2020 Financial Analysts Briefing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Automatic Payroll Deduction Program

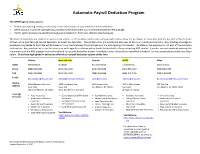

Automatic Payroll Deduction Program The APD Program allows you to: • Review participating vendor product and service information at your worksite on non-work time. • Select optional insurance coverage not provided by the State under your current employee benefit package. • Pay for optional insurance benefits through payroll deduction from your after tax take home pay. The State of Iowa does not endorse or sponsor any vendor, or the products and services they provide, it does allow the premiums for insurance policies, not offered by the State of Iowa, to be paid through payroll deduction as a post tax deduction. Payroll deduction is a simple and easy way to pay your insurance premiums. Any resulting coverage an employee may decide to purchase will be based on a contract between the employee and the participating APD vendor. The State as the employer is not part of the insurance relationship. Any questions or issues that may arise with regard to a chosen policy should be directed to the participating APD vendor. A vendor can participate by meeting the requirements of the APD program but not be offered as a payroll deduction option if enrollment does not meet the mandated threshold. Current participating vendors are listed below. Only those highlighted in yellow are offered as a payroll deduction option at this time. Allstate New York Life Colonial AFLAC Allied Agent Betty Bebout Jay Black Richard Ginther Todd DeVoss Daryl Johnson Phone (888) 584-8322 (515) 453-1328 (515) 205-9660 (312) 870-1007 (800) 982-0756 FAX (515) 225-8030 (515) 453-1490 (888) 361-6656 (888) 242-7108 (800) 548-8289 E-mail [email protected] [email protected] [email protected] [email protected] [email protected] Mailing 3636 Westown Parkway 4900 University Ave. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-07434 Aflac Incorporated (Exact name of registrant as specified in its charter) Georgia 58-1167100 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 1932 Wynnton Road Columbus Georgia 31999 (Address of principal executive offices) (ZIP Code) Registrant’s telephone number, including area code: 706.323.3431 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbols(s) Name of each exchange on which registered Common Stock, $.10 Par Value AFL New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. þ Yes ¨ No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes þ No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Twitter: a Uses and Gratifications Approach

University of Kentucky UKnowledge University of Kentucky Master's Theses Graduate School 2011 “WHAT’S HAPPENING” @TWITTER: A USES AND GRATIFICATIONS APPROACH Corey Leigh Ballard University of Kentucky, [email protected] Right click to open a feedback form in a new tab to let us know how this document benefits ou.y Recommended Citation Ballard, Corey Leigh, "“WHAT’S HAPPENING” @TWITTER: A USES AND GRATIFICATIONS APPROACH" (2011). University of Kentucky Master's Theses. 155. https://uknowledge.uky.edu/gradschool_theses/155 This Thesis is brought to you for free and open access by the Graduate School at UKnowledge. It has been accepted for inclusion in University of Kentucky Master's Theses by an authorized administrator of UKnowledge. For more information, please contact [email protected]. ABSTRACT OF THESIS “WHAT’S HAPPENING” @TWITTER: A USES AND GRATIFICATIONS APPROACH The uses and gratifications approach places power in the hands of the audience and is a helpful perspective when trying to understand media usage, exposure, and effects. However, while the uses and gratifications approach has been applied regularly to traditional media, research explaining why people use new social media networks as well as the gratifications they obtain from them is scarce at best. This thesis provides a comprehensive overview of the uses and gratifications approach as well as the current literature about social media networks. An argument is built within the thesis to study Twitter as one social media network through the uses and gratifications theoretical lens. Research questions are provided and a survey of 216 college undergraduates was conducted. Results show that people use a variety of Twitter functions, that the gratifications sought from Twitter are not the gratifications obtained from Twitter, and that people are careful about the types of information they share on the social media network. -

