Semestrale IT

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Relazione Finanziaria Semestrale Al 30 Giugno 2018

RELAZIONE FINANZIARIA SEMESTRALE AL 30 GIUGNO 2018 Relazione finanziaria semestrale al 30 giugno 2018 INDICE ORGANI SOCIALI E COMITATI ................................................................................................. 4 RELAZIONE SULL’ANDAMENTO DELLA GESTIONE AL 30 GIUGNO 2018 ................... 5 Risultati del Gruppo e situazione finanziaria .......................................................................................... 5 Outlook .................................................................................................................................................. 14 Operazioni industriali e finanziarie ....................................................................................................... 15 Operazioni con parti correlate ............................................................................................................... 17 Indicatori di performance “non-GAAP” ............................................................................................... 18 BILANCIO CONSOLIDATO SEMESTRALE ABBREVIATO AL 30 GIUGNO 2018.......... 22 Conto economico abbreviato separato consolidato ............................................................................... 23 Conto economico complessivo consolidato .......................................................................................... 24 Situazione patrimoniale finanziaria abbreviata consolidata .................................................................. 25 Rendiconto finanziario consolidato ...................................................................................................... -

Half-Year Financial Report at 30 June 2013 Finmeccanica

HALF-YEAR FINANCIAL REPORT AT 30 JUNE 2013 FINMECCANICA Disclaimer This Half-Year Financial Report at 30 June 2013 has been translated into English solely for the convenience of the international reader. In the event of conflict or inconsistency between the terms used in the Italian version of the report and the English version, the Italian version shall prevail, as the Italian version constitutes the sole official document. CONTENTS BOARDS AND COMMITTEES ...................................................................................................... 4 REPORT ON OPERATIONS AT 30 JUNE 2013 .......................................................................... 5 Group results and financial position in the first half of 2013 .................................................................. 5 Outlook ................................................................................................................................................. 12 “Non-GAAP” alternative performance indicators ................................................................................. 22 Industrial and financial transactions ...................................................................................................... 26 Corporate Governance .......................................................................................................................... 29 CONDENSED CONSOLIDATED HALF-YEAR FINANCIAL STATEMENTS AT 30 JUNE 2013 .................................................................................................................................................. -

Download the Full ARB Final Report

Customer : ESA/ESRIN Document Ref : IDEAS-VEG-OQC-REP-1274 Contract No : 21525lOBll-OL lssue Date : 12 August 2013 WP No : 10000 lssue r I Title AATSR {2 Micron Anomaly Review Board - Final Report Abstract This document is the final report from the AATSR '12 micron Anomaly Review Board. Author Sotta- Si6n O'Hara Secretary Distribution Hard Copy File: Filename: ideas-veg-oqc-rey127 4 _1 .doc, Copyright @ 2013 Tetespazio VEGA All ights reserved. No part of this work may be disclosed to any third party translated reproduced copied or disseminated in any form or by any means excepl as defined in tl:c contact or with the wiften permission of Telespazio VEGA UK Ltd. Telespazio VEGA UK Ltd 350 Capability Green, Luton, Bedfordshire LUI 3LU, United Kingdom Tel: +44 (0)1582 399 000 Fax: +4{ (0)1582 728 686 www.telespazio-vega.com GEN.CTF.007, lsue 6 AATSR 12 Micron Anomaly Review Board IDEAS-VEG-OQC-REP-1274 Final Report Issue 1 TABLE OF CONTENTS 1. PREFACE .................................................................................................................................. 4 1.1 Purpose and Scope ............................................................................................................... 4 1.2 Structure of the Document .................................................................................................... 4 1.3 ARB Participation .................................................................................................................. 5 2. EXECUTIVE SUMMARY .......................................................................................................... -

Espinsights the Global Space Activity Monitor

ESPInsights The Global Space Activity Monitor Issue 6 April-June 2020 CONTENTS FOCUS ..................................................................................................................... 6 The Crew Dragon mission to the ISS and the Commercial Crew Program ..................................... 6 SPACE POLICY AND PROGRAMMES .................................................................................... 7 EUROPE ................................................................................................................. 7 COVID-19 and the European space sector ....................................................................... 7 Space technologies for European defence ...................................................................... 7 ESA Earth Observation Missions ................................................................................... 8 Thales Alenia Space among HLS competitors ................................................................... 8 Advancements for the European Service Module ............................................................... 9 Airbus for the Martian Sample Fetch Rover ..................................................................... 9 New appointments in ESA, GSA and Eurospace ................................................................ 10 Italy introduces Platino, regions launch Mirror Copernicus .................................................. 10 DLR new research observatory .................................................................................. -

