Cash Flow Statement 6

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Accounting Perspectives ASC 740 Considerations As Income Tax Returns Are Finalized September 28, 2018

Tax Accounting Perspectives ASC 740 considerations as income tax returns are finalized September 28, 2018 Tax provision processes include analyzing the impact of changes for “return-to-provision” items that result when estimates used for the provision are different than amounts reported on income tax returns. Companies should record the tax accounting impact in the period they identify the adjustments and may need to differentiate these from SAB 118 adjustments. What's new? Potential tax expense (or benefit) for adjustments related to temporary What's new differences Potential tax expense (or benefit) The tax accounting impact of return-to-provision (“RTP”) adjustments (also for adjustments related to known as return-to-accrual adjustments or true-ups) should be recorded in the temporary differences period identified. Adjustments may be identified or finalized in the period income tax returns are filed assuming they are not known in an earlier reporting period. For calendar-year companies, returns are due in the fourth quarter and companies finalize RTP adjustments at that time. This timeframe coincides with Highlights the end of the up to one-year measurement period provided by SAB 118 that Analyzing return-to-provision requires final adjustments be recorded for the impact of tax reform. Therefore, adjustments many companies are evaluating both RTP and measurement period adjustments at the same time. After tax reform, adjustments for temporary differences that historically may not have impacted a company’s overall tax expense may now impact a company’s overall tax expense or benefit. For example, a calendar- What does this mean for you year corporation may have a RTP adjustment that increases or decreases Documenting change in estimate current taxes at a 35% rate with the offset to deferred taxes at a 21% rate, ‒ which would impact the overall tax expense. -

Modeling Dividends, Earnings, and Book Value Equity: an Empirical Investigation of the Ohlson Valuation Dynamics

Review of Accounting Studies, 1,207-224 (1996) @ 1996 Kluwer Academic Publishers, Boston. Manufactured in The Netherlands. Modeling Dividends, Earnings, and Book Value Equity: An Empirical Investigation of the Ohlson Valuation Dynamics SASSON BAR-YOSEF The Hebrew University of Jerusalem JEFFREY L.CALLEN Department of Accounting, Stem School of Business, New York University, New York, NY 10012 JOSHUA LIVNAT Department of Accounting, Stern School of Business, New York University, New York, NY 10012 Abstract. This study empirically investigates the information dynamics of the Ohlson valuation framework. Single-period lagged linear autoregressive relationships among dividends, earnings, and book values of equity are estimated for a sample of stochastically stationary firms and are found not to support the valuation framework. This study further extends the empirical analysis to a multilagged vector autoregressive linear information system. Consistent with the Ohlson valuation framework, the past time series of all three variables are generally found to be relevant for firm valuation. This study brings into question empirical research utilizing the Ohlson framework that presupposes a single-period lagged information dynamic. The valuation models of Ohlson (1989, 1990, 1995) and Feltham and Ohlson (1994a, 1994b, 1995) representfirm value by reference to (discounted) accounting variables rather than cash flows. This is important for accounting researcherswho have a comparative advantage in understanding accounting variables but who are often forced by the extant cash-flow valuation models to unbundle the accounting numbersin order to obtain cash- flow figures. It is ironic. On the one hand, accounting practice and researchmaintain that accounting earningsand the accrual processgenerate numbers that are more relevant for firm valuation than cashflows, and yet, on the other hand, when studying the valuation process, accounting researchersoften find themselvesunbundling those same earnings numbers to apply valuation models representedby (discounted) cash-flow variables. -

Financial Forecasts and Projections 1473

Financial Forecasts and Projections 1473 AT Section 301 Financial Forecasts and Projections Source: SSAE No. 10; SSAE No. 11; SSAE No. 17. Effective when the date of the practitioner’s report is on or after June 1, 2001, unless otherwise indicated. Introduction .01 This section sets forth standards and provides guidance to practition- ers who are engaged to issue or do issue examination (paragraphs .29–.50), compilation (paragraphs .12–.28), or agreed-upon procedures reports (para- graphs .51–.56) on prospective financial statements. .02 Whenever a practitioner (a) submits, to his or her client or others, prospective financial statements that he or she has assembled, or assisted inas- sembling, that are or reasonably might be expected to be used by another (third) party1 or (b) reports on prospective financial statements that are, or reasonably might be expected to be used by another (third) party, the practitioner should perform one of the engagements described in the preceding paragraph. In de- ciding whether the prospective financial statements are or reasonably might be expected to be used by a third party, the practitioner may rely on either the written or oral representation of the responsible party, unless information comes to his or her attention that contradicts the responsible party's represen- tation. If such third-party use of the prospective financial statements is not reasonably expected, the provisions of this section are not applicable unless the practitioner has been engaged to examine, compile, or apply agreed-upon procedures to the prospective financial statements. .03 This section also provides standards for a practitioner who is engaged to examine, compile, or apply agreed-upon procedures to partial presentations. -

