVI MUMBAI on the GROWTH of NAVI a FACT-FILE

Redefining Real Estate www.marathonrealty.com THE ERA OF TRANSCENDENCE ane-Dombivli A FACT-FILE ON THE GROWTH OF NAVI MUMBAI ON THE GROWTH OF NAVI A FACT-FILE Corporate Address: 702 Marathon Max, Mulund-Goregaon Link Road, Mulund West, Mumbai - 400080 www.marathonrealty.com Today, nobody fails to mention Thane-Dombivli when the subject of discussion is growth of infrastructure in Mumbai and its peripheries. Belapur, Panvel, Dronagiri and even the areas beyond them are taking rapid strides towards development. It is almost astounding to see this transformation take place. This is a compilation of evidences offering a glimpse into the making of the future. 2 3 2 3 INDEX 01 THANE-DOMBIVLI – REALTY 02 INFRASTRUCTURE Why Kalyan-Dombivli will drive Mumbai’s realty market now ........................................................................................................................................08 Kalyan-Dombivli-Taloja metro under consideration: Devendra Fadnavis .....................................................................................................................20 What is special about Thane real estate ................................................................................................................................................................................11 TMT starts new service from Thane to Dombivli west - Infrastructure ..........................................................................................................................21 Thane: A residential destination in sync with -

Registered Importer of Hazardous Waste (Ferrous / Non Ferrous Metal Waste) Mentioned and Marked ** (Double Star) in Part-B of Sc

Registered Importer of Hazardous Waste (ferrous / Non ferrous Metal Waste) mentioned and marked ** (Double Star) in Part-B of Schedule-III of Hazardous Wastes (Management, Handling & Transboundry Movement) Rules, 2008 Sr. No Name & Address of the Import Material Storage Address Outward No Importer 1 M/s. MTC Business Pvt. S.No: 44 to 47, Ltd, Jawahar Industrial 301-302, Vartex Vikas, Estate, Vill: A-Wing, Kalamboli, Tal: BO/RO(HQ)/HW/Import/ Opp.Railway Station, Steel Scrap Khalapur, Dist: 2009/PA/B- 7563, Andheri (E), Mumbai- Raigad dt: 19/11/2009. 400069 Phone: (022) 26843024/25/26, Fax: (022) 26844681 Iron & Steel Scrap, 2 M/s. Karan Metals, Aluminum Scrap, Godown No: 1, BO/RO(HQ)/HW/Import/ Godown No: 1, Arihant Nickel Scrap, Arihant Compound, 2009/PA/B-7720, Compound, Vill: Val, Copper Scrap, Vill: Val, Anjur Phata, dt: 25/11/2009 Anjur Phata, Bhiwandi, Brass Scrap, Zinc Bhiwandi, Dist: Dist: Thane Dross, Zinc Scrap, Thane Magnesium Scrap & Tin Scrap Steel Scrap, 3 M/s. Linbeck Metal Aluminum Scrap, Survey No: 11/0, BO/RO(HQ)/HW/Import/ Trading (PTY) Ltd, Nickel Scrap, Brass 12/0, 16/2, Vill: 2009/PA/B-7751, Survey No: 11/0, 12/0, Scrap, Zinc, Bhokerpada, Old dt: 27/11/2009 16/2, Vill: Bhokerpada, Molybdenum, Mumbai-Pune Old Mumbai-Pune Vanadium, Cobalt Highway, Near L& T, Highway, Near L& T, Tal: & Titanium Tal: Panvel, Dist: Panvel, Dist: Raigad- Raigad-410206 410206 4 M/s. Sals Shipping Pvt. Khan Compound, BO/RO(HQ)/HW/Import/ Ltd, Khan Compound, Iron & Steel Scrap Opp. Irani Masjid, 2009/PA/B-7809, Opp. -

Mumbai Residential March 2019 Marketbeats

MUMBAI RESIDENTIAL MARCH 2019 MARKETBEATS 20% 60% 49% GROWTH IN UNIT SHARE OF MID SHARE OF EXTENDED SUBURBS L A U N C H E S ( Q o Q ) SEGMENT IN Q1 2019 IN LAUNCHES (Q1 2019) HIGHLIGHTS RENTAL VALUES AS OF Q1 2019* Average Quoted Rent QoQ YoY Short term Submarket New launches continue to grow (INR/Month) Change (%) Change (%) outlook Quarterly unit launches continued to grow in Q1 2019, recording a 20% q-o-q increase, High-end segment South 60,000 – 700,000 0% 0% with majority of project launches seen in Extended Eastern and Western Suburbs along South Central 60,000 - 550,000 0% 0% Eastern with the Thane submarket. These three submarkets contributed nearly 72% of quarterly 25,000 – 400,000 0% 0% Suburbs Western launches in Q1 2019. Major developers active during the quarter were Puranik Builders, 50,000 – 800,000 0% 0% Suburbs-Prime Lodha Group, Hiranandani Developers, Shapoorji Pallonji Real Estate and SD Corp. Mid segment Eastern 18,000 – 70,000 0% 0% Suburbs Western Affordable and mid segment driving demand 20,000 – 80,000 0% 0% Suburbs Affordable and mid-segment housing continued to remain the preferred categories for Thane 14,000 – 28,000 0% 0% buyers when making home purchase decisions. To cater to this growth segment, Navi Mumbai 10,000 – 50,000 0% 0% developers remained focused on launching projects in these segments. The share of mid- segment projects was 60% of the total unit launches during the quarter, followed by the CAPITAL VALUES AS OF Q1 2019* Average Quoted Rate QoQ YoY Short term Submarket affordable segment holding a 36% share.