57 Creekside: a Luxury Apartment and Retail Community

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Residential Research

RESIDENTIAL RESEARCH THE DOWNSIZING LIFESTYLE TREND TOWARDS LUXURY APARTMENT LIVING Rightsizing beyond 2020 -Page 2 Dwelling migration routes The strong demand from downsizers Rightsizing also appeals to younger -Page 3 seeking easily maintainable prime generations, and we see this at a much properties close to city centre locations earlier stage than in previous years given Buyer profile of prime apartments has been identified as one of nine global the agile, transient and global nature of -Page 4 trends being monitored over the coming our work and play. years, as identified in the Knight Frank Prime Global Forecast 2020. Apartment living allows for low Trends in prime apartments maintenance living when at home, -Page 5 When working with our clients, many tell convenience of concierge and the ability us their home is no longer required to of lock-up-and-leave when away. provide the lifestyle they once had, and Pipeline of new dwellings in prime more often, the cost to upkeep This prime trend follows a similar path to suburbs -Page 7 outweighs the surplus space once the wider market with the average new desired. house size built in 2018/19 falling 1.3% on the year before, whilst the average Owning strata titled property With this new active retiree lifestyle, they new apartment size grew by 3.2%, -Page 8 seek simplicity, and to feel the vibe from according to the Australian Bureau of living close to the action. Downsizing the Statistics (ABS) when commissioned by Case study: The cost to upkeep living areas is not part of this movement CommSec. -

AVANT at Met Square

january 2016 volume XVIII AVANT at met square the next generation of urban living SUSTAINED MOMENTUM The U.S. economy remains healthy, with more than 2.8 million new jobs added during the 12 months ending October 2015. U.S. homeownership continues to decline, and at 63.7% percent, hovers near historic lows. These positive trends are continuing to drive rental demand. The third quarter of 2015 was the seventh consecutive quarter of positive net unit absorption. On average, rent growth registered 5.2 percent in the major U.S. markets, and the vacancy rate was 4.3 percent, the lowest level of the current cycle. Industry analysts expect that new unit production will peak in 2016, before tapering through the end of the decade. The near term increase in new supply is expected to have only modest impacts on vacancy and rent growth. However, due to continued job growth and a steady influx of new renters, primarily millennials entering the rental market and aging baby boomers who increasingly find rental housing more attractive than homeownership, the market will continue to perform well. With these positive market forces at work, ZOM is poised for continued success in 2016. In Florida, we will complete lease-ups at Moda and Bel Air Doral in early 2016, and will begin delivering units at Monarc at Met 3, Baldwin Harbor, Delray Preserve, and Luzano. In Texas, our Tate project in Houston will also open its doors. In our Mid-Atlantic region, construction continues at Banner Hill in Baltimore, and we are working on several new projects in other Mid-Atlantic target markets. -

Parc Huron Becomes Chicago's First LEED Gold High Rise Apartment

Friday, August 27, 2010 FOR: Parc Huron RMK Management Corp. Parc Huron Becomes Chicago’s First LEED Gold High Rise Apartment Building Luxury rental building first in Illinois, one of only a handful in the country Chicago-based M&R Development and RMK Management Corp. have announced their newest luxury apartment community, Parc Huron, located at 469 W. Huron St. in Chicago’s River North neighborhood, as the first of its kind in the city to earn LEED Gold certification from the U.S. Green Building Council (USGBC). To earn this nationally respected accreditation, Parc Huron’s design, construction and operation must meet the strict standards set forth by the USGBC, including a high level of energy and water efficiency; use of recycled and regional materials and recyclable construction materials; and an advanced degree of indoor air quality, which is attained through the use of low-VOC materials and a sophisticated air filtration system. Additional credits were earned for the development of an adjacent park, a green roof, extensive use of natural light throughout the units and the common areas, and for the walkable location in the heart of River North. “We are thrilled to be the first LEED Gold certified rental high rise in Illinois, and are even more excited to offer this type of residence to the people of Chicago,” said Anthony Rossi, Sr., president of RMK Management Corp. “Chicago has long been known as a leader in terms of art, fashion and architecture, and we continue to be ahead of the trend for high-end green living, too.” Rossi noted that the apartment homes, in addition to being exceptionally eco-friendly, offer upscale features on par with for-sale condominiums. -

