Notification Regarding Commencement of Tender Offer of Shares, Etc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Of Trust Beneficiary Interest in Domestic Real Estate

July 30, 2021 Real Estate Investment Trust Unit Issuer: TOKYU REIT, Inc. 1-12-1, Dogenzaka, Shibuya-ku, Tokyo, 150-0043, Japan Kazuyoshi Kashiwazaki Executive Director (Securities Code: 8957) Investment Management Company: Tokyu Real Estate Investment Management Inc. Representative: Kazuyoshi Kashiwazaki Representative Director & President, Chief Executive Officer Inquiries: Yuji Shimizu General Manager, Finance and IR TEL: +81-3-5428-5828 Notice Concerning Disposition (Daikanyama Forum) of Trust Beneficiary Interest in Domestic Real Estate TOKYU REIT, Inc. (“TOKYU REIT”) today announced that its investment management company, Tokyu Real Estate Investment Management Inc. (“Tokyu REIM”), had decided to dispose of trust beneficiary interest in domestic real estate (the “Disposition”). Brief details are as follows. 1. Disposition Details Property Name Daikanyama Forum Location 17-16, Sarugaku-cho, Shibuya-ku, Tokyo Disposition Price ¥4,250 million Book Value ¥4,119 million (Expected value as of disposition date) (Note 1) Amount of Difference from ¥130 million (Note 2) Disposition Price Purchaser Domestic company (Please refer to “5. Purchaser Profile”) Brokerage Yes Decision of Disposition July 30, 2021 Contract Date July 30, 2021 Disposition Date August 31, 2021 Receiving of Disposition Costs August 31, 2021 (Note 3) (Note 1) The amount includes the surplus for the management association after the conversion into the ownership interest of TOKYU REIT. (Note 2) Amount of difference between the disposition price and the expected book value as of the scheduled disposition date is indicated. (Note 3) TOKYU REIT is scheduled to receive 212,500,000 yen as a deposit on the date of conclusion of the purchase and sale agreement and the remaining amount on the disposition date. -

FOR IMMEDIATE RELEASE Toyota Tsusho Corporation Reports

FOR IMMEDIATE RELEASE Toyota Tsusho Corporation Reports Earnings for the Nine Months Ended December 31, 2016 Nagoya, Japan; February 2, 2017 — Toyota Tsusho Corporation (TSE: 8015) reported consolidated net sales of 5,810.338 billion yen and profit attributable to owners of the parent of 63.521billion yen, or 180.52 yen per share, for the nine months ended December 31, 2016. Consolidated Results of Operations In the first nine months of the fiscal year (April 1, 2016 – December 31, 2016), overall global economic growth picked up as the emerging market economic slowdown came to a halt while the U.S. and European economies held firm. The U.S. economic recovery remained intact, fueled by robust personal consumption, improvement in the employment and income environments, and dollar appreciation and equity market gains driven by optimism about the Trump Administration’s fiscal policies. The European economy gradually recovered by virtue of solid domestic demand and improvement in the employment environment despite uncertainty stemming from the UK's impending exit from the EU. The Chinese economy remained sluggish. While it was bolstered by a robust service sector and consumer spending on homes, autos and other goods in response to government policies, the Chinese economy was weighed down by efforts to reduce excess production capacity. Emerging market economies’ slowdown tapered off as resource prices stabilized. Against such a backdrop, the Japanese economy recovered slowly, driven largely by buoyant housing investment and growth in exports to Europe, the Americas and Asia. Amid such an environment, the Toyota Tsusho Group's consolidated net sales for the nine months ended December 31 decreased 450.5 billion yen (7.2%) year on year to 5,810.3 billion yen, largely as a result of yen appreciation. -