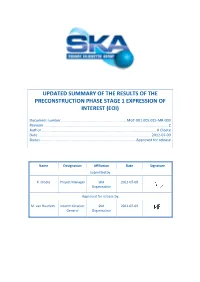

SKA Summary Statement

UPDATED SUMMARY OF THE RESULTS OF THE PRECONSTRUCTION PHASE STAGE 1 EXPRESSION OF INTEREST (EOI) Document number ................................................................. MGT-001.005.015-MR-003 Revision ........................................................................................................................... 2 Author .................................................................................................................. K Cloete Date ................................................................................................................. 2012-07-09 Status ............................................................................................... Approved for release Name Designation Affiliation Date Signature Submitted by: K. Cloete Project Manager SKA 2012-07-09 Organisation Approved for release by: M. van Haarlem Interim Director SKA 2012-07-09 General Organisation MGT-001.005.015-MR-003 Revision : 2 DOCUMENT HISTORY Revision Date Of Issue Engineering Change Comments Number 1 2012-06-07 - Approved for release 2 2012-07-09 - Updated with additional information. Approved for release DOCUMENT SOFTWARE Package Version Filename Wordprocessor MsWord Word 2007 MGT-001.005.015-MR-003-2_SummaryStage1EoIResults ORGANISATION DETAILS Name SKA Organisation Registered Address Jodrell Bank Centre for Astrophysics Room 3.116 Alan Turing Building The University of Manchester Oxford Road Manchester, UK M13 9PL Registered in England & Wales Company Number: 07881918 Fax. +44 (0)161 275 4049 Website www.skatelescope.org -

Raes Corporate Partner Scheme

Royal Aeronautical Society / Handbook 2018 / Corporate Partners RAeS Corporate Partner Scheme The Society now has over 300 Corporate Partners, 24,344 individual members and is host to over 100 events each year at the Society’s London HQ and 300 via its global Branches, Divisions and Specialist Committees, making it arguably the most influential aerospace society worldwide. The RAeS is the only professional body beneficial Corporate Partner rates. Please joining the elite of the aerospace industry dedicated to the entire aerospace visit the Corporate Partner section of the committed to best practice, heritage and community. RAeS website to find out more (www. innovation. A full Corporate Partner listing It retains a sense of history and aerosociety.com/corporate may be found on the RAeS website and in tradition, while maintaining its energy the RAeS Handbook. and relevance and ability to contribute to CONFERENCES, EVENTS, LECTURES, today’s environment and is ideally placed SPECIALIST GROUPS & BRANCH RAeS HANDBOOK to face the challenges of the future. MEETINGS By joining the Society’s Corporate Annually published at the beginning Partner Scheme, your organisation The Society has an extensive diary of of the year, the RAeS Handbook is aligns itself to the Charter of the Royal events many of which are free to attend an aide-mémoire to all Corporate Aeronautical Society and demonstrates a or are at a reduced rate for Corporate Partners highlighting the activities of its commitment to professional development Partners. Please visit the Events Section of membership and the Society’s activities of engineering and technical staff within the RAeS website (www.aerosociety.com/ and links in the international arena. -

