SAMBA Health Benefit Plan Customer Service 800-638-6589 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tutankhamun's Dentition: the Pharaoh and His Teeth

Brazilian Dental Journal (2015) 26(6): 701-704 ISSN 0103-6440 http://dx.doi.org/10.1590/0103-6440201300431 1Department of Oral and Maxillofacial Tutankhamun’s Dentition: Surgery, University Hospital of Leipzig, Leipzig, Germany The Pharaoh and his Teeth 2Institute of Egyptology/Egyptian Museum Georg Steindorff, University of Leipzig, Leipzig, Germany 3Department of Orthodontics, University Hospital of Greifswald, Greifswald, Germany Niels Christian Pausch1, Franziska Naether2, Karl Friedrich Krey3 Correspondence: Dr. Niels Christian Pausch, Liebigstraße 12, 04103 Leipzig, Germany. Tel: +49- 341-97-21160. e-mail: niels. [email protected] Tutankhamun was a Pharaoh of the 18th Dynasty (New Kingdom) in ancient Egypt. Medical and radiological investigations of his skull revealed details about the jaw and teeth status of the mummy. Regarding the jaw relation, a maxillary prognathism, a mandibular retrognathism and micrognathism have been discussed previously. A cephalometric analysis was performed using a lateral skull X-ray and a review of the literature regarding Key Words: Tutankhamun’s King Tutankhamun´s mummy. The results imply diagnosis of mandibular retrognathism. dentition, cephalometric analysis, Furthermore, third molar retention and an incomplete, single cleft palate are present. mandibular retrognathism Introduction also been discussed (11). In 1922, the British Egyptologist Howard Carter found the undisturbed mummy of King Tutankhamun. The Case Report spectacular discovery enabled scientists of the following In the evaluation of Tutankhamun’s dentition and jaw decades to analyze the Pharaoh's remains. The mummy alignment, contemporary face reconstructions and coeval underwent multiple autopsies. Until now, little was artistic images can be of further use. However, the ancient published about the jaw and dentition of the King. -

Diseases of the Digestive System (KOO-K93)

CHAPTER XI Diseases of the digestive system (KOO-K93) Diseases of oral cavity, salivary glands and jaws (KOO-K14) lijell Diseases of pulp and periapical tissues 1m Dentofacial anomalies [including malocclusion] Excludes: hemifacial atrophy or hypertrophy (Q67.4) K07 .0 Major anomalies of jaw size Hyperplasia, hypoplasia: • mandibular • maxillary Macrognathism (mandibular)(maxillary) Micrognathism (mandibular)( maxillary) Excludes: acromegaly (E22.0) Robin's syndrome (087.07) K07 .1 Anomalies of jaw-cranial base relationship Asymmetry of jaw Prognathism (mandibular)( maxillary) Retrognathism (mandibular)(maxillary) K07.2 Anomalies of dental arch relationship Cross bite (anterior)(posterior) Dis to-occlusion Mesio-occlusion Midline deviation of dental arch Openbite (anterior )(posterior) Overbite (excessive): • deep • horizontal • vertical Overjet Posterior lingual occlusion of mandibular teeth 289 ICO-N A K07.3 Anomalies of tooth position Crowding Diastema Displacement of tooth or teeth Rotation Spacing, abnormal Transposition Impacted or embedded teeth with abnormal position of such teeth or adjacent teeth K07.4 Malocclusion, unspecified K07.5 Dentofacial functional abnormalities Abnormal jaw closure Malocclusion due to: • abnormal swallowing • mouth breathing • tongue, lip or finger habits K07.6 Temporomandibular joint disorders Costen's complex or syndrome Derangement of temporomandibular joint Snapping jaw Temporomandibular joint-pain-dysfunction syndrome Excludes: current temporomandibular joint: • dislocation (S03.0) • strain (S03.4) K07.8 Other dentofacial anomalies K07.9 Dentofacial anomaly, unspecified 1m Stomatitis and related lesions K12.0 Recurrent oral aphthae Aphthous stomatitis (major)(minor) Bednar's aphthae Periadenitis mucosa necrotica recurrens Recurrent aphthous ulcer Stomatitis herpetiformis 290 DISEASES OF THE DIGESTIVE SYSTEM Diseases of oesophagus, stomach and duodenum (K20-K31) Ill Oesophagitis Abscess of oesophagus Oesophagitis: • NOS • chemical • peptic Use additional external cause code (Chapter XX), if desired, to identify cause. -

