Denholm Fishselling Limited - Written Evidence (NIP0015)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

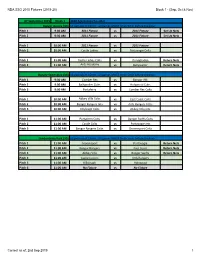

NDA SSG 2010 Fixtures (2019-20) Block 1 - (Sep, Oct & Nov)

NDA SSG 2010 Fixtures (2019-20) Block 1 - (Sep, Oct & Nov) 07 September 2019 Week 1 2010 Age Group (7-a-side) Bangor Aurora (3G) x3 periods of 15min - all games MUST finish 5min before the hour Pitch 1 9:00 AM 2011 Fixture vs 2011 Fixture Set Up Nets Pitch 2 9:00 AM 2011 Fixture vs 2011 Fixture Set Up Nets Pitch 1 10:00 AM 2011 Fixture vs 2011 Fixture Pitch 2 10:00 AM Castle Ladies vs Portavogie Colts Pitch 1 11:00 AM Castle Ladies Colts vs Donaghadee Return Nets Pitch 2 11:00 AM Ards Academy vs Ballywalter Return Nets Bangor Sportsplex (3G) x3 periods of 15min - all games MUST finish 5min before the hour Pitch 1 9:00 AM Comber Rec vs Bangor YM Pitch 2 9:00 AM Ballywalter Colts vs Holywood Colts Pitch 3 9:00 AM Portaferry vs Comber Rec Colts Pitch 1 10:00 AM Abbey Villa Colts vs East Coast Colts Pitch 2 10:00 AM Bangor Rangers Jets vs Ards Rangers Colts Pitch 3 10:00 AM Killyleagh Colts vs Abbey Villa Jets Pitch 1 11:00 AM Portaferry Colts vs Bangor Swifts Colts Pitch 2 11:00 AM Castle Colts vs Portavogie Jets Pitch 3 11:00 AM Bangor Rangers Colts vs Groomsport Colts Londonderry Park (3G) x3 periods of 15min - all games MUST finish 5min before the hour Pitch 1 11:00 AM Groomsport vs Portavogie Return Nets Pitch 2 11:00 AM Bangor Rangers vs East Coast Return Nets Pitch 3 11:00 AM Abbey Villa vs Bangor Swifts Return Nets Pitch 4 11:00 AM Castle Juniors vs Ards Rangers Pitch 5 11:00 AM Killyleagh vs Holywood Pitch 6 11:00 AM No Fixture vs No Fixture Correct as of: 2nd Sep 2019 1 NDA SSG 2010 Fixtures (2019-20) Block 1 - (Sep, Oct & Nov) 14 -

Constituency Profile Strangford - January 2015

Constituency Profile Strangford - January 2015 Constituency Profile – Strangford January 2015 About this Report Welcome to the 2015 statistical profile of the Constituency of Strangford produced by the Research and Information Service (RaISe) of the Northern Ireland Assembly. The profile is based on the new Constituency boundary which came into force following the May 2011 Assembly elections. This report includes a demographic profile of Strangford and indicators of Health, Education, the Labour Market, Low Income, Crime and Traffic and Travel. For each indicator, this profile presents: ■ The most up-to-date information available for Strangford; ■ How Strangford compares with the Northern Ireland average; and, ■ How Strangford compares with the other 17 Constituencies in Northern Ireland. For a number of indicators, ward level data is provided demonstrating similarities and differences within the Constituency of Strangford. A summary table has been provided showing the latest available data for each indicator, as well as previous data, illustrating change over time. Please note that the figures contained in this report may not be comparable with those in previous Constituency Profiles as government Departments sometimes revise figures. Where appropriate, rates have been re-calculated using the most up-to-date mid-year estimates that correspond with the data. The data used in this report has been obtained from NISRAs Northern Ireland Neighbourhood Information Service (NINIS). To access the full range of information available on NINIS, please visit: http://www.ninis2.nisra.gov.uk i Constituency Profile – Strangford January 2015 This report presents a statistical profile of the Constituency of Strangford which comprises the wards shown below. -

