Credit Card Conversion

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Brands

Global Consumer 2019 List of Brands Table of Contents 1. Digital music 2 2. Video-on-Demand 4 3. Video game stores 7 4. Digital video games shops 11 5. Video game streaming services 13 6. Book stores 15 7. eBook shops 19 8. Daily newspapers 22 9. Online newspapers 26 10. Magazines & weekly newspapers 30 11. Online magazines 34 12. Smartphones 38 13. Mobile carriers 39 14. Internet providers 42 15. Cable & satellite TV provider 46 16. Refrigerators 49 17. Washing machines 51 18. TVs 53 19. Speakers 55 20. Headphones 57 21. Laptops 59 22. Tablets 61 23. Desktop PC 63 24. Smart home 65 25. Smart speaker 67 26. Wearables 68 27. Fitness and health apps 70 28. Messenger services 73 29. Social networks 75 30. eCommerce 77 31. Search Engines 81 32. Online hotels & accommodation 82 33. Online flight portals 85 34. Airlines 88 35. Online package holiday portals 91 36. Online car rental provider 94 37. Online car sharing 96 38. Online ride sharing 98 39. Grocery stores 100 40. Banks 104 41. Online payment 108 42. Mobile payment 111 43. Liability insurance 114 44. Online dating services 117 45. Online event ticket provider 119 46. Food & restaurant delivery 122 47. Grocery delivery 125 48. Car Makes 129 Statista GmbH Johannes-Brahms-Platz 1 20355 Hamburg Tel. +49 40 2848 41 0 Fax +49 40 2848 41 999 [email protected] www.statista.com Steuernummer: 48/760/00518 Amtsgericht Köln: HRB 87129 Geschäftsführung: Dr. Friedrich Schwandt, Tim Kröger Commerzbank AG IBAN: DE60 2004 0000 0631 5915 00 BIC: COBADEFFXXX Umsatzsteuer-ID: DE 258551386 1. -

Novi Načini Poslovanja Banaka Na Primjeru Zagrebačke Banke D.D

Novi načini poslovanja banaka na primjeru Zagrebačke banke d.d. Maričić, Ivan Master's thesis / Diplomski rad 2018 Degree Grantor / Ustanova koja je dodijelila akademski / stručni stupanj: University North / Sveučilište Sjever Permanent link / Trajna poveznica: https://urn.nsk.hr/urn:nbn:hr:122:771432 Rights / Prava: In copyright Download date / Datum preuzimanja: 2021-10-05 Repository / Repozitorij: University North Digital Repository SVEUČILIŠTE SJEVER SVEUČILIŠNI CENTAR VARAŽDIN DIPLOMSKI RAD br. 233/PE/2018 NOVI NAČINI POSLOVANJA BANAKA NA PRIMJERU ZAGREBAČKE BANKE D. D. Ivan Maričić Varaždin, ožujak 2018. SVEUČILIŠTE SJEVER SVEUČILIŠNI CENTAR VARAŽDIN Studij Poslovna ekonomija DIPLOMSKI RAD br. 233/PE/2018 NOVI NAČINI POSLOVANJA BANAKA NA PRIMJERU ZAGREBAČKE BANKE D. D. Student: Mentor: Ivan Maričić, 0361/336 D izv. prof. dr. sc. Ante Rončević Varaždin, ožujak 2018. Predgovor U ovom radu želi se ukazati na važnost novih tehnologija u bankarskom poslovanju koje svakodnevno mijenjaju načine poslovanja, načine komunikacije i načine razmišljanja. S jedne strane postoji tehnologija koja, htjeli to ili ne, sve više zauzima prostora u našoj svakodnevnici koju čini praktičnijom i lakšom dok s druge strane je servis bez kojeg je danas teško zamisliti bilo kakav razvoj ili proces, servis koji nije vidljiv, a svi ovisimo o njemu – bankarski servis. Ovaj rad na temu Novi načini poslovanja banaka na primjeru Zagrebačke banke d.d. ukazati će koje su to nove tehnologije u primjeni, što se to promjenilo, čega nije bilo prije i što je ili će biti u novom poslovanju banaka, odnosno Zagrebačke banke d.d.. Sažetak Četvrta industrijska revolucija (Industrija 4.0) ili integrirana industrija internet stvari i internet usluga postaje sastavni dio poslovanja svakog poduzeća. -

