3. ETF Performances

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

USD XINT M EM HL Taiwan NTR USD Index

Created on 30 th April 2020 XINT M EM HL Taiwan NTR USD Index USD The XINT M EM HL Taiwan NTR USD Index covers the highly liquid and liquid segment of the Taiwanese equity market. The index membership comprises the 89 largest companies by freefloat adjusted market value and represents approximately 85% of the Taiwanese market. INDEX PERFORMANCE - PRICE RETURN USD 130 120 110 100 90 80 70 Dec 2017 Mar 2018 Jun 2018 Sep 2018 Dec 2018 Mar 2019 Jun 2019 Sep 2019 Dec 2019 Mar 2020 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M -7.33 3M 36.87 From 14 Jan 2020 6M 1.07 6M 27.83 To 19 Mar 2020 1Y 11.14 1Y 22.27 Return -29.23% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Taiwan Semiconductor Man Co Ltd 37.57% 252,160 37.57% Technology Hon Hai Precision Industry Co Ltd 4.81% 32,296 4.81% Industrial Goods & Services MediaTek Inc 3.14% 21,069 3.14% Technology Chunghwa Telecom Co Ltd 2.08% 13,992 2.08% Telecommunications Largan Precision Co Ltd 2.07% 13,900 2.07% Personal & Household Goods Formosa Plastics Corp 1.96% 13,167 1.96% Chemicals CTBC Financial Holding Co Ltd 1.86% 12,453 1.86% Banks Nan Ya Plastics Corp 1.71% 11,472 1.71% Chemicals Uni-President Enterprises Corp 1.68% 11,284 1.68% Food & Beverage Mega Financial Holding Co Ltd 1.64% 11,009 1.64% Banks Total 392,803 58.52% This information has been prepared by Index Intelligence GmbH (“IIG”). -

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

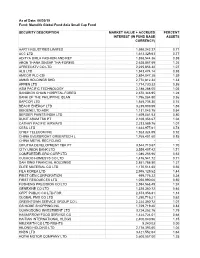

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Taiwan USD Net Tax Index Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country Accton Technology 0.45 TAIWAN Formosa Petrochemical 0.44 TAIWAN SinoPac Financial Holdings Co. Ltd. 0.45 TAIWAN Acer 0.29 TAIWAN Formosa Plastics Corp 1.56 TAIWAN Synnex Technology International 0.23 TAIWAN Advantech 0.49 TAIWAN Formosa Taffeta 0.13 TAIWAN Taishin Financial Holdings 0.53 TAIWAN Airtac International Group 0.42 TAIWAN Foxconn Technology 0.23 TAIWAN Taiwan Business Bank 0.19 TAIWAN ASE Technology Holding 0.87 TAIWAN Fubon Financial Holdings 1.21 TAIWAN Taiwan Cement 0.82 TAIWAN Asia Cement 0.38 TAIWAN Genius Electronic Optical 0.2 TAIWAN Taiwan Cooperative Financial Holding 0.75 TAIWAN ASMedia Technology 0.24 TAIWAN Giant Manufacturing 0.31 TAIWAN Taiwan Fertilizer 0.15 TAIWAN Asustek Computer Inc 0.7 TAIWAN GlobalWafers 0.36 TAIWAN Taiwan Glass Industrial 0.08 TAIWAN AU Optronics 0.42 TAIWAN HIWIN Technologies Corp. 0.29 TAIWAN Taiwan High Speed Rail 0.26 TAIWAN Capital Securities 0.09 TAIWAN Hon Hai Precision Industry 3.82 TAIWAN Taiwan Mobile 0.64 TAIWAN Catcher Technology 0.54 TAIWAN Hotai Motor 0.81 TAIWAN Taiwan Secom 0.1 TAIWAN Cathay Financial Holding 1.28 TAIWAN HTC Corporation 0.08 TAIWAN Taiwan Semiconductor Manufacturing 42.94 TAIWAN Chailease Holding 0.73 TAIWAN Hua Nan Financial Holdings 0.67 TAIWAN TECO Electric & Machinery 0.21 TAIWAN Chang Hwa Commercial Bank 0.45 TAIWAN Innolux 0.34 TAIWAN TPK Holding Co Ltd 0.07 TAIWAN Cheng Shin Rubber Industry 0.27 TAIWAN Inventec Co. -

