Price Clustering in the CAC 40 Index Options Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Are Retail Investors Less Aggressive on Small Price Stocks?

Are retail investors less aggressive on small price stocks? Carole M´etais∗ Tristan Rogery January 13, 2021 Abstract In this paper, we investigate whether number processing impacts the limit orders of retail investors. Building on existing literature in neuropsychology that shows that individuals do not process small numbers and large numbers in the same way, we study the influence of nominal stock price level on order aggressiveness. Using a unique database that allows us to identify order and trade records issued by retail investors on Euronext Paris, we show that retail investors, when posting non-marketable orders, are less aggressive on small price stocks than on large price stocks. This difference in order aggressiveness is not explained by differences in liquidity and other usual drivers of order aggressiveness. We provide additional evidence by showing that no such difference exists for limit orders of high frequency traders (HFTs) over the same period and the same sample of stocks. This finding confirms that our results are driven by a behavioral bias and not by differential market dynamics between small price stocks and large price stocks. ∗LaRGE Research Center, University of Strasbourg { Mailing address: 61 Avenue de la For^etNoire, 67000 Strasbourg FRANCE { Email: [email protected]. I acknowledge support from the French State through the National Agency for Research under the program Investissements d'Avenir ANR-11-EQPX- 006. yDRM Finance, Universit´eParis-Dauphine, PSL Research University { Mailing address: Place du Mar´echal de Lattre de Tassigny, 75775 Paris Cedex 16 FRANCE { Email: [email protected] 1 1 Introduction While conventional finance theory posits that nominal stock prices are irrelevant for firm valuation, a number of papers provide empirical evidence that nominal prices do impact investor behavior. -

Press Release Paris – June 21St, 2021

Press Release Paris – June 21st, 2021 Europcar Mobility Group rejoins Euronext SBF 120 index Europcar Mobility Group, a major player in mobility markets, is pleased to announce that it has re-entered into the SBF 120 and CAC Mid 60 indices, in accordance with the decision taken by the Euronext Index Steering Committee. This re-entry, which took place after market close on Friday 18 June 2021, is effective from Monday 21 June 2021. The SBF 120 is one of the flagship indices of the Paris Stock Exchange. It includes the first 120 stocks listed on Euronext Paris in terms of liquidity and market capitalization. The CAC Mid 60 index includes 60 companies of national and European importance. It represents the 60 largest French equities beyond the CAC 40 and the CAC Next 20. It includes the 60 most liquid stocks listed in Paris among the 200 first French capitalizations. This total of 120 companies compose the SBF 120. Caroline Parot, CEO of Europcar Mobility Group, said: “Europcar Mobility Group welcomes the re-integration of the SBF 120 and CAC Mid 60. This follows the successful closing of the Group’s financial restructuring during Q1 2021, which allowed the Group to open a new chapter in its history. Europcar Mobility Group re-entry into the SBF 120 and CAC Mid 60 is an important step for our Group and recognizes the fact that we are clearly "back in the game”, in a good position to take full advantage of the progressive recovery of the Travel and Leisure market. In that perspective, our teams are fully mobilized for summer of 2021, in order to meet the demand and expectations of customers who are more than ever eager to travel”. -

