The Evolution of Digital and Mobile Wallets August 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Terms and Conditions for Mobilepay for Businesses

TERMS AND CONDITIONS FOR MOBILEPAY FOR BUSINESSES Effective from 12 December 2016 MobilePay by Danske Bank® for Businesses (in These Terms and Conditions for MobilePay for A1. Changes to terms and conditions Businesses are divided into five sections: the following "MobilePay for Businesses") Danske Bank reserves the right to change Section A describes the general conditions consists of various payment solutions which these Terms and Conditions at any time for payment solutions and services can be used by the business for receiving and without notice. We will notify your business of Section B describes MobilePay Business requesting payments from users of MobilePay any changes by letter or electronically (by e- Section C describes MobilePay AppSwitch by Danske Bank® (in the following mail or notification in your eArchive in the Section D describes MobilePay Point of "MobilePay"). The payment solutions are online administration system, for example). Sale referred to as solutions and are described in Section E describes MobilePay Bonus more detail in the individual sections. A2. Commercial purposes etc. Section F describes MobilePay Memberships The business may also get access to services A2.1. Commercial purposes Sectiopn G describes the general which are not payment solutions, but are MobilePay for Businesses may be used for conditions for online administration of associated with MobilePay for Businesses. commercial purposes only. Any information MobilePay payment solutions and services These services are described in more detail in obtained is strictly for your business's own the sections on the individual solutions. use. Information may not be disclosed to any In addition to these Terms and Conditions, the third party. -

Industry Perspectives on Mobile/Digital Wallets and Channel Convergence

Mobile Payments Industry Workgroup (MPIW) December 3-4, 2014 Meeting Report Industry Perspectives on Mobile/Digital Wallets and Channel Convergence Elisa Tavilla Payment Strategies Industry Specialist Federal Reserve Bank of Boston March 2015 The author would like to thank the speakers at the December meeting and the members of the MPIW for their thoughtful comments and review of the report. The views expressed in this paper are solely those of the author and do not reflect official positions of the Federal Reserve Bank of Boston, the Federal Reserve Bank of Atlanta, or the Federal Reserve System. I. Introduction The Federal Reserve Banks of Boston and Atlanta1 convened a meeting of the Mobile Payments Industry Workgroup (MPIW) on December 3-4, 2014 to discuss (1) different wallet platforms; (2) how card networks and other payment service providers manage risks associated with converging digital and mobile channels; and (3) merchant strategies around building a mobile payment and shopping experience. Panelists considered how the mobile experience is converging with ecommerce and what new risks are emerging. They discussed how EMV,2 tokenization,3 and card-not-present (CNP)4 will impact mobile/digital wallets and shared their perspectives on how to overcome risk challenges in this environment, whether through tokenization, encryption, or the use of 3D Secure.5 MPIW members also discussed how various tokenization models can be supported in the digital environment, and the pros and cons of in-app solutions from both a merchant and consumer perspective. With the broad range of technologies available in the marketplace, merchants shared perspectives on how to address the emergence of multiple wallets and the expansion of mobile/digital commerce. -

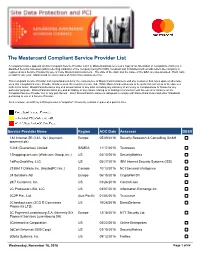

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Arvato Payments Review Essential Insights for E-Commerce Success in New Markets

Arvato Payments Review Essential insights for e-commerce success in new markets Cross-border e-commerce is opening up a We examined more than 200 primary sources and compiled the most essential information into a convenient guide to each country. world of opportunities for retailers. You can By combining the figures from a wide variety of research, we could reach out to dozens of new markets, and provide a holistic view – rather than relying on a single source. find millions of new customers. E-commerce Each country guide looks at key demographics and financials, the top also puts a world of choice in the hands online retailers, legal requirements, and consumer behaviour and expectations when it comes to things like delivery and returns. We of consumers, who think nothing of going also look in detail at how consumers prefer to pay in each market, identifying local payment heroes and the optimal mix of payment abroad to find what they want. They might be methods. looking for a better price, a better selection As well as success factors, it is also important to understand the or better service. Give them what they want, downsides. We take a close look at risks in each country in terms of the and the world is yours. types of fraud that can emerge and what you can do to minimise your exposure. But you need to know what you are getting into. The consumers in your new markets can behave completelydifferently to the ones In addition to the country guides, you can also compare markets in you know from home. -