Telespazio Vega UK Geo Information Services Overview

A New Space Applications Service Opportunity Integrated Situational Awareness Services With Telespazio VEGA UK Ian Encke – At the Imperial Space Lab Launch 1st July 2013 24/07/2013 1 Why a NEW service opportunity? • Today the space applications industry has an emerging capability to provide truly 24/7 surveillance services • Why? 4 Cosmo Skymed 1 TerraSAR-X /Tandem pair 1 Radarsat 2 • For the first time we have access to enough timely, high resolution, all weather, night and day space imaging 2 Cosmo Skymed alone revolutionises revisit capability >12 6 4 6 COSMO-SKYMED - UNMATCHED REVISIT >12 Acquisitions per day with the 4 satellites constellation (the acquisitions are not spread uniformly throughout the day) 3 Opportunity for UK? • Soon more Radar satellites will join the global constellation including, within a couple of years, our own UK Nova SAR • Meanwhile, through Telespazio VEGA UK and Astrium UK we have preferential access to: – 4 Cosmo Skymed & 2 future Argentinian SAR sats – 1 TerraSAR / Tandem pair & 1 future Spanish TerraSAR variant – Through ESA we will have access to the future 2 Sentinal 1 satellites • With the recent increased UK government investment in space, and the set up of UKSA and the Space Applications Catapult, UK is well placed to exploit this opportunity 4 Why Integrated Situational Awareness Services? It allows addition of UK innovation! • High revisit radar is well suited to a range of situational awareness applications – Maritime and O&G – Security and Crisis Management – Agriculture and Forestry • German and Italian companies have already cornered the market in ‘first level’ value add • Telespazio VEGA UK believe the opportunity is to take those products further downstream through “integration” of UK innovations • We are looking for ‘layer partners’ partners to join our ISAS team to supply / develop innovative value add 5 Who we are • Telespazio VEGA UK (VEGA Space Ltd rebranded in March 2012) – Part of Telespazio (a Finmeccanica / Thales Company) • UK SME made good! Small company ethos within a large company. -

Facts & Figures

OVERVIEW A specialised strategic sector _facts & figures 23rd edition, June 2019 Te European space industry in 2018 _f&f // 23rd edition, June 2019 // The European space industry in 2018 02 CONTENTS ABOUT EUROSPACE 01 OUTPUT OF THE EUROPEAN SPACE INDUSTRY IN 2018 35 FOREWORD 02 European spacecraft deliveries to launch 35 European spacecraft launched in 2018 35 OVERVIEW 03 Correlation between spacecraft mass A specialised strategic sector 03 at launch and industry revenues 37 Markets and customers 04 Ariane and VEGA launches 37 MAIN INDICATORS 06 METHODOLOGY 39 Long series indicators 07 Perimeter of the survey 39 Data Collection 39 SECTOR DEMOGRAPHICS 09 Consolidation Model 39 Industry employment - The need for consolidation 39 age and gender distribution 09 Methodological update in 2010 39 Industry employment - Qualification structure 09 Industry employment - distribution by country 10 DEFINITIONS 40 Industry employment - distribution by company 12 Space systems and related products Employment in large groups 12 considered in the survey 40 SMEs in the space sector 12 Launcher systems 40 Spacecraft/satellite systems 40 FINAL SALES BY MARKET SEGMENT 13 Ground Segment (and related services) 40 Overview: European sales vs. Export 13 Sector concentration: employment Overview - Public vs. Private customers 16 in space units, employment by unit and cumulated % 40 Customer details 17 Focus: SURVEY INFORMATION 41 European public/institutional customers 17 Eurospace economic model 41 Focus: The commercial market (private customers and exports) -

Small Satellite Operations (3)

61st International Astronautical Congress 2010 Paper ID: 8960 SMALL SATELLITE MISSIONS SYMPOSIUM (B4) Small Satellite Operations (3) Author: Mrs. Helen Page European Space Agency (ESA), The Netherlands, [email protected] Mr. Phil Beavis Telespazio VEGA UK LTD, United Kingdom, [email protected] Prof. Fernando Aguado Agelet University of Vigo, Spain, [email protected] Mr. Miguel Eduardo Gil Biraud European Space Agency (ESA), The Netherlands, [email protected] GENSO: A REPORT ON THE EARLY OPERATIONAL PHASE Abstract GENSO, the Global Educational Network for Satellite Operations, will be opened to the education and radio amateur communities in June this year, after a period of beta testing with a limited number of users. The network and associated software applications have been developed by students under the guidance of the ESA Education Office and its contractor SELEX Systems Integration Ltd. The European Operations Node is hosted at the University of Vigo, Spain. In this paper, the authors will describe the functionalities of the operational network and capabilities of the software, which will provide autonomous operations for its target end users: mission operators and ground stations at university and amateur radio level. A roadmap for further enhancements which may be carried out within the GENSO open source development project will also be presented. A performance study will provide an insight into what small satellite missions can expect from the net- work regarding the availability of ground stations, supported bands and global coverage. Moreover, several mission operation patterns have been identified, that can help the GENSO ground station community to optimise planning for their ground station availability. -