Download 27 March Agenda

ARDS AND NORTH DOWN BOROUGH COUNCIL 20 March 2019 Dear Sir/Madam You are hereby invited to attend a meeting of the Ards and North Down Borough Council which will be held in the Council Chamber, Town Hall, The Castle, Bangor on Wednesday, 27 March 2019 commencing at 7.00pm. Yours faithfully Stephen Reid Chief Executive Ards and North Down Borough Council A G E N D A 1. Prayer 2. Apologies 3. Declarations of Interest 4. Mayor’s Business 5. Mayor and Deputy Mayor Engagements for the Month (To be tabled) 6. Minutes of Meeting of Council dated 27 February 2019 (Copy attached) 7. Minutes of Committees (Copies attached) 7.1. Planning Committee dated 5 March 2019 7.2. Environment Committee dated 6 March 2019 7.3. Regeneration and Development Committee dated 7 March 2019 ***ITEM 7.3.1 IN CONFIDENCE*** 7.3.1 Belfast Region City Deal – Updated Heads of Terms (Report to follow) 7.4. Corporate Services Committee dated 12 March 2019 7.4.1. Veterans’ Day 2019 and Proposal to Mark 75th Anniversary of the D-Day Landings (Report attached) 7.5. Community and Wellbeing Committee dated 13 February 2019 8. Request for Deputation 8.1 Congress – Irish Congress of Trade Unions Northern Ireland Committee (Correspondence attached) 9. Resolution 9.1 Newry, Mourne and Down District Council – Geographical Disposal Facility by Radioactive Waste Management (Correspondence attached) 10. Courses/Invitations etc. 10.1 The Regimental Association UDR – The Ulster Defence Regiment Day Event on Sunday 7th April, Palace Barracks, Holywood. 11. Consultation Documents 11.1 Consultation Response on Allergen Labelling (Report attached) 12. -

NIFHA) Corporate Plan (2018-2022

Northern Ireland Fishery Harbour Authority (NIFHA) Corporate Plan (2018-2022) February 2018 Northern Ireland Fishery Harbour Authority Corporate Plan (2018 - 2022) February 2018 Table of Contents INTRODUCTION AND BACKGROUND ................................................................................. 1 INTRODUCTION .............................................................................................................................. 1 OVERVIEW OF NIFHA ..................................................................................................................... 1 FUNCTION AND ACTIVITIES ............................................................................................................... 1 ORGANISATIONAL STRUCTURE .......................................................................................................... 2 INCOME SOURCES & TRENDS ........................................................................................................... 2 CUSTOMERS AND STAKEHOLDERS ...................................................................................................... 3 THE PLANNING CONTEXT ................................................................................................. 5 INTRODUCTION .............................................................................................................................. 5 STRATEGIC /P OLICY CONTEXT ............................................................................................................ 5 MARKET CONTEXT ......................................................................................................................... -

Energy Performance Certificate Northern Ireland

Energy Performance Certificate Northern Ireland 141, Main Road Date of assessment: 04 April 2017 Portavogie Date of certificate: 05 April 2017 NEWTOWNARDS Reference number: 9923-0924-6980-2974-5906 BT22 1EL Type of assessment: RdSAP, existing dwelling Accreditation scheme: NHER Assessor's name: Mrs Carleen Branagan Assessor's accreditation number: NHER005510 Employer/Trading name: CB Energy Assessing Employer/Trading address: 103a, Rostrevor Road, Newry, BT34 5TZ Related party disclosure: No related party Energy Efficiency Rating Technical Information Benchmarks Main heating type and fuel: Boiler and radiators, oil Average for Total floor area: 91 m² Northern Ireland Primary energy use: 521 kWh/m² per year Approximate CO2 emissions: 142 kg/m² per year Dwelling type: Semi-detached house The primary energy use and CO2 emissions are per square metre of floor area based on fuel use for the heating, ventilation, hot water and lighting systems. The rating can be compared to the benchmark of the average energy efficiency rating for the housing stock in Northern Ireland. Page 1 of 9 141, Main Road, Portavogie, NEWTOWNARDS, BT22 1EL Energy Performance Certificate 05 April 2017 RRN: 9923-0924-6980-2974-5906 Estimated energy use, carbon dioxide (CO2) emissions and fuel costs of this home Current Potential Primary energy use 521 kWh/m² per year 194 kWh/m² per year Carbon dioxide emissions 13 tonnes per year 4.8 tonnes per year Lighting £118 per year £59 per year Heating £1,197 per year £517 per year Hot water £510 per year £117 per year The figures in the table above have been provided to enable prospective buyers and tenants to compare the fuel costs and carbon emissions of one home with another. -

