Be That at Were to Little Staying Eating in Tle Rock.”

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Restaurant Instagram Report Q2 2013

MomentFeed Index: Restaurant Instagram Report Q2 2013 MomentFeed Index: Restaurant Instagram Report, Q2 2013 MomentFeed.com Overview Instagram has quickly become one of the most popular social tools for consumers. With 130 For restaurant brands specifically, the visual storytelling that Instagram enables represents a million monthly active users taking 45 million photos per day as of August 2013, the “fast, tremendous opportunity in 2013 and beyond as customers capture their experiences in real beautiful and fun way to share your life with friends through a series of pictures” has created a time and share them with the world through the Instagram app. Several restaurants are off to a way for anyone to create visual content about their experiences and share their moments. great start, and this report takes a closer look at these brands. For brands, Instagram represents a new marketing channel in a number of ways. In addition Based on data captured by the MomentFeed marketing platform for 65 top restaurant brands, to taking photos themselves, brands can leverage content created by customers and fans the report breaks down Instagram performance in terms of total number of photos, average by, for example, sharing customer photos across other channels such as Facebook to reach number of photos per location, and photos as a percentage of check-ins. The report only additional fans. The comment feature also enables direct communication with customers. counts Instagram photos that have been explicitly place-tagged to a restaurant’s location between April 1 and June 30, 2012. MomentFeed Index: Restaurant Instagram Report, Q2 2013 MomentFeed.com Total Number of Instagram Photos 1. -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

Case 14 Outback Steakhouse: Going International*

CTAC14 4/17/07 14:02 Page 245 case 14 Outback Steakhouse: Going International* By 1995, Outback Steakhouse was one of the fastest growing and most acclaimed restaurant chains in North America. Astute positioning within the intensely- competitive US restaurant business, high quality of food and service, and a relaxed ambiance that echoed its Australian theme propelled the chain’s spectacular growth (see table 14.1). Chairman and co-founder Chris Sullivan believed that at the current rate of growth (around 70 new restaurants each year), Outback would be facing mar- ket saturation within five years. Outback’s growth opportunities were either to diversify into alternative restaurant concepts (it had already started its Carrabba’s Italian Grill restaurants) or to expand internationally: We can do 500–600 [Outback] restaurants, and possibly more over the next five years . [however] the world is becoming one big market, and we want to be in place so we don’t miss that opportunity. There are some problems, some challenges with it, but at this point there have been some casual restaurant chains that have gone [outside the United States] and their average unit sales are way, way above the sales level they enjoyed in the United States. So the potential is there. Obviously, there are some distribution issues to work out, things like that, but we are real excited about the future internationally. That will give us some potential outside the United States to continue to grow as well. In late 1994, Hugh Connerty was appointed President of Outback Inter- national to lead the company’s overseas expansion. -