Abstracts from the 51St European Society of Human Genetics Conference: Electronic Posters

European Journal of Human Genetics (2019) 27:870–1041 https://doi.org/10.1038/s41431-019-0408-3 MEETING ABSTRACTS Abstracts from the 51st European Society of Human Genetics Conference: Electronic Posters © European Society of Human Genetics 2019 June 16–19, 2018, Fiera Milano Congressi, Milan Italy Sponsorship: Publication of this supplement was sponsored by the European Society of Human Genetics. All content was reviewed and approved by the ESHG Scientific Programme Committee, which held full responsibility for the abstract selections. Disclosure Information: In order to help readers form their own judgments of potential bias in published abstracts, authors are asked to declare any competing financial interests. Contributions of up to EUR 10 000.- (Ten thousand Euros, or equivalent value in kind) per year per company are considered "Modest". Contributions above EUR 10 000.- per year are considered "Significant". 1234567890();,: 1234567890();,: E-P01 Reproductive Genetics/Prenatal Genetics then compared this data to de novo cases where research based PO studies were completed (N=57) in NY. E-P01.01 Results: MFSIQ (66.4) for familial deletions was Parent of origin in familial 22q11.2 deletions impacts full statistically lower (p = .01) than for de novo deletions scale intelligence quotient scores (N=399, MFSIQ=76.2). MFSIQ for children with mater- nally inherited deletions (63.7) was statistically lower D. E. McGinn1,2, M. Unolt3,4, T. B. Crowley1, B. S. Emanuel1,5, (p = .03) than for paternally inherited deletions (72.0). As E. H. Zackai1,5, E. Moss1, B. Morrow6, B. Nowakowska7,J. compared with the NY cohort where the MFSIQ for Vermeesch8, A. -

Single Nucleotide Polymorphisms (Snps) of COL1A1 and COL11A1 in Class II Skeletal Malocclusion of Ethnic Javanese Patient

Clinical, Cosmetic and Investigational Dentistry Dovepress open access to scientific and medical research Open Access Full Text Article ORIGINAL RESEARCH Single Nucleotide Polymorphisms (SNPs) of COL1A1 and COL11A1 in Class II Skeletal Malocclusion of Ethnic Javanese Patient This article was published in the following Dove Press journal: Clinical, Cosmetic and Investigational Dentistry I Gusti Aju Wahju Ardani1 Background: The prevalence of malocclusion cases in the orthodontic specialist clinic in Aulanni’am2 Airlangga University’s Dental Hospital in Surabaya, Indonesia, in 2014–2016 is fairly high, Indeswati Diyatri3 as 55.34% of the occurrences were identified as class II skeletal malocclusion. This type of skeletal malocclusion, which is usually recognized in adults, occurs as a result of variation 1Orthodontics Department, Faculty of Dental Medicine, Airlangga University, during growth and development. Lately, there have been many reports on gene polymorph- Surabaya, Indonesia; 2Biochemistry isms of COL1A1 and COL11A1, which are assumed to be associated with class II skeletal Department, Faculty of Veterinary malocclusion in Caucasians. Medicine, Brawijaya University, Malang, Indonesia; 3Oral Biology, Faculty of Purpose: This study aims to analyze the relationship between single nucleotide polymorph- Dental Medicine, Airlangga University, isms (SNPs) of COL1A1 and COL11A1 with class II skeletal malocclusion in Javanese Surabaya, Indonesia ethnic group patients with mandibular micrognathism. Materials and Methods: The diagnosis of class II skeletal malocclusion was established using the lateral cephalometric radiographs (ANB angle ≥4°) (n=50). DNA was extracted from the patient’s peripheral blood. After that, PCR, electrophoresis, and DNA sequencing were conducted on the extracted DNA based on COL1A1 and COL11A1 primers. Results: The SNPs in COL1A1 are c.20980G/A in 27 patients and c.20980G>A in 8 patients, whereas SNPs in COL11A1 are both c.134373C/A and c.134555C/T in 8 patients and both c.[134373A>C] and c.134582G>A in 10 patients. -