The Future of Digital Payments

March | April 2016 | paymentscardsandmobile.com in this issue Card Notes The changing global risks landscape in 2016 Real-time payments The need for speed Issuing & acquiring The future of the merchant payment ecosystem Contactless How UK payment habits The future of compare internationally digital payments The payments landscape beyond 2016 Let’s shape your future Enter the customer-centric digital world Merchant Services & Terminals Leveraging the customer engagement Mobility & eTransactional Services Enabling strategic digital transformation Financial Processing & Software Licensing Combining Innovation and Agility with Industrial payment processing Visit us at Money 2020 Europe 2016 Booth #A14 worldline.com Let’s shape your future Enter the customer-centric digital world www.paymentscm.com March | April 2016 Volume 8, Number 2 Editor-in-chief and publisher Alexander Rolfe Merchant Services Tel +44 1263 711 800 & Terminals [email protected] Editor If it ain’t digital and it ain’t fast, don’t bother! Leveraging Joyrene Thomas the customer Tel +44 1263 711 800 engagement [email protected] In this issue of PCM we acknowledge that three years in the Contributors payments industry is a very long time. The first findings of the Digital Joyrene Thomas Payments Report show just how far we have moved as an industry Head of Business Development and how the once-great have fallen. Wendy Sanders Tel +44 1263 711 801 In particular it is clear from the report that the once-strong and influential mobile Fax +44 1263 456 100 network operators have fallen from prominence in the digital wallet space and are [email protected] largely seen as being irrelevant in the conversation. -

Payment and Settlement Systems of the Bank for International Settlements and the International Organization of Securities Commissions

The Central Bank of the Russian Federation Payment and Settlement PSS Systems Analysis and Statistics No. 41 The National Payment System in 2012 2013 © The Central Bank of the Russian Federation, 2007 107016 Moscow, Neglinnaya St., 12 Prepared by the Bank of Russia National Payment System Department E-mail: [email protected] The survey was prepared for print by the Periodicals Division of the Bank of Russia Press Service The survey is available on the Bank of Russia website at: http://www.cbr.ru THE NATIONAL PAYMENT SYSTEM IN 2012 ANALYSIS AND STATISTICS – No. 41. 2013 Contents INTRODUCTION .............................................................................................................................7 CHAPTER I. PAYMENT SYSTEMS .....................................................................................................9 I.1. Payment systems registered by the Bank of Russia ............................................................10 Box 1. Payment systems’ importance criteria ........................................................10 Box 2. The National Settlement Depository ............................................................12 I.2. The Bank of Russia Payment System ................................................................................19 I.2.1. Functionality and services provided by the Bank of Russia .........................................19 I.2.2. Interaction with the Federal Treasury and other federal executive bodies ....................23 I.2.3. Quantitative and qualitative characteristics of -

10 Things You Can Do to Avoid Fraud Credit Builder Loans

MoneyLineLine 10 THINGS YOU CAN DO TO AVOID FRAUD CREDIT BUILDER LOANS EMBRACE OUR eSERVICES JULY 2020 PHILADELPHIA FEDERAL CREDIT UNION If you spot a scam, report it at ftc.gov/ complaint. Your reports help the FTC and other law 10 THINGS YOU CAN DO TO AVOID FRAUD enforcement investigate scams and bring crooks Crooks use clever schemes to defraud millions of people every year. ! to justice. They often combine new technology with old tricks to get people to send money or give out personal information. Here are some practical tips to help you stay a step ahead. Spot imposters. Scammers often pretend to be someone you trust, like a government official, a family member, a charity or a 1 company you do business with. Don’t send money or give out personal information in response to an unexpected request – whether it comes as a text, a phone call or an email. Consider how you pay. Credit cards have significant fraud Do online searches. Type a company or product name into protection built in, but some payment methods don’t. Wiring your favorite search engine with words like “review,” “complaint” 5 money through services like Western Union or MoneyGram 2 or “scam.” Or search for a phrase that describes your situation, is risky because it’s nearly impossible to get your money back. like “IRS call.” You can even search for phone numbers to see That’s also true for reloadable cards (like MoneyPak or Reloadit) if other people have reported them as scams. and gift cards (like iTunes or Google Play). -