Profil Financier Du CAC 40

Profil financier du CAC 40 Un CAC 40 agile et confiant en l’avenir 15e édition – Année 2020 15 ans, c’est l’âge de notre Profil financier du CAC 40. 15 ans d’une vie mouvementée pour un indice qui aura connu une belle croissance de son chiffre d’affaires et de ses résultats cumulés ainsi qu’un développement réel de ses fondamentaux, mais Nicolas Klapisz Associé, Responsable du également les affres de la crise financière de 2008 département Valuation, Modeling & Economics et, à présent, les conséquences d’une crise sanitaire sans précédent. Pour son quinzième anniversaire, nous Mais les conclusions de notre étude aurions souhaité offrir au Profil – et résident pour nous ailleurs : certes, surtout à ses lecteurs – une véritable les entreprises du CAC 40 ont connu envolée de la croissance et des records une contraction de leur activité et une en abondance. Las ! Les récents réduction de leurs marges inédites, le événements en ont décidé autrement et nier serait un non-sens. Cependant, sont venus contrarier nos ambitions. elles ont fait preuve, dans ce contexte, d’une agilité hors norme. Agilité Les chiffres sont têtus et l’on ne stratégique pour adapter leurs modèles pourra nier l’impact du Covid-19 : une économiques et développer leurs activité en chute de -15 %, un résultat activités digitales, agilité commerciale d’exploitation courant* en recul de -30 %, pour réduire l’impact de la pandémie sur un résultat net en baisse de près de le chiffre d’affaires au second semestre -60 % par rapport à l’an passé. L’ampleur 2020, agilité opérationnelle pour de ces évolutions est à l’image du maîtriser leurs coûts et agilité financière caractère inédit de cette pandémie pour piloter au mieux les résultats, les et des fermetures administratives dividendes et l’endettement. -

INDEX RULE BOOK Leverage, Short, and Bear Indices

INDEX RULE BOOK Leverage, Short, and Bear Indices Version 20-02 Effective from 15 May 2020 indices.euronext.com Index 1. Index Summary 1 2. Governance and Disclaimer 8 2.1 Indices 8 2.2 Administrator 8 2.3 Cases not covered in rules 8 2.4 Rule book changes 8 2.5 Liability 8 2.6 Ownership and trademarks 8 3. Calculation 9 3.1 Definition and Composition of the Index 9 3.2 Calculation of the Leverage Indices 9 3.3 Calculation of the Bear and Short Indices 9 3.4 Reverse split of index level 10 3.5 Split of index level 10 3.6 Financing Adjustment Rate (FIN) 10 4. Publication 11 4.1 Dissemination of Index Values 11 4.2 Exceptional Market Conditions and Corrections 11 4.3 Announcement Policy 14 5. ESG Disclosures 15 1. INDEX SUMMARY Factsheet Leverage, Short and Bear indices Index names Various based on AEX®, BEL 20®, CAC 40®, PSI 20® and ISEQ® Index type Indices are based on price index versions or Net return index or Gross return index versions. Administrator Euronext Paris is the Administrator and is responsible for the day-to-day management of the index. The underlying indices have independent Steering Committees acting as Independent Supervisor. Calculation Based on daily leverage. May include spread on interest rate or Financing Adjustment rate in the calculation Rule for exceptional trading Either suspend or reset if underlying index moved beyond certain threshold. See reference circumstances table. 1 Mnemo Full name Underlying Factor Rule for ISIN Base level index exceptional and date trading circumstances AEX® based AEXLV AEX® Leverage AEX® 2 Suspend if Underlying QS0011095898 1,000 at Index < 75% of close 31Dec2002 of previous day AEXNL AEX® Leverage AEX® NR 2 Suspend if Underlying QS0011216205 1,000 at NR Index < 75% of close 31Dec2002 of previous day AEXTL AEX® Leverage AEX® GR 2 Suspend if Underlying QS0011179239 1,000 at GR Index < 75% of close 31Dec2002 of previous day AEX3L AEX® NR 3 Reset if Underlying QS0011230115 10,000 at AEX® X3 Leverage Index < 85% of close 31Dec2008 NR of previous day. -

Execution Version

Execution Version GUARANTEED SENIOR SECURED NOTES PROGRAMME issued by GOLDMAN SACHS INTERNATIONAL in respect of which the payment and delivery obligations are guaranteed by THE GOLDMAN SACHS GROUP, INC. (the “PROGRAMME”) PRICING SUPPLEMENT DATED 23rd SEPTEMBER 2020 SERIES 2020-12 SENIOR SECURED EXTENDIBLE FIXED RATE NOTES (the “SERIES”) ISIN: XS2233188510 Common Code: 223318851 This document constitutes the Pricing Supplement of the above Series of Secured Notes (the “Secured Notes”) and must be read in conjunction with the Base Listing Particulars dated 25 September 2019, as supplemented from time to time (the “Base Prospectus”), and in particular, the Base Terms and Conditions of the Secured Notes, as set out therein. Full information on the Issuer, The Goldman Sachs Group. Inc. (the “Guarantor”), and the terms and conditions of the Secured Notes, is only available on the basis of the combination of this Pricing Supplement and the Base Listing Particulars as so supplemented. The Base Listing Particulars has been published at www.ise.ie and is available for viewing during normal business hours at the registered office of the Issuer, and copies may be obtained from the specified office of the listing agent in Ireland. The Issuer accepts responsibility for the information contained in this Pricing Supplement. To the best of the knowledge and belief of the Issuer and the Guarantor the information contained in the Base Listing Particulars, as completed by this Pricing Supplement in relation to the Series of Secured Notes referred to above, is true and accurate in all material respects and, in the context of the issue of this Series, there are no other material facts the omission of which would make any statement in such information misleading. -

