Adjustable-Rate Mortgage (ARM) Is a Loan with an Interest Rate That Changes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

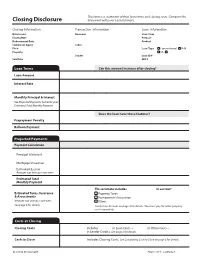

Closing Disclosure Document with Your Loan Estimate

This form is a statement of final loan terms and closing costs. Compare this Closing Disclosure document with your Loan Estimate. Closing Information Transaction Information Loan Information Date Issued Borrower Loan Term Closing Date Purpose Disbursement Date Product Settlement Agent Seller File # Loan Type Conventional FHA Property VA _____________ Lender Loan ID # Sale Price MIC # Loan Terms Can this amount increase after closing? Loan Amount Interest Rate Monthly Principal & Interest See Projected Payments below for your Estimated Total Monthly Payment Does the loan have these features? Prepayment Penalty Balloon Payment Projected Payments Payment Calculation Principal & Interest Mortgage Insurance Estimated Escrow Amount can increase over time Estimated Total Monthly Payment This estimate includes In escrow? Estimated Taxes, Insurance Property Taxes & Assessments Homeowner’s Insurance Amount can increase over time Other: See page 4 for details See Escrow Account on page 4 for details. You must pay for other property costs separately. Costs at Closing Closing Costs Includes $5,877.00 in Loan Costs + $7,642.43 in Other Costs – $0 in Lender Credits. See page 2 for details. Cash to Close Includes Closing Costs. See Calculating Cash to Close on page 3 for details. CLOSING DISCLOSURE PAGE 1 OF 5 • LOAN ID # 0000000000 This form is a statement of final loan terms and closing costs. Compare this Closing Disclosure document with your Loan Estimate. Closing Information Transaction Information Loan Information Date Issued Borrower Loan Term -

5/1 MOP Loan Program

GENERAL GUIDELINES 5/1 Maximum Loan-to-Value Ratio: Same as Standard MOP LTV Thresholds Fixed Rate Period: 5 Years ORTGAGE M Maximum Loan Term: 30 Years RIGINATION Qualifying Interest Rate: Initial 5/1 MOP Interest Rate O Minimum Interest Rate: 3.25% ROGRAM P Maximum Payment-to-Income Ratio: 40% Maximum Overall Debt-to-Income Ratio: 48% PROGRAM OVERVIEW 5/1 MOP Initial Interest Rate The 5/1 Mortgage Origination Program (5/1 MOP) loan is a fully-amortizing mortgage loan The initial fixed interest rate* in effect during the Fixed Rate that offers an initial fixed interest rate and payment for the first 5 years of the loan, after which Period of the loan is comprised of the following three (3) the loan converts to a 1-year adjustable rate mortgage (“Standard MOP”) for the remaining components: loan term. The maximum overall loan term is 30 years. All or any portion of the principal Index: 5-year Treasury Bond Yield balance may be prepaid without penalty at any time and there is no negative amortization associated with 5/1 MOP loans. For eligibility requirements, refer to the MOP Brochure. Spread: J.P. Morgan U.S. Liquid Index (JULI) Index Service Fee: .25% IMPORTANT CONSIDERATIONS: *The minimum 5/1 MOP Initial Interest Rate is 3.25% • The 5/1 MOP Initial Interest Rate may be higher or lower than the current Standard Rate offered for a Standard MOP loan. The current interest rate for each of these loan products is available at www.ucop.edu/loan-programs. QUESTIONS? • Fixed rate payments during the first 5 years of the loan provide a stable monthly payment Contact the local Campus Housing Programs to borrowers; however, there is potential for increased monthly payments when the Fixed Representative or the University of California Home Loan Rate Period ends. -

A Financial System That Creates Economic Opportunities Nonbank Financials, Fintech, and Innovation