List of Brands

Global Consumer 2019 List of Brands Table of Contents 1. Digital music 2 2. Video-on-Demand 4 3. Video game stores 7 4. Digital video games shops 11 5. Video game streaming services 13 6. Book stores 15 7. eBook shops 19 8. Daily newspapers 22 9. Online newspapers 26 10. Magazines & weekly newspapers 30 11. Online magazines 34 12. Smartphones 38 13. Mobile carriers 39 14. Internet providers 42 15. Cable & satellite TV provider 46 16. Refrigerators 49 17. Washing machines 51 18. TVs 53 19. Speakers 55 20. Headphones 57 21. Laptops 59 22. Tablets 61 23. Desktop PC 63 24. Smart home 65 25. Smart speaker 67 26. Wearables 68 27. Fitness and health apps 70 28. Messenger services 73 29. Social networks 75 30. eCommerce 77 31. Search Engines 81 32. Online hotels & accommodation 82 33. Online flight portals 85 34. Airlines 88 35. Online package holiday portals 91 36. Online car rental provider 94 37. Online car sharing 96 38. Online ride sharing 98 39. Grocery stores 100 40. Banks 104 41. Online payment 108 42. Mobile payment 111 43. Liability insurance 114 44. Online dating services 117 45. Online event ticket provider 119 46. Food & restaurant delivery 122 47. Grocery delivery 125 48. Car Makes 129 Statista GmbH Johannes-Brahms-Platz 1 20355 Hamburg Tel. +49 40 2848 41 0 Fax +49 40 2848 41 999 [email protected] www.statista.com Steuernummer: 48/760/00518 Amtsgericht Köln: HRB 87129 Geschäftsführung: Dr. Friedrich Schwandt, Tim Kröger Commerzbank AG IBAN: DE60 2004 0000 0631 5915 00 BIC: COBADEFFXXX Umsatzsteuer-ID: DE 258551386 1. -

How Mpos Helps Food Trucks Keep up with Modern Customers

FEBRUARY 2019 How mPOS Helps Food Trucks Keep Up With Modern Customers How mPOS solutions Fiserv to acquire First Data How mPOS helps drive food truck supermarkets compete (News and Trends) vendors’ businesses (Deep Dive) 7 (Feature Story) 11 16 mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved TABLEOFCONTENTS 03 07 11 What’s Inside Feature Story News and Trends Customers demand smooth cross- Nhon Ma, co-founder and co-owner The latest mPOS industry headlines channel experiences, providers of Belgian waffle company Zinneken’s, push mPOS solutions in cash-scarce and Frank Sacchetti, CEO of Frosty Ice societies and First Data will be Cream, discuss the mPOS features that acquired power their food truck operations 16 23 181 Deep Dive Scorecard About Faced with fierce eTailer competition, The results are in. See the top Information on PYMNTS.com supermarkets are turning to customer- scorers and a provider directory and Mobeewave facing scan-and-go-apps or equipping featuring 314 players in the space, employees with handheld devices to including four additions. make purchasing more convenient and win new business ACKNOWLEDGMENT The mPOS Tracker™ was done in collaboration with Mobeewave, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the findings presented, as well as the methodology and data analysis. mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved February 2019 | 2 WHAT’S INSIDE Whether in store or online, catering to modern consumers means providing them with a unified retail experience. Consumers want to smoothly transition from online shopping to browsing a physical retail store, and 56 percent say they would be more likely to patronize a store that offered them a shared cart across channels. -