HOSPITALITY GUIDE 10 H P INDEPENDENCE 40 Harry’S Steakhouse

2 90 COZUMEL RESTAURANTE TAVERN OF INDEPENDENCE 271 MBASSY UITES DOWNTOWN COURTYARD MARRIOTT 6 E S N 38 3 90 CLEVELAND 11 AMERICA’S BEST VALUE 77 RESTAURANT & 71 2 1 INN & SUITES EMBASSY GRILLE 480 16 422 YATT LACE 80 HOSPITALITY GUIDE 10 H P INDEPENDENCE 40 HARRY’S STEAKHOUSE 80 271 480 17 77 14 SPRINGHILL SUITES BY MARRIOTT 71 8 80 LONGHORN STEAKHOUSE VERSO 22 7 HAmpTON INN 77 21 L.A. PETE’S 3 AppLEBEE’S 3 6 10 13 RESIDENCE INN 16 14 13 7 28 OUTBACK STEAKHOUSE IBAchI APANESE TEAKHOUSE 22 HOLIDAY INN 18 H J S 41 9 8 3 28 21 8 SLYMAN’S TAVERN ZOUP! 35 44 8 35 1 HOME2 SUITES BY HILTON 25 36 9 18 44 10 CHIPOTLE ROCKSIDE 39 10 5 4 7 42 WASABI JAPANESE STEAK HOUSE & SUSHI BAR 4 14 30 41 ROAD 12 24 43 15 26 20 1 ALADDIN’S EATERY 34 29 23 8 BONEFISH GRILL 25 MIchAEL’S GRILL 11 13 5 2 31 36 STARBUCKS 42 WENDY’S 39 THAI GOURMET ROMITO’S PIZZA 7 BOB EVANS 5 AURA BISTRO & LOUNGE 4 AUGIE’S PIZZA 32 14 DENNY’S DAIRY KING 12 26 NAF NAF GRILL SUBWAY 37 6 19 27 O 8HIYO6 4 CROWNE PLAZA 30 POTBELLY SANDWIch SHOP 33 HONEY BAKED HAM BABES CAFÉ AND BAKERY 34 SHULA’S 2 STEAK & SPORTS 13 DELMONICO’S STEAKHOUSE SCRATch RESTAURANT C ONALD S JImmY JOHN’S 23 M D ’ 5 DOUBLETREE 24 MELT BAR 20 43 WINKING LIZARD TAVERN & GRILLED 12 RED ROOF INN 31 RED ROBIN 2 COMFORT INN 11 LA QUINTA INN 29 PANERA BREAD CHINA KING 15 DIBELLA’S OLD FASHIONED SUBMARINES 9 2 ANGIE’S PIZZA RESTAURANTS HOTELS DELIVERY AVAILABLE RESTAURANT & HOSPITALITY GUIDE RESTAURANT & RESTAURANTS 10. -

Agenda Item 7

Item Number: AGENDA ITEM 7 TO: CITY COUNCIL Submitted By: Douglas D. Dumhart FROM: CITY MANAGER Community Development Director Meeting Date: Subject: Conceptual Review of a Proposal for the July 19, 2011 Development of a Chase Bank at 5962 La Palma Avenue RECOMMENDATION: It is recommended that the City Council conceptually approve a proposal for the development of a Chase Bank at 5962 La Palma Avenue and direct staff to draft a Zoning Code Text Amendment and Development Agreement for further consideration. SUMMARY: The City has received a letter from Studley, the real estate brokerage firm representing the property owner at 5962 La Palma Avenue, requesting that the City consider the development of a JP Morgan Chase Bank on their property. The letter is provided as Attachment 1 to this report. The site is located at the southwest corner of Valley View Street and La Palma Avenue and has been vacant for over 10 years. Late last year, the subject parcel was rezoned from Neighborhood Commercial (NC) to Planned Neighborhood Development (PND) land use designation, which prohibits financial institutions and banks. The Broker has stated that they have exhausted attempts to find end users for his client’s property that are consistent with the goals of the new PND Zone and that meet the needs of his client. They have a ground lease offer from Chase to develop a free-standing bank. The financial institution use alone does not meet the requirements in the PND Zoning District to develop the commercial corner with retail uses that are lacking in the community. -

The Poor Credit Mall Poor Credit

The PPooroor CCredit Mall Companies in this faux mall are rated as speculative investments at Moody’s and S&P as of April 13. These stores are already in financial trouble, and may not be able to access government stimulus money. The stores with the worst ratings are closer to the top of the mall. Brands that are part of the same company, like the Gap and Old Navy, are included in the same storefront. Store footprint is relative to company revenue Lowest-rated stores Less than More than Specialty $1 billion $20 billion S1 GNC Near or in default, they have a low likelihood of recovering Restaurants Moody’s rates: Ca, CC R1 Steak ‘n Shake S&P rates: CC, C, D Restaurants Department Stores GPS Hospitality Holding owns R1 Red Lobster franchises for these chains D1 J.C. Penney R2 Burger King / Popeyes / Pizza Hut D2 Belk R3 Qdoba D3 Neiman Marcus R4 P.F. Chang’s China Bistro R5 California Pizza Kitchen R6 Chuck E. Cheese R7 Fogo de Chao Low-rated stores Poor-quality investment ratings with a very high credit risk Moody’s: Caa1, Caa2, Caa3 S&P: CCC Apparel Specialty Automotive A1 J. Jill S1 Main Event S5 Guitar Center A2 S2 S6 Talbots Same Petco At Home M1 AutoNation A3 J. Crew company S3 Jo-Ann S7 Bob’s Discount Furniture M2 Service King A4 S4 Party City S8 99 Cents Only Stores Specialty S1 Bed Bath & Beyond S5 Camping World S2 GameStop S6 Bass Pro Shops S3 S7 Conn’s HomePlus S4 PetSmart S8 Spencer’s / Spirit Halloween Medium-rated stores able to meet financial commitments Moody’s: B1, B2, B3 S&P: B Apparel Carrols Restaurant A1 Victoria’s Secret / Bath & Body Works / Pink Restaurants Group owns franchises A2 Abercrombie & Fitch / Abercrombie Kids / Hollister for these chains A3 Men’s Wearhouse / Moores / JoS. -

