Basildon Town Centre Masterplan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Welcome to St Martin of Tours Basildon

Welcome to St Martin of Tours Basildon Parish Profile 2019 www.stmartinsbasildon.co.uk Contents 1. Basildon and Our Church at Present 3. What are we looking for in a new Priest? 5. What can we offer? 8. The Wider Context 9. Finance 10. The Rectory 11. Basildon 12. Conclusion Basildon and Our Church at Present Basildon is situated in South Essex, positioned between the A13 and the A127. It was one of the many New Towns that were developed following the New Towns Act of 1946. London, which had been badly damaged throughout the Second World War, was overcrowded and housing was largely very poor. ‘New Towns’ were the Labour Governments answer to the problem. This year we celebrate the 70th anniversary of the start of the work in the building of Basildon. St Martins stands in the centre of the town, adjacent to St Martins Bell Tower, built in the millennium, the first steel and glass Bell Tower in the world, and the Civic Centre, housing the secular aspect of Basildon. From the outside the building is not particularly impressive but step through the door and stand at the back, looking towards the altar, and the magnificence of this house of God really hits you. On the far east wall hangs a very large cross and when the lights are on, the shadow from the cross depicts three crosses on the wall; just as they stood together at Calvary, at the crucifixion. The Sanctuary, chancel steps and centre aisle are carpeted. But what now really strikes the on-lookers’ eyes are the breath-taking modern stained-glass windows on the south and north sides of the church, almost ceiling to floor. -

Thurrock Shopping Park

Thurrock Shopping Park West Thurrock, RM20 3LP Bsho’s tortford Wre rooure Thurrock Shopping Park hesford West Thurrock, RM20 3LP A414 A12 Enfe M25 retwoo Wckford Tottenham ockey A127 Bso Roford Ilford Brk SoutheoSea A13 A13 Canve s Greenwich Thurrock Lesh Stoe Beey ravese heeress A2 A20 Mster ea roey Swey Rochester Croydon A232 M20 ttoure o B A249 M2 Seveoks Maidstone A228 Tre M20 M23 Tore Roy Ture Wes Thurrock Shopping Park West Thurrock, RM20 3LP The Scheme Thurrock Shopping Park A prime retail destination 1646 on site car parking spaces 286,277 sq ft of floor space Thurrock Shopping Park West Thurrock, RM20 3LP Lakeside RetailPark 385,000 sq ft Proposed A3 Pod TO LET 19,827 SQ FT Thurrock Shopping Park 286,277 sq ft Thurrock Shopping Park West Thurrock, RM20 3LP Retail Total Nike Factory Store 7,500 sq ft Poundland 7,500 sq ft Smyths Toys 15,000 sq ft M&S Outlet 18,615 sq ft Asda Living 30,000 sq ft TK Maxx 30,219 sq ft To Let 19,827 sq ft Go Outdoors 23,580 sq ft Boots 9,355 sq ft Gap Outlet 8,632 sq ft Costa 1,800 sq ft Proposed A3 Pod EE 1,500 sq ft Evans Cycles 3,493 sq ft Burger King 4,109 sq ft Decathlon 40,000 sq ft Home Bargains 12,300 sq ft Dunelm 21,230 sq ft Halfords 10,000 sq ft Pets at Home 8,199 sq ft TO LET 28.4M Thurrock Shopping Park West Thurrock, RM20 3LP 6 5 4 1 2 3 7 TO LET Key 19,827 SQ FT 1 intu Lakeside Shopping Centre 2 Lakeside Retail Park 3 Tesco Extra 4 Costco Junction 31 M25 5 B&Q 6 Ikea 7 West Thurrock Retail Park Thurrock Shopping Park West Thurrock, RM20 3LP 20,000 sq ft available to let with full mezzanine -

