Texas Snapshot

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ROWLETT City-Area Guide

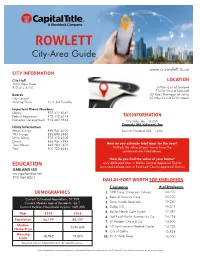

ROWLETT City-Area Guide www.ci.rowlett.tx.us CITY INFORMATION City Hall LOCATION 4000 Main Street 972.412.6100 5 Miles East of Garland 7 Miles West of Rockwall Boards 20 Miles Northeast of Dallas City Council 42 Miles East of DFW Airport Meeting Times 1st & 3rd Tuesday Important Phone Numbers Library 972.412.6161 Parks & Recreation 972.412.6145 TAX INFORMATION Economic Development 972.463.3953 City Sales Tax = 8.25% Property (Ad Valorem) Tax Utility Information Atmos Energy 888.951.6700 Rowlett (Garland ISD) 1.235 TXU Energy 855.898.8980 Utility Billing 972.412.6105 Directv 866.951.7998 How do you estimate total taxes for the year? Time Warner 888.280.1679 Trash 800.722.8653 Multiply the value of your home times the combined rate listed above. How do you find the value of your home? EDUCATION www.dallascad.com = Dallas Central Appraisal District www.rockwallcad.com = Rockwall County Appraisal District GARLAND ISD www.garlandisd.net 972.464.8201 DALLAS-FORT WORTH TOP EMPLOYERS Company # of Employees DEMOGRAPHICS 1. AMR Corp. (American Airlines) 24,700 2. Bank of America Corp. 20,000 Current Estimated Population: 57,939 Current Median Age of Residents: 36.7 3. Texas Health Resources 19,230 Current Median Household Income: $89,305 4. Dallas ISD 18,314 Baylor Health Care System 17,097 Year 2010 2018 5. 6. Lockheed Martin Aeronautics Co. 14,126 Population 56,199 58,407 7. JP Morgan Chase & Co. 13,500 Median - $240,630 8. UT-Southwestern Medical Center 13,122 Home Price 9. City of Dallas 12,836 Housing 18,969 19,373 10. -

Cedar Hill Market Study 2020

CEDAR HILL MARKET STUDY 2020 CEDAR HILL MARKET STUDY 2020 Prepared for: Cedar Hill EDC 285 Uptown Blvd, Bldg 100 Cedar Hill, Texas 75104 November 2020 Prepared by: 1001 S. Dairy Ashford, Suite 450 Houston, TX 77077 (713) 465-8866 www.cdsmr.com Cedar Hill Market Study TABLE OF CONTENTS Table of Contents ............................................................................................................................... i CDS Company Bio .......................................................................................................................................... 1 The Purpose of this Study ............................................................................................................................. 1 Executive Summary ............................................................................................................................2 Demographic and Economic ......................................................................................................................... 2 Demographic Characteristics .................................................................................................................................. 2 Economic Profile ..................................................................................................................................................... 3 Market Uses .................................................................................................................................................. 4 Office Market ......................................................................................................................................................... -

Claymoore Business Center

Industrial PROPERTY FEATURES Northwest Area 3900 Claymoore • Suite 160 Houston, TX 77043 • 22,275 SF Available ° 1,432 SF Class A Office Space • Endcap Space • Master-Planned Park • Excellent Accessibility Claymoore Business Center • Located in Claymoore Park 22,275 SF AVAILABLE off Clay Rd & Beltway 8 3900 Brittmoore • Suite 160 • 6 Overhead Doors plus 1 Drive in Ramp • Sprinklered • 24’ Clear Height • 167’ Truck Apron • Fenced Truck Apron • 45’x45’ Column Spacing Transwestern Houston • 1900 West Loop South, Suite 1300 • Houston, Texas 77027 P: 713.270.7700 • F: 713.271.8172 JUDE FILIPPONE DARRYL NOON BRIAN GAMMILL 713.270.3318 713.270.3325 713.270.3321 [email protected] [email protected] [email protected] The information provided herein was obtained from sources believed reliable, however, Transwestern makes no guarantees, warranties or representations as to the completeness or accuracy thereof. The presentation of this property is submitted subject to errors, omissions, change of price or conditions, prior to sale or lease, or withdrawal without notice. Industrial Site Plan Claymoore Business Center 22,275 SF AVAILABLE OFFICE SPACE AVAILABLE WAREHOUSE SPACE 1,432 SF AVAILABLE 22,275 SF Transwestern Houston • 1900 West Loop South, Suite 1300 • Houston, Texas 77027 P: 713.270.7700 • F: 713.271.8172 JUDE FILIPPONE DARRYL NOON BRIAN GAMMILL 713.270.3318 713.270.3325 713.270.3321 [email protected] [email protected] [email protected] The information provided herein was obtained from sources believed reliable, however, Transwestern makes no guarantees, warranties or representations as to the completeness or accuracy thereof. -

