Executive Summary of Study on Domestic Consumption of Tea in India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Afternoon Tea

AFTERNOON TEA Afternoon Tea ~ A brief history Nobody knows the exact origins of the afternoon tea but one lady features in all theories, Anna, Seventh Duchess of Bedford (1783-1857), Lady-in-waiting to Her Majesty, Queen Victoria. Traditionally, dinner was not served until 8.30 or 9.00 in the evening and the Duchess often became hungry, especially in the summer when dinner was served even later. Every afternoon, she experienced a “sinking feeling” and requested sandwiches & cakes between 3pm & 4pm in the afternoon. Soon others followed the Duchess’ lead. In 1842, a well-known actress named Fanny Kemble heard of afternoon tea, and began to invite some guests to join her. Soon all of fashionable London was sipping tea with a variety of sandwiches on the side. The custom of “taking tea” in the afternoon had become well established, along with a complex set of rules and etiquette. Afternoon tea prices are subject to change for special occasions. All prices are inclusive of VAT. A discretionary 12.5% service charge will be added to groups of 8 people or more. CURRENCY IS IN EUROS Champagne GL BTL Brut Champagne 125ml 750ml Perrier-Jouët Grand Brut, NV 20 95 Taittinger Brut, Reserve, NV 105 Deutz Brut, NV 120 Laurent-Perrier, Brut, NV 130 Bollinger Special Cuvée, NV 160 Ruinart, Blanc de Blancs 175 Rosé Brut Champagne Perrier-Jouët Blason Rosé, NV 23 110 “She is a girl and would not be Taittinger Prestige Rosé, NV 135 afraid to walk the whole world Ruinart, Rosé, NV 150 with herself.” Laurent-Perrier, Cuvée Rosé, NV 180 Dom Pérignon Rosé 2004 595 Lady Gregory Vintage Champagne Perrier-Jouët Belle Epoque 2008 170 Bollinger Grande Année 2005 180 Taittinger Comtes de Champagne, Blanc de Blancs 2006 335 Dom Perignon 2009 395 Louis Roederer Cristal 2009 420 At InterContinental Dublin, we consciously purchase our food from sustainable sources, and we support local growers and producers where possible. -

Tea Industry

Tea Industry Introduction The Indian tea industry is nearly 200 years old. Robert Bruce, a British national discovered tea plants growing in the upper Brahmaputra valley in Assam and adjoining areas. In 1838, Indian tea that was grown in Assam was sent to the UK for the first time, for public sale. Tea in India is grown primarily in Assam, West Bengal, Tamil Nadu and Kerala. Apart from this, it is also grown in small quantities in Karnataka, HP, Tripura, Uttaranchal, Arunachal Pradesh, Manipur, Sikkim and Meghalaya. India has a dual tea base, unlike most other tea exporting countries. Both CTC and Orthodox tea is produced in India. The tea industry is agro‐based and labour intensive. It provides direct employment to over 1 million persons. Through its forward and backward linkages another 10 million persons derive their livelihood from tea. In Northeast India alone, the tea industry employs around 900,000 persons on permanent rolls. It is one of the largest employers of women amonst organized industries in India. Women constitute nearly 51% of the total workforce. The tea estates in the North Eastern India are located in industrially backward areas. Tea being the only organised industry in the private sector in this region, people outside the tea estates have high expectations from the industry. The three most distinct known varieties of tea in India are: a) Assam tea (grown in Assam and other parts of NE India) b) Darjeeling tea (grown in Darjeeling and other parts of West Bengal) c) Nilgiri tea (grown in the Nilgiri hills of Tamil Nadu) Objective Through this dissertation project, I intend to study, with respect to the CIS nations and the United Kingdom that serve as the foremost export markets, the Indian tea industry in detail, the trends observed in the past, the highs and lows of export volumes to these countries and the reasons behind them, as well as future prospects on where Indian would stand in the global arena. -

Tea Drinking: Origin, Perceptions, Habits with Special Reference to Assam, Its Tribes, and Role of Tocklai