PDF Format, 4332Kbytes

Hitachi Integrated Report 2018 Year ended March 31, 2018 Hitachi Group Identity Originally set by Hitachi founder Namihei Odaira, the Mission has been carefully passed on to generations of Hitachi Group employees and stakeholders throughout the company’s 100-year history. The Values reflect the Hitachi Founding Spirit, which was shaped by the achievements of our company predecessors as they worked hard to fulfill Hitachi’s Mission. The Vision has been created based on the Mission and Values. It is an expression of what the Hitachi Group aims to become in the future as it advances to its next stage of growth. The Mission, Values, and Vision are made to Identity be shared in a simple concept: Hitachi Group Identity. The more than century-long history of Hitachi since its founding is built atop the Mission expressed by founder Namihei Odaira— “Contribute to society through the development of superior, original technology and products.” Based on continually honing its proprietary technologies, Hitachi has sought to fulfill this Mission by providing products and services that address societal issues as they have changed over time. Hitachi’s philosophy of contributing to society and helping efforts to address societal issues is fully aligned with the Sustainable Development Goals (SDGs) adopted by the United Nations and the Society 5.0* concept promoted by the Japanese government. Today and for the future, Hitachi aims through its wide-ranging business activities to resolve the issues of its customers and society in the quest to build a more dynamic world. * Society 5.0 expresses a new idea of society and related efforts to achieve this, as advocated by the Japanese government. -

Integrated Report 2019 Tokyu Corporation

INTEGRATED 2019 REPORT INTEGRATED TOKYU CORPORATION Corporate Planning Office https://www.tokyu.co.jp/global/english/index.html This product is made of FSC® -certified and other controlled material. INTEGRATED REPORT 2019 Urban Development DNA That Has Flowed Through Our Veins Since the founding of the Tokyu Group, we have balanced our public and private natures with Tokyu Corporation traces its roots back to Den-en-toshi Company, the development of public transportation and residential areas as our two pillars. At the same time, which was started in 1918 under the leadership of Eiichi Shibusawa. we have strived to offer new life values ahead of our competitors as we continued to work on In 1922, Den-en-toshi Company’s railway division was separated to independently found developing sustainable communities. Meguro-Kamata Electric Railway Company. Going forward, we will always offer quality of living from new perspectives and create beautiful living In the approximately 100 years since our founding, we have been undertaking environments so that all people may find genuine happiness and express an individual lifestyle amid urban development as a private company together with local residents. a harmonious society overflowing with kindness and consideration. The characteristics of our urban development have been summarized below. Balancing the convenience of urban access with the living environment of the suburbs based on the garden city ideology founded by Englishman Ebenezer Howard Group Slogan Creating towns centered on stations, and urban -

Financial Results for the Fiscal Year Ended March 31, 2001

6-7-35 Kitashinagawa Shinagawa-ku News & Information Tokyo 141-0001 Japan No: 01-024E Date: April 27, 2001 FINANCIAL RESULTS FOR THE FISCAL YEAR ENDED MARCH 31, 2001 FOR IMMEDIATE RELEASE Tokyo, April 27, 2001 -- Sony Corporation announced today its consolidated results for the fiscal year ended March 31, 2001. Consolidated Results for the Year (Millions of yen, millions of U.S. dollars, except per share amounts) Year ended March 31 2000 2001 Change 2001 Sales and operating revenue ¥ 6,686,661 ¥ 7,314,824 +9.4% $ 58,518 Operating income 223,204 225,346 +1.0 1,803 Income before income taxes 264,310 265,868 +0.6 2,127 Income before cumulative effect of accounting changes 121,835 121,227 -0.5 970 Net income 121,835 16,754 -86.2 134 Per share data* Income before cumulative effect of accounting changes — Basic ¥ 144.58 ¥ 132.64 -8.3% $ 1.06 — Diluted 131.70 124.36 -5.6 0.99 Net income — Basic ¥ 144.58 ¥ 18.33 -87.3 $ 0.15 — Diluted 131.70 19.28 -85.4 0.15 1 Consolidated Results Note I: i) In June 2000, the Accounting Standards Executive Committee of the American Institute of Certified Public Accountants (“AcSEC”) issued Statement of Position (“SOP”) 00-2, “Accounting by Producers or Distributors of Films.” SOP 00-2 is effective for fiscal years starting on or after December 16, 2000 with early application encouraged. Sony adopted SOP 00-2 in the first quarter ended June 30, 2000, effective as of April 1, 2000 (refer to page 20). -

![Corporate Information [PDF/1.01MB]](https://docslib.b-cdn.net/cover/8791/corporate-information-pdf-1-01mb-1508791.webp)

Corporate Information [PDF/1.01MB]

