Corporate Newsletter 2021 - Issue 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CONTACT US Call Your Local Depot, Or Register Online with Our Easy to Use Website That Works Perfectly on Whatever Device You Use

CONTACT US Call your local depot, or register online with our easy to use website that works perfectly on whatever device you use. Basingstoke 0370 3663 800 Nottingham 0370 3663 420 Battersea 0370 3663 500 Oban 0163 1569 100 Bicester 0370 3663 285 Paddock Wood 0370 3663 670 Birmingham 0370 3663 460 Salisbury 0370 3663 650 Chepstow 0370 3663 295 Slough 0370 3663 250 Edinburgh 0370 3663 480 Stowmarket 0370 3663 360 Gateshead 0370 3663 450 Swansea 0370 3663 230 Harlow 0370 3663 520 Wakefield 0370 3663 400 Lee Mill 0370 3663 600 Worthing 0370 3663 580 Manchester 0370 3663 400 Bidvest Foodservice 814 Leigh Road Slough SL1 4BD Tel: +44 (0)370 3663 100 http://www.bidvest.co.uk www.bidvest.co.uk Bidvest Foodservice is a trading name of BFS Group Limited (registered number 239718) whose registered office is at 814 Leigh Road, Slough SL1 4BD. The little book of TEA 3 Contents It’s Tea Time! With a profit margin of around 90%*, tea is big business. We have created this guide to tea so help you make the most of this exciting opportunity. Tea Varieties .............................. 4 Tea Formats ............................... 6 With new blends and infusions such as Chai and Which Tea Is Right For You? .... 8 Matcha as well as traditional classics such as Earl Profit Opportunity ....................10 Grey and English Breakfast, we have something for Maximise Your Tea Sales .......12 all, helping to ensure your customers’ tea experience The Perfect Serve ....................15 The Perfect Display .................16 will be a talking point! The Perfect Pairing ..................18 Tea & Biscuit Pairing ...............20 Tea Geekery ............................21 Recipes .....................................22 Tea Listing ................................28 4 People’s passion for tea All about tea has been re-ignited. -

Masterpiece Era Puerh GLOBAL EA HUT Contentsissue 83 / December 2018 Tea & Tao Magazine Blue藍印 Mark

GL BAL EA HUT Tea & Tao Magazine 國際茶亭 December 2018 紅 印 藍 印印 級 Masterpiece Era Puerh GLOBAL EA HUT ContentsIssue 83 / December 2018 Tea & Tao Magazine Blue藍印 Mark To conclude this amazing year, we will be explor- ing the Masterpiece Era of puerh tea, from 1949 to 1972. Like all history, understanding the eras Love is of puerh provides context for today’s puerh pro- duction. These are the cakes producers hope to changing the world create. And we are, in fact, going to drink a com- memorative cake as we learn! bowl by bowl Features特稿文章 37 A Brief History of Puerh Tea Yang Kai (楊凱) 03 43 Masterpiece Era: Red Mark Chen Zhitong (陳智同) 53 Masterpiece Era: Blue Mark Chen Zhitong (陳智同) 37 31 Traditions傳統文章 03 Tea of the Month “Blue Mark,” 2000 Sheng Puerh, Yunnan, China 31 Gongfu Teapot Getting Started in Gongfu Tea By Shen Su (聖素) 53 61 TeaWayfarer Gordon Arkenberg, USA © 2018 by Global Tea Hut 藍 All rights reserved. No part of this publication may be re- produced, stored in a retrieval system 印 or transmitted in any form or by any means: electronic, mechanical, pho- tocopying, recording, or otherwise, without prior written permission from the copyright owner. n December,From the weather is much cooler in Taiwan.the We This is an excitingeditor issue for me. I have always wanted to are drinking Five Element blends, shou puerh and aged find a way to take us on a tour of the eras of puerh. Puerh sheng. Occasionally, we spice things up with an aged from before 1949 is known as the “Antique Era (號級茶時 oolong or a Cliff Tea. -

