Memorandum and Articles of Association of TECH MAHINDRA LIMITED

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Coverage Of

MEDIA COVERAGE REPORT CMD’s Interview with Thomson Reuters SUBMITTED BY CORPORATE PUBLIC RELATIONS ITI LIMITED India’s ITI Expects 25% Revenue Growth This FY on Govt Orders - Chairman By New Delhi Newsroom/NewsRise State-run telecom and defense equipment maker ITI expects its revenue to grow 25% this fiscal year and 30% in the next on the back of a string of government orders, its chairman and managing director said. The company has already signed contracts worth 27 billion rupees for this financial year which will drive up revenue growth, Rakesh Mohan Agarwal told NewsRise. Agarwal said he expects revenues worth 22 billion rupees to flow in the next fiscal year that begins in April from the recent 77.79 billion rupees deal from defense department. ITI had, last month, signed a deal for phase IV of the Army Static Switched Communication Network, or Ascon, a telecom network spread across the north and western regions of the country. The company’s total order book at the end of September stood at 140 billion rupees, he said. ITI’s revenue in the last fiscal year ended March grew 23% to 20.59 billion rupees. The company also has a tie up with Indian software exporter Tech Mahindra to make fourth-generation, or 4G, and next- generation 5G network gear. Agarwal said the company along with Tech Mahindra has already submitted a proof-of-concept proposal to the telecom department, and is aiming to grab state- owned Bharat Sanchar Nigam and Mahanagar Telecom Nigam’s upcoming tender to supply telecom equipment in the southern region. -

Cloud Transformation/ Operation Services & Xaas

Cloud Transformation/ A research report Operation Services & XaaS comparing provider strengths, challenges U.S. 2019 and competitive differentiators Quadrant Report Customized report courtesy of: November 2018 ISG Provider Lens™ Quadrant Report | November 2018 Section Name About this Report Information Services Group, Inc. is solely responsible for the content of this report. ISG Provider Lens™ delivers leading-edge and actionable research studies, reports and consulting services focused on technology and service providers’ strength and Unless otherwise cited, all content, including illustrations, research, conclusions, weaknesses and how they are positioned relative to their peers in the market. These assertions and positions contained in this report were developed by and are the sole reports provide influential insights accessed by our large pool of advisors who are property of Information Services Group, Inc. actively advising outsourcing deals as well as large numbers of ISG enterprise clients who are potential outsourcers. The research and analysis presented in this report includes research from the ISG Provider Lens™ program, ongoing ISG Research programs, interviews with ISG advisors, For more information about our studies, please email [email protected], briefings with services providers and analysis of publicly available market information call +49 (0) 561-50697537, or visit ISG Provider Lens™ under ISG Provider Lens™. from multiple sources. The data collected for this report represents information that ISG believes to be current as of September 2018, for providers who actively participated as well as for providers who did not. ISG recognizes that many mergers and acquisitions have taken place since that time but those changes are not reflected in this report. -

Everest Group's PEAK Matrix for Banking AO

TM Topic: Everest Group’s PEAK Matrix for Banking AO Service Providers Focus on HCL Technologies July 2015 Copyright © 2015 Everest Global, Inc. This document has been licensed for exclusive use and distribution by HCL Technologies Background and scope of the research Background of the research Rise of digital consumers, need for business agility, growing costs of regulatory compliance, and threat from non-banking competitors in areas such as payments were the key challenges faced by banks in 2014. Banks are aligning their technology priorities around cost containment, efficiency, risk & compliance management, and transformation. Banks continued to invest in development of specific applications for regulatory compliance, risk management, channel-specific initiatives (social, mobile, etc.), and customer analytics The service provider landscape is intensifying as providers ramp up their capabilities, invest in innovative technologies, form alliances, and acquire strategic targets to address the growing and complex application services needs of banks and financial institutions In this research, we analyze the capabilities of 30 leading AO service providers, specific to the global banking sector. These providers were mapped on the Everest Group Performance | Experience | Ability | Knowledge (PEAK) Matrix, which is a composite index of a range of distinct metrics related to each provider’s capability and market success. Additionally, Everest Group has also profiled the capabilities of these 30 service providers in detail including a comprehensive picture of their service suite, scale of operations, domain investments, delivery locations, and buyer satisfaction specific to banking AO services This document focuses on HCL Technologies’ banking AO experience and includes: Overview of the banking AO service provider landscape Everest Group’s assessment of HCL Technologies’ delivery capability and market success on PEAK matrix Detailed banking AO profile for HCL Technologies Copyright © 2015, Everest Global, Inc. -