U.S. DEPARTMENT OF THE TREASURY A Financial System That Creates Economic Opportunities A Financial System That T OF EN TH M E A Financial System T T R R A E P A E S That Creates Economic Opportunities D U R E Y H T Nonbank Financials, Fintech, 1789 and Innovation Nonbank Financials, Fintech, and Innovation Nonbank Financials, Fintech, TREASURY JULY 2018 2018-04417 (Rev. 1) • Department of the Treasury • Departmental Offices • www.treasury.gov U.S. DEPARTMENT OF THE TREASURY A Financial System That Creates Economic Opportunities Nonbank Financials, Fintech, and Innovation Report to President Donald J. Trump Executive Order 13772 on Core Principles for Regulating the United States Financial System Steven T. Mnuchin Secretary Craig S. Phillips Counselor to the Secretary T OF EN TH M E T T R R A E P A E S D U R E Y H T 1789 Staff Acknowledgments Secretary Mnuchin and Counselor Phillips would like to thank Treasury staff members for their contributions to this report. The staff’s work on the report was led by Jessica Renier and W. Moses Kim, and included contributions from Chloe Cabot, Dan Dorman, Alexan- dra Friedman, Eric Froman, Dan Greenland, Gerry Hughes, Alexander Jackson, Danielle Johnson-Kutch, Ben Lachmann, Natalia Li, Daniel McCarty, John McGrail, Amyn Moolji, Brian Morgenstern, Daren Small-Moyers, Mark Nelson, Peter Nickoloff, Bimal Patel, Brian Peretti, Scott Rembrandt, Ed Roback, Ranya Rotolo, Jared Sawyer, Steven Seitz, Brian Smith, Mark Uyeda, Anne Wallwork, and Christopher Weaver. ii A Financial System That Creates Economic -

Agency Guideline Revisions Note: Suntrust Mortgage Specific Overlays Are Underlined

Agency Guideline Revisions Note: SunTrust Mortgage specific overlays are underlined. Impacted Revised Guidelines Topic Impacted Products Current Guidelines Document Effective Immediately for NEW AND EXISTING Loan Applications ON OR After May 26, 2017 Appraisal Correspondent HomeReady® Appraisal Analysis: Agency Loan Programs / Improvements Section of the Appraisal Report Appraisal Analysis: Agency Loan Programs / Improvements Section of the Appraisal Report Requirements Section 1.07 Mortgage / Accessory Appraisal- (non-AUS & Non-AUS Non-AUS Units Guideline DU) Note: Below is an EXCERPT only of the guidance from the above referenced section. All other currently published Note: Below is an EXCERPT only of the guidance from the above referenced section. All other currently published Home guidelines from this section remain the same. guidelines from this section remain the same. Possible® Accessory Units Accessory Units Mortgage Fannie Mae will purchase a one-unit property with an accessory unit. An accessory unit is typically an Fannie Mae will purchase a one-unit property with an accessory unit. An accessory unit is typically an (LPA) additional living area independent of the primary dwelling unit, and includes a fully functioning additional living area independent of the primary dwelling unit, and includes a fully functioning kitchen and bathroom. Some examples may include a living area over a garage and basement units. kitchen and bathroom. Some examples may include a living area over a garage and basement units. Whether a property is defined as a one-unit property with an accessory unit or a two-unit property Whether a property is defined as a one-unit property with an accessory unit or a two-unit property will be based on the characteristics of the property, which may include, but are not limited to, the will be based on the characteristics of the property, which may include, but are not limited to, the existence of separate utilities, a unique postal address, and whether the unit is rented. -

Managing Environmental Liabilities in Bankruptcy

I N S I D E T H E M I N D S Managing Environmental Liabilities in Bankruptcy Leading Lawyers on Identifying Environmental Risks, Implementing Emerging Risk Transfer Strategies, and Navigating Current Trends in U.S. Environmental Liability ©2010 Thomson Reuters/Aspatore All rights reserved. Printed in the United States of America. No part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, except as permitted under Sections 107 or 108 of the U.S. Copyright Act, without prior written permission of the publisher. This book is printed on acid free paper. Material in this book is for educational purposes only. This book is sold with the understanding that neither any of the authors nor the publisher is engaged in rendering legal, accounting, investment, or any other professional service. Neither the publisher nor the authors assume any liability for any errors or omissions or for how this book or its contents are used or interpreted or for any consequences resulting directly or indirectly from the use of this book. For legal advice or any other, please consult your personal lawyer or the appropriate professional. The views expressed by the individuals in this book (or the individuals on the cover) do not necessarily reflect the views shared by the companies they are employed by (or the companies mentioned in this book). The employment status and affiliations of authors with the companies referenced are subject to change. Aspatore books may be purchased for educational, business, or sales promotional use. -