Residential Hotels in Chicago, 1880-1930

NPS Form 10-900-b OMB No. 1024-0018 United States Department of the Interior National Park Service National Register of Historic Places Multiple Property Documentation Form This form is used for documenting property groups relating to one or several historic contexts. See instructions in National Register Bulletin How to Complete the Multiple Property Documentation Form (formerly 16B). Complete each item by entering the requested information. __x_____ New Submission ________ Amended Submission A. Name of Multiple Property Listing Residential Hotels in Chicago, 1880-1930 B. Associated Historic Contexts (Name each associated historic context, identifying theme, geographical area, and chronological period for each.) The Evolution of the Residential Hotel in Chicago as a Distinct Building Type (1880-1930) C. Form Prepared by: name/title: Emily Ramsey, Lara Ramsey, w/Terry Tatum organization: Ramsey Historic Consultants street & number: 1105 W. Chicago Avenue, Suite 201 city or town: Chicago state: IL zip code: 60642 e-mail: [email protected] telephone: 312-421-1295 date: 11/28/2016 D. Certification As the designated authority under the National Historic Preservation Act of 1966, as amended, I hereby certify that this documentation form meets the National Register documentation standards and sets forth requirements for the listing of related properties consistent with the National Register criteria. This submission meets the procedural and professional requirements set forth in 36 CFR 60 and the Secretary of the Interior’s Standards and Guidelines for Archeology and Historic Preservation. _______________________________ _______________________________________________ Signature of certifying official Title Date _____________________________________ State or Federal Agency or Tribal government I hereby certify that this multiple property documentation form has been approved by the National Register as a basis for evaluating related properties for listing in the National Register. -

Cleveland Heights RFQ

Request for Qualifications and Preliminary Development Proposals RFQ/RFP – Top of Hill Site Presented to: City of Cleveland Heights 40 Severance Circle Cleveland Heights, OH 44118 For More Information Contact: Deron Kintner General Counsel Flaherty & Collins Properties [email protected] 317.816.9300 www.flco.com May 23, 2016 Flaherty & Collins Properties (F&C) is pleased to submit this Request for Qualifications and Development Proposal to the City of Cleveland Heights for the development of the Top of the Hill site. As Developer, F&C will develop the Project in the same manner as the projects outlined in this proposal. For the reasons stated in this submission, F&C believes its extensive experience and proven track record make us the best and most uniquely qualified developer to undertake this complex and exciting development. If selected, F&C commits to deliver a first-class, high-quality, innovative mixed-use development in a timely and efficient manner. We believe we are the best and most qualified developer to execute and deliver upon this development. The materials to follow provide more detail to support each of these points. • Corporate Experience. F&C, which has over 450 employees, has developed 58 projects and more than 8,500 units in the past 15 years with a value in excess of $1 billion, currently manages over 15,500 units in 13 states and has been involved with the construction of over 15,000 units in 20 states. F&C is fully integrated with in-house development, construction and property management professionals and has the ability to structure, procure and close complicated, multi-layered financing. -

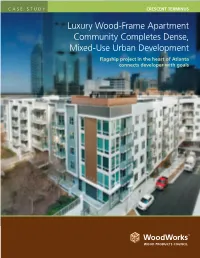

Luxury Wood-Frame Apartment Community Completes Dense, Mixed-Use Urban Development Flagship Project in the Heart of Atlanta Connects Developer with Goals