Appendix A: Electoral Rules

Appendix A: Electoral Rules Table A.1 Electoral Rules for Italy’s Lower House, 1948–present Time Period 1948–1993 1993–2005 2005–present Plurality PR with seat Valle d’Aosta “Overseas” Tier PR Tier bonus national tier SMD Constituencies No. of seats / 6301 / 32 475/475 155/26 617/1 1/1 12/4 districts Election rule PR2 Plurality PR3 PR with seat Plurality PR (FPTP) bonus4 (FPTP) District Size 1–54 1 1–11 617 1 1–6 (mean = 20) (mean = 6) (mean = 4) Note that the acronym FPTP refers to First Past the Post plurality electoral system. 1The number of seats became 630 after the 1962 constitutional reform. Note the period of office is always 5 years or less if the parliament is dissolved. 2Imperiali quota and LR; preferential vote; threshold: one quota and 300,000 votes at national level. 3Hare Quota and LR; closed list; threshold: 4% of valid votes at national level. 4Hare Quota and LR; closed list; thresholds: 4% for lists running independently; 10% for coalitions; 2% for lists joining a pre-electoral coalition, except for the best loser. Ballot structure • Under the PR system (1948–1993), each voter cast one vote for a party list and could express a variable number of preferential votes among candidates of that list. • Under the MMM system (1993–2005), each voter received two separate ballots (the plurality ballot and the PR one) and cast two votes: one for an individual candidate in a single-member district; one for a party in a multi-member PR district. • Under the PR-with-seat-bonus system (2005–present), each voter cast one vote for a party list. -

AFLAC U.S. Strong Sales Propel AFLAC to Record Year

AFLAC U.S. Strong Sales Propel AFLAC to Record Year 2000 was a year to remember for AFLAC U.S. for • Premium income rose 14.4% to $1.6 billion, up from many reasons. We added to our product line and $1.4 billion in 1999. significantly expanded our sales force. We also • Net investment income increased 13.2% to $277 million, introduced the most successful advertising campaign compared with $245 million in 1999. in our history. As a result, new sales rose to record levels and revenue growth accelerated. Below are • Total revenues were up 14.3%, rising from $1.6 billion in some highlights for the year: 1999 to $1.8 billion in 2000. • New annualized premium sales increased 28.3% to • Pretax operating earnings grew 13.3% to $290 million, $712 million, compared with $555 million in 1999. compared with $256 million in 1999. Mitchell Odendahl, 2, and Tabitha (Tabby) Collins, 3, patients at the AFLAC Cancer Center and Blood Disorder Services at Children’s Healthcare of Atlanta, have some fun with a giant AFLAC duck. AFLAC and AFLAC sales associates have raised millions of dollars for the AFLAC Cancer Center to help in the fight against childhood cancer. In 2000, sales of approximately 18,000 stuffed toy ducks generated $180,000 for the center. 17 Strong Product Line Makes Building a Larger Distribution System for Complete Coverage For us to further tap into the U.S. market, it is In 2000, AFLAC U.S. extended its position as the crucial that we continue to expand our sales force. -

Personal Accident Indemnity Plan Accident-Only Insurance

Level 2 Personal Accident Indemnity Plan Accident-Only Insurance Plan Benefits • Emergency Treatment • Follow-Up Treatment • Initial Hospitalization • Hospital Confinement • Physical Therapy • Accidental-Death • Wellness • Plus ... much more Form A34275BCA IC(9/05) Personal Accident Indemnity Plan Policy Series A-34000 Benefits are payable for a covered person’s death, Accident Specific-Sum Injuries Benefit dismemberment, or injury caused by a covered accident that Aflac will pay $35–$12,500 for: occurs on or off the job. Dislocations Burns Skin Grafts Accident Emergency Treatment Benefit Aflac will pay $120 for the insured and the spouse, and $70 for Eye Injuries Lacerations Fractures children if a covered person receives treatment for injuries Broken Teeth Comas Brain Concussions sustained in a covered accident. This benefit is payable for X-rays, treatment by a physician, or treatment received in a Paralysis Surgical Procedures hospital emergency room. Treatment must be received within 72 hours of the accident for benefits to be payable. This Treatment must be performed on a covered person for injuries benefit is payable once per 24-hour period and only once per sustained in a covered accident. We will pay for no more than covered accident, per covered person. two dislocations per covered accident, per covered person. Dislocations must be diagnosed within 72 hours of the covered accident. Benefits are payable for only the first Accident Follow-Up Treatment Benefit dislocation of a joint. If a physician reduces a dislocation with Aflac will pay $35 for one treatment per day for up to a local or no anesthesia, we will pay 25% of the amount shown maximum of six treatments per covered accident, per covered for the closed reduction dislocation. -