Taiwan Downstream Sector 6M 2020 Review: EMS Piling up Raw Material Inventory

3 September 2020 Equity Research Asia Pacific | Taiwan Taiwan Downstream Sector 6M 2020 review: EMS piling up raw material inventory IT Hardware | Quarterly Figure 1: PCB still led the EPS growth Research Analysts (NT$) 6M20 6M19 Pauline Chen 20 886 2 2715 6323 18 [email protected] 16 14 Angela Pan 12 886 2 27156352 10 [email protected] 8 6 4 2 0 Lens Passives Battery Hinge Power Cooling Connector Casing PC com PCB HS ex lens Source: Company data, Credit Suisse estimates 6M 2020 financial data from 131 sample downstream (components/EMS/IPC) companies showed (1) revenue growth acceleration, except lens, IC substrate, auto, and IPC; (2) profit recovery from COVID-19 lows, with power supply and CCL reporting record-high GM in 6M20; (3) nine out of 12 companies with record-high GM in 6M20 were PC/NB related, thanks to very favourable pricing/cost structure driven by WFH; (4) concerning inventory data, with EMS seeing a spike in raw materials days, vs relatively stable days in WIP and finished goods, and components’ finished goods inventory days still close to record-high level (only two days below); (5) YoY OPM improvement in most sub-sectors, except audio components, auto, and IPC; (6) IPC relatively underperformed EMS, given the former’s no revenue/OPM recovery, higher capex/labour intensity, and higher inventory days (from both raw material and finished goods). Stock calls: The set of data suggests sequential but sub-seasonal revenue growth in 3Q, as EMS inventory suggests that part of the supply chain strength is driven by EMS’ cautiousness to pile up raw material inventory as much as possible to avoid any supply constraints. -

US Ishares Template

iShares MSCI Taiwan ETF EWT Fact Sheet as of 03/31/2020 The iShares MSCI Taiwan ETF seeks to track the investment results of an index composed of Taiwanese equities. KEY FACTS Fund Launch Date 06/20/2000 Expense Ratio 0.59% WHY EWT? Benchmark MSCI Taiwan 25/50 Index 1 Exposure to large and mid-sized companies in Taiwan 30 Day SEC Yield 3.41% 2 Targeted access to 85% of the Taiwanese stock market Number of Holdings 90 Net Assets $2,951,293,689 3 Use to express a single country view Ticker EWT CUSIP 46434G772 GROWTH OF 10,000 USD SINCE INCEPTION Exchange NYSE Arca TOP HOLDINGS (%) TAIWAN SEMICONDUCTOR MANUFACTURING 22.96 HON HAI PRECISION INDUSTRY LTD 5.47 MEDIATEK INC 3.05 CHUNGHWA TELECOM LTD 2.48 LARGAN PRECISION LTD 2.32 FORMOSA PLASTICS CORP 2.03 CTBC FINANCIAL HOLDING Fund Benchmark LTD 2.03 The Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes UNI-PRESIDENT reinvestment of dividends and capital gains. Fund expenses, including management fees and ENTERPRISES CORP 1.97 other expenses were deducted. MEGA FINANCIAL HOLDING LTD 1.94 PERFORMANCE CATHAY FINANCIAL HOLDING 1 Year 3 Year 5 Year 10 Year Since Inception LTD 1.84 46.09 NAV -2.47% 2.65% 3.70% 5.46% 1.52% Holdings are subject to change. Market Price -2.24% 2.59% 3.77% 5.43% 1.51% Benchmark -1.93% 3.17% 4.35% 6.02% 2.24% The performance quoted represents past performance and does not guarantee future results. -