ในประเทศอังกฤษ Know More About Tea

Volume 6 Issue 23, Apirl - June 2016 ปที่ 6 ฉบับที่ 23 ประจำเดือน เมษายน - มิถุนายน 2559 สถาบันชา มหาว�ทยาลัยแมฟาหลวง TEA INSTITUTE, MAE FAH LUANG UNIVERSITY เรียนรู วัฒธรรมการดื่มชาในประเทศอังกฤษ Know More About Tea Special Report Health Tea Tea Research ชาอัสสัม ชะลออาการซ�มเศรา การพัฒนาเคร�่องดื่มชาเข�ยว กับงานสงเสร�มการเกษตรบนที่สูง ในกลุมผูสูงอายุ อัสสัมลาเตพรอมชง ในจังหวัดเช�ยงราย ดวยชาเข�ยวอุนๆ โดยใชสตีว�โอไซด เปนสารทดแทนความหวาน 2 Editor’s Desk โดย ทีมผู้จัดท�ำ สงกรานต์วันปีใหม่ของคนไทยใจสุขล้น ชื่นฉ�่าทั่วทุกคนความสุขล้นทั้งกายใจ รดน�้าและด�าหัวให้ทุกครัวเริ่มสิ่งใหม่ ฉ�่าชื่นทั้งกายใจทุกข์อันใดอย่าได้พาล สวัสดีวันสงกรานต์ค่ะ กลับมาเจอกันอีกแล้วในช่วงเดือนเมษายน เดือนที่ร้อนที่สุดในรอบปีถึงอากาศจะร้อนแค่ไหน ขอเพียงใจเราอย่าร้อนตามนะคะ ส�าหรับจดหมายข่าวชาฉบับนี้เราได้รับเกียรติจากผู้อ�านวยการศูนย์ส่งเสริมและพัฒนาอาชีพ เกษตรจังหวัดเชียงราย (เกษตรที่สูง) คุณนาวิน อินทจักร มาเล่าถึงบทบาทหน้าที่ของเกษตรที่สูงในการส่งเสริมเกษตรกร ผู้ปลูกชาอัสสัม ในคอลัมน์ Special Report และตามด้วยคอลัมน์ Know More About Tea ที่จะกล่าวถึงวัฒนธรรมการดื่มชา ของคนอังกฤษ ต่อด้วยคอลัมน์ Talk About Tea ที่ได้เล่าถึงที่มาที่ไปของโครงการพัฒนาหมู่บ้าน ผลิตภัณฑ์เมี่ยงเพื่อสืบสานภูมิปัญญาท้องถิ่น นอกจากนี้ยังมีงานวิจัยที่น่าสนใจของนักศึกษาส�านัก วิชาอุตสาหกรรมเกษตร มหาวิทยาลัยแม่ฟ้าหลวง ที่ใช้สตีวิโอไซด์เป็นสารทดแทนความหวาน ในเครื่องดื่มชาเขียวอัสสัมลาเต้พร้อมชง เอาใจคนรักสุขภาพ ในคอลัมน์ Tea Research ตาม ด้วยเมนูของอาหารที่มีส่วนผสมชา ใน Trendy Tea Menu นอกจากนี้ ในคอลัมน์ Health Tea ยังให้ความรู้เกี่ยวกับการดื่มชาเขียวเพื่อลดอาการซึมเศร้าในผู้สูงอายุ และคอลัมน์ -

