Leading the Transformation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download PDF, 19 Pages, 505.25 KB

VOLKSWAGEN AKTIENGESELLSCHAFT Shareholdings of Volkswagen AG and the Volkswagen Group in accordance with sections 285 and 313 of the HGB and presentation of the companies included in Volkswagen's consolidated financial statements in accordance with IFRS 12 as of 31.12.2019 Exchange rate VW AG 's interest Equity Profit/loss (1€ =) in capital in % in thousands, in thousands, Name and domicile of company Currency Dec. 31, 2019 Direct Indirect Total local currency local currency Footnote Year I. PARENT COMPANY VOLKSWAGEN AG, Wolfsburg II. SUBSIDIARIES A. Consolidated companies 1. Germany ASB Autohaus Berlin GmbH, Berlin EUR - 100.00 100.00 16,272 1,415 2018 AUDI AG, Ingolstadt EUR 99.64 - 99.64 13,701,699 - 1) 2019 Audi Berlin GmbH, Berlin EUR - 100.00 100.00 9,971 - 1) 2018 Audi Electronics Venture GmbH, Gaimersheim EUR - 100.00 100.00 60,968 - 1) 2019 Audi Frankfurt GmbH, Frankfurt am Main EUR - 100.00 100.00 8,477 - 1) 2018 Audi Hamburg GmbH, Hamburg EUR - 100.00 100.00 13,425 - 1) 2018 Audi Hannover GmbH, Hanover EUR - 100.00 100.00 16,621 - 1) 2018 AUDI Immobilien GmbH & Co. KG, Ingolstadt EUR - 100.00 100.00 82,470 3,399 2019 AUDI Immobilien Verwaltung GmbH, Ingolstadt EUR - 100.00 100.00 114,355 1,553 2019 Audi Leipzig GmbH, Leipzig EUR - 100.00 100.00 9,525 - 1) 2018 Audi München GmbH, Munich EUR - 100.00 100.00 270 - 1) 2018 Audi Real Estate GmbH, Ingolstadt EUR - 100.00 100.00 9,859 4,073 2019 Audi Sport GmbH, Neckarsulm EUR - 100.00 100.00 100 - 1) 2019 Audi Stuttgart GmbH, Stuttgart EUR - 100.00 100.00 6,677 - 1) 2018 Auto & Service PIA GmbH, Munich EUR - 100.00 100.00 19,895 - 1) 2018 Autonomous Intelligent Driving GmbH, Munich EUR - 100.00 100.00 250 - 1) 2018 Autostadt GmbH, Wolfsburg EUR 100.00 - 100.00 50 - 1) 2018 B. -

Volkswagen to Sell RENK Shares to Triton

Media information NO. 25/2020 Volkswagen to sell RENK shares to Triton • Volkswagen AG Board of Management and Supervisory Board approve sale of 76 percent stake or approximately 5.3 million shares in listed company RENK AG • Purchase price of 97.80 EUR per share is subject to adjustments in relation to dividend • Transaction implies cash inflow of approximately 530 million EUR for Volkswagen • Long-term location and employment guarantee for RENK’s German sites until December 31st 2026 agreed • CFO Frank Witter: ”Volkswagen is driving the transformation of the Group further forward and new perspectives for the future and for growth are opening up for RENK.” • Works Council Chairman Osterloh: “With the disposal of RENK to Triton we found a reasonable solution for the asset. The location and employment guarantee for the German plants until 2026 is an essential and future-oriented point of the transaction.” Wolfsburg January 30, 2020 – The Board of Management and Supervisory Board of Volkswagen AG have approved the sale of the 76 percent stake or approximately 5.3 million shares in the listed company RENK AG to Triton for a purchase price of 97.80 EUR per share which is subject to adjustments in relation to dividend. The planned disposal results in a book value gain according to IFRS of approximately 150 million EUR for the Group and implies a cash inflow of approximately 530 million EUR. In the agreement of the disposal a long-term location and employment guarantee for the three German sites in Augsburg, Rheine and Hanover until December 31st 2026 was agreed between RENK and Triton. -

