Fund Asset Class Ticker Security Name CUSIP Number Shares/Par

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report of the Tui Group 2019 2019 Annual Report of the Tui Group 2019 Financial Highlights

ANNUAL REPORT OF THE TUI GROUP 2019 2019 ANNUAL REPORT OF THE TUI GROUP THE OF REPORT ANNUAL 2019 FINANCIAL HIGHLIGHTS 2019 2018 Var. % Var. % at adjusted constant € million currency Turnover 18,928.1 18,468.7 + 2.5 + 2.7 Underlying EBITA1 Hotels & Resorts 451.5 420.0 + 7.5 – 4.9 Cruises 366.0 323.9 + 13.0 + 13.2 Destination Experiences 55.7 45.6 + 22.1 + 20.4 Holiday Experiences 873.2 789.5 + 10.6 + 3.6 Northern Region 56.8 278.2 – 79.6 – 77.1 Central Region 102.0 94.9 + 7.5 + 7.0 Western Region – 27.0 124.2 n. a. n. a. Markets & Airlines 131.8 497.3 – 73.5 – 72.2 All other segments – 111.7 – 144.0 + 22.4 + 18.5 TUI Group 893.3 1,142.8 – 21.8 – 25.6 EBITA2, 3 768.4 1,054.5 – 27.1 Underlying EBITDA3, 4 1,359.5 1,554.8 – 12.6 EBITDA3, 4 1,277.4 1,494.3 – 14.5 EBITDAR3, 4, 5 1,990.4 2,215.8 – 10.2 Net profi t for the period 531.9 774.9 – 31.4 Earnings per share3 in € 0.71 1.17 – 39.3 Equity ratio (30 Sept.)6 % 25.6 27.4 – 1.8 Net capex and investments (30 Sept.) 1,118.5 827.0 + 35.2 Net debt / net cash (30 Sept.) – 909.6 123.6 n. a. Employees (30 Sept.) 71,473 69,546 + 2.8 Diff erences may occur due to rounding. This Annual Report 2019 of the TUI Group was prepared for the reporting period from 1 October 2018 to 30 September 2019. -

Annual Report 2017 Contents & Financial Highlights

ANNUAL REPORT 2017 CONTENTS & FINANCIAL HIGHLIGHTS TUI GroupFinancial 2017 in numbers highlights Formats The Annual Report and 2017 2016 Var. % Var. % at the Magazine are also available online € 18.5 bn € 1,102.1restated m constant € million currency Turnover 18,535.0 17,153.9 + 8.1 + 11.7 Underlying EBITA1 1 1 + 11.7Hotels & %Resorts + 12.0356.5 % 303.8 + 17.3 + 19.2 Cruises 255.6 190.9 + 33.9 + 38.0 Online turnoverSource Markets underlying526.5 554.3 – 5.0 – 4.0 Northern Region 345.8 383.1 – 9.7 – 8.4 year-on-year Central Region 71.5 85.1 – 16.0 – 15.8 Western Region EBITA109.2 86.1 + 26.8 + 27.0 Other Tourism year-on-year13.4 7.9 + 69.6 + 124.6 Tourism 1,152.0 1,056.9 + 9.0 + 11.2 All other segments – 49.9 – 56.4 + 11.5 + 3.4 Mobile TUI Group 1,102.1 1,000.5 + 10.2 + 12.0 Discontinued operations – 1.2 92.9 n. a. Total 1,100.9 1,093.4 + 0.7 http://annualreport2017. tuigroup.com EBITA 2, 4 1,026.5 898.1 + 14.3 Underlying EBITDA4 1,541.7 1,379.6 + 11.7 56 %EBITDA2 4 23.61,490.9 % ROIC1,305.1 + 14.2 Net profi t for the period 910.9 464.9 + 95.9 fromEarnings hotels per share4 & € 6.751.36 % WACC0.61 + 123.0 Equity ratio (30 Sept.)3 % 24.9 22.5 + 2.4 cruisesNet capex and contentinvestments (30 Sept.) 1,071.9 634.8 + 68.9 comparedNet with cash 30 %(302 at Sept.) time 4of merger 583.0 31.8 n. -