Press Release

Press Release MphasiS appoints Ajay Jotwani as Senior Vice President and Head of Infrastructure Services Bangalore, December 12, 2013 MphasiS, today announced the appointment of Ajay Jotwani as Senior Vice President and Head of Infrastructure Services. Ajay will be part of MphasiS Leadership Team and report to Ganesh Ayyar, CEO MphasiS. He will be based out of Santa Clara, USA and will lead the global Infrastructure Services business unit. Ajay joins MphasiS with over 22 years of global business experience in leadership, organizational strategy, sales management, business development and operations. In the last 12 years, Ajay focused on making strategic breakthroughs - opening geographies, establishing practices, and building global teams. He has immense expertise and has run successful programs in data center consolidation; virtualization, workplace services and unified cloud strategy offering flexible services & consumption based models. “We are delighted to have Ajay head our Infrastructure business. The expertise he brings will help us expand our portfolio of services and provide innovative solutions to meet the evolving industry needs. His experience in North America and other key global markets will open new avenues and accelerate the pace of growth.” said Ganesh Ayyar, CEO MphasiS. “I am delighted to work with MphasiS’ Infrastructure Service (IS) Unit. The infrastructure services market hold great prospect for nimble service providers. With a talented team, a suite of innovative products and services, we intend to be the provider of choice.” said Ajay Jotwani, Senior Vice President and Head of Infrastructure Services. In his previous role at Wipro Technologies, Ajay led new business acquisition for Infrastructure Services across Manufacturing Hitech (MHT), Energy Utilities (ENU) and Banking Financial Services Insurance (BFSI) verticals. -

Corporate Governance Scores S&P BSE 100 Companies

Corporate Governance Scores S&P BSE 100 companies Technical Partner Supported by the Government of Japan January 2018 TABLE OF CONTENTS Foreword 2 1 Introduction 4 2 SENSEX Trends 6 3 S&P BSE 100 Findings 8 4 Conclusion 12 5 Annexures 13 6 1 1. FOREWORD Vladislava Ryabota Regional Lead for Corporate Governance in South Asia, IFC Welcome to this second report on the Indian Corporate Governance Scorecard, developed jointly by the BSE, IFC and Institutional Investor Advisory Services (IiAS), with the financial support of the Government of Japan. The goal of a scorecard is to provide a fair assessment of corporate governance practices at the corporate level. This, in return, gives investors, regulators and stakeholders key information to help them in their decisions with regards to such companies. Since we started this journey in India, with our first scorecard issued in December 2016, a lot of dynamic changes have been set in motion. For instance, the scorecard of 2016 scored 30 companies, and now we have a 100 in this year’s edition. We were also happy to notice that several best practice requirements, covered by the scoring methodology, have been recommended by the Kotak Committee, formed in 2017 at the initiative of the Securities and Exchange Board of India. Changes have also taken place at the regulatory level to incite investors to take a more active role at Annual General Assemblies and vote in order to bring positive changes in the practices of their investee companies. All these changes form part of an overall dynamic aimed at helping the private sector raise its visibility in India and throughout the world and IFC is proud to be a solid partner and actor to this initiative. -