Separate Financial Statements Fiscal Year 2017

Separate financial statements 2017 2017 3 Content 1 6 Group management report and management report of Porsche Automobil Holding SE 10 Fundamental information about the group 12 Report on economic position 12 Significant events and developments at the Porsche SE Group 20 Significant events and developments at the Volkswagen Group 27 Business development 31 Results of operations, financial position and net assets 35 Porsche Automobil Holding SE (financial statements pursuant to the German Commercial Code) 38 Sustainable value enhancement in the Porsche SE Group 38 Sustainable value enhancement in the Volkswagen Group 53 Overall statement on the economic situation of Porsche SE and the Porsche SE Group 54 Remuneration report 76 Opportunities and risks of future development 108 Publication of the declaration of compliance 109 Subsequent events 110 Forecast report and outlook 4 2 114 Financials 118 Balance sheet of Porsche Automobil Holding SE 119 Income statement of Porsche Automobil Holding SE 120 Notes to the fi nancial statements of Porsche Automobil Holding SE 243 Responsibility statement 244 Independent auditor’s report 5 1 Group management report and management report of Porsche Automobil Holding SE Porsche Cayenne S 6 7 8 1 Group management report and management report of Porsche Automobil Holding SE 10 Fundamental information about the group 12 Report on economic position 12 Significant events and developments at the Porsche SE Group 20 Significant events and developments at the Volkswagen Group 27 Business development 31 Results of -

Annual Report 20202020 Key Figures

Annual Report 20202020 Key figures 2020 2019 2018 IFRS IFRS IFRS Porsche SE Group Total assets € million 36,250 35,592 33,708 Equity € million 35,946 35,284 33,416 Investments accounted for at equity € million 35,259 34,597 32,518 Result from investments accounted for at equity € million 2,641 4,406 3,641 Revenue € million 107 116 103 Personnel expenses € million 80 80 77 Financial result € million 54 24 – 3 Result before tax € million 2,646 4,416 3,514 Result after tax € million 2,624 4,408 3,491 Earnings per ordinary share 1 € 8.56 14.39 11.39 Earnings per preference share 1 € 8.57 14.39 11.40 Net liquidity € million 563 553 864 Employees on 31 December 916 951 935 2020 2019 2018 HGB HGB HGB Porsche SE Net profit € million 703 788 480 Net profit available for distribution € million 676 952 676 Dividend per ordinary share € 2.204 2 2.204 2.204 Dividend per preference share € 2.210 2 2.210 2.210 1 Basic and diluted 2 Proposal to the annual general meeting of the Porsche SE Investments of Porsche SE Core Investment Stake of ordinary shares: 53.3 % (Represents a stake of subscribed capital: 31.4 %) Further Investments Minority stakes Status 10 March 2021 2020 “The fiscal year 2020 was also challenging for Porsche SE. We recorded a positive group result after tax of around 2.6 billion euro, despite conditions remaining difficult overall.” Hans Dieter Pötsch 3 1To our shareholders 6 Letter to our shareholders 8 Company boards of Porsche Automobil Holding SE and their appointments 10 Report of the supervisory board 18 Porsche SE share 26 4 -

Vtrqtr1a Nebraska Department of Motor Vehicles 10/01/2019 Vehicle Titles and Registrations Manufacturer Codes Alphabetically by Manufacturer Name