Novi Načini Poslovanja Banaka Na Primjeru Zagrebačke Banke D.D

Novi načini poslovanja banaka na primjeru Zagrebačke banke d.d. Maričić, Ivan Master's thesis / Diplomski rad 2018 Degree Grantor / Ustanova koja je dodijelila akademski / stručni stupanj: University North / Sveučilište Sjever Permanent link / Trajna poveznica: https://urn.nsk.hr/urn:nbn:hr:122:771432 Rights / Prava: In copyright Download date / Datum preuzimanja: 2021-10-05 Repository / Repozitorij: University North Digital Repository SVEUČILIŠTE SJEVER SVEUČILIŠNI CENTAR VARAŽDIN DIPLOMSKI RAD br. 233/PE/2018 NOVI NAČINI POSLOVANJA BANAKA NA PRIMJERU ZAGREBAČKE BANKE D. D. Ivan Maričić Varaždin, ožujak 2018. SVEUČILIŠTE SJEVER SVEUČILIŠNI CENTAR VARAŽDIN Studij Poslovna ekonomija DIPLOMSKI RAD br. 233/PE/2018 NOVI NAČINI POSLOVANJA BANAKA NA PRIMJERU ZAGREBAČKE BANKE D. D. Student: Mentor: Ivan Maričić, 0361/336 D izv. prof. dr. sc. Ante Rončević Varaždin, ožujak 2018. Predgovor U ovom radu želi se ukazati na važnost novih tehnologija u bankarskom poslovanju koje svakodnevno mijenjaju načine poslovanja, načine komunikacije i načine razmišljanja. S jedne strane postoji tehnologija koja, htjeli to ili ne, sve više zauzima prostora u našoj svakodnevnici koju čini praktičnijom i lakšom dok s druge strane je servis bez kojeg je danas teško zamisliti bilo kakav razvoj ili proces, servis koji nije vidljiv, a svi ovisimo o njemu – bankarski servis. Ovaj rad na temu Novi načini poslovanja banaka na primjeru Zagrebačke banke d.d. ukazati će koje su to nove tehnologije u primjeni, što se to promjenilo, čega nije bilo prije i što je ili će biti u novom poslovanju banaka, odnosno Zagrebačke banke d.d.. Sažetak Četvrta industrijska revolucija (Industrija 4.0) ili integrirana industrija internet stvari i internet usluga postaje sastavni dio poslovanja svakog poduzeća. -

Is Payment Tokenization Ready for Primetime?

Is Payment Tokenization Ready for Primetime? Perspectives from Industry Stakeholders on the Tokenization Landscape Marianne Crowe and Susan Pandy, Federal Reserve Bank of Boston David Lott, Federal Reserve Bank of Atlanta Steve Mott, BetterBuyDesign June 11, 2015 Marianne Crowe is Vice President and Susan Pandy is Director in the Payments Strategies Group at the Federal Reserve Bank of Boston. David Lott is a Payments Risk Expert in the Retail Payments Risk Forum at the Federal Reserve Bank of Atlanta. Steve Mott is the Principal of BetterBuyDesign. The views expressed in this paper are solely those of the authors and do not reflect official positions of the Federal Reserve Banks of Atlanta or Boston or the Federal Reserve System. Mention or display of a trademark, proprietary product or firm in this report does not constitute an endorsement or criticism by the Federal Reserve Bank of Boston or the Federal Reserve System and does not imply approval to the exclusion of other suitable products or firms. The authors would like to thank members of the MPIW and other industry stakeholders for their engagement and contributions to this report. Table of Contents I. Executive Summary ................................................................................................................. 3 II. Introduction .............................................................................................................................. 4 III. Overview of Tokenization ...................................................................................................... -

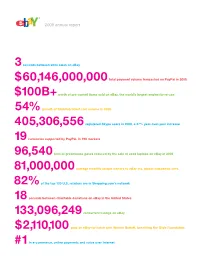

View Annual Report

To Our Stockholders, In 2008, we embraced a tremendous amount of fundamental change against the backdrop of a deteriorating external market and economy. Even with the challenges, we exited the year a stronger company and remain a leader in e-commerce, payments and Internet voice communications. Our performance for the full year not only reflects the strength of our portfolio, but also the operating discipline, strategic clarity and focus with which our management team is leading the company going forward. Financially, the company had a good year, marked by strong revenue growth, stronger EPS growth and excellent free cash flow. Despite the extremely challenging economic environment in 2008 – including a slowdown in global e-commerce, a strengthening dollar, and declining interest rates – we delivered $8.5 billion in revenues, an 11 percent increase from the prior year, and $1.36 of diluted EPS. We also delivered a solid operating margin of 24 percent. The size of the eBay marketplace continues to be the largest in the world with nearly $60 billion of gross merchandise volume (the total value of goods sold in all of our Marketplaces) in 2008. PayPal continues to experience strong growth, both on eBay and across e-commerce, and Skype had a great year, growing both revenues and user base. In addition, we strengthened our portfolio by investing in the growth of our emerging businesses and through key acquisitions. In 2008, advertising, global classifieds and StubHub, the leading online tickets marketplace, all gained momentum in terms of revenues. Key acquisitions we made during the year will help us build on our strengths. -

