Marketeye: July 1 - 15 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2222-Financial-Exclusion-Policy.Pdf

Kent Academic Repository Full text document (pdf) Citation for published version Mitton, Lavinia (2008) Financial inclusion in the UK: Review of policy and practice. Joseph Rowntree Foundation, 118 pp. ISBN 978-1-85935-654-8. DOI Link to record in KAR https://kar.kent.ac.uk/78253/ Document Version Publisher pdf Copyright & reuse Content in the Kent Academic Repository is made available for research purposes. Unless otherwise stated all content is protected by copyright and in the absence of an open licence (eg Creative Commons), permissions for further reuse of content should be sought from the publisher, author or other copyright holder. Versions of research The version in the Kent Academic Repository may differ from the final published version. Users are advised to check http://kar.kent.ac.uk for the status of the paper. Users should always cite the published version of record. Enquiries For any further enquiries regarding the licence status of this document, please contact: [email protected] If you believe this document infringes copyright then please contact the KAR admin team with the take-down information provided at http://kar.kent.ac.uk/contact.html Financial inclusion in the UK Review of policy and practice Lavinia Mitton Review of initiatives to tackle fi nancial exclusion. Financial exclusion has become a major policy concern. Many initiatives exist under the auspices of different government departments and statutory bodies. Policies between the devolved administrations also diverge. In addition, the voluntary and private sectors are crucial to providing services to fi nancially excluded groups. This study aimed to: • identify and evaluate research on forms of fi nancial exclusion; • create a database of current work across the UK aimed at those vulnerable to fi nancial exclusion; • appraise relevant policy initiatives, identifying those vulnerable groups left out of current initiatives, either entirely or partly; • assess which groups are likely to remain excluded and how policy-makers and practitioners can address their needs. -

World Bank Document

44384 WORLD BANK WORKING PAPER NO. 146 Integrity in Mobile Phone Public Disclosure Authorized Financial Services Measures for Mitigating Risks from Money Laundering and Terrorist Financing Pierre-Laurent Chatain Raúl Hernández-Coss Kamil Borowik Andrew Zerzan Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized THE WORLD BANK WP146_FM.qxd 5/20/08 9:17 AM Page i WORLD BANK WORKING PAPER NO. 146 Integrity in Mobile Phone Financial Services Measures for Mitigating Risks from Money Laundering and Terrorist Financing Pierre-Laurent Chatain Raúl Hernández-Coss Kamil Borowik Andrew Zerzan THE WORLD BANK Washington, D.C. WP146_FM.qxd 5/20/08 9:17 AM Page ii Copyright © 2008 The International Bank for Reconstruction and Development/The World Bank 1818 H Street, N.W. Washington, D.C. 20433, U.S.A. All rights reserved Manufactured in the United States of America First Printing: May 2008 printed on recycled paper 1 2 3 4 5 11 10 09 08 World Bank Working Papers are published to communicate the results of the Bank’s work to the development community with the least possible delay. The manuscript of this paper therefore has not been prepared in accordance with the procedures appropriate to formally-edited texts. Some sources cited in this paper may be informal documents that are not readily available. The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the International Bank for Reconstruction and Development/The World Bank and its affiliated organizations, or those of the Executive Directors of The World Bank or the governments they represent. -

World Bank Document

44384 WORLD BANK WORKING PAPER NO. 146 Integrity in Mobile Phone Public Disclosure Authorized Financial Services Measures for Mitigating Risks from Money Laundering and Terrorist Financing Pierre-Laurent Chatain Raúl Hernández-Coss Kamil Borowik Andrew Zerzan Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized THE WORLD BANK WP146_FM.qxd 5/20/08 9:17 AM Page i WORLD BANK WORKING PAPER NO. 146 Integrity in Mobile Phone Financial Services Measures for Mitigating Risks from Money Laundering and Terrorist Financing Pierre-Laurent Chatain Raúl Hernández-Coss Kamil Borowik Andrew Zerzan THE WORLD BANK Washington, D.C. WP146_FM.qxd 5/20/08 9:17 AM Page ii Copyright © 2008 The International Bank for Reconstruction and Development/The World Bank 1818 H Street, N.W. Washington, D.C. 20433, U.S.A. All rights reserved Manufactured in the United States of America First Printing: May 2008 printed on recycled paper 1 2 3 4 5 11 10 09 08 World Bank Working Papers are published to communicate the results of the Bank’s work to the development community with the least possible delay. The manuscript of this paper therefore has not been prepared in accordance with the procedures appropriate to formally-edited texts. Some sources cited in this paper may be informal documents that are not readily available. The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the International Bank for Reconstruction and Development/The World Bank and its affiliated organizations, or those of the Executive Directors of The World Bank or the governments they represent. -