Leaving It All on the Table

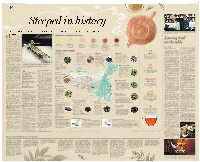

16 CHINA DAILY | HONG KONG EDITION Tuesday, July 21, 2020 | 17 LIFE Steeped in history The earliest artifacts related to tea in China reveal reciprocal influence between the drink and the civilization, Wang Kaihao reports. Tea-flavored cocktails are the new offerings of Yuanshe Tea Bar in Beijing. JIANG DONG / CHINA DAILY istory was rewritten in many respects when the 1,200-year-old underground palace Hwas unearthed at the Famen Bud- Leaving it all dhist Temple in Fufeng county, Shaanxi province, in 1987. Though the bone remains, of which some are thought to be of on the table Buddha, are generally considered to rank among the top archaeolog- ical discoveries in China in the By LI YINGXUE from China Food Information Cen- 20th century, other items found in [email protected] ter, the benefits of tea come from its the 30-square-meter altar of a antioxidants, such as tea polyphe- former Tang Dynasty (618-907) Using peaches from Tangshan, nols, as well as boost provided by royal Buddhist temple are also Hebei province, that were fresh of the caffeine. Additionally, it’s a unmatched. the branch, Chandler Jurinka, 49, good method of consuming water The exquisite silver tea set gilt co-founder of Beijing-based Slow and staying hydrated. with gold — including cages, a con- Boat Brewery, decided to create a He cites research published by tainer with sieves, a grinder, new craft beer. World Cancer Research Fund spoons and other instruments — However, one more ingredient International in 2015, which finds was the beloved possession of was required to perfect the flavor of that there is some evidence to sug- emperor Li Xuan, who reigned the beer, so he chose oolong tea. -

Name Pic Wholesale Price Wuyi Black Tea / Souchong Blacktea Lapsang

2018 Chinese Black Tea Wholesale List Name pic Wholesale Price Wuyi Black Tea / Souchong BlackTea Lapsang Traditional Smoked Tea Souchong ZSXZS-1:40USD/KG ZSXZS-2:105USD/KG (1st grade) ZSXZS-3:105USD/0.5KG (Super-grade) Flower & Fruity Aroma Tea ZSXZ-1: 15USD/KG ZSXZ-2: 20USD/KG ZSXZ-3: 35USD/KG (2nd grade) ZSXZ-4: 55USD/KG (2nd grade) ZSXZ-5: 85USD/KG (1st grade) ZSXZ-6: 125USD/KG (1st grade) ZSXZ-7: 95USD/0.5KG (Super-grade) ZSXZ-8:185USD/0.5KG (Lao-cong) High-end Tea ZSXZH-1:435USD/0.5KG Mei Zhan Flower Aroma Tea or Baked Tea Black Tea MZBT-1: 15USD/KG MZBT-2: 25USD/KG MZBT-3: 40USD/KG (2nd grade / Baked) MZBT-4: 40USD/KG (2nd grade) MZBT-5: 95USD/KG (1st grade) MZBT-6: 155USD/KG (Super-grade) Jin Guan Yin Flower Aroma Tea Black Tea JGYBT-1: 85USD/KG (1st grade) Chi Gan Black Tea Flower Aroma Tea CGBT-1: 70USD/KG (1st grade) Wholesale Website: 1 Online Wholesale www.jiangtea.com www.chinateawholesale.com 2018 Chinese Black Tea Wholesale List Da Chi Gan Flower Aroma Tea & Wild-growing Tea Black Tea DCGBT-1: 95USD/0.5KG (1st grade) JMM-1:55USD/KG Jin Jun Mei Tea (2nd grade tea / 2 buds) --- Honey Aroma JJMM-2:70USD/KG Type (2nd grade tea / Gold Bud) JJMM-3: 110USD/KG (1st grade tea / Single Bud) JJMM-4: 160USD/KG (Super grade) JJMM-5: 110USD/0.5KG (Supergrade) Jin Jun Mei Tea - Flower Aroma Jin Jun Mei Tea JJMF1: 30USD/KG (Yellow Bud) --- Original JJMF2: 35USD/KG (Spring tea) Flower Aroma JJMF3: 50USD/KG (Yellow Bud) Type JJMF4: 105USD/KG (1st grade) JJMF5: 155USD/0.5KG (Super grade) Jin Jun Mei Tea JJMG-1: 20USD/KG --- Longan (Yellow -

