News Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Discover Kelowna's Real Estate

GALLERY 12391 PIXTON ROAD, LAKE COUNTRY | EXCLUSIVE DISCOVER KELOWNA’S REAL ESTATE COLDWELL BANKER JANE HOFFMAN REALTY A WORD FROM JANE The beginning of a new year always has me reflecting on the year that has just passed. Over the last 12 months, our world has changed so much. We’ve had to find new ways to do almost everything, from having business meetings to visiting with family and friends. Even though there have been challenges in adapting to a new way of life, I can’t help but feel inspired. While so much about our daily lives has changed, we’ve also prioritized what has always been most important to us. Almost every day, I am met with how people’s home-buying preferences have shifted with our changing times. Families are looking for spaces that let them spend more time together, outdoor areas that allow them to take in the Okanagan lifestyle from the comfort of their own property, and more green space for kids and pets. All of this gives me hope because spending time with loved ones in a home that is loved, and in this beautiful valley, is a great gift. I hope that in the new year you get to enjoy special spaces at home that bring you joy. Or perhaps your perfect home is waiting to be found…Whatever 2021 has in store I wish you and your family health and happy memories. CONTENT 02 A WORD FROM JANE 04 ALL FOR ONE 06 SELLING ON THE WATER 08 OUR BROKERAGE 09 REALTOR PROFILES 20 12391 PIXTON ROAD 22 1532 GRANITE ROAD 24 3960 TODD ROAD 20 PROPERTIES 26 LAKESHORE OVER $4 MILLION 45 LAKESHORE $2 - $4 MILLION 55 LAKESHORE UP TO $2 MILLION 60 LAKESHORE LOTS AND ACREAGES 22 64 ESTATE PROPERTIES AND ACREAGES 76 HOMES OVER $2 MILLION 81 HOMES $1 - $2 MILLION 84 HOMES UP TO $1 MILLION 89 LOTS AND ACREAGES 24 92 DEVELOPMENT PROJECTS 98 MAP OF KELOWNA E and O Insurance: this publication is not intended to solicit properties currently listed for sale. -

COMMITTEE of the WHOLE Monday, September 11, 2017 - 7:00 PM Council Chambers

THE CORPORATION OF THE DISTRICT OF CENTRAL SAANICH COMMITTEE OF THE WHOLE Monday, September 11, 2017 - 7:00 PM Council Chambers (Please note that all proceedings of Committee of the Whole Meetings are video recorded) AGENDA 1. CALL TO ORDER 2. CLOSED MEETING (if required) 3. APPROVAL OF AGENDA 3.1. Agenda of the September 11, 2017 Committee of the Whole Meeting Recommendation: That the agenda of the September 11, 2017 Committee of the Whole Meeting be approved. 4. PRESENTATIONS AND DELEGATIONS 4.1. Victoria Compost Education Center Pg. 7 - 18 Marika Smith, Executive Director Background: • Letter to Council and Fact Sheets • Presentation to the District of Central Saanich 5. PLANNING & DEVELOPMENT 5.1. 7103 West Saanich Road - Development and Development Variance Pg. 19 - 39 Permit Report from the Planner dated August 25, 2017, attached. Recommendation: That the Committee of the Whole recommend that Council 1. authorize issuance of a Development Permit for the proposed exterior facade renovation of the existing shopping centre at 7103 West Saanich Road and new signage subject to: a. compliance with the attached plans; and, b. tenant fascia signage complying with the restrictions set out in the permit and the requirements of the Land Use Bylaw; and, 2. further the application to vary Section 43 of the Land Use Bylaw to reduce the required number of parking spaces for the subject property to a total of 105 spaces regardless of tenant occupancy (within the permitted uses of the C-1 zone) by directing staff to undertake the required notification for the Development Variance Permit. 5.2. -