FRONT COVER CASE STUDY CRESCENT TERMINUS Luxury Wood-Frame Apartment Community Completes Dense, Mixed-Use Urban Development Flagship project in the heart of Atlanta connects developer with goals $FRA-490_CrescentTerminus_CaseStudy.indd 3 3/13/15 4:18 PM Surrounded by high-rise buildings in the upscale Buckhead neighborhood of Atlanta, Crescent Terminus is a new three-building, luxury apartment complex offering resort-style amenities, including a salt-water pool, rooftop terraces with dramatic skyline views, a gourmet coffee bar and more. Featuring five stories of wood over a concrete podium, the project fills the last three parcels of land in the Terminus complex, completing this unique urban development. And while the prime piece of real estate carried a corresponding price tag, the developer was able to move ahead with the project thanks in large part to the choice of an affordable, high-quality wood-frame structure. 2 $FRA-490_CrescentTerminus_CaseStudy.indd 2 3/13/15 4:18 PM CRESCENT TERMINUS “This site has all the ingredients for a successful luxury apartment community,” said Jay Curran, Vice President of Crescent Project Overview Communities’ multi-family group. “Its location in the heart of Buckhead is ideal. Surrounded by world-class office space, luxury condominiums, outstanding public art, five-star dining and street- level retail, Crescent Terminus will offer a unique lifestyle that allows residents an opportunity to work, play and live all within easy walking distances. This location and all those attributes are consistent with the Crescent brand of exceptional development.” The Crescent Terminus project was inspired through extensive review and analysis of current industry trends and marketplace needs. -

Affordable Housing Needs and Market Value Analysis Report

AFFORDABLE HOUSING NEEDS & MARKET VALUE ANALYSIS CITY OF DENTON, TEXAS ATRIA JANUARY, 2021 PLANNING ACKNOWLEDGMENTS We would like to thank the following community leaders, housing professionals, nonprofit, business, university, and other major stakeholders from Denton who participated in this project. Denton City Council (2020): Daniel Armitage, University of North Texas Jean Latsha, Pedcor Mayor Chris Watts Lora Atkinson, Habitat for Humanity Chris Martin, Denton Veterans Coalition Gerard Hudspeth, District 1 Courtney Banatoski, Cumberland Marty Mascari, NT Aging and Disability Keely Briggs, District 2 Megan Bradshaw, Realtor Sherri McDade, Denton Housing Authority Jesse Davis, District 3 Jill Eckardt, Texas Woman’s University Jacon Moses, Denton Affordable Housing John Ryan, District 4 Sheryl English, Denton Housing Authority Jim Strange, Tremont Construction Deb Armintor, At Large Place 5 Doni Green, NT Area on Agency Jack Trager, Legacy Paul Meltzer, At Large Place 6 Pam Gutierrez, Denton County MHMR Terry Widmer, DC Homelessness Leadership Gary Henderson, United Way Team City of Denton Lee Ann Hubanks, Fair Oaks Senior Housing Ryan Zent, Michaels Corporation Stuart Birdseye, City of Denton Tony Johnson‐Simpson, DC Friends of the Family Julia Zwahr, Denton ISD Courtney Cross, City of Denton Dani Shaw, City of Denton Erica Sullivan, City of Denton Julie Wyatt, City of Denton Reinvestment Fund CONSULTING TEAM 1700 Market Street, 19th floor Emily Dowdall, Policy Director Philadelphia, PA 19103 Colin Weidig, Senior Policy Analyst TEL 215.574.5800 FAX 215.574.5900 Janine Simmons, Analyst https://www.reinvestment.com/ Atria Planning CONSULTING TEAM 1223 Cleveland Avenue Suite 200 Rebecca Rothenberg, Principal San Diego, CA 92103 Tel O: 619.375.0138 All images in this report were provided by CONSULTING TEAM https://www.atriaplanning.com/ the city of Denton unless otherwise noted. -