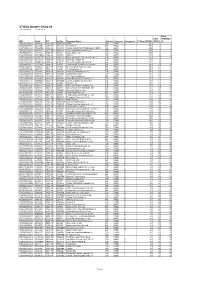

Security Description Market Value + Accrued Interest (In

As of Date: 06/30/19 Fund: Manulife Global Fund Asia Small Cap Fund SECURITY DESCRIPTION MARKET VALUE + ACCRUED PERCENT INTEREST (IN FUND BASE ASSETS CURRENCY) AARTI INDUSTRIES LIMITED 1,598,242.27 0.77 ACC LTD 1,613,329.63 0.77 ADITYA BIRLA FASHION AND RET 1,858,544.36 0.89 AEON THANA SINSAP THA-FOREIG 2,628,867.69 1.26 AFREECATV CO LTD 2,225,856.32 1.07 ALS LTD 1,943,474.14 0.93 AMCOR PLC-CDI 2,894,047.28 1.39 AMMB HOLDINGS BHD 2,772,812.34 1.33 APPEN LTD 1,774,730.32 0.85 ASM PACIFIC TECHNOLOGY 2,188,288.00 1.05 BANGKOK CHAIN HOSPITAL-FOREG 2,672,346.95 1.28 BANK OF THE PHILIPPINE ISLAN 1,796,084.90 0.86 BAPCOR LTD 1,545,735.30 0.74 BEACH ENERGY LTD 3,239,909.59 1.55 BEIGENE LTD-ADR 1,131,043.75 0.54 BERGER PAINTS INDIA LTD 1,659,081.53 0.80 BUKIT ASAM TBK PT 2,169,353.67 1.04 CATHAY PACIFIC AIRWAYS 2,233,589.76 1.07 CESC LTD 1,634,977.61 0.78 CHIEF TELECOM INC 1,923,324.59 0.92 CHINA EVERBRIGHT GREENTECH L 1,765,401.60 0.85 CHINA METAL RECYCLING - - CIPUTRA DEVELOPMENT TBK PT 3,544,710.67 1.70 CITY UNION BANK LTD 3,559,407.42 1.71 COMFORTDELGRO CORP LTD 1,086,255.96 0.52 CUCKOO HOMESYS CO LTD 1,476,541.72 0.71 DAH SING FINANCIAL HOLDINGS 2,851,788.80 1.37 ELITE MATERIAL CO LTD 1,170,514.66 0.56 FILA KOREA LTD 2,995,129.52 1.44 FIRST GEN CORPORATION 699,776.32 0.34 FIRST RESOURCES LTD 1,050,990.06 0.50 FUSHENG PRECISION CO LTD 2,594,568.49 1.24 GENEXINE CO LTD 1,328,360.72 0.64 GFPT PUBLIC CO LTD-FOR 2,373,356.81 1.14 GLOBAL PMX CO LTD 1,290,716.21 0.62 GREENTOWN SERVICE GROUP CO L 2,224,350.72 1.07 GS HOME SHOPPING INC 1,729,719.40 -

Another Year of Strong Growth China's Impact on the Semiconductor

www.pwc.com/technology Another year of strong growth China’s impact on the Technology Institute semiconductor industry Chapter 4: Greater China 2012 update September 2012 About this report In 2004, PwC released its original report, China’s impact on the semicon- ductor industry, in response to our clients’ interest in the rapid growth of the semiconductor industry in China. Specifically, clients wanted to find out whether China’s production volumes would contribute to worldwide overcapacity and a subsequent downturn in the industry. For the past seven years, we have provided updates that included an analysis of both the semiconductor market (consumption) and industry (production). We also covered design, the value chain and possible production growth scenarios along with a number of other topics. Because the report relies on a number of data sources, we have been un- able to deliver it in full until the fourth quarter of the following year. This year, in an effort to get you this vital information in a more timely fash- ion, we have chosen to release the report in a tiered fashion. This is the fourth chapter in the series. Please note that figure and table numbering continue from the second chapter, thus the first figure in this chapter is numbered 20 rather than 1. In the coming weeks, we will release ad- ditional chapters, until we have covered as much material as in previous reports. At the end of the release period, you will be able to download a complete pdf file of the full report. Please visit www.pwc.com/chinasemicon to read online or download this year’s report. -

View Annual Report

TSE Code: 2303 | NYSE Symbol: UMC ANNUAL REPORT 2005 YEARS of United Microelectronics Corporation Corporate Information Spokesperson Fab 8D ADR Exchange Marketplace Chitung Liu 8 Li-Hsin 3rd Rd., Hsinchu Science New York Stock Exchange, Inc. Chief Financial Officer Park, Hsinchu, Taiwan 300, R.O.C. 11 Wall Street 886 (2) 2700 6999 886 (3) 578 2258 New York, NY 10005, U.S.A. [email protected] 1 (212) 656 3000 Fab 8E www.nyse.com Deputy Spokesperson 17 Li-Hsin Rd., Hsinchu Science Ticker/Search Code: UMC Sandy Yen Park, Hsinchu, Taiwan 300, R.O.C. The Chairman and CEO Office 886 (3) 578 2258 Exchangeable Bond Exchange Senior Manager Marketplace 886 (2) 2700 6999 Fab 8F Luxembourg Stock Exchange [email protected] 3 Li-Hsin 6th Rd., Hsinchu Science 11, av de la Porte-Neuve Park, Hsinchu, Taiwan 300, R.O.C. L-2227 Luxembourg Bowen Huang 886 (3) 578 2258 352 (47) 79 36 - 1 Finance Division www.bourse.lu Senior Manager Fab 8S Ticker: UniMicElexCorp 886 (2) 2700 6999 16 Creation 1st Rd., Hsinchu Science EB Search Code: ISIN XS0147090533 [email protected] Park, Hsinchu, Taiwan 308, R.O.C. ECB Search Code: ISIN XS0231460709 886 (3) 578 2258 Headquarters Auditors 3 Li-Hsin 2nd Rd., Hsinchu Science Fab 12A Diwan, Ernst & Young Park, Hsinchu, Taiwan 300, R.O.C. 18 Nan-Ke 2nd Rd., Tainan Science James Wang, MY Lee 886 (3) 578 2258 Park, Sinshih, Tainan, Taiwan 744, 9th Fl., 333 Keelung Rd., Sec.1 R.O.C. Taipei 110, Taiwan , R.O.C. -

