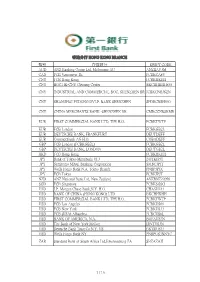

Financial Statements 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Execution Copy the EXPORT-IMPORT BANK OF

Execution Copy THE EXPORT-IMPORT BANK OF KOREA as Issuer and DEUTSCHE BANK AG, TAIPEI BRANCH as Lead Manager BANK OF TAIWAN FUBON SECURITIES CO., LTD. KGI BANK PRESIDENT SECURITIES CORP. SHANGHAI COMMERCIAL & SAVINGS BANK, LTD. SINOPAC SECURITIES CORP. TAIPEI FUBON COMMERCIAL BANK CO., LTD. TAISHIN INTERNATIONAL BANK as Co-managers SUBSCRIPTION AGREEMENT in respect of US$400,000,000 Floating Rate Notes due 2023 THE EXPORT-IMPORT BANK OF KOREA US$25,000,000,000 Global Medium Term Note Programme [SEOUL 13211_2] THIS AGREEMENT is made on 12 March 2018 AMONG: (1) THE EXPORT-IMPORT BANK OF KOREA (the “Issuer”); (2) DEUTSCHE BANK AG, TAIPEI BRANCH (the “Lead Manager”); and (3) BANK OF TAIWAN, FUBON SECURITIES CO., LTD., KGI BANK, PRESIDENT SECURITIES CORP., SHANGHAI COMMERCIAL & SAVINGS BANK, LTD., SINOPAC SECURITIES CORP., TAIPEI FUBON COMMERCIAL BANK CO., LTD. and TAISHIN INTERNATIONAL BANK. (the “Co-managers” and, together with the Lead Manager, the “Managers”). WHEREAS (A) The Issuer has entered into an amended and restated dealer agreement dated 13 May 2016 (the “Dealer Agreement”) with the Dealers named therein respect of the Issuer’s US$25,000,000,000 Global Medium Term Note Programme (the “Programme”). All terms with initial capitals used herein without definition have the meanings given to them in the Dealer Agreement. (B) The Issuer proposes to issue US$400,000,000 aggregate principal amount of its floating rate notes due 2023 (the “Notes”), which expression, where the context so admits, shall include the Global Notes to be delivered in respect thereof, and the Managers wish to subscribe such Notes, on a firm commitment basis, at the Subscription Price (as defined in clause 3.1 of this Agreement). -

2019Annualreport 2019

CONTENTS Letter to Shareholders 4 Operations Review 10 Company Introduction 32 Supervisors' Report 38 Internal Control Statement 39 Independent Auditors' Report (Consolidated) 42 Consolidated Balance Sheets 46 Consolidated Statements of 48 Comprehensive Income Independent Auditors' Report 50 Balance Sheets 54 Statements of Comprehensive Income 56 Schedule for Appropriation of Earnings 58 2019 ANNUAL REPORT TAIWAN DEPOSITORY & CLEARING CORPORATION 5 Letter to Dear shareholders: Shareholders The world's politics and economics are increasingly interconnected. Within this, the capital market plays the role of an economic window. Looking back on 2019, because global trade disputes and geopolitical frictions brought many uncertainties to the global economy, the momentum of economic growth slowed down. In terms of Taiwan's economy, external demand declined at the beginning of the year. Fortunately, after the middle of the year, the negative effects of the trade war gradually weakened, bringing about the effect of order transfers and additional investment for Taiwan, as well as some momentum toward growth. Although the performance of the capital market was not as good as in 2018, there was still a certain level of performance. Challenges from uncertainty risks due to changes in the political and economic environments also brought different opportunities to capital market participants. In the face of market challenges and customer needs, new Fintech applications and digital transformation have played leading roles. However, application in new technology is not the only factor creating competitive advantages. The key to successful transformation lies in whether enterprises can adapt to market trends, select appropriate system architectures, use professional talent to integrate cross-border resources, and realize the value of accumulated big data through innovative applications. -