RBC Mixed Use Sheet.Indd

The following are examples of projects we have recently completed Chiltern Street London RBC were appointed by Galliard Homes to provide full Building Control services for a development known as The Chilterns. This is a prestigious development which consists of 44 exquisite apartments that have been expertly designed to combine the highest technical specifications; a gymnasium, cinema, shops, library and car parking. Mixed Use & Shopping Centres Mixed Newbury Parkway Berkshire RBC worked with the Building Design Partnership headed by the Shearer Property Group and Standard Life Investments, for a major mixed-use regeneration scheme of Newbury town centre. The £120 million redevelopment of the 5.7 acre site includes 270,000 sq ft of retail space comprising major department stores for Debenhams, John Lewis, large fashion stores, a mix of medium and smaller retail units, and catering outlets. There is also a major residential component and car parking for up to 600 cars. Shopping Centres Nationwide RBC have worked on many high profile shopping centres, providing building control services for retail clients, below is a small selection of these: Arndale Centre Swan Shopping Centre Manchester Eastleigh Brentcross Shopping Centre Telford Shopping Centre London Shropshire Bullring Shopping Centre The Chimes Shopping Centre Birmingham Middlesex Churchill Square Shopping Centre The Cornbow Shopping Centre Brighton Halesowen Eagles Meadow Shopping Centre The Gracechurch Centre Wrexham West Midlands Eastgate Shopping Centre The Oracle Shopping Centre -

Basildon Town Centre Regeneration Early Engagement Results

Basildon Town Centre Regeneration Early engagement results Contact: Strategy, Insights and Partnerships team, [email protected] Release Date: 05/08/2021 CONTENTS 1. Survey context 1.1 Age representation 1.2 Location representation 2. General summary 3. Trend analysis 3.1 Visiting frequency 3.2 General design - activity elements 3.3 General design – aesthetic principles 3.4 Specific design – housing 3.5 Specific design principles – height criteria 3.6 Specific design – height estimates 4. Areas of further investigation 1. Survey context The consultation took place between 9 June and 7 July 2021. A total of 2948 people participated in the survey. The survey took on average 21 mins to complete. This sample size provides a confidence level of 95% with a confidence interval of + or - 1.79. 1.1 Age representation Respondents aged 16 to 24 present the highest under-representation gap; the most over- Middle-aged people are represented group was aged 60 to 64. over-represented in the survey sample The age bands were grouped into further categories for this analysis, based on life stages: - Starting out and young families – ages 16 to 39 (representing 30% of the sample) - Middle -aged – ages 40 to 59 (40% of respondents) - Close to or retired – people aged over 60 (30% of respondents) The biggest representation gap is for ages 16 to 24 The # of respondents who have not completed their age have been removed (210 out of a total of 2 948) 1.2 Location representation The survey responses had over-representation from the towns of Basildon and Laindon, with Billericay and Wickford being under-represented. -

Dunton Fields, Laindon Basildon Essex Archaeological Evaluation

Dunton Fields, Laindon Basildon Essex Archaeological Evaluation for Bellway Homes Limited CA Project: 660128 CA Report: 13381 June 2013 Dunton Fields, Laindon Basildon Essex Archaeological Evaluation CA Project: 660128 CA Report: 13381 prepared by Peter James, Project Supervisor date 28 May 2013 checked by Derek Evans, Project Manager date 30 May 2013 approved by Simon Carlyle, Principal Fieldwork Manager signed date 5 June 2013 issue 01 This report is confidential to the client. Cotswold Archaeology accepts no responsibility or liability to any third party to whom this report, or any part of it, is made known. Any such party relies upon this report entirely at their own risk. No part of this report may be reproduced by any means without permission. © Cotswold Archaeology Cirencester Milton Keynes Andover Building 11 Unit 4 Office 49 Kemble Enterprise Park Cromwell Business Centre Basepoint Business Centre Kemble, Cirencester Howard Way, Newport Pagnell Caxton Close, Andover Gloucestershire, GL7 6BQ MK16 9QS Hampshire, SP10 3FG t. 01285 771022 t. 01908 218320 t. 01264 326549 e. [email protected] © Cotswold Archaeology Dunton Fields, Basildon, Essex: Archaeological Evaluation CONTENTS SUMMARY ..................................................................................................................... 4 1. INTRODUCTION ................................................................................................ 5 2. FIELDWORK RESULTS.................................................................................... -