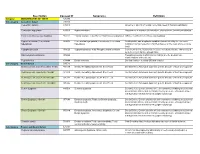

Description Concept ID Synonyms Definition

Description Concept ID Synonyms Definition Category ABNORMALITIES OF TEETH 426390 Subcategory Cementum Defect 399115 Cementum aplasia 346218 Absence or paucity of cellular cementum (seen in hypophosphatasia) Cementum hypoplasia 180000 Hypocementosis Disturbance in structure of cementum, often seen in Juvenile periodontitis Florid cemento-osseous dysplasia 958771 Familial multiple cementoma; Florid osseous dysplasia Diffuse, multifocal cementosseous dysplasia Hypercementosis (Cementation 901056 Cementation hyperplasia; Cementosis; Cementum An idiopathic, non-neoplastic condition characterized by the excessive hyperplasia) hyperplasia buildup of normal cementum (calcified tissue) on the roots of one or more teeth Hypophosphatasia 976620 Hypophosphatasia mild; Phosphoethanol-aminuria Cementum defect; Autosomal recessive hereditary disease characterized by deficiency of alkaline phosphatase Odontohypophosphatasia 976622 Hypophosphatasia in which dental findings are the predominant manifestations of the disease Pulp sclerosis 179199 Dentin sclerosis Dentinal reaction to aging OR mild irritation Subcategory Dentin Defect 515523 Dentinogenesis imperfecta (Shell Teeth) 856459 Dentin, Hereditary Opalescent; Shell Teeth Dentin Defect; Autosomal dominant genetic disorder of tooth development Dentinogenesis Imperfecta - Shield I 977473 Dentin, Hereditary Opalescent; Shell Teeth Dentin Defect; Autosomal dominant genetic disorder of tooth development Dentinogenesis Imperfecta - Shield II 976722 Dentin, Hereditary Opalescent; Shell Teeth Dentin Defect; -

Temporomandibular Joint Disorder

Medical Policy MP 2.01.21 Temporomandibular Joint Disorder BCBSA Ref. Policy: 2.01.21 Related Policies Last Review: 02/21/2019 2.01.30 Biofeedback for Chronic Pain Effective Date: 02/21/2019 7.01.29 Percutaneous Electrical Nerve Stimulation and Section: Medicine Percutaneous Neuromodulation Therapy DISCLAIMER Our medical policies are designed for informational purposes only and are not an authorization, explanation of benefits or a contract. Receipt of benefits is subject to satisfaction of all terms and conditions of the coverage. Medical technology is constantly changing, and we reserve the right to review and update our policies periodically. POLICY DIAGNOSTIC PROCEDURES The following diagnostic procedures may be considered medically necessary in the diagnosis of temporomandibular joint disorder (TMJD): Diagnostic x-ray, tomograms, and arthrograms; Computed tomography (CT) scan or magnetic resonance imaging (MRI) (in general, CT scans and MRIs are reserved for presurgical evaluations); Cephalograms (x-rays of jaws and skull); Pantograms (x-rays of maxilla and mandible). (Cephalograms and pantograms should be reviewed on an individual basis.) The following diagnostic procedures are considered investigational in the diagnosis of TMJD: Electromyography (EMG), including surface EMG; Kinesiography; Thermography; Neuromuscular junction testing; Somatosensory testing; Transcranial or lateral skull x-rays; intraoral tracing or gnathic arch tracing (intended to demonstrate deviations in the positioning of the jaw that are associated with TMJD); Muscle testing; Standard dental radiographic procedures; MP 2.01.21 Temporomandibular Joint Disorder Range-of-motion measurements; Computerized mandibular scan (measures and records muscle activity related to movement and positioning of the mandible and is intended to detect deviations in occlusion and muscle spasms related to TMJD); Ultrasound imaging/sonogram; Arthroscopy of the temporomandibular joint (TMJ) for purely diagnostic purposes; Joint vibration analysis. -