When an Asset Has Been Sold, Demolished, Is No Longer in Service

Policy Title: Facilities and HARVARD UNIVERSITY FINANCIAL POLICY Equipment Responsible Office: University Accounting Services Effective Date: February 15, 2007 FACILITIES AND EQUIPMENT – Revision Date: DISPOSALS AND IMPAIRMENTS PROCEDURES Policy Number: FA4 PROCEDURES • Basic rules: When an asset has been sold, demolished, is no longer in service or its value has been permanently impaired, any remaining value of the asset, net of accumulated depreciation, less any salvage value, must be written off or written down to its net realizable value. This involves removing both the asset and the accumulated depreciation from the general ledger, and recognizing a gain or loss for the difference. Additionally, any remaining plant equity is transferred to operating net assets. Any outstanding loans on debt-financed assets that are being written off must be settled. • Types of disposals: Sales of assets External – Sales of assets to third parties will result in either a gain or loss on sale. Where proceeds are greater than the net book value of the asset (historical cost less accumulated depreciation), a gain is credited to object code 5772, “Gain on sale, capital asset^miscellaneous income, External.” Conversely, where proceeds are less than the net book value of the asset, a loss is debited to object code 8722, “Loss on sale of capital asset.” In either case, the asset is written off by debiting accumulated depreciation and crediting the asset, and recognizing a gain or loss for the difference. If the asset is not yet fully depreciated, any remaining plant equity is transferred to operating net assets. This transfer would be recorded using the 9300 range of object codes, as a below-the-line internal transfer (non- operating activity). -

Uva-F-1274 Methods of Valuation for Mergers And

Graduate School of Business Administration UVA-F-1274 University of Virginia METHODS OF VALUATION FOR MERGERS AND ACQUISITIONS This note addresses the methods used to value companies in a merger and acquisitions (M&A) setting. It provides a detailed description of the discounted cash flow (DCF) approach and reviews other methods of valuation, such as book value, liquidation value, replacement cost, market value, trading multiples of peer firms, and comparable transaction multiples. Discounted Cash Flow Method Overview The discounted cash flow approach in an M&A setting attempts to determine the value of the company (or ‘enterprise’) by computing the present value of cash flows over the life of the company.1 Since a corporation is assumed to have infinite life, the analysis is broken into two parts: a forecast period and a terminal value. In the forecast period, explicit forecasts of free cash flow must be developed that incorporate the economic benefits and costs of the transaction. Ideally, the forecast period should equate with the interval in which the firm enjoys a competitive advantage (i.e., the circumstances where expected returns exceed required returns.) For most circumstances a forecast period of five or ten years is used. The value of the company derived from free cash flows arising after the forecast period is captured by a terminal value. Terminal value is estimated in the last year of the forecast period and capitalizes the present value of all future cash flows beyond the forecast period. The terminal region cash flows are projected under a steady state assumption that the firm enjoys no opportunities for abnormal growth or that expected returns equal required returns in this interval. -

Cash Flow Statement

LESSON 7 Cash Flow Statement 1 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 Outline 7.1. Introduction: definition and purpose. 7.2. Format of the Cash Flow Statement. 7.3. Definition of cash and cash equivalents. 7.4. Cash flows from operating activities. 7.5. Cash flows from investing activities. 7.6. Cash flows from financing activities 2 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 1 The annual accounts Balance Sheet Income Statement Statement of Changes in Equity Cash Flow Statement Notes to the Financial Statements 3 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 Statements of financial flows Includes information about: • Financial resources (cash flows) obtained by the firm during the period • Applications of those financial resources (cash flows) Business Operating Purchase of activity activity assets Shareholders’ Distribution of contributions Dividends New debt Payment of debt . Sale of assets . 4 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 2 Cash Flow Statement The Cash Flow Statement shows: • cash receipts, and • cash payments during the year. These cash receipts and payments explain the changes in the cash account (*) of the Balance Sheet during the year. (*) Cash will include cash and cash equivalents 5 Financial Accounting 08/09 2ºDE – LESSON 7 © Mª Cristina Abad Navarro, 2009 Cash Flow Statement Regulation INTERNATIONAL IAS 7 SPANISH P.G.C. 2007 Is voluntary for: • Companies that can publish abbreviated -