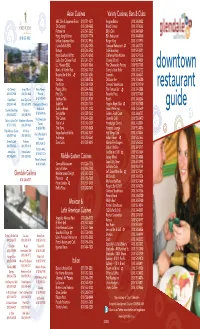

Resturant Map 2013 2/27/13 9:12 AM Page 1

Resturant Map 2013 2/27/13 9:12 AM Page 1 Asian Cuisines Variety Cuisines, Bars & Clubs ABC Chin & Japanese Food (818) 551-1677 Angelas Bistro (818) 240-0382 Chi Dynasty (818) 500-9888 Brand Terrace (818) 242-6565 Fortune Inn (818) 547-2832 Billy’s Deli (818) 246-1689 (818) 637-8982 Hong Kong Kitchen (818) 247-7774 BJ’s Restaurant (818) 844-0160 Ichiban Japanese Rest. (818) 242-9966 Burger King (818) 247-1914 I Love Tofu & BBQ (818) 242-0505 Carousel Restaurant (818) 246-7775 Katsuya (818) 244-5900 Café Broadway (818) 549-0311 Kyoto Seafood Buffett (818) 243-8168 California Pizza Kitchen (818) 507-1558 Lucky Star Chinese Food (818) 241-0211 Charles Billiard (818) 547-4859 L.L. Hawaiin BBQ (818) 637-8566 The Cheesacake Factory (818) 550-7505 Max’s of Manila Rest. (818) 637-7751 Clancy’s Crab Boiler (818) 242-2722 downtown Noypitz Bar & Grill (818) 247-6256 Conrad’s (818) 246-6547 Octopus (818) 500-8788 DA Juice Bar (818) 243-6200 Panda Inn (818) 502-1234 Damon’s Steakhouse (818) 507-1510 Chi Dynasty Jersey Mike's Richie Palmer's restaurant Peking China (818) 244-9888 The Famous Bar (818) 241-2888 (818) 500-9888 (818) 281-4888 Pizzeria Pho City (818) 555-3888 Favorite Place (818) 507-7409 CrepeMaker Jewel City Diner (818) 240-4440 Sedthee Thai (818) 247-9789 Foxy’s (818) 246-0244 (818) 243-1445 (818) 637-8998 Starbucks at Barnes & Sushi Kai (818) 243-7393 Giggles Night Club (818) 500-7800 guide Crumbs Bake Shop Katsuya Noble Café Sushi on Brand (818) 241-0133 Great White Hut (818) 243-5619 (818) 502-0050 (818) 244-5900 (818) 545-9146 Teriyaki -

Coast Packing/R&E Racing Team Returns to Georgia for Duck X

For Immediate Release Coast Packing/R&E Racing Team Returns to Georgia For Duck X Productions ‘Lights Out12,’ With World’s Fastest Radial Cars -- and Refreshed #FatMap229 Time Again for Fowl Play as R&E Racing’s Jason Lee Pilots Coast Packing’s ’69 Noonan Hemi ProCharger Pro Mod Camaro at Feb. 25-28 Event in Adel VERNON, Calif. (Feb. 22, 2021) – Returning to South Georgia Motor Sports Park (SGMP) in Adel on February 25-28 with radial tires and 3500 horses in tow, Coast Packing Company’s R&E Racing will uncork its ’69 Noonan Hemi ProCharger Pro Mod Camaro at Duck X Productions’ “LightsOut 12” (http://www.racedxp.com/), with “takeout or delivery” #FatMap229. For the event, Coast CEO Eric R. “Goose” Gustafson will yield the wheel to veteran driver Jason Lee. Showcasing the “baddest Radial vs. the World” cars, Duck X Productions LLC will welcome R&E Racing’s return to Adel, just months aFter its appearance in October’s Sweet 16 3.0 and its runner-up finish at SGMP at “No Mercy,” the week after Sweet 16 3.0 – “a pretty incredible feat considering it was the first time the car raced on Radial tires,” Gustafson says. For this pre-season stop, Coast Packing, the leading supplier oF animal Fat shortenings in the Western U.S., has assembled a reFreshed and expanded online gastronomic #FatMap229 (https://batchgeo.com/map/c1b794056f39142b0403de76ce703bdd), highlighting local spots where fans can “Taste the Difference” that lard and beeF tallow make in popular dishes, for take-out or delivery. Proximate to Valdosta, Georgia, Tallahassee and Jacksonville, Florida, and the OkeFenokee National WildliFe ReFuge, Adel is part oF the taste of the deep South. -

