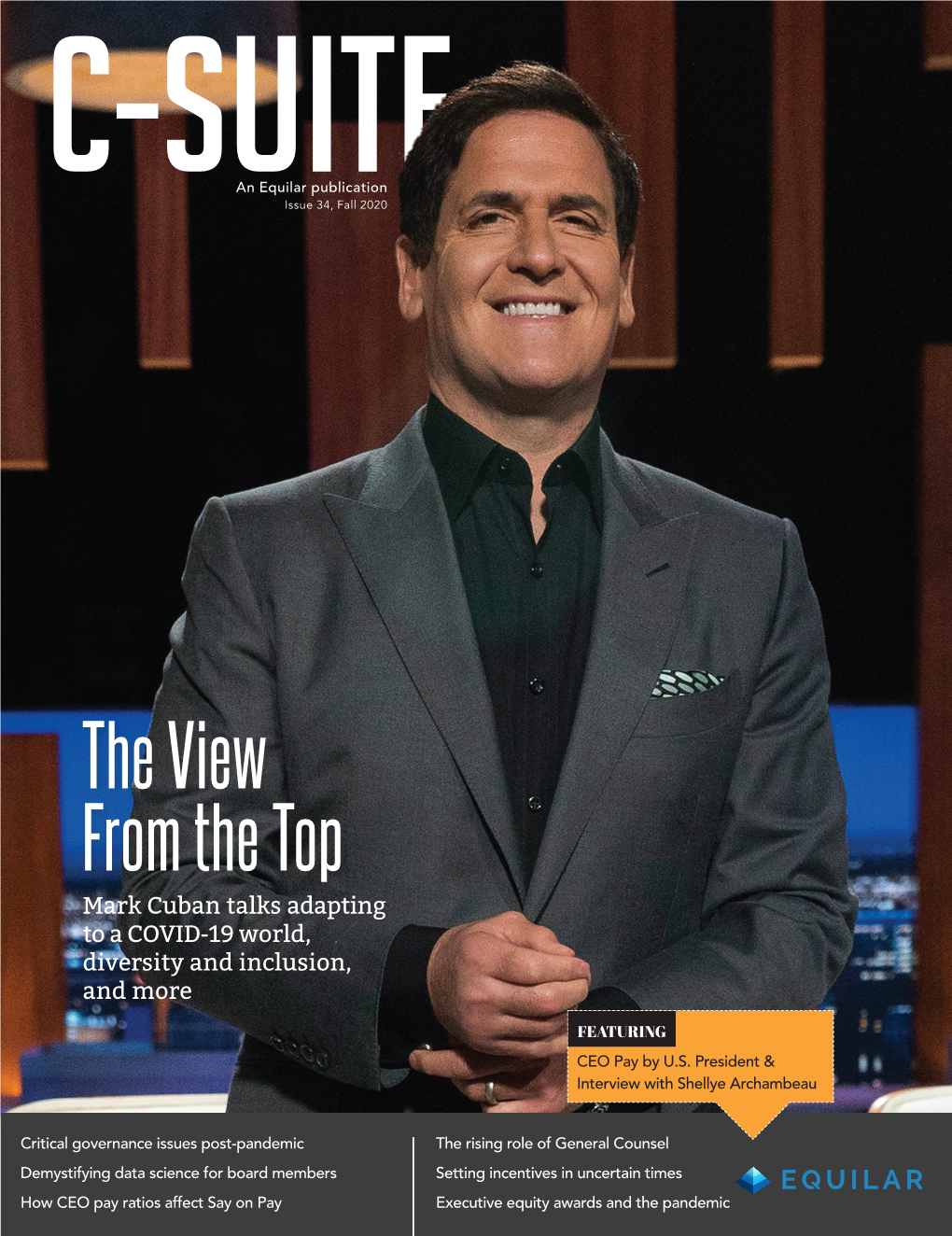

The View from the Top Mark Cuban Talks Adapting to a COVID-19 World, Diversity and Inclusion, and More

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Experimenting Team-Building Strategies in an Innovative Nexus Learning Capstone Course