LG V60 Thinq 5G

ENGLISH USER GUIDE LM-V600VM OS: Android™ 11 Copyright ©2021 LG Electronics Inc. All rights reserved. MFL71797801 (1.0) www.lg.com Important Customer Information 1 Before you begin using your new phone Included in the box with your phone are separate information leaflets. These leaflets provide you with important information regarding your new device. Please read all of the information provided. This information will help you to get the most out of your phone, reduce the risk of injury, avoid damage to your device, and make you aware of legal regulations regarding the use of this device. It’s important to review the Product Safety and Warranty Information guide before you begin using your new phone. Please follow all of the product safety and operating instructions and retain them for future reference. Observe all warnings to reduce the risk of injury, damage, and legal liabilities. 2 Table of Contents Important Customer Information...............................................1 Table of Contents .......................................................................2 Feature Highlight ........................................................................5 Camera features ................................................................................................... 5 Audio recording features ....................................................................................10 LG Pay ..................................................................................................................12 Google Assistant .................................................................................................14 -

REAPCHAIN.Inc Contents

REAPCHAIN.Inc Contents 1. Abstract 03 2. ReapPay Business Overview 04 2-1. Overview and status of the simple payment/remittance market 2-2. Simple payment/remittance market technology overview 2-3. Necessity of ReapPay 3. Definition of service (business) content and technology 11 3-1. O2O platform service - ReapPay / ReapPick / ReapOrder 3-2. O2O platform additional service - Integrated settlement and sales omission prevention service/ Next day payout (pre-settlement) service/Customized advertisement (Push) service 3-3. Cryptocurrency deposit and microloan service 3-4. Overseas simple payment and remittance service 4. ReapPay Ecosystem 23 4-1. ReapPay Ecosystem 4-2. Use of ReapPay for Pay 4-3. Business and revenue model 4-4. ReapPay Reward Policy 5. Target market and entry strategy 28 5-1. Global market status 5-2. Chinese market analysis and commercialization strategy 5-3. Detailed strategy for entering China - Establishment of foreign-funded companies and partnerships with local companies 6. Expected Sales and Profitability 34 6-1. Expected sales and profits according to the strategy to enter China 6-2. Expected domestic sales and revenue 1. Abstract 1. Abstract With the development of digital technology and various changes in the financial system, we are now living in a society where mobile payments such as Internet banking, Samsung Pay, and Alipay are common. However, the modern financial system has various side effects such as security, information cost, transaction stability, and maintenance cost due to its centralized system, and enormous technical and cost matters must be maintained and built. In other words, since the current financial payment system consists of a complex network that is organically coupled with each other, such as various institutions and companies, it is necessary to build a payment system that is compatible with each other, an authentication system for internal information exchange, and a messaging network. -