EUROCAT Syndrome Guide

JRC - Central Registry european surveillance of congenital anomalies EUROCAT Syndrome Guide Definition and Coding of Syndromes Version July 2017 Revised in 2016 by Ingeborg Barisic, approved by the Coding & Classification Committee in 2017: Ester Garne, Diana Wellesley, David Tucker, Jorieke Bergman and Ingeborg Barisic Revised 2008 by Ingeborg Barisic, Helen Dolk and Ester Garne and discussed and approved by the Coding & Classification Committee 2008: Elisa Calzolari, Diana Wellesley, David Tucker, Ingeborg Barisic, Ester Garne The list of syndromes contained in the previous EUROCAT “Guide to the Coding of Eponyms and Syndromes” (Josephine Weatherall, 1979) was revised by Ingeborg Barisic, Helen Dolk, Ester Garne, Claude Stoll and Diana Wellesley at a meeting in London in November 2003. Approved by the members EUROCAT Coding & Classification Committee 2004: Ingeborg Barisic, Elisa Calzolari, Ester Garne, Annukka Ritvanen, Claude Stoll, Diana Wellesley 1 TABLE OF CONTENTS Introduction and Definitions 6 Coding Notes and Explanation of Guide 10 List of conditions to be coded in the syndrome field 13 List of conditions which should not be coded as syndromes 14 Syndromes – monogenic or unknown etiology Aarskog syndrome 18 Acrocephalopolysyndactyly (all types) 19 Alagille syndrome 20 Alport syndrome 21 Angelman syndrome 22 Aniridia-Wilms tumor syndrome, WAGR 23 Apert syndrome 24 Bardet-Biedl syndrome 25 Beckwith-Wiedemann syndrome (EMG syndrome) 26 Blepharophimosis-ptosis syndrome 28 Branchiootorenal syndrome (Melnick-Fraser syndrome) 29 CHARGE -

Universidade De São Paulo Hospital De Reabilitação De Anomalias Craniofaciais

UNIVERSIDADE DE SÃO PAULO HOSPITAL DE REABILITAÇÃO DE ANOMALIAS CRANIOFACIAIS GABRIELA LETICIA CLAVISIO SIQUEIRA MACHADO Comportamento longitudinal do crescimento facial e mandibular em pacientes com Sequência de Pierre Robin isolada Longitudinal behavior of facial and mandibular growth in patients with isolated Pierre Robin sequence BAURU 2017 GABRIELA LETICIA CLAVISIO SIQUEIRA MACHADO Longitudinal behavior of facial and mandibular growth in patients with isolated Pierre Robin sequence Comportamento longitudinal do crescimento facial e mandibular de pacientes com Sequência de Pierre Robin isolada Dissertação constituída por artigo apresentada ao Hospital de Reabilitação de Anomalias Craniofaciais da Universidade de São Paulo para obtenção do título de Mestre em Ciências da Reabilitação, área de concentração Fissuras Orofaciais e Anomalias relacionadas. Orientadora: Profª. Drª. Terumi Okada Ozawa BAURU 2017 UNIVERSIDADE DE SÃO PAULO HOSPITAL DE REABILITAÇÃO DE ANOMALIAS CRANIOFACIAIS R. Silvio Marchione, 3-20 17012-900 - Bauru – SP – Brasil Telefone: (14) 3235-8000 Prof. Dr. Marco Antonio Zago – Reitor da USP Profa. Dra. Maria Aparecida de Andrade Moreira Machado – Superintendente do HRAC-USP Autorizo, exclusivamente para fins acadêmicos e científicos, a reprodução total ou parcial desta dissertação por processos fotocopiadores e outros meios eletrônicos. Assinatura: Machado, Gabriela Leticia Clavisio Siqueira Longitudinal behavior of the jaw and facial growth in patients M18l with isolated Pierre Robin Sequence / Gabriela Leticia Clavisio Siqueira Machado – Bauru, 2017. 76 p. : il. ; 30 cm. Dissertação (Mestrado) – Hospital de Reabilitação de Anomalias Craniofaciais Orientadora: Profª. Drª. Terumi Okada Ozawa Descritores: 1. Pierre Robin sequence 2. growth 3. photography FOLHA DE APROVAÇÃO Gabriela Leticia Clavisio Siqueira Machado Dissertação apresentada ao Hospital de Reabilitação de Anomalias Craniofaciais da Universidade de São Paulo para a obtenção do título de Mestre. -