Bloomberg-Taiwan-Capital-Market-Preliminary-League-Tables-Q1-2020-ENG.Pdf

TAIWAN CAPITAL MARKETS LEAGUE TABLES Q1 2020 Preliminary As of 25 March 2020 Q1 2020 PRELIMINARY AS OF 25 MARCH 2020 MANAGER RANKINGS TAIWAN CAPITAL MARKETS The Bloomberg Capital Markets Tables represent the top arrangers, bookrunners and advisors across a broad array of deal types including loans, bonds, equity and M&A transactions; according to Bloomberg standards. LEAG<GO> for a full range of league tables MA<GO> for a full range of merger & acquisition tables NI LEAG CRL<GO> or http://www.bloomberg.com/ for a full range of market-specific league table publications Due to the dynamic nature of the Professional Service product, league table rankings may vary between this release and data found on the Bloomberg Professional Service. DATA SUBMISSIONS AND QUERIES Contact Phone Email Equities Siying He +86 21 6055 3524 [email protected] Fixed Income Sheng Chiu +886 2 7719 1467 [email protected] Loans Jewel Ho +852 2293 1498 [email protected] © 2020 Bloomberg Finance L.P. All rights reserved. Bloomberg Preliminary Taiwan Capital Markets | Q1 2020 Taiwan Bonds: Industry Breakdown Taiwan Bonds 20% Q1 2020 Q1 2019 Mkt Volume (TWD Deal Prev Prev Mkt Mkt Share 58% Firm Rank Share(%) Mln) Count Rank Share(%) Chg(%) 21% Yuanta Securities 1 25.973 30,100 12 2 16.612 9.361 KGI Securities 2 21.745 25,200 9 4 7.309 14.436 Masterlink Securities 3 11.735 13,600 7 3 8.107 3.628 SinoPac Financial Holdings 4 8.888 10,300 8 8 4.588 4.300 Hua Nan Securities 5 6.903 8,000 6 17 2.358 4.545 Financials 58% HSBC 6 3.797 4,400 2 - - 3.797 Communications -

China Development Financial

Stock Code:2883 China Development Financial 2015 Annual Report Notice to readers This English-version annual report is a summary of the Chinese version and is not an official document of the share holders’ meeting. If there is any discrepancy between the English and Chinese versions, the Chinese version shall prevail. Annual Report is available at: http://www.cdibh.com Printed on February 29, 2016 Spokesperson Deputy Spokesperson Name: Eddy Chang Name: Beatrice Chou Title : Executive Vice President Title: Executive Vice President Tel : (02)2763-8800 Tel: (02)2763-8800 Web: www.cdibh.com Web: www.cdibh.com Headquarters, Branches and Plant China Development Financial Address: No. 125, Sec. 5, Nanjing E. Rd., Taipei 10504, Taiwan Tel: (02)2753-2201 Web: www.cdibh.com Subsidiaries China Development Industrial Bank Address: 11 &12F, No. 125, Sec. 5, Nanjing E. Rd., Taipei 10504, Taiwan Tel: (02)2763-8800 Web: www.cdibank.com KGI Bank Address: No. 125, Sec. 5, Nanjing E. Rd., Taipei 10504, Taiwan Tel: (02)2171-1088 Web: www.kgibank.com KGI Securities Address: No. 700, Mingshui Rd., Taipei 10462, Taiwan Tel: (02)2181-8888 Web: www.kgi.com Stock Transfer Agent Name: The Transfer Agency Department of KGI Securities Address: 5F, No. 2, Sec. 1, ChongqingSouth Rd., Taipei 10044, Taiwan Tel: (02)2389-2999 Web: www.kgi.com Credit Rating Agency Name: Taiwan Ratings Address: 49F, No. 7, Sec. 5, XingYi Rd., Taipei 11049, Taiwan Tel: (02)8722-5800 Web: www.taiwanratings.com Auditors Auditors: Yi-Chun Wu, Cheng-Hung Kuo Accounting Firm: Deloitte & Touche Address: 12F, No. 156, Sec. -

Consolidated Financial Statements 2019

KGI Bank Co., Ltd. and Subsidiaries Consolidated Financial Statements for the Years Ended December 31, 2019 and 2018 and Independent Auditors’ Report DECLARATION OF CONSOLIDATION OF FINANCIAL STATEMENTS OF AFFILIATES The Bank required to be included in the consolidated financial statements of affiliates in accordance with the “Criteria Governing Preparation of Affiliation Reports, Consolidated Business Reports and Consolidated Financial Statements of Affiliated Enterprises” for the year ended December 31, 2019 are all the same as the companies required to be included in the consolidated financial statements of parent and subsidiary companies as provided in International Financial Reporting Standard 10 “Consolidated Financial Statements”. Relevant information that should be disclosed in the consolidated financial statements of affiliates has all been disclosed in the consolidated financial statements of parent and subsidiary companies. Hence, we have not prepared a separate set of consolidated financial statements of affiliates. Very truly yours, KGI BANK CO., LTD. March 26, 2020 - 1 - KGI BANK CO., LTD. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS DECEMBER 31, 2019 AND 2018 (In Thousands of New Taiwan Dollars) 2019 2018 ASSETS Amount % Amount % CASH AND CASH EQUIVALENTS (Notes 4, 6 and 41) $ 8,152,200 1 $ 7,034,362 1 DUE FROM THE CENTRAL BANK AND CALL LOANS TO BANKS (Note 7) 28,303,064 4 26,431,383 4 FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS (Notes 4, 8, 41 and 42) 78,108,576 12 81,922,752 12 FINANCIAL ASSETS AT FAIR VALUE -