VTRQTR1A NEBRASKA DEPARTMENT OF MOTOR VEHICLES 10/01/2019 VEHICLE TITLES AND REGISTRATIONS MANUFACTURER CODES ALPHABETICALLY BY MANUFACTURER NAME CODE MANUFACTURER CODE MANUFACTURER ACEW ACE WELDING TRAILER COMPANY BORC BORCO EQUIPMENT CO INC ACIF ACIER FABREX INC BOTT BOYD TANK TRAILERS ACRO ACRO TRAILER COMPANY BOYD BOYDSTUN METAL WORKS ACTN ACTION EQUIPMENT BRTI BRAE TRAILERS INC ACUR ACURA BREN BRENNER TANK INC AEPD ADVANCE ENGINEERED PRODUCTS BRMR BRI-MAR MANUFACTURING AMIN ADVANCE MIXER BROK BROOKFIELD TRAILER CORP AJAX AJAX MANUFACTURING COMPANY INC BUEL BUELL AJRI AJR INC BUGA BUGATTI ALAB ALABAMA TRAILER COMPANY BUIC BUICK ALFA ALFA ROMEO BUIL BUILT-RITE TRAILERS ALFB ALFAB INC BLKE BULK MFG ALLW ALLENTOWN BRAKE & WHEEL SERVICE LBOS BURKETT'S AUTORAMA INC ALTK ALLIED TANK TRUCK BCIB BUS & COACH INTL (BCI) ALLO ALLOY TRAILERS INC BUTL BUTLER ALMI ALMAC INDUSTRIES LIMITED BWSM BWS MANUFACTURING ALMT ALMONT BYDA BYD COACH AND BUS LLC ALTE ALTEC IND INC CEEZ C Z ENGINEERING ALUT ALUMATECH CSTW C/S TRAILER ALUM ALUMINUM BODY CORP CADI CADILLAC AMCE AMERICAN CARRIER EQUIPMENT CAGI CAGIVA AMCR AMERICAN CRUISER MOTOR HOME CANA CAN-AM AMGN AMERICAN GENERAL CAPT CAPACITY OF TEXAS AIH AMERICAN IRON HORSE CAT CATERPILLAR LAFR AMERICAN LA FRANCE CENT CENTENNIAL INDUSTRIES AMER AMERICAN MOTORS CNTR CENTREVILLE TAG AMRE AMERICAN REBEL CHAC CHALLENGE-COOK BROTHERS INC AMRT AMERICAN ROAD TRAILER CHAL CHAMBERLAIN TRAILERS AMEM AMERICAN TRAILER MANUFACTURING INC CHMT CHAMPION TRAILERS AME AMERICAN TRAILERS INC CHCI CHANCE COACH TRANSIT BUS ANDS -

Slavery and Human Trafficking Statement – MAN Group

Slavery and Human Trafficking Statement – MAN Group This statement is made in accordance with Section 54 of the United Kingdom’s Modern Slavery Act of 2015. Organisation The MAN Group is one of Europe’s leading commercial vehicle and mechan- ical engineering groups and focuses on activities in the areas of transporta- tion and energy — market segments that offer long-term, global opportuni- ties. MAN’s business activities are grouped into two business areas: Com- mercial Vehicles, comprising MAN Truck & Bus and MAN Latin America, and Power Engineering, featuring MAN Diesel & Turbo and Renk. With a work- force of 53,824 employees, the Group operates in over 180 countries and has production sites in 14 countries. Commercial vehicles: MAN Truck & Bus AG, which is based in Munich, Germany, is the largest company in the MAN Group and one of Europe’s leading manufacturers of commercial vehicles. MAN Truck & Bus has pro- duction facilities in three European countries, Russia, South Africa, India, and Turkey. The company MAN Latin America produces trucks and buses in Resende, Brazil, and Querétaro, Mexico. In 2015, Volkswagen Truck & Bus GmbH, a holding company for commercial vehicles was created. The aim is to enhance the alliance of MAN Truck & Bus, MAN Latin America, most of whose sales are made through Volkswagen Caminhões e Ônibus, and Sca- nia, as part of Volkswagen Truck & Bus. Power Engineering: MAN Diesel & Turbo SE, which is based in Augsburg, Germany, is one of the world's leading developers and manufacturers of large-bore diesel engines, turbocompressors, industrial turbines, and chem- ical reactor systems. -