5221 Department of Labor and Industry Fees for Medical Services

MINNESOTA RULES 1993 465 CHAPTER 5221 DEPARTMENT OF LABOR AND INDUSTRY FEES FOR MEDICAL SERVICES 5221.0100 DEFINITIONS. 5221.2000 NEUROLOGY AND 5221.0200 AUTHORITY. NEUROMUSCULAR. 5221.0300 PURPOSE. 5221.2050 CHEMOTHERAPY INJECTIONS. 5221.0400 SCOPE. 5221.2070 DERMATOLOGICAL PROCEDURES. 5221.0500 EXCESSIVE CHARGES. 5221.2100 PHYSICAL MEDICINE. 5221.0550 EXCESSIVE SERVICES. 5221.2150 CASE MANAGEMENT SERVICES. 5221 0600 PAYER RESPONSIBILITIES 5221.2200 SPECIAL SERVICES AND REPORTS. 5221.0700 PROVIDER RESPONSIBILITIES. 5221.2250 PHYSICIAN SERVICES; SURGERY. 5221.0800 DISPUTE RESOLUTION. 5221.2300 PHYSICIAN SERVICES; RADIOLOGY. 5221.1000 INSTRUCTIONS FOR APPLICATION OF 5221.2400 PHYSICIAN SERVICES; PATHOLOGY THE MEDICAL FEE SCHEDULE FOR AND LABORATORY. REIMBURSEMENT OF WORKERS' 5221.2500 DENTISTS. COMPENSATION MEDICAL SERVICES. 5221.2600 OPTOMETRISTS. 5221.1100 PHYSICIAN SERVICES; MEDICINE. 5221.2650 OPTICIANS. 5221.1200 CONSULTATIONS. 5221.2750 SPEECH PATHOLOGISTS. 5221.1215 INFUSION THERAPY. 5221.2800 PHYSICAL THERAPISTS AND 5221.1220 THERAPEUTIC INJECTIONS. OCCUPATIONAL THERAPISTS. 5221.1300 PSYCHIATRY AND PSYCHIATRIC THERAPY. 5221.2900 CHIROPRACTORS. 5221.1410 BIOFEEDBACK. 5221.3000 PODIATRISTS. 5221.1450 DIALYSIS. 5221.3150 LICENSED CONSULTING 5221.1500 OPHTHALMOLOG1CAL SERVICES. PSYCHOLOGISTS. 5221.1600 OTORHINOLARYNGOLOGIC 5221.3155 LICENSED PSYCHOLOGIST. SERVICES. 5221.3160 SOCIAL WORKERS. 5221.1800 CARDIOVASCULAR. 5221.3200 HOSPITAL; SEM1PRIVATE ROOM 5221.1900 PULMONARY. CHARGES. 5221.1950 ALLERGY AND CLINICAL 5221.3300 EFFECTIVE DATE. IMMUNOLOGY. 5221.3500 EFFECTIVE DATE. 5221.0100 DEFINITIONS. Subpart 1. Scope. The following terms have the meanings given in this chapter unless the context clearly indicates a different meaning. Subp. la. Appropriate record. "Appropriate record" is a legible medical record or re port which substantiates the nature and necessity of a service being billed and its relationship to the work injury. -

Of Human Tongue and Associated Syndromes (Review)

B )dontol - Vol 35 n° 1-2, 1992 Developmental malformations of human tongue and associated syndromes (review) E.-N. EMMANOUIL-NIKOLOUSSI, C. KERAMEOS-FOROGLOU Laboratory ofHistology-Embryology, Faculty ofMedicine, Aristotelian University of Thessaloniki (Greece). SUMMARY The development of the tongue begins as known, in the floor of the primitive oral cavity, when the human embryo is four weeks old. More specifically, the tongue develops from the région of the first three or four branchial arches during the period that the external face develops. Malformations of the tongue, are structural defects, présent at birth and happening during embryogenesis. The most common malformations are : 1. Aglossia 2. Microglossia, which is always combined with other defects and syndromes, like Moebius syndrome 3. Macroglossia, which is commonly associated with cretinism, Down’s syndrome, Hunter’s syndrome, Sanfilippo syndrome and other types of mental retardation 4. Accesory tongue 5. Long tongue 6. Cleft or Bifid tongue, condition very usual in patients with the orodigitofacial syndrome 7. Glossitis Rhombica Mediana, a developmental malformation ? 8. Lingual thyroid. Malformations are extensively analysed and discussed. KEY WORDS : Developmental - Malformations - Defects - Syndromes - Tongue RÉSUMÉ MALFORMATIONS DE LA LANGUE HUMAINE ET SYNDROMES ASSOCIES (REVUE DE LA LITTERATURE) Le développement de la langue commence au niveau du plancher de la cavité orale primitive lorsque l’embryon humain est âgé de 4 semaines. Plus précisément, la langue se développe dans la région des trois ou quatre premiers arcs branchiaux durant la période du développement de la face externe. Les malformations de la langue correspondent à des défauts de structure présents à la naissance et survenant au cours de l’embryogenèse. -