Gecina Joins the CAC Next 20 and CAC Large 60 Indices

Paris, March 12, 2018 Gecina joins the CAC Next 20 and CAC Large 60 indices Gecina will be joining the CAC Next 20 and CAC Large 60 indices from March 19, 2018. This decision, announced by Euronext on March 8, follows the quarterly review of the make-up of the various CAC indices. Gecina’s inclusion in these indices reflects the impact of its solid stock market performance over the past few years, as well as the increase in the size of its float, particularly following its acquisition of Eurosic in the second half of 2017. Gecina’s market capitalization represented €10.6bn at March 9, 2018, with a float of nearly 60% or €6.3bn. Méka Brunel, Chief Executive Officer: “Joining the CAC Next 20, the index that groups together the Paris stock exchange’s 20 most representative stocks in terms of capitalization, float and liquidity after the 40 stocks from the CAC 40, sends out a strong message for Gecina”. Gecina, living the city in a different way Gecina owns, manages and develops property holdings worth 19.6 billion euros at end-2017, with nearly 93% located in the Paris Region. The Group is building its business around France’s leading office portfolio and a diversification division with residential assets and student residences. Gecina has put sustainable innovation at the heart of its strategy to create value, anticipate its customers’ expectations and invest while respecting the environment, thanks to the dedication and expertise of its staff. Gecina is a French real estate investment trust (SIIC) listed on Euronext Paris, and is part of the SBF 120, Euronext 100, FTSE4Good, DJSI Europe and World, Stoxx Global ESG Leaders and Vigeo indices. -

Portfolio Manager Commentary As of 6/30/2021

Equity Risk Management Strategy Portfolio Manager Commentary As of 6/30/2021 Q2 2021 Overview Objective In 2020, the economic impact of COVID-19 caused U.S. real Gross Domestic Product (GDP) growth to decline 2.4%—the first negative yearly reading in Tactical allocation strategy that seeks to over 10 years. However, with the introduction of vaccines beginning in adjust a portfolio’s equity exposure to potentially provide downside risk November of last year, the U.S. economy began to slowly reopen. In the first mitigation and volatility control quarter of 2021, U.S. real GDP advanced 0.4%—a small economic advance but definitely in the right direction. With several vaccines being administered and more doors of the U.S. economy starting to open, the Portfolio Management Team recovery was soon full speed ahead. Thus far, the economy and the stock market have rebounded as we Christopher M. Mutascio expected. In the second quarter of 2021, U.S. real GDP growth is expected Senior Managing Director to register 13.0%—the fastest economic growth since World War II. After enduring a recession in 2020, the U.S. economy is now expected to grow 6.6% in 2021—more than twice its long-term sustainable growth rate. Consensus earnings growth rates for value stocks in 2021, measured by the Russell 1000 Growth Index, are forecast to reach 34% year-over-year Timothy M. McCann compared to growth stocks at 24%. Year to date, the Russell 1000 Value Senior Portfolio Manager Index is up 17.05% versus the Russell 1000 Growth Index, which has gained 12.99%, including dividends. -