BWB) Complementing the Offer in a Revitalised Towngate Basildon’S ‘New and Other Key Partners Will Ensure That the Vision 1

BASILDON BOROUGH LOCAL PLAN BASILDON TOWN CENTRE MASTERPLAN INTERIM SUPPLEMENTARY PLANNING DOCUMENT DECEMBER 2012 Basildon Town Centre Masterplan Interim Supplementary Planning Document / i 1.0 The Vision...to 2030 & Beyond / 1 2.0 The Story So Far / 3 3.0 Masterplan Policy Status / 6 4.0 Methodology / 8 5.0 Drivers for Change... / 9 6.0 The Masterplan / 16 6.1 Overall Concept & Preferred Approach .....................16 6.2 Land Uses & Quantum of Development ....................18 6.3 Key Development Sites & Spaces .............................. 20 6.4 Design ........................................................................ 26 6.5 A High Quality Public Realm… ................................ 30 6.6 Access, Movement & Connectivity .......................... 44 6.7 Infrastructure & Utilities .............................................. 50 7.0 Phasing / 51 8.0 Delivery, Management & Risk / 53 9.0 Monitoring & Review / 57 Supporting Appendices (Separate) S ustainability Appraisal/ Statement of Community Involvement / Evidence Base 1.0 The Vision...to 2030 & Beyond In twenty years time, the centre of Basildon will be a truly successful place – a town centre to be proud of. Businesses will want to locate here and people will want to live, work and spend their leisure time here. 1.1.1 The town centre will have a higher quality • A strong sense of A Partnership Approach range of shops than today as well as a new unique local identity 1.1.6 A Partnership approach will be at the that is sensitive to the unique qualities of places street market, but it will be much more than a and civic pride “...lives up to forefront of delivering the vision for Basildon Town and enhance Basildon’s success. Specifically, this shopping location. -

'Together' Magazine

WE’VE BEEN CLEANING UP Communities, groups and schools have been coming together to fight the blight of dumped waste and litter across the borough of Basildon. We’re CLEANING UP OUR LITTLE HELPERS Schools across the borough got involved with litter picks Litter picks organised with Abacus Primary School, Wickford and Greensted Junior School, Basildon Greensted Junior School litter pick Basildon’s Arts Week, St Martin’s Square. Local artist Maxine Newell, worked with waste collected from around the borough each day to throw the spotlight on the sort of household items We’re that make up more than 80% of the borough’s flytipping. CLEANING UP 2 Help is at hand for Christmas Everything you need to know about your borough winter 2019 basildon.gov.uk togetherat Christmas Fun-filled festivities at Basildon at 70 Together a year to remember We can help to reduce that, by taking Inside... HOUSINGNEWS Reducing loneliness and social isolation Goi We can help to reduce that, by taking time to get together this Christmas. at The council’s ‘Unseen, Unheard’ campaign has been launched in support of the Mayor of Basildon’s charitable trust to reduce loneliness and social isolation in the borough. The campaign aims to raise Together awareness and funds over the Christmas period, for local charities to support local people, and bring the At least 6,000 households in Basildon each year are community together. likely to be lonely, or at high risk of isolation. Loneliness amongst older people is higher than the These charities provide activity centre services to help national average – in the worst affected areas by people create new social connections, through things up to 30%. -