Corporate Information 088 JR East: Domestic and International Perspectives 101 Glossary 102 Consolidated Subsidiaries and Equity-Method Affiliated Companies 104 Corporate Data 105 Stock Information Annual Report 2010 087 Corporate Information JR East: Domestic and International Perspectives PEER GROUP COMPARISONS In this section, several key performance indicators illustrate how JR East compares with selected well- known companies. Total Stock Market Value Millions of U.S. Dollars International Domestic JR East 27,647 JR East 27,647 British Airways 4,233 ANA 7,196 Lufthansa 7,210 Tokyu 5,249 Union Pacific 32,288 TEPCO 36,142 FedEx 17,259 NTT 56,058 UPS 56,957 • Data in these graphs have been computed from each company’s share price and shares outstanding at the end of the previous fiscal year. Operating Revenues Millions of U.S. Dollars International Domestic JR East 27,674 JR East 27,674 British Airways 12,071 ANA 13,208 Lufthansa 29,859 Tokyu 13,227 Union Pacific 14,143 TEPCO 53,938 FedEx 35,497 NTT 109,477 UPS 45,297 Net Income (Loss) Millions of U.S. Dollars International Domestic JR East 1,293 JR East 1,293 British Airways –642 ANA –617 Lufthansa –150 Tokyu 160 Union Pacific 1,898 TEPCO 1,438 FedEx 98 NTT 5,293 UPS 2,152 088 East Japan Railway Company Cash Flows from Operating Activities Millions of U.S. Dollars International Domestic JR East 5,152 JR East 5,152 British Airways 500 ANA 892 Lufthansa 2,668 Tokyu 1,623 Union Pacific 3,234 TEPCO 10,627 FedEx 2,753 NTT 30,299 UPS 5,285 Return on Average Equity (ROE) % International Domestic JR East 6.9 JR East 6.9 British Airways –21.5 ANA –14.4 Lufthansa –1.8 Tokyu 4.0 Union Pacific 11.7 TEPCO 5.5 FedEx 0.7 NTT 6.5 UPS 29.9 Average equity is the average of equity at the end of the previous and applicable fiscal years. -

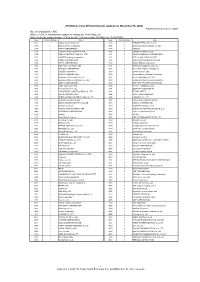

"JPX-Nikkei Index 400"

JPX-Nikkei Index 400 Constituents (applied on November 30, 2020) Published on November 9, 2020 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3086 1 J.FRONT RETAILING Co.,Ltd. 1333 1 Maruha Nichiro Corporation 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1605 1 INPEX CORPORATION 3092 1 ZOZO,Inc. 1719 1 HAZAMA ANDO CORPORATION 3107 1 Daiwabo Holdings Co.,Ltd. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3116 1 TOYOTA BOSHOKU CORPORATION 1721 1 COMSYS Holdings Corporation 3141 1 WELCIA HOLDINGS CO.,LTD. 1766 1 TOKEN CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3167 1 TOKAI Holdings Corporation 1802 1 OBAYASHI CORPORATION 3197 1 SKYLARK HOLDINGS CO.,LTD. 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3288 1 Open House Co.,Ltd. 1812 1 KAJIMA CORPORATION 3289 1 Tokyu Fudosan Holdings Corporation 1820 1 Nishimatsu Construction Co.,Ltd. 3291 1 Iida Group Holdings Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3349 1 COSMOS Pharmaceutical Corporation 1824 1 MAEDA CORPORATION 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1860 1 TODA CORPORATION 3382 1 Seven & I Holdings Co.,Ltd. 1861 1 Kumagai Gumi Co.,Ltd. 3391 1 TSURUHA HOLDINGS INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3401 1 TEIJIN LIMITED 1881 1 NIPPO CORPORATION 3402 1 TORAY INDUSTRIES,INC. -

Growth Strategy for Japan's Airline and Rail Industries:Tokyo Olympics to Trigger a Leap