1 / 16 香港分行 Hong Kong Branch 幣別 存匯銀行 Swift

香港分行 HONG KONG BRANCH 幣別 存匯銀行 SWIFT CODE AUD ANZ Banking Group Ltd, Melbourne AU ANZBAU3M CAD FCB Vancouver Br. FCBKCA8V CNY FCB Hong Kong FCBKHKHH CNY BOC,HK-CNY Clearing Center BKCHHKHH838 CNY INDUSTRIAL AND COMMERCIAL BOC, SHENZHEN BR ICBKCNBJSZN CNY SHANGHAI PUDONG DVLP. BANK SHENZHEN SPDBCNSH030 CNY CHINA MERCHANTS BANK -SHENZHEN BR CMBCCNBSRMB EUR FIRST COMMERCIAL BANK LTD, TPE H.O. FCBKTWTP EUR FCB London FCBKGB2L EUR DEUTSCHE BANK, FRANKFURT DEUTDEFF EUR Commerzbank AG H.O. COBADEFF GBP FCB London (FCBKGB2L) FCBKGB2L GBP DEUTSCHE BANK, LONDON DEUTGB2L HKD FCB Hong Kong FCBKHKHH JPY Bank of Tokyo-Mitsubishi UFJ BOTKJPJT JPY Sumitomo Mitsui Banking Corporation SMBCJPJT JPY Wells Fargo Bank N.A. Tokyo Branch PNBPJPJX JPY FCB Tokyo FCBKJPJT NZD ANZ National Bank Ltd. New Zealand ANZBNZ22058 SGD FCB Singapore FCBKSGSG USD J.P. Morgan Chase Bank,N.Y. H.O. CHASUS33 USD BANK OF CHINA (HONG KONG) LTD BKCHHKHH USD FIRST COMMERCIAL BANK LTD, TPE H.O. FCBKTWTP USD FCB Los Angeles FCBKUS66 USD FCB New York FCBKUS33 USD FCB (USA) Alhambra FCBCUS6L USD BANK OF AMERICA, N.A. BOFAUS3N USD The Bank of New York Mellon IRVTUS3N USD Deutsche Bank Trust Co N.Y. US BKTRUS33 USD Wells Fargo Bank NY PNBPUS3NNYC ZAR Standard Bank of South Africa Ltd,Johannesburg ZA SBZAZAJJ 1 / 16 香港分行 HONG KONG BRANCH 通匯銀行 SWIFT CODE ABN AMRO BANK N.V. HONG KONG BRANCH ABNAHKAA THE ROYAL BANK OF SCOTLAND PLC, HONG KONG BRANCH ABNAHKHH (FORMERLY KNOWN AS RBS NV) ABN AMRO BANK N.V. ABNANL2A ABN AMRO BANK N.V. ABNANL2R NEW YORK COMMERCIAL BANK ABNYUS33 AGRICULTURAL BANK OF CHINA, THE ABOCCNBJ AGRICULTURAL BANK OF CHINA LIMITED HONG KONG BRANCH ABOCHKHH CREDIT AGRICOLE SA AGRIFRPP AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED ANZBAU3M AUSTRALIA AND NEW ZEALAND BANK (CHINA) COMPANY ANZBCNSH LIMITED AUSTRALIA AND NEW ZEALAND BANKING GROUP LTD ANZBHKHX BANK ANZ INDONESIA, P.T. -