ARTICLE TEA DRINKING: ORIGIN, PERCEPTIONS, HABITS WITH SPECIAL REFERENCE TO ASSAM, ITS TRIBES, AND ROLE OF TOCKLAI PRADIP BARUAH* ea is the most popular drink in the planet and it The first authentic reference to tea is found in an occupies that position only after water. Its first use ancient Chinese dictionary which was revised about the Tis believed to be about 5,000 years back and has year 350 A.D. by P’O, a Chinese scholar. Tea leaves were remained popular as the most pleasurable and efficacious boiled at that time to prepare a medicinal decoction. The beverage in the world. Tea drinking has rather been gaining first book exclusively on tea was published in 780 A.D. by further acceptance now due to its natural health benefiting Lu Yu (733-804), respected as the Sage of Tea. The book properties. The heritage drink has withstood the test of ‘Ch’a Ching’ or ‘The Classic of Tea’ in three volumes is time and it may well be the drink of the future. The journey divided into ten chapters, each describing various kinds of the beverage through the passage of time has been of tea, cultivation, manufacturing methods, etc. and gives glorious and fascinating. The origin of tea in China, myths information on the tea growing districts of China. Use of associated with it, spread across the world, perceptions, tea as a beverage commenced towards the end of the sixth culture and habits, discovery in wild forests of Assam, century in China. Thereafter, tea grew in popularity and and tea drinking habit of the tribes of the state are all the Government levied a duty on tea in 783 A.D. -

Letter to Associations with Maili

Distribution : The Chairman Consultative Committee of Plantation Associations 6, Royal Exchange, N. S. Road, Kolkata 700 001 The Secretary General Indian Tea Association 6, Royal Exchange, N. S. Road, Kolkata 700 001 The President, Tea Association of India, 4, India Exchange, 7th Floor, Kolkata – 700 001 The Chairman, Darjeeling Tea Association 6, N. S. Road, Kolkata – 700 001. The Chairman Indian Bio Organic Tea Association 6, N. S. Road, Kolkata – 700 001 The Chairman Tea Research Association 113, Park Street, 9th Floor, “B’’ Block, Kolkata – 700 016 Principal Advisor Indian Tea Planters’ Association Post Box No. 74, Jalpaiguri, West Bengal Secretary Assam Tea Planters Association A. T. Road, Tarajan, Post box no. 21, Jorhat 785 001, Assam Additional Chairman Bharatiya Cha Parishad Jallannagar, Dibrugarh 786005, Assam The Secretary General United Planters' Association of Southern India (UPASI), Glenview, Post box. No. 11, Coonoor - 643 101, Nilgiris, Tamil Nadu The Chairman, North Eastern Tea Association, Jallan Golaghat Tea Co. (P) Ltd., Kushal Path, Amolapatty, Golaghat 785 621 Assam The Chairman, Terai Indian Tea Planters' Association, P.O. - Mattigara, Siliguri, Dist. - Darjeeling, West Bengal. 734010 The Chairman Karnataka Planters Association P.B. No 18, Spencer Road Chikmagalur - 577101 The Secretary Association of Planters of Kerala Palayam, Thiruvananthapuram, Kerala 695001 The Chairman Kangra Valley Tea Planters’ Association Kangra Valley Tea Estate Gopalpur Dist: Kangra Palampur – 176059 Himachal Pradesh The Executive Director -