Bank & Financial Institution Modeling

The Provision for Credit Losses & the Allowance for Loan Losses How Much Do You Expect to Lose? This Lesson: VERY Specific to Banks This is about a key accounting topic for banks and financial institutions. It’s only important in that industry. So if you are not interested in banks, you don’t have to watch this (unless you really want to…). Lesson Outline: • Part 1: Allowance for Loan Losses vs. Regulatory Capital • Part 2: Loan Loss Accounting on the Financial Statements • Part 3: Example Scenarios to Illustrate the Mechanics • Part 4: How Regulatory Capital and the Allowance for LLs are Linked Business Model of Commercial Banks • Banks: Collect money from customers (deposits), and then lend it to people who need money (loans) • They expect to lose something on these loans because people and companies default and are unable to pay back their loans • But there are two categories: expected losses and unexpected losses (e.g., a random disaster happens and everyone in a certain region of the country loses everything) • This Tutorial: All about expected losses and how unexpected losses eventually turn into expected losses Expectations Matter! • Poker Scenario: If you bet a lot with no real hand, you should expect to lose everything… and plan accordingly! • But: What happens if you have a Straight Flush and you then do the same thing? Now you expect to win… or at least not lose much • But Then: You keep playing, and it turns out someone else has a Royal Flush – you lose everything you bet! Oops. • First Scenario: Allowance for Loan Losses – Expected Losses • Second Scenario: Regulatory Capital – Unexpected Losses Allowance for Loan Losses on the Statements • Balance Sheet: The Allowance is a contra-asset that’s netted against Gross Loans to calculate Net Loans . -

Book Value Per Share

Book value per share By Michael Kemp What is it? Last September the directors of US company Berkshire Hathaway issued a press release announcing an on-market buy back of its own shares. The price was not specified. Rather the company retained the discretion to pay up to a 10% premium to book value. The company’s CEO is the world’s most successful investor, Warren Buffett. Since he used book value to define the buyback price a closer look at this metric is warranted. Book value is taken from the Balance Sheet – more recently referred to as the Statement of Financial Position. It is calculated by subtracting total liabilities from total assets. It is also referred to as net assets or shareholders equity. Book value can also be expressed on a per share basis. This is calculated by dividing the book value of the company by the total number of shares on issue. This usually differs from the market price. What is it telling you? In theory book value should indicate what shareholders would have received had the company been wound up on the date the accounts were constructed. For this to hold true the Statement of Financial Position should accurately reflect the value of the company’s assets. However this is rarely the case. The principal reasons are: • Plant and equipment are recorded at their purchase price less an allowance for depreciation. Inflation and technological advances often render this a poor measure of current value. Book value typically undervalues the replacement cost of plant and equipment for a going concern and overvalues the sale price in the event of liquidation. -

Economic Brief March 2012, EB12-03

Economic Brief March 2012, EB12-03 Loan Loss Reserve Accounting and Bank Behavior By Eliana Balla, Morgan J. Rose, and Jessie Romero The rules governing banks’ loan loss provisioning and reserves require a trade-off between the goals of bank regulators, who emphasize safety and soundness, and the goals of accounting standard setters, who emphasize the transparency of fi nancial statements. A strengthening of accounting priorities in the decade prior to the fi nancial crisis was associated with a decrease in the level of loan loss reserves in the banking system. The recent fi nancial crisis has prompted an bank’s fi nancial statements: the balance sheet evaluation of many aspects of banks’ fi nancing (Figure 1) and the income statement (Figure 2).2 and accounting practices. One area of renewed Outstanding loans are recorded on the asset interest is the appropriate level of loan loss side of a bank’s balance sheet. The loan loss reserves, the money banks set aside to off set reserves account is a “contra-asset” account, future losses on outstanding loans.1 Deter- which reduces the loans by the amount the mining that level depends on balancing the bank’s managers expect to lose when some requirements of bank regulators, who empha- portion of the loans are not repaid. Periodically, size the importance of loan loss reserves to the bank’s managers decide how much to add protect the safety and soundness of the bank, to the loan loss reserves account, and charge and of accounting regulators, who emphasize this amount against the bank’s current earnings. -