NASRC EE and Low-GWP Expo Attendee List 010820

NASRC EE & Low-GWP Expo Attendee List 1/10/20 CompanyOrganization Name Type of Organization Albertsons Wade Krieger End-User Genentech Joseph Semiklose End-User Grocery Outlet Inc. Courtney Hammer End-User Grocery Outlet, Inc. Megan Rodriguez End-User H-E-B / NASRC Keilly Witman End-User Raley's Edward Estberg End-User Raley's Chris Moniz End-User Sprouts Farmers Market Eli Arballo End-User Sprouts Farmers Market Tim Davis End-User Sprouts Farmers Market / NASRC Frank Davis End-User Stater Bros. Markets Beth Haarala End-User Stater Bros. Markets Ryan Stouvenel End-User Stater Bros. Markets Lance Durr End-User Stater Bros. Markets Dan Messner End-User Target KC Kolstad End-User The Kroger Co. Keith Oliver End-User Vallarta Supermakets Steve Goh End-User Walmart / NASRC Jim McClendon End-User Whole Foods Market Manny Garcia End-User Whole Foods Market Mike Ellinger End-User Whole Foods Market Paula Chavez End-User Whole Foods Market Greg Nelson End-User Whole Foods Market Luci Yuhl End-User Whole Foods Market / NASRC Tristam Coffin End-User Whole Foods Market / NASRC Aaron Daly End-User WinCo Foods LLC Andrew Beall End-User Alternative Energy Systems Consulting TBD Engineering/Consulting Cushing Terrell Rob Arthur Engineering/Consulting Cushing Terrell Nicholas Doherty Engineering/Consulting DC Engineering Glenn Barrett Engineering/Consulting DC Engineering Tom Wolgamot Engineering/Consulting DC Engineering Leia Waln Engineering/Consulting DNV GL Nick Brod Engineering/Consulting e2s Patrick Hiti Engineering/Consulting e2s Mike Guldenstern Engineering/Consulting Ecology Action John Peterson Engineering/Consulting Emerging Energy Solutions Sean McCaffery Engineering/Consulting Enreps LLC Scott Moore Engineering/Consulting Enreps LLC Thomas Hutchison Engineering/Consulting ETC Group Glen Anderson Engineering/Consulting J Vidal Associates Jonathan Tan Engineering/Consulting J Vidal Associates RJ Visciglia Engineering/Consulting kW Engineering Jim Kelsey Engineering/Consulting Optimized Thermal Systems, Inc. -

College Scholarship Recipients

2013-2014 College Scholarship Recipients Presented by the California Grocers Association Educational Foundation CGA Educational Foundation Congratulates the 2013–2014 College Scholarship Recipients Congratulations to the 2013-14 CGA The scholarship program includes four opportunity to provide college scholarships Educational Foundation College Scholarship types of scholarships: CGAEF Funded, to deserving students.” recipients. This year, 291 scholarships Legacy, Donor, and Piggyback. The CGA Educational Foundation totaling $359,750 were awarded to CGA Educational Foundation college was created under the direction of the deserving students attending college this fall scholarships are open to high school California Grocers Association Board – which represents an $18,500 increase over seniors, college freshmen, sophomores, of Directors in 1992. Its mission is to last year’s award total. juniors, seniors and graduate students provide financial assistance to advance Beginning with a single scholarship who are dependents of employees or are the educational goals of CGA member in 1992, the Foundation has grown themselves employed by a California company employees and their dependents exponentially over the last 21 years to Grocers Association member company. and offer educational programs to advance bestow nearly 2,600 college scholarships “CGAEF scholarship donors are investing the grocery industry. totaling more than $3 million—ensuring in the development of tomorrow’s grocery For more information on the scholarship that California’s grocery employees and industry leaders,” said CGAEF Executive program, please contact Brianne Page at their dependents have the resources Director Shiloh London. “We are grateful [email protected] or necessary to start or complete their for the tremendous ongoing support of our (916) 448-3545. -