Tuesday 25Th February 2020

Tuesday 25th February 2020 8:30 REGISTRATION / WELCOME 09:00 - 10:10 PLENARY SESSION 1 - OPENING Chair: Christian Mari (Chair of AEC2020) Welcome by Louis le Portz & Michel Scheller, 3AF Presidents Alain Rousset, "Nouvelle Aquitaine" Region President 10:10 - 10:40 COFFEE BREAK ANERS AERONAUTICS SPACE Auditorium A R01 (G1+G2) R02 (D1+D2) R03 (F1) R04 (E1) R05 (E2) R06 (F2) R07 (H1) R08 (H2) Session 1 : ANERS Session 2 : Aerodynamic/Flow Control Session 3 : Hybrid/electric airplanes design and Session 4 : Composites manufacturing Session 5 : Research infrastructures for greener and Session 6 : CS Project BLADE Session 7 : Clean Space, Space Debris I Session 8: Materials and Advanced Manufacturing for Session 9 : Space Propulsion I Chair: Ph. Beaumier (ONERA) analysis tools Chair: L. Paletti (NLR) safer aviation Chair: V. Selmin (CS) Chair: G. Ortega (ESA) Space Application I Chair: J. Gonzalez del Amo (ESA) Chair: F. Boudjemaa (Safran) Chair: C. Nae (INCAS) Chair: K. Pfaab (CNES) 49 156 136 363 109 721 578 703 10:40-11:00 Symposium Introduction and Session Moderation: A Method for Estimating Drag Reduction A General Preliminary Sizing Procedure for Pure- Automated Fiber Placement based manufacturing of Towards the Multimodal Detection of Sleep in Pilots BLADE - Breakthrough Laminar Demonstrator in Aerodynamically stabilized origami-based drag sail Design of a MoonFibre Spinning Apparatus for the Multidisciplinary design optimization framework for John-Paul Clarke (UTC & Georgia Tech) Performance of Riblets Installed on Aircraft Surfaces Electric and Hybrid-Electric Airplanes carbon fiber reinforced sandwich shell parts B. BOHDAN, Honeywell, CZ Europe - An Overview A. ABRISHAMI, Tsinghua University, CN Use on a REXUS Research Rocket the conceptual design of hybrid rockets S.KOGA, Japan Aerospace Exploration Agency, JP L.TRAINELLI, Politecnico Di Milano, IT T. -

Half-Year Financial Report at 30 June 2018

HALF-YEAR FINANCIAL REPORT AT 30 JUNE 2018 Disclaimer This Half-Year Financial Report for 2018 has been translated into English solely for the convenience of the international reader. In the event of conflict or inconsistency between the terms used in the Italian version of the report and the English version, the Italian version shall prevail, as the Italian version constitutes the sole official document WorldReginfo - 87529b96-28ff-41bc-a02a-3f645e347404 Half -year financial report at 30 June 2018 TABLE OF CONTENTS BOARDS AND COMMITTEES...................................................................................................... 4 REPORT ON OPERATIONS AT 30 JUNE 2018 .......................................................................... 5 Group results and financial position ........................................................................................................ 5 Outlook .................................................................................................................................................. 14 Industrial and financial transactions ...................................................................................................... 15 Related party transactions ..................................................................................................................... 17 "Non-GAAP" performance indicators ................................................................................................... 18 CONDENSED CONSOLIDATED HALF-YEAR FINANCIAL STATEMENTS AT 30 JUNE -

Espinsights the Global Space Activity Monitor

ESPInsights The Global Space Activity Monitor Issue 5 January-March 2020 CONTENTS FOCUS ..................................................................................................................... 1 The COVID-19 pandemic crisis: the point of view of space ...................................................... 1 SPACE POLICY AND PROGRAMMES .................................................................................... 3 EUROPE ................................................................................................................. 3 Lift-off for ESA Sun-exploring spacecraft ....................................................................... 3 ESA priorities for 2020 ............................................................................................. 3 ExoMars 2022 ........................................................................................................ 3 Airbus’ Bartolomeo Platform headed toward the ISS .......................................................... 3 A European Coordination Committee for the Lunar Gateway ................................................ 4 ESA awards contract to drill and analyse lunar subsoil ........................................................ 4 EU Commission invests in space .................................................................................. 4 Galileo’s Return Link Service is operational .................................................................... 4 Quality control contract on Earth Observation data ..........................................................