The Way of Tea

the way of tea | VOLUME I the way of tea 2013 © CHADO chadotea.com 79 North Raymond Pasadena, CA 91103 626.431.2832 DESIGN BY Brand Workshop California State University Long Beach art.csulb.edu/workshop/ DESIGNERS Dante Cho Vipul Chopra Eunice Kim Letizia Margo Irene Shin CREATIVE DIRECTOR Sunook Park COPYWRITING Tek Mehreteab EDITOR Noah Resto PHOTOGRAPHY Aaron Finkle ILLUSTRATION Erik Dowling the way of tea honored guests Please allow us to make you comfortable and serve a pot of tea perfectly prepared for you. We also offer delicious sweets and savories and invite you to take a moment to relax: This is Chado. Chado is pronounced “sado” in Japanese. It comes from the Chinese words CHA (“tea”) and TAO (“way”) and translates “way of tea.” It refers not just to the Japanese tea ceremony, but also to an ancient traditional practice that has been evolving for 5,000 years or more. Tea is quiet and calms us as we enjoy it. No matter who you are or where you live, tea is sure to make you feel better and more civilized. No pleasure is simpler, no luxury less expensive, no consciousness-altering agent more benign. Chado is a way to health and happiness that people have loved for thousands of years. Thank you for joining us. Your hosts, Reena, Devan & Tek A BRIEF HISTORY OF CHADO Chado opened on West 3rd Street in 1990 as a small, almost quaint tearoom with few tables, but with 300 canisters of teas from all over the globe lining the walls. In 1993, Reena Shah and her husband, Devan, acquired Chado and began quietly revolutionizing how people in greater Los Angeles think of tea. -

WHOLESALE Teasquared.Ca 6 Curity Ave | Toronto on | M4B 1X2 647.499.8222 | [email protected]

WHOLESALE teasquared.ca 6 Curity Ave | Toronto ON | M4B 1X2 647.499.8222 | [email protected] 1 TEA SQUARED | WHOLESALE 1-2 2 4-5 7 BLACK BLACK DECAF MATE SCENTED CONTENTS 9 11-12 12 14 GREEN GREEN STONE WHITE SCENTED GROUND 16 19 21-22 24 FRUIT TEAS CHAI OOLONG PU-ERH (CAFFEINE FREE) BLENDS 26-27 27-28 30 32-35 ROOIBOS HERBAL FOOD RETAIL (CAFFEINE FREE) (CAFFEINE FREE) SERVICES 36 BREWING SOLUTIONS BLACK TEA & MATE BULK k,gf Breakfast in Paris, Organic AKA English Breakfast Our tea master’s version of a traditional Breakfast blend. Created with smooth Summit Level black teas from three top-growing regions. A full body with depth and refined balance. Great on its own or with milk and sugar. Black teas have shown to protect against heart disease and strokes and to lower cholesterol. Ingredients: Black tea BLACK k,gf Irish Breakfast This blend is created for the lover of strong black teas. Spoon standing in your cup strong! We recommend this tea for fans of traditional English style teas with milk and sugar. Black teas have shown to protect against heart disease and strokes and to lower cholesterol. Ingredients: Black tea k,gf Bukhial Estate TGFOP – Assam A classic Assam with the typical malty depth that made this region famous. Full- bodied and smooth with excellent strength. Ingredients: Black tea k,gf Kenilworth - Ceylon A lighter style black tea from the best growing region in the mountains of Sri Lanka. Flowery with medium body. Great at any time of the day. -