South West Essex Pharmacy Opening Times Easter 2021

South West Essex Pharmacy Opening Times Easter 2021 Good Friday Easter Sunday Bank Holiday 2nd April 2021 4th April 2021 5th April 2021 Basildon AA Pharmacy, 98 Whitmore Way, Basildon, SS14 3JT Closed 10:00 - 13:00 Closed Asda Pharmacy, Eastgate Centre, Basildon, SS14 1AE 09:00 - 18:00 Closed 09:00 - 18:00 Asda Pharmacy, Heron Retail Park, Miles Gray Road, Basildon, SS14 3AF 09:00 - 18:00 Closed 09:00 - 18:00 Boots, 25 Town Square, Basildon, SS14 1BA 08:30 - 17:30 Closed 10:00 - 16:00 Tesco In-store Pharmacy, Mayflower Retail Park, Gardiners Link, Basildon, SS14 3HZ 08:00 - 20:00 Closed 09:00 - 18:00 Tesco In-store Pharmacy, Off Station Lane, Pitsea, Basildon, SS13 3JU 08:00 - 21:00 Closed 09:00 - 18:00 Billericay Boots, 64-66 High Street, Billericay, CM12 9BS 08:30 - 17:30 Closed 10:00 - 16:00 Brentwood Boots, 51 High Street, Brentwood, CM14 4RH 10:00 - 16:00 Closed 10:00 - 16:00 Ongar Road Pharmacy, 249 Ongar Road, Brentwood, CM15 9DZ Closed 10:00 - 13:00 Closed Village Pharmacy, 86 Church Lane, Doddinghurst, Brentwood, CM15 0NG Closed 09:00 - 11:00 Closed Corringham Allcures Pharmacy, 19-21 Lampits Hill, Corringham, Stanford-Le-Hope, SS17 9AA 09:00 - 19:00 09:00 - 17:00 09:00 - 19:00 Boots, 83-85 St Johns Way, Corringham, Stanford-Le-Hope, SS17 7NA 08:30 - 18:00 Closed 10:00 - 16:00 Thurrock Boots, 35-41 High Street, Grays, RM17 6LU 08:30 - 17:30 Closed 10:00 - 16:00 Boots, 74-75 Thurrock Lakeside Shopping Centre, West Thurrock, Grays, RM20 2ZG 10:00 - 20:00 Closed 10:00 - 20:00 Boots, Unit 1B, Junction Retail Park, Western Avenue, West Thurrock, Grays, RM20 3LP 09:00 - 18:00 Closed 09:00 - 18:00 Tesco In-store Pharmacy, Cygnet View, Lakeside Retail Park, Grays, RM20 1TX 08:00 - 20:00 Closed 09:00 - 18:00 Vision Pharmacy, 11 Crammavill Street, Stifford Clays, Grays, RM16 2AP 10:00 - 16:00 10:00 - 13:00 10:00 - 16:00 The above information was correct at time of publication. -

Chelmsford Retail Capacity Study 2014

Report GVA 10 Stratton Street London W1J 8JR Chelmsford Retail Capacity Study 2014 Chelmsford City Council November 2014 gva.co.uk Prepared By: Elizabeth Milimuka .......... Status . Draft ....................... Date June 2014 ....................... Reviewed By: Matt Morris ...................... Status . Draft ....................... Date October 2014 ................. For and on behalf of GVA Grimley Ltd October 2014 I gva.co.uk Chelmsford City Council Chelmsford Retail Capacity Study 2014 CONTENTS Executive Summary ............................................................................................................. 1 1. Introduction .................................................................................................................. 7 2. Policy Framework ........................................................................................................ 9 3. Retail Market Review and Town Centre Trends ....................................................... 22 4. Competing Centres ................................................................................................... 34 5. Qualitative Assessment – Chelmsford City Centre ................................................. 51 6. Qualitative Assessment - South Woodham Ferrers Town Centre ........................... 83 7. Qualitative Assessment - Principal Neighbourhood Centres ................................. 91 8. Quantitative Needs Assessment ............................................................................... 99 9. Opportunities for Growth -

September 2020 Imany It Has Been a Time of Reflection, Decluttering and Reorganisation