Rodzaje I Systemy Płatności Elektronicznych

Zygmunt Mazur, Hanna Mazur, Teresa Mendyk-Krajewska Rodzaje i systemy płatności elektronicznych Ekonomiczne Problemy Usług nr 122, 329-338 2016 Ekonomiczne Problemy Usług nr 122 ISSN: 1896-382X | www.wnus.edu.pl/pl/edu/ DOI: 10.18276/epu.2016.122-31 | strony: 331-340 ZYGMUNT MAZUR, HANNA MAZUR, TERESA MENDYK-KRAJEWSKA Politechnika Wrocławska1 RODZAJE I SYSTEMY PŁATNOŚCI ELEKTRONICZNYCH Streszczenie Realizowanie płatności drogą elektroniczną jest coraz bardziej popularne. Żadne obawy, negatywne przykłady i słowa krytyki nie są już w stanie powstrzymać upo wszechniania się tej formy rozliczeń. Celem artykułu jest przedstawienie aktualnego stanu w zakresie płatności elektronicznych - metod i form płatności, ich popularności, zagrożeń i kierunków rozwoju. Słowa kluczowe: e-płatność, bezpieczeństwo, transakcja elektroniczna. Wprowadzenie Zmiany technologiczne w teleinformatyce, prognozowane przez ekspertów od kilku lat, odmieniły sposób funkcjonowania przedsiębiorstw i obywateli w różnych obszarach. Przemiany te są niezwykle rozległe i dynamiczne. Wiele usług oferowa nych dawniej jako innowacyjne i początkowo o marginalnym znaczeniu - w krót kim czasie stało się dominującymi, a nawet zastąpiło ich dotychczasowe formy. Na przykład ogromną popularnością cieszy się dziś komunikacja za pomocą poczty elektronicznej i SMS-ów, a na uczelniach indeksy elektroniczne zastąpiły tradycyj ne indeksy papierowe1 2. Szeroka gama usług elektronicznych, pomimo rosnącej popularności, nie wyparła całkowicie form tradycyjnych, np. bankowość elektro niczna (ang. e-banking)3, wprowadzona w USA w postaci bankomatów w 1964 r. 1 Wydział Informatyki i Zarządzania, Katedra Informatyki. 2 Elektroniczne indeksy wprowadzono w Szwecji ponad 30 lat temu; indeksy papierowe są w Europiejeszcze w Polsce, Czechach, na Białorusi, Słowacji i Ukrainie (Szpecht 2009). 3 Usługi oferowane przez banki za pomocą urządzeń elektronicznych, w tym bankomaty, wpłatomaty, komputery, telefony, których podstawąjest elektroniczna wymiana danych. -

The Crucial Combination

September 2016 Issue 535 www.cardsinternational.com THE CRUCIAL COMBINATION Cards International talks to NCR, Wincor Nixdorf and the ATMIA on ATMs • M&A: VocaLink • TECHNOLOGY: Transparency • COUNTRY SURVEYS: New Zealand, South Korea and Ukraine • GUEST COMMENTS: myPINpad & Collinson Group CI 535.indd 1 27/09/2016 15:37:46 Multichannel digital solutions for fi nancial services providers To fi nd out more about us please visit: www.intelligentenvironments.com Intelligent Environments is an international provider of innovative mobile and online solutions for fi nancial services providers. Our mission is to enable our clients to always stay close to their own customers. We do this through Interact®, our single software platform, which enables secure customer acquisition, engagement, transactions and servicing across any mobile and online channel and device. Today these are predominantly focused on smartphones, PCs and tablets. However Interact® will support other devices, if and when they become mainstream. We provide a more viable option to internally developed technology, enabling our clients with a fast route to market whilst providing the expertise to manage the complexity of multiple channels, devices and operating systems. Interact® is a continuously evolving technology that ensures our clients keep pace with the fast moving digital landscape. We are immensely proud of our achievements, in relation to our innovation, our thought leadership, our industrywide recognition, our demonstrable product differentiation, the diversity of our client base, and the calibre of our partners. For many years we have been the digital heart of a diverse range of fi nancial services providers including Atom Bank, Generali Wealth Management, HRG, Ikano Retail Finance, Lloyds Banking Group and Think Money Group. -

Go Wireless and Walletless Stay Connected with Teller

MoneyLine GO WIRELESS AND WALLETLESS Learn more Bank your way on your time with PFCU’s • Transfer funds to yourself, another PFCU about how to digital services. Whether you want to deposit member or almost anyone. use digital a check from home or pay for groceries wallets at The Philadelphia FCU Mobile app is available with your phone, mobile banking and digital pfcu.com. for download in the Apple App Store and wallets are here to help. Google Play Store. ACCESS ACCOUNTS WHENEVER, WHEREVER! Take care of your finances wherever you have LEAVE YOUR WALLET AT HOME an internet connection with the Philadelphia Have you tried digital wallets yet? By FCU Mobile app. Using your smartphone adding your credit or debit card information or tablet you can: to a smart device, you can make payments • Deposit checks using your device’s camera. without using a physical card. Features • Get cash back rewards. include: • Locate the nearest PFCU branch or ATM. • Accepted at millions of retail locations • Pay bills (such as your rent, electricity worldwide. and credit card bills) from one • Compatible with most modern smartphones convenient location. and smartwatches. • Receive daily alerts for low balances, • Financial information is encrypted, offering You can connect your PFCU credit or debit large purchases and more. additional security over traditional cards. card to any devices with Apple Pay, Google • Securely view account balances and • Pay in-store by waving your device above Pay, Samsung Pay, LG Pay, Fitbit Pay or transaction history. the payment terminal – no contact required! Garmin Pay. Save Time with Online Account Opening STAY CONNECTED WITH TELLER NET Are your finances keeping up with you? accounts and handle most of your financial Pay bills. -