Ards and North Down Borough Council a G E N

ARDS AND NORTH DOWN BOROUGH COUNCIL 8 January 2020 Dear Sir/Madam You are hereby invited to attend a meeting of the Corporate Services Committee of the Ards and North Down Borough Council which will be held in the Council Chamber, 2 Church Street, Newtownards on Tuesday, 14 January 2020 commencing at 7.00pm. Tea, coffee and sandwiches will be available from 6.00pm. Yours faithfully Stephen Reid Chief Executive Ards and North Down Borough Council A G E N D A 1. Apologies 2. Declarations of Interest 3. Deputations 3.1. Deputation from Southern Division Department of Infrastructure. (Southern Division: Annual Report 2019/2020 to Ards and North Down Borough Council – Report attached) 4. Budgetary Control Report – November 2019 (Report attached) 5. Prudential Indicators & Treasury Management – 2019/20 In-Year Report (Report attached) 6. Nomination to Buckingham Palace Garden Party (Report attached) 7. Request to Light Up Council buildings in support of Holocaust Memorial Day (Report attached) 8. Annual Remembrance Event for those who have lost loved ones to Suicide (Report attached) 9. Civic Awards 2020 (Report attached) 10. Quarterly Report on Equality and Good Relations (Section 75 of The N.I. Act 1998) 1 October 2019 – 31 December 2019 (Report attached) 11. Recruitment of Members to the South Eastern Commissioning Group (Report attached) 12. Responses to Notice of Motion: (a.) NOM 109 - Imposition of Unregulated Abortion in Northern Ireland (Report attached) (b.) NOM 112 - Integrated Education Fund (Report attached) 13. Any Other Notified Business – Staffing Matter (verbal) MEMBERSHIP OF CORPORATE SERVICES COMMITTEE (16 Members) Councillor T Smith (Vice-Chairman) Councillor Gilmour (Chairman) Alderman Keery Councillor Blaney Alderman Gibson Councillor Chambers Alderman Girvan Councillor Dunlop Alderman Irvine Councillor Cooper Alderman McIlveen Councillor Greer Councillor Mathison Councillor McKimm Councillor P Smith Regent Street , Newtownards Resurfacing and Traffic Signal upgrade Ards and North Down Borough Council DfI Roads Report — 2019/20 Contents Page No. -

An Assessment of Aquatic Radiation Pathways in Northern Ireland

An Assessment of Aquatic Radiation Pathways in Northern Ireland Research Commissioned by the Scotland and Northern Ireland Forum For Environmental Research (SNIFFER) and Environment and Heritage Service (EHS). SNIFFER Contract AIR(99)03 CEFAS Contract C1187 Environment Report 17/01 1 Environment Report RL 20/02 An Assessment of Aquatic Radiation Pathways in Northern Ireland The Centre for Environment, Fisheries and Aquaculture Science Lowestoft Laboratory Pakefield Road Lowestoft Suffolk NR33 0HT D. L. Smith, B. D. Smith, A. E. Joyce and I. T. McMeekan December 2002 The work described in this report was carried out on behalf of the Scotland and Northern Ireland Forum For Environmental Research (SNIFFER) and Environment and Heritage Service (EHS), as part of CEFAS contract number C1187 (SNIFFER contract number AIR(99)03) . 2 CONTENTS Page EXECUTIVE SUMMARY 6 1. INTRODUCTION 8 2. THE HABITS SURVEY 9 2.1 Survey aims 9 2.2 Survey area 9 2.3 Conduct of the survey 9 3. LOCAL FISHING EFFORT 11 3.1 The fishing industry 11 3.2 Fishing areas 11 4. INTERNAL RADIATION EXPOSURE PATHWAYS 12 4.1 Fish 12 4.1.1 Inshore and offshore fishing 12 4.1.2 Angling 12 4.2 Crustaceans 13 4.2.1 Nephrops 13 4.2.2 Crabs and lobsters 13 4.3 Molluscs 14 4.3.1 Periwinkles and whelks 14 4.3.2 Oysters and mussels 14 4.3.3 Scallops and clams 14 4.3.4 Razor fish and squid 15 5. EXTERNAL RADIATION EXPOSURE PATHWAYS 15 5.1 Beach and coastal area activities 15 5.2 Watersport activities 16 5.3 Handling 16 6. -