Indigo Soars with $33Bn A320neo Order

EEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEE THE HINDU DELHI WEDNESDAY, OCTOBER 30, 2019 BUSINESS 15 EEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEE market watch Awaiting clarity on AGR, 29-10-2019 % CHANGE Sensex dddddddddddddddddddddd 39,832 ddddddddddddddd1.48 IndiGo soars with $33bn A320neo order US Dollardddddddddddddddddddd 70.84 ddddddddddddddd0.08 Gold ddddddddddddddddddddddddddd 38,857 ddddddddddddd-1.39 Bharti defers Q2 results Brent oil ddddddddddddddddddddd 61.62 ddddddddddddddd0.16 300plane order is Airbus’ largest ever with a single airline; to take IndiGo’s A320neo count to 730 ‘Moving DoT to arrive at total amount’ SPECIAL CORRESPONDENT economic growth and mobil IndiGo is keen on the MUMBAI ity,” Ronojoy Dutta, CEO, In A321XLR, which is the next Special Correspondent matter arising out of recent N IFTY 50 InterGlobe Aviation Ltd., diGo, said in a statement. evolutionary -

TECH MAHINDRA Integrated Report 2018-19

TECH MAHINDRA Integrated Report 2018-19 “Enabling Purpose – Sustainability and Digital Transformation” 1 Company Driven By Purpose There is growing consensus that the pursuit of profit must be accompanied by the pursuit for purpose - that companies driven by purpose outperform their peers. There is an increasing expectation from employees at all levels to have a purpose beyond the balance sheet: one that contributes to a positive impact on society. Companies, which are able to harness purpose, are the ones that are able to attract and retain talent. They are the ones that are able to connect with customers in a completely different ways and have greater resilience, which are so important in the age of choice. Customers view purpose-driven brands as being more caring and, as a result, are more loyal to them The Company’s purpose is governed by the expectations of the stakeholders. Being connected means taking into account the aspirations of the company’s full range of stakeholders, beyond the providers of capital – the customers, employees, regulators, partners and collaborators, suppliers and society at large. At Tech Mahindra, we challenge conventional thinking and innovatively use all our resources to drive positive change in the lives of our stakeholders and communities across the world, to enable them to Rise. Our pursuit of purpose is enabled by Technology. As a provider of information technology solutions, we believe that the future is in using technology to provide solutions to the sustainability needs of the company, society and the planet. It requires us to adapt and align our business model and strategy to remain relevant in today’s dynamic business environment. -

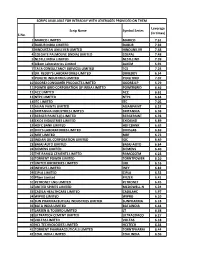

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

Tech Mahindra Press Release

Tech Mahindra forays into the world of Mobility Products Acquires controlling stake in Comviva Technologies Limited Builds 360 degree portfolio in Mobile VAS, Mobile Money and Mobile payments space For Immediate Release – New Delhi, India, September 17, 2012 - Tech Mahindra Limited, India’s sixth largest software exporter today, announced the acquisition of 51% stake on a fully diluted basis in Comviva Technologies Limited, a Bharti Group Company, and a global leader in providing mobile Value Added Services (VAS), Mobile Money and Mobile Payment solutions, for a value of INR 260cr. The deal will be subject to regulatory approvals. The new brand identity will be Mahindra Comviva, reflecting the combined strength and spirit of both the entities. As part of this arrangement, Tech Mahindra will make an upfront payment of INR 125cr towards the stake acquired and the balance amount of INR 135cr will be paid out over a period of five years based, on Comviva achieving mutually agreed performance targets. The current promoters will continue to hold a 20% stake on a fully diluted basis in Comviva, post the deal closure. Commenting on this move, Vineet Nayyar, Executive Vice Chairman, Tech Mahindra said “This acquisition is a significant step forward, in our vision of being a complete and comprehensive partner to our clients and like always, we are confident of making this a successful venture for our stakeholders. In addition to the market leading capabilities, this will also add to our relationship with large operator groups across the world.” “The world of mobility today encompasses wide range of solutions, where customers be it enterprise or consumers are driving their business and entertainment needs through mobility. -