Maybach Miami Hisart Kilikia Kokular

4/2015 MengerlerYAŞAMIN RENKLERİNİ YANSITIR... Lifestyle Mengerler Lifestyle MAYBACH MIAMI HİSART KİLİKİA YAŞAMIN RENKLERİNİ YANSITIR... RENKLERİNİ YAŞAMIN KOKULAR 4/2015 YILDIZLI HAYATLAR • KÜLTÜR • SANAT • SÖYLEŞİ • GEZİ • LEZZET • SAĞLIK Merhaba saygıdeğer dostlarımız, Her yıl sonu otomotiv sektöründe, yeni modellerin tanıtıldığı heyecanlı, bir o kadar da yoğun günler başlar. Konu Mercedes-Benz olunca da, seçkin müşterilerimiz, sektöre yön verecek yenilikleri bir an önce öğrenmek için showroom’larımıza gelirler. Bizleri mutlu eden bu yoğun ziyaretleriniz için şimdiden hepinize ayrı ayrı teşekkür etmek isterim, yeni modellerimiz, ayıracağınız vakte fazlası ile değecektir. Servislerimiz ise araçlarınızı yaklaşan kışa hazırlamak için hizmetinizdedir. Lüks segmentte yepyeni standartlar belirleyen Mercedes-Benz Maybach S-Serisi, hakkında bir an önce bilgi edinmek isteyen okuyucularımız için bu sayımızda işlendi. Amerika’daki konsolosluklarımıza bir yenisi daha eklendi. Türk Hava Yolları, Miami Konsolosluğumuzun açılışı ile birlikte, uzun süredir ara verdiği direkt İstanbul-Miami uçuşlarına tekrar başlıyor. Hal böyle olunca da, kış aylarının vazgeçilmez destinasyonlarından biri olan Miami’yi dergimizin Sanat Yönetmeni Ayşen Gürel Sile sizler için yazdı. Dünyanın ilk diorama müzesi kurucusu Nejat Çuhadaroğlu ile dergimiz yazarlarından Zeynep Çiftçioğlu keyifli bir söyleşi gerçekleştirdi. Gazeteci Yazar Hülya Ekşigil’in söyleşisinde ödüllü Fotoğraf Sanatçısı Ani Çelik Arevyan’ı daha yakından tanıyabilirsiniz. Fotoğrafları Senih Gürmen çekti. Yazarlarımızdan Bünyad Dinç sonbaharda direksiyonunuzu güneye çevirmenizi öneriyor. Hala yazdan kalma günlerin yaşandığı güney bölgemizde deniz, tarih ve keyifli sürüş arayanlar için, ihtişamı ile göz kamaştıran Kilikia Trakheia, yani Dağlık Kilikia hakkında, ayrıntılı bilgi veriyor. Tropikal bölgelerde, ormanların içinde yaşayan orkideler, salonlarımızda başköşeyi hak edecek kadar alımlılar. Ayşen Gürel Sile orkideleri ve bakımlarını anlatırken; keyifli aranjmanlar hazırlayabilmeniz için sizlere ipuçları veriyor. -

Technology of Articulated Transit Buses Transportation 6

-MA-06-01 20-82-4 DEPARTMENT of transportation HE SC-UMTA-82-17 1 8. b .\37 JUL 1983 no. DOT- LIBRARY TSC- J :aT \- 8 ?- Technology of U.S. Department of Transportation Articulated Transit Buses Urban Mass Transportation Administration Office of Technical Assistance Prepared by: Office of Bus and Paratransit Systems Transportation Systems Center Washington DC 20590 Urban Systems Division October 1982 Final Report NOTICE This document is disseminated under the sponsorship of the Department of Transportation in the interest of information exchange. The United States Govern- ment assumes no liability for its contents or use thereof. NOTICE The United States Government does not endorse prod- 1 ucts or manufacturers . Trade or manufacturers nam&s appear herein solely because they are con- sidered essential to the object of this report. 4 v 3 A2>7 ?? 7 - c c AST* Technical Report Page V ST‘ (* Documentation 1 . Report No. 2. Government A ccession No. 3. Recipient’s Catalog No. UMTA-MA-06-0 120-82- 4. Title and Subti tie ~6. Report Date October 1982 DEPARTMENT OF I TECHNOLOGY OF ARTICULATED TRANSIT BUSES TRANSPORTATION 6. Performing Organization Code TSC/DTS-6 j JUL 1983 8 . Performing Organization Report No. 7. Author's) DOT-TSC-UMTA-82-17 Richard G. Gundersen | t |kh a R 9. Performing Organization Name and Address jjo. Work Unit No. (TRAIS) U.S. Department of Transportation UM262/R2653 Research and Special Programs Administration 11. Contract or Grant No. Transportation Systems Center Cambridge MA 02142 13. Type of Report and Period Covered 12. Sponsoring Agency Name and Address U.S. -