Ards and North Down Borough Council a G E N

ARDS AND NORTH DOWN BOROUGH COUNCIL 30 August 2017 Dear Sir/Madam You are hereby invited to attend a meeting of the Environment Committee of the Ards and North Down Borough Council which will be held in the Council Chamber, 2 Church Street, Newtownards on Wednesday, 6 September 2017 commencing at 7.00pm. Tea, coffee and sandwiches will be available from 6.00pm. Yours faithfully Stephen Reid Chief Executive Ards and North Down Borough Council A G E N D A 1. Apologies 2. Declarations of Interest 3. Deputation - Application for Entertainment Licence –Salty Dog, Bangor (Report attached) 4. Environment Directorate Budgetary Control Report – July 2017 (Report attached) 5. Q1 Performance Reports 5.1 Waste & Cleansing Services (Report attached) 5.2 Building Control, Licensing & Neighbourhood Environment (Report attached) 5.3 Assets & Property Services (Report attached) 6. Development Works at Harbours (Report attached) 7. Signage at Accessible Toilets (Report attached) 8. Landfill Allowance Scheme – Draft Reconciliation for 2016/17 Scheme Year (Report attached) 9. NI Local Authority Collected Municipal Waste Management Statistics January to March 2017 (Report attached) 10. Recycling Education Programme (Report attached) 11. Building Control Activities 2017/2018 – April to June 2017 (Report attached) 12. Live Here Love Here Small Grants Scheme (Report attached) 13. Grant of Pavement Café Licences (Report attached) 14. Result of Court Proceedings (Report attached) 15. Proposed Street Naming – Rockfield Meadows/Hurricane Close (Report attached) 16. Grant/Transfer of Entertainment Licences (Report attached) 17. Notice of Motions 17.1 Notice of Motion submitted by Councillor Chambers ‘That this Council forms a policy that allows a more flexible approach with regard to the closing times of public toilets, outside of seasonal opening hours, across the Borough. -

Recommendations Accepted by Planning Committee Members – Week Commencing 26 June 2017

Delegated applications – recommendations accepted by Planning Committee members – Week Commencing 26 June 2017 Reference No. Applicant Proposal Site Location Officer Objections Recommendation LA06/2017/0071/F Mr Robert Erection of two storey dwelling Immediately adjacent Approval 0 Gardiner (Renewal of approval and north (side garden) X/2011/0053/F) of No 9 Dunover Road North Ballywalter. DEA: Ards Peninsula LA06/2017/0042/F Mr Adam New 1st floor dormer window 3 Uprichard Crescent Approval 0 Armstrong to form new bedroom in store. Bangor DEA: Bangor Central LA06/2017/0575/A Windsor Retention of 2 no. non- Lands at Balloo Approval 0 Developments Ltd illuminated totem signs Crossroads at the junction of Saintfield Road and Comber Road, Killinchy LA06/2017/0417/F Malcolm Roberts Two-storey extension to rear 14 Londonderry Approval 0 of dwelling Avenue, Comber DEA: Comber LA06/2017/0232/F L E Pritchitt & Co Proposed single storey 46 Belfast Road, Approval 0 Ltd modular office building Newtownards DEA: Newtownards LA06/2017/0216/O Mr and Mrs B One single dwelling (one and Land 30m Northwest of Approval 0 Taylor a half storey) and garage No 12 Hazelwood Glen, Lisbane DEA: Comber LA06/2017/0366/F Robert Ferguson New building with disabled 85 Thornyhill Road, Approval 0 therapy room/gym on ground Raffery, Killinchy floor with first floor storage. Application renewal - DEA: Comber X/2011/0456/F LA06/2017/0434/F Mr Johnathan Detached garage to rear of 3 Cornmill Walk, Approval 0 McMullan dwelling and creation of new Millisle access. DEA: Ards Peninsula -

Co. Leitrim & Mohill A3175 ABBOTT A2981 ABERNETHY Stewartstown

North of Ireland Family History Society - List of Ancestor Charts SURNAME AREA MEM. NO. ABBOTT Shane (Meath), Co. Leitrim & Mohill A3175 ABBOTT A2981 ABERNETHY Stewartstown, Arboe & Coalisland A3175 ABRAHAM London A2531 ABRAHAM Pettigo, Co. Donegal & Paisley A2145 ACHESON County Fermanagh B1804 ADAIR Gransha (Co. Down) & Ontario A2675 ADAMS Ballymena & Cloughwater B2202 ADAMS Coleraine B1435 ADAMS Rathkeel, Ballynalaird, Carnstroan, Ballyligpatrick B1751 ADAMS Carnmoney A2979 ADAMSON Northumberland A2793 ADAMSON Montiaghs A3930 AIKEN A3187 AKENHEAD British Columbia, Canada & Northumberland A2693 ALDINGTEN Moreton Bagot A3314 ALEXANDER Co. Tyrone A2244 ALEXANDER Malta B2239 ALEXANDER County Donegal B2324 ALEXANDER A3888 ALFORD Dublin South & Drogheda B2258 ALLAN Greenock A1720 ALLAN Alexandria A3561 ALLANDER County Londonderry B2324 ALLEN Belfast A0684 ALLEN Co. Down A3162 ALLEN Ballymena B2192 ALLEN County Wicklow & Carlisle, England B0817 ALLEN Crevolea, Macosquin A0781 ALLEN Comber B2123 ALLISON A3135 ALLSOPP Abersychan & Monmouthshire, Wales A2558 ALLWOOD Birmingham B2281 ALTHOFER New South Wales & Denmark A3422 ANDERSON A3291 ANDERSON B0979 ANDERSON Greenock A1720 ANDERSON Sweden A3700 ANDERSON Greenock, Scotland A3999 ANGUS A2693 ANGUS A3476 ANGUS Ayrshire & Lanarkshire A3929 APPELBY Hull B1939 APPLEBY Cornwall B0412 ARBUCKLE A1459 ARCHER A0431 ARCHIBALD Northern Ireland & Canada A3876 ARD Armagh A1579 ARLOW Co. Tyrone & Co. Tipperary A2872 ARMOUR Co. Limerick A1747 ARMOUR Paisley, Scotland B2366 ARMSTRONG Belfast & Glasgow A0582 ARMSTRONG Omagh A0696 May 2016 HMRC Charity No. XR22524 www.nifhs.org North of Ireland Family History Society - List of Ancestor Charts ARMSTRONG Belfast A1081 ARMSTRONG New Kilpatrick A1396 ARMSTRONG Aghalurcher & Colmon Island B0104 ARMSTRONG B0552 ARMSTRONG B0714 ARMSTRONG Co. Monaghan A1586 ARMSTRONG B1473 ARMSTRONG Magheragall, Lisburn B2210 ARMSTRONG A3275 ARMSTRONG Cumbria A3535 ARNOLD New York & Ontario A3434 ARNOLD Yorkshire B1939 ARTHUR Kells, Co. -