Part 3 – General Regulations

CITY OF WEST KELOWNA ZONING BYLAW No. 0154 PART 3 – GENERAL REGULATIONS 3.1 APPLICATION .1 Except as otherwise specified by this Bylaw, Part 3 applies to all zones established under this Bylaw. 3.2 PERMITTED USES AND STRUCTURES .1 The following uses and structures are permitted in all zones: (a) Air or marine navigational aids; (b) Transit stops; (c) Civic plazas; (d) Community garden; (e) Community mailboxes placed by Canada Post; (f) Environmental conservation activities; (g) Highways; (h) Mobile vending; (i) Parks, playgrounds and recreational trails; (j) Public service facilities for community water or sewer systems (including pumphouses and sewage and water treatment plants), community gas distribution systems and similar public service facilities or equipment such as those required for the transmission of electrical power, telephone or television, communication towers and municipal works yards, but not including electrical substations, maintenance buildings or offices; (k) Storage of construction materials on a parcel for which the construction of a building or structure has been authorized by the City, provided all surplus materials are removed within 20 days of final inspection of the building or structure; (l) Temporary construction and project sales offices authorized by building permit as temporary buildings; and (m) The temporary use of a building as a polling station for government elections or referenda, provided that the time period of use does not exceed 60 consecutive days. 3.3 PROHIBITED USES AND STRUCTURES .1 The following uses are prohibited in every zone: (a) Outdoor storage of materials beneath electrical power distribution lines; and (b) Vacation rentals other than bed and breakfasts, short term accommodations, agri- tourism accommodations, and the use of resort apartments and resort townhouses. -

West Kelowna Transmission Project

Welcome to the BC Hydro open house West Kelowna Transmission Project We’re planning for a new, secondary transmission line delivering clean, reliable power to the communities of West Kelowna and Peachland. The new transmission line will strengthen and reinforce the existing transmission network. We’re here to share the most recent project information and to gather your comments on what we know so far. We hope you’ll share your local knowledge of the project study area with us. WEST KELOWNA TRANSMISSION PROJECT OPEN HOUSE BCH18-305 Why it’s important Approximately 22,000 customers are served by the Westbank Substation and a single 138 kilovolt transmission line. We’ve prioritized the West Kelowna area as needing a redundant supply of power because of: ○ The large number of customers served by a single transmission line. ○ The challenge of restoring power on the existing transmission line resulting from its 80 kilometre length, remote location and rough terrain. ○ The risk of destructive forces like forest fires and landslides. In the meantime, we’ll continue to monitor and manage any risks to the existing transmission line. What’s redundant supply? Redundant supply means there is more than one source (for example, a transmission Iine) providing power to the community or “back-up” power. That way, if one source is taken out of service, the other can still supply the community with electricity. WEST KELOWNA TRANSMISSION PROJECT OPEN HOUSE BCH18-305 Our electricity system Generation Transmission Substations Distribution Electricity is generated Electricity is Voltage is reduced at Low voltage by BC Hydro and moved from where substations to provide electricity is provided independent power it’s produced to power suitable for use in to neighbourhoods producers. -

Okanagan Lake Second Crossing Project

Okanagan Lake Second Crossing Project Welcome Public Open House Central Okanagan Planning Study Central Okanagan Planning Study Open House Objectives College Way Provide information /Clerke Rd on project background, City of Vernon Kalamalka objectives, status and Lake schedule. District Review your input of Lake Country on mobility and safety problem areas in the Central Okanagan transportation corridor. OKIB IR #7 WFN IR #10 Highway 97 H ighwa H y 33 ig WFN h WFN w District IR #8 ay 97 of West IR #9 C Kelowna City of Kelowna Okanagan Lake District of Peachland Greata Ranch Winery Okanagan Lake Second Crossing Project Central Okanagan Planning Study Background, Goals & Outcomes The Ministry of Transportation and When the William R. Bennett Bridge opened to traffic Infrastructure has initiated the Central in 2008, it was estimated the bridge would serve the region’s traffic needs for 25 years, based on extensive Okanagan Planning Study to understand traffic analysis. While traffic counts on the bridge the future transportation needs of the area. continue to support this estimate, starting the planning process now will ensure the government can move It will ultimately develop potential route forward when necessary. proposals to address future mobility, including preferred locations and timing for a possible Covering the corridor from Peachland to Lake Country, the study considers public needs, community plans and alternative crossing of Okanagan Lake. provincial transportation priorities. It takes into account recent transportation improvements, as well as those that are already lined up for implementation. While the emphasis is on long-term planning, it will also identify possible additional near-to-intermediate term improvements to address more immediate safety and mobility concerns. -