World Bank Document

48165 THE WORLD BANK PRINCIPLES AND GUIDELINES FOR Public Disclosure Authorized EFFECTIVE INSOLVENCY AND CREDITOR RIGHTS SYSTEMS April 2001 Effective insolvency and creditor rights systems are an important element of financial system stability. The Bank accordingly has been working with partner organizations to develop principles on insolvency and creditor rights systems. Those principles will be used to guide system reform and benchmarking in developing countries. The Principles and Guidelines are a distillation of international Public Disclosure Authorized best practice on design aspects of these systems, emphasizing contextual, integrated solutions and the policy choices involved in developing those solutions. While the insolvency principles focus on corporate insolvency, substantial progress has been made in identifying issues relevant to developing principles for bank and systemic insolvency, areas in which the Bank and the Fund, as well as other international organizations, will continue to collaborate in the coming months. These issues are discussed in more detail in the annexes to the paper. The Principles and Guidelines will be used in a series of experimental country assessments in connection with the program to develop Reports on the Observance of Standards and Codes (ROSC), using a common template based on the principles. In addition, the Bank is collaborating with UNCITRAL and other institutions to develop a more elaborate set of implementational guidelines based Public Disclosure Authorized on the principles. If you have -

Borrower Legal Opinion

Borrower Opinion (Massachusetts Sample) Document 5037B www.leaplaw.com Access to this document and the LeapLaw web site is provided with the understanding that neither LeapLaw Inc. nor any of the providers of information that appear on the web site is engaged in rendering legal, accounting or other professional services. If you require legal advice or other expert assistance, you agree that you will obtain the services of a competent, professional person and will not rely on information provided on the web site as a substitute for such advice or assistance. Neither the presentation of this document to you nor your receipt of this document creates an attorney-client relationship. [DATE] [LENDER NAME] [LENDER ADDRESS] Re: [LOAN] Ladies and Gentlemen: We represent: (a) [NAME OF BORROWER], a ______________[ corporation/limited liability company] (the “Borrower”), (b) [NAME OF PROPERTY OWNER], a ______________ [corporation/limited liability company] (the “Property Owner”), of which the Borrower is the [sole member], and which itself is the owner of certain real property known as [NAME OF PROPERTY] [LOCATION] (the “Real Property”), and (c) [INSERT GUARANTORS NAMES] (individually each a “Guarantor” and referred to herein, collectively, as the “Guarantors”) in connection with a loan in the stated principal amount of $______________ (the “Loan”) made by ______________ (the “Lender”) to Borrower as of the date hereof. This opinion is rendered to you as a condition of your making the Loan. In connection with this opinion, we have examined and relied on copies of each of the following (including the documents listed below which evidence and secure the Loan each of which are dated as of [DATE] unless otherwise indicated below): 1. -