GIFTING CATALOGUE.Cdr

R GIFTING COLLECTION You can't buy happiness, but you can buy Tea, and that's kind of the same thing. Assam Tinkaharia Tea estate Sonajhuli Tea estate Kenduguri Tea estate Dhullie Tea estate SPECIALTY LOOSE STAPLE FREE LEAF TEAS PREMIUM TEA BAGS The Darjeeling Ltd ClassicAuthentic A Assamssam Tea Rhino Assam DarjeelingThe Darjeeling T eLtad Velvet Vanilla Charles Earl Grey Mount Darjeeling 1st Flush Earl Grey English Breakfast Purple Earl Grey Upagga Lemon Masala Chai English Breakfast Masala Chai Gulkand Paan Lemon Tea Mango Lychee Shape of Green Sweet Ginger Peach MasalaJasmine GrChaieen Kashmiri Kahwa Green Kashmiri Kahwa Green Tea Jasmine Green Tulsi Immunity+ Dancing Green JasmineLa Menta P Greppereenmint Calming Chamomile+ Calming Chamomile+ La Menta Peppermint Kashmiri Kahwa Green Tea Turmeric Glow Turmeric Glow Tulsi Green Super Berry Aloe Cleanse Detox+ PDigestivepperemint+ Saintly White Kalkatta Paan Oolong Rose THE GOODWYN GIFT COLLECTION Blend for ELEGANCE Blend for Elegance CUSTOMIZABLE 9x10 Alluring Chest 30 TB Alluring Chest REUSABLE CLASSY 60 TB IDEAL FOR Alluring Chest Senior management gifting, Keynote speakers, Festive gifting, Wedding gifts, Anniversary gifts. Blend for NATURE Blend for Elegance ECO-FRIENDLY 4 TIN Jute Bag ORGANIC 2 TIN Jute Bag IDEAL FOR Store launch, Product launch, Hampers Blend for POCKET-FRIENDLY GIVEAWAY ASSORTMENT SUPER BERRY Sqaure tin ASSORTED COLLECTION Square tin SUPER BERRY CUSTOMIZABLE Sqaure tin IDEAL FOR REUSABLE Store launch, Product launch, Hampers, Seminars/exhibition giveaways Blend -

AFTERNOON TEA STAPLEFORD PARK - a BRIEF HISTORY (Additional 30 Minute Preparation If Not Pre-Ordered)

VEGAN AFTERNOON TEA STAPLEFORD PARK - A BRIEF HISTORY (Additional 30 minute preparation if not pre-ordered) Finger Sandwiches Early historical records indicate that Stapleford Park was held under the King by Henry de Ferrers, who fought at the battle of Hastings in 1066, and afterwards was appointed Butternut squash, red cabbage slaw, onion chutney Domesday Commissioner. After passing through a succession of owners, in 1402 the house was acquired from the Earl of Lancaster by Robert Sherard, a descendant of Vegan feta cheese, fig chutney, wild rocket William the Conqueror, and for the next 484 years remained in the possession of his Tofu smoked paprika, baby spinach family, who later became the Earls of Harborough, and it was Thomas who is said to be the builder of the Old Wing as we know it today. The Old Wing was restored in 1633. Coriander hummus, roasted red pepper A change of ownership came in 1894 when the House was purchased by Lord Gretton, a wealthy brewer of the firm Bass, Ratcliffe and Gretton. The House was enlarged with a series of reception rooms and further bedrooms. His son did not share his social ambitions and when his grandson, the third Lord Gretton, succeeded in 1982, he Scones inherited a house designed for entertaining on an Edwardian scale and therefore decided to sell the House but retain the estate. Plain and fruit scones The American entrepreneur Bob Payton bought the House and, in April 1988, after more Strawberry jam than a year of renovations, with rooms designed by notable names like Wedgwood, Turnbull & Asser and Crabtree & Evelyn, Stapleford Park was opened as a hotel. -

Bone Dry Gin

BONE DRY GIN At Backbone Bourbon Company, we are huge fans of the gin category and couldn’t imagine our company without at least one gin. We love the way gin as a clear spirit can have complexity and nuance. We are also fans of a traditional style gin. To this end, we sought to develop the “driest” but also the most satisfying gin possible. Bone Dry gin makes a great martini (even with a little vermouth added, we don’t mind!). It’s also a great companion to a little tonic and ice that makes a refreshing drink in the warmer, summer months. Please give it a try! INGREDIENTS: The base spirit is made from wheat. Bone Dry is made with the following botanicals: Juniper berries, Smoked black tea (Lapsang Souchong), Black Pepper, Assam Tea, Coriander, Chamomile, Grains of Paradise, Lemon zest, Lime zest, Cassia, Lemongrass and Rosemary Approximately 2/3 of the botanicals are juniper berries which comes from Bulgaria. DISTILLATION STATE & CITY: Los Angeles, CA PROOF: 92 CURRENT BATCH#: N/a CASES PRODUCED: 764 (last run) TASTING NOTES: The nose provides fresh aromas of pine trees in the Spring. Upfront is a great, slightly oily texture. Mid-palate provides just a hint of peppermint candy and some base citrus notes that add a refreshing quality. Dry but lingering finish. 3090 Grapevine Street, Suite 100 Jurupa Valley, CA 91752 USA 323.358.4555 backbonebourbon.com BIGGEST BADDEST BOLDEST BOURBON IN INDIANA! Our products were made by responsible adults, for responsible adults. Please enjoy them that way. © Backbone Bourbon Company. -