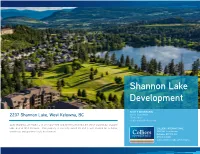

Shannon Lake Development

Shannon Lake Development SCOTT BEUERLEIN 2237 Shannon Lake, West Kelowna, BC SALES ASSISTANT 250 861 8102 [email protected] 2237 Shannon Lake Road is a 1.5 acres parcel of land perfectly located in the scenic and popular Shannon Lake area of West Kelowna. This property is currently zoned R3 and is well situated for a duplex, COLLIERS INTERNATIONAL townhouse and apartment style development. 304-546 Leon Avenue Kelowna, BC V1Y 6J6 250 763 2300 www.collierscanada.com/kelowna SHANNON LAKE 2237 SHANNON LAKE ROAD, WEST KELOWNA THE OPPORTUNITY DEMOGRAPHICS The Shannon Lake community is perfectly located to take full advantage of all that the Okanagan Lake, Kelowna and West Kelowna communities have to offer. Surrounding Shannon Lake, the community has developed an ideal layout to support multi-family homes and developments. Located centrally in the community, an elementary school supports newer families who enjoy living just outside busy city streets. As a lake side community nestled among rolling hills and large pockets of farmland, offering recreational and cultural amenities and modernized infrastructure, West Kelowna is an attractive place for development. • Located on the northern side of Highway 97 homes in this SHANNON neighbourhood offer convenient access to all of the amenities of LAKE West Kelowna • The Shannon Lake neighbourhood is surrounded by Shannon Lake Regional Park and the exceptional Shannon Lake Golf Course • Demand for all real estate in this community continues to be strong, helped by the fact that Shannon Lake Elementary has a reputation as the best school on the Westbank • Property is already zoned for development 2016 Estimated 1 KM 3 KM 5 KM Population 2,145 13,019 33,910 Number of Households 869 5,504 14,292 Average Household Income $96,718 $84,387 $90,998 Demographic information collected from Piinpoint. -

Understanding Physical Address Geocoder Results March 21, 2014 Document Version 0.1

Understanding Physical Address Geocoder Results March 21, 2014 Document Version 0.1 This document explains how to use the output of the Physical Address Geocoder to improve the quality of your addresses. The geocoder returns two quality indicators: address match score and location positional accuracy. Address match score reflects how well an input address matches an address in the geocoder’s reference list of addresses. Location positional accuracy reflects how well the geocoder knows the geographic position of a given address. 1. Matching geocoder input to output The online geocoder always shows you the input address as well as one or more result addresses. The batch geocoder results file doesn’t include input address. The fullAddress field in the results file is the standardized, corrected, and matched address, not the input address. To effectively analyse batch geocoder output, you need to open and view both input and results files at the same time. In each line of the results file there is a sequence number which represents the nth address in your input file. Remember to account for the first row being column definitions (e.g., sequence number 6091 is row 6092 in input file). If you pull up both files in MS Excel and turn on View.View Side by Side and Synchronous Scrolling, you can see both input and result addresses at the same time. 2. Address match score The geocoder determines the quality of an address match by computing a score between 0 and 100. The score is determined in two parts: match precision and match faults. -