Chapter 6 Compliance, Enforcement, Appeals

6. COMPLIANCE, ENFORCEMENT, APPEALS – 129 Chapter 6 Compliance, enforcement, appeals Whilst adoption and communication of a law sets the framework for achieving a policy objective, effective implementation, compliance and enforcement are essential for actually meeting the objective. An ex ante assessment of compliance and enforcement prospects is increasingly a part of the regulatory process in OECD countries. Within the EU's institutional context these processes include the correct transposition of EU rules into national legislation (this aspect will be considered in chapter 9). The issue of proportionality in enforcement, linked to risk assessment, is attracting growing attention. The aim is to ensure that resources for enforcement should be proportionately higher for those activities, actions or entities where the risks of regulatory failure are more damaging to society and the economy (and conversely, proportionately lower in situations assessed as lower risk). Rule-makers must apply and enforce regulations systematically and fairly, and regulated citizens and businesses need access to administrative and judicial review procedures for raising issues related to the rules that bind them, as well as timely decisions on their appeals. Tools that may be deployed include administrative procedures acts, the use of independent and standardised appeals processes,1 and the adoption of rules to promote responsiveness, such as “silence is consent”.2 Access to review procedures ensures that rule-makers are held accountable. Review by the judiciary of administrative decisions can also be an important instrument of quality control. For example scrutiny by the judiciary may capture whether subordinate rules are consistent with the primary laws, and may help to assess whether rules are proportional to their objective. -

Bankruptcy Code Section 523.Pdf

Page 133 TITLE 11—BANKRUPTCY § 523 ‘‘(C)(i) a tax lien, notice of which is properly filed; ‘‘2,950’’ was adjusted to ‘‘3,225’’; in subsec. (d)(3), dollar and amounts ‘‘475’’ and ‘‘9,850’’ were adjusted to ‘‘525’’ and ‘‘(ii) avoided under section 545(2) of this title.’’ ‘‘10,775’’, respectively; in subsec. (d)(4), dollar amount Subsec. (d)(3). Pub. L. 98–353, § 306(b), inserted ‘‘or ‘‘1,225’’ was adjusted to ‘‘1,350’’; in subsec. (d)(5), dollar $4,000 in aggregate value’’. amounts ‘‘975’’ and ‘‘9,250’’ were adjusted to ‘‘1,075’’ and Subsec. (d)(5). Pub. L. 98–353, § 306(c), amended par. (5) ‘‘10,125’’, respectively; in subsec. (d)(6), dollar amount generally. Prior to amendment, par. (5) read as follows: ‘‘1,850’’ was adjusted to ‘‘2,025’’; in subsec. (d)(8), dollar ‘‘The debtor’s aggregate interest, not to exceed in value amount ‘‘9,850’’ was adjusted to ‘‘10,775’’; in subsec. $400 plus any unused amount of the exemption provided (d)(11)(D), dollar amount ‘‘18,450’’ was adjusted to under paragraph (1) of this subsection, in any prop- ‘‘20,200’’; in subsec. (f)(3), dollar amount ‘‘5,000’’ was ad- erty.’’ justed to ‘‘5,475’’; in subsec. (f)(4), dollar amount ‘‘500’’ Subsec. (e). Pub. L. 98–353, § 453(c), substituted ‘‘an ex- was adjusted to ‘‘550’’ each time it appeared; in subsec. emption’’ for ‘‘exemptions’’. (n), dollar amount ‘‘1,000,000’’ was adjusted to Subsec. (m). Pub. L. 98–353, § 306(d), substituted ‘‘Sub- ‘‘1,095,000’’; in subsec. (p), dollar amount ‘‘125,000’’ was ject to the limitation in subsection (b), this section adjusted to ‘‘136,875’’; and, in subsec. -

Overdraft: Payment Service Or Small-Dollar Credit?

March 16, 2020 Overdraft: Payment Service or Small-Dollar Credit? Funding Gaps in Consumer Finances Figure 1. Annual Interest and Noninterest Income One of the earliest documented cases of bank overdraft U.S. Commercial Banks, 1970-2018 ($ millions) dates back to 1728, when a Royal Bank of Scotland customer requested a cash credit to allow him to withdraw more money from his account than it held. Three centuries later, technologies, such as electronic payments (e.g., debit cards) and automated teller machines (ATMs), changed the way consumers use funds for retail purchases, transacting more frequently and in smaller denominations. Accordingly, today’s financial institutions commonly offer point-of-sale overdraft services or overdraft protection in exchange for a flat fee around $35. Although these fees can be large relative to the transaction, alternative sources of short-term small-dollar funding, such as payday loans, deposit advances, and installment loans, can be costly as well. Congress has taken an interest in the availability and cost of providing consumers funds to meet Source: Federal Deposit Insurance Corporation (FDIC). their budget shortfalls. Legislation introduced in the 116th Congress (H.R. 1509/S. 656 and H.R. 4254/S. 1595) as well Banks generate noninterest income in a number of ways. as the Federal Reserve’s real-time payments initiative could For example, a significant source of noninterest income impact consumer use of overdraft programs in various comes from collecting fees for deposit accounts services, ways. (See “Policy Tools and Potential Outcomes” below such as maintaining a checking account, ATM withdrawals, for more information.) The policy debate around this or covering an overdraft. -