SPECIAL ARTICLE OPEN ACCESS Tea Plantations and Socio-Cultural

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Space and Culture, India Magar and Kar. Space and Culture, India 2016, 4:1 Page | 25 DOI: 10.20896/saci.v4i1.188 SPECIAL ARTICLE OPEN ACCESS Tea Plantations and Socio-Cultural Transformation: The Case of Assam, India Chandra Kala Magar†*and Bimal Kumar KarῙ Abstract The tea plantations of Assam, which constitute the country’s 53.97 per cent tea area, 49 per cent tea worker population, and 52.04 per cent tea production, occupy an important place in the economy, culture and polity of the state. The onset of tea plantations during British colonial rule has not only changed the landscape of the upper Brahmaputra valley through green tea bushes being nourished by tea tribes from east-central India, but also evolved a distinct tea culture. Although formation of small tea growers has added a new dimension to the growth of tea industry of Assam in recent times, the culture that emerged due to the long continued interaction of British planters, tea worker tribes and indigenous Assamese is well reflected in the language, way of life, work culture, food habits and many other socio-cultural practices in most of the large tea estates in the state. In fact, the impact of tea culture is so penetrative that it has been able to bring about development in the form of tea festival, tea tourism, tea folk songs and dances, etc. in the state. An attempt is made in this paper to explore the role of tea plantation and the people associated with it to the socio-cultural transformation of Assam based on both secondary data and primary data through field study. -

Power Structure, Discipline, and Labour in Assam Tea Plantations Under Colonial Rule

IRSH 51 (2006), Supplement, pp. 143–172 DOI: 10.1017/S0020859006002641 # 2006 Internationaal Instituut voor Sociale Geschiedenis Power Structure, Discipline, and Labour in Assam Tea Plantations under Colonial Rule Rana P. Behal The tea industry, from the 1840s onwards the earliest commercial enterprise established by private British capital in the Assam Valley, had been the major employer of wage labour there during colonial rule. It grew spectacularly during the last quarter of the nineteenth century, when tea production increased from 6,000,000 lb in 1872 to 75,000,000 lb in 1900 and the area under tea cultivation expanded from 27,000 acres to 204,000 acres.1 Employment of labour in the Assam Valley tea plantations increased from 107,847 in 1885 to 247,760 in 1900,2 and the industry continued to grow during the first half of the twentieth century. At the end of colonial rule the Assam Valley tea plantations employed nearly half a million labourers out of a labour population of more than three-quarters of a million, and more than 300,000 acres were under tea cultivation out of a total area of a million acres controlled by the tea companies.3 This impressive expansion and the growth of the Assam Valley tea industry took place within the monopolistic control of British capital in Assam. An analysis of the list of companies shows that in 1942 84 per cent of tea estates with 89 per cent of the acreage in the Assam Valley were controlled by the European managing agency houses.4 Throughout India, thirteen leading agency houses of Calcutta controlled over 75 per cent of total tea production in 1939.5 Elsewhere I have shown that the tea companies reaped profits over a long time despite fluctuating international prices and slumps.6 One of the most notable features of the Assam Valley tea plantations was that, unlike in the cases of most of the other major industries such as jute, textiles, and mining in British India, it never suffered from a complete 1. -