Lies of the Face Have Most Often Been Classified Etc.) Do Not Fulfill the Criteria Necessary for According to a Major Structure Involved, I.E

A Proposed New Classification of Craniofacial Anomalies LINTON A. WHITAKER, M.D. HERMINE PASHAYAN, M.D. JOSEPH REICHMAN, M.D. for The American Cleft Palate Association Committee on Nomenclature and Classification of Craniofacial Anomalies Introduction In the fall of 1976, Kenneth R. Bzoch, President of the American Cleft Palate Association, requested the formation of an Ad Hoc Committee for Reclassification of Craniofacial Anomalies. The impetus for this was the rapid growth of new knowledge and understanding about the malformations that had occurred as a result of the development of craniofacial surgery during the previous few years. The original committee consisted of the following people: Linton A. Whitaker, M.D., Chairman; Howard Aduss, D.D.S.; Asa Berlin, Ph.D.; Mutaz Habal, M.D.; and Joseph Reichman, M.D. Each of these people helped in the early formulation of ideas about the new classification. Subsequently, Malcolm Johnson, D.D.S., and Hermine Pashayan, M.D. were added to the committee. The paper, as finally developed and edited, was written by Drs. Whitaker, Reichman, and Pashayan and was completed in the spring of 1980. Since it was thought to be desirable to present the information at the International Cleft Palate Meeting in Acapulco in May, 1981, publication has been withheld until following that meeting. KEY WORDS: craniofacial anomalies, classification of anomalies, malformations Malformations of the craniofacial complex cian requires simplicity with clinical applica- abound with great variation. Previously, fa- bility. Such a system should be broadly based cial malformations were usually categorized both etiologically and anatomically and by two means: 1) pathogenic mechanisms and should, ideally, combine treatment goals and 2) anatomic conditions. -

Bilateral Mandibular Distraction in Micrognathism Or Hypoplasia Of

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Elsevier - Publisher Connector Journal of Acute Disease (2014)296-299 296 Contents lists available at ScienceDirect Journal of Acute Disease journal homepage: www.jadweb.org Document heading doi: 10.1016/S2221-6189(14)60064-0 Bilateral mandibular distraction in micrognathism or hypoplasia of mandible, hazrat fatemeh hospital Mohammad-Esmaiil Hassani1, Hamid Karimi1, Hosein Hassani2, Ali Hassani3 1Assistant Professor of Plastic Surgery, Faculty of Medicine, Iran University of Medical Sciences, Tehran , Iran 2Family Practice, Davis University, Modesto, California, USA 3Family Practice , Michigan Medical University, Ann Arbor, Michigan, USA ARTICLE INFO ABSTRACT Article history: Objective: To determine the results of Bilateral Distraction Osteogenesis (DO) versus traditional Article history: Methods: methods in treatment of micrognathia. During 6 years we had 67 patients with Received 12 December 2014 I A 35 (S Received in revised form 3 January 2015 micrognathia. n group , randomly were treated with traditional methods aggital osteotomy ) B 32 B E D Accepted 10 January 2015 and/or bone grafts and group cases were treated with ilateral xternal istraction 36+ 6 Available online 20 January 2015 Osteogenesis.Follow up was /- months.X-Ray , CT scan and cast modelling were done for all of the patients. SNA, SNB angles were measured in cephalograms. The patients were 12 Keywords: examined after one, two, three, six, months for any complications and signs of bone resorption Results:and relapse. Bony and soft tissue advancements were measured and compared with each other. Micrognathia During 6 years we had 67 patients with class II malocclusion.