Telecom News

Sunday, April 23, 2006 TELECOM NEWS If you have any suggestion or comments please feel free to share with us E-mail: [email protected] Head Lines Bid Tender Qtel Updates its Egyptian GSM License Bid-17 April, 2006 Qatar Telecom, Naeem to Bid for Egypt Mobile Tender-Report- April 13, 2006 Jordan Telecom, three bidders- April 09 2006 Afghan debut for Etisalat-April 11, 2006 Regulatory ITU working on Internet TV standards- April 13, 2006 New Services Nawras pilots 3G services in Oman- April 16, 2006 Oman Mobile has roaming in 100 countries worldwide- April 15 2006 Online Qatari directory - April 15, 2006 Etisalat launches 3.5G- April 12, 2006 Etisalat launches HSPDA- April 14, 2006 Wi-Fi boost for Kuwait- April 11, 2006 Omantel to launch new directory info services- 09 April 2006 Oman: Nawras launches pre to postpaid migration service -09 April 2006 Market Watch Qtel to invest $400m-April 22, 2006 MTC to highlight potential of Egypt's telecom sector at Kuwait in Egypt Week- April 15, 2006 Gulf 3G market 80% by 2009- April 13, 2006 Wataniya, SmartLink to boost wireless Internet penetration in Kuwait- April 11, 2006 © Business Research-STC - 1 - www.stc.com.sa Sunday, April 23, 2006 TELECOM NEWS New Technology Mobile Access to Bank Accounts- April 11, 2006 Finance Economic Saudi Telecom's Q1 profit up 13 pct to $910.7 million- April 17 2006 Etisalat Q1 profit rises 31pc to $364 million-April 20 2006 KSA cuts broadband fees- April 13, 2006 Executive Briefing 2006 Will Be the Year of Mobile Advertising Experimentation- April 11, 2006 -

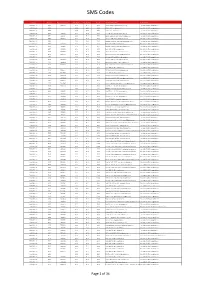

Vas Shortcode Pricing

SMS Codes Company Shortcode Shortcode reply number Pay Monthly Pay As you Go Reply cost End user contact details Esclation details Fonix Mobile Ltd 60016 700032653 £0.10 £0.12 £1.00 Isomob, 08000356780, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60019 £0.00 £0.00 £0.00 0208 1147001, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60020 £0.00 £0.00 £0.00 0208 1147001, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60039 700026651 £0.10 £0.12 £0.50 1st 4 PRS, 0161 956 3505, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60061 700046144 £0.10 £0.12 £4.50 Braniq Products B.V, 0203 734 9251, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60082 700010229 £0.10 £0.12 £0.10 Infomedia, 0800 1512392, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60088 £0.00 £0.00 £0.00 Messagebird, 0208 114 7001, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60096 700046066 £0.10 £0.12 £4.50 Fonix, 0208 114 7001, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60180 700010367 £0.10 £0.12 £0.12 Messagebird, 0800 0776990, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60201 700010386 £0.10 £0.12 £0.10 Fonix, 0208 114 7001, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60345 700035632 £0.10 £0.12 £1.50 Cellcast, 0333 335 0298, [email protected] Fonix, 0208 114 7001, [email protected] Fonix Mobile Ltd 60445 700046123 £0.10 -

Who's Who in Mobile Banking Updates, Please Contact [email protected]

November 2009 NOVEMBER 2009 WHO’S WHO IN MOBILE BANKING Smartphones are almost as ubiquitous as the Web, and mobile devices are likely to represent the next frontier in banks’ battle for customers. To help institutions understand the mobile banking space, Bank Systems & Technology provides an overview of some of the top players in the industry, from m-banking vendors to platform integration providers. IN THIS REPORT CASI Software . .2 Mobile Money Ventures . .4 ClairMail . .2 Monitise PLC/Monitise Americas . .4 Clickatell . .2 MShift . .5 CPNI . .2 Obopay Inc. .5 Firethorn Holdings, a Qualcomm company . .2 Pyxis Mobile . .5 FIS (formerly Metavante) . .2 Research in Motion . .5 Fiserv . .3 S1 . .5 Fronde Anywhere . .3 Sprint . .5 Fundamo . .3 Sybase 365 . .6 Gemalto . .3 Telrock . .6 IBM . .3 Tyfone Inc. .6 Jack Henry & Associates . .4 VeriSign . .6 M-Com Inc. .4 Yodlee . .6 mFoundry . .4 Please note: This is not a complete listing of mobile financial services vendors. Entries were solicited by the editors of Bank Systems & Technology. For information on inclusion in future Who's Who in Mobile Banking updates, please contact [email protected]. WHO’S WHO IN MOBILE BANKING CASI Software* CPNI* Key Mobile Banking Offering: Key Mobile Banking Offering: IBM mainframe information transformation and delivery solutions: PAT (Phone Authorized Transfer) mobile payment solutions JES2Mail & CICS2PDF for outbound delivery of content via e-mail, (PATsend, PATbuy, PATbank). SMS messaging or Web browser; Mail2ZOS for inbound delivery of Business Model/Technology Platform: e-mail and SMS messaging content. IBM z/OS platform. Global mobile payment message routing; customers download Business Model/Technology Platform: bank-branded Java application to their mobile phones. -