Tech-Mahindra-Integrated-Report

1 Contents Message from the Vice Chairman ................................................................................................................. 4 Message from the Managing Director & CEO ............................................................................................... 5 Message from the Chief Sustainability Officer ............................................................................................. 7 About the Report .......................................................................................................................................... 9 External Assurance ...................................................................................................................................... 11 About Tech Mahindra ................................................................................................................................. 15 Stakeholder Relations ................................................................................................................................. 18 Material Topics ........................................................................................................................................... 23 Governance ................................................................................................................................................. 29 Risks and Opportunities .............................................................................................................................. 33 External Environment ................................................................................................................................ -

Momentum Pick

Momentum Picks Open Recommendations New recommendations Gladiator Stocks Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 1-Oct-21 Nifty Nifty Sell 17520-17545 17482/17430 17583.00 Intraday Scrip Action 1-Oct-21 ONGC ONGC Buy 142.50-143.00 144.25/145.70 141.20 Intraday Hindalco Buy PICK MOMENTUM 1-Oct-21 UPL UPL Sell 707.00-708.00 700.60/693.80 714.60 Intraday Bata India Buy 30-Sep-21 Trent TRENT Buy 1010-1025 1125 948.00 30 Days HDFC Buy 30-Sep-21 Dhampur Sugar DHASUG Buy 290-294 312 282.00 07 Days Duration: 3 Months Click here to know more… Open recommendations Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration 29-Sep-21 SJVN SJVLIM Buy 28.3-29 31.50 27.00 14 Days 29-Sep-21 National Aluminium NATALU Buy 92-94 101.00 86.50 07 Days Intraday recommendations are for current month futures. Positional recommendations are in cash segment Retail Equity Research Retail – October 1, 2021 For Instant stock ideas: SUBSCRIBE to mobile notification on ICICIdirect Mobile app… Research Analysts Securities ICICI Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT [email protected] [email protected] [email protected] Pabitro Mukherjee Vinayak Parmar [email protected] [email protected] NSE (Nifty): 17618 Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices Day that was… Open High Low Close Indices Close 1 Day Chg % Chg Equity benchmarks concluded the monthly expiry session on a subdued note tracking mixed global cues. -

TECH MAHINDRA | IT Services | 23 October 2020

RESULT REVIEW BUY TP: Rs 980 | 16% TECH MAHINDRA | IT Services | 23 October 2020 Communication vertical recovers; TCV robust Tech Mahindra (TECHM) posted 2.9% QoQ CC revenue growth and stellar Ruchi Burde | Seema Nayak 390bps EBITDA margin expansion, bettering our estimates for Q2FY21. The [email protected] telecom vertical has finally started recovering (+3% QoQ USD). Traction in the TME, BFSI and retail segments led QoQ recovery for the enterprise segment. TCV was robust at US$ 421mn. We raise FY21-FY23 EPS by 7-10% to bake in the Q2 beat and roll over to a revised Sep’21 TP of Rs 980 (Rs 910 earlier), based on an unchanged target P/E of 15.7x. Reiterate BUY. Strong growth momentum: Revenue growth of 2.9% QoQ CC exceeded our Ticker/ Price TECHM IN /Rs 848 estimate of 1.3%, backed equally by growth in supply and demand. The enterprise Market cap US$ 10.1bn segment grew 4.3% QoQ CC and communication was up 0.8% after two Shares o/s 873mn 3M ADV US$ 63.0mn quarters of decline. Within enterprise, technology, media and entertainment 52wk high/low Rs 888/Rs 471 (TME), BFSI and retail revived the most. Alliances with cloud hyperscalers have Promoter/FPI/DII 36%/39%/25% also seen increased focus. EBIT margin at 14.2% surged 410bps QoQ on lower Source: NSE SG&A and employee cost. Margin tailwinds arose from the supply and demand side (+160bps each), increased cost efficiency (+160bps) ; offset by STOCK PERFORMANCE normalisation from seasonality (-70bps). (Rs) TECHM Deal win recovery: With numerous multiyear wins across the software engineering 880 790 services, communication, healthcare, ENU and BFSI verticals, net new TCV 700 stood at US$ 421mn (+45% QoQ, –72% YoY).