DAX Vs S&P 500 – INSPECTION of a SPECIAL RELATIONSHIP

DAX vs S&P 500 – INSPECTION OF A SPECIAL RELATIONSHIP by Tobias Stoehr – Spectrum Markets When the S&P 500 moves up, the DAX rises, too. When the S&P 500 moves down, so does the DAX. The indices’ similar performance patterns – although there are some notable exceptions – have left investors intrigued and puzzled for decades. The Standard & Poor’s 500 (S&P 500), launched 63 years ago in the United States of America, is one of the most quoted stock indices in the world. And as such, the index is not only a guiding force for the DAX in Germany but also for the leading indices of many other countries. Indeed, the famous saying “When Wall Street sneezes the rest of the world catches a cold” is not least a reference to the S&P 500: its loss of points sometimes leads to even more severe losses of other indices. Then again, when markets turn, the latter may recover more quickly than the S&P 500. The prominence of the index as one of the best overall indicators of market performance can be ascribed to its great diversification: By tracking 500 US-based large-cap companies in various industries (all listed on the New York Stock Exchange and the Nasdaq), the S&P 500 represents the US economy as a whole. At least, that’s the intention. As a capitalisation-weighted index, stocks with higher market caps affect the average more. Yet, the selection of the components doesn’t follow strict rules. Rather, a committee periodically picks the companies based on criteria such as market capitalisation, financial viability, liquidity and length of time publicly traded. -

Monthly Economic Update

From the desk of GS Wealth Management MONTHLY ECONOMIC UPDATE May 2020 MONTHLY QUOTE “Concern for man and his fate must THE MONTH IN BRIEF always form the U.S. Markets chief interest of all technical endeavors. Stocks rebounded sharply in April, fueled by a flattening pandemic Never forget this in curve and positive results from a clinical trial investigating a the midst of your diagrams and treatment for COVID-19. equations.” The Dow Jones Industrial Average, which dropped 14% in March, jumped 11.08%. The Standard & Poor’s 500 Index rose 12.68%, and - Albert Einstein the NASDAQ Composite surged 15.45%.1 Slowdown in Infections MONTHLY TIP Just as it appeared that April might be a repeat of March, stocks How large should an turned higher with signs of a slowdown in COVID-19 infections, emergency fund be? especially in Italy and New York state. Though jobless claims were There is no “one-size- breathtakingly high, they were expected, allowing investors to focus fits-all” answer. The on positive developments. A more stable bond market also helped ideal amount may support the rally. depend on your financial situation and lifestyle. For The stock market struggled to move higher, as a weak start to earnings example, if you own season and troubling economic data created some underlying a home or have crosscurrents. dependents, you may be more likely to face financial emergencies. A Stock Market Lesson to Remember Confidence can quickly erode, but it can also quickly emerge Undeniably, spring 2020 has tried the patience of investors. An 11-year bull market ended. -

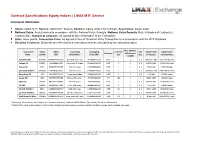

Contract Specifications Equity Indices | LMAX MTF Service

Contract Specifications Equity Indices | LMAX MTF Service Instrument information Venue: LMAX MTF, Service: LMAX MTF Service, Contract: Equity Index CFD Contract, Asset Class: Equity Index Notional Value: As determined in accordance with the Notional Value Formula, Notional Value Formula: Rate x Number of Contracts x Contract Size, Number of contracts: As agreed at time of formation of the Transaction Units: Index points, Transaction Price: As agreed at time of formation of the Transaction or in accordance with the MTF Rulebook Dividend Treatment: Dividends are reflected as a cash adjustment as calculated by the calculation agent Min. Number Instrument LMAX LMAX Underlying Underlying Contract Tick LMAX Ticker LMAX Ticker Currency of Contracts Name symbol ISIN Index Name* Index ISIN Size Size on Reuters on Bloomberg Tradable Australia 200 AUS200 GB00BGDW1Q76 S&P ASX 200 Index XC0006013624 AUD 1 1 0.1 AUS200.LMX AUS200LM Index Europe 50 EUR50 GB00B44SGZ45 Eurostoxx 50 Index EU0009658145 EUR 1 1 0.1 EUR50.LMX SX50ELM Index France 40 FCHI GB00B3YPW496 CAC 40 Index FR0003500008 EUR 1 1 0.1 FCHI.LMX FCHILM Index Germany 30 Miniꜞ GER30m GB00BQJZVC60 DAX 30 Index DE0008469008 EUR 1 1 0.1 GDAXIm.LMX GDAXIMLM Index Hong Kong 50 HSI GB00BYVYNL07 Hang Seng Index HK0000004322 HKD 1 1 0.5 HSI.LMX HSILM Index Japan 225 J225 GB00B97P3W36 Nikkei 225 Index JP9010C00002 JPY 100 1 1 N225.LMX J225LM Index Spain 35 SPN35 GB00BYYC8M74 IBEX 35 Index ES0SI0000005 EUR 1 1 0.1 SPN35.LMX SPN35LM Index UK 100 UK100 GB00B3W77191 FTSE 100 Index GB0001383545 GBP 1 1 -