Multifamily, Investment Fueling Cincinnati's CRE Growth by Susan

22 CINCINNATI Midwest Real Estate News | NOVEMBER/DECEMBER 2018 | www.rejournals.com Multifamily, investment fueling Cincinnati’s CRE growth By Susan Branscome Encore Apartments in downtown is an example of the high-end multifamily projects rising in Cincinnati. he amount of private and this effort are government-sponsored Cincinnati Children’s Hospital began building, retail space, restaurants, public capital investment entities and non-profits such as development of a $650 million expan- apartments and two hotels. in the city of Cincinnati 3CDC, The Greater Cincinnati Rede- sion to the Avondale campus, which during the last 10 years velopment Authority, REDI Cincinnati, will add 600 jobs. FC Cincinnati, Cincinnati’s profession- has been unprecedented. Northern Kentucky Tri-Ed and the al soccer team, began as a vision by T Greater Cincinnati Chamber of Com- The recently opened MLK/I-71 inter- manager Jeff Berding. With the finan- Cincinnati has experienced a resur- merce. change has allowed much better ac- cial support of the Lindner family the gence unlike any time in the city’s cess to 670 underutilized properties team was accepted into the MLS for recent history given an incredible Some of the following major develop- near the UC Medical Center and the the 2019 season. The club has record amount of capital invested during the ments have recently been completed University of Cincinnati in an area attendance, averaging 25,000 per last 10 years. Cincinnati is one of the or in the planning phases: known as Uptown. The expectation game and plans to develop new stadi- top cities in the country for millennial is to create an additional 7,000 jobs um in 2021 just west of the Cincinnati migration and ranked in the top 10 Amazon is expanding its Global Prime with the investment by local develop- CBD. -

Avison Young Commercial Real Estate Investment Review

Fall 2018 Avison Young Commercial Real Estate Investment Review North America and Europe Partnership. Performance. Contents Overview 05 Canada Investment Market Overview 43 Memphis 71 London 11 U.S. Investment Market Overview 44 Miami 72 Manchester 45 Minneapolis Canada 46 Nashville Germany 17 Calgary 47 New Jersey 74 Berlin 18 Edmonton 48 New York 75 Duesseldorf Montreal 19 49 Oakland 76 Frankfurt 20 Ottawa 50 Orange County 77 Hamburg 21 Toronto Orlando 51 78 Munich Vancouver 22 52 Philadelphia Phoenix Romania United States 53 Pittsburgh 54 80 Bucharest 24 Atlanta 55 Raleigh-Durham 25 Austin 56 Sacramento More from Avison Young 26 Boston San Antonio 57 Company Overview 27 Charlotte 84 58 San Diego County 28 Chicago 86 Publications and Social Media 59 San Francisco 29 Cleveland 87 Contact Us 60 San Jose/Silicon Valley 30 Columbus, OH 61 San Mateo 31 Dallas 62 St. Louis 32 Denver 63 Tampa 33 Detroit Washington, DC 34 Fairfield County 64 West Palm Beach 35 Fort Lauderdale 65 Westchester County 36 Hartford 66 37 Houston Mexico 38 Indianapolis 39 Jacksonville 68 Mexico City Disclaimer 40 Las Vegas United Kingdom The statistics contained in this report were obtained from sources deemed reliable, including Altus InSite, Avison Young, Collette, Plante & Associés, Commercial Edge, CoStar Group 41 Long Island Inc., Desjarlais Prévost Inc., Gettel Network, Property Data Ltd., Real Capital Analytics, Inc., RealNet Canada, RealTrack, Reis Services, LLC, and Thomas Daily GmbH. However, Avison Young (Canada) Inc. does not guarantee the accuracy or completeness of the information presented, nor does it assume any responsibility or liability for any errors or omissions. -