Restaurant Market Potential

Restaurant Market Potential CAROL STREAM Prepared by Esri Area: 9.46 square miles Demographic Summary 2020 2025 Population 39,598 39,443 Population 18+ 30,887 30,958 Households 14,440 14,441 Median Household Income $84,909 $90,921 Expected Number of Product/Consumer Behavior Adults Percent MPI Went to family restaurant/steak house in last 6 months 24,146 78.2% 106 Went to family restaurant/steak house 4+ times/month 9,030 29.2% 112 Spent at family restaurant last 30 days: <$1-30 2,126 6.9% 87 Spent at family restaurant last 30 days: $31-50 2,980 9.6% 105 Spent at family restaurant last 30 days: $51-100 5,483 17.8% 120 Spent at family restaurant last 30 days: $101-200 3,554 11.5% 123 Went to family restaurant last 6 months: for breakfast 4,564 14.8% 114 Went to family restaurant last 6 months: for lunch 6,222 20.1% 109 Went to family restaurant last 6 months: for dinner 15,570 50.4% 111 Went to family restaurant last 6 months: for snack 629 2.0% 104 Went to family restaurant last 6 months: on weekday 10,177 32.9% 111 Went to family restaurant last 6 months: on weekend 14,173 45.9% 114 Went to family restaurant last 6 months: Applebee`s 6,222 20.1% 101 Went to family restaurant last 6 months: Bob Evans 732 2.4% 79 Went to family restaurant last 6 months: Buffalo Wild Wings 3,377 10.9% 114 Went to family restaurant last 6 months: California Pizza Kitchen 888 2.9% 108 Went to family restaurant last 6 months: The Cheesecake Factory 2,868 9.3% 132 Went to family restaurant last 6 months: Chili`s Grill & Bar 4,148 13.4% 127 Went to family restaurant -

Teamrolls 009 Sales

18 ARKANSAS BUSINESS MARCH 1, 2010 Overview Golden Corral Steamrolls Highest-Grossing Restaurants BENTONVILLE 2009 Revenue 2008 Revenue % Change 1 Eurest Dining (Wal-Mart cafeteria) $4,815,437 $4,574,136 5% Red Lobster in 2009 Sales 2 Chick-fil-A* $2,399,200 $1,613,884 49% 3 McDonald’s (South Walton Boulevard) $2,376,400 $2,395,600 -1% By Robert Bell ator at Little Rock National Airport, 4 McDonald’s (Southeast 14th Street) $2,063,000 $2,109,400 -2% [email protected] by less than $5,000 — a fraction of a 5 McDonald’s (Peach Orchard) $1,888,800 $1,946,700 -3% percent for establishments that both 6 Sam’s Club $1,768,200 $1,840,770 -4% T ALMOST HAPPENED IN 2008, sold nearly $4.3 million worth of food 7 Wal-Mart Supercenter Deli $1,690,000 $1,680,757 1% but this time there seems to be no last year. 8 Lin’s Garden Chinese Restaurant $1,625,800 $1,777,300 -9% Iquestion: Golden Corral was the Despite holding on to the Little 9 Sonic Drive-In (Southeast 14th Street) $1,586,900 $1,556,000 2% heavyweight champion among North Rock list’s top spot, HMSHost’s food 10 Taco Bell (South Walton Boulevard) $1,559,900 $1,549,523 1% Little Rock restaurants in 2009 with revenue was off almost 6 percent — food sales that topped $6 million. not surprising during a year in which Source: Bentonville Advertising & Promotion Commission *Opened in April 2008 Perennial champ Red Lobster on air travel was also sluggish. -