List of Participants As of March 23, 2021

2021 Airblast: Optimizing Canopy Sprayers next Monday‐Tuesday, March 29‐30 List of Participants as of March 23, 2021 First Last Affiliation City State Country Virginia Abbott Health Canada Burnaby British Columbia Canada Niagara‐on‐the‐ Josh Aitken Two Sisters Vineyards Lake Ontario Canada Jeff Alicandro agr.assistance North Rose New York United States of America Jeff Allen G.S. Long Co., Inc. Yakima Washington United States of America lee allen western farm press tucson Arizona United States of America Cristiano Alves BASF Kingsburg California United States of America Nicholas Antignano SFC Napa California United States of America craig Arbogast whyler company Orland California United States of America Greg Ardzrooni Ardzrooni Vineyard mgmt Philo California United States of America BC Ministry of Agriculture, Adrian Arts Food and Fisheries Summerland, BC British Columbia Canada Jesus Avalos Ardzrooni Vineyard Mgmt Philo California United States of America Oscar Ayala Industry Plattsville Ontario Canada Michael Babbitt Pesticide Investigator Salem OR USA jamie baird baird orchards othello Washington United States of America Roger Bannister Excelsior Farms Kent New York United States of America Kathy Baynton Health Canada/PMRA Ottawa Ontario Canada Bazan Vineyard Mario Bazan Management LLC Napa California United States of America Bazzano Azienda / Bazzano Philip Bazzano Vineyards Concord California United States of America Ben Beeles Pesticide Investigator Salem OR USA Lindsay Benbow Government Vernon British Columbia Canada William Bennett Health Canada/PMRA Ottawa Ontario Canada Alan Bergen LMHIA Abbtosford British Columbia Canada Ministry of Environment and Climate Change Conrad Berube Strategy Nanaimo British Columbia Canada Bevill Vineyard Duff Bevill Management, LLC Healdsburg California United States of America Bisordi Ranch and Vineyards Robert Bisordi LLC. -

District & Minor Hockey Associations

DISTRICT & MINOR HOCKEY ASSOCIATIONS EAST KOOTENAY – (DISTRICT ASSOCIATION: EAST KOOTENAY MHA) CANAL FLATS MHA CRANBROOK MHA CRESTON VALLEY MHA ELK VALLEY MHA (Sparwood) FERNIE MHA GOLDEN & DISTRICT MHA KIMBERLEY MHA WINDERMERE VALLEY MHA (Invermere) Minor Hockey Association Boundaries LOWER MAINLAND – (DISTRICT ASSOCIATION: PACIFIC COAST AHA) ABBOTSFORD FEMALE MHA ABBOTSFORD MHA ALDERGROVE MHA ARBUTUS CLUB BURNABY MHA BURNABY WINTER CLUB CHILLIWACK MHA Minor Hockey Association Boundaries CLOVERDALE MHA COQUITLAM MHA HOLLYBURN COUNTRY CLUB HOPE & DISTRICT MHA LANGLEY GIRLS MHA LANGLEY MHA MEADOW RIDGE FEMALE MHA (Maple Ridge, Pitt Meadows) Minor Hockey Association Boundaries MISSION MHA NEW WESTMINSTER MHA NORTH DELTA MHA NORTH SHORE FEMALE MHA NORTH SHORE WINTER CLUB NORTH VANCOUVER MHA PORT COQUITLAM MHA Minor Hockey Association Boundaries PORT MOODY MHA RICHMOND JETS MHA (formerly Richmond MHA and Seafair MHA) RICHMOND RAVENS FEMALE MHA RIDGE MEADOWS MHA (Maple Ridge, Pitt Meadows) SEMIAHMOO MHA (South Surrey, White Rock) SOUTH DELTA MHA (Ladner, Tsawwassen) SQUAMISH MHA Minor Hockey Association Boundaries SUNSHINE COAST MHA SURREY FEMALE MHA SURREY MHA TRI-CITIES FEMALE MHA (Coquitlam, Port Coquitlam, Port Moody) VANCOUVER MHA VANCOUVER FEMALE MHA VANCOUVER THUNDERBIRD MHA Minor Hockey Association Boundaries WEST VANCOUVER MHA (Bowen Island, Lions Bay, West Vancouver) WHISTLER MHA NORTH CENTRAL – (DISTRICT ASSOCIATION: CARIBOO AHA) 100 MILE HOUSE & DISTRICT MHA MACKENZIE MHA MCBRIDE MHA PRINCE GEORGE MHA QUESNEL & DISTRICT MHA VALEMOUNT MHA Minor Hockey Association Boundaries WILLIAMS LAKE MHA NORTH EAST – (DISTRICT ASSOCIATION – PEACE RIVER DISTRICT MHA) CHETWYND & DISTRICT MHA CLEARVIEW MHA DAWSON CREEK MHA FORT NELSON MHA Minor Hockey Association Boundaries FORT ST. JOHN MHA HUDSON’S HOPE MHA TAYLOR & DISTRICT MHA TUMBLER RIDGE MHA YUKON – (DISTRICT ASSOCIATION – YUKON AHA) DAWSON CITY MHA HAINES JUNCTION MHA WATSON LAKE MHA WHITEHORSE MHA NORTH WEST – (DISTRICT ASSOCIATION – NORTH WEST DISTRICT MHA) BURNS LAKE MHA FORT ST. -