TCL Communication Technology Holdings Limited

TCL Communication | November 9, 2014 November 9, 2014 MORGAN STANLEY ASIA LIMITED+ Yunchen Tsai TCL Communication [email protected] +852 2848-5636 1st Take: October Shipments On TCL Communication ( 2618.HK , 2618 HK ) Greater China Technology Hardware / China Stock Rating Overweight Track Industry View In-Line Shr price, close (Nov 7, 2014) HK$8.00 52-Week Range HK$10.96-6.70 Retain OW: October shipments were on track; 2014 full-year smartphone Sh out, dil, curr (mn) 1,180 shipments could come in slightly ahead of management guidance of 40mn. Mkt cap, curr (mn) HK$9,440 We believe Street concerns about TCLC are overdone: EV, curr (mn) HK$11,699 Avg daily trading value (mn) HK$47.40 1. Samsung’s pricing war in the mid-range/low-end segment will initially focus on China, where TCLC generated only ~8% of revenue in 3Q14. 2. Smartphone penetration and transition towards 4G continue in emerging markets, supporting growth for TCLC. 3. We believe the Street is ignoring a potential limited opex increase in 2015e, which would help boost OPM and provide a buffer for a potential GPM decline. At 6.6x 2015e P/E, we retain our OW rating. Smartphone volume reached 5mn (+22% MoM and +134% YoY); feature phone volume was 3mn (feature phone volume has stabilized at ~2.6mn/month in the past couple of months). Assuming flat MoM growth in November and December for smartphones, 2014 full-year smartphone volume would reach 40.9mn, slightly above management guidance of 40mn. Total handset shipments reached ~8mn (+40%YoY), with overseas accounting for 90% of the total and China ~10%. -

FTSE TWSE Taiwan 50

2 FTSE Russell Publications 19 August 2021 FTSE TWSE Taiwan 50 Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country Advantech 0.47 TAIWAN First Financial Holding 0.76 TAIWAN Realtek Semiconductor 0.8 TAIWAN Airtac International Group 0.53 TAIWAN Formosa Chemicals & Fibre 0.97 TAIWAN Shanghai Commercial & Savings Bank 0.49 TAIWAN ASE Technology Holding 1.28 TAIWAN Formosa Petrochemical 0.48 TAIWAN Silergy 0.78 TAIWAN Asia Cement 0.39 TAIWAN Formosa Plastics Corp 1.67 TAIWAN Taishin Financial Holdings 0.53 TAIWAN Asustek Computer Inc 0.87 TAIWAN Fubon Financial Holdings 1.81 TAIWAN Taiwan Cement 0.88 TAIWAN AU Optronics 0.66 TAIWAN Hon Hai Precision Industry 4.45 TAIWAN Taiwan Cooperative Financial Holding 0.68 TAIWAN Cathay Financial Holding 1.48 TAIWAN Hotai Motor 0.65 TAIWAN Taiwan Mobile 0.56 TAIWAN Chailease Holding 0.85 TAIWAN Hua Nan Financial Holdings 0.59 TAIWAN Taiwan Semiconductor Manufacturing 47.57 TAIWAN Chang Hwa Commercial Bank 0.35 TAIWAN Largan Precision 1.06 TAIWAN Uni-president Enterprises 1.17 TAIWAN China Steel 1.63 TAIWAN MediaTek 4.74 TAIWAN United Microelectronics 2.06 TAIWAN Chunghwa Telecom 1.44 TAIWAN Mega Financial Holding 1.19 TAIWAN Wan Hai Lines 1.19 TAIWAN CTBC Financial Holding 1.37 TAIWAN Nan Ya Plastics 1.56 TAIWAN Yageo 0.85 TAIWAN Delta Electronics 2.18 TAIWAN Nan Ya Printed Circuit Board 0.27 TAIWAN Yang Ming Marine Transport 0.91 TAIWAN E.Sun Financial Holding 1.05 TAIWAN Nanya Technology 0.22 TAIWAN Yuanta Financial Holding 1.04 TAIWAN Evergreen Marine 1.71 TAIWAN Novatek Microelectronics 0.95 TAIWAN Far Eastern New Century Corporation 0.42 TAIWAN Pegatron 0.47 TAIWAN Far EasTone Telecommunications 0.34 TAIWAN President Chain Store 0.49 TAIWAN Feng TAY Enterprise 0.36 TAIWAN Quanta Computer 0.78 TAIWAN Source: FTSE Russell 1 of 2 19 August 2021 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points. -