ENTERPRISE PLAZA 4816 Milan Road (US 250) Sandusky, Ohio (Perkins Township)

ENTERPRISE PLAZA 4816 Milan Road (US 250) Sandusky, Ohio (Perkins Township) Space from 1,500 to 3,000 sq. ft. Available December 2013 Signage on building and pylon sign Located on US 250, directly in front of Meijer Access to 2 traffic signals Lease rate: $20 per sq. ft. NNN Kula Hoty Lynch 419-609-7000 [email protected] 4918 Milan Road • Sandusky, Ohio 44870 • (419) 609-7000 • (800) 416-4689 • www.hoty.com Brokerage • Leasing • Project Development • Construction Management • Site Selection • Consulting SITE: 4816 Milan Road Also for sale/lease by Enterprise Plaza Hoty Enterprises Sandusky (Perkins Twp.), Ohio 1. Commerce Plaza: Plato’s Closet, AAA, Jimmy John’s, AT&T, Menchie’s 2. Lee’s Famous Recipe 3. Wendy’s 10 4. Goodyear 5. Clean Scene 6. Five Guys 9 7. Available site - call for details! 8. Bob Evans 11 9. Red Lobster 10. Sandusky Pavilion: Target, 12 15 ULTA, Dick’s Sporting Goods, Old Navy, Bed Bath & Beyond 1 13 11. Pizza Hut 2 12. McDonald’s 3 14 13. Best Buy 4 14. Cracker Barrel 5 16 15. Chipotle 6 16. Sandusky Mall: Macy’s, Sears, 7 JCPenney 17. Great Wolf Lodge 8 18. Steak ‘N Shake 19. Meijer 20. Starbucks/Cold Stone Creamery 21. Outback Plaza: TanPro, Sprint, Outback Steakhouse, H&R Block, Subway, Best Cuts, SVS 17 Vision, Miracle-Ear 22. Park Place Plaza: Lowe’s, 18 Staples, Toys R Us 23. Fazoli’s 24. Pier 1 Imports 19 25. Chili’s Grill & Bar 26. Walmart Supercenter 27. Quarry’s Edge: Mattress Matters, Performance Vision 28. -

Edinburg Restaurant Market Potential

Restaurant Market Potential Shoppes at Rio Grande Valley Prepared by The Canvass Group 419 E Trenton Rd, Edinburg, Texas, 78539 Latitude: 26.26144 Drive Time: 5 minute radius Longitude: -98.16832 Demographic Summary 2018 2023 Population 19,833 22,345 Population 18+ 13,885 15,644 Households 5,697 6,433 Median Household Income $50,230 $58,724 Expected Number of Product/Consumer Behavior Adults Percent MPI Went to family restaurant/steak house in last 6 mo 10,854 78.2% 104 Went to family restaurant/steak house 4+ times/mo 3,884 28.0% 104 Spent at family restaurant/30 days: <$31 1,082 7.8% 89 Spent at family restaurant/30 days: $31-50 1,532 11.0% 111 Spent at family restaurant/30 days: $51-100 2,323 16.7% 108 Spent at family restaurant/30 days: $101-200 1,476 10.6% 114 Spent at family restaurant/30 days: $201-300 356 2.6% 103 Family restaurant/steak house last 6 months: breakfast 2,059 14.8% 111 Family restaurant/steak house last 6 months: lunch 3,135 22.6% 116 Family restaurant/steak house last 6 months: dinner 6,617 47.7% 102 Family restaurant/steak house last 6 months: snack 410 3.0% 150 Family restaurant/steak house last 6 months: weekday 4,097 29.5% 96 Family restaurant/steak house last 6 months: weekend 6,378 45.9% 108 Fam rest/steak hse/6 months: Applebee`s 2,713 19.5% 87 Fam rest/steak hse/6 months: Bob Evans Farms 265 1.9% 52 Fam rest/steak hse/6 months: Buffalo Wild Wings 1,802 13.0% 124 Fam rest/steak hse/6 months: California Pizza Kitchen 342 2.5% 88 Fam rest/steak hse/6 months: Carrabba`s Italian Grill 591 4.3% 141 Fam rest/steak