In the Matter of the Companies' Creditors Arrangement Act, R.S.C

IN THE MATTER OF THE COMPANIES' CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED AND IN THE MATTER OF THE BUSINESS CORPORATIONS ACT, S.B.C. 2002, c. 57, AS AMENDED AND IN THE MATTER OF A PLAN OF COMPROMISE OR ARRANGEMENT OF ARTHON INDUSTRIES LIMITED., ARTHON CONTRACTORS INC., ARTHON EQUIPMENT LTD., COALMONT ENERGY CORP., ROBEKA PROJECTS INC., AND 0755049 B.C. LTD. List of Known Creditors of Arthon Industries Limited, Arthon Contractors Inc., Arthon Equipment Ltd., Coalmont Energy Corp., Robeka Projects Inc. and 0755049 B.C. Ltd. (the "Arthon Group") as at November 29, 2013* Name Address Amount ($) Trade and Other Unsecured Creditors 1 0797721 BC Ltd 2340 Somerset Court West Kelowna BC V1Z 3L5 Canada $ 3,514.88 2 0857544 B.C. Ltd. 9, 1790 KLO Road Kelowna BC V1W 3P6 Canada - 3 0873371 BC Ltd (RT Equipment Solutions) 799 Curtis Rd Kelowna BC V1V 2C9 Canada 936.04 4 0956485 BC Ltd 201-540 Groves Ave Kelowna BC V1Y 4Y7 Canada 12,833.48 5 1750566 AB Ltd 9-1790 KLO Rd Kelowna BC V1W 3P6 Canada 2,318.98 6 537207 BC Ltd (Eric Beresford) Box 1529 Carstairs AB T0M 0N0 Canada 71,105.74 7 A & G Supply 827 Fairweather Pl Vernon BC V1T 9B5 Canada 160.77 8 Aardvark Pavement Marking Services (0647354 BC Ltd) PO Box 27031 Willow Park PO Kelowna BC V1X 7L7 Canada 5,020.96 9 Accu-Sweep Services 282D Campion St Kelowna BC V1X 7S8 Canada 409.50 10 Ace Courier Services 122, 3016 - 10 Ave NE Calgary AB T2A 6A3 Canada 1,916.59 11 Ace Ina 1400-25 York St Toronto ON M5J 2V5 Canada 4,418.28 12 Acklands Grainger 90 West Beaver Creek Rd Richmond Hill ON -