Important Notice

JOBNAME: HCR1905004_E_PWoori_ PAGE: 1 SESS: 18 OUTPUT: Wed May 8 14:38:39 2019 //English/HCR/HCR1905004e_Project_Woori_Bank/00important IMPORTANT NOTICE THIS DOCUMENT IS AVAILABLE ONLY TO INVESTORS WHO ARE NON-U.S. PERSONS WITH ADDRESSES OUTSIDE OF THE U.S. IMPORTANT: You must read the following before continuing. If you are not the intended recipient of this message, please do not distribute or copy the information contained in this e-mail, but instead, delete and destroy all copies of this e-mail including all attachments. The following applies to the offering circular as supplemented by the pricing supplement (the “Offering Circular”) following this page, and you are therefore advised to read this carefully before reading, accessing or making any other use of the Offering Circular. In accessing the Offering Circular, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from us as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE SECURITIES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE U.S. OR OTHER JURISDICTION AND THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE U.S. OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT), EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. -

League Tables Q1 2020 Q1 2020

TAIWAN CAPITAL MARKETS LEAGUE TABLES Q1 2020 Q1 2020 MANAGER RANKINGS TAIWAN CAPITAL MARKETS The Bloomberg Capital Markets Tables represent the top arrangers, bookrunners and advisors across a broad array of deal types including loans, bonds, equity and M&A transactions; according to Bloomberg standards. LEAG<GO> for a full range of league tables MA<GO> for a full range of merger & acquisition tables NI LEAG CRL<GO> or http://www.bloomberg.com/ for a full range of market-specific league table publications Due to the dynamic nature of the Professional Service product, league table rankings may vary between this release and data found on the Bloomberg Professional Service. DATA SUBMISSIONS AND QUERIES Contact Phone Email Equities Siying He +86 21 6055 3524 [email protected] Fixed Income Sheng Chiu +886 2 7719 1467 [email protected] Loans Jewel Ho +852 2293 1498 [email protected] © 2020 Bloomberg Finance L.P. All rights reserved. Bloomberg Taiwan Capital Markets | Q1 2020 Taiwan Bonds: Industry Breakdown Taiwan Bonds 20% Q1 2020 Q1 2019 Mkt Volume (TWD Deal Prev Prev Mkt Mkt Share 58% Firm Rank Share(%) Mln) Count Rank Share(%) Chg(%) 21% Yuanta Securities 1 22.781 26,400 13 2 15.295 7.486 KGI Securities 2 21.745 25,200 9 4 6.729 15.016 Masterlink Securities 3 11.735 13,600 7 3 7.464 4.271 SinoPac Financial Holdings 4 8.888 10,300 8 10 4.224 4.664 Hua Nan Securities 5 6.903 8,000 6 18 2.171 4.732 Financials 58% HSBC 6 3.797 4,400 2 - - 3.797 Communications 21% KGI Bank 7 3.710 4,300 1 - - 3.710 Technology 20% Mega Financial Holding -

Cosmos Bank, Taiwan

Cosmos Bank, Taiwan Financial Statements for the Years Ended December 31, 2007 and 2006 and Independent Auditors’ Report INDEPENDENT AUDITORS’ REPORT The Board of Directors and Stockholders Cosmos Bank, Taiwan We have audited the accompanying balance sheets of Cosmos Bank, Taiwan as of December 31, 2007 and 2006, and the related statements of income, changes in stockholders’ equity and cash flows for the years then ended. These financial statements are the responsibility of the Bank’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the Rules Governing the Audit of Financial Statements of Financial Institutions by Certified Public Accountants and auditing standards generally accepted in the Republic of China. Those rules and standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. As stated in Note 15 to the financial statements, the Bank signed individual contracts with asset management companies between 2002 and 2006 to sell nonperforming loans. Based on the Law Governing Mergers of Financial Institutions, the losses on these sales were amortized using the straight-line method over 60 months. The unamortized balance was recorded as deferred loss on the sale of nonperforming loans. -