FIC-Prop-65-Notice-Reporter.Pdf

FIC Proposition 65 Food Notice Reporter (Current as of 9/25/2021) A B C D E F G H Date Attorney Alleged Notice General Manufacturer Product of Amended/ Additional Chemical(s) 60 day Notice Link was Case /Company Concern Withdrawn Notice Detected 1 Filed Number Sprouts VeggIe RotInI; Sprouts FruIt & GraIn https://oag.ca.gov/system/fIl Sprouts Farmers Cereal Bars; Sprouts 9/24/21 2021-02369 Lead es/prop65/notIces/2021- Market, Inc. SpInach FettucIne; 02369.pdf Sprouts StraIght Cut 2 Sweet Potato FrIes Sprouts Pasta & VeggIe https://oag.ca.gov/system/fIl Sprouts Farmers 9/24/21 2021-02370 Sauce; Sprouts VeggIe Lead es/prop65/notIces/2021- Market, Inc. 3 Power Bowl 02370.pdf Dawn Anderson, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02371 Sprouts Farmers OhI Wholesome Bars Lead es/prop65/notIces/2021- 4 Market, Inc. 02371.pdf Brad's Raw ChIps, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02372 Sprouts Farmers Brad's Raw ChIps Lead es/prop65/notIces/2021- 5 Market, Inc. 02372.pdf Plant Snacks, LLC; Plant Snacks Vegan https://oag.ca.gov/system/fIl 9/24/21 2021-02373 Sprouts Farmers Cheddar Cassava Root Lead es/prop65/notIces/2021- 6 Market, Inc. ChIps 02373.pdf Nature's Earthly https://oag.ca.gov/system/fIl ChoIce; Global JuIces Nature's Earthly ChoIce 9/24/21 2021-02374 Lead es/prop65/notIces/2021- and FruIts, LLC; Great Day Beet Powder 02374.pdf 7 Walmart, Inc. Freeland Foods, LLC; Go Raw OrganIc https://oag.ca.gov/system/fIl 9/24/21 2021-02375 Ralphs Grocery Sprouted Sea Salt Lead es/prop65/notIces/2021- 8 Company Sunflower Seeds 02375.pdf The CarrIngton Tea https://oag.ca.gov/system/fIl CarrIngton Farms Beet 9/24/21 2021-02376 Company, LLC; Lead es/prop65/notIces/2021- Root Powder 9 Walmart, Inc. -

Village at West Oaks HOUSTON , TEXAS

Village at West Oaks HOUSTON , TEXAS Village at West Oaks is a power center in West Houston along highly trafficked thoroughfares Westheimer RD and HW-6. LEVCOR.COM Village at West Oaks 2306 Highway 6 South • Houston, TX, 77077 Village at West Oaks is a 282,024 SF power center located in West Houston at the northwest corner of Highway 6 and Westheimer Rd, some of Houston’s largest and most traveled thoroughfares. The Village at West Oaks is anchored by Best Buy, Bed Bath & Beyond, Barnes & Nobles, Ross Dress for Less and Academy. Further, the center has ample parking (1,353 spaces) and eight curb cuts for convenient access. The immediate and surrounding area offers attractive demographics. The three and five mile population is 116,000 and 331,000 people, respectively, with an average household income of $80,000, providing a solid foundation for the trade area. West Oaks Mall (1.05mm SF) is located across the street and has undergoing a $24 million redevelopment, adding a new 14-screen Edwards Cinema and several other national retailers. MAP & GALLERY AREA DEMOGRAPHICS Population 1 mile 3 miles 5 miles Household 1 mile 3 miles 5 miles 2017 Estimate 12,620 121,810 337,066 2017 Estimate 5,316 49,555 127,357 2022 Projection 13,956 134,718 378,912 2022 Projection 5,833 54,400 141,199 2010 Census 9,846 106,247 304,271 2010 Census 4,016 41,739 111,562 Projected Annual Growth 2017-2022 2.1% 2.1% 2.5% Projected Annual Growth 2017-2022 1.9% 2.0% 2.2% Estimated Household Income 1 mile 3 miles 5 miles Traffic Counts Cars per day 2017 Average HH Income $87,608 $85,618 $73,149 Highway 6 51,000 2017 Median HH Income $67,872 $67,453 $73,149 Westheimer Rd. -