LOAN RATES America First Credit Union Offers Members Competitive Loan Rates, Listed Below

LOAN RATES America First Credit Union offers members competitive loan rates, listed below. The annual percentage rates (APR) quoted are based on approved credit. Rates may be higher, depending on your credit history and other underwriting factors. Our loan offices will discuss your application and available rates with you. Variable APRs may increase or decrease monthly. Go to americafirst.com or call 1-800-999-3961 for more information. EFFECTIVE: OCTOBER 1, 2021 VARIABLE APR FIXED APR FEE DISCLOSURES VEHICLE 2.99% - 18.00% 2.99% - 18.00% ANNUAL PERCENTAGE RATE (APR) FOR PURCHASES 60-MONTH DECLINING RATE AUTO N/A 3.24% - 18.00% When you open your account, the applicable APR is based on creditworthiness. SMALL RV LOAN 4.49% - 15.24% 5.49% - 16.24% After that, your APR will vary with the market based on the Prime Rate. RV LOAN 4.49% - 15.74% 5.49% - 16.74% APR FOR CASH ADVANCES & BALANCE TRANSFERS When you open your account, the applicable APR is based on creditworthiness. RV BALLOON N/A 5.49% - 6.74% After that, your APR will vary with the market based on the Prime Rate. PERSONAL 8.49% - 18.00% 9.49% - 18.00% HOW TO AVOID PAYING INTEREST ON PURCHASES LINE OF CREDIT 15.24% - 18.00% Your due date is the 28th day of each month. We will not charge any interest on the portion of the purchases balance that you pay by the due date each month. SHARE-SECURED LINE OF CREDIT 3.05% FOR CREDIT CARD TIPS FROM THE CONSUMER FINANCIAL PROTECTION CONSUMER SHARE LOAN + 3.00% BUREAU CREDIT BUILDER PLUS 10.00% To learn more about factors to consider when applying for or using a credit card, visit the Consumer Financial Protection Bureau at CERTIFICATE ACCOUNT * 3.00% consumerfinance.gov/learnmore. -

How to Become a Mortgage Broker

HOW TO BECOME A MORTGAGE BROKER What is a Mortgage Broker? A Mortgage Broker is a go-between between the borrower and the lender (usually a bank), who negotiates the loan on your behalf. They will research products on the market from the hundreds available, and then support the customer through the application and settlement process. They facilitate the transaction between the lender and the borrower. A Mortgage Broker will look at the client’s specific needs and circumstances and should be able to interpret which type of loan best suits their client and why. They will look at the different aspects of a loan application, present their client's application in its most positive light, rather than just seeing whether it meets a checklist or not. Good Mortgage Brokers will 'follow up' approvals for their clients. The service offered by Mortgage Brokers doesn’t stop with just submitting the loan application, it continues right up to and after settlement. A Mortgager Broker should be trying to minimise the legwork and hassle for their clients, and remain available to answer any questions they may have, even well after the loan settles. The Role or Job Description of a Mortgage Broker A Mortgage Broker serves as a financial expert, retained by a homeowner or homebuyer to explore financing options for real estate purchases or refinancing, and to take care of the loan origination process up to the point of disbursing the funds. Armed with credit and financial information from the potential borrower, a Mortgage Broker uses a network of lenders and institutions to find a loan that suits the needs and desires of the buyer, then negotiates with the lender to secure terms and options for the buyer.