Luxury Apartment Tower Rises from Parking Lot in Downtown Seattle

Under way: luxury apartment tower rises from parking lot in downtown Seattle Construction has started on Clise Properties' 40-story luxury apartment project at 2202 Eighth Ave., Seattle. Graphite Design Group is the architect. By Marc Stiles – Staff Writer, Puget Sound Business Journal Jan 13, 2016, 12:26pm EST The booming Denny Triangle area of downtown Seattle is getting another apartment skyscraper. Construction is under way on the 40-story tower at 2202 Eighth Ave., project developer, Al Clise, chairman and CEO of Clise Properties, said Tuesday. The site, which is just south of the La Quinta Inn & Suites off Denny Way, was a surface parking lot. Within about a one-block radius of Clise's project are three other high-rise apartment tower projects. Together the four towers will bring a total of 1,725 apartments to the area between Amazon.com's (Nasdaq: AMZN) headquarters in South Lake Union and the company's downtown high-rise campus. Also on Tuesday, JLL (NYSE: JLL) Capital Markets announced it has secured senior construction and mezzanine financing for Clise's $284 million development. Bank of the Ozarks (Nasdaq: OZRK) provided the senior construction loan. EverWest Real Estate Partners, in partnership with Diamond Realty, a division of Mitsubishi Corp., provided the mezzanine loan. It's Japan-based Mitsubishi's first significant investment in Seattle, according to JLL officials, who said this shows the strength of the market and the high-profile status of the Clise project. The Clise project is the latest big Seattle real estate development that Little Rock, Arkansas-based Bank of the Ozarks is financing. -

Manhattan's Luxury Hudson Yards Tower Is 25% Sold More Stories by Oshrat Carmiel

Manhattan's Luxury Hudson Yards Tower Is 25% Sold More stories by Oshrat Carmiel A condo tower rising in what’s billed as Manhattan’s newest neighborhood reported that more than a quarter of its 285 units have sold since marketing began in September, a sign that local buyers are willing to commit to the borough’s far west side. Signed contracts at Fifteen Hudson Yards range from about $2 million for a one-bedroom apartment to about $10 million for a three-bedroom unit, said Sherry Tobak, senior vice president of sales at Related Cos., which is developing the $25 billion Hudson Yards commercial and residential project with Oxford Properties Group. One buyer acquired two individual three- bedroom units for a combined $16 million, she said. “Seventy percent of the buyers are New Yorkers, coming from downtown or the Upper West Side,” Tobak said. “We are definitely getting those primary buyers who are coming here.” With 75 signed deals, reached between September and Dec. 31, the building recorded the largest number of sales at a ground-up development in 2016, said Ryan Schleis, vice president of research and analytics for Corcoran Sunshine Marketing Group, the brokerage working with Related to handle sales at the property. Deals have totaled more than $300 million, at an average of $3,250 a square foot, Tobak said. Travel with us, drive with us, eat with us. Manhattan’s luxury apartment market is Get our weekly Pursuits newsletter. seeing sparks of life after sputtering for much of last year as a construction surge created an abundance of choices for the well-heeled. -

Real Estate Alert’S Deal Database

DECEMBER 10, 2014 Handful of Finalists in Running to Buy Gables Several players have reached the final round of bidding for apartment giant 3 KBS Buying Bay-Area Office Towers Gables Residential. Among those in the running is New York-based Clarion Partners, which already 3 Federal Partners Nabs Virginia Offices owns a piece of the Atlanta REIT. Other bidders include a joint venture between Greystar Real Estate Pimco 3 Luxury NY Apartments Up for Grabs of Charleston, S.C., and of Newport Beach, Calif.; Denver REIT AIMCO; the team of Calpers and GID Investments of Boston; and a partnership 4 Shop Eyes 2nd Gain on Illinois Offices between DRA Advisors of New York and the Abu Dhabi Investment Authority. It was not clear if there were other finalists. 6 John Buck Fund Holds First Close The initial bidding valued the company at roughly $3 billion. Best-and-final bids 6 GreenOak Rolls Out Japan Offering are expected this week, and a buyer is likely to emerge by yearend. Eastdil Secured is advising Gables. 6 Value-Added Office Listing in Phila. The private REIT, which put itself on the block in August, is both an owner and a third-party manager of multi-family properties, overseeing about 40,000 apartments 7 KBS Marketing Offices in Delaware See GABLES on Page 4 7 Foreign Buyers Lift Retail Purchases 8 Court Orders Sale of NJ Retail Center Hilton to Buy 4 Hotels With Waldorf Proceeds 8 Suburban NY Offices Up for Sale Flush with capital from its pending sale of the Waldorf Astoria in Manhattan, Hilton Worldwide has agreed to buy four hotels from Blackstone and its partners for 8 Garrison Markets Distressed Assets well over $1 billion.