Establishment Address Score2 Inspection Date 3 Nations Brewing Co

No Food Prep - 1 inspection/year permitting PER Light Food Prep - 2 inspections/year Complaint COM Heavy Food Prep - 3-4 inspections/year updated 10/19/2020 Followup FOL Heavy Food Prep - 2-3 inspections/year consultation CON pass/fail due to pub. disaster Establishment Address Score2 Inspection Date 3 Nations Brewing Co. 1033 E VANDERGRIFF DR permitting02/25/2020 55 Degrees 1104 ELM ST temp clsd 07/14/2020 7 Degrees Ice Cream Rolls 2150 N JOSEY LN #124 95 06/22/2020 7 Leaves Café 2540 OLD DENTON RD #116 96 12/12/2019 7-Eleven 1865 E ROSEMEADE PKWY 97 01/06/2020 7-Eleven 2145 N JOSEY LN 90 02/19/2020 7-Eleven 2230 MARSH LN 92 03/10/2020 7-Eleven 2680 OLD DENTON RD 96 08/27/2020 7-Eleven 3700 OLD DENTON RD 92 02/05/2020 7-Eleven #32379 1545 W HEBRON PKWY 93 10/13/2020 7-Eleven Convenience Store #36356B 4210 N JOSEY LN 100 09/02/2020 1102 Bubble Tea & Coffee 4070 SH 121 98 10/13/2020 85C Bakery & Cafe 2540 OLD DENTON RD 91 02/18/2020 99 Pocha 1008 Mac Arthur Dr #120 95 09/16/2019 99 Ranch Market - Bakery 2532 OLD DENTON RD 92 07/21/2020 99 Ranch Market - Hot Deli 2532 OLD DENTON RD 96 07/21/2020 99 Ranch Market - Meat 2532 OLD DENTON RD 88 07/15/2020 99 Ranch Market - Produce 2532 OLD DENTON RD 88 07/15/2020 99 Ranch Market - Seafood 2532 OLD DENTON RD 90 07/21/2020 99 Ranch Market -Supermarket 2532 OLD DENTON RD 93 07/15/2020 A To Z Beer and Wine 1208 E BELT LINE RD #118 87 12/11/2019 A1 Chinese Restaurant 1927 E BELT LINE RD 91 02/11/2020 ABE Japanese Restaurant 2625 OLD DENTON RD 95 10/08/2020 Accent Foods 1617 HUTTON DR 97 02/11/2020 -

Optionalistapril2019.Pdf

Account Number Name Address City Zip Code County Signed Affidavit Returned Affidavit Option Final Notice Sent DL20768 Vons Market 1430 S Fairfax Ave Los Angeles 90019 Los Angeles 4/28/17 OPTION A 4/19/17 DL20769 Sunshine Liquor 5677 W Pico Blvd Los Angeles 90019 Los Angeles 4/25/17 OPTION A 4/19/17 DL20771 Selam Market 5534 W Pico Blvd Los Angeles 90019 Los Angeles 4/27/17 OPTION A 4/19/17 DL61442 7-Eleven Food Store 1075 S Fairfax Ave Los Angeles 90019 Los Angeles 5/8/17 OPTION A 4/19/17 DL63467 Walgreens Drug Store 5843 W Pico Blvd Los Angeles 90019 Los Angeles 5/2/17 OPTION A 4/19/17 DL141090.001 Jordan Market 1449 Westwood Blvd Los Angeles 90024 Los Angeles 7/28/14 OPTION A 7/17/14 DL220910.001 Target 10861 Weyburn Ave Los Angeles 90024 Los Angeles 12/4/14 OPTION A DL28742 7-Eleven 1400 Westwood Blvd Los Angeles 90024 Los Angeles 3/24/15 OPTION A 7/17/14 DL28743 Tochal Mini Market 1418 Westwood Blvd Los Angeles 90024 Los Angeles 7/29/14 OPTION A 7/17/14 DL28745 Bristol Farms 1515 Westwood Blvd Los Angeles 90024 Los Angeles 12/3/14 OPTION A 7/17/14 DL41783 Stop Market 958 Gayley Ave Los Angeles 90024 Los Angeles 7/21/14 OPTION A 7/17/14 DL54515 Ralphs Fresh Fare 10861 Weyburn Ave Los Angeles 90024 Los Angeles 11/24/14 OPTION A 7/17/14 DL55831 Chevron 10984 Le Conte Ave Los Angeles 90024 Los Angeles 11/24/14 OPTION A 7/17/14 DL60416 Whole Foods Market 1050 Gayley Ave Los Angeles 90024 Los Angeles 8/7/14 OPTION A 7/17/14 DL61385 CVS/pharmacy 1001 Westwood Blvd Los Angeles 90024 Los Angeles 4/23/15 OPTION A 7/17/14 DL61953 CVS/pharmacy -