Foreign Approved Products Chart (September 2019)

September 11, 2019 Attached please find the updated Foreign Listed Stock Index Futures and Options Approvals Chart, current as of September 1, 2019. All prior versions are superseded and should be discarded. Please note the following developments since we last distributed the Approvals Chart: (1) The Micro S&P 500 futures contract has been certified for trading on B3 (formerly BM&F Bovespa) by U.S. Persons. (2) The following futures contracts have been certified for trading on Eurex Exchange by U.S. Persons: (i) the Euro STOXX 50 Low Carbon futures contract; (ii) the STOXX Europe 600 ESG-X (EUR) futures contract; (iii) the STOXX Europe Climate Impact Ex Global Compact Controversial Weapons & Tobacco futures contract; and (iv) the STOXX Europe Select 50 futures contract. (3) The following futures contracts have been certified for trading on the Korea Exchange by U.S. Persons: (i) the KOSDAQ 150 futures contract; and (ii) the KRX 300 futures contract. (4) The following equity options contracts have been approved for trading on the Korea Exchange by Eligible U.S. Institutions: (i) the KOSDAQ 150 options contract; (ii) the KOSPI 200 options contract; (iii) the Mini KOSPI 200 options contract; and (iv) options on various individual stocks. (5) The Micro IBEX 35 futures contract has been certified for trading on the MEFF by U.S. Persons. (6) The Nifty 50 futures contract has been certified for trading on the National Stock Exchange of India International Financial Services Center by U.S. Persons. (7) The following futures contracts have been certified for trading on the Singapore Exchange Derivatives Trading by U.S. -

Indexing and Stock Market Serial Dependence Around the World

Indexing and Stock Market Serial Dependence Around the World Guido Baltussen, Sjoerd van Bekkum, and Zhi Da∗ August 16, 2017 Abstract We document a striking change in index return serial dependence across 20 major market indexes covering 15 countries in North America, Europe, and Asia. While many studies found serial dependence to be positive until the 1990s, it switches to negative since the 2000s. This change happens in most stock markets around the world and is both statistically significant and economically meaningful. Further tests reveal that the decline in serial dependence links to the increasing popularity of index products (e.g., futures, ETFs, and index mutual funds). The link between serial dependence and indexing is not driven by a time trend, holds up in the cross-section of stock indexes, is confirmed by tests exploiting Nikkei 225 index weights and S&P 500 membership, and in part reflects the arbitrage mechanism between index products and the underlying stocks. Keywords: Return autocorrelation, Stock market indexing, Exchange Traded Funds (ETFs), Arbitrage JEL Codes: G12, G14, G15 ∗Baltussen, [email protected], Finance Group, Erasmus University, Rotterdam, Netherlands; Da, [email protected], Finance Department, Mendoza College of Business, University of Notre Dame, Notre Dame, IN 46556; van Bekkum, [email protected], Finance Group, Erasmus University, Rotterdam, Netherlands. We thank Nishad Matawlie and Bart van der Grient for excellent research assistance, and thank Zahi Ben-David, Heiko Jacobs, Jeffrey Wurgler, and seminar participants at Erasmus University, Maastricht University, and the Luxembourg Asset Management Summit for useful comments. Any remaining errors are our own.