Cost Efficiency Affects Sustainable Operations

International Journal of Economics and Financial Issues ISSN: 2146-4138 available at http: www.econjournals.com International Journal of Economics and Financial Issues, 2018, 8(1), 90-92. Cost Efficiency Affects Sustainable Operations Chun-Ying Chen1*, Chun-Hung Chen2, Ai-Chi Hsu3 1School of Accounting and Finance, Xiamen University Tan Kah Kee College, Zhangzhou, Taiwan, 2Department of Finance, National Yunlin University of Science and Technology, Yunlin, Taiwan, 3Department of Finance, National Yunlin University of Science and Technology, Yunlin, Taiwan. *Email: [email protected] ABSTRACT This study adopted a cost efficiency model to assess the operational efficiency of the banking industry in Taiwan. Empirical results show that the Bank of Taiwan, Taiwan Cooperative Bank, and First Commercial Bank have higher operational efficiency than the other banks. Banks with relatively low operational efficiency include Taipei Star Bank, the Enterprise Bank of Hualien, which was merged into the CTBC Bank, and the ABN AMRO- acquired Taitung Business Bank, which together with ABN AMRO’s other business in Taiwan, was later acquired by the Australia and New Zealand Banking Group (ANZ) and renamed ANZ Bank (Taiwan). These findings show that banks with low operational efficiency are unable to maintain sustainable operations. Keywords: Operational Efficiency, Cost Efficiency, Data Envelopment Analysis JEL Classifications: C1, G1, J3 1. INTRODUCTION that the banking industry plays an important role as a financial intermediary. However, the efficiency values between business Although financial indicators can be used to measure operational units are notoriously difficult to obtain and the majority of DEA efficiency objectively, they are unable to reflect comprehensively analysis only provides approximate values, making it difficult to the differences between business units. -

China Life KGI Bank KGI Securities CDIB Capital Group Content

China Life KGI Bank KGI Securities CDIB Capital Group Content Letter to Shareholders 4 About Us 6 Professional Services 20 Operating Performance 62 Office Locations 72 Letter to Shareholders Venture Capital ⁄ Private Equity Investment Business Industry changes and U.S.-China trade disputes affected the valuations of certain investment positions and funds under management of CDIB Capital Group in 2019. The company completed the establishment and fund-raising of Renminbi- denominated CDIB Yida Healthcare Fund and closed the second tranche of USD-denominated Global Opportunities In 2019, even if U.S. economy performed relatively well among the world’s major economies, the Fed cut interest rates to Fund in 2019. Ten funds denominated in New Taiwan dollars, US dollars and Renminbi, are currently under management, boost liquidity into the market in view of U.S.-China trade uncertainty. The eurozone’s economic performance has been with investment mainly in the US and Greater China. These funds totaled NT$39.8bn as of the end of 2019, of which relatively lackluster despite a quantitative easing policy adopted by the European Central Bank. China was under pressure NT$25.8bn has been drawn down for investment and proceeds of around NT$4bn have been received. CDIB Capital to transform its industrial and economic structures in addition to facing the continued impact of trade wars. Driven by Group plans to raise new funds denominated in New Taiwan dollars and US dollars in 2020 to further expand the scale of the repatriation of China-based Taiwanese companies and the trade diversion, Taiwan’s economy grew 2.71% in 2019, on a assets under management. -

Page 1 Is Bank Lending Channel Functional? an Analysis of Data in Taiwan. 1* 1 * [email protected] 1980 (VAR) (Panel VAR) 1. 2010 Donald L. Kohn 1980 (Interest