2009-Fall-Dividend.Pdf

dividendSTEPHEN M. ROSS SCHOOL OF BUSINESS AT THE UNIVERSITY OF MICHIGAN Thrown to the (Detroit) Lions Team President Tom Lewand, MBA ’96, Tackles the Ultimate Turnaround PLUS Financial Reform: Regulation vs. Innovation Directing New Business at Cleveland Clinic FALL 09 Solve the RIGHT Problems The Ross Executive MBA Advanced leadership training for high-potential professionals • Intense focus on leadership and strategy • A peer group of proven leaders from many industries across the U.S. • Manageable once-a-month format • Ranked #4 by BusinessWeek* • A globally respected degree • A transformative experience To learn more about the Ross Executive MBA call 734-615-9700 or visit us online at www.bus.umich.edu/emba *2007 Executive MBA TABLEof CONTENTS FALL 09 FEATURES 24 Thrown to the (Detroit) Lions Tom Lewand, AB ’91/MBA/JD ’96, tackles the turn- around job of all time: president of the Detroit Lions. 28 The Heart of the Matter Surgeon Brian Duncan, MBA ’08, brings practical expertise to new business development at Cleveland Clinic. 32 Start Me Up Serial entrepreneur Brad Keywell, BBA ’91/JD ’93, goes from odd man out to man with a plan. Multiple plans, that is. 34 Building on the Fundamentals Mike Carscaddon, MBA ’08, nails a solid foundation in p. 28 international field operations at Habitat for Humanity. 38 Adventures of an Entrepreneur George Deeb, BBA ’91, seeks big thrills in small firms. 40 Re-Energizer Donna Zobel, MBA ’04, revives the family business and powers up for the new energy economy. 42 Kickstarting a Career Edward Chan-Lizardo, MBA ’95, pumps up nonprofit KickStart in Kenya. -

Amadeus Yearbook of Ancillary Revenue by Ideaworks

Issued 29 August 2012 The Amadeus Yearbook of Ancillary Revenue by IdeaWorks Table of Contents 2012 Amadeus Yearbook of Ancillary Revenue ................................................................................... 4 Europe and Russia ............................................................................................................................... 17 The Americas........................................................................................................................................ 28 Asia and the South Pacific ................................................................................................................. 52 Middle East and Africa ........................................................................................................................ 63 Currency Exchange Rates Used for the Worldwide Statistics .................................................. 67 Disclosure to Readers of this Report IdeaWorks makes every effort to ensure the quality of the information in this report. Before relying on the information, you should obtain any appropriate professional advice relevant to your particular circumstances. IdeaWorks cannot guarantee, and assumes no legal liability or responsibility for, the accuracy, currency or completeness of the information. The views expressed in the report are the views of the author, and do not represent the official view of Amadeus. Issued by IdeaWorksCompany.com LLC Shorewood, Wisconsin, USA www.IdeaWorksCompany.com The free distribution of this report -