Benefits and Business at Aflac and L.L. Bean

TOtal REWarDS INSTRUCTOR’S MANUAL Benefits and Business at Aflac and L.L. Bean By Sandra M. Reed, SPHR PROJECT TEAM Author: Sandra M. Reed, SPHR SHRM project contributors: Bill Schaefer, SPHR Nancy A. Woolever, SPHR External contributor: Sharon H. Leonard Copy editing: Katya Scanlan, copy editor Design: Kellyn Lombardi, graphic designer © 2009 Society for Human Resource Management. Sandra M. Reed, SPHR Note to HR faculty and instructors: SHRM cases and modules are intended for use in HR classrooms at universities. Teaching notes are included with each. While our current intent is to make the materials available without charge, we reserve the right to impose charges should we deem it necessary to support the program. However, currently, these resources are available free of charge to all. Please duplicate only the number of copies needed, one for each student in the class. For more information, please contact: SHRM Academic Initiatives 1800 Duke Street, Alexandria, VA 22314, USA Phone: (800) 283-7476 Fax: (703) 535-6432 Web: http://www.shrm.org/education/hreducation 09-0235-IM Case Overview In its 2008 annual Job Satisfaction Survey Report, the Society for Human Resource Management (SHRM) reported that for the past five years, employees rated compensation and benefits among the top three aspects most important to their job. But despite the importance of these aspects, employee satisfaction with their compensation and benefits packages remains low. According to a Conference Board report, “employees are least satisfied with their companies’ bonus plans, promotion policies, health plans and pensions”. Employers are missing critical opportunities to maximize employee job satisfaction and other organizational outcomes through their total rewards programs.1 In the book Dynamic Compensation for Changing organizations: People, Performance & Pay, The Hay Group asserts that traditional pay structures no longer keep pace with the emerging, strategy-focused organizations that exist in today’s globally competitive market. -

Prizm Premier

Claritas Consumer Profiles 2021 - Change List prizm Premier Variable Description Category Status SB000770PC Domestic light beer drank past 30 days Bud Light Lime (A) Alcohol NEW SB004988PC Malt alternatives drank past 30 days Other malt alternative (A) Alcohol NEW SB004989PC Malt alternatives drink most often Other malt alternative (A) Alcohol NEW SB004956PC Wine (types) bought past 3 months Other wine (A) Alcohol NEW SB004957PC Wine (types) drink most often Other wine (A) Alcohol NEW MM70300PC Buy Riders by Lee - 12 mo(A) Apparel and Jewelry NEW SB005203PC Model year of any vehicle (HHLD): 2010 (H) Automotive NEW SB005204PC Model year of any vehicle (HHLD): 2011 (H) Automotive NEW SB005213PC Model year of new vehicle (HHLD): 2008 or earlier (H) Automotive NEW SB005214PC Model year of new vehicle (HHLD): 2009 (H) Automotive NEW SB005223PC Model year of new vehicle (HHLD): 2018 (H) Automotive NEW SB005224PC Model year of new vehicle (HHLD): 2019 (H) Automotive NEW SB005233PC Model year of used vehicle (HHLD): 2016 (H) Automotive NEW SB005234PC Model year of used vehicle (HHLD): 2017 (H) Automotive NEW SB005243PC Number of new cars 2 New cars (H) Automotive NEW SB005244PC Number of new cars 3 New cars (H) Automotive NEW SB005253PC Number of vehicles 2 Vehicles (H) Automotive NEW SB005254PC Number of vehicles 3:Vehicles (H) Automotive NEW SB005263PC Number of used vehicles 2 Used vehicles (H) Automotive NEW SB005264PC Number of used vehicles 3 Used vehicles (H) Automotive NEW SB005273PC Make of any vehicle Chrysler (H) Automotive NEW SB005274PC -

C C Communications Claims Allowed by the Board of County Commissioners at Their Regular Meetings for the Months of July Thru September 2019