No. 199 February 1, 2015 Growth Strategy for Japan’s Airline and Rail Industries: Tokyo Olympics to Trigger a Leap Keisuke SANO and Kotaro SHINTANI NRI Papers No. 199 February 1, 2015 Growth Strategy for Japan’s Airline and Rail Industries: Tokyo Olympics to Trigger a Leap Keisuke SANO and Kotaro SHINTANI I Vision for the Airline and Rail Markets as They Reach a Turning Point II Japan’s Stagnant and Shrinking Domestic Airline Market III Higher Demand in West Japan and Lower Demand in East Japan for Low Cost Carriers (LCCs) IV Success in the Market of Foreign Visitors to Japan is Key to Sustainable Growth V Approaching a Time Where Railway Company’s Business Model May No Longer Be Relevant VI Strengthening Cooperation between Companies to Spur Growth of Railway Business VII The Challenge of New Ways to Increase Revenues VIII The 2020 Tokyo Olympics Would Be an Ideal Showcase for Introducing Japan iven Japan’s shrinking population, in order for infrastructure businesses such as airlines and G railways to attain sustainable growth, it is vital that they both uncover latent demand in the domestic market and tap into overseas markets with a particular emphasis on emerging markets. Traditionally, transport service products have been designed for the working-age population as a major user base. However, in the future, increased attention must be paid to the senior market. Because people travel less as they age, transport companies must develop new services such as those that encourage senior citizens to travel as well as those related to nursing care. -

The Attachment(PDF:40KB)

Attachment The participants to be dispatched to Silicon Valley *Names are in Japanese alphabetical order. Name Company name Project title and summary (Tentative name) Tatsuhisa Ishii Digital Collaborations Hardware development Corporation revision control and data management system Haruki Izumikawa KDDI R&D Laboratories Yuru-mima: Inc. Secure & High privacy Monitoring system for elderly people Hiroko Inoue TOKYU CORPORATION Fuluro: Long stay program for elderly people Toru Ogawa Future Architect, Inc. Fashion-related services Hiroaki Kiyokami Toyota Motor Corporation Business model to disseminate FCVs Yuki Shimahara LPixel Inc. AI based analytics system for Cancer diagnostics Hidehisa Shimamoto SCREEN Holdings Co., Organ preservation system Ltd. outside of the human body Hironori Takagi Daiwa Securities Group Wealth management software Inc. application system. Tsuyoshi Tateishi appArray Inc. Project Edison: AI enabled language learning system Yasuko Chigira TOSHIBA Open Nail: CORPORATION Personalized service for artificial nails for working women Soichiro Tsuboi NIKON CORPORATION Sha-vegi-N: Nutrient analytics system to keep people healthy Kousuke Nagatsuka Japan Tobacco Inc. Hitotoki farm: Matching platform for farm land owners and farmer applicants Yasunori Nitta Nissan Motor Co., Ltd. P2P car sharing service Masutoshi Nojiri Kaneka Corporation Green Sustainable Agro-Solution Project Ibuki Nomura Mori Building Co., Ltd. hOur Office: Platform to connect offices to enterprises and individuals Go Fukino Link Wiz Incorporated Next Generation Industrial robotic system. Tomoka Meguro NEC Corporation Biometrics authorization system Arisa Yamashita Terumo Corporation Hi, My Doctor!: Symptom based doctor search Fukutaro Yamashita NIPPON TELEGRAPH Smart bed mattress AND TELEPHONE WEST CORPORATION Tomoki Yamada Seven Bank, Ltd. Extended ATM service . -

Greater Tokyo Pass “SAKURA Campaign” Will Run from March 16

March 11, 2019 Greater Tokyo Pass Council “Greater Tokyo Pass” – Now Even More Convenient and Easier to Use! Greater Tokyo Pass “SAKURA Campaign” Will Run from March 16 (Sat.), 2019! ・Extension of the period of validity to five days for a limited time ・Start of advance sales from the day before the beginning of use all year The Greater Tokyo Pass Council, to which 63 railway and bus companies in Kanto have joined, will run the “SAKURA Campaign.” This campaign will see the period of validity of the “Greater Tokyo Pass” extended to five days for a limited time. This pass is a special ticket for foreign visitors to Japan. It gives users unlimited rides for three days on railways, streetcars and ordinary fixed-route buses in the permitted usage area. The reason for this is that many foreign travelers visit Japan during the cherry blossom season. Therefore, extending the period of validity of the “Greater Tokyo Pass” will allow users to visit even more tourist spots in the Kanto area with plenty of charms. Users will then be able to experience the charms and hospitality of Japan. We will extend the period of validity of a “Greater Tokyo Pass” purchased from March 16 (Sat.) to April 30 (Tue.), 2019 during the period of the “SAKURA Campaign” from three days to five days without changing its sales price. Currently, the “Greater Tokyo Pass” is sold only for use beginning on the same day. However, we will start advance sales from the day before the beginning of use all year from March 16 (Sat.), 2019 – the same day as the start of the “SAKURA Campaign.” With this, users will be able to fully utilize the number of days of the period of validity of the pass from the next day onward regardless of the time they make their purchase when arriving in Japan on flights in the afternoon or at night. -