Waymark Holidays 1973-2007

THE WAYMARK STORY 2nd Edition The history of WAYMARK HOLIDAYS 1973-2007 by COLIN SAUNDERS Plus reminiscences from directors, staff, leaders and clients THE WAYMARK STORY Written and edited by COLIN SAUNDERS (staff member 1982 to 1989) In memory of Peggy Hounslow and Noel Vincent Second edition published online 15 March 2013 (replacing first edition published online 28 April 2009) by Colin Saunders 35 Gerrards Close Oakwood London N14 4RH [email protected] www.colinsaunders.org.uk © Colin Saunders 2009, 2013 2 THE WAYMARK STORY ACKNOWLEDGEMENTS Waymark Holidays owed its existence to the courage and foresight of its founders, Peggy Hounslow, Noel Vincent and Humfrey Chamberlain. The author is indebted to the following people and organisations, who have contributed in various ways: Mike Brace, Charlie Brown, The Cabinet Office, Alan Castle, Humfrey Chamberlain, Peter Chapman, Viju Chhatralia, Toni Clark, Dulcie Cringle, Rosemary Crosbie, Brian Fagg, Jill Hollingworth, Andy Hosking, Philip Hoyland, Nancy Johns, Anthony Jones, Ian Jones, Michael Mace, Bob Mason, Stuart Montgomery, Sue O’Grady, Tom Phillips, Elizabeth Philpott, Robert Pick, Adam Pinney, Martin Read, Brian and Gill Reader, Theo Rowlands, Paul Sibert, Alan Smith, Beryl Vincent, Nigel Watson and Jim Wood. Also many other former leaders and clients who have contributed material to Waymark News, much of which has been incorporated into this second edition. He is especially indebted to Peter Chapman, Stuart Montgomery and Martin Read for allowing him access to their collections of Waymark brochures, without which writing this work would have been immeasurably more difficult and devoid of detail. Finally, thanks to Exodus who have acquiesced in the publication of this document. -

Policy-Agenda the TUI Group Perspective on the 18Th Parliament of the German Bundestag (2013–2017)

17 policy-AGENda The TUI Group perspective on the 18th parliament of the German Bundestag (2013–2017) Aktiengesellschaft 18 TUI’S political DEMANDS: 10 POLICY BULLET POINTS 1. STRENGTHEN TOURISM AS A DRIVER FOR GROWTH n Greater recognition and support for tourism to drive growth and jobs 2. TAX POLICY n No excessive taxation by imposing additional business taxes on tour operators (disproportionate interpretation of section 8 (1e) German Trade Tax Act) n Scrap air passenger tax, which does not serve its original purpose of reducing CO2 emissions but instead skews competition with other EU countries n Keep the lower VAT rate on overnight accommodation to permit continued investment in modernising and expanding hotels n Abolish uncoordinated local bed taxes 3. AVIATION POLICY n Active support for the Single European Sky (SES) to reduce CO2 emissions and coordinate aviation regulations across Europe n Suspend EU emissions trading (ETS) until an international system is in place to ensure a level playing field n No tighter bans on night flying and greater recognition for new, quieter aircraft when allocating slots 4. INFRASTRUCTURE POLICY n Development of port infrastructures for ship fuelling based on environmentally friendly liquefied natural gas (LNG) technology n More investment in tourism infrastructure following the withdrawal of EU funds n Federal responsibility for airport planning in Germany to stem the uncontrolled proliferation of small airports 5. SUSTAINABILITY AND THE ENVIRONMENT n Greater recognition for the tourism industry’s commitment to sustainability n Provision of an adequate time frame for implementing new environmental standards (e.g., reducing CO2 emissions) n More effective integration of Germany’s National Biodiversity Strategy into international contexts 6. -

Insolvency Protection Arrangements for Linked Travel Arrangements and Packages in Ireland

Insolvency Protection Arrangements for Linked Travel Arrangements and Packages in Ireland Development of consumer protection arrangements October 2019 Commission for Aviation Regulation FINAL REPORT www.cepa.co.uk FINAL REPORT IMPORTANT NOTICE This report was prepared by Cambridge Economic Policy Associates Limited (CEPA) for the exclusive use of the client(s) named herein. Information furnished by others, upon which all or portions of this report are based, is believed to be reliable but has not been independently verified, unless expressly indicated. Public information, industry and statistical data are from sources we deem to be reliable; however, we make no representation as to the accuracy or completeness of such information, unless expressly indicated. The findings enclosed in this report may contain predictions based on current data and historical trends. Any such predictions are subject to inherent risks and uncertainties. The opinions expressed in this report are valid only for the purpose stated herein and as of the date of this report. No obligation is assumed to revise this report to reflect changes, events, or conditions, which occur subsequent to the date hereof. CEPA does not accept or assume any responsibility in respect of the report to any readers of the report (third parties), other than the client(s). To the fullest extent permitted by law, CEPA will accept no liability in respect of the report to any third parties. Should any third parties choose to rely on the report, then they do so at their own risk. 2 FINAL REPORT CONTENTS 1. Introduction ................................................................................................................................. 4 1.1. Changes since the interim report .................................................................................................................... -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM -

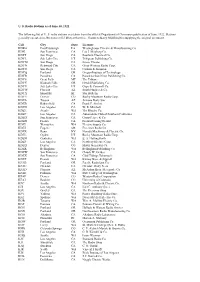

U. S. Radio Stations As of June 30, 1922 the Following List of U. S. Radio

U. S. Radio Stations as of June 30, 1922 The following list of U. S. radio stations was taken from the official Department of Commerce publication of June, 1922. Stations generally operated on 360 meters (833 kHz) at this time. Thanks to Barry Mishkind for supplying the original document. Call City State Licensee KDKA East Pittsburgh PA Westinghouse Electric & Manufacturing Co. KDN San Francisco CA Leo J. Meyberg Co. KDPT San Diego CA Southern Electrical Co. KDYL Salt Lake City UT Telegram Publishing Co. KDYM San Diego CA Savoy Theater KDYN Redwood City CA Great Western Radio Corp. KDYO San Diego CA Carlson & Simpson KDYQ Portland OR Oregon Institute of Technology KDYR Pasadena CA Pasadena Star-News Publishing Co. KDYS Great Falls MT The Tribune KDYU Klamath Falls OR Herald Publishing Co. KDYV Salt Lake City UT Cope & Cornwell Co. KDYW Phoenix AZ Smith Hughes & Co. KDYX Honolulu HI Star Bulletin KDYY Denver CO Rocky Mountain Radio Corp. KDZA Tucson AZ Arizona Daily Star KDZB Bakersfield CA Frank E. Siefert KDZD Los Angeles CA W. R. Mitchell KDZE Seattle WA The Rhodes Co. KDZF Los Angeles CA Automobile Club of Southern California KDZG San Francisco CA Cyrus Peirce & Co. KDZH Fresno CA Fresno Evening Herald KDZI Wenatchee WA Electric Supply Co. KDZJ Eugene OR Excelsior Radio Co. KDZK Reno NV Nevada Machinery & Electric Co. KDZL Ogden UT Rocky Mountain Radio Corp. KDZM Centralia WA E. A. Hollingworth KDZP Los Angeles CA Newbery Electric Corp. KDZQ Denver CO Motor Generator Co. KDZR Bellingham WA Bellingham Publishing Co. KDZW San Francisco CA Claude W. -

Case No COMP/M.4600 - TUI / FIRST CHOICE

EN Case No COMP/M.4600 - TUI / FIRST CHOICE Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(2) NON-OPPOSITION Date: 04/06/2007 In electronic form on the EUR-Lex website under document number 32007M4600 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 04-VI-2007 SG-Greffe (2007)D/203384 In the published version of this decision, some PUBLIC VERSION information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information MERGER PROCEDURE omitted has been replaced by ranges of figures or a ARTICLE 6(1)(b) and 6(2) general description. DECISION To the notifying party Dear Sir/Madam, Subject: Case No COMP/M.4600 - TUI/ First Choice Notification of 4 April 2007 pursuant to Article 4 of Council Regulation No 139/20041 1. On 4 April 2007, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which the undertaking TUI AG ("TUI", Germany, or the “notifying party”) acquires within the meaning of Article 3(1)(b) of the Council Regulation sole control over First Choice Holidays PLC ("First Choice", United Kingdom). The travel activities of both groups will be combined in a new group, TUI Travel PLC ("TUI Travel", United Kingdom). TUI Travel will consist of TUI's Tourism division, excluding certain hotel assets and the German ocean cruise and other shipping activities, and First Choice. -