Experimenting Team-Building Strategies in an Innovative Nexus Learning Capstone Course Gulbin Ozcan-Deniz, Ph.D, LEED AP BD+C, [email protected] Assistant Professor, College of Architecture and the Built Environment, Philadelphia University, Philadelphia, PA Agenda Motivation and Primary Goals Re-design Steps of Capstone Sample Team-building Activities Problem-solving in a Team Student Assessment Results Digital Tools for Collaboration Conclusions Motivation and Primary Goals Research Primary Goals Motivation the need for a experiment with stimulate peer and collaborative team-building and team-based capstone course in collaborative learning many disciplines working problems Ozcan Deniz, G. (2016), Innovative Nexus Learning Capstone Experience for Construction Management Students, Philadelphia University Nexus Learning Grant Proposal, 2016-2017. Motivation and Primary Goals Specific Project Goals To understand the background, To determine the characteristics, To determine which impact of collaborative processes, and digital tools enables learning on preparing dynamics that collaboration within and presenting an contribute to team- teams actual bid package to working and team- external parties success in construction Re-design Steps of Capstone Revise learning outcomes Design an active Create an hybrid teaching database of course delivery team-building and module by using team-work activities Blackboard Prepare start-of-semester, mid- Run the revised course semester and end-semester Analyze survey results with a group of pilot surveys to analyze team- and update course students and collect building and collaborative material as needed feedback working problems faced by Capstone students Sample Team-building Activities 3-truths and a lie Which team player style are you? Contributor Challenger Collaborator Communicator Parker, G.M. -

BENDING the CHAIN the Surprising Challenge of Integrating Purchasing and Logistics

BENDING THE CHAIN The Surprising Challenge of Integrating Purchasing and Logistics A REPORT BY THE SUPPLY CHAIN MANAGEMENT FACULTY AT THE UNIVERSITY OF TENNESSEE SPRING 2014 NUMBER TWO IN THE SERIES | GAME-CHANGING TRENDS IN SUPPLY CHAIN The Surprising Challenge of Integrating Purchasing and Logistics IN A CH E TH ING BEND TABLE OF CONTENTS Executive Summary 2 The Surprising Challenge of Integrating Purchasing and Logistics 5 The Research: Linking Purchasing and Logistics Integration to Improved Functional and Financial Performance 10 Best Practices 19 7 Actions a Supply Chain Leader Can TakeToday 26 How High Is Your PLi? 28 2 BENDING THE CHAIN GAME-CHANGING TRENDS IN SUPPLY CHAIN BENDING THE CHAIN: THE SURPRISING CHALLENGE OF INTEGRATING PURCHASING AND LOGISTICS A REPORT BY THE SUPPLY CHAIN MANAGEMENT FACULTY AT THE UNIVERSITY OF TENNESSEE SPRING 2014 CONTRIBUTORS: THEODORE (TED) STANK, PhD J. PAUL DITTMANN, PhD CHAD AUTRY, PhD KENNETH J. PETERSEN, PhD MIKE BURNETTE DANIEL PELLATHY, PhD CANDIDATE IN A H C HE T ING BEND Executive Summary ver the last several decades, supply chain (SC) profes- sionals have focused on performance issues that have emerged from a lack of commercial/business alignment with supply chain operations. Significant improvements have been made, and systemic processes (IBP—integrated business planning—and S&OP—sales and operations planning) have been Odeveloped to drive a fully integrated business. As business integration has continued to improve, the biggest SC opportunities have shifted. Every year, the University of Tennessee’s Global Supply Chain Institute networks with hundreds of companies, requesting information on emerging supply chain issues. -

Organizational Change and Development Chapter 12

Organizational Change and Development Chapter 12 ORGANIZATIONAL CHANGE AND DEVELOPMENT Introduction Change is a constant, a thread woven into the fabric of our personal and professional lives. Change occurs within our world and beyond -- in national and international events, in the physical environment, in the way organizations are structured and conduct their business, in political and socioeconomic problems and solutions, and in societal norms and values. As the world becomes more complex and increasingly interrelated, changes seemingly far away affect us. Thus, change may sometimes appear to occur frequently and randomly. We are slowly becoming aware of how connected we are to one another and to our world. Organizations must also be cognizant of their holistic nature and of the ways their members affect one another. The incredible amount of change has forced individuals and organizations to see “the big picture” and to be aware of how events affect them and vice versa. Organizational development (OD) is a field of study that addresses change and how it affects organizations and the individuals within those organizations. Effective organizational development can assist organizations and individuals to cope with change. Strategies can be developed to introduce planned change, such as team-building efforts, to improve organizational functioning. While change is a “given,” there are a number of ways to deal with change -- some useful, some not. Organizational development assists organizations in coping with the turbulent environment, both internally and externally, frequently doing so by introducing planned change efforts. Organizational development is a relatively new area of interest for business and the professions. While the professional development of individuals has been accepted and fostered by a number of organizations for some time, there is still ambiguity surrounding the term organizational development. -