Volkswagen Subsidiary TRATON Refines Portfolio

Media information NO.402/2018 Volkswagen subsidiary TRATON refines portfolio • Volkswagen AG acquires MAN Energy Solutions SE and all shares in Renk AG from MAN SE • TRATON AG is thereby focusing exclusively on trucks, buses and digital transportation solutions • Frank Witter, CFO: “In the light of our decision to prepare TRATON for a possible initial public offering (IPO), separating the Power Engineering business is a consistent step.” • Andreas Renschler, TRATON CEO: "With the sale, we are refining our portfolio and taking another step towards capital market readiness.” Wolfsburg, October 25, 2018 – In the context of achieving capital market readiness of TRATON AG, Volkswagen AG and TRATON AG with consent of their respective corporate bodies today have agreed on the sale of the 76 % stake of MAN SE in listed Renk Aktiengesellschaft as well as the 100 % stake of MAN SE in MAN Energy Solutions SE to a subsidiary of Volkswagen AG. The purchase price shall correspond to the expected IFRS equity book value of these participations as of 31 December 2018 in the range of approx. EUR 1.85 bn. to approx. EUR 2.05 bn. In addition, the indirect 100% participation of MAN SE in MAN Energy Solutions USA, Inc., will be sold and transferred to a subsidiary of Volkswagen AG for a purchase price of approx. USD 99 m. The transferred entities form MAN group’s business area Power Engineering. The sale is intended to be completed by year-end 2018. As a result of this transaction, TRATON AG will become the lead company of a pure truck & bus group. -

Anticipating Restructuring in the European Defense Industry

ANTICIPATING RESTRUCTURING IN THE EUROPEAN DEFENSE INDUSTRY A study coordinated by BIPE with contributions from: Wilke, Maack & Partners - Wmp Consult (Germany), The Centre for Defence Economics, York University (UK), Institute for Management of Innovation and Technology (Sweden) ZT Konsulting (Poland) Authors: Professor Ola Bergstrom, Mr. Frédéric Bruggeman, Mr. Jerzy Ganczewski, Professor Keith Hartley, Mr. Dominique Sellier, Dr. Elisabeth Waelbroeck-Rocha, Dr Peter Wilke, Professor Dr. Herbert Wulf The consultant takes full responsibility for the views and the opinion expressed in this report. The report does not necessarily reflects the views of the European Commission for whom it was prepared and by whom it was financed. European Defence Industry Anticipating Restructuring Table of Contents EXECUTIVE SUMMARY ....................................................................................................................................5 I. INTRODUCTION ............................................................................................................................................9 II. DEVELOPMENT DURING THE PAST DECADE AND PRESENT INDUSTRY STRUCTURE ........................................11 1. Defining the defence industry............................................................................................................................... 11 2. Structure of the EU Defence Industry: the demand side.................................................................................... 12 2.1. Budgets................................................................................................................................................................ -