Paypal Welneteller.Com Neteller.Com Member.Neteller.Com

List of websites compiled from browser history, categorized by area of interest: FINANCE GAMBLING E-COMMERCE DATING OTHER paypal pokerstars store.apple.com cupid.com whoer.net welneteller.com unibet.com newegg.com zoosk steampowered.com neteller.com LuckyAcePoker.com bestbuy.com meetic yahoo.com member.neteller.com fulltiltpoker.com amazon.com match.com gmail.com moneybookers.com www.parispokerclub.fr ebay meetme.com mail.google.com webmoney.ru partypoker.com bhphotovideo.com date.com indeed.com westernunion poker.770.com swiftunlocks.com sendspace.com wellsfargo.com 770.com target.com hotmail.com coinbase.com 770poker.com airbnb.com skype.com perfectmoney.com bwin.com walmart adwords.google.com liqpay.com betfair.com lowes airbnb.com payeer.com 32redpoker.com qvc.com datehookup.com entropay.com amateurmatch.com sears.com open24.ie suntrust.com titanpoker.com business.att.com aib.ie skrill.com ipoker.com ebillplace.com ups.com paysurfer.com bet365.com capitalone.com starbucks chase.com 888poker.com verizonwireless.com craiglist.org chaseonline.chase.com www.fulltilt.eu att.com exoclick.com money.yandex.ru 188bet.com barclaycardus.com plugrush.com qiwi.com leonbets.net leaseville.com zeropark.com paysafecard.com paysurfer.com officedepot.com juicyads.com sportingbet.ru sprint.com popads.net sportingbet.com verizon.com expedia.com betsson.no vzw.com expedia.no williamhill.com northskull.com expedia.se bwin.es keller-sports.de accurint.com bwin.com farfetch.com kohls.com netbet.co.uk playerauctions.com hottopic.com netbet.com circle.com pacmall.net paddypower.com. -

How People Pay Australia to Brazil

HowA BrandedPay™ StudyPeople of Multinational Attitudes Pay Around Shopping, Payments, Gifts and Rewards Contents 01 Introduction 03 United States 15 Canada 27 Mexico 39 Brazil 51 United Kingdom 63 Germany 75 Netherlands 87 Australia 99 Changes Due to COVID-19 This ebook reflects the findings of online surveys completed by 12,009 adults between February 12 and March 17, 2020. For the COVID-19 addendum section, 1,096 adults completed a separate online survey on May 21, 2020. Copyright © 2020 Blackhawk Network. There are also some trends that are impossible to ignore. Shopping and making payments through entirely digital channels is universal and growing, from How People Pay Australia to Brazil. A majority of respondents in every region say that they shop online more often than they shop in stores. This trend is most pronounced in younger generations and in Latin American countries, but it’s an essential fact Our shopping behaviors are transforming. How people shop, where they shop and across all demographic groups and in every region. how they pay are constantly in flux—and the trends and patterns in those changes reveal a lot about people. After all, behind all of the numbers and graphs are the In the rest of this BrandedPay report, you’ll find a summary and analysis of trends people. People whose varied tastes, daily lives and specific motivations come in each of our eight surveyed regions. We also included a detailed breakdown of together to form patterns and trends that shape global industries. how people in that region answered the survey, including any traits specific to that region. -

2021 Prime Time for Real-Time Report from ACI Worldwide And

March 2021 Prime Time For Real-Time Contents Welcome 3 Country Insights 8 Foreword by Jeremy Wilmot 3 North America 8 Introduction 3 Asia 12 Methodology 3 Europe 24 Middle East, Africa and South Asia 46 Global Real-Time Pacific 56 Payments Adoption 4 Latin America 60 Thematic Insights 5 Glossary 68 Request to Pay Couples Convenience with the Control that Consumers Demand 5 The Acquiring Outlook 5 The Impact of COVID-19 on Real-Time Payments 6 Payment Networks 6 Consumer Payments Modernization 7 2 Prime Time For Real-Time 2021 Welcome Foreword Spurred by a year of unprecedented disruption, 2020 saw real-time payments grow larger—in terms of both volumes and values—and faster than anyone could have anticipated. Changes to business models and consumer behavior, prompted by the COVID-19 pandemic, have compressed many years’ worth of transformation and digitization into the space of several months. More people and more businesses around the world have access to real-time payments in more forms than ever before. Real-time payments have been truly democratized, several years earlier than previously expected. Central infrastructures were already making swift For consumers, low-value real-time payments mean Regardless of whether real-time schemes are initially progress towards this goal before the pandemic immediate funds availability when sending and conceived to cater to consumer or business needs, intervened, having established and enhanced real- receiving money. For merchants or billers, it can mean the global picture is one in which heavily localized use time rails at record pace. But now, in response to instant confirmation, settlement finality and real-time cases are “the last mile” in the journey to successfully COVID’s unique challenges, the pace has increased information about the payment.