8361/20 LSV/IC/Rzu RELEX.1.A

Council of the European Union Brussels, 9 July 2020 (OR. en) 8361/20 Interinstitutional File: 2020/0088 (NLE) WTO 92 AGRI 158 COASI 54 LEGISLATIVE ACTS AND OTHER INSTRUMENTS Subject: Agreement between the European Union and the Government of the People's Republic of China on cooperation on, and protection of, geographical indications 8361/20 LSV/IC/rzu RELEX.1.A EN AGREEMENT BETWEEN THE EUROPEAN UNION AND THE GOVERNMENT OF THE PEOPLE'S REPUBLIC OF CHINA ON COOPERATION ON, AND PROTECTION OF, GEOGRAPHICAL INDICATIONS EU/CN/en 1 THE EUROPEAN UNION, of the one part, and THE GOVERNMENT OF THE PEOPLE'S REPUBLIC OF CHINA, of the other part, hereinafter jointly referred to as the "Parties", CONSIDERING that the Parties agree to promote between them harmonious cooperation and the development of geographical indications as defined in Article 22(1) of the Agreement on Trade-related Aspects of Intellectual Property Rights (the "TRIPS Agreement") and to foster the trade of products carrying such geographical indications originating in the territories of the Parties; HAVE DECIDED TO CONCLUDE THIS AGREEMENT: EU/CN/en 2 ARTICLE 1 Scope of the Agreement 1. This Agreement applies to the cooperation on, and protection of, geographical indications of products which originate in the territories of the Parties. 2. The Parties agree to consider extending the scope of geographical indications covered by this Agreement after its entry into force to other product classes of geographical indications not covered by the scope of the legislation referred to in Article 2, and in particular handicrafts, by taking into account the legislative development of the Parties. -

Tea Sector Report

TEA SECTOR REPORT Common borders. Common solutions. 1 DISCLAIMER The document has been produced with the assistance of the European Union under Joint Operational Programme Black Sea Basin 2014-2020. Its content is the sole responsibility of Authors and can in no way be taken to reflect the views of the European Union. Common borders. Common solutions. 2 Contents 1. Executıve Summary ......................................................................................................................................... 4 2. Tea Sector Report ............................................................................................................................................ 7 1.1. Current Status ............................................................................................................................................... 7 1.1.1. World .................................................................................................................................................... 7 1.1.2. Black Sea Basin ................................................................................................................................... 49 1.1.3. National and Regional ........................................................................................................................ 60 1.2. Traditional Tea Agriculture and Management ............................................................................................ 80 1.2.1. Current Status ................................................................................................................................... -

Bacterial Growth and Morphology Found in Tea

Bacterial Growth and Morphology found in Tea Biology Department, PSU Kiersten Fullem Chongwen Shi Sebastian Cevallos Why Study the Microbiology of Tea? ● 3 billion cups of tea are consumed daily all over the world. ● Most people think tea is clean after being brewed with boiling water. ● Some people use tea to clean. ● Iced tea in restaurants has been found to have lots of bacteria (especially coliforms). Looking at 3 Types of Tea ● We used 3 types of tea: Oolong(Tieguanyin), White, and Black. ● All types of tea come from same plant: Camellia sinensis. ● They are turned into different types by oxidation. What is Oxidation in Tea? ● A series of chemical reactions that result in the browning of tea leaves and the production of flavor and aroma compounds. ● Oxidation is not fermentation! What Happens When Tea is Oxidized? ● When a leaf’s cells are damaged their insides are exposed to oxygen. ● When polyphenols in the cell’s vacuoles, and the peroxidase in the cell’s peroxisomes, mix with polyphenol oxidase in the cell’s cytoplasm, a chemical reaction begins. ● This reaction converts the polyphenols known as catechins into flavonoids: compounds responsible for the teas’ tastes and colors. Types of Oxidation in Tea Spontaneous oxidation: ● Begins as soon as tea is picked. ● Can be allowed to wilt naturally after being picked: withering/wilting. ● Either stopped or continued in controlled oxidation. Controlled oxidation: ● Much faster than spontaneous. ● Oxidation can be encouraged by controlling temperature and physically breaking leaves to release enzymes. Stopping Oxidation ● Oxidation can be stopped by denaturing oxidative enzymes with heat, (steaming, pan- frying, or baking the leaves). -