C C Communications Claims allowed by the Board of County Commissioners at their regular meetings for the months of July thru September 2019 Supplies & Services ADAMS CABLE EQUIPMENT INC 5,695.85 ADI 13,081.87 ADOBE MAX 2019 1,790.00 ADVANCED MEDIA TECHNOLO 1,786.69 AFLAC 4,869.81 AIR FILTER SALES & SERVICE 260.72 ALLISON, MACKENZIE,PAVLAKIS, WRIGHT 1,848.08 ALLSTREAM 157.29 AMAZON CAPITAL SERVICES- NET 30 11,256.04 AMERICAN CAR WASH 10.00 AMERICAN DOCUMENT DESTRUCTION 129.00 AMERIGAS 536.00 ANAYA, KRISTI 140.00 ANIXTER, INC 51.24 ANPI, LLC - NS 16,316.84 APPLE COMPUTER, INC. 2,098.00 ARIN 2,000.00 AT&T 3,224.32 AUDIO ON HOLD LTD 212.00 BALLARD, DAWN 64.98 BOISE STATE UNIVERSITY 1,000.00 BROADCASTERS GENERAL STORE INC 4,092.00 BROWN, PATRICIA 435.00 BSG TPV, LLC 302.10 C BAR R 1,107.02 CABLE TECHNOLOGIES INTERNATIONAL, INC 441.50 CALIX INC 314,721.12 CAMILON, MELESSA 2,237.00 CBS SPORTS NETWORK 1,886.92 CC COMMUNICATIONS 8.10 CCHS CHEER 110.00 CDW GOVERNMENT, INC 2,279.09 CEDA BUSINESS COUNCIL 430.00 CHRISTENSEN AUTOMOTIVE OF FALLON 418.08 CHURCHILL AREA REGIONAL TRANSPORTATION 2,500.00 CHURCHILL ARTS COUNCIL 1,800.00 CHURCHILL COUNTY CLERK/TRES. 624,999.99 CHURCHILL COUNTY COMPTROLLER 8,655.41 CHURCHILL COUNTY COMPTROLLER FUEL 11,523.47 CHURCHILL COUNTY FEDERAL CREDIT UNION 121,587.14 CHURCHILL COUNTY PLANNING DEPARTMENT 11,514.87 CHURCHILL COUNTY SOCIAL SERVICES 100.00 CHURCHILL COUNTY TREASURER 4,563.51 CIGNA HEALTH & LIFE INSURANCE 126,075.79 CIGNA-LINA 6,500.37 CITY OF FALLON/ CITY CLERK 15,446.25 CLEARFIELD, INC 14,371.55 COALITION FOR WILLIAM N PENNINGTON LIFE 2,500.00 CODALE ELECTRIC SUPPLY, INC 12,485.57 COGENT COMMUNICATIONS INC 6,075.00 COMCAST SPORTSNET BAY AREA 20,492.64 COMMSOFT 13,918.50 COMMUNICATIONS WORKERS OF AMERICA 1,351.38 COMSTOCK TELECOM 16,364.96 CONNECTWISE, INC. -

Japanese Electoral Politics: Reform, Results, and Prospects for the Future

Japanese Electoral Politics: Reform, Results, and Prospects for the Future Author: Joe Michael Sasanuma Persistent link: http://hdl.handle.net/2345/470 This work is posted on eScholarship@BC, Boston College University Libraries. Boston College Electronic Thesis or Dissertation, 2004 Copyright is held by the author, with all rights reserved, unless otherwise noted. BOSTON COLLEGE JAPANESE ELECTORAL POLITICS: REFORM, RESULTS AND PROSPECTS FOR THE FUTURE A SENIOR HONORS THESIS SUBMITTED TO THE HONORS PROGRAM OF THE DEPARTMENT OF POLITICAL SCIENCE AND THE COLLEGE OF ARTS AND SCIENCES BY JOE M. MICHAEL SASANUMA April 2004 - 1 - Table of Contents Part I: Introduction 3 Chapter 1: The Lost Ten Years 4 Part II: Revolution, Realignment, and the Man Named Ozawa 12 Chapter 2: Money and Machine Politics 13 Chapter 3: Ozawa Ichiro’s Reform, Revolt, and Revolution 15 Chapter 4: Hosokawa’s Fall, LDP’s Return, and Ozawa Again 21 Chapter 5: Realignment 24 Part III: The Electoral System: Before and After 38 Chapter 6: The Medium Size Election District System 39 Chapter 7: The Mixed System 43 Chapter 8: Analyzing the New Electoral System 49 Part IV: Previous Elections 66 Chapter 9: The Election of 1996 67 Chapter 10: The Election of 2000 69 Part V: The Election of 2003 77 Chapter 11: Results and Analysis 78 Chapter 12: Predictions and Results 88 Chapter 13: District Analysis 102 Part VI: Conclusion 132 Chapter 14: Prospects for the Future 133 - 2 - Part I Introduction - 3 - Chapter 1: The Lost Ten Years In an interview conducted by the Yomiuri Shinbun newspaper in May of 2003, then- vice-speaker of the Lower House Watanabe Kozo called the past decade of Japanese politics “The Lost Ten Years.”1 Although the term is used more commonly to describe the Japanese economic stagnation of the 1990s, in many ways his use of the term to describe politics was equally appropriate. -