ߞҔᆅၰӸӧ༏ǻɡаҁ୯ሌՉၗϐ Is bank lending channel functional? An analysis of data in Taiwan. ߋিዝ 1* ғزࣴ !س୯ҥကεᏢ! ᔈҔᔮ 1 *[email protected] ᄔा ፓճѐ่మޣɡճᆅၰаϷߞҔᆅၰɡςቶݱፕǺڋεሀᐒٿԾவ1980ԃжଆǴჾࡹϐ ǶҁЎట٬ҔӛໆԾسঁߎᑼᡏډёສၗߎॷҗჾࡹሀޑໆۓၸࢌޣສීՉࣁǹࡕکѱ٠ቹៜॷී ӵՖڀय़ӛǺǵύѧሌՉϐჾࡹπٿᘜ (Panel VAR) ϩձךᘜኳࠠ (VAR) аϷଓᙫၗӛໆԾך ךǵӸීᕴᡏϷߎᑼᡂኧǹΒǵаҁ୯ሌՉϐଓᙫၗǴՉӛໆԾීܫሽǵނளǵ܌ၸߞҔᆅၰቹៜ୯҇ ǵӸීǵԖၗౢᔮࢲǶჴ่݀วǴීܫځ୯ϐঁձሌՉךࢂցၸߞҔᆅၰቹៜڀᘜǴჾࡹπ ᔮޑϐǴߞҔᆅၰᆶሌՉقᆅၰ٠όठǴඤීܫሌՉޑကکቚуΨᒿϐวғǴԶ೭ීܫᒿჾᆙᕭǴሌՉ ࢲϐ໔ޑᜢᖄ܄ம১ᗋԖࡑᄮǶ ᘜךǵߞҔᆅၰǵӛໆԾڋᜢᗖӷǺჾࡹሀᐒ ق .1 ᔮᆶۓሽᛙނᆶۓǴаၲԋߎᑼᛙڀჾࡹࢂࡰύѧሌՉҗፓჾᕴीኧǵճНྗჾࡹπ ߏᇻวϐനಖᔮҞǶฅԶǴჾࡹૈցԖਏԶЪਔӦౢғѧՉႣϐਏޑϐਏ݀Ǵ٠ߦᔮۓߎᑼᛙ ᕴᡏᔮፕΠǴ೭٤ᡂኧޑϐࡕख़ाᔮᡂኧϐวǴᕕှӧόӕڀॺёаᙖҗᢀჸѧՉ٬ҔჾࡹπךǴ݀ ࡹፂᔐԶϸᔈǶډڙӵՖ ǵഩӢථǵཥђڂݩǴђރࢂᕴᡏᔮፕϐख़ᗺǶࣁΑᅰёૈ٬ፕ಄ӝჴᔮޔჾࡹᚒ ᕴᡏᡂزፕჾࡹӵՖቹៜᕴᡏᔮǶԶࣴٮਔжङඳΠගޑӧόӕޣǵཥഩӢථǵჾᏢࢴᏢڂ ӧǶ܌ϐख़ᗺڋჾࡹሀᐒزኧӵՖӢᔈჾࡹፂᔐวғᡂǴջࣁࣴ ྗޑॺᖼວၗౢਔǴౢғΑεໆךԃΟДਔऍ୯ᖄٖྗഢ٣ୋЬৢ Donald L. Kohn ම߄ҢǺȨ 2010 ԖᡉԶᐱҥسᔮᡏکୋౢࠔǴѬॺόϼёૈӧߎᑼѱޑεໆሌՉྗഢࣁᖼວၗౢޑബр܌ഢߎਏ݀ǴǾǶ ๏ၰٮჾډᢀᗺ٠όठǴȐȑமፓྗഢߎޑჾࡹ܈ኳࠠൂޑӭ௲ࣽਜکϐਏ݀ǶԜᢀᗺ ᔠຎ೭చᆅၰǶȩکزॺሡाвಒӦࣴךӢ݀ᜢ߯Ƕӧޑ೯ᑩ೭చጕډ ᔮ૰ଏǴࠅΨᏤठऍ୯ሌՉޑు؈کߎᑼӒᐒޑᝄל٣ჴǴऍ୯ᖄྗჴࡼߚჾࡹҔаჹ ঁᔮᡏډவྗഢߎزΕࣴޣӭᏢ׳ᑫ፪ǴޑཥޑჾࡹܭഢߎᎩᚐεᑩǶΨӢԜǴെᒬΓॺჹྗޑسᡏ Ƕڋሀᐒޑس ࢂճᆅၰ(interest rate channel)Ǵᙖҗፓճѐ่మѱځςቶݱፕǺڋεሀᐒٿԾவ 1980 ԃжǴ ঁߎᑼᡏډёສၗߎॷҗჾࡹሀޑໆۓΒࣁߞҔᆅၰ (credit channel)ǴࢌځສීՉࣁǹک٠ቹៜॷී ޑǴᇡࣁӧϦ໒ѱۺᝩჾ४ኧཷ܍ᆅၰ(bank lending channel) ᢀᗺීܫሌՉޑǶӧߞҔᆅၰЎǴကس ߎᚐǶޑௗቹៜሌՉёаॷීޔኧໆޑഢߎྗکᡂ ԋࣁۈBernanke and Blinder (1992) ϐࡕǴ໒ ک (ᘜኳࠠ (Auto Regressions, VAR) ӧ Sims (1980ךӛໆԾ Ϧ໒ၗޑஒճҔѠޑҞزǴҁЎࣴ܄ӭኬޑǶࣁΑᘉкѠჴЎڀϩჾࡹਏ݀ϐߐᕴᡏीໆπ ᆅၰϐೱීܫჾࡹᆶሌՉزՉࣁᆶၗߎᝢԋቹៜǴࣴීܫჾࡹǴࢂցჹሌՉޑ௦Չ܌ǴٰѧՉ ᆅၰϐቹៜǴಃΒීܫᕴᡏၗаϷҁ୯ሌՉၗሌՉޑᆶբҔӧҁ୯ሌՉၗࢂցᡉǶҁЎ٬ҔѠ่