CEDAR HILL

MARKET STUDY 2020

CEDAR HILL MARKET STUDY 2020

Prepared for:

Cedar Hill EDC

285 Uptown Blvd, Bldg 100 Cedar Hill, Texas 75104

November 2020 Prepared by:

1001 S. Dairy Ashford, Suite 450

Houston, TX 77077

(713) 465-8866 www.cdsmr.com

Cedar Hill Market Study

TABLE OF CONTENTS

Table of Contents............................................................................................................................... i

CDS Company Bio..........................................................................................................................................1 The Purpose of this Study .............................................................................................................................1

Executive Summary............................................................................................................................2

Demographic and Economic .........................................................................................................................2

Demographic Characteristics..................................................................................................................................2 Economic Profile .....................................................................................................................................................3

Market Uses..................................................................................................................................................4

Office Market..........................................................................................................................................................4 Industrial Marke t . ...................................................................................................................................................5 Retail Market..........................................................................................................................................................6 Multifamily Market.................................................................................................................................................7 For-Sale Housing Marke t . .......................................................................................................................................7 Hospitality Market..................................................................................................................................................9 Downtown / Town Center Development ..............................................................................................................10

Demographic and Economic Analysis................................................................................................12

Population and Households........................................................................................................................12 Economy and Employment.........................................................................................................................21

Average Wages.....................................................................................................................................................23 Total Wages..........................................................................................................................................................25 Unemployment Rate.............................................................................................................................................27 Major Regional Employers....................................................................................................................................27

Notable Upcoming Commercial Developments .........................................................................................31

Adaptive Reuse – Village Crossing – Phillips Lumber Project................................................................................31 Hillwood Industrial Development .........................................................................................................................33 Walton Masterplanned Communit y . ....................................................................................................................34

Office Market ..................................................................................................................................35

DFW Office Market .....................................................................................................................................35 Southwest Dallas Submarket ......................................................................................................................37 CMA Office Market .....................................................................................................................................38

Performance Trends .............................................................................................................................................38 Supply 39

Cedar Hill Office Market..............................................................................................................................50

Performance Trends .............................................................................................................................................50 Cedar Hill Office Supply ........................................................................................................................................51 Interview with Interra Capital (owner) – 610 Uptown..........................................................................................54 Examples of Cedar Hill Office................................................................................................................................55

Medical Office CMA ....................................................................................................................................56

CMA Medical Office Supply ..................................................................................................................................57

i

Cedar Hill Market Study

Examples of CMA Medical Office..........................................................................................................................58

Potential Demand – Office Space ...............................................................................................................59

Cedar Hill Absorption............................................................................................................................................60

Industrial Market.............................................................................................................................61

Metro Area Industrial Market.....................................................................................................................61 Southwest Dallas/US 67 Submarket ...........................................................................................................62 CMA Industrial Market................................................................................................................................63

Performance Trends .............................................................................................................................................63 CMA Supply...........................................................................................................................................................65 Interviews with CMA Industrial Developers..........................................................................................................85 Interviews with CMA Industrial Brokers ...............................................................................................................85

Cedar Hill Industrial Market........................................................................................................................86

Market Performance ............................................................................................................................................86 Supply 88

Retail Market...................................................................................................................................91

DFW Retail Market......................................................................................................................................91 Cedar Hill/Duncanville/DeSoto Submarket.................................................................................................93 Southwest Outlying Submarket ..................................................................................................................94 CMA Retail Market......................................................................................................................................95

Performance Trends .............................................................................................................................................96 CMA Supply...........................................................................................................................................................96 Interview with Transwestern regarding Retail – Steve Williamso n . .....................................................................99 Interview with Monte Anderson, small-scale developer across southern Dallas..................................................99 Interview with Midlothian Founders Row Developer .........................................................................................100

Cedar Hill Retail Market............................................................................................................................101

Market Performance ..........................................................................................................................................101 Retail Suppl y . ......................................................................................................................................................104 Interview with Hillside Village ............................................................................................................................109 Other Examples of Cedar Hill Retail....................................................................................................................111 Effective Buying Power .......................................................................................................................................112 Cedar Hill Retail Sales Trends .............................................................................................................................112 Retail Surplus/Leakag e . ......................................................................................................................................113 Estimating Supportable Retail in the CMA and Cedar Hil l . .................................................................................113 Conclusions and findings include the following for the CMA:.............................................................................114

Multifamily Market........................................................................................................................115

DFW Multifamily Market ..........................................................................................................................115

DFW Market – August, 2020 – Dallas Business Journal .....................................................................................116

South Dallas County Submarket ...............................................................................................................117 CMA Multifamily Market ..........................................................................................................................118

Performance Trends ...........................................................................................................................................118 CMA Multifamily Supply .....................................................................................................................................120

ii

Cedar Hill Market Study

Interviews with CMA Multifamily : . .....................................................................................................................127 Examples of CMA Multifamily ............................................................................................................................128

Cedar Hill Multifamily Market...................................................................................................................129

Performance Trends ...........................................................................................................................................129 Supply ...............................................................................................................................................................131 New Construction ...............................................................................................................................................132 Examples of Cedar Hill Multifamily.....................................................................................................................134 Potential Demand – Multifamily Housing ..........................................................................................................135 Conclusions and Recommendations ...................................................................................................................136