The Evolution of Digital and Mobile Wallets August 2016

The Evolution of Digital and Mobile Wallets August 2016 The Evolution of Digital and Mobile Wallets AUGUST 2016 © 2016 Mahindra Comviva. All rights reserved. Reproduction of this report by any means is strictly prohibited. 1 The Evolution of Digital and Mobile Wallets August 2016 TABLE OF CONTENTS THE DIGITAL WALLET: INTRODUCTION .......................................................................................................... 3 DEFINING THE DIGITAL WALLET ................................................................................................. 4 DIGITAL WALLET DELIVERY TECHNOLOGIES ............................................................................... 5 ECONOMICS AND GROWTH POTENTIAL..................................................................................... 7 THE EVOLUTION OF DIGITAL WALLETS ........................................................................................................... 8 ONLINE ACCEPTANCE MODELS ................................................................................................... 8 REDUCING FRICTION: SIMPLE IS BETTER .................................................................................... 9 ACCEPTANCE OF MOBILE WALLETS .......................................................................................... 10 EVOLUTION OF THE MOBILE WALLET SPACE ........................................................................... 12 THE BLENDED DIGITAL/MOBILE WALLET .................................................................................. 13 REGIONAL -

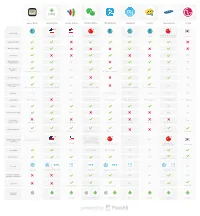

Apple Wallet Android Pay Google Wallet Mywallet Pass2u Wechat

Apple Wallet Android Pay Google Wallet WeChat Wallet AliPay Wallet MyWallet Pass2U Samsung Pay LG Pay Availability China, Hong Kong & China, HK, USA, UK, Singapore, Global USA , Australia, USA Only Global Global Global South Korea Singapore South Africa South Korea, Australia, Spain Support in China NFC Tap to Pay Scan to Pay N/A GPS Lockscreen N/A Notifications N/A Time Based N/A N/A Alerts N/A Event tickets, boarding passes No image customization Push Messages N/A N/A Support Bluetooth N/A N/A Beacons N/A Lockscreen Notifications Lockscreen Notifications Content Delivery by Shake Lockscreen Notifications Lockscreen Notifications Barcode 1D & 2D 1D & 2D N/A 2D 1D, 2D & Sound Wave 1D & 2D 1D & 2D 1D & 2D N/A Localization 35 Languages N/A 20 Languages 4 Languages 35 Languages 35 Languages 4 Languages 1 Language Ad-Free N/A N/A Link to Partner App N/A N/A N/A Server Side N/A Asset Storage Not Required Google Servers Not Required WeChat Servers AliPay Servers Not Required Not Required Not Required Mobile Payment Apple Pay Android Pay Google Wallet Card WeChat Payment AliPay Server Samsung Pay White Card China, HK, UK, USA, Japan, USA, UK, Canada, Australia, Canada, Australia, Europe, Payment Supporting Spain, Singapore, HK, China N/A N/A Countries New Zealand, Korea, and some international banks USA , Australia, USA Only China, HK, Macao, Taiwan China, HK, USA, China South Korea, Spain South Korea Pay In-App N/A API for Apps API for Apps N/A N/A Pay In-Store N/A N/A Only Support for Latest Devices All LG Smartphones Security N/A N/A Fingerprint ID Fingerprint ID, Password PIN Password Fingerprint ID, Password PIN Fingerprint ID, PIN Money transfers N/A N/A N/A between individuals Cash Out N/A N/A Google Wallet Card Money Transfers Money Transfers White Card Operating System iOS Android Android iOS and Android iOS and Android Android Android Android Android.