Power Phrases to Build Your Resume

POWER PHRASES TO BUILD YOUR RESUME . Avoid burdening management with administrative ACCURACY detail . Effectively use exception reporting to keep . Recognize the importance of accuracy management informed. Perform with a high degree of accuracy . Clearly establish administrative rules and regulations . Perform with consistent accuracy . Enumerate and specify procedures for implementing . Achieve results with accuracy and precision and administering written policies . Maintain high statistical accuracy . Develop policies and procedure to improve . Expect perfection department. Strive for perfection . Improve administrative support systems . Excel in achieving perfection . Supply necessary support services . Avoid mistakes and errors . Develop successful administrative strategies . Conform to strict tolerances . Excel in simplifying systems and reducing paperwork . Meet precise standards . Excel in eliminating unnecessary paperwork . Meet rigid specifications . Effectively control paperwork. Keep accurate records . Manage paperwork efficiently and effectively . Maintain accurate documentation . Improve administrative efficiency through the . Provide explicit documentation effective use of forms . Meticulous with detail . Establish effective systems for record retention . Excel in detail checking . Keep simple records with little duplication . Forecast with extreme accuracy . Effectively handle information overload . Make accurate predictions about future trends, . Establish effective systems for information retrieval directions and developments. -

Managing Design with the Effective Use of Communication Media: the Relationship Between Design Dialogues and Design Team Meetings

1072 CIB World Building Congress 2007 CIB2007- 213 Managing Design With The Effective Use Of Communication Media: The Relationship Between Design Dialogues And Design Team Meetings Stephen Emmitt and Ad den Otter ABSTRACT Effective and efficient design team communication is an essential component of architectural design and construction projects. Face-to-face communication, via meetings and dialogue, is an essential means for design team members to discuss and communicate design ideas. Meetings represent an important forum in which all parties have an opportunity to understand the implications of design decisions on a number of levels. Dialogue between design team members forms an important part of the interpersonal communication that occurs during design development. Dialogues have the highest chance of achieving understanding of the design, especially in the early phases when uncertainty is high and less design information is generated compared with later stages in the project. A survey of communication practices via project websites across multiple cases found that design team members chose dialogues as their preferred communication medium. The results are discussed against research findings from communication in design and management team meetings. The relationship between dialogues and team meetings is then explored from a design team management perspective. The results have implications for the effectiveness of communications within international design teams and hence the manner in which communications are planned and managed. Keywords: Design management, Team communication, Dialogues, Interaction, Meetings, Project Websites. CIB World Building Congress 2007 1073 1. INTRODUCTION Architectural design is a collaborative act that relies on effective interaction between project actors and stakeholders. Interaction affects the strength of relationships between the actors and ultimately colors their ability to work together successfully. -

Global Supply Chain Management 1

Global Supply Chain Management 1 Global Supply Chain Management Certificate in Global Supply Chain Management The Certificate in GSCM is an option for domestic and international candidates who need to gain or upgrade their supply chain management skills to meet current market demands as well as prepare for the American Production and Inventory Control Society (APICS) certification. This Certificate program is suitable for those students who have obtained a Bachelor’s degree and are interested in managing or working in various aspects of the global supply chain. The program will prepare students to optimize and support the business, as well as design innovative operating models and cost reduction strategies. Required Course GSCM 504 Fund Global Supply Chain Mgmt 3 Take 12 Credits from the following: GSCM 580 Global Strategic Sourcing 3 GSCM 581 Managing Global Production/Operation 3 GSCM 582 Total Quality and Service Management 3 GSCM 583 Logistics and International Trade 3 GSCM 584 Supply Chain Strategies Planning 3 Courses GSCM 504. Fund Global Supply Chain Mgmt. (3). This course provides basic definitions and concepts for planning and controlling the flow of materials into, through and out of an organization. It explains fundamental relationships among the activities that occur in the supply chain from suppliers to customers. In addition, the course addresses types of manufacturing systems, forecasting, master planning, material requirements planning, capacity management, production activity control, purchasing, inventory management, distribution, quality management, and Lean manufacturing. The basic concepts in managing the complete flow of materials in a supply chain from suppliers to customers are covered in this basics module. -