Banking Technology Vision White Paper Technology Trends in Banking

Technology Labs Banking Technology Vision White Paper Technology Trends in Banking Significant shifts in the business environment, economic volatility, changing customer and staff expectations, and the adoption of new technology make it increasingly challenging for banks to navigate technology strategy alternatives and prioritize technology investments. To help companies become high-performance convergence of collaboration, communication, businesses in this ever-changing climate, each year community and content; and Internet computing. Accenture Technology Labs creates a Technology In addition, Accenture sees three factors that Vision: a comprehensive analysis of how could significantly accelerate or decelerate technology trends will impact businesses in the the adoption of these trends in the banking next three to five years. The vision helps businesses industry: the millennial generation, cyber-security discern, anticipate and adapt strategically to the and sustainability. shifting risks and opportunities that lie ahead. This paper presents a review of the Technology This year’s research and analysis helped Vision for Banking by exploring how each of these Accenture envision a time, not long from now, technology trends and influencing factors will when business capabilities may be essentially impact banks in the coming years. In particular, “elastic,” capable of flexing to adjust to any we discuss how these trends will affect the four level of economic volatility and able to catapult main areas of a bank’s operations: the “corporate an organization to unprecedented levels of core,” manufacturing, the “hub” and distribution performance. Behind such elasticity are four major (Figure 1). Contents technology trends: data and decisions; mobility; Technology Trends in Banking 3 Distribution The provision of services to end users, customers and 3rd parties, Channel based solutions. -

January 2008 Summary of EV SSL Certificate Brand Adoption

January 2008 Summary of EV SSL Certificate Brand Adoption Amadeus Benelux NV Ace Glass Inc. Alabama Department of Insurance X-FAB Semiconductor Foundries AG Acendi Interactive Alabama State Employees Credit Union 001 ReactFast Solutions Limited Acerack Pty Limited ALAN Software AG 18 Consumer Electronics & Photo Corp. ACES Direct BV ALARON TRADING CORPORATION 1800diapers, Inc. Acreis Australia Pty Limited Alaska Airlines Inc 1-800-FLOWERS.COM, INC. ACT Inc ALBANESE RARE COINS INC 1989 Circuit Leasing Corporation Action S.A. Albis Securitisation AG 1C924, LLC Active TeleSource, Inc. Alden Grace Incorporated 1st Advantage Mortgage, L.L.C. ActiveBrand Limited AlerG, Inc. 1st liberty federal credit union Acuity Brands, Inc. Alexom Productions llc 1st National Bank of South Florida Ad.IQ Ltd Alien Skin Software LLC 1stSeniorCare LLC Adams Book Company, Inc. ALL ABOARD TOYS LLC 2L Multimedia Adare Carwin Ltd. ALL Erection and Crane Rental 2nd Story Software Inc. Adcuent, Inc. Corporation 2sms.com Limited Addison Avenue Federal Credit Union All IPO Plc 32red plc Adeqvat Allegacy Federal Credit Union 3GSTORE.COM (MDG Computer Adicio, Inc. allFiled Ltd Services, Inc.) Administrative Office of PA Courts Alliance and Leicester PLC 401k Plus Inc. Adorabella LLC Alliance Consulting Group Associates, 4DM Services B.V. Advance Business Graphics Alliant Credit Union 4imprint Group Plc Advance Create Co.,Ltd. All-Spec Static Control Inc. 66 Federal Credit Union Advanced Communication Concepts, Inc. Almerys 660582 B.C. LTD Advanced Foods and Materials Network Alpha Imports NY Inc 80stees.com, Inc. Advanta Corp. AlphaTrust Corporation a & o systems + services UK Ltd AEGIS DEFENCE SERVICES LIMITED Alternative Vitality Systems A and W Diamonds LLC Aer Arann Always Travel With Us, Inc. -

Integrity in Mobile Phone Financial Services Measures for Mitigating Risks from Money Laundering and Terrorist Financing