Guide to Tea and Cheeses

Pairing Fine Teas and Cheeses presented by JAS-eTea © 2015 JAS-eTea. All rights reserved. Get Your Cheese on at Tea Time! One of the similarities between wine and tea is that, with a bit of trial and error and some tips from your friends and folks like us, you can pair them very well with cheeses. And, just like with wine, how you pair tea and cheese can be a true art. That’s why we wanted to present some pairing recommendations – both our own and ones that tea connoisseurs (also known as sommeliers and aficionados) have presented. Who knows, you may be inspired to invite over friends and family for a tea and cheese tasting party! A Natural Combo Cheese and wine are a natural combination. In some people’s minds, they go together like apple pie and ice cream, hot dogs and baseball games, or even SUVs and Soccer Moms. Beer is getting more into the act, too, which isn’t surprising with all the microbreweries around. And home brewing is on the up- swing, from what I have seen online. Lately, though, cheese is becom- ing a bigger part of tea time with pairings becoming the rage. Some pros are so successful at pairing teas and cheeses properly that they are being sought after by restaurants and party givers. Get ready to go exploring the wonderful world of tea and cheese pairings! Pairing Fine Teas and Cheeses presented by JAS-eTea © 2015 JAS-eTea. All rights reserved. Contents Pairing Basics By Tea Type White Teas Green Teas Oolong Teas Darjeeling Teas Black Teas By Cheese Tea and Cheese Short Chart About Us Pairing Fine Teas and Cheeses presented by JAS-eTea © 2015 JAS-eTea. -

1455189355674.Pdf

THE STORYTeller’S THESAURUS FANTASY, HISTORY, AND HORROR JAMES M. WARD AND ANNE K. BROWN Cover by: Peter Bradley LEGAL PAGE: Every effort has been made not to make use of proprietary or copyrighted materi- al. Any mention of actual commercial products in this book does not constitute an endorsement. www.trolllord.com www.chenaultandgraypublishing.com Email:[email protected] Printed in U.S.A © 2013 Chenault & Gray Publishing, LLC. All Rights Reserved. Storyteller’s Thesaurus Trademark of Cheanult & Gray Publishing. All Rights Reserved. Chenault & Gray Publishing, Troll Lord Games logos are Trademark of Chenault & Gray Publishing. All Rights Reserved. TABLE OF CONTENTS THE STORYTeller’S THESAURUS 1 FANTASY, HISTORY, AND HORROR 1 JAMES M. WARD AND ANNE K. BROWN 1 INTRODUCTION 8 WHAT MAKES THIS BOOK DIFFERENT 8 THE STORYTeller’s RESPONSIBILITY: RESEARCH 9 WHAT THIS BOOK DOES NOT CONTAIN 9 A WHISPER OF ENCOURAGEMENT 10 CHAPTER 1: CHARACTER BUILDING 11 GENDER 11 AGE 11 PHYSICAL AttRIBUTES 11 SIZE AND BODY TYPE 11 FACIAL FEATURES 12 HAIR 13 SPECIES 13 PERSONALITY 14 PHOBIAS 15 OCCUPATIONS 17 ADVENTURERS 17 CIVILIANS 18 ORGANIZATIONS 21 CHAPTER 2: CLOTHING 22 STYLES OF DRESS 22 CLOTHING PIECES 22 CLOTHING CONSTRUCTION 24 CHAPTER 3: ARCHITECTURE AND PROPERTY 25 ARCHITECTURAL STYLES AND ELEMENTS 25 BUILDING MATERIALS 26 PROPERTY TYPES 26 SPECIALTY ANATOMY 29 CHAPTER 4: FURNISHINGS 30 CHAPTER 5: EQUIPMENT AND TOOLS 31 ADVENTurer’S GEAR 31 GENERAL EQUIPMENT AND TOOLS 31 2 THE STORYTeller’s Thesaurus KITCHEN EQUIPMENT 35 LINENS 36 MUSICAL INSTRUMENTS