Regional Responses to U.S.-China Competition in the Indo-Pacific: Japan

Regional Responses to U.S.-China Competition in the Indo-Pacific: Japan Indo-Pacific: the in Competition U.S.-China Regional Responses to Regional Responses to U.S.-China Competition in the Indo-Pacific Japan Scott W. Harold Harold C O R P O R A T I O N For more information on this publication, visit www.rand.org/t/RR4412z4 For more information on this series, visit www.rand.org/US-PRC-influence Library of Congress Cataloging-in-Publication Data is available for this publication. ISBN: 978-1-9774-0519-7 Published by the RAND Corporation, Santa Monica, Calif. © Copyright 2020 RAND Corporation R® is a registered trademark. Cover: globe: jcrosemann/GettyImages; flags: luzitanija/Adobe Stock Limited Print and Electronic Distribution Rights This document and trademark(s) contained herein are protected by law. This representation of RAND intellectual property is provided for noncommercial use only. Unauthorized posting of this publication online is prohibited. Permission is given to duplicate this document for personal use only, as long as it is unaltered and complete. Permission is required from RAND to reproduce, or reuse in another form, any of its research documents for commercial use. For information on reprint and linking permissions, please visit www.rand.org/pubs/permissions. The RAND Corporation is a research organization that develops solutions to public policy challenges to help make communities throughout the world safer and more secure, healthier and more prosperous. RAND is nonprofit, nonpartisan, and committed to the public interest. RAND’s publications do not necessarily reflect the opinions of its research clients and sponsors. -

Japan: 'Abenomics' Has NOT Resigned

September 2, 2020 Japan: ‘Abenomics’ has NOT resigned Prime Minister Abe’s successor is likely to focus on continuity The LDP will elect a new leader in two weeks who will succeed Shinzo Abe as Japan’s prime minister. Continuity is expected in terms of fiscal and monetary policy, but it will not be easy to handle the pandemic, prepare for the Olympics, engage on the global stage, and enact further regulatory reform all while striving to win the hearts and respect of a nation. Even so, candidates willing to face the challenge are already lining up Source: Håkan Hedström, NHK 2020 ceremonies. Instead, he was making headlines with the government’s handling of the I cannot be prime minister if I cannot make last Friday by resigning from his post as prime COVID-19 crisis. Indeed, the Cabinet’s the best decisions for the people. I have minister due to health reasons, only days after approval rating fell to a record low of 34% in decided to step down from my post ... before having become Japan’s longest serving prime a poll conducted by Japan’s major public TV accomplishing my goals. minister. Prior to the start of his second term broadcaster NHK (Nippon Hoso Kyokai). 69% in 2012, Abe served as prime minister from of those polled opposed Abe serving as PM Shinzo Abe 2006 to 2007 before having to step down, Liberal Democratic Party (LDP) leader for a also due to health reasons. fourth term. It is also interesting to note that Had the COVID-19 pandemic not erupted despite falling support for the Cabinet, the Abe’s public support had faltered recently Prime Minister Abe would have been in the overall support rate for the LDP remains far following a vote-buying scandal involving a global spotlight last month during the above that of opposition parties.