RFP) N°: RHO21085 of 08 Apr 2021

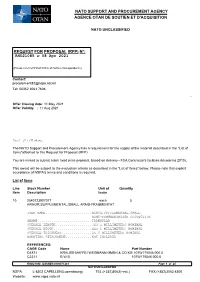

NATO SUPPORT AND PROCUREMENT AGENCY AGENCE OTAN DE SOUTIEN ET D'ACQUISITION NATO UNCLASSIFIED REQUEST FOR PROPOSAL (RFP) N°: RHO21085 of 08 Apr 2021 (Please refer to RHO21085 in all further correspondence) Contact: [email protected] Tel: 00352 3063 7608 - Offer Closing date: 11 May 2021 Offer Validity : 11 Aug 2021 Dear Sir/Madam, The NATO Support and Procurement Agency has a requirement for the supply of the materiel described in the "List of Items"attached to this Request for Proposal (RFP). You are invited to submit a firm fixed price proposal, based on delivery - FCA Contractor's facilities (Incoterms 2010). This award will be subject to the evaluation criteria as described in the "List of Items" below. Please note that explicit acceptance of NSPA's terms and conditions is required. List of Items Line Stock Number Unit of Quantity item Description Issue 10 2540123907077 each 5 ARMOR,SUPPLEMENTAL,SMALL ARMS-FRAGMENTAT ITEM NAME.......................ARMOR,SUPPLEMENTAL,SMALL ARMS-FRAGMENTATION PROTECTIVE SHAPE...........................IRREGULAR OVERALL LENGTH..................723.5 MILLIMETERS NOMINAL OVERALL WIDTH...................445.1 MILLIMETERS NOMINAL OVERALL THICKNESS...............25.0 MILLIMETERS NOMINAL MOUNTING ATTACHMENT.............NOT INCLUDED REFERENCES: CAGE Code Name Part Number D1871 KRAUSS-MAFFEI WEGMANN GMBH & CO KG 107W175046.000.0 C2311 B.W.B. 107W175046.000.0 RHO21085 /LM-MB1-6000871261 Page 1 of 25 NATO UNCLASSIFIED NSPA L-8302 CAPELLEN(Luxembourg) TEL:(+352)3063(+ext.) FAX:(+352)3063 4300 Website: www.nspa.nato.int NATO SUPPORT AND PROCUREMENT AGENCY AGENCE OTAN DE SOUTIEN ET D'ACQUISITION NATO UNCLASSIFIED Quality assurance requirements: This contract shall meet the AQAP 2110 requirements (NATO Quality Assurance Requirements for Design, Development and Production). -

SETTLEMENT AGREEMENT (The “ Settlement Agreement ”) Dated As of September 4, 2020 TABLE of CONTENTS

Court File No. CV-16-564517-00CP ONTARIO SUPERIOR COURT OF JUSTICE BETWEEN: UDO RENK Plaintiff -and- AUDI CANADA INC., AUDI AKTIENGESELLSCHAFT, AUDI OF AMERICA INC., VW CREDIT CANADA INC., PORSCHE CARS CANADA LTD., BENTLEY MOTORS CANADA LTD, VOLKSWAGEN GROUP CANADA INC. and VOLKSWAGEN AKTIENGESELLSCHAFT Defendants Court File No. 500-06-000828-166 SUPERIOR COURT OF QUÉBEC BETWEEN: STÉPHANE GAGNON and JACQUES BOUCHARD Petitioners -and- AUDI CANADA INC., AUDI AG, VOLKSWAGEN GROUP CANADA INC., VOLKSWAGEN AG, PORSCHE CARS CANADA, LTD. and BENTLEY MOTORS CANADA, LTD. Respondents TRANSMISSION/FUEL CONSUMPTION SETTLEMENT AGREEMENT (the “ Settlement Agreement ”) Dated as of September 4, 2020 TABLE OF CONTENTS Page 1. INTRODUCTION 1 2. DEFINITIONS 1 3. FOR SETTLEMENT PURPOSES 7 4. APPROVAL OF SETTLEMENT AGREEMENT 8 5. Compensation for SETTLEMENT class members 8 6. RELEASE AND WAIVER 11 7. claims administration 15 8. PAYMENT OF SETTLEMENT FUND 17 9. COOPERATION of the parties 18 10. NOTICE to settlement class 18 11. opt-out Requests and settlement objections/support 19 12. COUNSEL FEES and class counsel’s requests for honoraria 20 13. TERMINATION OF SETTLEMENT AGREEMENT 21 14. OTHER TERMS AND CONDITIONS 23 -i- 1. INTRODUCTION The Parties agree to settle the Actions, and all claims on behalf of the Settlement Class, related to the Audi-, Bentley-, Porsche-, and Volkswagen-brand gasoline vehicles, as identified in Schedule “A”, originally sold or leased in Canada on or before the Pre-Approval Notice Date of this Settlement Agreement. The Actions seek relief on behalf of consumers on the basis that software used to manage the vehicle transmissions in these gasoline vehicles resulted in higher fuel consumption and CO2 emissions than originally represented.