Houston, Texas

MEMORIAL MANAGEMENT DISTRICT 2015 INVENTORY AND DATABASE Houston, Texas Prepared for: Prepared By: Memorial Management District 9821 Katy Freeway, Suite 180 Houston, Texas May 2015 Memorial Management District 2015 Inventory and Database Table of Contents Table of Contents ........................................................................................................................................... i Table of Exhibits ............................................................................................................................................. i Introduction and Overview ........................................................................................................................... 1 Major Employers ........................................................................................................................................... 4 Land Use ........................................................................................................................................................ 5 Land Use Maps ........................................................................................................................................... 5 Development Summary ............................................................................................................................ 10 Multi‐Family Housing ............................................................................................................................... 12 Retail Buildings ........................................................................................................................................ -

Philip Levy Offering Memorandum

PHILIP LEVY 972.755.5225 SENIOR MANAGING DIRECTOR [email protected] OFFERING MEMORANDUM Uptown Center 613 & 617 Uptown Boulevard, Cedar Hill, TX 75104 Confidentiality & Disclaimer Contents The information contained in the following Marketing Brochure is proprietary and strictly PROPERTY INFORMATION 3 confidential. It is intended to be reviewed only by the party receiving it from Marcus & Millichap and should not be made available to any other person or entity without the written consent of LOCATION INFORMATION 8 Marcus & Millichap. This Marketing Brochure has been prepared to provide summary, unverified FINANCIAL ANALYSIS 14 information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due SALE COMPARABLES 21 diligence investigation. Marcus & Millichap has not made any investigation, and makes no RENT COMPARABLES 28 warranty or representation, with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the DEMOGRAPHICS 35 property and improvements, the presence or absence of contaminating substances, PCB's or asbestos, the compliance with State and Federal regulations, the physical condition of the improvements thereon, or the financial condition or business prospects of any tenant, or any tenant’s plans or intentions to continue its occupancy of the subject property. The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable; however, Marcus & Millichap has not verified, and will not verify, any of the information contained herein, nor has Marcus & Millichap conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. -

San Antonio, Texas San Antonio Arts, Culture and Commerce

BUSINESS CARD DIE AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). SAN ANTONIO, TEXAS SAN ANTONIO ARTS, CULTURE AND COMMERCE San Antonio is a market of 2.3 million residents. Ingram Park Mall has a large trade area that serves the northwest side of the San Antonio market. — Tourism is a top-ranking industry with over 47,000 hotel rooms and more than 25 convention facilities in the market. — The area hosts 117 companies each with over 1,000 employees including USAA, H-E-B, Cullen/Frost Bankers, Inc., Valero Energy Corp., Rackspace, Inc., Wells Fargo, Baptist Health System, JP Morgan Chase & Co., Six Flags Fiesta Texas, and Southwest Research Institute. — The area also has five military bases, 15 certified colleges and universities, and 25 major hospitals. — San Antonio is home to the San Antonio Spurs, The Alamo, and the Historical Riverwalk. INGRAM PARK MALL SAN ANTONIO, TX EVOLVING OUR STYLE Easily accessible from heavily traveled Loop 410, Ingram Park Mall is situated on San Antonio’s energetic northwest side, one of the fastest growing areas of the city. — A strong, suburban super-regional center catering to families, professionals, military and millennials. — As the primary center on the west side of town, the trade area reaches over 900,000 people and has grown by more than 20% over the past decade. — Plans are underway for a comprehensive mall renovation to include new main entrances with sliding glass doors, new mall finishes, new lighting, flooring, interior graphics, and signage along with a renovated Dining Pavilion with a new dedicated entrance and enhanced restrooms.