19 November 2014

PRIMARY INSPECTION Name of Agency: Positive Futures Ards Peninsula Supported Living Service Agency ID No: 11971 Date of Inspection: 19 November 2014 Inspector's Name: Audrey Murphy Inspection No: 20092 The final version of this report was uploaded onto the RQIA website on {6 August 2015}. An earlier version was incorrectly available on the RQIA website before this date. Any version of this report downloaded or accessed before {6 August 2015} should be disregarded and replaced by this final report. RQIA apologises for any inconvenience caused by this error. The Regulation And Quality Improvement Authority 9th floor Riverside Tower, 5 Lanyon Place, Belfast, BT1 3BT Tel: 028 9051 7500 Fax: 028 9051 7501 Final Publication Inspection ID: 20092 General Information Name of agency: Positive Futures Ards Peninsula Supported Living Service Address: 2 Coastguard Cottages Harbour Road Portavogie BT22 1EA Telephone Number: 028 91475397 E mail Address: [email protected] Registered Organisation / Positive Futures Registered Provider: Miss Agnes Lunny Registered Manager: Ms Anne Magee Person in Charge of the agency at the Ms Anne Magee time of inspection: Number of service users: Nine Date and type of previous inspection: 15 October 2013, primary announced inspection Date and time of inspection: 19 November 2014 09:15 – 17:00 Name of inspector: Audrey Murphy Announced Primary Inspection - Positive Futures Ards Peninsula SLS- 19 November 2014 1 Final Publication Inspection ID: 20092 Introduction The Regulation and Quality Improvement Authority (RQIA) is empowered under The Health and Personal Social Services (Quality, Improvement and Regulation) (Northern Ireland) Order 2003 to inspect supported living type domiciliary care agencies. -

Litter on Beaches in Northern Ireland 2013

Litter on beaches in Northern Ireland 2013 This report summarises the main findings of a comprehensive survey of litter Sewage related debris found on fourteen reference accounted for 4.9% of the total beaches around Northern Ireland during 2013. 127 The survey was carried out using the items/km were internationally recognised OSPAR methodology. cotton bud sticks The results form part of the Department of the Environment’s response to the requirements of the Marine Strategy Framework Directive (MSFD) for marine litter. Four surveys were carried out during the year. After each survey volunteers clean the beach, improving the local environment for people Out of 252 metal items/km and wildlife. 139 were drinks cans plastic bottles were found on average per kilometre – if this were replicated around the whole coast of Northern Ireland we would have enough to fill six 284 shipping containers every year. Never Executive summary An average of 3,498 items of litter per Centuries kilometre was recorded. 75.3% of the items observed were made of plastic. The most common type of litter was pieces of string and cord, which were observed at an average rate of 476 items per kilometre. Plastic drinks bottles were observed at an average of 284 items per kilometre, and for metal drinks cans it was 139. These were particularly abundant around the three fishing harbours of Portavogie, Ardglass and Kilkeel on the east coast. Across these three beaches there were an average of 980 plastic bottles per kilometre, and 509 metal drinks cans per kilometre. Decades These are some of the most common types of litter found around the coast of Northern Ireland.