For-Sale Housing Market................................................................................................................137

Cedar Hill Housing Characteristics............................................................................................................137

Housing Value Profile .........................................................................................................................................138 Household Income by Tenure .............................................................................................................................139

Existing Home Market...............................................................................................................................140

Price Distribution ................................................................................................................................................141 For-Sale Condominium s . .....................................................................................................................................143 For-Sale Duplexes and Townhome s . ...................................................................................................................143

New For-Sale Housing...............................................................................................................................143 Projected For-Sale Housing Demand ........................................................................................................150

NCTCOG Projections ...........................................................................................................................................150 Planned New Development ................................................................................................................................151 Supportable Additional Single-family .................................................................................................................151

Hospitality Market.........................................................................................................................153

Texas Hotel Market...................................................................................................................................155

CMA Hotel Performance Trends .........................................................................................................................156 CMA Under Construction Hotel s . ........................................................................................................................157 CMA Proposed and Planned Hotels ....................................................................................................................157 Interviews with CMA Hotels: ..............................................................................................................................157

Cedar Hill Market (75104).........................................................................................................................158

The Aloft Hotel and Convention Center ..............................................................................................................158 Cedar Hill Performance Trend s . ..........................................................................................................................158 CMA Conference Center Space ...........................................................................................................................159 Projected CMA Hotel Demand............................................................................................................................160 Hospitality Conclusions and Findings..................................................................................................................161

Downtown / Town Center Development ........................................................................................162

Commercial / Retail Uses..........................................................................................................................162

Dining / Restaurants...........................................................................................................................................162 Consumer Market Changes, Challenges, and Opportunities ..............................................................................162 Nighttime, Culture, and Entertainmen t . .............................................................................................................163 Office Spac e . .......................................................................................................................................................164 Summary – Commercial / Retail Uses.................................................................................................................164

iii

Cedar Hill Market Study

Residential Uses........................................................................................................................................165

Rental Housing ...................................................................................................................................................165 For-Sale Housing.................................................................................................................................................165

Table of Tables and Figures

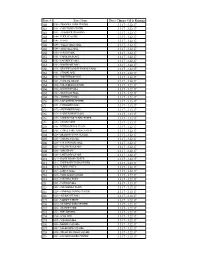

Figure 1: Inner Suburban Demographic Area ............................................................................................12 Table 1: Population and Households, 2000 to 2025..................................................................................13 Table 2: Population by Age, 2020 ..............................................................................................................14 Table 3: Ethnic Makeup, 2020....................................................................................................................14 Table 4: Household Size and Type, 2020 ...................................................................................................15 Table 5: Household Type, 2020..................................................................................................................16 Table 6: Family Households and Poverty, 2020.........................................................................................17 Table 7: Educational Attainment, 2020 .....................................................................................................17 Table 8: Cedar Hill ISD K-12 School Enrollment, 2013 to 2020..................................................................18 Table 9: Household Income, 2020 .............................................................................................................18 Table 10: Household Income, 2025 ...........................................................................................................19 Table 11: Occupation of Residents, 2020 Age 16 and Older......................................................................20 Table 12: Cedar Hill Employment by Industry, 2010-2017 ........................................................................21 Table 13: Employment Change by Industry – Dallas County......................................................................22 Table 14: Employment Change by Industry – Ellis County .........................................................................23 Table 15: Average Weekly Wages by Industry – Dallas County..................................................................23 Table 16: Average Weekly Wages by Industry – Ellis County .....................................................................24 Table 17: Total Wages by Industry – Dallas County....................................................................................25 Table 18: Total Wages by Industry – Ellis County .......................................................................................26 Figure 2: Unemployment Rate, Dallas and Ellis Counties...........................................................................27 Table 19: Major North Texas Employers....................................................................................................28 Table 20: Major Cedar Hill Employers........................................................................................................28 Figure 3: Cedar Hill Job Inflow/Outflow, 2017............................................................................................29 Table 21: Cedar Hill LEHD Inflow/Outflow Job Counts, 2017 .....................................................................29 Figure 4: Where Cedar Hill Workers Live, LEHD 2017.................................................................................30 Table 22: Distance – Work to Home, 2017 .................................................................................................30 Table23: ZIP Codes Where Cedar Hill Workers Live, LEHD 2017 ................................................................31 Figure 5: Rendering of Village Crossing......................................................................................................32 Figure 6: Village Crossing Site Plan .............................................................................................................32 Figure 7: Hillwood Site Plan .......................................................................................................................33 Figure 8: Metro Area Office Market Vacancy and Absorption ..................................................................35 Table 24: Metro Area Office Market Summary..........................................................................................36 Figure 9: Southwest Dallas Submarket ......................................................................................................37 Table 25: Southwest Dallas Submarket Summary .....................................................................................37 Figure 10: Cedar Hill CMA Office Market...................................................................................................38 Figure 11: CMA Office Market Vacancy Trends .........................................................................................38 Figure 12: CMA Office Absorption, Deliveries and Vacancy ......................................................................39 Table 26: CMA Office Supply.......................................................................................................................39 Figure 13: Cedar Hill Office Properties.......................................................................................................50