Niennis ()~ Tlasij/INE. •

28 eHIC:ACO .DAILY TRIBUNE ,. Taulla,,·"""", ~7 C .. ** Gifts for Father Complete Radio IGREIN & PABLS Weddingss Anniversaries CBlCAGO FUQUENCIE8 New De I.uxe IROM.X FRIG·I· TOR W-G-N-720 WMBI-ll10 FM- Stainless Steel WlND-560 WJJD-1160 WON_5.' IC•• p. Ica c U" •• WILL-58 0 WJOB-1230 and 98.5 WMAQ-670 WSBC-1240 WDLM-99.T SPARKLET lOUd lon••••r, hold. WBBM-780 WEDC-I240 WEFM_S.l th. h.at of .OUIII WAIT-820 WCRW-1240 and 98.S Refillable .nd oth.r food•• WENR-890 WMR~1280 WBEz-44.11 $995 WLS-89 0 WJOL-1340 WBBM-99.3 SYPHO~ I.utl/ully .Ir.am· WAAF-950 WGES-1390 WEAW-I04.S WCFL-I000 WHFC-1450 WEHS-I00.l lin. d .Iumlnu 1 M.~.s • full qUilrt of (MJ Indlcatea MBS, [NJ NBC, [CI CBS. h.. fibo'9141 In.u· and [AJ ABC. .p.,~ling charged w.t.r I• t lon, spa,klln9 in • minut •• "Lucit," knob .nd Pro,rama are lilted In central dayll,ht sav- handl•• ID, time. Spark/.' 'ulb., pack., •• t t.". 79. Fonnerly $7.50 $5 MORNING 95 BLUE BAND BULBS .vailabl. NIW LOW PRICI ••••••••••• ':IO-W-G-N-FarJD bour ant n•••• WMAQ-Prayer; Early Bird. lIgain! For makinq whipped cream WBBM-The Country hour. WIND-Early Bird Rhythma., and ice cream in • minute without Finest Liquor Values WLS-Smll •..•.·Whlle .ho •• beating. C WJJD-Breakfut Froll. to '1 a. m. 69 Our O,n Pr/vat. Stoell ':45-WIND-Coflee Pot Parade. Pkg. of 5. " , . -W-G-N-Qld Tbne Mul e, WMAQ-Ed Allen, new•. -

Revitalization of the AM Radio Service ) ) ) )

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, DC In the matter of: ) ) Revitalization of the AM Radio Service ) MB Docket 13-249 ) ) COMMENTS OF REC NETWORKS One of the primary goals of REC Networks (“REC”)1 is to assure a citizen’s access to the airwaves. Over the years, we have supported various aspects of non-commercial micro- broadcast efforts including Low Power FM (LPFM), proposals for a Low Power AM radio service as well as other creative concepts to use spectrum for one way communications. REC feels that as many organizations as possible should be able to enjoy spreading their message to their local community. It is our desire to see a diverse selection of voices on the dial spanning race, culture, language, sexual orientation and gender identity. This includes a mix of faith-based and secular voices. While REC lacks the technical knowledge to form an opinion on various aspects of AM broadcast engineering such as the “ratchet rule”, daytime and nighttime coverage standards and antenna efficiency, we will comment on various issues which are in the realm of citizen’s access to the airwaves and in the interests of listeners to AM broadcast band stations. REC supports a limited offering of translators to certain AM stations REC feels that there is a segment of “stand-alone” AM broadcast owners. These owners normally fall under the category of minority, women or GLBT/T2. These owners are likely to own a single AM station or a small group of AM stations and are most likely to only own stations with inferior nighttime service, such as Class-D stations.