FSSA Asian Growth Fund Quarterly Investment Report

Quarterly Investment Report 31 December 2020 FSSA Asian Growth Fund – The Fund invests primarily in equity or equity-related securities of companies that are listed, or have their registered offices in, or conduct a majority of their economic activity in Asia excluding Australia, Japan and New Zealand. –The Fund invests in emerging markets which may have increased risks than developed markets including liquidity risk, currency risk/control, political and economic uncertainties, high degree of volatility, settlement risk and custody risk. –The Fund may expose to China market risk including repatriation risk, uncertainties to PRC taxation policies and risks associated with StockConnects, RQFII, SME board, the ChiNext market and/or the STAR board. The Fund may also expose to RMB currency and conversion risk. –The Fund's investments may be concentrated in a single sector, country, specific region or small numbers of countries/companies which may have higher volatility or greater loss of capital than more diversified portfolios. Investing in securities of small/mid-capitalisation companies may have lower liquidity and more volatile prices during adverse economic developments. –The Fund may use FDIs for hedging and efficient portfolio management purposes, which may subject the Fund to additional liquidity, valuation, counterparty and over the counter transaction risks. –It is possible that a part or entire value of your investment could be lost. You should not base your investment decision solely on this document. Please read the offering document including risk factors for details. Investment objective and strategy Fund information The Fund aims to achieve long term capital appreciation and invests Fund Size (US$m) 569.7 primarily in equity or equity-related securities of companies that are Benchmark MSCI AC Asia ex Japan Net Index▲ listed, or have their registered offices in, or conduct a majority of their economic activity in Asia excluding Australia, Japan and New Zealand. -

Stoxx® East Asia 80 Index

STOXX® EAST ASIA 80 INDEX Components1 Company Supersector Country Weight (%) Samsung Electronics Co Ltd Personal & Household Goods KR 10.67 TSMC Technology TW 6.66 AIA GROUP Insurance HK 4.40 CHINA CONSTRUCTION BANK CORP H Banks CN 3.52 Toyota Motor Corp. Automobiles & Parts JP 3.45 Hon Hai Precision Industry Co Industrial Goods & Services TW 2.89 China Mobile Ltd. Telecommunications CN 2.82 ICBC H Banks CN 2.46 SK HYNIX INC Technology KR 1.95 PING AN INSUR GP CO. OF CN 'H' Insurance CN 1.95 BANK OF CHINA 'H' Banks CN 1.88 Mitsubishi UFJ Financial Group Banks JP 1.84 CK HUTCHISON HOLDINGS Industrial Goods & Services HK 1.74 Hong Kong Exchanges & Clearing Financial Services HK 1.50 Softbank Group Corp. Telecommunications JP 1.42 Nippon Telegraph & Telephone C Telecommunications JP 1.38 Sun Hung Kai Properties Ltd. Real Estate HK 1.31 DBS Group Holdings Ltd. Banks SG 1.30 LARGAN Precision Personal & Household Goods TW 1.17 United Overseas Bank Ltd. Banks SG 1.15 Oversea-Chinese Banking Corp. Banks SG 1.15 Sumitomo Mitsui Financial Grou Banks JP 1.12 Honda Motor Co. Ltd. Automobiles & Parts JP 1.12 CLP Holdings Ltd. Utilities HK 1.11 CK Property Holdings Real Estate HK 1.10 China Life Insurance Co 'H' Insurance CN 1.09 Sony Corp. Personal & Household Goods JP 1.02 KDDI Corp. Telecommunications JP 1.02 POSCO Basic Resources KR 0.95 China Petroleum & Chemical 'H' Oil & Gas CN 0.94 CNOOC Ltd. Oil & Gas CN 0.93 Mizuho Financial Group Inc.