Corporateactionnews210415.Pdf

BOARD STOCK SEQ. UPDATE COMPANY RECORD EFFECTIVE DATE EVENT NAME QUICK LOT ISIN EXCHAN EX-DATE RATIO REMARKS NO. OF NAME DATE DATE SIZE GE* OFFERER : KUFU COMPANY INC. (4399/JP3266300007) NUMBER OF SHARES : 12,608,200 OFFERED PRICE : JPY 138 TENDER PERIOD : 2021/4/15 TO 2021/5/18 PAYMENT DATE : 2021/5/25 2021/4/15 278 TENDER OFFER 6192 HYAS&CO.INC. 100 JP3765170000 M N/A N/A N/A N/A TAX : NON-APPLICABLE WHEN UNDERSUBSCRIBED : NO SHS WILL BE PURCHASED (UNDER5,746,130 SHS) WHEN OVERSUBSCRIBED : PRORATED (OVER 12,608,200 SHS) CURRENT FISCAL YEAR END (INTERIM) : 2/END (9/30) NEW FISCAL YEAR END (INTERIM) : 3/31 (8/31) TRANSITORY FISCAL YEAR (THE26TH) : CHANGE OF CAREERLINK 2021/4/15 277 6070 100 JP3244520007 T N/A N/A N/A N/A 2021/3/31-2022/3/31 (13MONTHS) FISCAL YEAR END CO.,LTD. *SUBJECT TO THE APPROVAL OF AGM SCHEDULED ON 2021/5/28 CURRENT FISCAL YEAR END (INTERIM) : 2/END (8/31) NEW FISCAL YEAR END (INTERIM) : 3/31 (9/30) KYORITSU TRANSITORY FISCAL YEAR (THE57TH) : CHANGE OF COMPUTER & 2021/4/15 276 3670 100 JP3253820009 J N/A N/A N/A N/A 2021/3/1-2022/3/31 (13MONTHS) FISCAL YEAR END COMMUNICATION CO.,LTD. *SUBJECT TO THE APPROVAL OF AGM SCHEDULED ON 2021/5/27 CURRENT FISCAL YEAR END (INTERIM) : 2/END (8/31) NEW FISCAL YEAR END (INTERIM) : 1/31 (7/31) TRANSITORY FISCAL YEAR (THE14TH) : CHANGE OF TOKYO BASE 2021/4/15 275 3415 100 JP3399710007 T N/A N/A N/A N/A 2021/3/1-2022/1/31 (11MONTHS) FISCAL YEAR END CO.,LTD. -

The Railway Market in Japan

www.EUbusinessinJapan.eu The Railway Market in Japan September 2016 Lyckle Griek EU-JAPAN CENTRE FOR INDUSTRIAL COOPERATION - Head office in Japan EU-JAPAN CENTRE FOR INDUSTRIAL COOPERATION - OFFICE in the EU Shirokane-Takanawa Station bldg 4F Rue Marie de Bourgogne, 52/2 1-27-6 Shirokane, Minato-ku, Tokyo 108-0072, JAPAN B-1000 Brussels, BELGIUM Tel: +81 3 6408 0281 - Fax: +81 3 6408 0283 - [email protected] Tel : +32 2 282 0040 –Fax : +32 2 282 0045 - [email protected] http://www.eu-japan.eu / http://www.EUbusinessinJapan.eu / http://www.een-japan.eu www.EUbusinessinJapan.eu Contents 1. Executive summary .................................................................................................................................................... 2 2. Introduction ............................................................................................................................................................... 3 3. Market structure........................................................................................................................................................ 4 a. Network overview (technical characteristics) ...................................................................................................... 4 b. Public & private operators .................................................................................................................................... 6 c. Large operators ...................................................................................................................................................