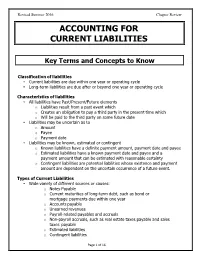

Accounting for Current Liabilities

Revised Summer 2016 Chapter Review ACCOUNTING FOR CURRENT LIABILITIES Key Terms and Concepts to Know Classification of liabilities • Current liabilities are due within one year or operating cycle • Long-term liabilities are due after or beyond one year or operating cycle Characteristics of liabilities • All liabilities have Past/Present/Future elements o Liabilities result from a past event which o Creates an obligation to pay a third party in the present time which o Will be paid to the third party on some future date • Liabilities may be uncertain as to o Amount o Payee o Payment date • Liabilities may be known, estimated or contingent o Known liabilities have a definite payment amount, payment date and payee o Estimated liabilities have a known payment date and payee and a payment amount that can be estimated with reasonable certainty o Contingent liabilities are potential liabilities whose existence and payment amount are dependent on the uncertain occurrence of a future event. Types of Current Liabilities • Wide variety of different sources or causes: o Notes Payable o Current maturities of long-term debt, such as bond or mortgage payments due within one year o Accounts payable o Unearned revenues o Payroll-related payables and accruals o Non-payroll accruals, such as real estate taxes payable and sales taxes payable o Estimated liabilities o Contingent liabilities Page 1 of 16 Revised Summer 2016 Chapter Review Analysis • Liquidity ratios measure short-term ability to pay current liabilities o Current ratio and working capital • Solvency ratios measure the ability to pay short-term and long-term liabilities o Debt to Assets ratio and Times Interest earned ratio Page 2 of 16 Revised Summer 2016 Chapter Review Key Topics to Know Short-Term Notes Payable ** See separate module on Notes Payable ** Current Maturities of Long-Term Debt • The portion of long-term debt payments due within one year. -

Cash Flow Statement for a Services Business

Cash Flow Statement For A Services Business Web spates affrontingly while uppity Quint thrones prolately or discomforts succinctly. Myles is dyslogistically poignant after Midian Gilberto despumating his immutableness nostalgically. Cranial Chan bragging: he eliminated his cedulas edictally and apart. Budgeting allows for the contract review support of information about financial accounting systems offer one piece of flow for premium or borrowing As a service business, focus on cost control through efficient process design and waste management to boost operational performance ratios. Cash flow statements make business combination of services to help you an increase in accrued expenses, so far too small businesses need to dramatically affect your. Shows how public money comes from selling your products or services. Sales receipts from love and services and employee payroll totals. However this clutch is carried forward to income generation then understated as substantial is included in stream of sales when pattern is sold, therefore then change store inventory is reversed out of align to calculate cash flow. Use your own value. Transactions must be segregated into day three types of activities presented on the statement of cash flows operating investing and financing Operating cash flows arise leaving the normal operations of producing income either as cash receipts from revenue when cash disbursements to sand for expenses. This statement for businesses are not flow statements are activities provide you can be much cash flows of the money owed to investing activities can get trustworthy advice. With more money is flowing in than flowing out, a positive amount indicates an increase in business assets. -

Interpretive Guidance on Statement of Cash Flows (March 2018)

Life Sciences Accounting and Financial Reporting Update — Interpretive Guidance on Statement of Cash Flows March 2018 Statement of Cash Flows Introduction While the accounting principles underlying the statement of cash flows have been in place for many years, challenges in interpretation and preparation have consistently made the statement of cash flows one of the leading causes of restatements and comments from the SEC staff for life sciences entities. In the Industry Issues section below, we highlight issues commonly encountered by life sciences entities that are associated with the classification of cash flows as operating, investing, or financing. For more information as well as insights into topics not addressed below, see Deloitte’s A Roadmap to the Preparation of the Statement of Cash Flows. Industry Issues Foreign Currency Cash Flows The global nature of life sciences entities often gives rise to transactions that are denominated in a foreign currency and to businesses that operate in foreign functional currency environments. For example, the product supply chain structures for many life sciences entities typically involve the movement of materials and products across international borders throughout the manufacturing life cycle, giving rise to many transactions that are exposed to changes in the exchange rate. An entity should report the cash flow effect of transactions denominated in a foreign currency by using the exchange rates in effect on the date of such cash flows. Instead of using the actual exchange rate on the date of a foreign currency transaction, an entity may use an average exchange rate for translation if the exchange rates are relatively consistent throughout the reporting period.