Leader's Guide to Team Building

Leader’s Guide to Team Building Building Adaptive High-Performance Teams DIGITAL VERSION AVAILABLE A digital version of this CALL publication is available to view, download, or reproduce from the CALL restricted website, <https://call2.army.mil>. Reproduction of this publication is welcomed and highly encouraged. Common Access Card (CAC) or Army Knowledge Online (AKO) login is required to access the digital version. Editor’s Note: This product was previously titled, “Teams of Leaders Coaching Guide: Building Adaptive, High-Performing Interagency Team.” This Leader’s Guide is an updated, redated version of the June 2009 edition (Volume 2), European Command. LEADER'S GUIDE TO TEAM BUILDING Foreword The Leader’s Guide to Team Building handbook provides lessons and best practices (“a way”) to rapidly build and effectively employ cross-boundary teams that are highly competent both in making and executing decisions and in learning and adapting together. It helps the team gain common understanding of the situation and requirements and quickly reach a higher level of performance. This approach provides a deliberate methodology for forming, launching, operating, and sustaining nested teams and developing member’s capacity to work at higher performance levels. It also furnishes a set of practical thinking drills and orgainizing tools that applies and balances three key elements: information management, knowledge management, and team qualities, which boosts team communication and collaboration skills. Through coached deliberate practice and performance, it systematically builds relationships on a basis of shared purpose, trust, confidence, and competence. Chapter 3 contains useful tip sheets that leaders and team members can pull out as quick reference tools to enable effective team building and enhance effectiveness for diverse, challenging mission sets across a wide range of operational environments. -

Team Building for Managers

Team Building for Managers Atlantic Speakers Bureau and Human Skills Development 980 Route 730, Scotch Ridge NB Canada E3L 5L2 or P.O. Box 55 Calais, ME USA 04619 1-506-465-0990 FAX: 1-506-465-0813 [email protected] [email protected] Atlantic Speakers Bureau and Human Skills Development Student Training Manual Training Materials Atlantic Speakers Bureau and Human Skills Development TABLE OF CONTENTS Module One: Getting Started ........................................................................................................... 10 Workshop Objectives .............................................................................................................................. 10 Module Two: What Are the Benefits of Team Building? .................................................................... 11 Better Communication and Conflict Resolution ...................................................................................... 11 Effectiveness ........................................................................................................................................... 12 Motivation .............................................................................................................................................. 12 Camaraderie ........................................................................................................................................... 12 Case Study .............................................................................................................................................. -

Teams, Team Process, and Team Building

Loyola University Chicago Loyola eCommons School of Business: Faculty Publications and Other Works Faculty Publications 2014 Teams, Team Process, and Team Building James W. Bishop Dow Scott Loyola University Chicago, [email protected] Stephanie Maynard-Patrick Lei Wang Follow this and additional works at: https://ecommons.luc.edu/business_facpubs Part of the Business Administration, Management, and Operations Commons, and the Performance Management Commons Recommended Citation Bishop, James W.; Scott, Dow; Maynard-Patrick, Stephanie; and Wang, Lei. Teams, Team Process, and Team Building. Clinical Laboratory Management, 2nd Edition, , : 373-391, 2014. Retrieved from Loyola eCommons, School of Business: Faculty Publications and Other Works, http://dx.doi.org/10.1128/ 9781555817282.ch18 This Book Chapter is brought to you for free and open access by the Faculty Publications at Loyola eCommons. It has been accepted for inclusion in School of Business: Faculty Publications and Other Works by an authorized administrator of Loyola eCommons. For more information, please contact [email protected]. This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License. © ASM Press 2014 18 Introduction Teams, Team Process, Definition of a Team Distinguishing Teams from Work Groups • Types and Classifications of Teams • Why Define a “Team” So and Team Building Precisely? Group Process and Teams James W. Bishop, K. Dow Scott, Guidelines for Choosing Whether To Have Teams Stephanie Maynard-Patrick, and Lei Wang Common -