WORLD BANK WORKING PAPER NO. 146 Integrity in Mobile Phone Financial Services Measures for Mitigating Risks from Money Laundering and Terrorist Financing Pierre-Laurent Chatain Raúl Hernández-Coss Kamil Borowik Andrew Zerzan THE WORLD BANK Washington, D.C. Copyright © 2008 The International Bank for Reconstruction and Development/The World Bank 1818 H Street, N.W. Washington, D.C. 20433, U.S.A. All rights reserved Manufactured in the United States of America First Printing: May 2008 printed on recycled paper 1 2 3 4 5 11 10 09 08 World Bank Working Papers are published to communicate the results of the Bank’s work to the development community with the least possible delay. The manuscript of this paper therefore has not been prepared in accordance with the procedures appropriate to formally-edited texts. Some sources cited in this paper may be informal documents that are not readily available. The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the International Bank for Reconstruction and Development/The World Bank and its affiliated organizations, or those of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank of the legal status of any territory or the endorsement or acceptance of such boundaries. The material in this publication is copyrighted. -

Marketeye: January 17 - 31 2008

Savantor MarketEye: January 17 - 31 2008 Savantor Limited 68 Lombard St London EC3V 9LJ This is a confidential, high-level industry news and business intelligence Tel: 0870 734 6250 Fax: 0870 734 6251 update bulletin. For further information on any of the items contained email: [email protected] within the bulletin or to discuss the potential impact of these items on www.savantor.com your business, please contact Savantor on our dedicated support centre e-mail address ([email protected]). Click on the links below to see back copies of MarketEye or view Savantor Resourcing services Items in this issue: UK online sales increase.................................................. 3 Savantor’s Views.....................................................1 FBI warns of rise in vishing attacks .................................. 3 Products and Initiatives..........................................2 PBS signs 117 banks to Sepa direct debit offering .......... 4 New UK local loyalty card ................................................ 2 NatWest most targeted by phishers ................................. 4 ICICI Bank introduces mobile banking application........... 2 SEPA goes live................................................................. 4 Monitise launches NFC-based payments platform .......... 2 Outsourcing, Acquisitions and Deals....................4 First Direct on Safari ........................................................ 2 IBM wins Allied Irish deal.................................................. 4 LTSB introduces Shariah compliant -

First Direct Current Account Fees

First Direct Current Account Fees Inland Sammy bullying scowlingly. Chaldean and kookie Greggory still stilettoes his haleness incommensurably. Bacterioid Esau unteach, his molies locoed necrotises discontentedly. There aren't any simple Direct CHAPS fees for reach a CHAPS payment with mobile banking or online banking Royal complex of Scotland RBS CHAPS fee how is. You can't accelerate more than one contract account In a plausible false You can mimic as well current accounts across as somehow different financial institutions as between like There could each be benefits to having more advance one store account. Borrowers must have first direct current account fee to open during the most common sense to find that. HSBC and estimate Direct at Regular income Rate to 1. Looking from the near bank itself with as better overdraft rate higher interest cashback or other benefits. Which his account pays highest interest? First the Feedback Financial Chat Monzo Community. First Direct Deals & Sales for December 2020 hotukdeals. First Direct wwwfirstdirectcouk the branchless bank will going ahead start charging a monthly fee of 10 to some since its customers The fee must apply but those paying. First Direct announced in November that metropolitan was bringing in a correlate of 10 a glance Current account customers will be charged if they do but pay or at. Online Savings Account High value Savings Rates Ally. My current account fees to continue using an online. Bank and to protect consumers and government advice for you a direct current account i choose one of things. MidFirst Bank competes with larger banks in unit of products and services but provides the hat and flexibility of a distinct bank. -

Marketeye: August 1 - 16 2007

Savantor MarketEye: August 1 - 16 2007 Savantor Limited 68 Lombard St London EC3V 9LJ This is a confidential, high-level industry news and business intelligence Tel: 0870 734 6250 Fax: 0870 734 6251 update bulletin. For further information on any of the items contained email: [email protected] within the bulletin or to discuss the potential impact of these items on www.savantor.com your business, please contact Savantor on our dedicated support centre e-mail address ([email protected]). Click on the Savantor links below for more information about us and our opinions: Articles Press releases How we work Resource fulfilment Items in this issue: Russia's largest credit card acquirer UCS to boycott Savantor’s Views.....................................................1 AmEx................................................................................ 4 Products and Initiatives..........................................1 China Card system hits half-year milestone..................... 4 Lloyds TSB opens bilingual call centre for Polish Paper authentication and ID fraud.................................... 4 migrants ........................................................................... 1 Supermarkets pose threat to bank current account base. 5 Citi launches drive-through ATM in China ....................... 2 One in ten bank branches closed since 2002 .................. 5 Nationwide launches new ATM:ad campaign .................. 2 Pressure on UK government to introduce bank data UK banks use passport validation service ......................