8822 The Resident Sept 2020 proof 2:Layout 2 16/8/20 17:46 Page 1 FREE to members of BDRA The Resident, “Help us to help you” Billericay District Residents Association MAYFLOWER Wow! Who saw that coming? was away on holiday in March and then returned on 23rd to chaos. Six months on, life and its priorities have changed beyond anything we could imagine. For September 2020 Imany it has been a time of reflection, decluttering and reorganisation. This edition is an opportunity to know that we can still make a seen a number of appeals for In This Issue: celebrate what we want to keep difference. volunteers to keep the Resident, and value the position of the committees and distribution of BDRA as a voice to challenge As you will see this is my last the Resident going. This is now the structures we do not want edition since after a year we are crunch time. Andy Maddocks 1 Wow! Who saw that to keep. See Mike Andrew’s at last on the move. Prior to my has written a state of the BDRA coming? update on page 11 and decision to move you will have letter to you all. 1 The Future of the BDRA Commemorative tree planting in 1 Commemorative tree Lake Meadows THE FUTURE OF THE BDRA planting in Lake Meadows e have known for some time that Chris Wade, our Editor would 1 Can you help? be moving away from the area. This time is upon us and this Wedition will be her last. -

June 2020 Basildon Town Centre Masterplan

Basildon Town Centre Masterplan Draft for consultation: June 2020 Contents 1.0 p5 4.0 p27 5.0 p61 Introduction Proposals Phasing and 1.1 Introduction 4.1 Focus areas: 1.2 Wider & Strategic context St. Martins quarter and Westgate area 1.3 Town centre: past and present Town Square and East Square Delivery Station environs Eastgate Great Oaks 3.0 p11 4.2 Inclusivity 4.3 Design Quality Appendices Strategy 4.4 Sustainability & Response to the Climate Appendix 1: Basildon Town Centre 3.1 Vision Statement Crisis Masterplan urban appraisal 3.2 Guiding Principles Appendix 2: Planning Policy 3.3 Strategic Aims: Appendix 3: Property Market Drivers Land use Appendix 4: What We Learnt from Local Connectivity and movement Engagement Public realm and open space Building heights Culture Biodiversity net gain and greenery Local economy Deliverability Inclusivity Design Quality Sustainability and response to climate change Introduction 1 2.1 Introduction Introduction About This Project Purpose of the consultation and next steps The Council are pleased to present an exciting and ambitious Basildon Borough Council commissioned architects and This document is a draft version of the masterplan which has new masterplan for Basildon town centre. We want to redefine urban designers We Made That and real estate consultants been prepared for public consultation in line with Government what the town centre offers, meeting the needs for housing, Cushman & Wakefield to develop a Masterplan for the future guidance regarding the production of Supplementary Planning retail, leisure and business opportunities. This is about a total of Basildon Town Centre. The Masterplan aims to build on the Documents (SPDs). -

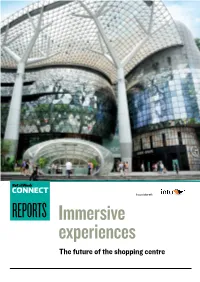

Immersive Experiences the Future of the Shopping Centre Retailweek Connect Reports

RetailWeek CONNECT In association with REPORTS Immersive experiences The future of the shopping centre RetailWeek CONNECT REPORTS RETAIL WEEK FOREWORD JameS KNOWLES HEAD OF COMMERCIAL CONTENT OPERATIONS oday’s consumer buys into new set of criteria; does this centre offer experiences. Not just within the the immersive experience the modern stores they visit, but also from customer wants? Retailers have to base retail destinations themselves. Understanding this is key. What store openings on a TAs a result UK shopping centres do today’s consumers expect from the are rising to the challenge by giving experience shopping centres provide? new set of criteria consumers more reasons than just retail And how will these expectations evolve? to pay a visit. What are centres doing, and what can they – does this centre Look no further than intu. The do, to meet these demands? offer the experience shopping centre operator will open its To find out, this Retail Week report, first Nickelodeon park at intu Lakeside, produced in association with intu, has consumers expect? strengthening its appeal to the family- surveyed a nationally representative pool day-out market. of 2,000 UK consumers to find out. This is a clear indication that shopping Over the coming pages we will reveal centres are about much more than simply how the shopping centre landscape has shopping. changed, bringing you the exclusive While not every centre is going to insights from our survey, identifying feature an all-singing, all-dancing fun examples of centres leading the way, and park, it does mean retailers now have to arming retailers with key takeaways on base store-opening decisions on a whole what they need to consider.