Key Elements to an Effective Building Design Team

Available online at www.sciencedirect.com ScienceDirect Procedia Computer Science 64 ( 2015 ) 838 – 843 Conference on ENTERprise Information Systems / International Conference on Project MANagement / Conference on Health and Social Care Information Systems and Technologies, CENTERIS / ProjMAN / HCist 2015 October 7-9, 2015 Key elements to an effective building design team Fredrik Svalestuena,b*, Kristoffer Frøystadb, Frode Drevlanda,Saad Ahmada, Jardar Lohnea, Ola Lædrea aDepartment of Civil and Transport Engineering,The Norwegian University of Technology and Science, NO 7491 Trondheim, Norway. bVeidekke Entreprenør AS, P.O.Box 506 Skøyen, N-0214 Oslo, Norway. Abstract The building design phase requires intense collaboration between the participants. However, achieving this can prove difficult. The project often has a short time span, at the same time as the participants have limited experience from working together. This paper reports on the experience with teambuilding and collaboration from several Norwegian building design participants. The ambition has been to find out what characterizes a highly efficient building design team. In addition to a literature review and interviews with five key participants, a survey in a large Norwegian contractor firm was carried out. The findings identify twelve key elements that influence the performance of a building design team. The three most important elements are good collaboration between all project leaders, identifying the design team members’ role and trust between the team members, respectively. Having a highly efficient team is important for the collaboration between participants in the building design phase, and knowing what elements that influence the performance can help the industry to develop design teams on their projects. -

Towards Effective Team Building in the Workplace

International Journal of Education and Research Vol. 1 No. 4 April 2013 Towards Effective Team Building in the Workplace Fapohunda, Tinuke. M. Department of Industrial Relations and Public Administration Lagos State University Ojo. Nigeria E mail: [email protected] Abstract Team building involves a wide range of activities, designed for improving team performance. Its aim is to bring out the best in a team to ensure self development, positive communication, leadership skills and the ability to work closely together as a team to problem solve. This article reviews current literature on teams in an attempt to outline some of the attractions and challenges of implementing teams so as to give a realistic preview of what can be achieved through teamwork. The literature indicates that the effects of teamwork (both positive and negative) are contingent upon many factors, including the organizations’ culture and climate, effectiveness of team leadership, employee commitment, the system of compensation and rewards, and the level of employee autonomy. This article outlines eight key points that have been identified by a number of authors which facilitate the effective development of teams. These points are: clear goals; decision making authority; accountability and responsibility; effective leadership; training and development; provision of resources; organizational support; and rewards for team success. Keywords: Effective, Team, Building, Workplace 1. Introduction Team building is an important topic in the current business climate as organizations are looking to team-based structures to stimulate further improvements to their productivity, profitability and service quality. Managers and organization members universally explore ways to improve business results and profitability. Many view team-based, horizontal, structures as the best design for involving all employees in creating business success. -

What Leaders Can Learn About Teamwork and Developing High Performance Teams from Organization Development Practitioners

“The irony is that while virtually everyone believes in teamwork, leaders passionately preach the importance of teamwork, an abundance of research supports the value of teamwork, and teamwork is almost always a central theme of text books and practitioner books on leadership and how to build successful organizations, most organizations do little if anything to build teamwork.” What Leaders Can Learn About Teamwork and Developing High Performance Teams From Organization Development Practitioners By D.D. Warrick Introduction supports the value of teamwork, and teamwork is almost always a central theme The ability of organizations to be skilled of text books and practitioner books on at teamwork and building high perfor- leadership and how to build successful mance teams is a major key to competitive organizations, most organizations do little advantage and may very well determine the if anything to build teamwork. In fact, future success or failure of many organiza- leaders are rarely trained how to build tions. The payoffs of teamwork are well teamwork and high performance teams, documented (see for example, Katzenback and organization cultures, designs, priori- & Smith, 1993; LaFasto & Larson, 2001; ties, pressures, and rewards often discour- McShane & Von Glinow, 2010; Hellriegel age teamwork. Yes, there are excellent & Slocum, 2011; Levi, 2011). Teamwork can examples of teamwork in some organiza- significantly improve performance, effec- tions, athletic teams, the military, and a few tiveness, efficiency, morale, job satisfaction, other organizations. However, excelling unity of purpose, communications, inno- at teamwork is not the norm. If you want vative thinking, quality, speed in getting a reality check on how effective organiza- things done, and loyalty to an organization.