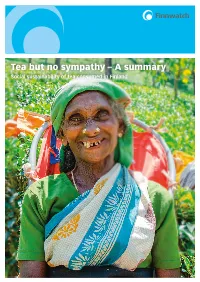

Tea but No Sympathy – a Summary

Tea but no sympathy – A summary Social sustainability of tea consumed in Finland Supported by crowdfunding organised on the People´s Cultural Foundation’s Kulttuurilahja -plat- form and by the Finnwatch Decent Work Research Programme. The Programme is supported by: An abbreviated and translated version of the original Finnish report. In the event of interpretation disputes the Finnish text applies. The original is available at www.fi nnwatch.org. Finnwatch is a non-profi t organisation that investigates the global impacts of Finnish business en- terprises. Finnwatch is supported by 11 development, environmental and consumer organisations and trade unions: The International Solidarity Foundation ISF, Finnish Development NGOs – Fingo, The Finnish Evangelical Lutheran Mission Felm, Pro Ethical Trade Finland, The Trade Union Solidarity Centre of Finland SASK, Attac, Finn Church Aid, The Dalit Solidarity Network in Finland, Friends of the Earth Finland, KIOS Foundation and The Consumers’ Union of Finland. Layout: Petri Clusius/Amfi bi ky Publication date: October 2019 Cover photo: A worker on a tea plantation in the Nuwara Eliya district in Sri Lanka. The person in the photo is not connected to Finnwatch’s investigation. Finnwatch will not publish pictures of the individuals who were intervie- wed for this report due to consideration for their safety. Contents 1. INTRODUCTION .............................................................................................................................. 4 2. INDIA: THE NILGIRIS ..................................................................................................................... -

The Journey of a Tea Merchant

Summer, 2018 Upton Tea Quarterly Page 1 Vol 27 No. 3 Holliston, Massachusetts Summer, 2018 THE JOURNEY OF A TEA MERCHANT ith a lifelong passion for the world’s finest teas, Roy Fong, owner of the Imperial Tea Court in San Francisco, has been importing premium tea to the United States for more than thirty years. WHe has journeyed to China countless times in the pursuit of happiness to be found in a cup of tea. “Tea chose me. Looking back, there was no other path but tea.” I recently had the pleasure of sitting down with him at the Imperial Tea Court. Over many cups of tea, he shared his story. PLEASE TURN TO PAGE 51. ' (800) 234-8327 www.uptontea.com Copyright© 2018 2018 Upton Upton Tea Tea Imports. Imports. All rights All rights reserved. reserved. PagePage 2 2 UptonUpton Tea Tea Quarterly Quarterly Summer,Summer, 2018 2018 Summer,Summer, 2018 2018 UptonUpton Tea Tea Quarterly Quarterly PagePage 3 3 NOTEWORTHY...NOTEWORTHY... TABLETABLE OF OF CONTENTS CONTENTS MayMay 12, 12, 2018 2018 OverOver twenty twenty new new teas teas have have been been introduced introduced AA Note Note to to our our Valued Valued Customers Customers ................................. .................................3 3 inin this this issue issue of of our our newsletter newsletter, including, including spring- spring- CurrentCurrent Tea Tea Offerings Offerings AA Note Note to to our our Valued Valued Customers: Customers: harvestharvest first first flush flush Darjeelings Darjeelings (page (page 9) 9) and and a afirst first AfricaAfrica..............................................................................................................................................3131 -

Corporate Responsibility for Human Rights in Assam Tea Plantations: a Business and Human Rights Approach

sustainability Article Corporate Responsibility for Human Rights in Assam Tea Plantations: A Business and Human Rights Approach Madhura Rao 1 and Nadia Bernaz 2,* 1 Food Claims Centre Venlo, Maastricht University, 5911 BV Venlo, The Netherlands; [email protected] 2 Law Group, Wageningen University, 6708 PB Wageningen, The Netherlands * Correspondence: [email protected] Received: 16 July 2020; Accepted: 7 September 2020; Published: 9 September 2020 Abstract: This paper explores how UK-based companies deal with their responsibility to respect the human rights of Assam (India) tea plantation workers. Through qualitative content analysis of publicly available corporate reports and other documents, it investigates how companies approach and communicate their potential human rights impacts. It highlights the gap between well-documented human rights issues on the ground and corporate reports on these issues. It aims to answer the following research question: in a context where the existence of human rights violations at the end of the supply chain is well-documented, how do companies reconcile their possible connection with those violations and the corporate responsibility to respect human rights under the United Nations Guiding Principles on Business and Human Rights? This paper reveals the weakness of the current corporate social responsibility (CSR) approach from the perspective of rights-holders. It supports a business and human rights approach, one that places the protection of human rights at its core. Keywords: tea plantations; Assam; business and human rights; corporate social responsibility; UN Guiding Principles on Business and Human Rights; UK Modern Slavery Act 1. Introduction This paper explores how UK-based tea companies deal with their responsibility to respect the human rights of Assam tea plantation workers.