Vancouver Island

Child Passenger Safety Community Contacts Child seat checks: Individual sessions for all child car seat users. These are learning sessions done in the vehicle only. You will be guided to install your child car seat in your own vehicle. If your organization offers Child Seat Instructional Checks not currently listed, please contact us by phone: 1-877-247-5551 or e-mail: [email protected] Greater Vancouver: Burnaby, Coquitlam, Delta, Greater Vancouver, Maple Ridge, New Westminster, North Vancouver, Powell River, Richmond, Squamish, Vancouver, White Rock, Bowen Island Location Contact Agency Phone Fee Bowen Island Keith Tyler BCEHS 604-827-0237 No Burnaby Jude Hopkinson Burnaby Family Life 604-659-2225 No Judith McLaren Burnaby Family Life 604-659-2228 Kathryn Dula 604-771-0139 Mi Ryoung Yoo 778-322-3487 Sashene Cooper 778-710-7422 Kaitie Bruinink Auntleah’s Place 778-957-3665 No Coquitlam Colleen Jones CPSAC 604-466-0787 Maple Ridge, Sandie Mallan Pitt Meadows Fire Appointment only No Pitt Meadows 604-465-2401 or email: [email protected] Lynn Malbeuf Maple Ridge/Pitt Appointment only No Dea Bailey Meadows Community 604-467-6911 Services Jo-Anne MacKenzie Helen Rex Westcoast Family Center Appointment only No 604-417-6992 New Chantelle Kennedy CPSAC 778-829-3553 Westminster North Community Policing Appointment only No Vancouver 604-969-7465 Holly Choi Safe Beginnings 778-994-1675 Powell River Tricia Greenwood Powell River Fire 604-485-8647 No Jacob Hansen Powell River Fire 604-485-8647 No Brian Bomprezzi BCEHS 604-223-8041 No Jn August 2019 Coco Kao Immigrant Services 604-414-3630 No Tla’amin Health Appointment only No 604-483-3449 Powell River Family Place 604-485-2706 No Richmond Fadi Mado TJ’s Kiddie Store For appointment Yes 604-773-5787 Aidan McGillveray Independent Appointment only Yes 778-998-6963 Sechelt Sechelt Fire Dept. -

City Gender Division Age Group Time Points 1 Jon Bird Calgary MW 30

Race Name: Across the Lake Swim Race Date: 19-Jul-14 Distance: 2.1km Name: (first, last) City Gender Division Age Group Time Points 1 Jon Bird Calgary M W 30-39 0:28:49 99.92 1 Josh Zakala Kelowna M N 19&U 0:28:49 99.92 3 Alex Diaz West Kelowna M W 19&U 0:30:48 99.76 4 Scott Andreen West Kelowna M W 19&U 0:32:13 99.69 5 Sean Bell West Kelowna M W 20-29 0:32:14 99.61 6 Brent Hobbs Kelowna M W 40-49 0:32:16 99.53 7 Trevor Wurtele Kelowna M W 30-39 0:32:17 99.45 8 George Colbert Calgary M W 30-39 0:32:35 99.37 9 Rob Charland Maple Ridge M W 30-39 0:33:10 99.29 10 Rod Craig North Vancouver M W 50-59 0:33:19 99.21 11 Glenn Carlsen Calgary M W 50-59 0:33:30 99.14 12 Spencer Dean Kelowna M W 19&U 0:34:00 99.06 13 Michael Stamhuis Coldstream M N 60-69 0:35:02 98.98 14 Rob Davis Calgary M W 50-59 0:35:48 98.90 15 Brock Hoel Peachland M W 19&U 0:37:13 98.82 16 Rob Wiebe Calgary M W 50-59 0:37:19 98.74 17 Kate Aguiar West Kelowna F W 20-29 0:37:41 98.66 18 Heather Wurtele Kelowna F W 30-39 0:37:44 98.58 19 Eden Saari Lac Le Jeune F W 19&U 0:38:02 98.51 20 Carmelle Guidi-Swan Kelowna F W 40-49 0:39:33 98.43 21 Mike Cooke Summerland M W 40-49 0:39:37 98.35 22 John Zakala Kelowna M W 50-59 0:40:00 98.27 23 Matthew Granley Airdrie M W 19&U 0:40:27 98.19 24 Kieran Bruce Airdrie M W 19&U 0:40:27 98.11 25 Stephen Ott Kelowna M W 50-59 0:41:51 98.03 26 Mercedes MacDougall Banff F W 20-29 0:41:53 97.96 27 Marnie Andersen Calgary F W 40-49 0:42:05 97.88 28 Gail Amundrud Calgary F W 50-59 0:42:09 97.80 29 Craig Slater Surrey M W 50-59 0:42:30 97.72 30 Lisa